Yves here. Wolf’s post focuses on the economic impact of the loss of Saudi oil production via drone strikes over the weekend. He thus skips over a point important to the geopolitically-minded: the Saudis have not confirmed US claims that the attacks are Iranian in origin and have asked the US to share its intel.

By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street

The attacks on Saudi Arabia’s largest oil-processing plant at Abqaiq and its second-largest oil field in Khurais on Saturday knocked out about 5.7 million barrels a day of output – about half of Saudi production and about 5% of global production. Saudi military officials told reporters on Monday that the preliminary investigation of “debris and wreckage” shows “it belongs to the Iranian regime,” and that the long-range drones were not launched from Yemen, as Iran-backed Houthi rebels there had claimed.

The White House has pointed the finger directly at Iran. Trump tweeted on Sunday that the US government was “locked and loaded depending on verification,” but was “waiting to hear from the Kingdom as to who they believe was the cause of this attack, and under what terms we would proceed!”

On Monday, the Wall Street Journal reported that “people familiar with the discussions” said that US officials said that intelligence suggests that the attacks were staged in Iran. Retaliatory strikes are being weighed.

Some of the production could be restored in days. But Bloomberg reported, based on a source, that “Aramco officials are growing less optimistic that there will be a rapid recovery in production.” Saudi Arabia can use part of its stock of about 645 million barrels of crude and petroleum products to make up for lost production in the near term. But “Aramco could consider declaring itself unable to fulfill contracts on some international shipments – known as force majeure – if the resumption of full capacity at Abqaiq takes weeks.”

In 2007, this scenario would have caused unspeakable upheaval and chaos in the oil markets globally, but particularly in the US, which at that time had relied heavily on Saudi oil. Prices would have hit astronomical levels and causing all kinds of wreckage.

But this isn’t 2007 anymore.

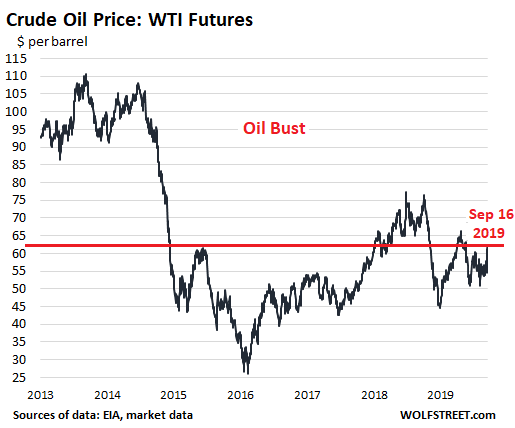

The price reaction in the market was breath-taking of sorts, with the price of WTI spiking 13% to about $62 a barrel at the moment.

But wait: The US is stuck in an oil bust that started in mid-2014, after years when WTI traded between $90 to over $110 a barrel. By early 2016, the price of WTI had collapsed to $26 a barrel. The Fed pulled back from the four expected rate hikes in 2016 because the oil-and-gas sector was threatening to collapse, and credit was already freezing up for the sector, and bankruptcy filings occurred in rapid-fire sequence. The Fed was worried that the collapse of the industry and the freezing of credit could spread to other industries.

That was the opposite scenario of today. Today, US shale oil drillers are seeing a modicum of relief from the 13% price spike. But it’s not much of a relief. At $62 a barrel, WTI is still $6 (9%) below where it had been last year at this time. And it’s about $44 (43%) below where it had been in July 2014:

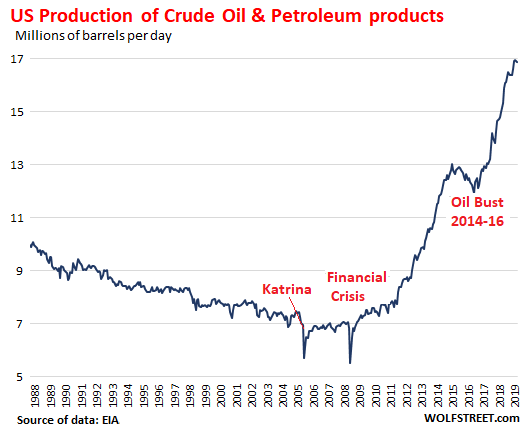

The most important factor that changed since 2007 is that US production of petroleum and petroleum products has skyrocketed by 142% from about 7 million barrels per day (bpd) in 2007 to about 17 million bpd:

In the process, the US has become the largest crude oil producer in the world, and imports from Saudi Arabia have shriveled to about 450,000 barrels per day. China, Japan, and South Korea are now large customers of Saudi Arabia.

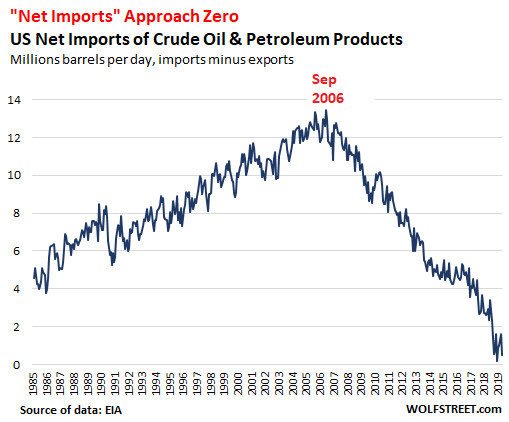

The US has been involved in a lively trade – importing and exporting – with the rest of the world in crude oil and petroleum products such as gasoline. Among the reasons are pricing, demand by refineries in the US and around the world for various grades of crude, and geographical reasons.

California, for example. There is no pipeline connecting the state to the oil producing areas east of the Rockies. Since California’s own production is not nearly enough to meet demand, it has been importing crude oil from Alaska. As Alaskan and Californian production has been shrinking, California increased imports from other countries. At the same time, California’s refineries are refining imported crude oil into gasoline and are exporting it to other countries, mostly in Latin America.

Netted out across the US, imports and exports of crude oil and petroleum products are now nearly in balance. Net imports (imports minus exports) of crude oil and petroleum products in June were down to merely 506,000 bpd. The US is on track to become a net exporter in 2020:

This soaring production in the US is at least in part responsible for the collapse of the price of crude oil since 2014. The word is overproduction.

Shale-oil drillers were heavily incentivized to maximize production, and not worry about negative cashflows and losses – and the industry has been burning large amounts of cash from day one that Wall Street was happy to provide. But recently Wall Street has gotten a little skittish, and credit conditions for shale-oil drillers have tightened. So a rise in the price of oil from the collapsed levels is a godsend for the industry.

Natural gas production in the US has skyrocketed as well, making the US the largest natural gas producer in the world years ago. Last year, the US became a net exporter of natural gas (exporting more than importing). This trend has strengthened in 2019.

The oil-and-gas industry and the industries that support it – manufacturing (specialized vehicles, heavy equipment, etc.), finance, insurance, suppliers of raw materials, the tech sector, and others – combine into a very large field of economic activity around oil and gas production.

A boom in this industry has a powerful impact on the real economy in the US, including in areas that are otherwise not favored by economic development. Workers are highly paid. And they spend much of this money, and it spreads to other sectors.

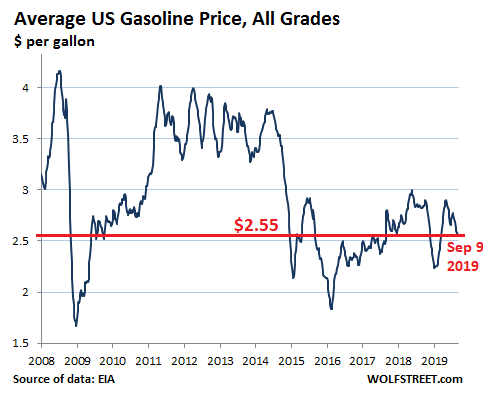

A higher price of crude oil on a sustained basis translates into higher prices at the pump. But gasoline prices have been crushed by the oil bust, and despite years of inflation overall, the average price of gasoline, all grades combined, as of September 9 at $2.55, is where it had first been in August 2005:

Even if gasoline prices rise, and some consumers are feeling the pain in their budgets, there remains a simple fact: Gasoline sales are also part of the economy and enter into GDP calculations. Any additional dollar spent on gasoline is an increase in GDP. If some consumers curtail spending money on clothing in order to spend more on gasoline, the net effect on the economy is still positive:

Unlike clothing and many other things, gasoline is not imported from China or Bangladesh; it’s a US product, requiring a sophisticated, high-value production chain with highly paid US workers. On the other hand, the value of imports are subtracted from GDP.

In 2007, part of the money that consumers spent on gasoline went to pay for imported crude oil to enrich foreign oil producers at the expense of the US economy. But this is no longer the case. And an enduring surge in the price of oil to $70-plus for WTI will unleash an even more intense production boom that will turn the US more quickly and more sharply into a net exporter of crude oil and petroleum products, which would be a net positive for the US economy, and which would eventually cause the price of oil to re-collapse.

What would the Fed do if economic factors were all it looked at? Read… “Core” Inflation Rises Most Since Sep 2008, Powered by Services and Now Even the Peculiar Case of Durable Goods

Wolf never says anything of value. Shale per NCs own links is slowing. Capex and well productivity are declining per oilfield service co earnings commentary and parent child well issues. If anything expectation of continued output growth are optimistic and oil prices were poised to increase sans current economic conditions.

I find WolfStreet to be worthwhile reading. Wolf regularly deflates a lot of the hype and misinformation about the financial markets, the operations of the Fed, inflation calculations, etc.

He’s a good reporter on matters financial. He generally stays out of foreign policy and politics, and that makes it easier for him to maintain good relations among the commentariat. He also tolerates very little pettiness and bad temper among the commenters, and that elevates the discourse considerably.

====

One thing I have always wondered about the shale play. It’s been well-known since the 70s that massive amounts of oil and gas were present in the shale. I always thought that the national policy, unspoken, was to use other people’s relatively cheap oil first (Saudi, Venezuela, etc.) and then use our own as needs dictate. Horizontal drilling, fracking, using water to force oil to the wellhead, etc. are not new technologies.

It may be that there is some method to our madness; the production losses for the industry can be compensated by energy security interests of the rest of the country. The fact that oil field operations has such a positive impact on the economy (lots of jobs that pay well) is a bonus.

That’s the economic story. The environmental story is completely the opposite. It gave us the chance to double-down on fossil, and we took that route. Worst possible move at the worst possible time.

Watching Dallas, GoT-Texas… can vouch for: “Horizontal drilling, fracking, using water to force oil to the wellhead, etc. are not new technologies.” I’d always hoped we were using up other people’s oil first, real resource stuff that. I don’t think that anyone in power anywhere in the world has any delusions about renewables, once some real shootin’ gets started. The world isn’t ratcheting up arms purchases, tweaking alliances, and psychologically prepping their respective populations for conflict, just cuz. Dark cynicism is my light humor, but WWI didn’t begin in the summer of 1914.

I think “the economic story” is more clearly explained by Gail Tverberg. It’s 6s. Manufacturing has been cut drastically, everywhere. We are in an ongoing global depression. The demographics are terrifying and offer no hope. The price of oil cannot go up because no one will buy it; it can’t go down because no one will pump it. So that makes this attack on the Saudi oil field puzzling, If it can have no, or very little effect, on the price of oil, what effect can it have? And to whose benefit? It is true we have become oil self sufficient and the price of oil will not skyrocket here; it probably won’t amount to enough revenue to dig shale out of its hole. So our self sufficiency comes at a continuing subsidy by the government (not, as Wolf implies, by Wall Street “investors” – that’s gotta be disinformation.) I’m guessing that the party who benefited from the fire was actually the Saudis because they have such overcapacity it must now be very expensive to keep it all online. So this was a good way to shut down half of their operations. And maybe collect some insurance. The price of oil will go up for China, but not beyond China’s capacity to pay, which is going down as well. I did notice on the BBC that there was PR about how Aramco is the most profitable company in the world because it is so easy to pump that oil. That is, until everybody stops buying it. And if Aramco, which is undeniably valuable and will continue to be, does spread the risk with an IPO then it becomes a public company and it can be considered to be a strategic interest and governments and central banks will subsidize it. But Iran droning Saudi oil? I doubt it. Those “Houthis” who claimed they did it with Iranian drones need to be identified. Betcha they are Saudis.

The price of oil cannot go up because no one will buy it; it can’t go down because no one will pump it.

Thank you. More clear insight from STO

The Houthis didn’t claim they did it with Iranian drones. They only recently displayed a new range of Yemeni drones.

Yahya Sari’ of the Yemen Armed Forces claimed Houthi responsibility (same link). I’ve no idea whether he is actually a Saudi (agent), but my bet would be that he’s emphatically not.

I think some folk think Yemenis are too inherently stupid or addled by khat to master any weaponry beyond an AK47. A bit like how some thought a bearded bin Laden hiding in a cave couldn’t possibly attack the USA.

bin Laden had some Yemeni ethnic origins. He was also well-educated with a college degree in either Business or Engineering from a large Saudi university. Your point is well-taken, though. Don’t sleep on the inventiveness/creativity of the folks living in the Middle East.

Aramco was ramping up for an IPO. There’s no way the Saudis would be interested in crippling their own infrastructure and making themselves look powerless with a hundred billion dollars on the line. In order to find this speculation as anything other than laughable I’d need to see a lot more motivation and perhaps even some evidence.

our policy is to drain America first, and then pay quadruple for what we need when we ain’t got no more..

Wolf has a graph up there that shows total production rising from 7 million barrels per day to 17 million barrels per day…trouble is, we’re only pulling 12.3 million barrels per day out of the ground…the rest of that 17 million bopd is from imports that we refine into diesel, gasoline & other products…

Could be Iran…or could be a fabrication to drive up prices; and justify war with Iran…but people don’t blow up their own refineries, do they??? (just like they don’t burn their own buildings for insurance)

…either way, its good for business!!!

With a little thought, who benefits politically, financially and in terms of geopolitical power from the drone attack on Saudi Aramco oil facilities can be teased out. I suspect that is why the Saudis question and have asked the US for the intel that supports a position that the Iranians were responsible for the attack, particularly given strong statements of denial by Iran’s leaders.

As an ordinary American, it is my view that the most important aspect of how we react to this attack is that it not be used as a catalyst for further wars. Instead, it should be a catalyst for the requisite political and social will to implement cooperative domestic and international policies to prevent climate change above existential thresholds while minimizing damage to lives and communities, including to the many who directly or indirectly depend upon fossil fuel production for their livelihoods.

“the long-range drones were not launched from Yemen, as Iran-backed Houthi rebels there had claimed”

According to the Houthis, “This operation is one of the largest operations carried out by our forces in the depth of Saudi Arabia and came after a accurate intelligence operation and advance monitoring and cooperation of honorable and free mans within the Kingdom.” Seems to me they’re pretty clear about claiming it was Houthis, and pretty deliberately unclear where exactly the missiles/drones were launched from – from Yemen with help from sympathisers in Saudi, or directly from Saudi?

If I’m reading Wolf correctly, the missiles/drones were likely launched from Texas. Check the satellite images over Midland. ;)

Well no, it isn’t 2007 anymore. America has used fracking to put off the day when it will need to import large quantities of oil once more. But when those fracked wells die in the next few years then you will have a totally different situation. This is probably why Trump and his people tried to steal Venezuela’s oil reserves recently – in preparation for that day. But for the moment losing those oil supplies is no skin off their noses.

For the rest of the world, this is more of a problem. It is not so much the amount of oil out there but the countries that the Trump regime will allow them to buy from. Here is a list illustrating the problem-

The World’s Largest Oil Reserves By Country-

Venezuela – 300,878 million barrels.

Saudi Arabia – 266,455 million barrels. …

Canada – 169,709 million barrels. …

Iran – 158,400 million barrels. …

Iraq – 142,503 million barrels. …

Kuwait – 101,500 million barrels. …

United Arab Emirates – 97,800 million barrels. …

Russia – 80,000 million barrels.

So to meet the shortfall, logic says to go the country with the biggest reserves which is Venezuela. But if you do that, Trump will punish your country and will perhaps sanction it. Next is Saudi Arabia but 50% of their production just dropped off the edge of the planet. If the Yemenis had used 20 drones instead of 10, that might have been all oil production. Next is Canada but probably the US west coast has dibs on a lot of it. After that is Iran which is also a big no-no for Trump. Iraq, Kuwait and the UAE may be OK but not Russia which is next on that list. Add up these countries on the bad boy list and that is a lot of world oil production that Trump is saying that you are not allowed to buy from. I suspect that this fact will really strain relations with other countries if a tightened oil supply means those countries having to scale back their economies.

Trump is finished Jan 20 2021

Not if the DNC has any say in the matter.

10 fighters killed in new, unclaimed strikes in east Syria

No luck with that link.

better link:

https://www.msn.com/en-ca/news/world/10-fighters-killed-in-new-unclaimed-strikes-in-east-syria/ar-AAHqIu6

also:

https://www.nytimes.com/aponline/2019/09/17/world/middleeast/ap-ml-syria.html

Here’s the original report from the Syrian Observatory for Human Rights:

Gunmen attack checkpoints of the SDF in the eastern countryside of Deir Ezzor

Uh-oh. “The US has reportedly identified locations in Iran from which drones and cruise missiles were launched against major Saudi oil facilities.”

True or not – and I don’t believe it (see my previous comments) – should we expect a barrage of US and UK cruise missiles targetting Iran?

This is getting bizarre. If you told me 20 years ago we would be self reliant on oil, yet defending a nation who’s citizens are responsible for the worst terrorist attack on our country ever, based on the assumption we need their oil when the opposite is true that we benefit from their production failure, all because we want to go to war with Iran, because we don’t like their influence on oil exports…yada yada, I’d a thought you were absolutely nuts.

Well said Tim. America’s natural ally in Middle East is Iran but we ceased doing what comes naturally at the turn of the century.

When even Wolf is implying that we produce 30% more than we actually do, while implying energy independence when we burn about 40% more than we produce, I know the situation is a great deal more dire than is generally implied.