Has CalPERS lost its mind? I’ve put in many Public Records Act requests over the years, and never got a response even remotely resembling the one former board member JJ Jelincic received when he asked CalPERS for information about the loans it has made, either on its own or possibly in loan syndications. CalPERS would rather claim it needs to hide the information because it might expose informants, which in that section of the code are usually police informants, who are usually trading inside information about criminal activities in return for reduced sentences or immunity. It’s troubling to see CalPERS assert it needs to protect parties like that because they were involved in investing trust funds.

Let me repeat: As Jelincic alleges, CalPERS looks so desperate to shield what it has been doing on the lending front that it’s willing to depict itself as tied up with crooks in order not to expose basic details about its loans. That would suggest that whatever one would find out about these loans would put CalPERS in an even worse light.

And mind you, as we’ll explain shortly, there is way more opportunity for flat out corruption via loans to favored parties than there is with investing in private equity, where CalPERS is at least dealing with large fund managers on an arm’s length basis who also have some, if admittedly weak, SEC oversight. Now admittedly, CalPERS could have made its private loans to date through so-called credit funds, which are limited partnerships typically operated by private equity firms, such as Apollo and Blackstone. But there’s no good reason to be so spooky about that. And on top of that, that sort of investment arguably should have been reported to the board.

We’ve attached Jelincic’s letter to CalPERS questioning its basis for largely rejecting his Public Records Act (“PRA”) request, as well the request proper. We’ll also discuss the limited amount of information CalPERS did provide, but bear in mind the PRA response is an admission that CalPERS withheld some of the information Jelincic sought.

This Public Record Act request is important for two reasons. First is to see what if any experience CalPERS has in entering into private debt deals. Recall that the now-departed Chief Investment Officer, Ben Meng, announced that CalPERS would be making large commitments to “private debt” as part of CalPERS’ “pile on risk in a desperate effort to meet our unrealistic return targets” strategy. This was alarming because CalPERS was out to make risky loans, a hazardous undertaking even at the best of times, at the peak of the market, and even worse, when it has little to no existing expertise.

One sign of a frothy corporate lending market, well known to anyone paying even a modicum of attention to the financial press, is that lending terms for the last few years have been exceptionally favorable to borrowers, due to the Fed’s protracted super low interest regime producing intense chasing for yield. For instance, in 2019, Axios reported that “cov-lite” loans dominated the US and European markets. As its story explained:

The loans are called covenant-lite because they lack traditional loan requirements and offer less protection for lenders and investors than traditionally structured credits if borrowers default.

Since Meng left, CalPERS has insisted that it is full steam ahead with its private debt initiative, even though sticking doggedly to Meng’s plans would tie the hands of an incoming Chief Investment Officer and is likely to reduce the pool of candidates.

As part of that scheme, CalPERS sponsored AB 2473, which provided that private debt would not be subject to disclosure. During its lobbying for the bill, CalPERS argued it was necessary because CalPERS intended to act as a direct lender, meaning act as a bank and make its own loans to businesses, as opposed to simply investing in private debt funds run by seasoned players. Needless to say, this confirmed the worst fears about what CalPERS planned to do. AB 2473 would have also given “private debt” the same secrecy afforded venture capital if the fund chose to contract out the running of the program.

Sacramento insiders people believe the purpose of the private lending program is to help Mayor Darrell Steinberg get his wish for local ownership of the Sacramento Bee. Having a friendly lender provide most of the money on favorable terms would increase the attractiveness of the investment. And CalPERS would get the bennie of assuring that the Bee would continue to publish CalPERS’ spin. Notice how beneficiary interests are absent from this calculus.

The sponsor of the bill, Assemblyman Jim Cooper, pulled it after the Meng scandal broke.

The second reason this PRA is important is for the high potential for corruption. And let us not forget that this is a valid concern with CalPERS, given that its former CEO Fred Buenrostro is in Federal prison for taking bribes.

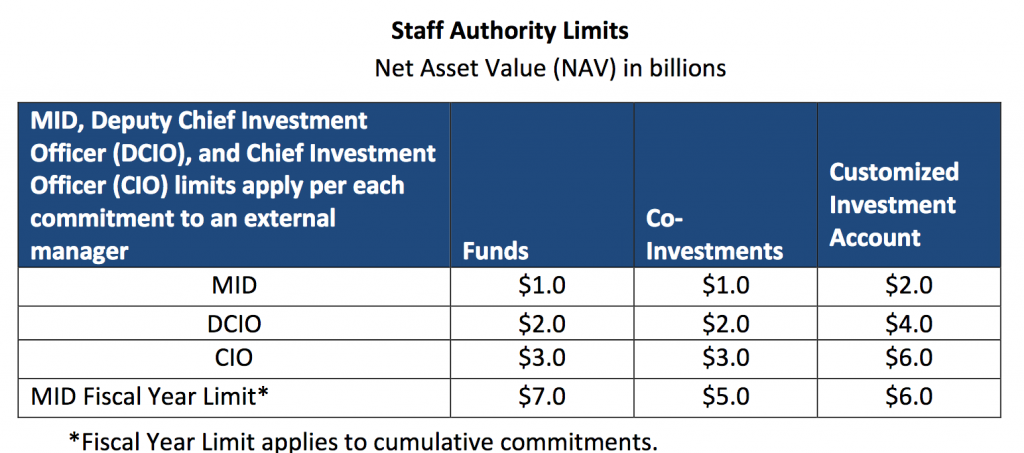

Recall that CalPERS investment staff now has very high limits for how much it can invest without getting approval of the board. This is the governance lapse that ought to have beneficiaries and California taxpayers deeply concerned. Look at how much various CalPERS executives can deploy on their own authority, with no board oversight.

Further notice the least senior officer listed, the MID, for Managing Investment Director, is the only one subject to a cumulative limit for the fiscal year. And as we saw with Ben Meng’s conflicted $500 million commitment to a Blackstone fund, such investments are subject only to one-line disclosure after the fact.

It is striking that board members don’t seem concerned about their legal exposure under this private debt initiative. The Public Employees Retirement Law, makes the board and only the board liable for the stewardship of trust assets. They can’t hide behind, “Staff did this, how were we to know?”

On top of that, misappropriation of public funds is criminal in California, and the government officer does not have to benefited personally to be liable. Does the board not recognize it is exposed by Ben Meng’s conflicted $500 million commitment to a Blackstone fund, as well as a $500 million Carlyle transaction initiated on his watch that still appears to be moving forward?

At a minimum, CalPERS needs to reboot these transactions to clear up the misappropriation exposure, since Meng’s high velocity departure is tantamount to an admission that something was seriously amiss. But CalPERS appears to be more afraid of private equity firms than the risk of wearing orange jumpsuits, despite the fact that that’s actually happened within the past decade.

The limited records Jelincic obtained shows that CalPERS is currently putting private debt in its “Opportunistic” category.

And the documents that Jelincic did obtain showed that you can’t figure out what is going on beyond the dollar amounts and maturity dates:

![]()

These records are also internally inconsistent. CalPERS can’t be both investing in securities and making a bank loan, particularly since it it not a bank. But in fact, Mesa West Core Lending Fund, L.P. is a roughly $4 billion commercial real estate lending fund, with over 50 limited partners, and has to file annual disclosures with the SEC. Given that the Mesa Core Lending Fund’s parent, Mesa West Capital, appears to regard Mesa West Core Lending Fund, L.P. to be subject to the SEC’s reporting requirement for private equity funds, one wonders why CalPERS has not included it in its mandate quarterly private equity fund disclosures.

And consistent with real estate lending not being secretive, the Mesa West site proudly lists quite a few “sample transactions” with addresses and photos, the purpose of the loan and closing date. Odds are decent that more details were reported at the time of closing in specialist publications or Crain’s Business.

On top of that, as most lawyers and bank employees will know, secured lenders make UCC (Uniform Commercial Code) filings. Among other things, UCC filings prevent the same collateral from being pledged multiple times. They are public records, typically filed with the Secretary of State. So again.

Normally when CalPERS turns down a PRA request related to investing, it tries claiming everything that uses a limited partnership structure is an “alternative investment” even when courts have said otherwise. Specifically, in 2010, CalPERS lost a lawsuit over its efforts to hide documents regarding a lossmaking real estate investment, Page Mill Properties. The judge ruled that real estate was a traditional investment and subject to disclosure. Nevertheless, CalPERS has taken the “sue us” posture, continuing to reject PRAs for information about real estate investments.

CalPERS also typically cites a catchall provision, Government Code Section 6255(a), which amounts to “we think the public is better served by our hiding the records.” California courts have consistently rejected this section as a rationale for evading disclosure.

By contrast, as Jelincic points out, the pretexts CalPERS offers are not just novel but also come off as desperate. As you can see, the PRA response (the second embedded letter) invokes Califorinia Government Code Section 6254, which incorporates Evidence Code section 1040, subdivision (a) and section 1060. From Jelincic’s letter (emphasis original):

Section 6254 (k) reads “Records, the disclosure of which is exempted or prohibited pursuant to federal or state law, including, but not limited to, provisions of the Evidence Code relating to privilege”

You cite Evidence Code section 1040. I can only assume that you know Evidence Code section 1040 et seq. is about protecting the identity of confidential police informants. If the disclosure of borrowers and the term of the loans would actually disclose confidential informants the private debt program is a cesspool in which no prudent fiduciary would invest trust assets.

Which is it, a bad faith claim of exemption, a cesspool or both?

You also cite Evidence Code section 1060 which reads “If he or his agent or employee claims the privilege, the owner of a trade secret has a privilege to refuse to disclose the secret, and to prevent another from disclosing it, if the allowance of the privilege will not tend to conceal fraud or otherwise work injustice.” You do realize that Evidence Code section 1060 et seq. refer to criminal cases? I would assume you do since you chose to cite it. I guess that is why a confidential informant might get exposed.

At best, CalPERS appears to be tilting at windmills in its unusually extensive to ‘splain why it does not have to disclose what it has been up to with its lending. As one lawyer remarked:

A court would find the “in confidence” provision not “in the interest of justice” under EC 1040 because it is designed to mislead the public and to disguise conflicts of interest and undue influence.

Finally, although less scandalous-looking, CalPERS effort to claim trade secret status is ludicrous. First, it can’t credibly apply to any information that its lenders provided to CalPERS in any assessment process. Lenders don’t receive anywhere near as much information about a company’s strategy because lending reviews aren’t to assess upside but downside. They are much more concerned about historical performance and any reasons to worry that might not continue.

And “trade secret” is a rarefied standard. It is so important that it is central to a company’s success, like the formula for Coke, and is not shared with external parties due to the risk to the business.

Second, if CalPERS claims anything it is doing in the investment arena could possibly be considered bo to a “trade secret,” it would be laughed out of court. Has CalPERS gotten high on its “innovation” PR?

Jelincic’s letter shows that CalPERS has gone into “The lady doth protest too much” mode in its desire to hide its private lending. Given the hot water CalPERS is already in, this is not behavior that engenders confidence.

00 ain't gonna00 Jelincic 5268 Final

At the risk of being called Dr. Obvious, it sure looks to me like CalPERS is heading for another version of the Buenrostro type of criminal debacle.

Do these folks never learn?

It just seems to get “worser and worser”.

Thanks, Yves, for your continuing coverage of this ongoing tragedy.

Hear hear JZ; Did everyone notice that JJ gave Yves a shout out in his letter? The last line says;

“Please try again. Since you have already done the research, I hope your definition of “prompt” is more consistent with Webber’s.

Now if that isn’t a shout out to Yves, I don’t know what is!

I need to re-read this post to fully understand it; this part is very understandable and a worry. The other remaining big California dailies, the San Francisco Chronicle, San Jose Mercury, and Los Angeles Times are not the papers that they were, not that the Chronicle or the the Merc were anything impressive before. Forty million Californians and we one decent paper and three small town rags.

I emphasized the word remaining because one of reasons, besides my state’s endemic corruption, is the lack of good news organizations. There are a few, but none aside from perhaps the LA Times, that has the exposure, reputation, and resources to cause any effective and sustained reforms. CalPERS might soon get the loving attention from the State and the Feds that it deserves, but what about next year?

Perhaps the reason, aside from climate change, for all the power outages and the non-lightening caused fires is the unending, century plus, corruption of California’s Public Utilities Commission, the PUC. The commission is almost a department of PG&E. The names of the agencies change, along with the org. charts, and very occasionally someone is sent to prison. This when there are multiple investigations by multiple news organizations. But nothing really changes especially when one party is in complete control. Will anything truly change with CalPERS?

It is really rather depressing to read the story over and over again be it from a California history book, a news article, or this site. To say in another way, this might have started before my great-grandparents were married, and is likely to going on long after I’m dead with just cosmetic changes done. Heh, is it California Dreamin indeed, to wish that was not so?

I’ve always thought that one of the curses afflicting California is that it is just so darned beautiful. I’d move there like a shot, if they’d let me in on agreeable terms. When you’re surrounded by all that lovely scenery, the sunshine, the ocean, the mountains, the perky perfect bodies and the glitter, you get seduced into thinking that there’s no way anything anything unwholesome could ever happen there.

Sydney is as pretty as California (and beaches!!!) and it didn’t have anywhere near California’s level of corruption (and even with its slide into neoliberalism, it has a long way to go to catch up with the US).

But Oz is famous for being well managed for a small country. It either does things very well or terribly (like its stupid GST; a retail sales tax raises just as much money with much lower admin costs). I think that’s because it knows it is little despite having so much territory and far away and therefore more on its own. So my sense it it is part of their collective psyche that they can’t afford to screw things up all that much.

By contrast, as my tax lawyer friend who used to lecture all around the world say, the US is so rich it can afford a lot of corruption. A less wealthy could not support our horrible health care system and our level of military pork, for starters.

Unfortunately, Oz is also being hit hard by climate change – potentially worse than Cal. And while it has Cal level stupidity on water management, it has much less water.

NZ is better managed than Oz (and that was before Arden, who some of my Kiwi friend consider good at international stuff and crisis, not very good at day to day domestic ops), and while it doesn’t have such great beaches as Oz (well, it does, but they are more remote), for living and scenery I’d still prefer Aotearoa to Oz.

The downside (well, for some, for others it’s upside) is that if you want interesting stuff work-wise, you pretty much have to invent it yourself (Weta, Xero to name a few I know of)

I think that you have put your finger on one of the great weaknesses of the US, something not often recognised. Quite simply, the US is rich enough in people and resources to make huge mistakes and not pay a real price. For example, no other country in recent history could lose so many unnecessary wars over the past 50 years and still be politically and economically viable. The USSR screwed up in Afghanistan and the French screwed up in Vietnam, and were both deeply and permanently wounded. The US didn’t pay the same price for screwing up in both. This may well apply on a State level as well. States like Texas and California can have terrible administration and deep corruption and still be rich.

Very often, the best run countries are those with the narrowest margin of error. For all sorts of climatic, environmental and political reasons countries like Finland or New Zealand or Iceland or Taiwan simply have to get most big decisions right, or they cease to exist as prosperous havens. It focuses the collective mind.

As a California native & Oregonian transplant, I actually think the Pacific Northwest is prettier overall (with a few notable, tall, and very old arboreal exceptions).

Shh! No, it’s terrible here in the PNW! Everyone should stay in California! Please!

I loved the three years we lived near Portland when I was a kid, but you have to not mind the frequent clouding up and light rain. It never bothered me because the ambient light level was still high and the rains were warm. Not at all like most rainy days in the East!

Unbelievable. This is so out of real world that I just can’t comment on it, it’s like some sort of combination of a MAD, Onion and 1984.

It’d be as if a traffic patrol stopped you and you refused to say anything citing the fifth amendment (against self-incrimination).

Oh, and using the “protect the informer” section in a blanket way like this would mean that _every single loan_ CP made was criminal in some way, as of course it would never stop them providing information on normal “non informer” loans.

I’ve always considered that, if patriotism is the last refuge of the scoundrel, then secrecy is the second-to-last.

Jelincic has skewered CalPERS brain-dead efforts at subterfuge and evasion and, topped off with Yves’ coverage, there’s little to add to this comprehensive documentation of how CalPERS is up to its old tricks again.

As a more broad note on the overall mood-music which CalPERS is playing here, I will add that in Japan, where corruption has been elevated to a level which is redolent of of a Geisha performance (where the key to being seen as performing it correctly is to deliver apparently effortless delicacy and subtly so that the onlooker attributes to natural, carefree ease to what is underlyingly a convoluted and complex setup), the corruptors and the corruptees have long since moved on from a suitcase stuffed full of cash being exchanged in a hotel room.

No, the name of the game in Japan where you want to get something you might not really be supposed to be getting is via soft loans which seem to have no discernible repayment schedule worthy of the description, loans to dubious parties without the appropriate underwriting and scam loans where there isn’t an asset being secured for the funds being advanced or there is a rapid default without any attempt to do any recoveries. Here’s a typical example.

So I’ll say this for CalPERS — it is getting a teeny tiny bit smarter with its malfeasance. It does have a long way to go to be able to hope to match the Japanese way of hiding suspect transactions in loans — CalPERS comedic stonewalling and PRA “let’s make up the most ridiculous excuse we can, if we’re going to tell lies, let’s make them big ones” evasions was way too cack-handed. The Japanese would have done a “we’re giving you’re questions considerable thought and will not hesitate to provide you with any assistance we can when we have looked into the matter with all diligence and care” (then done exactly nothing) response.

So, CalPERS, I’ll give you 8/10 for concept and style, 2/10 for the performance.

Ummm, exactly what investments was Meng getting CalPERS involved in anyway? And ones that to protect their secrecy that you quote legislation to do with criminal matters? Was reading too here that CalPERS wanted to act as a direct lender, which means acting as a bank, and make its own loans to businesses but without having to follow banking laws and other inconvenience regulations.

This being so, you don’t think that maybe CalPERS did what the big banks did several years ago and get involved with laundering money for ahem, dubious groups by any chance. Yeah, this sort of investments you would want to keep quiet about. CalPERS was not quite taking the fifth here but they are getting closer to doing so.Even when you are as big as Wachovia and Wells Fargo, that still attracts the attention of people in the Internal Revenue Service who you do not want on your case.

Here is another possibility. Considering the fact that Meng got the ejector-seat treatment, could it be that CalPERS themselves are still trying to work out what he was investing in and where all the money was going. Worse yet, perhaps they did find out and what they found caused them to shut up. And now they are trying to find out how to unwind those deals without anybody noticing.

The more I read about this aspect of Calpers operations, the more it seems to resemble the Teamsters pension fund operations as depicted in The Irishman. Maybe Marcy is a secret Scorsese fan.

Yves, you have very good information security practices so I assume J.J. Jelincic’s address and e-mail etc. may be a matter of public record because of his former role at Calpers or his PRA requests (freedom of information requests are public in the UK) but, even if it is, would it not be better to redact it when republishing his letter?

No, he gave it to me to publish in full. And yes, since he has been a state official for many years and at the same address, his coordinates are well known in CalPERS circles.

This looks like a potential for cloaked signature loans to the favored few. What could go wrong? sheesh! And who is really behind this cooked up this scheme?

Thanks for your reporting on CalPERS, PE, and pensions. CalPERS looks more and more like the “bad example” other state pensions should not follow.

In my experience (n=1) working in a small investment advisory group, the external members of the board were there only to provide the illusion of compliance. Granted they were appointed not elected, but there seems little difference these days. I would also add that the operations department knows more about the book than the board does.

My jaw hit the floor.

This is above and beyond, even for CalPers.

The job of the Attorney General is to make sure no one rocks the boat but I don’t think AG Basura can ignore this mess any longer.

My thanks to JJ and Yves.

Just an opinion, but comments insulting the AG (who hopefully is frequenting this site) won’t help win him over to action.

He’s useless. His reputation for uselessness even washes up over here across the pond. CA’s image for competent governance is in the toilet, Bloomberg (no less) bemoans how badly the likes of PG&E’s failures are affecting business. Basura can’t be “elevated” to politics quickly enough, so an AG who does at least seem to have some basic grasp of the rule of law can be put in his place. Some public servants are just lost causes. Basura is one such.

I sincerely doubt the AG has any interest in the comments here. People with a lot more influence in CA say similar things. Since he’s not going to act, calling him out won’t make matters worse.

He didn’t have a law license for something like 20 years before he became AG. You see from Eric Schneiderman, who actually did practice law (admittedly in a small firm) for a few years before going into politics what happens when you get a non-prosecutor as AG. At best, all hat, no cattle. And Schneiderman was willing at least to stick his neck out a bit even if he was no good on follow through.

Why, it’s almost like the CA Dem estab is selecting for ineptitude in certain positions… for some unknown reason. /heh

If the ‘police informant’ were Mr. Meng, would’t that include the entire loan program?

Imagine the largesse and patronage CalPERS could dispense if it could secretly lend billions without the need to disclose the identity of borrowers, the purposes or terms of the loans, or repayment histories. Individual loan losses might be hidden, by bundling results into categories. The potential conflicts of interest alone boggle the mind. Why does the Central States Pension Fund come to mind?

Yves, in all your years of reporting on the CalPERS flea circus, today’s post has to take the cake for jaw-dropping gall on the part of the CalPERS staff.

Loans are the equivalent of “official information” reported to a public agency which must be kept secret “in the interest of justice?” The terms of such a loan are “trade secrets?”

Am I the only one concerned that these “Private Loans” are being categorized in the Investment Class of “Bank Loan” when they are nothing of the sort, being nothing less than unregulated lending a hair’s breadth removed from loan-sharking? Or should they be properly categorized as “Gifts”, since for all we know they’re being made to cronies with no prospect of repayment.

As always, Follow the Money…