This is Naked Capitalism fundraising week. 1189 donors have already invested in our efforts to combat corruption and predatory conduct, particularly in the financial realm. Please join us and participate via our donation page, which shows how to give via check, credit card, debit card, or PayPal. Read about why we’re doing this fundraiser and what we’ve accomplished in the last year, and our current goal, burnout prevention.

By Justin Mikulka, a freelance writer, audio and video producer living in Trumansburg, NY. Originally published at DeSmog Blog

This week, the Wall Street Journal highlighted that the U.S. oil and gas shale industry, already struggling financially, is now facing “core operational issues.” That should be a truly frightening prospect for investors in American fracking operations, but one which DeSmog has long been warning of.

This one line from the Journal sums up the problems: “Unlike several years ago, when shale production fell due to a global price collapse, the slowdown this year is driven partly by core operational issues, including wells producing less than expected after being drilled too close to one another, and sweet spots running out sooner than anticipated.”

As we have reported at DeSmog over the last year and a half, the shale oil and gas industry, which has driven the recent boom in American oil and gas production, has been on a more than decade-long money-losing streak, with estimated losses of approximately a quarter trillion dollars. Those losses have continued in 2019.

This failure to generate profits led to the Financial Times recently reporting that shale investors are having a “crisis of faith” and turning away from U.S. oil and gas investments. That’s been bad news for frackers because the entire so-called “shale revolution” was fueled by massive borrowing, and these companies are increasingly declaring bankruptcy, unable to pay back what they borrowed because they haven’t been turning a profit.

Scott Forbes, a vice president with leading energy industry research firm Wood Mackenzie, also has noted the structural problems in the finances of the fracking industry, referring to the current business model as “unsustainable.”

When DeSmog first began reporting on the failed finances of the fracking industry, publications like the Wall Street Journal were writing about the optimistic financial future for shale companies. A year and a half later, that optimism has died. But all of these dynamics played out before the industry ran up against “core operational issues.”

The shale patch is seeing some serious pain today in junk-bond land as oil prices drop. Diamond Offshore, Rowan Cos. & Valaris bonds are the biggest losers, with bonds down 5 or more cents on the dollar. pic.twitter.com/1jkVBjdX9P

— Lisa Abramowicz (@lisaabramowicz1) 2 October 2019

Core Operational Issues

Over the last 10 years, the fracking industry has made impressive gains with technological improvements that have resulted in lower costs and higher performing wells. But despite these improvements, shale companies have failed to be profitable, and two years ago, industry analysts at Wood MacKenzie were warning about the limits of technology in overcoming geology.

More recently, the industry’s attempts to extract more oil and gas out of the shale — dubbed Fracking 2.0 by the Wall Street Journal — have flopped. Even the longest drilled wells have not made money, indicating a limit to optimal well length. Likewise, attempts to drill many wells in the same area — so-called cube development — haven’t been the financial savior the industry needs either.

Shows the potential surface impact of vertically drilled wells, Jonah gas field, Wyoming. Credit: Peter Aengst, The Wilderness Society, CC BY-SA 4.0

Perhaps the surest sign of desperation among shale firms is the issue of “frac hits” or “child wells,” an issue DeSmog flagged over a year ago. These companies are aware that if secondary or “child wells” are drilled too close together around the primary, or “parent well,” the fracking process can damage the nearby wells. And they also know that, as a result, these wells do not perform as well as those with greater spacing.

Nevertheless, they continue to do it.

Instead, wells are declining faster, meaning the output of the wells drops off very quickly and leads to lower overall well production — and more losses for the increasingly financially insolvent companies.

James West, a managing director at Investment bank Evercore ISI, assessed the situation for the Wall Street Journal. “We’re getting closer to peak production and we are reaching the peak of the general physics of these wells,” he said.

Physics, Geology, and Disappearing Sweet Spots

Perhaps the most important fact in the Wall Street Journal’s recent story was only mentioned once: “sweet spots [are] running out sooner than anticipated.”

Sweet spots are the areas of shale basins that have the best-performing wells. David Hughes, earth scientist and author of the 2019 report, “How Long Will The Shale Revolution Last: Technology versus Geology and the Lifecycle of Shale Plays,” has estimated that these sweet spots (also known as “Tier 1 acreage”) make up 15 to 20 percent of a shale basin (also known as a “play”).

In a recent online presentation, Hughes noted that these productive areas, “of course, are exploited first.”

As shale companies have chased profits, they first drilled the sweet spots, but now that most of those have been depleted, drillers must try to make a profit with Tier 2 acreage, which isn’t going so well.

Scott Sheffield, CEO of Pioneer Resources, told investors in August that “Tier 1 acreage is being exhausted at a very quick rate.”

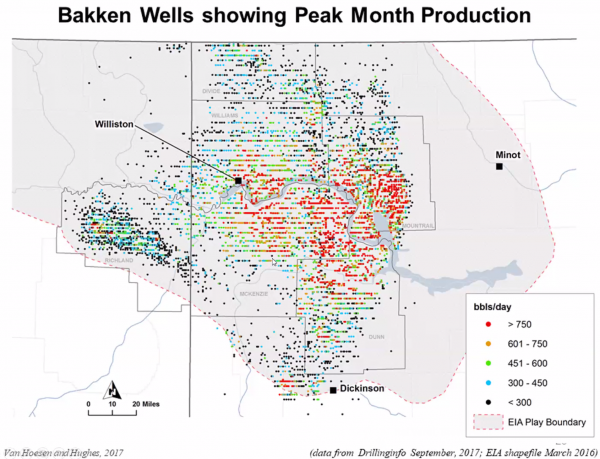

In Hughes’ 2019 report, he maps the sweet spots of the Bakken Shale using well performance, with the highest producers shown in red.

Bakken wells showing peak month production. Credit: How Long Will the Shale Revolution Last?

As the Wall Street Journal noted, “Across North Dakota’s Bakken Shale region, well productivity hasn’t improved since late 2017,” with a notably dismal example coming from fracking firm Hess. Bakken wells this company drilled in 2019 “…generated an average of about 82,000 barrels of oil in their first five months, 12 percent below wells that began producing in 2018 and 16 percent below 2017 wells,” the Journal reported.

There is plenty of evidence — including warnings from industry leaders like Scott Sheffield — that the fracking industry has depleted most of the sweet spots in the major shale plays over the past decade or so. With fewer of those plum acres left, firms are forced to drill in areas with less favorable geology for production, which means spending the same amount of money to drill wells but produce less oil.

And that means shale companies have no way to pay back the huge amount of debt, which they incurred to drill the sweet spots in the first place.

Even though it began as Enron Oil and Gas, a spinoff of Enron, EOG is considered the gold standard of fracking companies and has earned the nickname “the Apple of Oil.”

The Wall Street Journal reported the declining performance of new EOG wells in the Eagle Ford Shale, noting that EOG “declined to comment” on this issue, which is rarely an indication of good news.

Many signs are pointing to the fact that geology — how much oil and gas is present in the shale — will be the defining factor going forward for the U.S. fracking industry.

In June DeSmog reported that Steve Schlotterbeck, former CEO of shale company EQT, told a petrochemical industry conference, “The shale gas revolution has frankly been an unmitigated disaster for any buy-and-hold investor…”

Those buy-and-hold investors were buying and holding companies that were drilling sweet spots. But today’s buy-and-hold investors are holding companies working with less productive shale, which doesn’t bode well for the industry’s future fortunes.

What. A. Sh*tshow. Sub $2Bn market cap E&P companies…

Most of these companies are dead men walking.

We all knew a reckoning was coming in 2016/2017 but never thought it would come with such force. Truly a bubble bursting… pic.twitter.com/QuYx1q8fWe

— EnergyCynic (@EnergyCynic) 2 October 2019

Follow the DeSmog investigative series: Finances of Fracking: Shale Industry Drills More Debt Than Profit

Included in the cost base are the royalty/lease costs. These are significant ( the following study https://home.uchicago.edu/~kelloggr/Papers/HKL_primaryterms.pdf placed it at 39 billion $ for the year 2014 alone).

This is pure unearned income, it can (and should !) go to zero without jeopardising the existence of the industry. The bottom line is that shale plays can feed the blue collars and the Engineers, but not the landowners and the finance industry. It is therefore a myth that “shale exists because of the Fed lax lending and low rates”. What is true is that “shale justified financial plundering exists because of the Fed”, but this is not really news for NC readers…

@charles 2

October 6, 2019 at 5:43 am

——-

While it is true that royalties could be eliminated without jeopardizing the fracking industry, I take exception to the idea that these are unearned income and therefore unnecessary.

The landowners deserve the royalties they receive. Once the land has been cleared for construction of the drilling rigs, etc., it is useless for any other future use. The landowners deserve to be compensated for the loss of potential future earnings from that land.

Disclosure: I am the beneficiary of a royalty lease signed by my grandfather in 1974, for a traditional oil and gas play. Fortunately, traditional producing wells don’t take up nearly the acreage that fracking does.

Just refer them back to the picture of what used to be Wyoming ranch land above and ask them if they would allow that to be done to their land for no compensation.

I know people who agreed to that. I myself would prefer poverty before I would allow something like that to be done.

Fracking, assuming it is performed with all environmental precautions, should not impair usage of the remaining land, which, according to the picture above, is still around 90% of the original land. Not very different than a windmill field really. There is not much opportunity cost for farmers that practice extensive farming.

Also, considering that shale plays deplete very quickly, the land will be used for 5 to 10 years only.

So “zero” may have been an unwarranted rhetorical emphasis, but epsilon would be an accurate statement.

Any word on what the chemicals are that are used by companies to make fracking more efficient and which remain present underground? Are those companies still claiming that they cannot disclose what they are as it is a trade secret? How long before you can stop setting your taps on fire with an open flame due to chemical contamination? Sorry but you could not pay me to live next to an ex-fracking site. That truly frightens me.

The central tenet of a sustainable economy is that no natural asset, and most artificial one, should be destroyed, whether they are private or public. So you are 100% right, there shouldn’t be a market for privately issued “right to destroy” a property under the disguise of “royalties”, because it shouldn’t be the owners to sell. See my mention of “abusus” below.

charles, I hate the rentier class as much as anybody. That’s why I found NC. I hate frackers possibly more than anybody else here, being a rural WPa resident. But if I own a physical property you have to compensate me if you want to access it for profit. Do you get to store your stuff in the backseat of my car because I don’t use that area very much?

yes, I also have difficulty with that argument.

There is no way to abolish the rentier class than to abolish rent itself on all properties, and I am afraid it include yours (and mine).

But I should emphasize that the “rent” that should be abolished is what comes on top of maintaining the producing capacity of the property. The share of the rent that covers amortization and depreciation is entirely legitimate and is what property rights should be for.

So, in your hypothetical scenario, I would have to compensate for the depreciation of your car, the time it takes to you to make the back seat available to me and the opportunity costs of having a filled back seat ; Not sure it is going to be worth the trouble ! But FYI, I actually do store some stuff on my neighbor’s land, of which he has plenty, and it costs me a few bottles of wine, that we drink together anyway as we don’t really see it as a “market” transaction. Thinking like Milton Friedman 100% of the time is not a recipe for happpiness if you ask me.

Additionally, your mention of the fact that you are not using your back seat is interesting as it relates to the “abusus” of the property, I.e. the right to destroy it. Importantly , not using a property for a limited time is equivalent to partial destruction. “Abusus” is one of the pillars of unearned rent (the other being Ricardian rent) , because it allows the rentiers as a class to corner the market and maximize their rents through monopoly or oligopoly power (and it is especially true for oil). So, taming the abuses of “abusus” (yes, it is not called “abusus” for nothing ! ) through eminent domain or property taxes or state royalty fees is indeed essential. I would say however, that unused backseats of cars would rank very low on my list of “abusus” to tame !

But at least the money stayed in the US.Otherwise the money would have gone to the Mid East. Perhaps it’s time to make up with Iran!

Interesting that the Bloomberg reporter cited all offshore drilling bonds. From an investment standpoint it means shale production will surprise to the downside much more significantly than expected and oil should be a bit higher barring massive slowdown in economy. It would actually be credit positive and equity positive for offshore drilling companies. That sector has become more competitive than shale in terms of lower breakevens. The only advantage was shale is short cycle production vs long term conventional production.

John Michael Greer has some clarifying thoughts on oil which includes the subject of fracking. He writes-

Like most peak oil bloggers back in the day, I assumed that shale oil extraction would be subject to ordinary economic forces, and that these would put a hard lid on the extent to which shale oil would be able to make up for declining petroleum extraction from other sources. Fracking isn’t cheap, and tight oil deposits have very high rates of depletion: where a conventional oil well can keep pumping for decades at a steady pace, fracked wells taper off very quickly, and it’s a rare shale deposit that will still pay for the costs of its upkeep ten years after it’s first drilled.

Those of us who expected the shale oil boom to turn into a bubble and then a bust were wrong. We were wrong because we forgot the first law of petroleum: when it comes to oil, politics always trumps economics. Access to petroleum is so crucial for industrial nations, and especially for extremely wasteful industrial nations such as the United States and Canada, that all other factors get to sit in the waiting room when decisions about petroleum are made.

https://www.ecosophia.net/waiting-for-the-next-panic/

I agree with what JMG says about fracking up to his statement that politics trumps economics. I would say that economic survival trumps political concerns. In the modern economy economic forms shape political forms and that politics reflect economic forces.

I too made the same error as John Greer when I evaluated the prospects of shale as part of my professional responsibilities a dozen years ago.

Ayup. Oil from fracking is one of the legs propping up the empire’s stool. The money will be found to keep it (and BAU) going as long as possible. Finance is a very secondary consideration. If nothing else, we’ll bail them out just like the banks.

You hit the nail on the head, my friend. It was never done to make money, but to squeeze the cojonas of our enemies. Doesn’t seem to be working.

Druid tip: When reading a Greer essay, don’t forget to Find search his name and read through his replies to the comments, which surface additional thought provoking ideas and often preview his future essays.

For example:

If we’d gone heavily into renewables in the wake of the 1970s, the core lesson of that decade — “weatherize before you solarize” — would have reduced energy expenditure drastically. Most buildings, commerclal as well as residential, would be well insulated, with earth sheltering and the like very common, and so we’d just need less energy to start with.

Reviving electric streetcars for urban use and rebuilding the nation’s rail system so that every town of any size had passenger rail service would have made a lot of cars, trucks, and planes unnecessary, so again we’d need much less energy.

The US would be a net petroleum exporter, so its economy would be thriving; there would be plenty of jobs for all

So many things we now do with energy would be done instead by employees

The end of commuting would have helped drive the return to livable neighborhoods. Residences, businesses, and workplaces would be in walking distance of each other, as used to be the case before the Second World War — I could go on.

When we cashed in our ideals and bought into Reagan’s cotton candy fantasies, we closed the door on a much better future.

Fracking reversed the decline of conventional oil, reaching the 1970 peak. By 2006 production dropped in half, or about 2%/year.

Bankruptcy doesn’t stop production, the debt free assets will continue producing. But new wells require new money. Fracked wells mostly run dry in just 2-3 years, so three years after they can’t get new loans we will return to the conventional oil decline slope… but we will be 15 years further down slope, so conventional may be under 4mmb/day. To put this another way, the decline would about equal total Saudi exports.

We will change from a 6mmb/day net importer at present to a 12mmb/day net importer.

This change will affect the world oil price, possibly enough to bring back some fracking.

We who read NC knew this when fracking first started out. It was based on the old “buy high, sell low, and make itup in volume” – the part left out was what every good monopolist knows, “until you kill the competition.” In those 6+ intervening years I’ve had cold calls asking me to invest in fracking. I’m not gonna tell you what I tell them. Yves isn’t prescient, she’s just way smart. Sometimes they are the same thing. And when everyone was pretending that fracking was an energy contender, the Saudis were calling it “a drop in the bucket.” Interesting then how fracking was able to continue until the Saudis collapsed. One day we’ll get the entire backstory. The absolute worst thing about the fracking magic show is that it has polluted ground and ground water alike; pushed through pipelines that will have little future use, and will go bankrupt – putting the burden on fewer and fewer taxpayers. But one good thing Obama did was avoid a hot war. Although he used every other hideous tactic – like fracking. So he bought time for diplomacy, science and tech to come up with solutions. Which seems only now to be surfacing.

Once again there comes to mind the saying ” I don’t have to outrun the bear. I just have to outrun you.”

If the bear is eventual bankruptcy and liquidation-collapse of the fracking bussiness, then the “you” which the frackers have to outrun is the “lenders and investors”. The frackers don’t care, and don’t have to care, whether fracking-overall makes net money for everyone involved. They only care about exiting the frack process with more of their-own-money than what they went into it with.

So let the investors and lenders end up holding an empty bag to try feeding the hungry bear with when it catches up to the investor-runners and the lender-runners.

https://www.instagram.com/p/uyJGwDDKGg/

The title of this post refers to fracking as a revolution. I recall a statement years ago by Art Berman, a geologist and Oil E&P analyst, where he said that fracking was not a revolution, it was a retirement party.

Looking at the map of the Bakken in North Dakota, I see the red dots indicate the best spots at greater than 750 barrels per day. Much of it is probably not crude in the traditional sense. Compare this to the Lucas Gusher outside Beaumont, TX. On January 10,1901 at Spindletop, a well was drilled to the depth of 1139 feet when oil was struck and a geyser of oil shot 150 feet into the air. The oil came out at the rate of 100,000 barrels per day. This lasted for 10 days before they brought it under control. One million barrels in 10 days. Spindletop was productive until 1936.

Back in the days of Spindletop the EROEI, energy returned on energy invested, was at least 1barrel of oil got you another 100 barrels. With fracking, the EROEI might be 1 to 15.

How can anyone believe that this a sustainable replacement? The capacity of some for self deception seems to be very high. In the words of Saul Bellow: “A great deal of intelligence can be invested in ignorance when the need for illusion is deep”.

Everyone should know by now that fracking operators, as an investment, are a con. As a means of flooding the market, they continue to function.

As far as imminent collapse of production… wake me up when WTI goes to $70, or Henry Hub goes to $4.00. No offense to the author, who makes good points and has been making them for years.

Just one question here. I’m speaking as a geologist employed for over 14 years in the oil industry. Is there ONE poster here with either degrees in Geology or Petroleum Engineering, or (preferably both) who has ever worked in the oil industry? When I read these “fracking doesn’t work, and it all stopped after 5 minutes, years ago” threads, I feel a bit like when I read stuff by young-Earth creationists or unbribed human-caused-global-warming Chicken Littles, who NEVER in my experience have relevant backgrounds to entitle them to any more of an opinion worth taking seriously than, say, the college sophomore Greta Thunberg has on graduate-school-level science and engineering, e.g., not much if any.

I will throw in here that I have seen noticeable improvements in drilling going faster and faster, bits holding out for more footage, rarer and rarer drill strings getting stuck, MWD getting more and more reliable, hygroscopic shale inhibitor chemicals working better and better, etc., etc., just over the past couple of years. Why would anyone who knew all this say that the industry is becoming ever more dysfunctional, at least in the field? (The offices are admittedly ever more converged, but at least there are still seemingly enough old guys who’d have fit in Apollo Mission Control photos to make the tough calls.)

I think your points are acknowledged, and certainly a lot of oil and gas is being produced, doubling us production.

The concern here seems mostly regarding the lack of sufficient income to pay past debts in spite of low rates, the losses investors have taken as e&p’s go bankrupt such that the companies complain they can’t raise new capital.

Plus as noted the best sites have been drilled while the wells go dry long before conventional wells would.

My uneducated .02 is that production will fall like a rock unless price rises substantially, which it might bc saudi likely too optimistic about when production returns… to say nothing about possibility of new attack.

fyi, debts will affect profitability from the point of view of previous investors – but not future activity. (i.e. restructure, screw the first round investors, raise capital, continue to operate as before… common pattern)

reason for lack of profitability was more so an underestimation of commodity prices, than the overestimation of costs.

at somewhere between $50 – $80 WTI they will break even with current production levels. chronic transport bottlenecks and other market dysfunctions might mean producers never get the cut of this $ they told investors they’ll get, but the material is there, the technology exists to get it, and the governments inoperative give zero s##ts about the environment. we all draw our own conclusions from this…

I don’t think anyone would argue with you that geology like all other sciences are advancing. But as a geologist what is the extent of your knowledge about the performativity of economics and how corporate capitalism creates a ruling ideology of infinite growth, expansion and exploitation? What is your knowledge of physics and the laws of thermodynamics and entropy and that we will cook ourselves with perpetual energy increase?

As I understand and correct me if I’m wrong, fracking was developed by Haliburton over 50 years ago and I would assume the technology has advanced. However the issue is that using fossil fuels for energy is changing the climate. So to fix climate change we need to sort out a new way of getting energy. The climate problem is mostly an energy problem. How can geology fix this?

Hi, Nels. Please look up some articles on the East Anglia email scandal. That place is a clearinghouse for proponents of anthropogenic global warming. Someone snuck out thousands of emails showing massive and near-universal data falsification. It was on a level with USSR economic data, e.g., best disregarded by anyone interested in the truth. The truth is that humans just don’t control enough energy to significantly affect the climate, and that if anything the climate is cooling. Such periods historically tend to lead to famines, falls of empires, murderous impoverishing disorder, etc. So, if we WERE doing anything significant to increase global temps, odds are that’d be desirable.

that was a scam, they cherrypicked quotes from a small selection of emails they hacked (not, “snuck out”) and it was investigated multiple times. there was no data falsification. you’re making stuff up.

+ 1

Oh maaaate, I just deleted a kind comment I wrote encouraging you to comment more based on your boots-on-ground industry experience. Then I saw this howler.

Look, many of us here don’t buy the Repent Sinners, the Thunbergian Apocalypse Is Upon Us! and are aware that industrial society still has a few tricks up its sleeve before we all have to live like Amish or go into zombie mode.

But you also aren’t going to get very far swooping in here and copy-pasting a very narrow and tenuous denialist meme as evidence of absence.

The one thing most of us share here is yuuuge skepticism of handwaving quick fixes (and the motives of the would-be fixers). But ‘Those Damned Lying Commies Faking Data’ is just as simplistic a thoughtstopper as ‘The Science Is In, So Don’t Bother Me With Your Tech Fairy Because We’re All Doomed Anyway.’

Luke – The jist of the so called “East Anglia email scandal” was that when the got new, more accurate information they adjusted their thinking.

What do you do?

Further, re Nels’ question on my thermo/Physics background:

I’ve had a year of college Physics and Chemistry through the end of Chemistry-major Organic Chemistry (is two years Chem). There is also a certain amount of it in some higher-level Geology classes (had Geochemistry courses in both undergrad and grad schools). Chemists actually don’t learn much about chemistry of solids; they’re more focused on fluids and solutions.

Re the Saudis… I’ve worked in their country, and can tell you it’s not a low-cost place to drill*, despite the wells being highly productive. Further, there are many reasons they can’t do what they did in 1986 and 2014 to impoverish the U.S. oil industry (mostly being too broke).

*Example: they used rotary steerable tools on EVERY well I had anything to do with there. It’s sufficiently expensive that I still don’t see it that often in the U.S.

Last here: there are plenty of un/under-drilled decent prospects remaining in the U.S., and that’s without resorting to offshore areas long forbidden or ANWR.

So despite zero education or background on economics you feel qualified to comment on the economic viability of fracking?

Jef, I’ve HAD two graduate-level semester-length classes (at different schools) entitled “Economic Geology”. The career mining geologist I took about 5 classes from stressed that “ore” is as much an economic term as it is a petrologic one, in that price determines what is on either side of that cutoff. When I presented my thesis proposal on oil shale (after doing about 15 papers on it), one member of my committee had in his SECOND sentence a reference to the price of oil and the economics of the shale in question. Trust me, past the sophomore level, economic issues in mineral resource exploitation comes up at least regularly in most Geology courses. (Now, if you want to talk pipelines and refineries, sure, the Pet Engineers will have considerably more to say than my fellow Geos.)

So, is there ONE person with the quals I mentioned reading this thread, besides myself?

I worked in the oil bidness for 10 years, mostly pipelines though but you know there isn’t much going on out there and I got to talk to a lot of smart people.

But I didn’t even have too, my brother has a PhD in Mat Science and literally worked in the oil bidness (Haliburton and various), including fracking for several decades and he says it’s all a fraud. And beyond that, most of the PhD’s he worked with agreed… there just aren’t many jobs for hard-core PhDs anywhere *but* the oil companies.

So sorry to disillusion you, but we are well educated around here. You’ll be way more disillusioned eventually, with no help from us.