It looks like a bloodbath is coming Monday for Europe and the US based on overnight trading in Asia. Coronavirus is showing that financial instruments can’t trump the real world.

Mr. Market has finally digested that the world isn’t prepared for coronavirus and the US is particularly poorly set up to cope, thanks to our fragmented public health system and overpriced, privatized and less than comprehensive health care. That bad situation is made worse by the CDC being short on resources and hamstrung further by the Trump Administration’s PR imperatives.

At a minimum, the market rout may force the Administration to go into overdrive on real world responses, but I doubt it has the capacity. For starters, Pence is badly cast as a crisis manager. But as we’ll discuss briefly, the US has such hollowed out capacity on the medical front that a better response would have needed to start weeks ago to have much hope of blunting outcomes.

The US’ best hope is that hotter weather will slow the infection rate, but that’s not coming soon enough to rescue the Eastern corridor or the West Coast from San Francisco Bay north from serious propagation till at least mid May (and San Francisco doesn’t get all that hot except when the weather gets freaky).

Market Freakout

As of 3:00 AM EDT:

Safe-haven bonds continue to rise to unprecedented prices, sinking the long bond yield and with it, all Treasuries, below 1%. From the Financial Times:

The 10-year US Treasury yield dived by more than a quarter of a percentage point to a record low of 0.4949 per cent. The 30-year US Treasury yield dropped below 1 per cent, taking the entire US yield curve below that level for the first time. Investors now face the prospect of the 10-year yield — which stood at 1.5 per cent just 18 days ago — soon joining government bonds in Europe and Japan in negative territory.

S&P futures trading was halted because its 5% plunge hit limit-down circuit breakers. Bloomberg reports traders are “flying blind” thanks to the most important equity futures contract not being off line.

Dow futures were also ugly. From CNBC:

Futures on the Dow Jones Industrial Average plunged 1,198 points, implying an opening loss of 1,246.78 points at Monday’s open. The S&P 500 futures and Nasdaq-100 futures also indicated significant losses at Monday’s open.

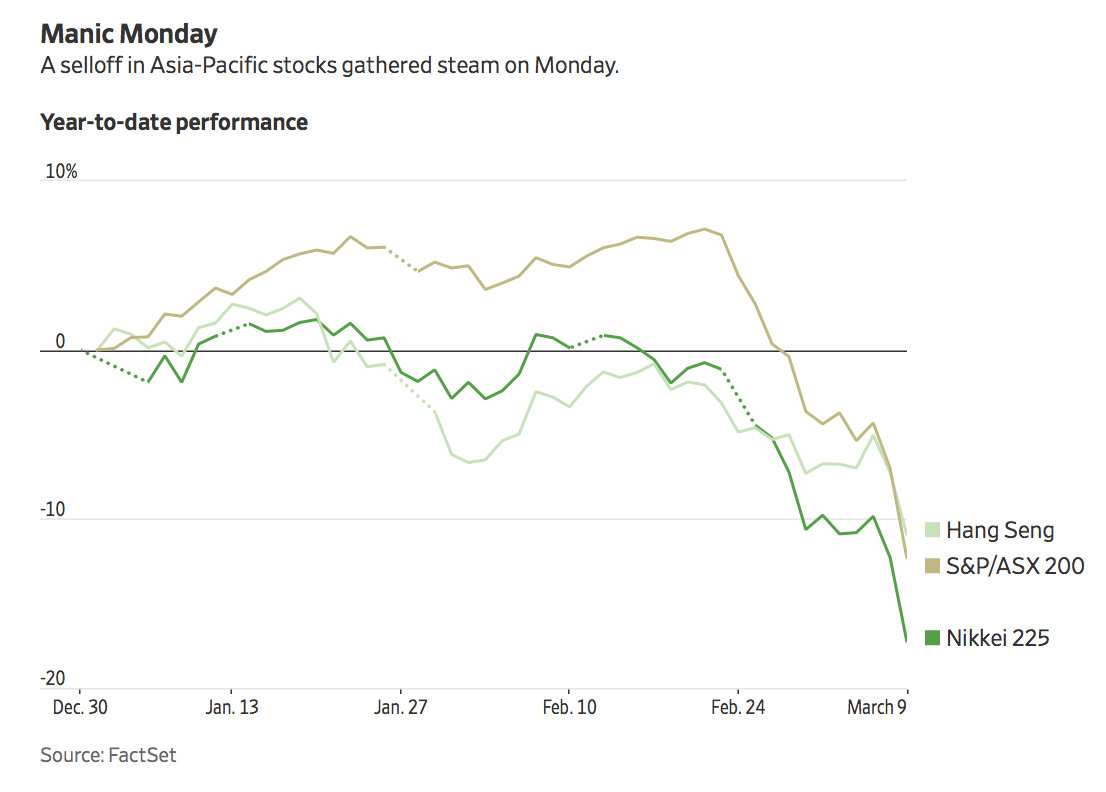

This cheery chart comes from the Wall Street Journal:

The headlines in the pink paper blamed the market rout on oil prices plunging by as much as 30% due to the Saudis cutting benchmark prices for April in a price war with Russia after a production-cutting deal collapsed. Some experts contend that the S&P can’t recover with oil prices cratering, but the bond market rout and other market action (and reactions in the FT’s comment section). However, it was coronavirus which whacked and is expected to continue to diminish demand for oil, leading to the arm-wrestling between Riyadh and Moscow. So coronavirus is the ultimate cause of the upheaval, even though the oil breakdown is a major accelerant. From the Financial Times:

“If you ever wondered what would happen if someone lobbed a hand grenade into a bloodbath, now you know. It’s not pretty,” said Gavekal Research analyst Tom Holland.

A big investor concern is such a rapid fall in oil prices, if sustained, will quickly lead to downgrades and bankruptcies. From the Wall Street Journal:

Oil plunged more than 25%, 10-year Treasury yields dipped below 0.5%, stocks dropped, and currencies swung as the prospect of an energy glut ratcheted up turmoil across markets world-wide.

Investors are responding to Saudi Arabia’s decision over the weekend to cut most of its oil prices and boost output, despite existing threats to demand from the coronavirus epidemic. The move escalates a clash with another major oil producer, Russia.

“The fear today is about a global recession,” said Thomas Hayes, chairman of Great Hill Capital, a hedge fund-management firm based in New York. He said lower oil prices make it more likely some companies would default on their debts.

A Bloomberg story described how the prospect of low oil prices weighs directly on stocks

While the energy sector is now the third smallest in the S&P 500, a change from a decade ago when the industry made up 11% of the benchmark, tumbling oil prices is yet another risk for traders to contemplate.

“If WTI falls into the low $30s and stays there, it’s going to cause lay-offs in the oil patch and stresses in the high yield market — like it did when oil fell dramatically in 2015,” said Matt Maley, an equity strategist at Miller Tabak & Co.

As of the latest report, Brent oil prices have come back a bit off their bottom, down a mere 29%, while West Texas Intermediate is continuing to reel, with prices down by nearly 32% at $28.16 a barrel.

Needless to say, the Saudi logic is puzzling. Riyadh tried this move once before. Its “market share strategy” in 2016 was intended to cripple US shale gas players and other high cost producers like Iran and Russia. But it’s hard to depict that gambit as having been very successful.

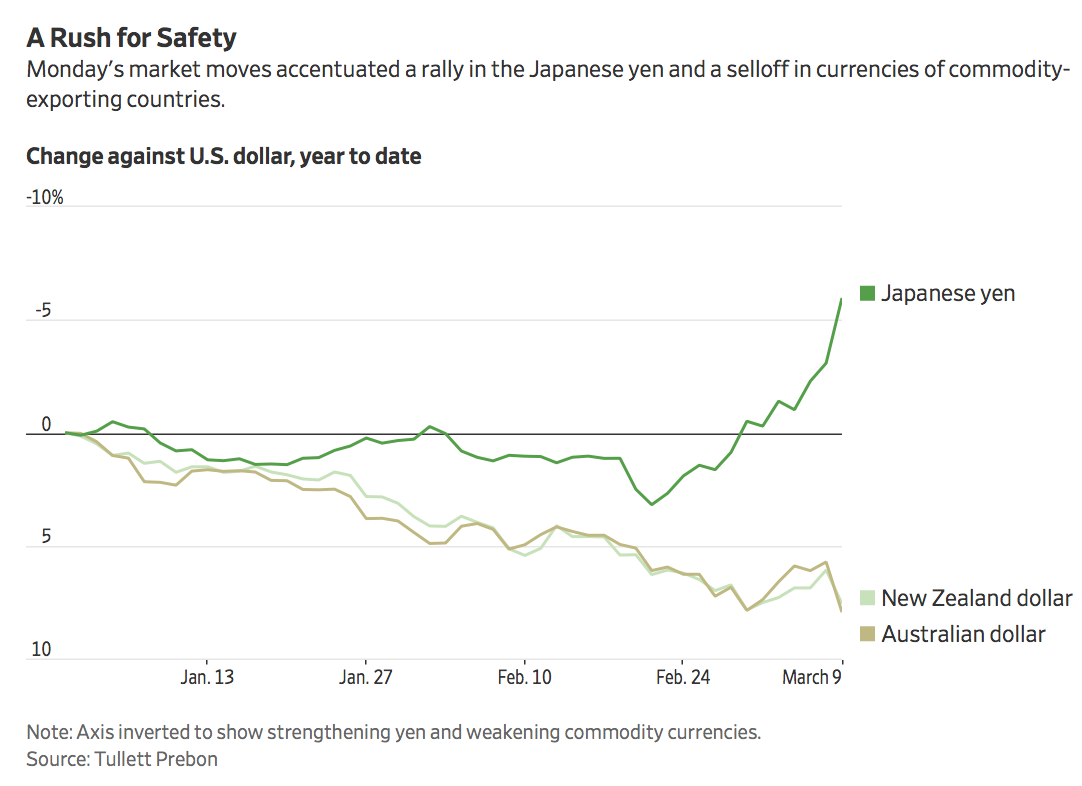

Regardless, other markets are behaving in more or less predictable crisis fashion. Again from the Journal:

However, today, the dollar softened by 0.8% against other major currencies while the euro strengthened by nearly 2% against the dollar. Oil producing nations’ currencies took a dive. From the Financial Times:

The Canadian dollar dropped 1.7 per cent against the greenback while Norway’s krone fell as much as 4.7 per cent to its lowest level against the US currency since 1985. Russia’s rouble dropped 4.5 per cent against the dollar.

The Australian dollar experienced a “flash crash”, plunging almost 5 per cent against the US dollar in just 20 minutes to briefly touch its lowest level since the global financial crisis in 2008. Traders blamed algorithmic trading platforms affecting market liquidity.

Gold had a wild ride, rising 1.8% to top $1700 an ounce before falling 1%. It was at roughly $1663 in Singapore at 1 PM local time.

Some analysts are anticipating another emergency Fed interest rate cut. And bizarrely, there’s even talk of the Fed going into negative interest rate territory, when the central bank had made clear it believes they are ineffective and perhaps even counterproductive. As vlade said by e-mail, “Basically, it can cut to just-above-zero, but then it’s up to the government… which is going to be fun.”

Real World Situation Ugly

The US is still in Keystone Kops mode. We don’t have remotely enough coronavirus tests being done. We have no idea when we will have enough test kits ready. No one is even talking about how to implement a system like the drive by tests in South Korea which is not only efficient but even more important, greatly reduces risks to patients and doctors versus having to show up in a waiting room.

We have lots of ad hoc measures, like conferences cancelled, businesses ordering travel bans, some schools halting classes (most recently Columbia University).

But too many people are operating on a business as usual basis, including Congress. An estimated 2/3 of its members attended the AIPAC conference, where two a participants tested positive for coronavirus (oddly, the press has taken little note). An attendee at CPAC, a large conference for conservatives, also tested positive for coronavirus, but only two Congresscritters are self-quaranting.

Readers Monty and Leroy R posted a link to an account from a surgeon in Bergamo on how a hospital in one of the badly-hit areas is holding up. I strongly urge reading it in full (Leroy also linked to the original in Italian). Key sections:

I myself looked with some amazement at the reorganization of the entire hospital in the previous week…

I still remember my night shift a week ago spent without any rest, waiting for a call from the microbiology department. I was waiting for the results of a swab taken from the first suspect case in our hospital…Well, the situation is now nothing short of dramatic…The war has literally exploded and battles are uninterrupted day and night. One after the other, these unfortunate people come to the emergency room. They have far from the complications of a flu. Let’s stop saying it’s a bad flu. In my two years working in Bergamo, I have learned that the people here do not come to the emergency room for no reason. They did well this time too. They followed all the recommendations given: a week or ten days at home with a fever without going out to prevent contagion, but now they can’t take it anymore. They don’t breathe enough, they need oxygen….

Now, however, that need for beds in all its drama has arrived. One after another, the departments that had been emptied are filling up at an impressive rate. The display boards with the names of the sicks, of different colors depending on the department they belong to, are now all red and instead of the surgical procedure, there is the diagnosis, which is always the same: bilateral interstitial pneumonia…

I can also assure you that when you see young people who end up intubated in the ICU, pronated or worse, in ECMO (a machine for the worst cases, which extracts the blood, re-oxygenates it and returns it to the body, waiting for the lungs to hopefully heal), all this confidence for your young age goes away… And there are no more surgeons, urologists, orthopedists, we are only doctors who suddenly become part of a single team to face this tsunami that has overwhelmed us.

The cases multiply, up to a rate of 15-20 hospitalizations a day all for the same reason. The results of the swabs now come one after the other: positive, positive, positive. Suddenly the emergency room is collapsing. Emergency provisions are issued: help is needed in the emergency room. A quick meeting to learn how the to use to emergency room EHR and a few minutes later I’m already downstairs, next to the warriors on the war front. The screen of the PC with the chief complaint is always the same: fever and respiratory difficulty, fever and cough, respiratory insufficiency etc … Exams, radiology always with the same sentence: bilateral interstitial pneumonia. All needs to be hospitalized. Some already needs to be intubated, and goes to the ICU. For others, however, it is late. ICU is full, and when ICUs are full, more are created. Each ventilator is like gold: those in the operating rooms that have now suspended their non-urgent activity are used and the OR become a an ICU that did not exist before. I found it amazing, or at least I can speak for Humanitas Gavazzeni (where I work), how it was possible to put in place in such a short time a deployment and a reorganization of resources so finely designed to prepare for a disaster of this magnitude….Nurses with tears in their eyes because we are unable to save everyone and the vital signs of several patients at the same time reveal an already marked destiny. There are no more shifts, schedules.

Ambrose Evans-Pritchard has another fine piece on the coronavirus outbreak. He flags that the UK is very poorly situated to handle it, with only 1/6 the ICU beds per capita of South Korea. As an aside, the US has 10x as many per capital as the UK…but read the Bergamo piece again. The entire hospital has been turned into a coronavirus ward. Lord only knows what happens to accident victims….are some hospitals in each region being set aside for regular emergency care?

Here is AEP’s take on Italy and the implications:

Data from China suggest a death rate of 15pc for infected cases over the age of 80. It is 8pc for those in their seventies, and 3.6pc in their sixties (or 5.4pc for men). No elected government in any Western democracy will survive if it lets such carnage unfold….

Unfortunately, the early figures from Italy seem to be tracking Hubei’s epidemiology with a horrible consistency. The death rate for all ages is near 5pc. While there may be large numbers of undetected infections – distorting ratios – Italy has tested widely, much more than Germany or France.

For whatever reason, the Italian system seems unable to save them. The death rate is six times the reported rate in Korea, even adjusting for age structures. Is it because the Italian strain has mutated into a more lethal form (we don’t yet have the sequence data) or because Europeans are genetically more vulnerable?

Is it because Italy’s nitrogen dioxide pollution is the worst in Europe (the UK is bad too), leading to chronic lung inflammation? Is it the chaotic administration that led to a catalogue of errors in the hotspot of Codogno?… If you think Britain’s NHS has been starved of funds, spare a thought for Italy, Portugal, Spain, or Greece….

The US is about to face its grim reckoning. It has the best health care in the rich world – and the worst. Pandemics exploit the worst.

Let’s tease out AEP’s line of thought. The US is sorely wanting in operational capacity despite being able to provide top flight care for certain types of ailments.

US hospitals are now overwhelmingly run by MBAs. It’s difficult to conceive of them being able to execute the sort of rapid reordering of space and duties described in Bergamo. It’s not simply that the top brass is too removed from the practice of medicine to have the right reflexes. Unless ordered to do so, they will also be loath to devote enough resources to tackling the disease. When a crisis hits, they won’t be allowed to charge (in their minds) for coronavirus services. They’ll want to preserve as much hospital capacity for “normal” full ticket services as possible. They might rationalize that by arguing that they don’t want to risk more of their staff’s health than necessary.

But even worse, remember that most hospitals no longer control much their staffing. They’ve outsourced specialist practices like emergency room doctors….and those have been bought up by private equity. If you think private equity won’t exploit this crisis for their gain, I have a bridge I’d like to sell you.

One possible silver lining to this probable tragedy is if the US medical system performs as badly as it appears likely to is that it might finally end the delusion that there’s a lot (aside from individual doctors and nurses) in the current system worth saving. The broad public needs to make sure that their crisis does not go to waste.

I guess another mixed positive is that it shows you don’t need Bernie Sanders to crash the stock markets. The thing is quite unstable on its own thank you very much.

Biden, Sanders and Trump are all 70+, the most at-risk part of the population, and will be exposed to lots of people (Biden and Sanders more so now, Trump probably later on). I guess if Trump died of CV, Pence would stand at the elections as the candidate, but what would happen if say Biden died after selected at the convention?

His VP Hillary would be chosen well before his death.

Biden is now having attacks of senility every day even with his exposure to the public being kept to a minimum. I’m not sure he makes it to July, particularly with the GOP now guns a blazin’ on his cognitive abilities.

Yes- quite illuminating to see the contempt Dem party worthies hold for us and the office of President In selecting Goofy Joe as « the » candidate.

When I saw the video showing Biden mistaking his wife for his sister, I was reminded of my father. And, yes, Dad had Alzheimers.

It’s sad. BUT, what is astounding is the MSM goose-step synchronized Joe Joe Joe drumbeat tempo march. Sickening.

Blinders? Grasping at straws? Credibility capital be damned/ squandered?

Bloomberg is forcing the party to commit suicide in exchange for cash?

Bloomberg could have given everyone in the US $1 million dollars and still had money left over instead of wasting $500 million dollars on ads.

Based on an estimated fortune of around $65++ billion, Bloomberg could afford to give every citizen of the US (current pop = 330 million?) just under $200 per person and still have a billion or so left over for himself.

Not too bad but quite a long way from a million per head.

No. The party is choosing the risk of suicide in order to achieve No Nominee Sanders.

No doubt that JB is having cognitive and memory problems but it seemed to me that his wife and sister switched placed when he turned to where he thought his sister was and mistook one for the other without looking!

I have more issues with that crook Biden besides his senility – he’s a dyed in the blue neoliberal. He wants to cut social security and other programs for the people. He’s a big supporter of the financial industry and the MIC to name a few. His son should be behind bars for graft.

Why just Biden? This is a question that should be asked of all three: Trump, Biden and Sanders – with or without COVID-19. It’s pretty much a given that a lot of illnesses like flu, pneumonia and other viruses cause significantly more harm to the over 70 crowd. Plus, as my cardiologist says to me at the end of every visit (since I flew by age 75): DON’T FALL.

At least Sanders would understand the question and give a cogent and detailed reply.

The best objection I’ve heard to Bernie came from someone who said he feared for his 401K if a Sanders presidency occurred. I reminded him that the markets managed to crash all by themselves in 2007-8, but further thought discloses he was mistaken about what constituted wealth.

“Wealth isn’t about having lots of money; it’s about having lots of options.” – Chris Rock

So if the hedgies and other plutocrats crash the economy providing the options, even if lots of dollars, stock certificates, gold bullion, etc. is in their hands, they are sabotaging their own wealth.

“Saving” Wall Street really amounts to “saving” the tapeworm while discarding the host.

“Saving” Wall Street really amounts to “saving” the tapeworm while discarding the host.

But we love love love our tapeworm — especially our “healthcare plans” and “capitalism”.

The Fed was supposed to take away the punchbowl just when the party was getting going, instead we had the troika of Greenspan, Bernanke, and Yellen gleefully pouring in gallons of 101 Wild Turkey at 2 A.M. and now the hapless Powell is zero-bound and duty-bound to do the only thing in the modern CB playbook: ease more. TARP and the first trillion? OK, keep the doors open at Citi. The next 3 trillion in free money (thanks Obama)? Socialist handout to the rentier class. That bill is now due and payable.

The grotesque distortions in the entire concepts of lending and investing were as plain as day to see. The four CEOs of the top four Eurozone banks told the tale, quote: “zero interest rates destroy the banking system”. Was anyone listening? Did our titans of central banking, whose *first* stated job is the stability of the banking system, heed the call? How do systems and currencies based on the extension of credit even work if lenders are to receive *nothing* in exchange for taking risk? Riddle me that, Ph.D-breath.

This is malpractice and criminal incompetence on a galactic scale, from our hallowed universities, who feed a steady monocultured diet of pure neo-Keynesianism, through to our “financial press” paid cheerleaders, to our mustachioed “economic pundits” who treated the entire crisis diagnosis and prescription (“we must make things more expensive!!! More gasoline on the fire!!!”) as though it seriously made *any* logical sense at all. In lockstep they go, right over the plainly and painfully obvious cliff.

So now we get to watch, again, as they play a game of “who gets screwed worse than me?”. The phone lines are absolutely buzzing, as Hapless Jerome realizes his broom is so short it cannot possibly stop this outbound tide. I’m sure Bezos and Dimon and Gates and Buffet will be fine, again, Mr. Henry Longbottom of Periwinkle Court, Anytown, Ohio, homeowner, coupla kids in college, small 401(k) not so much.

If Mr.Longbottom actually owns a real home with a real yard around it, one hopes that he has spent some of his meager savings turning that home into a suburban doomstead-fortress of neo-peasant survival. High intensity micro-gardens, super-insulation, house able to produce its own heat and cool, roof and cistern system set up to store thousands of gallons of roofwater, water-free composting toilet, etc.

I don’t get why EUR is strenghtening against USD, as the CV will hit EU economy harder than the US – Germany is still massively dependent on exports, and narrowly avoided recession last year, and Italy, one of the largest EU economies, might be going into lockdown. There’s zero chance of ECB not doing something, and likelyhood of at least some governments spraying cash is high.

Meanwhile, it looks like in the UK the time fo July 1 EU extension date will be spent fighting coronavirus, so no-deal is pretty much assured by now. That said, there’s a silver lining for Johnson, as any recession next year can now be safely blamed on CV.

It will be interesting to see what the UK’s budget, due on Wed will have, although any stuff that could have been eyecatching a month ago is likely to be overshadowed now.

“Why EUR is strengthening against the USD”

I think there is an idea that a lot of money is sitting in USD because of its safe haven status, strong economy, and current lack of negative rates, but this crisis leaves some thinking that the Fed is thinking about going negative (even though they say they are not) which means since major currencies are negative or near negative, so that (a) money will have to move out the risk curve to get a positive yield and (b) the EUR starts looking attractive as a carry trading currency.

EUR is already negative at -0.5%. US would have to cut by a full percent to get there, and I believe that extremely unlikely.

Moreover, it’s very likely that the Europe will get fiscal stimulus – whatever the Germans say, there’s no avoidining the fact that no rate cut (even deeper into negative territory) will do little for the EUR economy. If Germans become pigheaded about it, it may even risk EUR/EU IMO.

The only reason I could see going long EUR against USD would be if you except the US response to be so much worse than the EU one. Which, with Trump at the helm and the elections coming, is possible – but certainly not given.

I would agree that the Europe would announce stimulus. However, at the moment it seems the market is more focus on possible US rates and stimulus, much as it was not focusing on the coronavirus as much weeks ago.

As much as Trump has made about as much a hash of this as he possibly could, the Federal government can’t do much save pass some bills to throw money at the problem. And remember, it is the Dems that are the party of fiscal orthodoxy. They’ll be as reluctant to commit big numbers as the Republicans.

Public health is in the hands of states and localities, not the Feds. In theory, the Feds can declare an emergency and do things by force, but in practice, states beg for help and then the Feds declare an emergency and send $ and FEMA and maybe the National Guard.

Our screwed up private health care system is not even remotely fit for or inclined to deal with a public health crisis. You may have seen in Links how one of America’s elite hospitals, Mass General, told an prestigious private employer that if any of their employees came to the ER for coronavirus testing, they’d be hauled off by (campus) police. And they didn’t offer an alternative.

Remember how the supposedly oh so technically/bureaucratically competent Obama Administration botched the comparatively simple Obamacare rollout?

I’m really sorry.

That said, I doubt the market can see it clearly as you do, and baking in very bad US reaction IMO would break too many of their “givens”.

I remember it well. Then they threw money at it with yuuge corporations to try and fix it. Probably to one of Obomba’s buddies.

The whole concept of connectinginsurance cos’ databases to the Obamacare site was a patently bad idea.

At the very least, our favorite neo-liberal democratic President Obama did set up 47 anti-pandemic programs in countries that have enormous vulnerability to deleterious viruses in order to keep them from spreading worldwide…….and President PT Barnum dismantled 37 of those programs. Maybe we would have a better handle on Coronavirus if he hadn’t shuddered those programs.

The glue appears at the start of the article:

“the US is particularly poorly set up to cope, thanks to our fragmented public health system and overpriced, privatized and less than comprehensive health care. That bad situation is made worse by the CDC being short on resources and hamstrung further by the Trump Administration’s PR imperatives.”

Basically, it is expected that Europe manages the crisis less badly.

As I replied to Yves, I buy that – maybe, seeing the confused, contradictory etc. reactions of the government in the place I spend most of my time, and the not so much better UK ones (at least UK has a plan. But it doesn’t have the resources to implement even parts of the plan. Anyone for a game of fantasy pandemic?)

But I don’t believe enough market participants believe that.

Ben Carson and the Surgeon General were on the talking head shows yesterday and both said there was a plan but it couldn’t be revealed because it wasn’t fully ready yet. That was a masterstroke of PR genius to ensure confidence in the public and markets as we are seeing.

The USD is partially being hammered because it is an oil exporter.

US exports will drop; EUR trade balance will improve.

We have swapped diesel to Europe gasoline for many years, so we both import and export oil and it’s products.

The us has been a net oil importer every year for the past half century, including 2019, though declining on account of uneconomic fracking to the point that we did net export for the last four months of 2019. Fracking has been a money loser from the beginning.

Recent net exports of around 1/10 that of Saudi are not particularly significant, both bc the sweet spots were fracked first and now in decline, and anyway foolish investor funds chasing imaginary yield were drying up prior to ongoing oil crash. Many bankruptcies coming to the oil patch. IMO we will revert to our historic net importer status this year.

EUR has negative rates, so is a funding currency. If you need to shut down your positions you will end up buying EUR, CHF and JPY. All excellent currencies to fund your positions.

Also worth noting that EU has been exporting capital to the US for years. EU pension funds like +ive yields.

Finally, EU may be useless. But US is in total denial. This country will have maximal infection rates. Indeed it might well already. We just dont know cos they dont test, cos they dont have tests!

I see, so it’s technical (in sense people closing their funding trades). Hmm. I’d have thought that people who would be closing (say) US equities positions that needed funding would move to UST or similar, as opposed to buy into appreciating EUR and realise their losses – even if they believe that their funding is about to become cheaper.

It has been interesting watching Dr. John Campbell’s growing realisation & some shock that everything is not well with the US healthcare system & he has received some abuse but also support from Americans for his growing criticism. His listing as requested of his 2 degrees & Phd, never mind his long front line experience & his books I think shut some up for perhaps thinking that he was only a nurse, but perhaps he shouda gone to NakedCapitalism.

Well if you were real money that might well be so. But not if you were a hedge fund. One should also consider the VAR shock effect on risk carry capacity. Even if you still liked your UST bonds funded out of EUR, your risk manager (hedge fund or bank) might well wander past you and tell you to cut the position by 30% cos vol has risen.

One should probably avoid thinking like a Dutch pension manager, but as US rates come down, the advantage in holding US bonds relative to EUR bonds is declining. Still better than paying for the privilege of lending a government money, but the its not the trade it was 3 months ago.

Re UST – well, the UST is appreciating right now. The problem becomes when you have to roll anything maturing (or, as a fund investor, put somewhere new money, should any come in..), but then the question is “where?” and might become the least-worst option rather than really something special.

Re real money vs. hedgies – TBH, it’d be a pretty bad risk manager (internal, banks are dumb like this), as either he’d have done it a week ago (hey, I knew it was coming, and re-weighted, so professional investors should know too), or look at other options to mitigate first. But if there’s a risk manager who follows the advice of VaR, then you’re already doomed (banks at least have the excuse that they regulators tell them to).

The likelihood I’ll be able to continue my Chemotherapy ( I’m halfway through a 6 moth course of treatment) is now close to zero.

And I have a lot of company.

I am so sorry. But if my guess about provider profit motives is correct, you may be OK.

I think TS is concerned about his immune system being suppressed by the chemotherapy (BTDT). Making him more susceptible to Covid-19. The US hospital system is likely to be under duress for the duration of CV.

Hang in there, Tom.

I can only send my heartfelt best wishes, powerless as I am to do anything other than offer warm words. But you can have them, without hesitation, for what little they are worth.

One thing which will need to be forcibly addressed when the dust has settled on all this is how we treat older people in our healthcare settings. I will quote directly from the Telegraph comments section (yes, I know, that Telegraph; it does though sometimes yield useful and informed reading reading):

I am making firm plans to do battle with whoever needs to have battle done with, should the need arise, to ensure my mother-in-law doesn’t get lumped into the “disposable” bucket. I’ve seen, firsthand, how this is genuinely the case. Not everyone will have someone fighting their corner, or, even if they do, knowing how to effectively fight.

2 of about 15 serious cases in the NY area in hospital are people in their 30s. This idea that the young don’t get very sick too is bogus. And Americans are generally unhealthy (diabetes leads to a much higher rate of pneumonia even with garden variety flu) so generalizing from China may not apply that well.

And see this from Twitter:

https://twitter.com/FYang_EP/status/1236723843097649154

I don’t think that “young don’t get very sick”. But the statistics so far says that fewer of younger cohorts get serious complications.

The “normal” flu complicatins/mortality curve is U shaped (spanish flu had a hump in the middle).

This one, so far, appears to be more J shaped.

But it very well could be that the shape of the curve (J not U) is not due to the virus, but something entirely different, and when it hits RotW, it gets normalised to the U shape.

It’s clear that anyone can die of it, but the risk seems to be considerably higher based on health and age (Italy has some of the oldest population in Europe, and a lot of that population smokes or used to smoke).

“Serious complications” = like the Italian cases above, being so sick you are having trouble breathing.

It’s not at all clear that people in their 30s-50s get serious cases less frequently than older people but that they are more likely to survive if they get to a hospital when they are really sick. Recall that there were >150,000 people in Wuhan at home begging for help on Weibo because they or an immediate relative was desperately ill and told there was nothing that could be done to them because the hospitals were full. That is 2x the official # of cases in Hubei. So we have no data on how people fare when left to their own devices.

I can go only the data I have. The only two papers I saw on large samples both claim that younger cohorts are less likely to develope serious conditions.

Per the BBG article I posted yesterday, the tipping point is whether the virus gets to the lower respiratory tract. IMO, that is affected by viral loads and the health of the upper respiratory tract, which _in general_ will be better in younger people.

Neither of which means that young are ok, don’t get ever sick, and don’t die. But the numbers so far suggest that it’s less likely they get severely sick, and can recover better (one of the key drivers of the pulmonary death is the immune system going to overdrive and killing stem cells that help with lung regeneration., basically stopping any chance of recovery. This is clearly bigger problem for the older than younger, who have fewever stem cells to begin with).

Thus far, the WHO is sticking to its line that:

And in France, Macron is saying similar:

They could all be lying or misleading by omission or selectivity, of course.

Same in the U.K. and on the Diamond Princess — deaths were in the older cohort.

That isn’t to say that some young people won’t get sick and some won’t get serious illnesses and some won’t die. But so far, the reliable (i.e. non-China) data does continue to support the age-indicator for the likelihood of morbidity.

What is — and continues to be — a big mystery is the lack of deaths in Germany.

Limits to visiting the elderly have been imposed in Spain. I think it is necessary but it is sad for me. I don’t know if next Sunday I will be able to bring mom home, as long as nobody at home shows symptoms, of course.

If its any comfort, a colleague was saying that a few years ago a ban on visits to a nursing home due to a flu outbreak was the best thing that happened to her elderly father. They didn’t realise that their frequent visits had led to him not bothering to socialise with other residents. When no family could visit for a month, the staff told them he made lots more friends and was generally much happier.

I’ve been wondering about Germany, too.

One possible explanation: Germany counts a COVID-19 death only if there is no other pathology present to explain the death. (I also saw yesterday that the FAZ then reported one death, but that hasn’t shown on the Johns Hopkins site.)

From Italy’s numbers (where I live in a newly-red zone), I’d guess they count every case in which COVID-19 is a factor, regardless of other pathologies.

I’m no medical person, but I’d guess given the pace of events, each authority must choose one or the other of these rules. I’d think no nation can possibly do enough autopsies fast enough to meaningfully tease out a “principal” cause of death.

I think this is correct. Here in the U.K. for example, if you croak with COVID-19 as an active diagnosis and the cause of death is primarily caused by, say, respiratory failure, you’re a COVID-19 cause-of-death fatality. But all of the deaths in the U.K. have been in people who were already sick (and it’s suggested they were perhaps very sick — “had been in and out of hospital” for one poor unfortunate patient) so their primary disease process was maybe quite justifiable as listing as a cause of death but in the U.K. the coroners are being guided to issue death certificates with COVID-19.

I’m sure this is customary. When my grandmother-in-law passed away, she had long term lymphoma. But she was finished off by a respiratory infection so that was the cause of death that got listed. As I knew her well, I knew for certain that, in fact, her real cause of death wasn’t either the lymphoma or the respiratory infection, it was the “killer” heatwave in 2003 which had severely weakened her physically that summer. But what I, as a mere family member, suspect (with good reason) isn’t medically qualified and so doesn’t enter into what gets listed as the cause of death.

Germany may apply a more “primary illness” cause of death categorisation. It is made out like it’s a science by the medical profession, but as my tale of my grandmother-in-law shows, it is in reality much more subjective sometimes.

Aw, c’mon, it’s not rocket science, it’s medical science. The older you are the more severe infections of this kind are going to be. The danger here is that a younger person with the COVID-19 virus will infect older people. The younger will survive; the older will not. These are medical probabilities.

“What is — and continues to be — a big mystery is the lack of deaths in Germany.”

Not anymore, first two deaths reported today, Heisenberg and Essen.

“What is — and continues to be — a big mystery is the lack of deaths in Germany.”

I’m curious that I’ve not heard of a single case in any South American country – tho’ that may just be that South America does qualify as news these days.

Yves,

Just a POI.

A friend of mine – one of the world’s experts in the human genome and a molecular biologist (ret) – said that it is not the heat that causes the virus the problems but the humidity.

He explained that increased humidity brings the growth of both bacteria and fungi that eat viruses. He said that the effect is that the virus cannot live long on exposed surfaces and this slows down the infection rate.

On surfaces SARS CoV 1 has shown to retain infectivity for longer when these are dry. Then, you cannot separate easily the effects of humidity and temperature but usually the higher the temperature, the higher the absolute humidity, and this means our epithelial mucosae are better hydrated and less susceptible to infection, in part probably because protective microflora in good shape helps to protect us. So, in order to become infected in warm/hot weather a higher virus load is necessary and the possibility for a mild or very mild infection is higher. I personally think that passing a mild cough these summer would be preferable to something more serious next winter, though I am not sure if a mild infection would trigger a protective immune response.

What I’d like to know is whether inhalation therapy (saline solutions) may make it better or worse.

We use it now and then as a therapy for my young daughter, but I’d hate if this helped to introduce the virus from upper to lower respiratory tract.

I wonder how many people have contracted the virus @ higher altitudes, where humidity isn’t a factor?

Comparison of Durban and Johannesburg in S Africa would answer your question.

Durban is on the Coast.

Johannesburg is 5000 ft+ on the Highveldt.

One in Tibet, one in Nepal.

One in Tibet, one in Nepal.

None in Bolivia.

“It ain’t the heat, it’s the humanity.”

This article gives a very cogent identification of the factors leading to a fatal lung infection. To distill it in few words : it is either because the immune response is slow, and let the virus multiply too much in the lungs, or there are several infections occurring at the same time, and even if the immune system reaction time is normal, there are too much virus in the lungs after that time. In both cases, the immune system response to too much virus triggers an irreversible necrosis of lung tissues.

Young and healthy fatalities clearly belong to the second group, and explain why young Doctors and Nurses are impacted.

Therefore the strategy must be self isolation of fragile people (old is not equivalent to fragile, both way, and yes, being immuno-depressed by chemo sucks, it is really being thrown between a rock and a hard place), and frequent rotation of healthcare workers. Ideally, one should have them work one day, then send them home three days, test and send back to work is negative.

Another way is too have 2 health systems, one for the virus, one for the rest. This is what one of the main hospital in Paris did : they installed their reception and triage area in a tent separate from the rest of the hospital

For others, lowering the absolute quantity of virus to which they are exposed when they contract the virus is essential : open these windows if you can !

That is very helpful re the explanation of cases among the young.

Might that suggest that those who suffer from autoimmune diseases are also at higher risk?

Perfectly consistent with Bergamo reddit you kindly posted

Clive, as an almost-80 year old myself, I appreciate your care for your mother-in-law. I have been touched by the daily concern of my son and daughter-in-law, as they check in with me a couple of times a day, offer to do grocery shopping, drop off little bags of herbal tea and chocolate cookies. It means a lot.

Last night, I had read the ‘testimony’ of the hospital physician in Bergamo, whom Yves quotes above. One thing to watch for is the speed at which this virus results in respiratory distress (and this was mentioned by the Seattle-area care home staff recently; a patient was symptomatic but not distressed, then, boom, they can’t breathe, and they die.)

The Bergamo doctor explains the difference between the ‘normal’ seasonal flu and this virus: ” … in classical flu, besides that it infects much less population over several months, cases are complicated less frequently: only when the virus has destroyed the protective barriers of our airways and as such it allows bacteria (which normally resident in the upper airways) to invade the bronchi and lungs, causing a more serious disease. Covid 19 causes a banal flu in many young people, but in many elderly people (and not only) a real SARS because it invades the alveoli of the lungs directly, and it infects them making them unable to perform their function. The resulting respiratory failure is often serious and after a few days of hospitalization, the simple oxygen that can be administered in a ward may not be enough. “

Like all the others here, I can only offer you my best wishes, please just take care of your health. With luck, specialist areas like oncology can be ‘ringfenced’ from the chaos that will occur elsewhere.

Thank you all for your good wishes.

I am taking all of the recommended precautions so my survival will be largely a matter of luck and I have always been lucky when it counted.

I know many cancer survivors, Tom. You will be another one.

I wonder about some other impacts on the supply end as well as the demand end of health systems.

A NZ example: plasma production. NZ is proud to collect all its plasma needs in country, as a completely volunteer system (we won’t get paid to donate). Average donor gives 5-7 times a year (max is once every 2 weeks). It’s all collected in one of 10 donor centers around the country. And this is the time of year when they normally try to ramp up production to prepare for the winter rush.

But how are they going to keep collection going in large room, adjacent donor setups where we are in the chairs for 45-120 minutes? The risk-factor for community spread seems huge. And not much collection if we’re all self-isolating. How many other vulnerabilities are there?

But Tom, the physicians have to follow the protocol and complete the treatment, don’t they?

Take all precautions required and keep hope!

We need to destroy this system.

Best wishes Tom.

I would think Chemotherapy wouldn’t compete for equipment or drugs with pneumonia treatment – or even for personnel, unless things get really extreme.

And as Yves suggested, you may benefit from the hospital’s profit motive: Covid-19 treatment will have to be free, yours won’t.

Anyway, good luck and best wishes. Try to keep us informed.

Hang in there, Tom. I just finished in Nov. The first half of the course will have knocked over almost all your cancer cells, the rest is to be sure. Even if you not fully cured, the cancers will be on last legs and you will be okay until the world resumes again. Stay safe and at home if you can

That’s tough to hear Tom Stone. I know a few people, including my wife, who will probably, no certainly lose their chance at an operation because of all this.

The Australian stock market had a blood bath today and lost about $100 billion with comparisons of 2008. There has even been talk of Quantative Easing but will have to wait and see what are in the details of the economic package that the Australian government is about to announce. Now that it is hiting the economy is the government taking Coronavirus seriously.

I wonder if there will be a shaking out of a lot of false value in the stock market. What I mean is that people will be taking a very hard look at what a company does and what it’s projected earning will be, especially after the worse of the Flu Pandemic is over. I just find it hard to believe that there are a lot of people saying “Oh man – the market is crashing. I have to go get me some shares in the US shale industry, Uber, Lyft and Airbnb!”

https://7news.com.au/business/markets/virus-driven-slip-tipped-for-aussie-shares-c-735679

On the oil thing: might the supposed ‘war’ between Russia and KSA have other collateral victims? The fracking industry might hold on internal US demand and massive bail outs if needed, but what if US’s demand falls?

It should be carefully analysed the, IMO more than very likely, relationship between the severity of respiratory diseases with NOx and particles pollution and then act consequently. We don’t want a recovery in oil consumption.

There will be lots of collateral damage – Venezuela, Iran, Brazil, Nigeria, Canada, plus US fracking – all will suffer seriously from oil prices that low. Environmentally, its pretty good that both tight (fracked) oil and heavy tar sands crudes will be catastrophically unviable.

It might also ironically be a serious blow to many airlines as they will have hedged for higher prices.

US demand falls?

One option is our strategic petroleum reserve.

Other nations might have too, or consider having one.

Does China benefit? Or other oil importers?

How much does this hurt Russia, if this does?

Because of its reliance on oil, the Méxican peso fell more than 5% today. An oil price war will be a disaster for this country. The economy here already was on its knees before this.

https://www.bloomberg.com/news/articles/2020-03-08/coronavirus-nears-fatal-tipping-point-when-lungs-are-inflamed

this suggests that mild cases are where the virus is topped in upper respiratory tract (nose/throat). Once it gets to lungs, that’s where problems start.

Not an expert, but IMO:

– higher viral load = more likely to get to lungs.

– asthma, smoking, pollution, other respiratory diseases = more likely to get to lungs.

Sounds exactly like what I already had near the end of January, which is similar to something I’ve gotten many winters living here (in AZ). Although this case this year was particularly nasty as far as the cough, it did not go deep into my lungs as in some previous years. It was mostly the upper part of the lungs. I suspect it was a coronavirus, but perhaps not the CV.

The SW is a hotbed for Aspergillus, a fungus that infects the lungs, esp. if immune suppressed. The lesions show up on x-ray and can look like cancer. You might want to be checked for that.

Anyway, glad you recovered.

IMO you are right. Haven’t look at this and don’t know what is more harmful if NOx, the particulate material or their combination. I will do a search when I I have time. West Germany has great concentrations of NOx but so far no fatalities have been reported there, as well as very few recoveries, they are in the first stages of the epidemic. They may have also provided good prevention measures for the most vulnerable.

I too was thinking the oil price war Saudi Arabia launched against Russia, after Russia said no to output limits, might add the possibility of Western recession, as Saudi Arabia is running out of financial reserves and can’t win such a war as Russia better positioned. And the irony of Russia turning the tables on the West regarding low oil prices to help push the West to recession.

But seeing this morning all the other things going on in the market, this seems a small contributory factor.

How would low oil prices push the West into recession? Low oil is generally good for consumers.

It’s bad for investors in US oil (shale in particular), so can be bad for a lot of pension funds, but for day to day stuff, low oil tends to be good.

Saudi have 500bln in reserves, Russia 450bln.

Where it would play something is moving Russia to even more of an autarky.

That said, from what I know Russian health system is in a real mess, so if CV came to Russia in force, they would be in very serious troubles (especially given that a lot of 50+ Russians aren’t in great health).

It could crash Mr Market oil stocks and wipe out fracking and such, creating possible liquidity issues and bankruptcies which could spread. But honestly I’m not up on the details if this could even cause any domino affects with bankruptcies, or not.

But to the Fed, Mr Market is the whole economy and nothing but the economy, Fed job #1 being to make stocks always go up.

Saudi Arabia is far more dependent on oil and tourism (also being hit) than Russia. Hence Russia’s reserves I think would last far longer that SA’s can.

Saudi Arabia is already in the hurt locker and has run down their financial reserves under Mohammad Bin Salman Al Saud. In addition, their little expedition to Yemen is costing them billions of dollars per month which is not helping. With international tourism fading away, the threat of some two million pilgrims not being able to travel to Mecca and spending their money there as well as plummeting oil prices, 2020 is not going to be a good year for Saudi Arabia. Just to make things worse, they have their own problems with Coronavirus which may knock out important links in the Royal family.

Indeed. A pattern with Salman seems to be emerging, of him rashly starting wars or policies he can’t win/finish. Makes you wonder if others in the royal family are seeing this and noticing SA is burning thru it’s reserves and the solution might be a change in leadership?

I was just reading an article saying how Saudi Arabia need $60 a barrel for their budget but that now it is heading towards $20 a barrel. If they wanted to achieve a massive cost-saving, they could give their Royal Family the chop – perhaps literally so. Last I heard there were over 6,000 of them-

https://asiatimes.com/2020/03/oil-to-hit-20-amid-saudi-russian-price-war/

SA would have more problems with reserves than Russia, that’s definite – if nothing else, Russia exports/has other things than oil, SA doesn’t.

Oil stock crash would not cause Western recession. It could well cause recession in Texas and similar, but I very much doubt it would cause even US recession, as the problems in Texas & co would be offset by the much lower prices at the pump.

Oil debt crash would be much worse, but still I suspect brunt of it would be borne by investors, not banks.

best energy writer Gregor McDonald breaks it down

Thanks for this excellent analysis! When oil consumption permanently plateaus, as it’s about to, the stock and debt value of the industry . . . flatlines.

That’s the good news from Grow or Die.

>Oil stock crash would not cause Western recession.

You are right; it won’t be a “recession”.

Modi could be one big winner – i saw one estimate (on Twitter, so it must be true) that the drop in oil import costs could add 2% in Indian GNP this year.

It is not good for all consumers as so many of them depend on the oil/fossil fuel industry for jobs and sales. In the US the oil/gas industry accounts for almost 10 million jobs and their average pay is well above median income. A recession in the states which are dominated by this industry will have large ripple effects into other industries like auto/truck/heavy truck manufacturing. Having low oil prices adversely effects the renewable industry as well. House prices tend to fall some, consumption drops. All the usual things. Couple this into all the other headwinds facing the economy and they will overwhelm the positive effects of lower prices at the pump.

A quick example: One of my BIL’s runs an oil field service company in Wyoming. In a downturn like this he might order 10 fewer HD 4×4 3/4 – 1 ton diesel pickups, 5 fewer HD trailers and associated welders, generators, tool sets just this year. That is over a million less spending in his community. He would need about 20 less employees to operate the trucks at salaries around 100K each so there goes another million out of the community. Lots of ripple effects from there.

see my comment in moderation. US GDP mining (most of which could well be oil) is 1.6% of the GDP.

I’m extremely sure that your 10m jobs is wrong. Total US employment is about 130m, and I very much doubt that the extraction industry would account for just about 8% of all US jobs.

A brief look at the breakdown says it’s less than 1m, which is about 1/4 of the agri jobs – and agriculture would get a lift, since fuel is one of the main inputs. So your BIL buys fewer 4×4, but some farmer in Iowa may buy a new tractor instead, because his fuel bill just went down dramatically.

It would, as I wrote, create “local recession”, but even if the total number of dependent jobs jobs would be your 10m, it’s still way less than the whole of the US.

I was more thinking along the lines of jobs in the energy sector and those dependent on them. And I did not bother looking it up for exactitude.

But the point stands I think. There is a big ripple effect when these jobs go away that flows through the other job categories. When my BIL does not buy all of his 30 or so new trucks every year (and the host of ancillary trailers and equipment) that results in economic reductions for those vendors. The fact he needs less workers means that rents are not paid, items not purchased, cars and trucks not purchased, restaurants not used, and so on and on. This hits the bottom line for every kind of business there is and employment in those sectors. The effect of losses in high paying working class jobs is really magnified. Add this to the effects of various other negatives and it can be a big contributor to a recession which easily overwhelms the lower pump prices.

Hmm…I don’t feel like I end up saying what I am trying to say today. I’ll try again.

In an economy which is in fair or better shape a decline in fuel prices is likely to be a net positive. But that is not our economy today. All is economic headwinds right now, and having a oil price war (which I am convinced was initiated to kill off a large amount of the US fracking industry due to its current vulnerability) will result in a net negative (maybe a large one) to the US economy. And be of great assistance in generating a recession here. A global recession is already underway.

Having at one time owned and operated a farm I can assure you that in US farming today they are facing very tough economic times and declining prospects some distance out in time. If I was still farming I would not be using a drop in fuel expenses to buy new equipment, but rather to try and get ahead of loans that in the current environment are difficult to service. I note that CAT and John Deer are being obliterated in the market today so it does not seem anyone is thinking their sales are going way up.

Re: Saudi strategy

If all you have is a hammer, then everything is a nail.

The Saudis have the lowest marginal cost of oil production in the world and it is high quality oil to boot. So if people don’t want to work with them on limiting oil production across the board to maintain prices, then the Saudis have the capability of out-pumping everybody else and crush both their market share and their prices. I think they are betting there is enough stress out there in producers that bond defaults and bankruptcies will start in short order.

Yes well Mr Market was well into bubble territory and a correction courtesy of coronavirus perhaps a bit radical, nonetheless due.

Fascinating sociological drama unfolding. I’m headed for the woods for thé duration.

Scientist were close to coronavirus vaccine was ready four years ago but:

https://www.nbcnews.com/health/health-care/scientists-were-close-coronavirus-vaccine-years-ago-then-money-dried-n1150091

One hast to wonder what other cost savings are going to come back to bite us.

Looks like the Ides of March are going to be tough on 3 letter acronym investments, et tu brutal.

Once again though in a diving market, there’ll be buyers for every seller of stocks, and that’s the biggest chimera ruse going in Dow Jonestown.

One ray of hope may be IV Vit C. While it has been touted for decades by a small number of doctors the hostility of organized medicine has limited the high-quality trials needed to Conclusively demonstrate its effectiveness.

But now china has several RCTs underway with IV vitamin C. And the government of Shanghai has issued an official statement supporting the use of IV C in its hospitals based upon the excellent clinical results doctors are having with advanced pneumonia.

It’s not clear how much less effective oral vitamin C might be as it’s poorly absorbed compared to the IV.

https://bibliotheek.ortho.nl/39477/omns-shanghai-government-officially-recommends-vitamin-c-for-covid-19/

It’s the one thing we all feared: A Psychopath and his butt-kissers running the country during a crisis.

Yes indeed. And (repeating others) a for profit health care system almost the opposite of what’s needed to handle a Pandemic.

As compared to the others psychopaths running it previously?

But Hillary would be worse. No scratch that, no one who isn’t crazy believes that. Most of them would be insufficient to the level of REAL crisis we face, very much including climate change, we need the kind of shut downs going on now permanently, shutter the airports forever, ecosocialism now.

But most could handle an immediate crisis like this better than Trump. It could hardly be handled worse.

Hillary is only worse for countries with lots of foreign brown people or the US working class. And neither group votes in US elections.

Well, this is all depressing to read upon getting up. Forwarded via tweet and FB to share the misery.

What if Trump ignorantly ordered everyone to be COVID19 tested (hmmm… maybe to inflate the denominator and thereby “lower” the mortality rate)? Notwithstanding the logistical impossibility. Would you comply? I would not.

HoW aRe We GoInG tO PaY fOr ThAt?

A very reasonable question, but the stipulation was, ‘”Notwithstanding the logistical impossibility” of which cost would be a part (though in my not very valuable opinion, not a legitimate one – the gov. could easily afford it just as it can afford endless war).

The answer is…resistance, because that is a Putin plot.

Why would you not comply? I’m curious.

My own reason for non compliance would be if I thought there was a high risk of getting infected.

Otherwise, it could only help or so my train of thought goes.

That’s a snapshot of a moment in time.

Continuous monitoring, of everyone, notwithstanding logistical impossibility, is more desirable.

It seems that at a minimum, testing should be much easier and available than it currently is and that furthermore when an area comes up with a high rate of infection, additional, more extensive testing, such as in South Korea, should be triggered. I could be wrong, but without an idea of scope, it seems we are flying blind.

Since our hospitals, even though we have more of them than many places, are going to be overwhelmed, isolation in various forms and degrees seems to be a viable way of slowing down the case load that hospitals have to bear, but isolation because of the problems it causes should only be used in the areas that need it, for the periods they need it, again, pointing to the utility of making tests more generally available for as long as needed (addressing your point of continuous monitoring) as long as they minimize risk of further contamination.

In an NPR article linked yesterday, the University of Washingtion medical center was quoted to be able to increase to do 4000 tests a day, quickly.

That compares favorably, adjusted for poplulation, with Korea.

Thank you. Good news to me. I missed it yesterday.

You’re welcome.

It was marym who first posted the link.

Anyone have an idea just what the effectiveness of existing tests is? False positive rate? False negative rate? I assume this is still unknowable at this point.

Former forensic-level analytical lab QC analyst here. Assuming the exactitude of mass screenings is not warranted, certainly not in this case. Assay accuracy is in significant measure inverse to specimen workload. And I really mean people who are asymptomatic. There’s a reason why the CDC protocol includes clinical judgment pre-screening criteria.

Thank you, a very good explanation. Do you think the level of testing in S. Korea is unwarranted?

Part of the problem I see with this is that without a good idea of the extent of overall infection in the US, we do not have sufficient information to project the load our hospitals are going to have to bear and thus have no way of preparing.

We are coming in that territory in the Netherlands now. For most infections the cause is known (visit to Italy, or contact with someone who did) but for one province they now have a number of cases (about 20 to 30) for which the origin of the infection is still unknown.

Their protocol (and we are talking about technical experts here), is to advice everyone in that province with very minor complaints which might point to an infection to stay home till further notice to more or less freeze the situation. In the mean time they are performing tests on the medical personal in that province to get an idea about how severe the infection rate is (medical personal because that is easiest to organize).

So my kids, who both have a light coughing, probably from a mild cold, are now at home instead of at school.

I certainly hope this approach works. Isolation is definitely key. How did they determine that that one province had community spread if they are only testing medical personnel?

The Netherlands is much smaller than the US, has universal health care if I’ve understood correctly meaning no one is going to be left out due to cost and thus spreading the disease around, and the population may be more in tune with and trusting of government directives meaning they will follow instructions better than say in a country such as the US where many (certainly enough) feel they have a god given right, and the money to prove it, to flaunt any public health directives meant to protect everyone.

That said, I would far prefer our government here to start out with the same approach toward isolation, trusting the majority of the population to do as told for their own good. But as to testing, given our size and varied population densities, I suspect we need more far reaching testing to determine what should be done in different areas of the country to slow down the spread and plan for hospital loads as much as humanly possible.

Yes, you are right. It’s problematic. Requiring mass indiscriminate screening is not an effective solution, IMO. We have a mess on our hands, perhaps moreso economically than clinically at the moment.

Try to be safe.

Yes, the economic situation looks bad, really bad, right now.

No matter who goes up against him, I don’t see Trump being able to withstand this politically, short of declaring martial law and eliminating the upcoming election process altogether. I’m not saying at all that he is going to do that, and even less that he would succeed if he did, but if it were the case, it would be one more wrenching horror show the country doesen’t need at the moment.

Adding, I very much respect your opinion due to your expertise. I only wish I was qualified to make a constructive argument on the “for” side. I think Vlade below at 11:31am raises a fair point (as I understand it) that would apply to broad testing in which accuracy is secondary as long as variance was reasonably well understood.

And Ignacio raises a possibility at 11:53am that might also address the issue in a cost and implementation effective way.

But one thing that could be easily done is to use the FluNet resources to analize not only for flu subtipes but SARS Cov 2. Not that expensive and an approximation to real infection incidence would be obtained.

Different context.

I do agree that workload has significant impact on assay – depending on test complexity.

But in pandemic situation, false positives don’t matter. I.e. if someone is asymptomatic and you tell them to quarantine, it’s no loss.

False negatives are what matters here, but you can get around that by re-testing, and even in the worst case is no worse than using pre-screening criteria.

I.e. mass screening wouold generate a set of asymptomatic infected, some false positives (no prob), and some false negatives. But the false negatives would most likely go on develop symptoms and be retested, which is when you’d catch them with pre-screening. So overall, you’d remove more potential virus carriers than otherwise.

Pre-screening criteria in pandemics is IMO of only very limited usability, especially if you don’t know when an infected person becomes infectious.

The main goal here is to slow the spread, while limiting the economic impact. Way different critieria apply than say for a cancer test, or whatever.

If we want accurate data to base decisions on, universal testing would be the only way. Any other path will rest on shaky assumptions and guesses. Testing only those presenting symptoms will not give an accurate picture.

And we would have to do it again and again.

It could be because we are not tested all at the same time. In that case, some may have caught it after testing from others still waiting to be tested.

Even we are all tested at the same time, and everyone is clean, unless we bar all people from coming in, we still have a problem.

As I wrote before – does it mattter whether your (say) 1m deaths is from 10m “symptomatic cases” (and mortality of 10%) or 200m total cases (for 0.5% mortality)?

It makes no difference either to the dead or their families.

IMO what does make a difference is that if you tested only 20m, you don’t really know whether there’s another source waiting to erupt.

Ah, all foretold centuries in advance, I can see this as possibly being the start of the end of this system of things and the ushering in of the Great Tribulation. All that is left is for the political rulers through the UN to destroy all false religion and this is the trigger for the Great Tribulation. Those who know the truth of what is happening still live in peace even in this system of insanity, stupidity and decline.

Cheap oil means no fracking, as proposed in the Sierra Nevada and environs, why bother @ $30 a barrel?

Email Alert pops up on my phone just now

9:50 am

Monday Mar 9

The Boston Globe

BREAKING: Markets paused trading after Dow plunged 1,800 points shortly after trading began Monday

Back in my well-spent youth (late-1970s) I remember a suggestion that a good solution to much of what ails us was to just buy out the entire stock market and end it once and for all. Well, no, probably not. But an interesting thought nonetheless.

Retirement looking pretty iffy these days…

Japan is about half way there to actually implementing the “let’s just buy the whole market” idea. Interestingly, Japan now joins Switzerland as a flight-to-safety destination in times of market sell-off. So it might not be such a dumb idea after all…

Swiss bought the whole foreign market (well, not, but at some time SNB was the largest shareholders in Apple for example).

For a time I thought the clever Swiss were ahead of the curve, with debt-based money an impossibility why not try equity-based money. Turn your CB into a hedge fund. Makes about as much sense as “negative interest rate money”, a complete misnomer that should instead read: “confiscation of principal money”.

So they will “quantitatively ease” money out of your wallet while you sleep, euthanizing savers. “Consume, citizens, or we will consume your money for you”.

Sigh and some are asking the Fed for help like they haven’t been propping up the entire system by injecting liquidity into the repo market.

Pneumonia…you now have my undivided attention.

I had it three times when I was a kid and possibly had walking pneumonia a fourth time. Colds…flu…I’d get a case every spring and fall when I was a cigarette junkie. I’d just wander around sneezing on people. Pneumonia is an order of magnitude worse than the flu. If I get pneumonia there will be no wandering around at all. At my age I’ll be lucky to be able to stagger into the bathroom. Ordinarily, I’d do some sort of sardonic link to The Stooges playing No Fun, but now, Iggy and I are both in the very same boat…although he looks a little better then me, which is a sad commentary indeed.

The worst pneumonia I ever got came from getting on a 747 with a day old cold, LAX en route to Auckland, circa 1982.

I got a taxi to a motel and either had the night sweats or chills, take your pick. When after a couple of days I wasn’t getting any better, I rang the front desk for a doctor, and 30 minutes later I get my only ever adult visitation, knocking on the door-with black bag in hand.

He looks me over and pronounces that I have pneumonia and in need of certain drugs, but i’m in no condition to go out, so he tells me he’ll go to the chemist, and 15 minutes later he’s back with the goods, and then lowers the boom, $4 for the visit, $3 for the Rx.

Don’t let a good crisis go to waste? Some one needs to tell Bernie Sanders who seems to have gone back to “I’ll support the nominee” mode of campaigning. The crises should allow him to go on the offensive for M4A. Hell, M4A may be obsolete now. If the crises is as bad as it appears, out-right full nationalization may be necessary. But I have yet to hear Bernie mention the pandemic, save maybe in passing when pressed by voters.

In so far as Sanders is actually going back to “I’ll support the nominee,” I suspect it’s because he is overwhelmed like the rest of us and is simply falling back on his core decency. I also suspect his whole run for office has been difficult in that dirty pool (the norm in our political environment) goes against everything in his nature. He has fought the good fight because there was no one else willing to so – consistently that is, not because he likes that kind of politics. To now have this sort of atom bomb dropped in all our laps must be just as mind numbing to him as it is to the rest of us.

Correction, the first sentence would better have been written: “If Sanders is actually…”

You missed my point. The accusation is that Sanders is being tone deaf to the reality on the ground. Indeed, is main push right now is SS cuts. Normally, this would be a strong attack line. But the pandemic trumps everything. This is major.

In fact, its so big that I think it renders M4A obsolete. To respond to the outbreak requires a far more aggressive posture. Full nationalization is the only way we can respond. Even then, it may still be too little… too late.

And its bad. Mr. Market has even dared utter the ‘R-word’. HA! It wishes a recession is the worst it can get. This will even be worse than depression. We are looking at a major contraction here, of not an out-right collapse. The massive hole that the virus will tear into in labor alone could take decades to recover from. And Bernie is talking about SS? What the hell! Dose he read the news at all? How the hell can he miss this?

And what galls me is that this is his strongest hand! If he pivots on to the pandemic, he would control ALL the cards. Why oh why would he not pivot?

Yeah everyone around here is so good at running for president, I don’t know why more of us aren’t doing it.

Sanders hosted a panel specifically to address the topic today in Michigan. Marym posted notice in the Water Cooler two days ago and Bill Carson posted the event link in the Water Cooler today. For some reason the content doesn’t begin until around the 46 minute mark.

A discussion as to why South Korea seems to be doing so much better keeping it large number of cases alive. https://asiatimes.com/2020/03/why-are-koreas-covid-19-death-rates-so-low/

Since the MOST* a risk-free asset should return is ZERO percent MINUS overhead costs, there’s nothing bizarre about negative interest and yields on the inherently risk-free debt of a monetary sovereign like the US.

What’s bizarre to me is the persistent belief that we can have a just society with an inherently unjust money system.

*Otherwise we have welfare proportional to account balance, not need.

RE: the oil situation. If the drop in prices leads to a halt in new drilling in shale plays, we would see a 25-35% decline in production in a single year. That would have a dramatic impact in and of itself, let alone the knock-on effect on financial and global energy markets. It’s a good thing I suppose that demand is cratering.

US private health care system meets US public health crisis — cosmic hilarity ensues :-/