The controversy over CalPERS CIO Ben Meng’s decision to exit tail risk hedges just before a $1 billion payday is not going away as quickly as CalPERS would like. The Nassim Nicholas Taleb-affiliated fund manager, Universa, which managed the bigger and more lucrative hedge, has cleared its throat to debunk CalPERS’ excuses justifications for terminating the program despite it having the support of CalPERS’ consultant, Wilshire, and over the objections of staff. Now Universa itself has responded, via a letter to clients that we’ve embedded at the end of the post.

Julie Segal at Institutional Investor, who was first to write about the Universa missive, called it “scathing,” which is accurate as far as the substance is concerned, but not the tone, which is exceedingly polite.

For those of you who have not followed this fiasco closely, Bloomberg broke the story of CallPERS’ $1 billion tail risk hedge fail, which led CIO Meng to offer strained defenses. Taleb, who has little tolerance for intellectual dishonesty, roused himself to issue a high level rebuttal of Meng’s major claims, that tail-risk hedges were too pricey and not suited to long-term investors. Meng cited two papers that supposedly substantiated his views; we pointed out that one wasn’t even a study and that the second one, a 2012 article by AQR’s Antti Ilmanen,1 was off point in fundamental ways, such as relying on VIX, which is an at-the-money option, when Universa uses out-of-the-money options. A 2013 note by Taleb, which we are also embedding, eviscerates the Ilmanen piece. One tidbit that will hopefully entice you to read it in full: Taleb describes how Ilmanan cherry picked his data by excluding events like the 1987 crash.

CalPERS did respond to Taleb’s charges, but it amounted to broken record, as in simply repeating its assertions.

The Universa letter, written by former CalPERS officer Ron Lagnado, lays waste to Meng’s assertion that the Universa hedge was not suitable for CalPERS, and by implication, to pension funds generally.

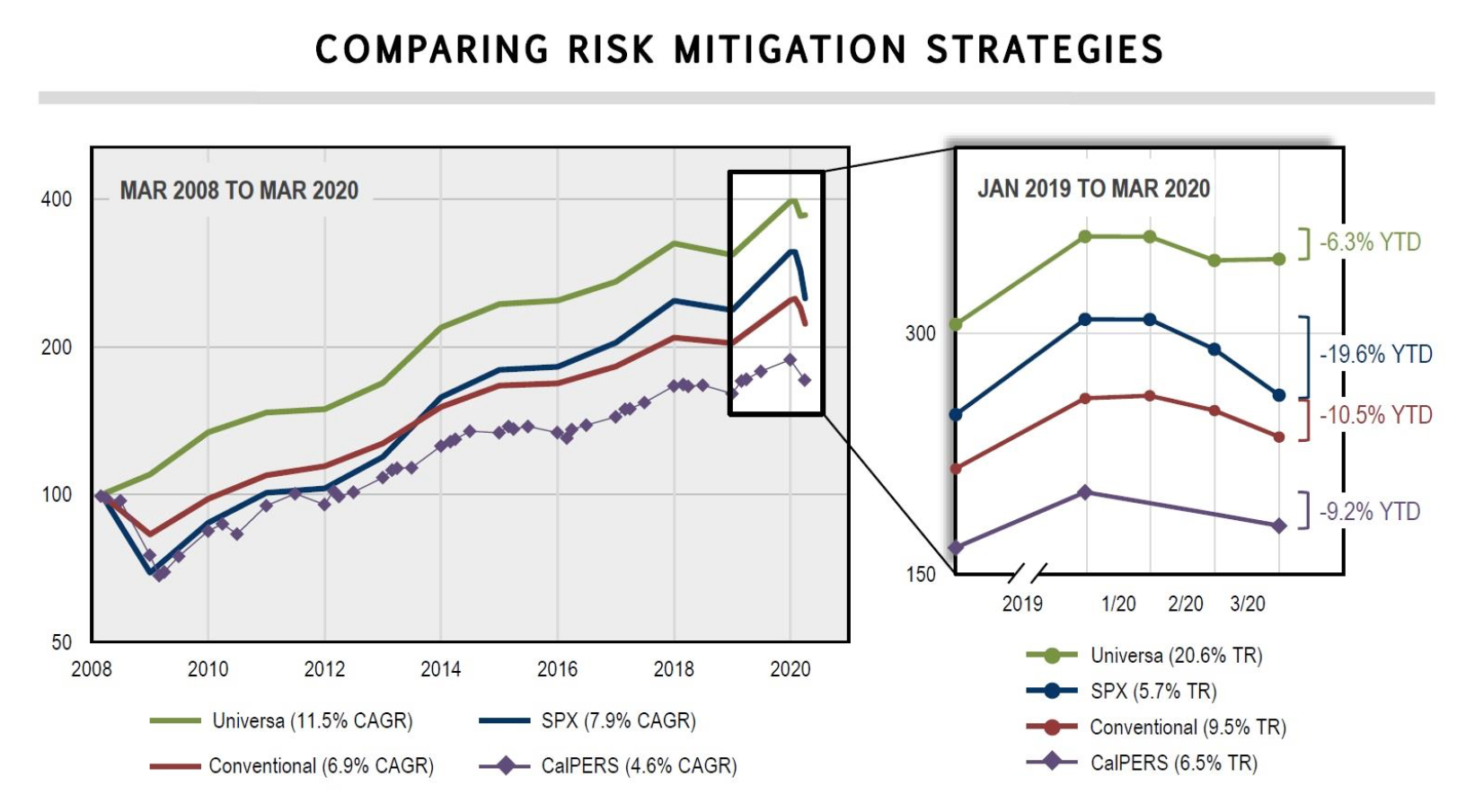

Meng’s claim that tail risk hedges like Universa’s are too costly rests on his argument that he has other, cheaper “risk mitigation strategies”. Lagnado points out that the term is ill defined but then goes on to look at what sort of things Meng is referring to, which as we’ve seen is good old fashioned diversification by asset class. Lagnado looks not only at the results of a Universa-hedged portfolio compared to a widely used benchmark among pension funds, a 60/40 stock/bond portfolio, but he also performs the same analysis using CalPERS’ own returns. Both show that incorporating the Universa hedge delivered markedly better results for beneficiaries. From the letter (emphasis original):

To be fair, we must point out that CalPERS alludes to further nuances of diversification in its portfolio, including an allocation to “factor-weighted equities.” Although the precise nature of that allocation is undisclosed, a passive investment in low volatility stocks might be involved. They also diversify across both public and private asset classes. (I am using only publicly available information in this memo.) While in this case study we are using the “conventional” risk mitigated portfolio as our CalPERS proxy, we do not want to be accused of a strawman argument. Therefore, we also have included on the chart for reference actual CalPERS portfolio return data points (using data that CalPERS provides on its website). Visibly, CalPERS has not been able to outperform the proxy that we are using historically.

…. the Universa tail hedge has demonstrably added tremendous value to its risk mitigated portfolio by lowering risk, observable in 2008 and 2020 YTD when the portfolio returns were +9.9% and -6.3%, respectively. Universa’s returns plainly show that this is most definitely not a comparison between two portfolios with similar risk, as Universa’s has been much lower.

Just as important, Universa’s risk mitigation also cost relatively little to employ. The benefit outweighed the cost; thus, the Universa risk mitigated portfolio CAGR bested the SPX CAGR by 3.6% over the total 12 years observed, which translates to a 47.9% gain in terminal wealth. It arguably added more value than could have been realized in any other risk mitigation strategy, at least that we know of (including long-duration treasury bonds).

Now admittedly, there are limits to how much hedging Universa can engage in without bidding up option prices. But that’s no excuse for not hedging as much of the CalPERS’ portfolio as feasible.

Ron Lagnado inserting himself into this controversy puts another issue into the spotlight: how Meng has been driving the most competent senior investment professionals out of CalPERS. Oddly, the press has been silent on this issue even though CalPERS beneficiaries are concerned. From public comments at the last board meeting by Robert Girling and Sherry Keith, speaking on behalf of CSU-ERFSA, one of the influential retiree groups:

CalPERS is afflicted with the worst crisis since the Great Depression and, based on a series of articles in the Wall Street Journal and other financial publications, it appears that the Chief Investment Officer is not up to his job. In the last two weeks, two of CalPERS best and brightest employees have quit to go back to the private sector. Ron Lagnado who has essentially — who essentially followed Meng’s career path as the fund’s Fixed Income quant and then became the deputy head of Asset Allocation…” — and in parentheses — “…(and is a CalPERS…” — or excuse me — “…. a Caltech PhD)…” — end parentheses — “…has just left to work for an options specialty firm.

Paul Mouchakkaa who ran Real Assets and did much to turn the real estate portfolio around and divest bad assets is going back to his native Canada to be a senior partner at one of the biggest Canadian real estate firms.

It is an open secret that Meng forced Lagnado and Mouchakkaa out.

Meng appears to be out to destroy what CalPERS had in the way of an investment brain trust. The previous Chief Investment Officer, Ted Eliopoulos, had established a team called Portfolio Allocation Subcommittee (PAS). Eliopoulos envisaged it as a tactical asset allocation group and staffed it with senior managers who had hands on active portfolio management experience with proven alpha generation, meaningful careers in finance in the private sector prior to CalPERS, a graduate degree, plus at least one of a macro orientation, experience working in different asset classes, or strong quantitative skills. The aforementioned Ron Lagnado and the recently-ousted head of real estate, Paul Mouchakka, were both members of PAS.

Meng’s efforts to cite the debunked-by-Taleb Ilmanen paper as a justification for blowing up a $1 billon payday are seen internally as further evidence of Meng’s dishonesty. The aforementioned PAS, at a meeting that Meng did not attend, did discuss the Ilmanen paper, as well an op-ed by Robert Litterman, which Meng had also invoked. But they were not considering ending the tail hedges. Instead, the focus was examining alternative approaches to taking the quantum of equity risk CalPERS required to meet its return targets while either hedging or allowing the fund to be more broadly diversified than the direction it was moving in. Meng has not taken up either approach. As one observer put it. “The fund is effectively betting it all on black with no hedges and very little diversification.”

It is becoming more and more apparent that Meng is dishonest. He lied to the board about exiting the tail hedges. Virtually none of the beneficiaries commenting at the last board meeting bought Meng’s lame claim that he hadn’t give a direct and false answer to a direct question. He’s continued to prevaricate with his attempts to rationalize exiting the hedges. And far more important, he’s tried to pretend to the board and the general public that he’s been engaged in “risk mitigation,” as in lowering risks to the fund, when he’s been taking more concentrated and hence riskier bets.

This is not going to end well.

____

1 It is unfortunate that Julie Segal took the word of a CalPERS spokesperson that the Ilmanen article (which Segal calls “AQR’s research” when it was not an AQR document) as recent when it was published in 2012. Hopefully she will examine CalPERS’ claims in the future. A different Institutional Investor reporter ran a too-obviously planted piece on MSCI research that claimed to debunk tail risk strategies using options that were 10% out of the money. 10% is well within normal stock and index volatility ranges. It’s quite a stretch to call them “deep out of the money” in this context. This analysis is so disingenuous as to make it look like MSCI had to cook its analysis to prove its headline claims.

00 UniversaLetter 427202000 Taleb on Ilmanen

Good post, understandable even to the numerally-challenged (such as myself). Of course the Universa strategy isn’t “scalable” for the entire CalPERS equity portfolio for the reasons stated — relating to the limitations of options markets. But even a limited investment in this strategy would clearly have mitigated CalPERS return problems when compared to conventional indices. To suggest otherwise is pure sophistry.

It’s almost as if CalPERS wants to dump insurance and to realize losses in the public equity markets. Perhaps this is simply sleight-of-hand to divert attention from other losses being realized due to high-fee partnerships with politically-connected “partners” who can be counted-on to pay kick-backs to the politicals.

Follow the money…

Wait!

I thought it was the job of the MBA/economist/kleptocrat class to separate the rubes from their money.

“Yu, a U.S. citizen born in China, returned to CalPERS after more than three years as the deputy CIO at the State Administration of Foreign Exchange (SAFE), the largest asset pool in the world with assets under management of over $3 trillion U.S. dollars.”

Sooner or later, the people who do not like China are going to start connecting dots that Yu may well not deserve to have connected. Besides, he has a Doctorate in civil Engineering.

I’m still amazed, but not surprised, at the continuing revelations of the corruption and incompetence at CalPERS. Thanks, Yves, for keeping on top of this, it’s really important.

I just hope that Mitch McConnell doesn’t latch on to this for propaganda for his latest plan to destroy public pensions by forcing states into bankruptcy.

Re Mitch McC. This is why I consider the relevant Cal unions either exceedingly stupid, corrupt, incompetent or any combination of the three. They protect Marcie and co, and in doing so give their opponents ammunition. Tons of it.

But they most certainly are not protecting their members.

an aside:

About Marcie and Meng and similar : the rise of the schmoozers.

All talk, no walk. imo. They seem to regard their CalPERS jobs as a vanity project; a job designed to fluff their own egos instead of serious business affecting thousands of lives.

I think that I am starting to see shades of Donald Trump in Ben Meng. No, seriously. Consider the fact that Trump has been appointed to a job beyond his qualifications and so tries to surround himself with people whose sole qualification is that they are loyal to him which in his case means family members. Could it be that Meng is a physical demonstration of the Peter principle? And it would not be the first time that this happened at CalPERS. Or even the second come to think of it.

It may be that the main reason that Meng dumped those tail risk hedges was not through his own analysis but the simple fact that he did not really understand them. It was as simple as that. His behaviour seems to reinforce this surmise as at first he tried to lie his face off in front of the Board about them and then he tried to cite two studies to defend his actions that he probably found on the first page of a Google search. If he did not really understand either of them, then perhaps he did not understand those tail risk hedges as well which is why he dumped them.

As for chasing out competent professionals from his department, that would suggest that either he is insecure enough to only want yes-people surrounding himself or else he did not want in-house professionals that the Board could ask their opinions of what is going on. And this is the Trump like approach I mentioned here. But in the same way that Trump is not the problem but only the symptom of a greater problem, I think that it is fair to say that Meng here is also not the problem but the symptom of a greater problem – the misgovernance going on in CalPERS. Having Meng exit stage left would be a good start but you would have to go further up the food chain to see who else needs to be cut loose.

California: We can have a Trump administration too, we just call it CalPERs! It’s younger, it diverse, it’s cooler!

I’m glad that Lagnado stresses the same thing I did. The fund must, first and foremost, avoid large losses (“drawdowns” as he terms it).

There are tons of studies that show that the real performance of a portfolio depends on the drawdowns and when in the lifetime of the portfolio occur – portoflios with the same volatility and annual return can result in vastly different outcomes.

Because CalPers liability is open-ended, there’s no “good drawdown” (for a personal investment, if you are investing over time, and experienced a large drawdown early on, it can be beneficial as only a small part of your overall investment suffered the drawdown and the remaineder of the investment can benefit from the subsequent recovery, if there is any. A large drawdown in the late stage of a personal investment is a killer.), and thus limiting downside is way more important than chasing upside, by simple maths – to recover 10% loss, you need >11% gain, and it’s convex (i.e. the gain needed grows much faster than the loss. With 25% loss you need 34% gain, with 50% loss you need 100% gain).

Hence, if you can hedge at a reasonable cost, you should.

“The first rule in making money is not to lose it.” – Steven J. Lee

Julie Segal at Institutional Investor, who was first to write about the Universa missive, called it “scathing,” which is accurate as far as the substance is concerned, but not the tone, which is exceedingly polite.

‘Walk softly and carry a big stick.’ – TR

CalPERS continues down the easy path of least resistance, (‘down’ being the key word) while the serious pencil work is left undone; it’s like watching a slow-motion train wreck or a pack a lemmings headed for the cliff… over and over again.

Unbelievable.

Thanks for your continued reporting on CalPERS, PE, and pensions.

The perfect forum for Taleb. CalPERS had to blow up sooner or later with all those “passive, low volatility investments.” Like investing in corpses that can be mined for their organs. In a battle between Private Equity liquidation capitalism with ever diminishing returns, and defensive hedge fund investments it looks like Meng became convinced that PE was the best bet. There must have been a confrontation between PE and hedge funds as returns are running low at CalPERS (due to PE plunder). The confrontation of a wasted world desperately trying to hang on to a prize like CalPERS. PE strips capital from struggling companies and leaves them wasted; ruins. Hedge funding protects against devastation by analyzing the big picture – looking at how costly it would be to invest in a struggling company, a bad idea. The hedge fund strategy was common sense; private equity was piracy. One conserves the other one plunders.

Taleb should start a new hedge fund. One designed especially for the ditzy management of CalPERS. Maybe the Tuttle Fund. Named in honor of Robert DeNiro’s convincing performance. Tuttle, not because it is a contrarian fund (risk management is the opposite) but because Tuttle was the Plummer. The Fixer in a world of waste and denial and ruin.

I live in Sacramento near CalPERS headquarters and was in my day an executive for a state agency in California. I dealt with feds and with staff at the Governor’s office as well as the legislature. There are some predictable patterns of behavior for all of them. I have read with interest the ongoing saga of CalPERS incompetence and lack of qualifications at the highest levels and the ejection of staff there who are highly qualified and had been doing their jobs well.

Summarizing the behaviors I have seen at the Capitol: first is to keep things quiet and never to have a newspaper or other form of media chasing one around, second is to make money for the next campaign if one is elected either in the legislative branch or executive branch, third is to minimize spending. There has always been a desperate struggle to get money for campaigns and to save every penny one can in the operating budget no matter what branch of the government you are talking about.

There have been some very good comments in this blog regarding possible corruption structuring fees, the companies CalPERS contracts with and more. I don’t discount the possibilities at all. Converting spending into campaign funds is a time honored process. Back in the day it was outright bribes with characters such as Artie Samish (https://www.sjsu.edu/faculty/watkins/samish.htm) and (https://en.wikipedia.org/wiki/Arthur_Samish).

Artie was before my time but he is still a legend here in Sacramento. It is said that Artie would sit in the back of the chamber during voting and hold up fingers. Each finger was worth $1,000 for a vote in his favor. The cash was delivered later that day in brown paper envelopes. Of course that was flamboyant and could not continue forever but was the rule of the day for decades.

After Artie, there was a Thursday afternoon buffet at the Senator Hotel across the street from the Capitol. All you could eat and drink for free plus ladies upstairs for your convenience before leaving for your home office. The legislature was not in session on Fridays giving the legislators a three day weekend every week. Circulating at the buffet was for making deals and settling the price of votes. It was nicknamed Moose Milk. (See here https://www.latimes.com/archives/la-xpm-1986-09-14-mn-12454-story.html) and also here (https://books.google.com/books?id=maHaVKxLAWgC&pg=PA131&lpg=PA131&dq=california+moose+milk+lobbyists&source=bl&ots=gznvlT0NuN&sig=ACfU3U3938BA1iSUY3e2fas6p9mbJOKYDA&hl=en&sa=X&ved=2ahUKEwjG653W1prpAhUCDKwKHblOBzEQ6AEwA3oECAkQAQ#v=onepage&q=california%20moose%20milk%20lobbyists&f=false

Terrific comment above, especially regarding the history of Sacramento lobbyists, who are alive and well even if they don’t frequent Frank Fat’s quite the way they once did.

I must disagree about the presence of elected officials on the CalPERS Board. Yes, over a decade ago famed legislative fixer Willie Brown got himself appointed to a stint on the CalPERS Board and long-time legislator Bill Lockyer served there when he got himself elected Treasurer. Today, only the State Treasurer and the State Controller are actual elected officials on the Board. The Governor appoints four members; the President of the Senate one. The five members who are directly elected to the Board represent the members and beneficiaries, who are the only eligible voters.

I do agree it appears that CalPERS is being intentionally run into the ground — but this is to cover-up the losses to political contributions which have been laundered the old-fashioned way, through high fees and lobbyists. Politically, it will be expedient to time the reporting of losses with a market downturn. “Who coudda node Mr. Market would have a sad? it was beyond our control.” This will provide the cover that is suggested to gut benefits, including vested benefits.

As Jerry “The Mad Monk” Brown said in his parting interview with George Skelton of the L.A. Times and Brown family biographer Miriam Pawel:

Ah, the magic of outsourcing. If you have no talent left inside, you have to buy it from the outside, but at a higher cost than paying even well-compensated employees. What benefits might compensate for that much higher cost?

A common pitfall in outsourcing is that those left inside lose the know-how and bureaucratic juice to properly manage outside talent doing the work they used to do. They become story-telling drones, selling the good news and obscuring the bad. Outside talent, in turn, tends to circumvent their relatively low-level in-house bosses by upselling to executives higher up the food chain. They, in turn, tend to have conflicting goals, beyond, say, maximizing returns. But the in-house management job is easier, because there are fewer people to manage and fewer people who can leak bad news without losing a lucrative services contract.

Presumably, the competence-challenged Meng and Frost prefer that, since it requires more political juice than substantive expertise, which they both lack. I would call that Trump Mismanagement Syndrome.

That syndrome centralizes control over payouts, while cutting the number of key employees who might object to conduct they believed was incompetent, outside policy, or flatly illegal. Senior executives who lack basic expertise might find that attractive, and worth the higher operating cost.

On the other hand, big law firms, consultants, and investment advisers would see the promise of less oversight and bigger paychecks. The tendency for them to conform their work product to that end would be hard to resist, especially as they would immediately spot an obvious ass-covering management model. Corruption would seem to inevitably follow.

No surprise that well-regarded investment staff left after Yu (Ben) Meng arrived. Meng has always prized loyalty to him above all else. When Meng secured a transfer to head Asset Allocation in late 2013, he perfected his techniques for eliminating staff deemed insufficiently loyal to him.

Meng’s unbounded ambition permits no limits on what he will say or do to gain and maintain power.

In early January 2019, the first week that Elisabeth Bourqui and Ben Meng were both in the CalPERS office was Bourqui’s last week at CalPERS. Bourqui then hired an attorney in Emeryville who appeared with her at the CalPERS late Jan 2019 off-site meeting. Does anyone know if CalPERS settled this case? My understanding is that the terms of public agency settlements are subject to Public Request Act requests.