Yves here. On the one hand, Covid will be with us for some time, and so will its effects on the housing market. But a recent Wall Street Journal interview of CEOs showed way over 90% hated remote work. They think a lot of informal collaboration has gone down the tubes, and some also claimed productivity was down (not implausible given that many employees are now having to contend with a lot more child management). So expect work-at-home to be curtailed when Covid is eventually contained. And bear in mind that Silicon Valley firms are also cutting pay for staffers who have moved to places with lower costs of living.

And that’s before you get to the elephant in the room, which is Wolf’s focus: that the willingness of DC to continue to throw enough stimulus at the economy is already waning, witness the scrapping over the latest bill. The erosion of the economy from the bottom, like gangrene, will eventually work its way to the core if not checked, and it looks like it won’t be.

By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street

Another batch of crazy housing data yesterday. Crazy in the sense that the housing market, or rather part of it, namely the higher end of it, has gone totally crazy and that by now everyone knows that this isn’t “sustainable,” that “there’s no way it can last forever,” as Redfin CEO Glenn Kelman told CNBC. And he pointed out what everyone has already been pointing out, that “part of what is fueling this boom is that the economy has just split into two, and rich people are able to access capital almost for free, so, of course, they’re going to use that money to buy homes.”

But “there’s just another group of Americans who are still struggling, who can’t access the credit because we’ve raised credit standards, and you have high unemployment. I just think those two trends, at some point, have to collide.”

It’s the now well-established phenomenon of the “K-shaped recovery,” where one part is doing well, and the other part is getting crushed.

Or as WOLF STREET commenter IdahoPotato called it vastly more accurately and unforgettably, the “FU-shaped recovery.” Meaning, people who got bailed out and enriched by the Fed’s $3 trillion that it threw at the markets to inflate the prices of stocks, bonds, housing, etc. are now happy as a lark, and to heck with the rest of the people that are getting crushed.

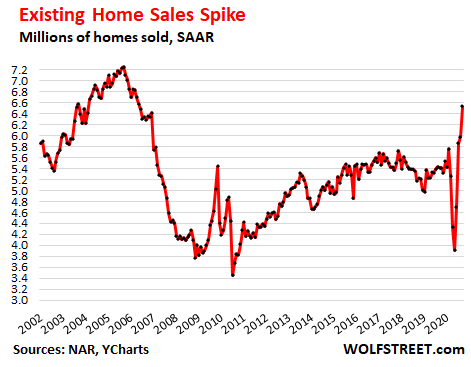

But this craziness in the housing market is not sustainable. The National Association of Realtors reported yesterday that sales of existing homes – single-family houses, condos, and co-ops – surged in September by 9.4% from August and by 20.9% from a year ago to a seasonally-adjusted annual rate of 6.54 million homes, the highest since 2006 (data via YCharts):

Seasonally, home sales normally decline in late summer and fall. But not this year. And the seasonal adjustments of the above numbers are designed for normal seasons. The NAR also releases raw(-er) sales numbers that are neither “seasonally adjusted” nor “annualized.”

On a not-seasonally adjusted basis and not annualized, 500,000 homes were sold in September, up 24.7% from September last year, the highest year-over-year increase in the data except for two months during the depth of the Housing Bust – April 2010 and November 2009 – when sales were compared to a year earlier when sales had collapsed. Sales went through some wild gyrations from 2009 through 2011.

And on this basis (not seasonally adjusted, not annualized), and compared to September 2018, homes sales were up by 34%.

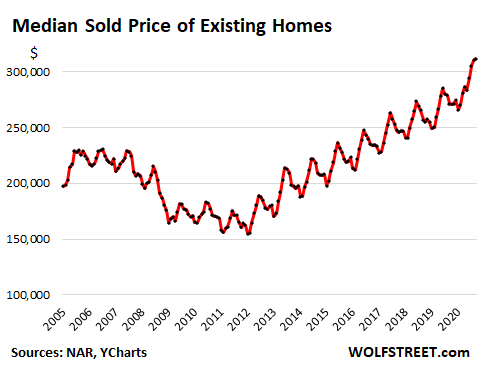

The median price of existing homes in September jumped 14.8% year-over-year to $311,800. The median price is skewed by a shift in the mix, and the price increase could also partially a result of red-hot demand for higher-priced homes (data via YCharts):

“The uncertainty about when the pandemic will end coupled with the ability to work from home appears to have boosted sales in summer resort regions, including Lake Tahoe, mid-Atlantic beaches (Rehoboth Beach, Myrtle Beach), and the Jersey shore areas,” the report said.

I have heard similar stories from real-estate brokers, such as red-hot demand in very pricy Carmel-by-the Sea, in California, about 76 miles south from San Jose and 116 miles south from San Francisco. The demand is said to be particularly hot for homes in the $2-million-plus range.

But here is what I also heard: People bought their new home without first selling their old home. They still have their place in San Francisco, or wherever, and will eventually put it on the market, but meanwhile they plowed a few million bucks into a house in Carmel and moved. These stories are everywhere.

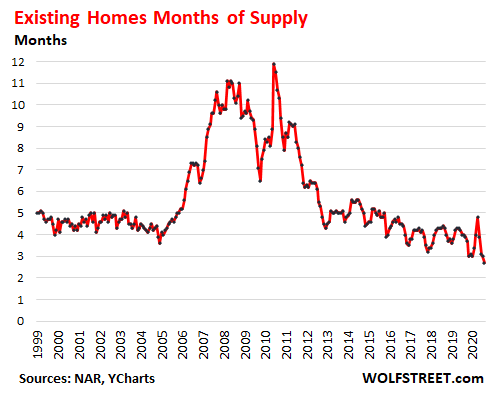

Total housing inventory of homes for sale at the end of September fell 1.9% from August and 19.2% from September, to 1.47 million homes, according to the NAR. Given the sales rate in September, this represented 2.7 months of supply, the lowest ratio in the data going back to 1999. Granted, with today’s technologies of advertising, selling, financing, and closing the sale of a home, sales take a lot less time than the did in 1999, but still (data via YCharts):

There is a shortage until suddenly there is a glut. This always surprises people.

This is happening in San Francisco — and something similar is happening in Manhattan and some other cities. The City was long described by its “housing shortage” that drove up prices and rents though there has been plenty of housing, but all high-priced, and people couldn’t afford it. And suddenly that “housing shortage” has turned into a glut. The city is flooded with a historic amount of inventory, including a record-breaking number of condos for sale, and there is a large offering of vacant apartments, and rents have plunged, with one-bedroom rents down 19% in five months.

The inventory of homes for sale spiked from “shortage” to “glut” in a matter of months. As of the week ended October 11, there were a record 2,476 homes listed for sale, up by 72% from the same week last year, with condos accounting for the lion’s share. Note how the glut has blown all seasonality out of the water (chart via Redfin):

These gyrations in the housing market are occurring as, at the lower end, homeowners are steeped in turmoil, with nearly 7% of all mortgages in forbearance, according to the Mortgage Bankers Association, and with delinquency rates of FHA-insured mortgages, which cater to the lower end of the market, skyrocketing to a record 17.4% in August, and with 23 million people still claiming state or federal unemployment insurance. That’s the other part of the “K-shaped” recovery.

Surging home prices like these are a terrible toll to pay for buyers, except for those where wealth is such that it doesn’t make any difference. As these home prices surge, the market will inevitably run out of buyers willing and able to buy, even at record low interest rates, especially in an economy like this.

In addition, there is lots of supply waiting in the wings, including: A portion of the homes whose mortgages are in forbearance and delinquent will have to be sold to cure the delinquent mortgage; homes whose owners moved into their recently-bought new home will end up on the market; and homes owned by investors for vacation rentals will end up on the market if vacation rentals continue to be a drag in those cities. This surge in supply can happen suddenly, as it has happened in San Francisco.

And then there are interest rates. Oh no… Not again. They’re going to be negative, right? Um, the Bank of Canada announced it will cease buying mortgage-backed securities after October 26, having realized that it has gone overboard, seeing the same kind of insane surge in the Canadian housing market that is taking place in the US.

Which makes me wonder: Will the Fed, after the election (it never changes policy shortly before an election), start muttering musings in the same direction concerning its MBS purchases? It too is seeing this housing insanity, and after having already quietly mothballed its corporate bond-buying program, its repos, and its dollar liquidity swaps, it would be an unsurprising next step.

Somebody, hand me a fiddle and some matches, quickly.

“So expect work-at-home to be curtailed when Covid is eventually contained.”

I do wonder about productivity. I had IT jobs back in the 80s and I do remember that they had no real way of measuring my productivity. They pretty much relied on you being there physically and being motivated. I was occasionally motivated but most times not. I do remember often sleeping at my “work” station and doing things other than work on the machine. Someone was over your shoulder or could be. Of course, at that time, they were bringing in employee monitoring software so I imagine that in that area they have more techniques now to get employee compliance.

So, one hears all this about “miss my job”, my office, etc. but one really wonders that productivity isn’t taking a real hit from goofing off at home. Personally, I would be looking at any ways to defeat or skewer productivity measurement of working from home. I wouldn’t think I am an exception in that regard.

Also, face to face interaction, reading body language and other physical manifestations probably assist managers and supervisors in assessing job performance and motivation. Abruptly remove those tools and it may hurt productivity.

In terms of measurable outputs, my employer was rather shocked to find last month that the organisation had become more efficient with working from home. I suspect there was an effect whereby staff were making more of an effort to hit quantitive targets. It also helped that working away from the office removed many of the time wasting distractions (usually called ‘meetings’) that interfere with real work.

That said, I know of a few individuals who have really been suffering away from the office and are in trouble with outputs. I was talking this week to a new colleague who was hired just before the outbreak and took up her post over the summer. She was very stressed out, not really knowing what to do, she said the lack of anyone around to tell help her out with simply queries was making it very hard to know if she was doing things correctly, and as she was still on a probationary period she felt she would not be given any leeway.

through my grapevine (non-scientific, informal) poll, senior management LOVES work-at-home….

similar productivity, more time w/family. Less time traveling on baloney sausage client trips.

Caveats: all were established companies, which don’t need to pitch for clients. Work-at-home would stink for a junior employee or a new business.

IMO, some form of work-at-home will be permanent.

Two core problems with work from home: 1. employee development/promotions; 2. child care.

In our business these two problems hit the same people and they’re key people for the business.

I think that whether CEO’s like or dislike working from home depends on their management style. One of my sons has worked from home since February and he manages employees all over the world – he hasn’t seen any downside to working from home. In fact, he sees more collaboration between his employees because they have become very adept at talking to each other via video calls so now, for example, his people in Shanghai actually spend more time talking to his people in California than they ever did before. His company is going to permanent online

One of my daughters has a VP, on the other hand, who is having a really hard time with working from home, but he was always walking around the offices making sure people were working. He can’t do that now. He is already trying to force people into the office, basically so that he feels he has important work to do.

Deadlines still exist, metrics still exist, I really don’t see what difference it makes where you work.

I 100% agree. I have been working from home (when I work that is) for 20 years for the most part and I love it. I find myself to be way more productive mainly because there are no interruptions. As a software architect being able to concentrate is paramount.

Even for an eight hour workday people spend between 10 to 12 hours doing it – getting ready for the day, breakfast, going to work then coming back home. Even at work people typically only spend 6 hours working. Working from home you can use the whole 8 hours.

Tracking workers productivity is fairly easy – are they getting the work done properly and in a timely manner.

I realize, however, that working from home is not for everyone.

I was always more efficient working part-time than full-time. For years, I worked a 25 to 30 hour week (in an office). I was much more productive on that schedule than I was for the several years I worked full-time, and as a part-timer I was more productive than other full-timers, too. Also, happier. Granted, I was a young mom, and the family was seldom totally reliant on my income.

Unfortunately it was not by choice on my part. Globalization and the H1-B visa made sure of that.

Indeed. And there’s another couple (at least) aspects to it.

For lower management, it’s we used to call face time, i.e. time you could get your face before your boss, so that they woudl at least have an idea who you are, and if they see you first thing in the office and last thing in the office, it must mean you work hard, right?

For higher management, if everything is running smoothly remotely, with the same or even higher productivity, how exactly do you justify that magic you’re meant to bring to the company and hence your pay?

I seem to recall a long ago study that concluded that changes in the physical work environment, such as office remodels, almost always produce a temporary increase in productivity. Reduces ennui, I suppose.

Informal collaboration, the fulfillment of social needs through flirting, griping, encouragement, the transmission of helpful hints, and all sorts of other stuff happens on the job when people are in close proximity to one another. “All civilizations are the result of people just hanging out together” a sign read over the bar of one of my watering holes of old.

Consider the name The 2:00PM Watercooler as an evocation of a period of socially satsfying, open ended and informal group communication at the workplace.

But if there were no pandemic, these things could be arranged only when necessary. Workers could still meet after work and socialize.

It’s like saying, “Well, you can’t drive your car during effectively during a blizzard, so driving isn’t an effective way to travel.”

I find meetings and conference calls easier now. Mute on, video off, and I can do other handle-turning tasks at the same time. By boss told me she was on two concurrent 1 hour calls, on different computers, and nobody realised.

Calling Jeffrey Toobin. Sorry, couldn’t resist.

This pandemic and social turmoil environment (with its effects on mental and physical health) is not the environment to render judgement on the “efficiency” of working from home or remotely.

If the kids could be at school and co-workers still able to to gather in person when necessary, for example, then it could be compared fairly to working from the office.

‘But here is what I also heard: People bought their new home without first selling their old home.’

By the sounds of it, they are having an each way bet. With those for San Francisco for example, if the pandemic ends in the next year or so, then they have their place in San Francisco to go back to and work from for their regualr work. If the pandemic is with us for a coupla years more, then I am betting that they will opt for distance working from their second home.

With spending on long-distance travel out and interest rates at rock bottom levels, now is the time to do this if you have the money. In either case, either home is a salable asset. What would be interesting to watch for is any colonies developing. What I mean by that is clusters of such people that congregate around particular towns or areas recreating their own version of the Hamptons. I suppose that such places would show up on social media eventually or more likely in real estate values.

There are a set of “Brooklyn on the Hudson” towns, like Hudson NY.

And Nyack, NY, my hometown.

In the Portland, ME area one real estate agent told my wife he had sold 50+ properties to people from Brooklyn in just the preceding year, and that was a few years ago. It hasn’t gotten better since. A modest home in my neighborhood was on the market last week very briefly for a little over $500K, which is already way too much for most people who actually work in the area. After a bidding war it sold for over $600K.

This area has rapidly become a boutique community for wealthy people from Boston and New York. Downtown Portland has been hollowed out by expensive new hotels and Airbnb properties, and it’s only gotten worse since the pandemic started and the rich started to flee.

This can’t possibly be sustainable and I joke that the developers running wild over the last decade are merely building the slums of 2030s and 2040s. But they won’t stop. Took a walk this morning and yet another small, tree filled lot has had the trees cut and land prepped for another house to be crammed in, and I won’t be at all surprised if it sells to some person from away who overpays without ever seeing it other than in an online listing. That has definitely been the trend here over the last several years, and especially in 2020.

I think this might just look like a boost to market in areas already with high rate of second homes. Some tourist towns with halfway decent off season weather and proximity to core might see that type of agglomeration like you say.

That’s not what I’m seeing in my working class neighborhood. Not a 2nd home area at all. I live in a nice area of mixed town some avoid and not known for having good schools. Homes around me are selling immediately over asking and listings are in short supply. Price are way up the internets raise the supposed value of my house almost weekly.

timbers, same thing happening around here(Upper Valley of NH/VT) and in southeastern MI where my brother has a home appraisal/inspection business. Places are selling within hours of going on the market for above asking price, multiple offers, for cash, etc. Prices are climbing higher and higher. A lot of places are selling to people from out of state, around here to well-off NY/NJ/CT/MA city people. Brother is seeing same where he is located. He said he has been working non-stop, exhausted, but glad for the extra dough.

I went to my credit union last month to look into what I could get for a mortgage and at the most, I could get a shitty falling down single-wide trailer out in the boonies. I have a degree in biology and manage a lab and do academic research, but in my early 40s, this is all I would be able to get. It’s humiliating. Am $800 away from paying off what had been $30,000 in student loans, but it doesn’t even matter anymore. A decent little starter place is completely out of reach and getting further away. The lady that helped me at the CU said places are overpriced right now, stuff is selling fast and for more than it’s actually worth. She suggested I look an hour away, you know, because commuting 2+ hours on the highway per day is what poor people like me are supposed to do. I just don’t see an end in sight. It is so hard to keep even a slice of hope alive anymore.

My folks live in the same area and are saying the same thing as you. My family has lived in the Upper Valley for at least 6 generations and the younger one now coming of age can’t afford anything. My own father recently told me they never had a bank mortgage because my grandfather set each of his four children up with a home and they paid him back instead. My grandfather was a dairy farmer milking 60 cows, not some corporate magnate. I can’t even imagine doing that now.

And the idea that buying a home an hour away from where you work will be more affordable is often nonsense. When we bought our house, we considered commuting 30 minutes or so to save on the house price, but quickly figured out that the extra cost of gas would be way more than any savings on the house. And we were very lucky we bought when we did, right after the 2007-2008 crash. Houses are now going for 2-3 times more than we paid and if I tried to buy in this area in Maine now I’d never be able to afford it.

She said “You should look in Washington, NH” after she had asked me if there was someone I could get the mortgage with, etc. When I got home I looked it up on a map and started laugh-crying.

lyman alpha blob, if you guys are ever in town, I’d be happy to buy lunch.

Congratulations for getting out from under your student loan! That’s a real achievement. Housing is soaring here in Oregon, too. I don’t know what the answer is; all I can do is wish you a good future.

Thank you, Janie! Best wishes to you.

Petal, I am near your age and in the same paradox of downwardly mobile-while-upwardly mobile, and the gaslighting is awful. The “younger” people (literally 5 years younger) think we had it made because things were 20% less bad 10 years ago, and those who bought housing pre-2000s are willfully ignorant of the situation.

But the math does not lie. Buying has been a bad investment relative to renting unless you are a speculator who could hedge your bets with multiple properties and pay the absolute minimum in maintenance, and at any rate, I could not have gotten a mortgage for most of the last 20 years anyway except maybe sometimes on a condo (which seem to be rapidly going down in price now, so wise decision there to continue renting).

Keep up the faith, you made the right life choices, it is just that the available choices were so much worse than what the last few generations had.

Hi Joe, thanks for replying. Rent is high around here as well, which is why I looked into a mortgage. The payments tend to be cheaper than a rent payment, esp if you or a comfortable family member can cough up a DP. Things are so messed up. When I think that my parents bought a house near a beach for next to nothing in the late 70s, all while one was going to university and raising a kid, it blows my mind and I think that I must have done something majorly wrong. I tried to always do the right thing and it hasn’t mattered a lick-go to college, pay your loans off, keep a stable job, etc. Your 1st sentence characterisation of it is bang-on.

>>always did the right thing

The one right thing that I could have done, that my alma mater was urging me to do, was go into some branch of finance or management consulting. But I just could not do it. Partly because of my conscience but more because I could not stand the people I saw going into it. Not just valueless, not just soulless, but boring, and the kind of people who put huge pressure on others to be like them.

If liquidity (in real estate) becomes a problem, the folks who have a second home may have to sell at a lower price. Worse still, if they lose their job, they’ll be up the creek with no paddle!

I think it might be well to consider the notion of bullshit jobs when thinking about how the housing market is going to play out. I worked in computer technology for about 50 years, and during that whole time I would say that the totality of what I did for money was valuable locally but globally worthless. People paid me well because I was White, spoke and wrote good English, and could make computers do things they thought they wanted them to do and then describe what I had done clearly. However, I am pretty sure higher management had no idea what I was really doing or how to measure it, and if my work product had vanished at some point, it would not have affected global wealth in any way, although there might have been some incidental local difficulties. I suspect many of the PMC are working under these conditions. What actually keeps the economy going (in the sense of providing people with things they actually need or want) is borrowed and printed money, and the labor of the lower orders who are denied most of this funny money. If so, and if there is some kind of setback in present political and economic arrangements (which seems likely) many of the PMC now fleeing to the ‘burbs and the exurbs may find themselves stranded. They will have to dump the condo or the country home in a buyers’ market (at best) and they will have to find new kinds of work which may not be very remunerative. The Fed etc. can try to fight this deflation by producing more funny money, but if they give it to the rich the rich will just make it disappear in their accounts, and if they give it to the poor (nouveau or ancien) wild inflation will ensue, which the banks and investors won’t like. It will be Correction time, and ‘Who has no house will now not build him one’ as Rilke wrote. I suppose They could start a war, but wars have become dangerous.

The number of people that we know who are leaving the SF Bay Area for Portland or Austin is staggering. (And we’re not social butterflies.) Not that these aren’t established migration parts already, but it’s also be curious to see whether a “colonial” mindset develops.

“keeping both houses”, The number of houses dumped onto the market in San Francisco is symptomatic of the opposite:

People are selling so as to afford to leave for self preservation. As to Brooklyn on the Hudson and it’s local effects, lots of

New York out of Marin signs around Mill Valley.

Can’t figure if that refers to demographics, or politics being injected into the community by new arrivals from San Francisco, originally from N.Y.?

“… It’s the now well-established phenomenon of the “K-shaped recovery,” where one part is doing well, and the other part is getting crushed….”

I think of it as a less-than shaped recovery (<) because it is less than it should be.

The article is incorrect.

IMO this article is failing to account for a big change since 2008: The Fed’s never ending and now very aggressive QE, which (I believe but not sure) it was allowed to do in response to the Great Recession in 2008. Those new powers evolved from intervening to save the wealthy elites from their misdeeds and collapsing economy at that time, to a general and continuous non ending increase of application for the purpose of making the stocks go up along with asset prices in general.

Keep in mind predictions of falling home prices have been never ending over at WS. And all the while, home prices have been going up. For years and years. Along with stocks and asset prices in geneal. Sure, there will be changes due to what kind of home people want – like reduced prices in San Fran or New York. But that’s more than wiped out be rising prices elsewhere. And there might be a pause even slight pull back in prices due to demographics. But I don’t see how we can get a home price crash like we did after 2008, unless the Fed reverses course and seeks a reduction in asset prices.

I don’t see how housing prices can decline overall unless the Fed does an about face of it’s deeply entrenched policies that it is very firmly committed, and instead raises rates and reverses it’s QE and lets asset prices like stocks fall. If the Fed really cared in the slightest about inflated housing prices as the article suggests, it would raise rates and end QE. In fact, the Fed does not care about inflated assets prices. It wants the to go higher.

The Fed should, of course, raise rates and terminate QE. But it should have done this since 2008 and it not only hasn’t, but has ever more aggressively embraced these policies.

The Fed isn’t going to raise rates nor end QE but increase it. And it would be doing negative rates right now if it weren’t captive to banks. The additional 3 trillion QE refereed to can just as easily become 30 or 300 trillion at the Fed’s pleasure it that’s what’s needed to make stocks go up…and the one thing we do know for sure is that the Fed wants the stocks to go forever and ever.

Still K-shaped though. I don’t see Blackstone et al having much interest in flyover country.

The Fed doesn’t have to stop QE or rise interest rates for home prices to fall, they could slow or stop buying MBS , it will do the trick.

Sure.. but what makes you think they will?

Similar to Yves’ point, “As these home prices surge, the market will inevitably run out of buyers willing and able to buy, even at record low interest rates, especially in an economy like this.”

Now maybe this will happen, but if current inequalities accelerate that’s more disposable income for the rich to invest somewhere.. anywhere in any asset that still has decent yield. It doesn’t matter if the masses can’t afford owner occupancy if Blackstone is driving up prices. Price to earnings of stocks have plummeted as have yields on bonds. We should expect real estate prices to increase as well, even if rents aren’t increasing with them.

It’s all hypothetical at this point. It’s borderline pointless to try to analyze current supply/demand when so much of the real estate market is predicated on political and Fed actions that can turn on the flip of a switch (or administration)

The Fed not buying MBS is a mire pin prick compared to QE. So you are incorrect – the Fed MUST stop QE and raise rates to curb asset inflation.

Since August our schools have been open under an alternate day scheme with the option–up to the parent–of sticking to strictly remote teaching via computer. I overheard a parent, herself a teacher, saying that her son was begging to go back to school because the virtual classes were sooo boring. Worth bearing in mind that schools have always been as much about socialization as teaching which has led to an endless stream of H’wood movies where high school becomes a metaphor for life–something we can all relate to.

So it’s quite possible that all those home offices being built into new houses will be abandoned in a few months and turned into, say, media rooms. We have a virtual Water Cooler here at NC but cabin feverish PMCs may decide they really can’t manage without the real thing.

Wait a second!

Just yesterday in Links there was an article which stated that work from home was going to stay very high DUE to the measured increases in productivity. Double the rate of before…..so are we really sure this trend will not continue.

https://www.reuters.com/article/us-health-coronavirus-technology-idUSKBN2772P0

After all, if we are already seeing big productivity gains after such a short time imagine the possibilities after continued tweeking of all the factors involved in raising productivity further. And let’s not forget that it is the bottom line which really counts and we need to take into that account the dramatic reduction in costs to the corp’s due to less office building costs, salary costs, reduced travel, and – need we mention it – the eventual reduction in fringe benefits.

Analyzing this covid situation without keeping in mind that the old world is dead and gone and it will not come back is a big mistake. There is going to be a new normal down the road ….

“dramatic reduction in costs to the corp’s due to less office building costs, salary costs, reduced travel, and – need we mention it – the eventual reduction in fringe benefits.”

I don’t know one way or the other what the RE market will do or why, but I can point out that one persons cost reduction is another’s profit loss.

Not 1:1 though. Every cost/expense is predicated on physical constraints somewhere–time, land, commodities. These are true costs that can be saved without making someone worse off (or at least not as worse off as the benefit derived up the system)

1. See a comment early. Google Hawthorne Effect. Any change in the physical environment produces short-term increases in productivity.

2. CEOs overwhelmingly hate remote work. What they believe is dispositive. They may also see second order effects missing in short term metrics.

Sp this is too early to call. Yes, shifting RE costs onto employees looks like a big bennie but it turns a company in a collection of independent contractors. At a minimum, it makes people way easier to fire due to having weak/no social ties to them.

In other words, be careful what you wish for.

>Re: Hawthorne Effect

A second set of researchers went back and attempted to replicate the Hawthorne Effect study.

They learned that the increased productivity observed by the first researchers (and attributed to the improved environmental lighting) was not due to improved lighting; it was rather that the workers/respondents felt “special” because researchers considered them worthwhile enough to study. Workers’ reactivity explained the increased productivity. The “Hawthorne Effect” is a threat to internal validity when working with study participants.

The point is that any change in the environment leads the workers to feel more noticed and increases productivity short term. And it isn’t just “second set”. Multiple efforts to replicate the results have led to this conclusion.

I work for a relatively conservative company (the DoD) when it comes to remote work, but they are most definitely swinging into this mode on a permanent basis for many. in my IT Group.

We recently had a sort of “data call” where we were all asked whether we needed a permanent workstation and desk on site. The new norm for us will be what is known as Hoteling, sharing desks, as needed, as in turning your desk into a hotel room. To the best of my knowledge, most have opted to hotel their desk space which is exactly what the Directors of our group are pushing for (not myself, for good reason, but that’s another story). Management is predicting a large cost savings.

The old world, depending on what you do for a living, is changing. And, for some of us, for the better when it comes to work. I’m very happy in having to go in only 10 hours a week or so on average. For me it’s the best of both worlds and I’m definitely more productive (depending on what one may call productive).

I know at least one major UK insurance company based in my city that has gone into ‘remote work is permanent’ mode, but the driver was that one of their two major office buildings was up for rent renewal. I suspect that the short term benefit of cutting their office costs substantially precipitated the decision. From their point of view, if it turns out not to work, it won’t necessarily cost them much more money in the longer term if they build up their office floorspace again over time as they may be anticipating that there will be a long term surplus.

I’m sitting it out here in Sonoma County due to Covid risks, my immune system is still compromised.

The fires seem to have made no difference in demand, which is a bit of a surprise and the inventory of nice properties is low.

Competition for listings is off the charts and prices have gone up substantially, if the price is right you see multiple all cash offers ( Forget it if you don’t have all cash) and many are selling for 10-15% more than asking.

An acquaintance sold his own home to a realtor, it never hit the market and he got 20% above a 3 month old comp.

As is, no inspections, no contingencies, all cash, 30 day close.

It’s in nice shape and has a river view, a 1500 Sq Ft 3/2 on a tiny lot..

It is the most volatile and least rational Market I have ever experienced.

Prices can drop as quickly as they rose, it’s a great time to sell.

That’s not representative of the national market . I think much of this article is trying to extrapolate too much of the California and NY market onto the rest of the country

I’m not sure what “would be” sellers would do with any proceeds. Stocks and bonds are yielding historic lows

Same deal here in N. Fulton County (metro Atlanta). Inflated prices, bidding wars, so many gigantic 10,000 sq ft monsters going up, who has all this money?! I make a good salary but the only things in my price range are gross old condos that look like a converted motel.

Downtown Phoenix, Arizona is also crazy.

FIRE is the answer to keeping the housing market moving on in places like California and Oregon. When purchasing a home in the Northern California woods the most important metric is not price or future market value but whether the insurance company will value it at 125% of real value and pay out promptly when it burns down.

While it is entirely possible to build a new home that will remain untouched as a wildfire sweeps over it there are none of that design being built on the foundations of Paradise. In the American system of values it is far better to build a tinderbox McMansion just like neighbor’s and use it as an ATM.

As Wolf said, 7% of all mortgages are in forbearance. This is a temporary blip in the housing market caused by government policy and the FED’s continual asset inflation. Once those homes clear, and the stimulus stops, all bets are off.

Forbearance was just extended to December 2021. https://www.housingwire.com/articles/in-a-bid-for-stability-fhfa-and-fha-extend-forbearance-policies/

Everyone keeps assuming Government policy is just going to abruptly change… Maybe?

this timeline.. the realtors are laughing at them. No inventory to be had for another year.. prices are going to hit the stratosphere. We are already at or close to a 5:1 price to household income multiplier at the median.. when will it end?

7% is 10 mil homes, or twice the number sold per year. Some will cure, but many won’t, especially if stimulus dries up.

Mark to Market. The Banks will just swap properties to one another just like they did in 2009 and 2010. Asset managers will hire cheap labor to monitor homes and mow lawns and sit it out with the help of endless QE?

I am curious if brand new supply, in the form of new apartment buildings particularly, isn’t affecting prices?

Here in Greater Boston, new residential towers have been the most visible sign of the housing boom, but there have been many more units built in smaller buildings, including conversions of historic buildings.

A huge number either started opening in the last two years or haven’t opened yet.

“So expect work-at-home to be curtailed when Covid is eventually contained.”

Perhaps in parts of the country – but I don’t see this happening in NYC. The PMC there has had a taste of true quality of life. Do you actually think they are going to be willing to move back to the city to get on a decrepit subway system, crammed together like sardines for their 45 minute commute to travel 10 miles? I don’t think so…and there will be enough of them at individual corporations that will allow them to negotiate. And I don’t blame them. This is de Blasio’s and Cuomo’s ineptitude that allowed the transportation infrastructure to crumble into decay so massively. And now…where are they going to find the money to fix it?

And yet the better-off of the previous generation (1980s) fled the suburbs their parents had constructed to a city which had worse problems then than it does today.

The suburb versus big city equation has changed somewhat with the advent of the internet and other technologies. There was a time when you had to live in NYC (and I did) in order to see foreign films or visit the great museums. Now I can get many of those films on DVD or BluRay from my local library and virtual tours of all the great world museums are available on the internet. Things have been looking up for ‘the Sahara of the Bozarts.’

And whilethere is a renewed zeal for urban living–the New Urbanism–it may have gone small and be more symbolic than real. My town has a revived and rather hip downtown but I don’t have to get on a freeway or subway to get there. It’s a mile away. I can walk…

On the other hand, no one will ever meet a totally cool Puerto Rican girl on a fire escape in a slum one hot summer evening in Tarrytown or Nyack. But I suppose not in New York, either, any more. Look what happened to the HIgh Line.

Mass transit is at an all time nadir in NYC and almost every major US metro. Derailments, runaway trains and pizza rats have made headlines and gone viral around the world. And don’t mention the loss of cool people like Yves and working and younger people.

The big cities were far less attractive in the 2010s than in the 1980s but cost far more.

As a 50-something naturalized PMC in the Bay Area, where to go? Obvious places are discovered already, have “CA: go home” signs, or have conspicuous segregation. Still amazed about the racist outbreak in Portland, OR which I’d always been sold as a let’s-all-get-along cosmopolitan city.

Don’t come to the Midwest, you coasters. It’s so awful here. You’ll hate it.

Higher probability of tornadoes, flooding, hailstorms the further E and S one goes anyways… although southern OR has the pleasure of the Cascadia Subduction Zone, which raisies the possibility or Eugene being underwater from a tidal wave.

Midwest does have the advantage of being outside the 100 miles from a border rule.

Don’t forget almost the whole of California is laced with known and unknown earthquake faults and not just the San Andreas. Nothing as bad as the subduction zone or even the New Madrid fault line, but interesting enough.

They count from the shores of the Great Lakes too — even Lake Michigan, which is why they claim basically the whole state as within the 100-mile zone.

(Which might be, I suppose, one of the reasons that ballot question on putting a ban on warrantless searches of electronic devices into the Michigan state constitution is so broadly popular.)

Left out of this discussion is the transportation problem in big cities.

My wife and I live in Forest Hills — 50 minutes to Manhattan. the subway is operating at 30% capacity, and is broke and will cut back service.

Worst of all, people are not wearing masks, and violence is way up — violence over fights over masks.

My wife has asked her employer to let her continue working from home (her entire office is) until there is a vaccine, because she fears getting infected and infecting me.

I’m sorry to hear that, I was hoping FH would be spared. I spent a year in Parker Towers and enjoyed living there after 20 years in Manhattan. Lots of nice walks in FH Gardens and over to Jackson Heights (best casual food spot in the city).

I have been marveling at the recent listings back in Manhattan. The property taxes have doubled in the last 10 years or so, along with common charges you’re looking at monthly carrying costs of $3K or more for a basic 1BR that will still cost $750K-1MM or so. A real 3BR could be $50K or more. Condo prices could go negative if the pandemic persists, although I doubt the stuffy co-op boards would allow anything like that.

I’d say that CEOs might claim that the reasons why they hate remote work are about loss of productivity and lost opportunities for collaboration, however, it might be that CEOs are not telling the full story and are forgetting to mention other reason which might be real reasons. Yep, it is possibly a tin-foil hat conspiracy theory but still….

My experience of those kinds of people is that they care about themselves, nothing more and nothing less. Some thoughts:

What fun is it to be a big dog if there are no other dogs around to dominate? The perks given to the CEO in the office might not be available to be seen when working from home. Best parking space? Irrelevant. Best office? Irrelevant. Etc etc. CEOs tend to like to be the big dogs…

What if it is noticed that the activities of the CEOs are not that important? Fewer meeting means less work for the CEOs and they need to find new ways of pretending to be working etc etc The self-driving car might be a threat to drivers but organisations running themselves well without CEOs might make CEOs less relevant.

In the end the reasons for/against might not matter, if the CEOs has the power and the will to force their workforce back into the offices then that is what they will try to make happen.

& another thing left out in the calculation of productivity is the time saved by not commuting. That time was unpaid but since it was unavoidable there might be some arguments for including the hours spent (which is now saved) in a calculation of hourly producitivity.

Workday shortened from 10 hours to 8 hours with same amount of output is quite a big increase in hourly productivity. Calculating the change of productivity that way would make life better for individuals but lower the all-important GDP so it probably makes sense for many economists to force people to do something with no useful purpose.

I’d prefer spending one hour digging a hole in the ground in the morning and then filling it in again in the evening over going back into long commuting in packed public transport.

Jesper:

“…organisations running themselves well without CEOs might make CEOs less relevant.”

What if that read “…governments running themselves well without presidents and congress might make presidents and congress less relevant.”

I can’t locate any references — I recall reading back in the late 1970’s that the images of the office spaces in the movie “All the Presidents Men” encouraged the cubicles movement that swept large organizations as offices disappeared for all but those with high status. The article in Time Magazine(?) said something to the effect that managers envied the way the manager in “All the Presidents Men” could look out into an office space and enjoy a view of workers beavering away. I also recall the first cubicles tending to be much lower than those of the present. With work from home I suspect managers greatly miss the comfort of looking out at a sea of bodies. I very much agree with your judgment that managers miss all the badges of their status, and the satisfactions of directly experiencing their powers of control over their minions. They miss the sweet fragrances of the desperation, defeat, and stress they could conjure.

The middle management should fear being discovered as redundant and counter productive, but the upper management has been blind to the cost savings their firm might enjoy by replacing upper management from the same foreign sources replacing the lower levels of employment. The upper management has been blind to the cost savings that lowering upper management pay and bonuses might provide to their firm’s shareholders. Strangely the large financial firms that own many of the shares in our firms have been similarly blind to this profit opportunities.

Perhaps the end of Capitalism, locally, will occur when all our firms exist only in trademarked name. I think GE light bulbs might be a good example or GE appliances.

The article mentions a sudden countervailing glut of available housing in NYC and San Francisco. Isn’t there a narrative out there that explains those cities as outliers due to individuals wanting to flee those areas for “less urbanized” (varying interpretations) locales?

In Los Angeles (which is 502 square miles and geographically heterogeneous), housing prices keep rising. Humble 2 bedroom, 1 and 1/2 bath detached houses in lower-rent areas of the San Fernando Valley are selling for slightly over $1 million. Anecdotally, what had been $1.5 and up properties are now up by at least 500K. Houses in “turn-key” condition sell very rapidly, and for the highest prices. Here and there, some bargains show up: houses not in totally turn-key condition on large lots in apparent estate or distress sales. An example is a house on .37 acre owned by the aged producer which recently sold for $2.1, below market.

The ~18 year property cycle clock –

https://propertyadvice.com.au/property-cycle/

Georgists know this game well. Fred Foldvary wrote a paper @1995 predicting what happened in 2008 – didn’t get any credit for it of course…

https://econjwatch.org/File+download/490/GaffneyMay2011.pdf?mimetype=pdf

Interesting experience last week, I work in financial services and spouse works in gov’t. In both workplaces we finally had our “how we return to work” town halls — and both “town halls” turned out to be one way monologues with no Q&A at the end. That is it in a nutshell.

They both quoted information from April, spoke about hand sanitizers, neither mentioned anything about aerosols or HVAC and pretty-much pumped mud insisting it’s safe to return. They both mumbled the same mumbles about informal collaboration, productivity, and mental health without providing any facts whatsoever.

The general peer to peer consensus is that the C-suite is unable to express what their actual concerns are. The general worker bees are coping well, collaborating just as much albeit differently, everything’s getting done. Meanwhile costs for the business are down hugely and at least in our two “industries”, “business” is up!

So any half thinking C-suiter should seize this opportunity to craft a win-win for all concerned. The fact that they don’t appears to be more that they can’t. Most of them don’t have the skills for it. It’s the same old Mr. Market two-faced problem these people have: they find themselves on the wrong side of the bet and now want to make it everyone else’s problem.

They had both been planning their town halls for weeks now, but each day was worse than the day before for Covid stats, and like a 1st grader who badly has to go pee, they just had to go for it and deliver their desperate town halls on Covid record-breaking news release days, making the whole thing even stranger and more out of touch.

There’s a power shift at the bottom of all this. Employees have been given more permission to make decisions about their own health, their family’s health, their community’s health. And the bosses just hate that kind of thing. It shows the effectiveness, or at least impact, of gov’t agencies and other social constructs forcing business to choke back the lip- service they often pay to their employees and communities.

The housing market here in Boise ID has seen the same phenomenon of increased buyer interest, low inventory and rising prices. One factor unmentioned above is the flood of investor money flowing into the lower end of the market (here defined as $350000 and below). Such properties often attract 10-20 offers within days of listing, many for all cash and sometimes with no inspection contingency. Sellers naturally prefer cash, quick closing and as few contingencies as possible, so first time buyers are squeezed out even if they can qualify for financing. Fierce competition for multifamily properties has driven prevailing cap rates into the 3-4% range, making single family rentals a better ROI even with reduced economy of scale. If rising house prices are a function of financial repression and a secular shift from ownership to rental then they may persist beyond the end of COVID.

I am going to agree with Sam’s point that the ROI on rental houses is likely driving up housing prices in certain parts of the country. Boise and Idaho in general is a destination for some people, so that might make a difference. Kansas City, Missouri and the suburbs on either side of the state line, not much of a destination. Yet in my neighborhood of 1920-1930’s homes (well built, well-maintained over the decades, and in walking distance of many amenities), prices are just crazy and houses sell quickly. I can’t know for certain how many houses in my neighborhood are being purchased by REIT or mom-and-pop landlords, but I can guess that many lower priced homes are being snapped up by investors, meaning owner-occupy buyers have to move up a price tier or two. That seems to be the dynamic in My little slice of Kansas City.

It makes sense, sort of. Around here, you can buy a 3-bed, 2-bath, two car garage home in a nice neighborhood for 300K and rent it out at the classic rate of 1 percent of value per month. Looking at the high valuations in stocks, where else could you park your money and make 10 per cent per annum on a real asset? Of course, even this scenario is starting to look wobbly with the unrealistic housing prices. If a young couple can’t afford the down payment for 300K house and the monthly payments, then how likely are they going to be willing and able to come up with 3K a month to rent the same property? What goes up will come down.

Wolf and most others are either ignoring the elephant in the room or have never dug deep enough to notice…our banking supervision system is broken and to work around it, bankers do a happy dance with non agency loans…unlike in the rest of the world, we really don’t have bankers who lend to business intelligently nor supervisory agencies who let them…if one took some time to match up ucc type business filings and look at the jumbo high end market, one will find a “need” to jack up large home values to help facilitate business loans cloaked as “quasi-home equity” loans…since the “capital regulatory costs” for making a home equity loan are much lower than a business loan…so lenders, to “sustain” their capacity to expand lending to business owners, “strongly suggest” biz owners buy big properties well beyond agency loan limits to allow the “flow” of money to continue…four sales within a tight geographic area allows a new “general” area property evaluation to “justify” additional lending…

remember…the old saying was that wondrous MAI appraisal designation meant “made as instructed”

A solution to less productivity for at home employees is tax free incentives. A new $20k company car for hitting 3 major tech or sales targets. Or the company paying $300 month of the employees rent for that home office.

The self motivated will do or. The people that arent fall by the wayside.

There may be a silver lining to this housing madness. I noticed mention of “particularly hot [demand] for homes in the $2-million-plus range” in the mid-Atlantic beaches (Rehoboth Beach, Myrtle Beach), and the Jersey shore areas,and Carmel-by-the Sea. Maybe the people who matter intend to do something meaningful about the rising sea-levels?

However — there are other less pleasing possibilities:

The people who matter may be convinced the government will recover their losses and rebuild for them in the event of storms — much as it did after Hurricane Sandy.

Or — The people who matter tend to be older and either childless or little concerned for their children at this stage of their lives. Perhaps they expect to be gone before the flooding begins.

Or — The people who matter are so wealthy they don’t care about a little loss here and there.

Or — With the loss so many perks as Jesper at 24 OCT 12:49 pm commented above — they might have decided going to the office just isn’t that much fun so they plan to enjoy life at the beach for a while. They can always find a bigger fool to pick up their beach house when the Corona has gone and they can return to enjoy the pleasures of the office.

For those of lesser wealth who believe their Corona work-from-home jobs are secure … Good luck!

Boise is a destination city but Sam is right on the mark. It seems to be mostly investment companies buying up the starter homes around here. My house is 1400 square feet and in a good neighborhood just outside Boise city limits – so basically it could be considered a starter home. I get at least one junk mail a day from some company wanting to buy my house and at least two texts a week ( and boy, do I love those: They are the usual “Do you own the house at XXXXX? My name is Ryan and I want to buy it!” BS) and my house is not for sale!

He’s right too about people who could afford to buy a house normally but can’t afford the concessions that the investment companies can offer, like not requiring an inspection, or paying all the points themselves, or offering a quick cash sale, no to mention just plain paying more than the house is assessed for, etc.

This is what I’m wondering to – how much of the home market is being driven by PE?

All that easy Fed money has to go somewhere, and so it’s time for Wall St to price Americans out of the home market FOREVER.

Well observed.

Is the recovery K-shaped? Is it FU shaped? Perhaps we could go further. Perhaps the recovery is

FU K-shaped.

i c what you did there.

Also crazy in Columbia SC area. My subdivision was built in 1992-1993. Homes have a few different floor plans and exteriors and are 1000-1250 sf on 1/4 acre lots or less. Some have 1-car garages, most have decks, a few have 2-car garages. Rentals here go for $1000-$1300 monthly. It is hard to believe.

Next-door neighbors sold their house a couple of months ago. On market about a week. 3/2 with no garage, no deck, only a washer-dryer closet in small hallway, front door opens directly into a small room they used as the dining room, but all nicely upgraded inside including a room addition in the back bringing sf up to 1440.

Neighbors sold for $159,000. Just shocking to me. I could not afford to buy here, much less rent here. Bought my home in 2002 for $90,000 which was overpriced for the condition it was in at that time.

The economic impacts of the virus can be clearly seen in capacity utilization (declines):

https://fred.stlouisfed.org/graph/?g=x3nX

Why don’t you wreck your economy with a real estate boom and bust?

World leaders can’t resist it.

The wealth is there and then it’s gone – real estate.

1990s – UK, US (S&L), Canada (Toronto), Scandinavia, Japan, Philippines, Thailand

2000s – Iceland, Dubai, US (2008), Vietnam

2010s – Ireland, Spain, Greece, India

Get ready to put Australia, Canada, Norway, Sweden and Hong Kong on the list.

This is the trouble with neoclassical economics; you get these ponzi schemes of inflated prices.

When they collapse it feeds back into the financial system.

Neoclassical economics still has its 1920’s problems.

The last lamb to the slaughter, India

https://www.wsj.com/articles/indias-ghost-towns-saddle-middle-class-with-debtand-broken-dreams-11579189678

Now they need to recapitalize their banks.

We have to face up to the facts.

Policymakers have no idea what they are doing.

The American are real gluttons for punishment.

They are going for the hat-trick.

1990s – S&L

2000s – 2008

All ready for the next one

How did the Americans convince themselves house prices always go up before 2008, but after the S&L crisis?

Good question.

God only knows.