It’s not a good look when financial disclosure deadlines result in a company ‘fessing up to ugly truths. Boeing has had to admit that its fond hope that the FAA would give the troubled 737 Max a green light in February or March was optimistic.

The airline announced it estimated that the “ungrounding” of the 737 Max would start in “mid 2020” which it by which it indicated it means June or July. And remember, it takes time to get planes out of mothballs, plus pilot simulator training looks like a probable requirement, so it would be a couple of months after that before the planes were back in service. Boeing’s stock price fell by over 5% on this news to close down 3.3% for the day.

That means another summer of running fewer flights than they’d planned for Southwest, American, and other 737 Max buyers. The Wall Street Journal states that having the 737 Max out of service has reduced the global passenger airline capacity by 5%.

And if you read the various stories on the state of play with the 737 Max, this early-mid summer forecast is yet another guess. An article in the Seattle Times, based on a single source at an airline, claims the aircraft maker is being conservative and the plane may be good to go earlier.

The reality is that Boeing does not know. It has a punchlist with the FAA that it has to clear up. The new CEO Dennis Calhoun has only officially been in the CEO seat for a week. He no doubt really does want to manage expectations better….but making this announcement under what amount to duress isn’t a confidence builder.

However, the company had to provide internal assessments of the MAX return to close its 2019 accounts, with fourth-quarter earnings due to be reported on Jan. 29. Boeing issued its statement Tuesday after a report by CNBC.

Boeing’s revised estimate takes into account extensive reviews expected by regulators, new hiccups that could emerge and the potential to approve additional simulator training for pilots, one of the people familiar with the projection said….

While Boeing’s previous estimates for when regulators would approve the MAX have irked the FAA, the plane maker felt compelled to provide an update for financial planning and to inform airline customers and suppliers, this person added. Boeing notified the FAA of its revised estimate on Tuesday, this person added.

Notice the FAA will not give any forecast. Per the Financial Times:

The FAA said in a separate statement that “the agency is following a thorough, deliberate process to verify that all proposed modifications to the Boeing 737 Max meet the highest certification standards”, adding: “We have set no timeframe for when the work will be completed.”

The pink paper pointed out that FAA Director Steve Dickson had said in December that the Boeing had almost a dozen items to clear up, but the Financial Times also said that the latest MCAS software problem wasn’t the basis for pushing back the estimated back-in-service date.

My assumption as to why the estimate of when the plane would be back in service affects 4Q earnings is liability reserves. Boeing already plans to compensate buyers for having grounded 737 Max planes via concessions on future purchases. In addition, the Southwest pilot’s union is suing Boeing over lost member flying time. As of when the Southwest union filed its suit, no other union planned to file similar actions. But will this posture hold if the grounding continues?

According to the Seattle Times, Boeing maintains even with the further delay, it won’t be cutting headcount. But the financial pain is set to increase. From the Financial Times:

Airlines may be less eager to accept deliveries during their autumn slowdown, said Bank of America Merrill Lynch analyst Ron Epstein. Purchasing contracts also usually allow airlines to walk away after a year, giving customers the muscle to negotiate discounts from the plane maker. It also prolongs the cash bleed at Boeing, which Mr Epstein estimates at $1.5 billion per month.

Wolf Richter looked at Boeing’s sorry state before this bout of bad news broke, focusing on its continuing borrowings to cover its cash bleed. Key points:

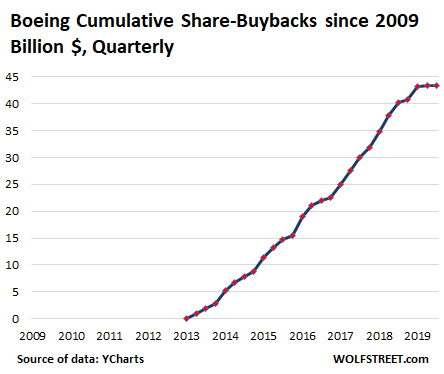

The first thing to know about Boeing’s mad scramble to line up “$10 billion or more” in new funding via a loan from a consortium of banks, on top of the $9.5 billion credit-line it obtained in October last year – efforts to somehow get through its cash-flow nightmare caused by the 737 MAX fiasco – is that the company blew, wasted, and incinerated $43.4 billion to buy back its own shares since June 2013, having become a master of financial engineering instead of aircraft engineering…..(share buyback data from YCharts):

The second thing to know about Boeing’s mad scramble to borrow another $10 billion is that it already has a huge amount of debt and other liabilities, and that its total liabilities ($136 billion) exceed its total assets ($132 billion) by about $4 billion as of September 2019, meaning that it has negative net equity, that the share buybacks have destroyed its equity, which is what share buybacks do to the balance sheet.

It also means that every dime in “cash” and “cash equivalent” listed on the balance sheet is borrowed. And this is about to get a whole lot worse. In October 2019, Boeing had already obtained a new credit line of $9.5 billion, which about doubled the size of its existing credit line. Credit lines serve as liquidity backup.

And now Boeing is scrambling to pile “$10 billion or more” in new loans on top of it.

Recall that Matt Stoller pointed out that Boeing is virtually alone in using an aggressive accounting approach that allows it to count expected future profits as if they were already earned 9emphasis his):

Boeing is one of the few companies that uses a technique called program accounting. Rather than booking the huge costs of building the advanced 787 or other aircraft as it pays the bills, Boeing—with the blessing of its auditors and regulators and in line with accounting rules—defers those costs, spreading them out over the number of planes it expects to sell years into the future. That allows the company to include anticipated future profits in its current earnings. The idea is to give investors a read on the health of the company’s long-term investments.

Our December warning still stands:

If Boeing and the FAA are still at loggerheads in six months, with still no date for the 737 Max going into service, it isn’t just that pressure on Boeing’s suppliers and customers will become acute, perhaps catastrophic for some. Boeing’s practice of booking future, yet to be earned, profits as current income means persistent negative cash flow could lead to an unraveling. The last time we saw similar accounting was how supposedly risk free future income from CDOs was discounted and included in the current earnings of banks. Remember how that movie ended?

And as this fiasco continues, Boeing loses more credibility with a critical audience, airline passengers, who unlike suppliers and customers, do have option. On the one hand, it’s easy for a traveler to vow “Never a 737 Max” or “No 737 Max until they’ve been safely in the air a year” and quite another to pay extra for that choice or refuse to board last-minute replacement equipment and incur time as well as money losses. But the flip side is US travelers can stick to the 737 Max-free Delta. And the customers most likely to throw their weight around this way are the lucrative front of the plane fliers.

The plural of anecdote is not data, but the comments to the latest Wall Street Journal article on the 737 Max suggest the reputation problem is real. For instance:

Rahul H

I am certainly not flying on the Max until plenty of other guinea pigs have.

jill candelier

There is no way I will get on one of those planes.

David Bildner

The 737 MAX will forever by know as The Flying Coffin. Better to scratch it from the fleet and sell the remaining planes to Iran.

Joshua Power

I would cancel my flight before I got on a 737 MAX. No doubt about it.

The 737MAX is an uber-kludge, and that is why Boeing’s having a helluva time getting

it back in the air. The 777X™ will rightly undergo similar scrutiny, and they have nothing

else in the pipeline. They badly need, *at minimum*, a worthy competitor to Airbus’s A321LR/XLR..

popcorn

Adding: I predict that the satisfaction and well-being of each company’s workforce- you know, the people who actually build the things- will become the prevailing factor in

the relative positions of these two companies.

The 787 has problems with the Rolls-Royce Trent 1000 engines, faults which were also the result of rushed development.

In good news, the Boeing 707 and 747 continue to be very reliable planes. Hpwever, yhe current Boeing management could fix that reliability.

“Boeing, fully supporting the Rapture, one planeload at a time!”

“the Boeing 707 and 747 continue to be very reliable planes.” kkkkkk

As employees and supplier employees lose talent and muscle memory and some suppliers go bankrupt, manufacturing quality may become unacceptable.

> “ But the flip side is US travelers can stick to the 737 Max-free Delta ”

Or JetBlue, which has an Airbus fleet, or Virgin America. The only way to be safe is to avoid any airline that has 737 MAX delivered:

https://en.wikipedia.org/wiki/List_of_Boeing_737_MAX_orders_and_deliveries

True, but for the business traveler, Delta flies way more routes. But point taken.

Virgin America was bought by Alaska Airlines. The combined airline has a mixed fleet of 737s and A320s. I do not believe that Alaska had any 737 Max orders.

With the consolidation and ring fencing of the US airline industry, it will be impossible for many passengers,

to totally avoid the MAX if they want reasonable itineraries.

Delta might be great for JFK-SEA or DTW-LAX, but offers no nonstops EWR-SFO, BOS-DFW or IAH-ORD.

Personally I hate EWR, but I never lived in New Jersey….

the only way to be safe is to avoid any airline that has 737 MAX delivered:

We can thank our lucky stars that they only delivered a little less than 400 of the 5000 ordered…

Or Amtrak. Or the bus. Or driving. Or just plumb staying home.

I believe that Spirit airlines and Frontier don’t fly the MAX either. But of course, those are discount “no frills” operations that leave much to be desired in the way of customer experience.

Still, I’ll take having to sit in plastic seats and paying for every bag over ending up dead every time.

Southwest really has their reputation hitched onto the MAX’s reputation… (310 ordered of which 34 were delivered).

I wonder how THAT’s going to play out… (not well for Southwest, methinks).

Well its not like Airbus hasn’t. Had their own problem children, they have.

Now we might why this happens now. Who decided in the US to ….encourage FAA to out source their inspections? Well its not hard, its Congress, executive branch that pushed for and approved it. Now of course the manufacturers all pushed for this to be done. And that let them speed up approval of new planes and equipment. But with the business mind set, they truly didn’t think there was a down side to all of these decisions. Till now. When all of the bad decisions have come to roost, and cost Boeing billions, and many executive jobs, cost the FAA their credibility, which leads higher costs for all later. Short termism at its finest .

And to add to it….

AL companies are guilty of this

It just doesn’t always become the nightly news….every night….for months…and maybe years

Future whatever… (surely shome mishstake?)

Sounds like magical thinking leveraging ga-ga-nomics to me.

Enronics rule (but does it remain airborne?)

Pip-pip!

Hey Abatemagic,

Sounds like you are a fellow Frank reader [fellow Canuck?]

(surely shome mishstake?)

Pip-pip!

Looking longer term, it seems inevitable that Boeing will have to seek US government assistance*, which will be precisely the signal that Europe and China (and possibly Japan) will take to start to use aviation as a pawn in any trade wars/negotiations. Since so many US companies will need their Airbus’s (and maybe Comacs and Mitsubishi’s), there will be little downside to putting excess tariffs on Boeings in order to benefit their own manufacturers.

*this will have to be direct assistance to the civil aviation side, as the military and aerospace elements of Boeings business are simply too small to compensate.

A lot of Boeing subcontractors are also getting hurt by Boeing’s fiasco. There’s a ripple effect hitting more than Boeing’s stock price.

Thanks for this post.

I think that our methods of social organization are not working any more.

Which subs and vendors are most into them?

Here’s one of the subs.

https://www.washingtonpost.com/business/2020/01/10/airplane-fuselage-supplier-spirit-aerosystems-lays-off-2800-wichita-due-boeing-737-max-production-cut/

boeing doing irs bit for climate change

Being very cynical ..population control???

Considering the substantial harm Boeing did to Bombardier with their completely unjustified charges of C-series dumping, which nearly bankrupted Bombardier and forced it to give away their C-series to AirBus. As a Canadian, I am very happy to see Boeing suffer.

However I do predict that with Boeing’s financial situation will become much worse with the continued grounding of the 737 MAX. And either just before or just after the election in November, Boeing will need to receive a generous bailout from the American tax payer.

Boeing is one of those too big to fail corporations. And of course it will be yet another example of privatizing short term profits and socializing long term losses.

I wonder if one option to help fix this crony capitalism mess might be reverse dividends, in which current and past shareholders and board of directors are personally forced to cover corporate losses in the shares they hold.

The story is worse than you say – Boeing and Bombardier were far along in the due diligence process for a merger or a purchase by Boeing of the C-series. So Bombardier had basically pulled down their pants, giving Boeing access to trade secrets and detailed technical information on their business. Boeing, after they had gotten all the info they wanted, abruptly ended the talks and THE NEXT DAY filed a gross and false trade accusation of dumping against Bombardier.

Boeing Board and senior management are scum. Moral failings aside, they are incompetent. They are responsible for Boeing’s current mess and deserve to be in the stocks for their greed and incompetence.

Why not put management in jail? Hundreds of people died because of their company’s negligence.

We can’t jail the job creators!?! If we do they can’t create more jobs for us! And today, we each need 2-3 jobs just to survive.

From the wolfstreet section of the post…

“The second thing to know about Boeing’s mad scramble to borrow another $10 billion is that it already has a huge amount of debt and other liabilities, and that its total liabilities ($136 billion) exceed its total assets ($132 billion) by about $4 billion as of September 2019, meaning that it has negative net equity, that the share buybacks have destroyed its equity, which is what share buybacks do to the balance sheet.

It also means that every dime in “cash” and “cash equivalent” listed on the balance sheet is borrowed. And this is about to get a whole lot worse. In October 2019, Boeing had already obtained a new credit line of $9.5 billion, which about doubled the size of its existing credit line. Credit lines serve as liquidity backup.”

Share buybacks destroy equity…good thing no one else is doing it…/s

I was calling it the 737 NFW, but I think I’ll change that to “The Black Swan”

I wonder if they have any of the tools and dies for the B-29 laying around the shop.

Except for that nuke thing, it still has a pretty good brand, doesn’t it?

Bring back the Stratoliner (which employed B-29 technology)!

No, the Straotoliner (Boeing 307) came out in 1938 and used the wings, empennage, and engines from the then current B-17C. Not a big success with ten made – but at the time Boeing was about to become very busy building the B-17 so it didn’t have much of a chance. The 377 Stratocruiser was based on the B-29 and used the big R-4360 Wasp Major “corncob” engine installation developed for the B-50. It wasn’t much of a success as an airliner either with less than 60 made. Fortunately for Boeing the nearly 900 tanker and freighter versions bought by the military made up for that. They had considerable difficulties with the propellers leading to a less than impressive safety record.

The 707 was the aeroplane that finally made Boeing a serious player in the airline market. The book “The Road To The 707” (by a retired Boeing engineer) is a fascinating account of how the 707 came to be – and how close run a thing it was as well as how much luck was involved.

Not at first. The B-29 was so urgently needed that it was rushed into service before all the bugs had been worked out. Just read the section on its development-

https://en.wikipedia.org/wiki/Boeing_B-29_Superfortress#Design_and_development

Na.. the engines had magnesium components and caught on fire all the time. Now the Lockheed Constellation, that’s a pretty airplane airplane.

I’m a Ford Trimotor man, myself.

Things could conceivably get a lot worse for Boeing. Trump has said today that he is no fan of Boeing but as this corporation is one of those Too Big Too Fail entities, there may be pressure on Trump to bail them out nonetheless. But using an idea floated by Trump concerning infrastructure, what if there is a government-private effort organized to save Boeing. But that the “private” part is coming from a consortium of private equity firms such as Bain Capital? We all know what would happen next.

Goodbye union workforce!sacrifices had to be made to save america’s aviation industry.

and the loss of the company, as they would continue the cost cutting, short termism that Boeing has

And got it I to so much trouble

If Boeing is already in negative equity, then there isn’t much left for private equity to strip-mine that Boeing itself hasn’t already done so with their buybacks.

$43 Billion sucked out of the business by financial parasitism. And they went cheap and nasty on running the business – under-investing, downgrading engineers, using cheap third-world programmers – and going cheap on the 737 MAX. They now are reaping what they sowed. Now the company has negative net worth – no equity. And if I were an employee, one of the crapped-upon engineers, eg., I would be utterly enraged at the scum in the senior management suite.

I think these people have managed to destroy a fine company. The entire Board should resign in disgrace – they are responsible for this and they should be exposed as the parasites they are. Worse than parasites – they’ve killed the goose that laid the golden egg.

Also known as “You get what you pay for” among the lower classes. My observation of the upper classes based on near-daily contact, is that they are forever and always trying to find ways around this little rule, always bargain shopping.

To be fair to them, do you really think any of the upper level management that is responsible for the fiasco are ever going to face any consequences? I doubt they will (well, unless the dead people weigh on their consciences – ha! just joking, we know that ain’t gonna happen! , which makes their actions seem much more sleazy than stupid.

Well there is very slim almost non existent possibility they might loose their job. But beyond that, not much. Congress would have to outlaw stupidity. And based on their record, they never will

Cockpit Confidential by Patrick Smith is a fascinating book which looks at air travel from the pilot’s perspective. It’s a compilation of Q&As from his blog.

I found this answer to the question “Is there a difference in the quality of Boeing aircraft versus Airbus? I get the impression Airbus planes are made more cheaply.” fascinating, especially the part I have emboldened:

BTW, it was published in 2013.

I guess Boeing tried their hand automation. With spectacularly bad results, mostly caused by executives and management

Boeing is likely to be bankrupt by the time this is over. They are trying to borrow 10B but no one in their right mind would or should lend them a penny.

If the “Lazy B” goes bankrupt, I can imagine the WA state legislature coming up with the necessary corporate welfare, err rather tax breaks, to keep them afloat. They are too much of an employment institution around here to let it go Chapter 11.

Lobbyists for Boeing will be busting out the maps which show every congressional district that has one of their suppliers.

It would be interesting to see where they get the money for that, considering they can barely find money to fully fund education (which is constitutionally mandated) and they won’t tax corporations or individual incomes.

Yesterday’s NYTimes has an additionally damning article on Boeing’s effort to suppress criticisms of its sensor-based landing system arising from a 2009 crash in outside of Amsterdam. They’ve been peddling control systems that put additional burdens on pilots for decades; their pilot error mantra has become well-polished.

https://nyti.ms/2tvsieJ

Boeing , and the FAA, have a credibility situation which goes beyong the 737 Max.

Going back to year 2009 and the Boeing 737 NG had problems and when a deadly crash occurred issues were covered up.

In the recent Dutch media ( english language website. jan 21) ;

“U.S. pressured Dutch safety board to downplay tech faults in 2009 Turkish airlines crash : report. ”

https://nltimes.nl/2020/01/21/us-pressured-dutch-safety-board-downplay-tech-faults-2009-turkish-airlines-crash-report

Which is a brief cover from the NYT article of two days ago :

“How Boeing’s responsibility in a deadly crash ‘got burried ‘ “.

https://www.msn.com/en-us/money/companies/how-boeings-responsibility-in-a-deadly-crash-got-buried/ar-BBZ8Saf?li=BBnbfcL

If i fly it won’t be anything Boeing , ever ! There seems to be no respect for human life at the top level of that company, nor at some level of the F.A.A.

or the FAA’s boss Congress. Now we could wonder how Congress’s boss feels now about this

All this reminds me of the demise of the British car brands, as their Empire imploded: Morris, Austin, Daimler, Hillman, Rover. In the 1950’s, the older sister of a friend owned an MG and a highlight of our young lives was being taken (one at a time) for a spin. Most of these automobile companies are new owned by Asian firms … or at least the names are owned.

Your comment reeminds me of “I”m Allright Jack” with Peter Sellars.

Without stupid, extractive management there would not have been the inevitable response tinged with base human nature and class-war.

My view is that Thatcher could see that Britain’s managers were effectively incapable of managing the process of making things* so went hell-bent into the “service” economy** as a last resort.

Pip-pip!

*effectively getting ones hands dirty in “trade”.

** “trade” nonetheless, but nothing as dirty as a factory involved..

Boeing’s situation would look much less awful if an Airbus or three suddenly dropped from the sky…

Fast, cheap and dirty “solutions” appear to have been Boeing management’s recent modus operandi.

Potential twofer if blame could be placed on the Persians.

Just saying.

As the final paragraph notes, Boeing’s major issue at this point is not the 737 Max but the fact that they have lost the trust of the public. I’m still not sure if they have realized it. They insisted all along that the 737 Max was safe to fly. After the accidents they argued that it should be back in the air right away. They’ve provided a series of estimated dates for bringing it back into service, all of which have been wrong, and none of which seem to have reflected a realistic assessment of the problem. The overall impression is that they still don’t think they did anything wrong, and any public statements to the contrary are damage control exercises and not sincere.

At this point it almost doesn’t matter when they say it will be back in service, because nobody believes them any more. If they want to convince the public that they have fixed their problems, they first need to convince the public that they understand what they are and have taken the lessons of the crashes to heart. This could easily become an existential problem for them.

Legitimacy is more important for corporations than politicians because the political animal (in power) is burnt-out after three or four years – a lot less than the working life of an airliner.

Pip-pip!

Firing the entire board, not just their incompetent CEO (eventually), would be a great start.

I think Boeing realizes something is wrong, and that’s part of the reason for all the trial balloon articles. They’re hoping at some point that their announcement won’t be met with a chorus of “hell no’s” from the public.

Not sure that will work, might keep reminding the public of the debacle

Boeing has other troubles that are getting overlooked. Several years ago Airbus got a $35 billion contract to supply the US Air Force with aerial fuel tankers based on an Airbus plane. Boeing kicked up a stink and said that it was unpatriotic to have a foreign company get that contract and had the politicians to cancel it so that they could get it themselves in a dodgy process (https://en.wikipedia.org/wiki/KC-X#Restarted_competition).

Well to date the US Air Force have received about 30 of Boeing’s offerings based on the 767 but the only problem is that they cannot actually refuel planes in the air which is kinda what they are all about and the US Air Force is getting a sad face on and again looking at the Airbus design which several other countries are flying with (https://en.wikipedia.org/wiki/Airbus_A330_MRTT) but this whole headache is something that the US Air Force does not need-

https://www.heraldnet.com/business/another-unsatisfied-boeing-customer-the-u-s-air-force/