Pictures like this are indeed worth a thousand words. From Item 5d for CalPERS’ Risk and Audit Committee meeting last week.

This misconduct matters ever more than ever because the board wants to reduce its already lax supervision by delegating even more authority to staff.

Despite the whopping number of violations, CalPERS executives orchestrated the Committee meeting to minimize visibility of this disturbing record, and almost succeeded. Since the board played along, failing even to acknowledge the existence of the information in this slide, let alone its seriousness, CalPERS staff isn’t exaggerating by much when it tries to depict its ongoing power grab as a mere formalization of the status quo.

Procedurally, the placement of this item on the “consent calendar” and the Committee’s failure to discuss it (or any part of the Enterprise Compliance Activity report which contains other troubling items, like the number of missing board, employee, and consultant Form 700s) was a calculated effort to hide CalPERS’ dirty laundry.

The use of consent items is intended to be for non-controverial items. CEO Marcie Frost, General Counsel Matt Jacobs and the head of compliance Marlene Timberlake D’Adamo apparently see a 2017% increase in violations as routine, not even worth mentioning or explaining in the agenda item.

In keeping with the “Nothing to see here, move along” pretense, the CalPERS staff did not present the slides describing the personal trading and Form 700 (personal financial disclosure) abuses. The board therefore raised no questions about what they were about, their significance in dollar terms, the seniority of the perps, whether they had broken the rules in the past, and when and how disciplinary measures would be taken. All of this is Supervision 101 yet none of it happened.

How was this embarrassment kept under the radar? Via another abuse, of impermissibly holding whatever actual discussion there was in closed session. This is particularly cheeky because there was no Risk and Audit closed session beforehand; CEO Marcie Frost and her fixer, General Counsel Matt Jacobs, tried treating this as a personnel matter as the justification for relegating what little discussion there was in closed session.

I sent this e-mail to all members of the Risk and Audit Committee:

Dear Members of the Risk and Audit Committee,

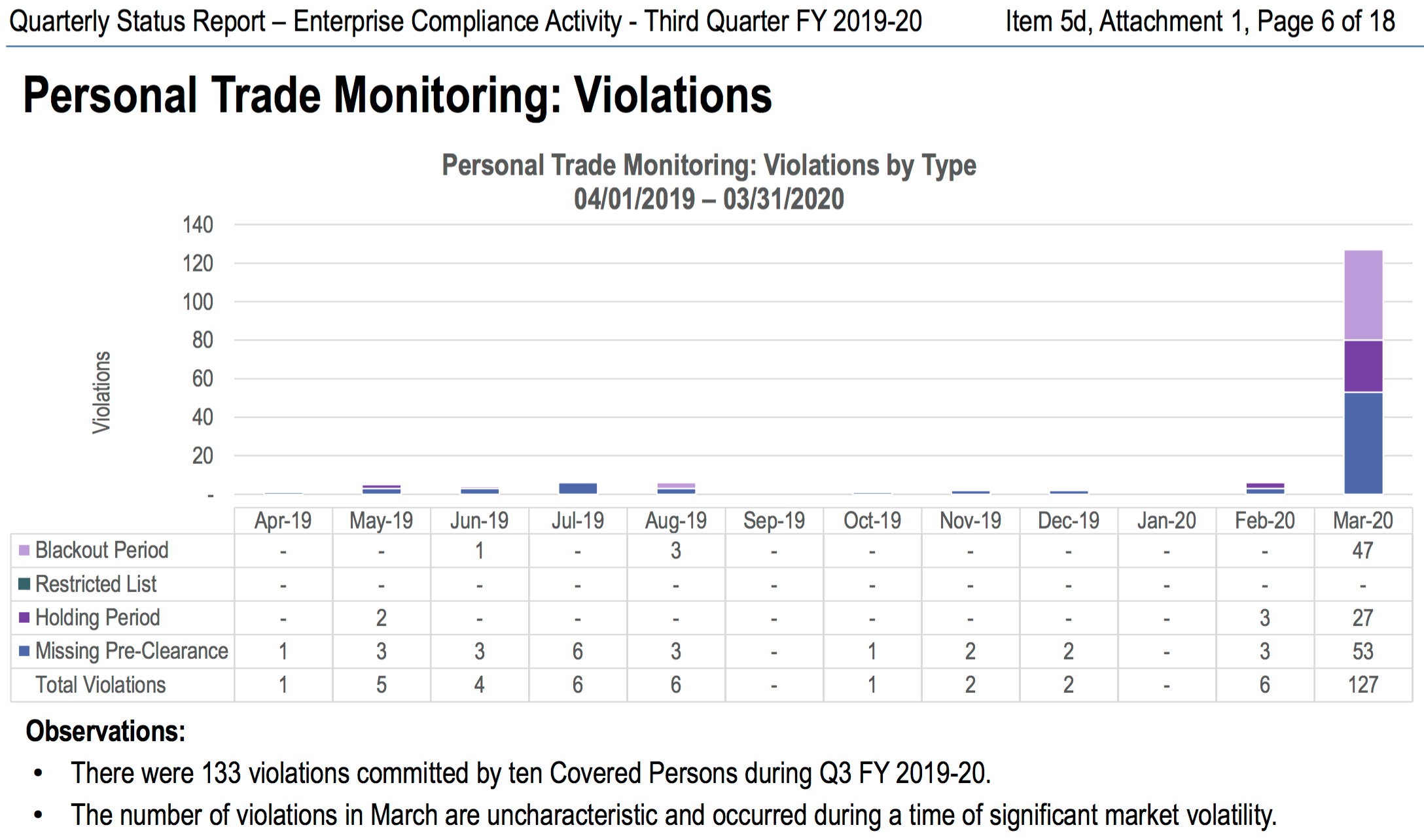

Attachment 1 to Item 5d in last week’s Risk and Audit Committee meeting included a chart which showed personal trading violations. Experts say that even one violation a year is a serious matter, yet CalPERS has barely had a month with no violations, let alone the 127 for March.

The placement of this item on the consent calendar and the Committee’s failure to discuss it (or any part of the Enterprise Compliance Activity report which contains other troubling items, like the number of missing board, employee, and consultant Form 700s) looks like a deliberate effort to prioritize CalPERS’ PR objectives by minimizing the visibility of this document, rather than have the board perform its fiduciary duty. The lapse is particularly noteworthy give that many members of the public called out the board the day before for dereliction of duty.

I would appreciate any comment you have on this matter. Thanks.

Susan Webber

I did get a reply from Margaret Brown:

Ms. Webber,

I take my role as a Fiduciary seriously and I am not bashful about asking tough questions of staff and consultants.

The Board has been informed that these types of violations are an HR matter. As a result of this information, I did not ask questions in Open Session about the violations.

Respectfully,

Margaret Brown

Brown is defensive because she knows better and despite her protestation here, sat pat. She could easily have queried staff during the open session discussion and chickened out.

For Frost and Jacobs to assert the personnel exemption is bogus. It would apply only to the extent that Frost and Jacobs discussed which employees had engaged in violations. I am highly confident they didn’t because if Frost started that practice, Frost would have to name names of top executives and board members if they were included in the current or future violations.The violators will skew to people with higher net worths, meaning more senior. And what if she or Jacobs or her favored henchman Doug Hoffner or Ben Meng is on the list? How about board members?

And yes, sports fans, this is even worse than it looks. CalPERS, with its footnote “The number of violations in March are uncharacteristic and occurred during a time of significant market volatility” tries to act as if the routine level of violations is acceptable. It isn’t. As we’ll show, even a single violation in a year for a large private sector financial services firm would be seen as a serious lapse.

And keep in mind: this isn’t one rogue employee (or board member or executive). It’s ten in the last quarter alone! That is evidence of a breakdown in supervision.

The number is almost certainly more for the full year, since attributing that number to the entire time period would seem a smidge less bad.

The number of bad actors and impermissible transactions is yet more proof that CalPERS is out of control. Worse, when transgressions this severe arise, we’ve seen again and again that the organization simply tries to sweep them under the rug. Earth to CalPERS: The wider world has not only noticed that that rug is awfully lumpy, they can even see that it’s moving.

And as we’ll discuss, these abuses not only include explicit violations of CalPERS’ regulation on personal trading but also having constructed the regulation to omit the areas where insider trading is most likely to occur. Continuing board negligence rounds out this sorry spectacle.

CalPERS Insider Trading, Erm, Personal Trading Policy

CalPERS’ personal trading regulation, which includes its insider trading policy1, covers Board members, executives, member of the Investment, Enterprise Compliance, and Enterprise Risk Management, offices, and other CalPERS employees who have access to CalPERS’ pre-trading information. These rules are designed to prevent violations of SEC insider trading rules as well prevent CalPERS board members and staffers from profiting by front-running CalPERS’ trades.

Before we discuss the types of abuses, let us reiterate that there is no excuse for these unheard-of high numbers.

We spoke with Keith P. Bishop, a partner at Allen Matkins Leck Gamble Mallory & Natsis LLP, who has written several articles for the National Law Review questioning CalPERS’ insider trading policy. His reaction:

That’s a very large number of violations. Even one violation in a year is very concerning. This would be extremely atypical in the private sector.

Needless to say, the big spike in misconduct in March from a level that was already pretty bad (hardly a month with no violations) suggests that at least some CalPERS staffers were more fixated on their personal balance sheets than their day jobs.

On top of that, notice that ten people engaged in verboten transactions in the past quarter. It’s not as if CalPERS could pin this sorry picture on a hyperactive newbie. Eyeballing CalPERS’ staffing levels (for instance, 344 in the Investment Office), 500 is a high estimate of how many are subject to the personal trading policy. There’s no prettying up having 10 of CalPERS supposed best and brightest thumbing their noses at it.

If you read the personal trading regulation, the theory of how it is works is all Covered Persons submit proposed trades of covered public securities (which includes stocks, ETFs and ETNs but not thing like mutual funds and government securities) though an approved designated broker that is connected to CalPERS on-line platform to get pre-trade clearance. The investor will receive “immediate” notification if the transaction has been approved, and if not, will be given the reason for rejection.

The never-made presentation shows the types of violations for Covered Persons:

Blackout Period. If CalPERS trades a Covered Security, it’s off limits for the three days spanning the day before to the day after the transaction

Restricted List. This is a list of securities that are off limits because CalPERS insiders may have material non-public information about the company.

Holding Period. CalPERS requires at least a 30 calendar days between buying and selling, or alternatively, selling and re-purchasing, of a Covered Security. This is more a policy to discourage speculation generally than to bar abuse of internal-to-CalPERS information.

Missing Pre-Clearance. Not getting the required pre-clearance per above.

The biggest category of violations in March is in pre-clearance, which is also the biggest and most regularly abused type over the year. If CalPERS employees really are trading through the on-line platform, are they simply ignoring denials of trades? That makes the misconduct willful.2 One would normally wonder if these violations are twofers (someone violated pre-clearance to circumvent the blackout period) but knowing CalPERS, it’s a likely guess that the violations were catalogued in such a way as to minimize the total count.

Admittedly, brokerage firm employees will point out pre-clearance violations are not that uncommon, but the fact that they keep happening at meaningful levels relative to what is almost certainly a small population that actually trades stocks and ETFs and CalPERS (many with the liquid assets won’t want the hassle) indicates the violations aren’t being addressed in a serious manner.

Next is running roughshod over the blackout period. Recall that this restriction is meant to stop employees from front-running CalPERS.3

Now some might point to the lack of restricted list abuses as a sign that at least one part of CalPERS personal trading policy is working. It is, but not in the way you think.

Remember that the restricted list flags companies where CalPERS board members and employees might have material non-public information.

But as Keith Bishop pointed out in California Corporate Law many years ago, CalPERS is highly unlikely to be on the receiving end of corporate inside information. Big companies don’t talk to CalPERS about their businesses. Not only are the issuers not allowed to disseminate information to favored external parties, there’s also no incentive. In equities, CalPERS is an indexer; its active investing is through outside managers and CalPERS has been severely thinning their ranks.4

That formulation misses where CalPERS is most likely to have inside information, which is government securities. From Bishop:

CalPERS is an agency of an issuer (the State of California). Thus, it is possible that CalPERS’ board members and employees could, like the employees of any other issuer, become privy to material, non-public information about the state. In this way, CalPERS’ board members and employees are in no different position than the employees of any publicly traded company. Remarkably, however, the proposed rules specifically exclude debt securities issued by state and municipal governments from the definition of “covered securities”.

Mind you, it’s not just the State of California. CalPERS runs over 2200 pension plans, some of them for cities that issue their own debt. CalPERS employees are in a position to hear a lot of intel about the pain their contribution increases are causing, even more so than ever due to Covid-19. In other words, CalPERS is in a particularly advantaged position to know which entities are in acute distress, particularly which might wind up filing for bankruptcy. That insight like has market value.

In other words, the lack of restricted trading violations may largely be a function of CalPERS having made sure the areas where abuse is most likely to occur are never up for consideration.

But even if there were any names on the restricted trading list, no one is to know about it! I am not making this up. CalPERS takes the bizarre position that telling employees what was on the restricted list that would be inside information.

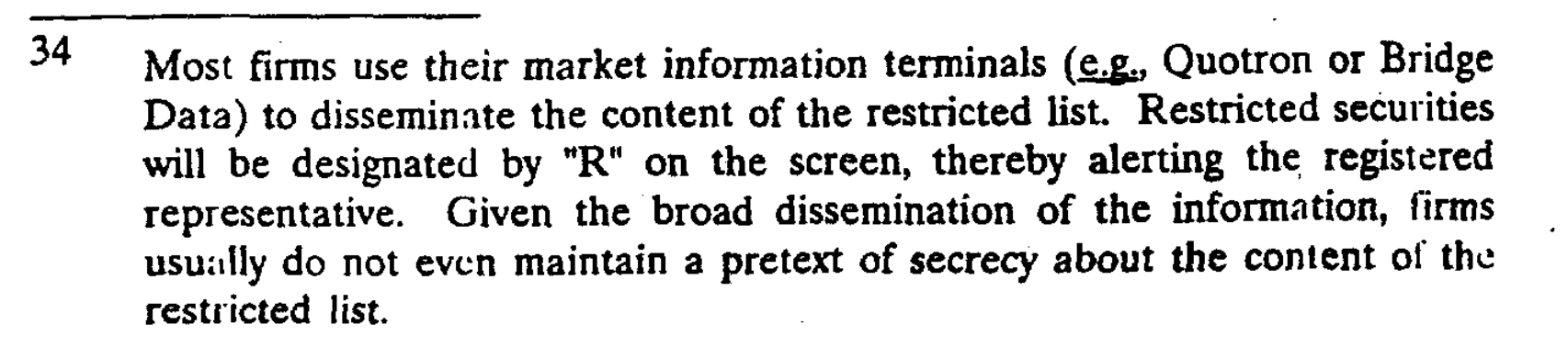

Anyone who has worked at a real firm that gets inside information all the time would tell you that’s bonkers. Confirmation comes via the fact that the SEC has no problem with widespread internal dissemination of restricted lists. From a SEC study of practices at broker-dealers:

As one attorney described CalPERS’ position:

What moron came up with this? I can’t even call it a “plan.” It’s Abbott and Costello.

“You can’t trade restricted stocks.” Which stocks are those? “I can’t tell you.” Then how will I know what not to trade? “Just don’t trade on inside information.” But I’m on the inside; everything I know could be deemed inside information. “I can’t tell you not to trade, just don’t trade based on anything that you know.” So I can only trade if I don’t know anything? “How do you know you don’t know anything? That’s inside information.” But will you know what I don’t know? “The SEC will tell me if they don’t like a trade you made. Then I’ll tell them that I didn’t know what you don’t know.” It sounds to me like you don’t know anything! “Exactly. Now get to work.”

CalPERS Toothless Enforcement

One reason the personal trading misconduct is so routine is that enforcement is a joke. The organization has sent the message that the policy is eyewash. At the very end of the regulation:

Violations. In the event of any alleged violation of this section 558.1, Enterprise Compliance shall conduct an investigation, which will include notification of an employee’s direct supervisor. Violations will be treated in accordance with Government Code section 19990, including but not limited to, Government Code section 19572.

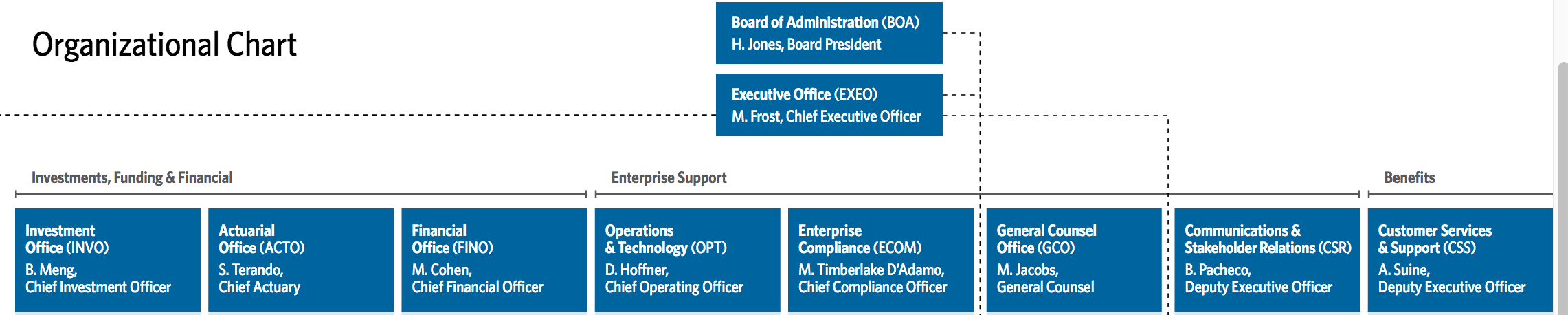

Have a look at the CalPERS org chart:

Even though “Enterprise Compliance” is the equivalent of a C-level position, it’s less powerful than any other on that level. It has all of 24 employees. By contrast, Communications and Stakeholder Relations is set to increase to 80 in the next year.

Remember that “Covered Persons” includes all of the board, Marcie Frost, General Counsel Matt Jacobs and his key deputies, and Chief Investment Officer Ben Meng. Do you seriously think the Compliance Office could investigate CalPERS players who are clearly more powerful than they are? And the enforcement clearly does not contemplate how to handle abuse by board members, even though they are included in Covered Persons.

One of our long-standing observations about CalPERS: that it can’t be bothered to obey rules, even its own rules.

Let’s go back to one of the big sins we mentioned at the outset, using the consent calendar to hide serious misconduct. This is one of the mechanisms by which staff strips the board of power and to which the board all too happily acquiesces. Some other recent abuses of the consent calendar, which sets up the board simply to rubber-stamp an item with no discussion whatsoever:

Having the board cede most of its remaining authority over investments to staff (that was withdrawn due to blistering public comments)

Having the Pension, Health and Benefit Committee hand over more authority to staff (also on deck for last week, withdrawn by committee chair at the top meeting, apparently resulting from public comments firestorm the day before)

Having the board cede all of its authority over Treasury Management Policy and Treasury Management Reserve Policy, even over policy-setting to staff (the Finance and Administration Committee did wave that through, but amended at the full Board of Administration session last week)

Enough members of the public appear to be waking up to CalPERS dirty tricks that the board is now getting embarrassed by staff chicanery on a more regular basis, so much so that it is finally starting to penetrate their unwarranted lofty opinion of themselves. Maybe they’ll wake up to the fact that they are on the receiving end of a con job where no matter what, they’ll be the ones holding the bag.

____

1 See this document, which was incorporated into “Personal Trading Regulation” approved by the Office of Administrative Law in late 2016:

2 I’m at a loss to understand the notion of having what appears to be an honor system, given the toothless sanctions. At most brokerage firms, you have to have your account at the firm and if a security is on a restricted list, you can’t execute the transaction. Brokerage firms also have watch lists, where the usual concern is the appearance of front-running a client transaction. Transactions in those securities are subject to approval by the compliance department.

3 Those trying to minimize the misconduct might argue that CalPERS rebalances its S&P 500 index every day, and thus it’s hard to trade a stock like Microsoft since there will hardly be a day when CalPERS isn’t buying or selling it. The reality is no one was forced to join CalPERS. Its personal trading policy is public and can be read by anyone who might work there. If prospective employees can’t ditch their trading jockey habits and buy mutual funds, maybe this isn’t the right job for them.

4 Bishop did miss one area where CalPERS has occasionally been an insider to company information: on litigation. For instance, CalPERS was privy to the mortgage-backed securities settlement with Morgan Stanley. The amount Morgan Stanley agreed to pay was less than Mr. Market anticipated, so an insider would have made a nice turn if he had bought the stock before the terms were announced.

It seems to me that people who think their remaining tenure is short, and perhaps that should be true of CALPERS senior management, are more likely to be focused on maintaining their personal financial position and not that worried about breaking a couple of usually unenforced rules.

What better (and more rewarding) a time to break the rules and trade on inside information than during a period of high volatility and losses.

“Than usual” I meant “in the previous month”. 6 in Feb, 127 in March.

This is beyond pale. 10 people responsible for 130+ violations in just two months????

That means the policy is nothing, and everyone knows it. Or, worse yet, that there’s a cabal of “untouchables” who can do whatever they want.

The number above means that a few people caused massive, repeated violations of the policy. There is not a single instance of the violation that would be below 10, so it’s repeated, and knowing.

In a normal financial institution, that’s a firing offence, and for good reasons – by not firing you’re opening yourself to an external lawsuit if someone can show that by your policy they lost money (because staff front-run).

Someone who trades a lot and has spare cash should send CalPers fact-finding notice asking what securities were affected on what daysm and the volume, so that they can identify if they lost money as a result.

This March spike in insider trading happened during the period when CalPERS CIO Ben Meng is seeking to make financial and transactions data LESS transparent to the board. That’s quite a co-incidence.

Where is Gavin Newsome in all this? Hasn’t the Governor a role to play bis a vis the safety and security of z CALPERS pension fund??

It seems to me that I have been reading about CalPERS up to a few times a day for a year. I have a master’s in muni finance and I would like to know how this crap keeps going on and on and the good people of CA are certainly paying for it.

Someone tell me how this keeps going on if it is true??

The pensions systems in many of our states are underwater, some, like Kentucky and maybe New Jersey have ZERO chance of saving themselves.

Maybe someone needs to call the Gov of CA and mention that his pension fund seems to be run by incompetents and criminals?? If I were a resident of CA that is certainly what I would do??

I’ve been wondering that exact thing. It’s really almost unbelievable. WTF California?

Mr. Ness: Mr. Capone, how many times have your capo regimes bribed and corrupted public officials? Violated tax laws and statutory bans on the manufacture and distribution of alcohol? Coerced, extorted, and intimidated citizens? Deprived them of their constitutional rights, privileges, and immunities?

Mr. Capone: I’m afraid that’s a personnel matter, and I have been advised I cannot discuss it in open session.

The “Its an HR matter” is a laugh-out-loud obvious dodge. They could certainly discuss policy, procedure failures, and oversight failures, and how to correct the process failures without discussing individual persons.

It would appear that the practical effect of the board ceding its authority to staff – however much that leaves board members dangling on ugly legal hooks of their own devising – is to empower a high school graduate CEO to do as she pleases, no questions asked.

Who needs expertise, honesty, and a track record of success when their will to power is so absolute? The answer, according to Ms. Frost and Mr. Trump, is nobody. The consequences for hardworking Californians will be catastrophic. Mr. Meng, in fact, has already helped them come to pass.

Dont they have a compliance officer who you can ask if it is OK to do a trade and who should then say yes or no, so it is crystal clear if it is above board or not?

I think that’s the question. In the upheaval Calpers may have been deciding among many courses of action and may have simply paused any approvals. This can work in the short-term or in limited circumstances but in reality if it is extended employees will feel like the rules have been changed from under them and go ahead and decide to bear the consequences (suspecting there will not be any).

No, that is not correct. Please read the post. It states the different types of personal trading violations. They are listed in the post. They are all clearly defined and are either triggered by dates (trading with a certain # of days of a planned CalPERS trade, buying/selling or selling/buying in 30 days), by failing to follow procedures (failing to obtain pre-trade clearance) or violating the restricted trading list.

The post also explains that no personal consultation is needed. Covered Persons are supposed to submit trades only through approved brokers. CalPERS’ online platform tells them if the trade is OK or not “immediately” and tells they why if the answer is a “no” so they can figure out if/when to resubmit the trade. The ground save the secretive restricted list are clear and there weren’t any restricted list violations, so that’s not part of this problem.

And CalPERS has has someone in place as the head of Enterprise Compliance. There has not been a vacancy.

TBH, I thought about it some more, and it’s clear the process is broken beyond repair – and I figured out what was bugging me.

Trading on restricted list, or buy/sell within 30 days means either you didn’t get a pre-clearance to start with, or the pre-clearance just didn’t do their job.

In the latter case, the process is clearly broken.

In the former case, it means the people doing the trade (all 10 of them) are knowingly ignoring the rules.

Moreover, they are doing so blantanty, _knowing_ they will be caught – because the breaches were identified (part and parcel of the policy is registering all your brokers with the compliance, and compliance asking for the statements being sent to them as well to check).

So again, the policy is either broken to the point of being ignored, or, more likely IMO, there’s a few untouchables that do whatever they want – and don’t even bother to cover it.

In addition to the external liability I mentioned above, I believe SEC should investigate this as to find whether none of the trading was insider trading – because clearly, it cannot rely on the compliance to do its job.

Agreed and I didn’t take the time to unpack this plus was not 100% sure re my assumptions. I don’t understand how the pre-clearance violations could come about and be found. You are supposed only to use designated brokers. Those brokerage services are supposed to run the trades through a CalPERS system (which I believe is actually a Schwab system CalPERS licenses, so it ought to be pretty robust).

So the pre-clearance “no” is just advisory and they traded anyhow? This would imply a second violation for each of the nixed “pre-clears”.

But if it was truly a failure to “pre-clear”, as in run it through the platform, how would CalPERS have found out a non-pre-cleared trade occurred? Either some CalPERS employees trade through non-designated brokers (but they why/how would the transaction reports get to CalPERS), or the pre-clearance system fails from time to time, or employees know how to circumvent it (say by something as simple as placing an order with a broker rather than electronically?) Or since the CalPERS system sits outside the broker, it’s just an honor system? I’m used to the Wall Street approach where you have to trade through the firm, so stuff like this could not happen ex a system problem.

Looking at the data, I believe they are counting the breaks twice. In no month there’s fewer pre-clearance breaks than any other ones.

In two months (Aug 19 and Feb 20), there is exactly the same number of fail-to-clear + one another (holding in one, blackout in another).

So, it looks to me like there were 53 trading breaches in March, and a large number of them also broke the holding or blackout periods (and a large number broke both).

IMO there are only two possible explanations:

– a total compliance failure at CalPERS, where the employees believe that as long as they have the account with approved broker, they can trade as they wish. In which case, HR heads should roll, and ultimately Marcie is responsible for that.

– a total compliance failure at CalPERS, where the rules are knowingly ignored at least by some, with no consequences.

Repeated offence like these are really a cause for dismissal + disgorging any gains made (selling a held security compared to what one could sell for now is counted as a gain) and/or forcing to realise any losses made.

Wellie, but why would a trade not pre-clear unless it triggered another violation? As in all months should be like Aug 19 and Feb 20, where the # of failures to pre-clear = the combined total of other violations.

Unless they are lying about the restricted list violations…..

If you do not ask for a pre-clear, it’s a pre-clear violation by default, even if the trade would have been oked to trade. Lazy, arrogant or just uninformed or stupid.

If you trade and violate something else (say holding period), you violated pre-clear and the other one.

A high number of pre-clear violations compared to any others means that people would not even bother to pre-clear trades they know they would have be oked, which would have been a total shambles.

This way, some people seem to want to do the trades they should not, so do not pre-clear. Seek forgivness, not permission. Which suggests that the forgivness is easy to get, but once you’re on record of being denied, people are a bit more wary. Although for repeated offenders, there should have been no forgivness.

We are talking past each other.

You do not “ask” to pre clear. You are supposed to trade ONLY with a designated broker and that broker is set up to have the trades routed through a CalPERS platform for “immediate” approval (or not). I am pretty sure the wording overstates what happens (as in this is Schwab software, it sits in a cloud, CalPERS puts in data daily but you get the idea).

Trading with those brokers is how CalPERS also gets the trade records ex post facto. If someone traded with a non-approved broker, in theory CalPERS would not find out (as in not get the monthly records).

So it would seem there are only a few possibilities

1. CalPERS person put trade through despite getting a no on pre-trade clearance. “No” is the result of some other issue in addition to pre-trade clearance so that is presumably 2 violations. But that does not explain the data. So…

2. CalPERS person has a way to circumvent pre-trade clearance at a designated broker even though the policy requires routing through the pre-trade clearance platform (this is done by the broker, so pretty hard to see how CalPERS person gets around that). I suggested perhaps a phone order.

3. Pre-trade clearance system has known issues, some people ignore a “no” willing to take the risk that it’s a false positive because sometimes it is.

4. Pre-trade clearance system is working correctly but CalPERS for some reason is burying some of the additional violations.

Ok. I wasn’t aware how CP does it. Where I have experience you trade with a registered broker, and you pre-clear trades in the institution’s system, but the broker has no visibility of that, it is entirely the responsibility of the trading person.

I.e. the process I know is:

You submit trade to the internal system, for pre-clearing. Then, on apporval, you can submit the order to the broker (directly). If you submit it regardless, it’s a pre-clear breach.

The data above clearly says that CP personell can execute trade w/o pre-approval – so even if 4 was correct, if the system is supposed to stop the trade w/o an explicit approval, it’s not working.

If the system’s no would really mean no trade, then there could not be any violations, full stop.

So either the pre-approval is advisory to the broker, and they ignore it, which I don’t believe they would, given the liabilities attached. For the same reason I’d be surprised if Schwab allowed any order entry that would bypass the pre-clearance.

Or the system is broken and never worked.

There is an alternative explanation – close family. Trading policies often involve close family, but it’s legally dicey to force close family to have account at the corporate brokers I believe (since they have no legal connection to the organisation, and their spouses/parents etc. cannot legally force them either).

Yes, to your point, I’ll recheck, but I think at least the intent was that the broker’s system be linked to CalPERS’ system. That of course would create an issue with a restricted list given how fetishistic CalPERS is. Or it could just be failure to spell out the process in full detail in the regulation. That seems more likely.

If it works as you suggest, which does seem more logical, another possible source of problems is that the pre-clearing authorization for orders is time-limited. I could easily see people putting in orders later than the permitted window. That could produce pre-clearing violations with no other category involved. Either person didn’t pre-clear because they were determined to trade and/or didn’t want delay of dealing with 2 systems/institutions (which is your picture) or they got approval but traded after the approval expired (which seems odd but possible, maybe they wanted a better price, didn’t want to put in a limit order, and thought an expired approval would be comparatively forgivable).

This really needs the talent of a Jimmy Dore to do justice to this level of f******. With each new post you have to wonder – what did they do now? At this point, they are not even worried about leaving a trail for the prosecuters to use against them down the track. Their attempts to hide what they are doing amounts to a vague handwave.

With all these dodgy trades, any future investigation will also have to investigate the financial records form any close family or friends. You can’t hide stuff like that. There is always a record made of financial transactions – always. And if they are so sloppy as not do hide these sorts of transactions in their working hours, then it is guaranteed that they did not bother to hide any of transactions when outside of hours.

The trouble is that Coronavirus will send the economy reeling so any plans that CalPERS has are now toast. And however much Governor Newson wants to ignore the whole organization and its corrupt nature, I am pretty sure that CalPERS is not a hill that he will willingly die on. California’s budget must be getting a hammering at the moment with no signs of the Feds riding to the rescue. So if CalPERS is seeking mass infusion of cash to solve their shortfalls, this may not fly so well this time.

I think the lawyer giving the example of an Abbott & Costello explanation is a genius. I’d love to have a T-shirt with that exact quote. Pretty sure it will apply more and more frequently – just because it’s not an honor system as much as it is an honor among thieves system. And it’s funny because we’re all thieves at heart. Which makes me think, why doesn’t CalPERS use even the teensiest bit of common sense?

Because it doesn’t have to. If doing the not-common sense stuff is working, why change it?

Yves and others have been at CalPERS for a long time, achieving some spectacular victories (anyone remember the CFO wannabe?).

But Marcie is still there, running the shop. So until she ends in jail (although personally I think it’s more likely that at least some current and former board members end up bankrupted and possibly in jail), why change it?

I agree with the comments above.

But, in addition, I have to wonder how much damage this kind of behavior ultimately does to political will for any kind of federal “bailout” of state and local pensions. I suspect petty kinds of insults, like rude DMV staff or unreasonable delays in processing mandatory paperwork, could make the average citizen slightly less inclined to be sympathetic to such bailouts, but it seems like this kind of open and notorious misconduct _in a pension fund itself_ could ultimately push citizens towards hard refusal–why would the national public want to reward staff that behave this way, and why are such “public servants” deserving of any pension benefit?

Even if this involved a “personnel matter,” a sound fiduciary would have demanded that the reports be redacted and anonymized so that these shocking lapses in governance and management oversight could be explained to the members and beneficiaries and corrected.

The CalPERS Board is controlled by four Governor-appointees, a Senate-appointee, the State Treasurer, and the State Controller. The elected state leadership clearly couldn’t care less about CalPERS being out of control. Why? Cui bono?

Follow the money…

Holy Moly! Look at that March spike. Who do CalPERS staff think they are… Congress people?? /s

adding:

2 I’m at a loss to understand the notion of having what appears to be an honor system, given the toothless sanctions.

I think it’s called having a lazy system. And, they do. /not even a snark

Thanks for your continued reporting on CalPERS, PE, and pensions.

It’s likely much of this can be explained by margin selling. Account liquidation would trigger trades in employee accounts that would not have preclearance. If positions have been held for less than 30 days it would create an additional violation.

That is possible, but it’s still a problem with the system:

a) the note should have said that the large number of breaches were technical due to the margin selling. A jump of 100s of % needs an explanation. If none is given, it’s strange.

b) normally, force-majeure trades are extempt from preclearance (discretion is the decisive factor in trading – say if your funds are held by a broker who trades on your behalf and all you do is sit down once a year to discuss allocations, all policies I know exclude it from pre-clearance. You’d be still done for insider trading if you were found to be passing hints to your broker. But few brokers would be willing to risk that for small fish clients though). If CP allows employees to trade on margin, it knows forced liquidation is possible. Then it either should exclude forced-liquidation from the approval system (deficient reconciliation) , or ban employees margin trading.