Yves here. The findings of this paper, that workers who have low or no wealth wind up stuck in low wage work, is particularly striking since the study uses data from Norway, a country with a good public health system and social safety nets. I’m not sure how being poor would drive job opportunities in Norway, but here, it’s not hard to see how not having a car or showing up at interviews in ill-fitting clothes or having bad teeth would severely restrict work options here. Similarly, poverty makes it hard to afford the time, let alone the cost, of paying to obtain certifications or technical skills.

By Roberto Iacono, Associate Professor of Economics and Social Policy at the Norwegian University of Science and Technology and Marco Ranaldi, Postdoctoral scholar, Stone Center on Socio-Economic Inequality at the Graduate Center, CUNY. Originally published at VoxEU

The uneven distribution of wealth in society is commonly perceived as a matter of concern per se for inequality-averse policymakers. However, being wealth-poor or wealth-rich is also correlated with outcomes in the labour market. This column examines how wages and unemployment vary across the relative distribution of personal wealth in Norway, focusing on the wage-to-unemployment ratio across the different percentiles of the wealth distribution. It finds that wealth-poor individuals cannot escape low labour incomes regardless of the unemployment rate they face, while the unemployment elasticity of wages is substantially higher for wealth-rich individuals.

Economists have long come to accept inequality in the pace of wealth accumulation across the wealth distribution as a more accurate measure of inequality than income (Mankiw 2015).

However, the academic debate has in recent years focused on documenting the extent to which both capital income and wealth are concentrated in the hands of a few individuals (Piketty 2014, see also König et al. (2020) for a recent survey).

Stiglitz (2015) highlights the need to document the changing distribution of income and wealth, but also calls for new complementary facts to be studied. In their Vox column, Kanbur and Stiglitz (2015) conclude: “We need to focus on the interaction between income from physical and financial capital and income from human capital in determining snapshot inequality”.

Along these same lines, our research highlights the extent to which the distribution of wealth holdings is unambiguously associated with outcomes in the labour market (Iacono and Ranaldi 2020). We argue that the relative distribution of personal wealth is relevant not only per se but also to better comprehend the role of wealth in shaping individuals’ working trajectories over the life cycle.

Personal Wealth and the Labour Market

The empirical relationship between gross wages and the unemployment rate (the so-called wage curve) is a matter of great relevance to policymakers and has been studied extensively by economists. Do wages respond to changes in the unemployment rate, for instance? I.e. do wages adjust if there is an unexpected surge in unemployment, as in the current pandemic? Does the unemployment rate vary when wages rise? This wage curve has been estimated previously across space, both at the national (Blanchflower and Oswald 1994) and regional levels (Blanchflower and Oswald 1995). In our paper, we estimate the wage curve through the lens of the personal wealth distribution. Ranking individuals according to their wealth holdings allows us to uncover several stylized facts related to labour market outcomes that are associated with wealth, rather than with traditional explanatory variables such as educational attainment or parental background. Thanks to the rich and fine-grained administrative data on personal wealth in Norway, our sample covers the entire population of residents between 2000 and 2015. Based on this large-scale sample, we document several novel facts about the wage curve across the wealth distribution.

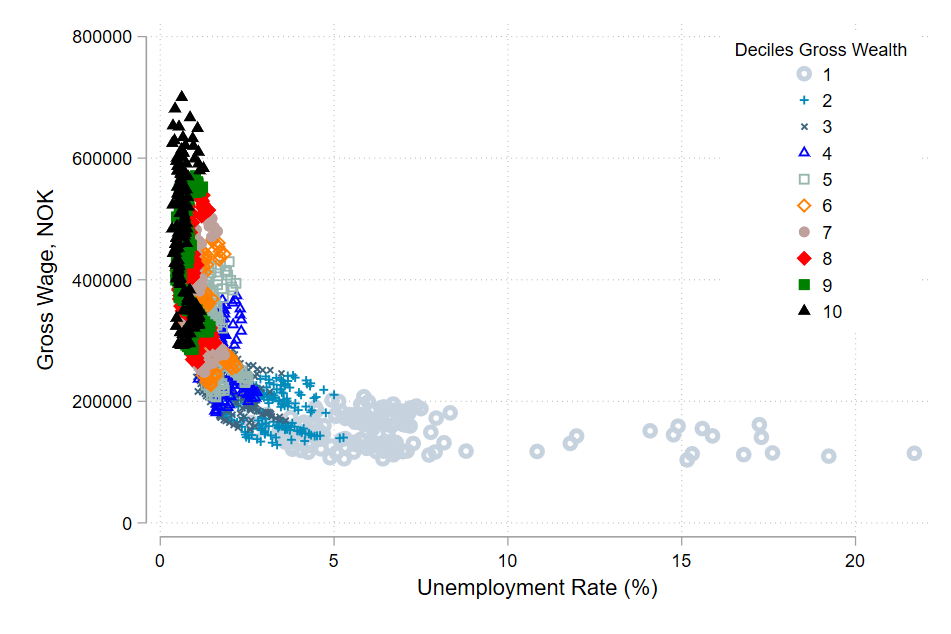

The first stylised fact shows that the elasticity of the wage curve – how gross wages change with a change in the unemployment rate – increases monotonically with gross wealth, as shown in Figure 1.

Figure 1 The wage curve across the wealth distribution

This figure shows that wealth-poor individuals cannot escape low labour incomes regardless of the unemployment rate they face (a sort of double poverty trap in the sense of low income and low wealth), while variation in unemployment is much lower for wealth-rich individuals. The latter enjoy a higher range of wage incomes, regardless of the unemployment rate they face. Note that we always compare individuals in the same percentiles of the wealth distribution in our analysis.

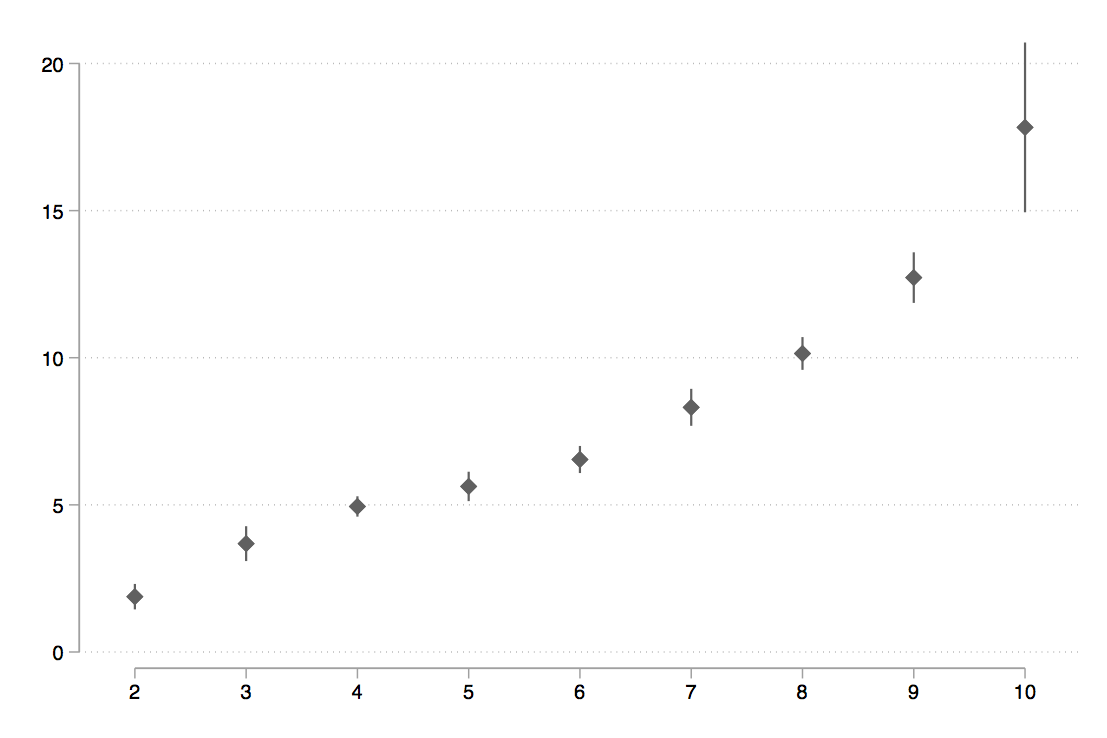

Second, we highlight that the distribution of unemployment across the wealth ladder is highly uneven when comparing the bottom with the top of the wealth distribution. In fact, we construct the first distribution of unemployed individuals across the wealth ladder between 2000 and 2015 in Norway and show that the share of unemployed individuals in the bottom 10% of the wealth distribution is ten times larger than the share in the top 10% of the distribution in Norway (compare Figure 2).

Figure 2 Share of unemployed by gross wealth decile

In our view, the unemployment share at the bottom of the wealth distribution can be considered a measure of the vulnerability of the unemployed. Assume that two countries have the same overall unemployment rate but a different share of unemployed at the bottom of the wealth distribution; then, an economic shock might be more harmful to the country with a higher share of unemployed at the bottom of the distribution. In fact, if an economic shock, such as a financial crisis or a pandemic, should suddenly occur, the ability to economically overcome that shock is a positive function of the wealth held by the unemployed.

We also analyse how the relationship between wages and unemployment changes when individuals move along the wealth ladder. To answer this question precisely, one would ideally need to follow the same individuals across the life cycle to disentangle the effect of switching from one decile of the wealth distribution to another. Alternatively, we provide a first step in this direction by estimating the relationship between wealth deciles (our preferred measure of wealth status) and the wage-to-unemployment ratio, summarizing the principal labour market characteristics. Whenever the wage-to-unemployment ratio is low, we have a labour market with rather stagnant wages and sustained rates of unemployment. In contrast, a high wage-to-unemployment ratio is associated with high wages and rather low unemployment rates. Figure 3 confirms the findings presented in Figure 1 of this column, showing that the wage-to-unemployment ratio (vertical axis) increases across wealth deciles (horizontal axis), indicating that belonging to higher deciles of the wealth distribution is associated with better wages and lower unemployment.

Figure 3 The wage-to-unemployment ratio across gross wealth deciles

All in all, these findings show the extent to which wealth inequality shapes labour market outcomes. This further motivates the need to better design wealth redistribution policies. In addition, the stylised fact that wealth-poor individuals are trapped in a state of low income regardless of the unemployment rate does not easily follow from standard competitive labour market modelling. Hence, we advocate for more evidence on the matter, not only to inform public policies aimed at improving employment opportunities but also to improve the macroeconomic modelling of the labour market. Moreover, we think that our main result, whereby the slope of the wage curve is a positive function of gross wealth, can be incorporated in any macroeconomic model of the labour market that wishes to account for wealth inequality in its dynamics.

Concluding Remarks

The new stylized facts of our column on wealth and its role in the labour market can be summarised as follows:

- The distribution of unemployed people across the wealth ladder in Norway is highly uneven.

- The negative slope of the wage curve, previously estimated in the national or regional space, is also confirmed within the (distributive) wealth space.

- The wage-to-unemployment ratio increases monotonically with increasing gross wealth.

- Wealth-poor unemployed individuals are substantially more vulnerable to economic shocks than wealth-rich individuals since the former also receive lower wages in the labour market.

See original post for references

We have two economies in the world;

Those who work for money and Those whose money works for money.

The first one is stagnant at best and mostly declining. The second isn’t really an economy as there are no earthly rules by which it operates.

If you pour money into the first economy you get inflation. Pour money into the second economy and you just get more billionaires, no problem. This can go on a very long time but obviously will not end well.

The winners took it all in the 80s. Since the end of the USSR, it’s been a completely virtual economy, untethered to any actual economics, but for the time being, the archons still feel compelled to offer justification for their rule “it’s science-based” “I deserve it because of my IQ! It’s a meritocracy!”. But no one believes this anymore, the lie has grown so flimsy. Soon the iron fist beneath the threadbare velvet glove will be revealed. The hog is in the tunnel. The fat is in the fire. (Nothing like a good rant to start the day at the salt mine!)

excellent!

i almost want to put it on a sign and hang it in the woods, somewhere.

i’ve always though of the decoupling as happening in the mid-70’s, though.

instead of a Constantinian Shift, a Neoliberal Turn.

Figure 1 is very peculiar.

First of all, the top decile is usually the 1st decile, not the tenth, but the chart appears, from the explanation, to show that the bottom decile experiences inelastic low wages which only fits the points plotted in open grey circles, which is the 1st decile by the legend.

Assuming this is correct (I have have misinterpreted it), the 10th (top) decile experiences a wide range of wages across a low and narrow range of unemployment rates (I think this must be unemployment rates for that decile but it might be for the economy as a whole, it is too badly labelled to tell). The 1st (bottom) decile experiences and a low and narrow range of wages across a broad range of unemployment rates.

thank you for deciphering those graphs. i could not make head nor tail of them. and since they did not spell it out as clearly as you do in your brief paragraph verbally, i am wondering about the people who wrote this and what their motivations are.

Ole Peters presentation at Gresham College gives further evidence why expectation values are irrelevant for understanding real-world economic systems.

https://larspsyll.wordpress.com/2020/11/02/ergodicity-wonkish/

An error [????] extended thingy.

The globalists found just the economics they were looking for.

The USP of neoclassical economics – It concentrates wealth.

Let’s use it for globalisation.

Mariner Eccles, FED chair 1934 – 48, observed what the capital accumulation of neoclassical economics did to the US economy in the 1920s.

“a giant suction pump had by 1929 to 1930 drawn into a few hands an increasing proportion of currently produced wealth. This served then as capital accumulations. But by taking purchasing power out of the hands of mass consumers, the savers denied themselves the kind of effective demand for their products which would justify reinvestment of the capital accumulation in new plants. In consequence as in a poker game where the chips were concentrated in fewer and fewer hands, the other fellows could stay in the game only by borrowing. When the credit ran out, the game stopped”

This is what it’s supposed to be like.

A few people have all the money and everyone else gets by on debt.

I wonder if Eccles “giant suction pump” was the source of H. Ross Perot’s “giant sucking sound?”

Public discourse on this topic is too oversimplified to be much help. Wealth inequality is addressed as if it were a singular thing. On one side they say it is bad, on the other inevitable.

Actually having perfect equality of wealth is what is impossible, so the question is actually: how much wealth inequality is healthy for a capitalistic system. If that were the discussion we might be able to come up with a range of Gini coefficients or some other metric that indicates the health of our system. If the system moves outside of the healthy bounds, there are various interventions that can be applied.

For those who detest government intervention in the system, it behooves them to figure out how they, privately, can shift the system back to a “healthy” status.

I just saw a photograph of Jared & Ivanka. They are like the Kardasians to me. She always looks available which was something Maryln Monroe also projected. In the underground economy the pimps make the most money. I might need evidence. Start up expenses for pimps may be less than for a drug business. Sociologists say that crime is the path to respectability for the disadvantaged as are immigrants and is the story of mobster Scilians and Italians.

When there is a social network paid for by the government that does not allow lower wage citizens to be made so hungry stealing and crime as ways to get the money to eat it amounts to subsidies for near criminal business which simply doesn’t pay because they are not expected to pay.

Communists get a lot out of saying citizens will be paid according to their needs. We in the US have been so obsessed with teaching Business Managers that they have a responsibility to stockholders to pay as little as allowed by law. It has become so much the focus that the actual reason for the company is forgotten.

There is the family business you won’t be promoted in because you are not family. There is then the huge corporation you won’t even be hired for on the basis of your adaptability, experience, merit or anything else if now you are not in possession of a bachelors.

I once figured out that for me to be able to hold a degree it would cost at least 5,000 dollars at a reputable Independent Studies institution like Empire State in Rochester. (What a beautiful street their building was on. Prince St. Nathan Lyons the photographer ran the photography college across the street. Visual Studies? Not like on 17th in NYC. SVA but SVW?, beautiful street is Prince St.)

So I agree finding the money for certifications keeps some of us back. It is a shame since I know quite a lot and could teach.

If you are a publisher you are encouraged to find me. I’ve written a few books, and would like to be bought out for work done. Most places I’m Transcendian.

I enjoy commenting about things I know in web world, the internet, up to a point.

The educational systems in and all over the world do not want excess excellence to know that they are trapped in their class and caste, not because they cannot do better paying jobs, but because they are not made to be needed by the overall economy they are born into.

You can be born into a satisfied economy and an old family that has forever been on the bottom. From reading memoirs and in particular Bert Styles “Serenade to the Big Bird” I have come to have an appreciation of public schools and universities and colleges in the US. Certainly in the 40s and 50s it was common for people to love their schools.

Then came the Drug War and narcs sneaking around in your school.