Yves here. Wolf does a public service in providing a short unpacking of what happened with the “protect investors from the Covid meltdown” special purpose vehicles that would buy junk bonds and stocks and be managed by BlackRock. The short answer is that this was a successful application of the Hank Paulson bazooka principle:

If you’ve got a squirt gun in your pocket, you may have to take it out. If you’ve got a bazooka, and people know you’ve got it…you’re not likely to take it out… By increasing confidence, it will greatly reduce the likelihood it will ever be used.

Nevertheless, Paulson’s bazooka failed. He had to take over Fannie and Freddie about two months later. However, “Super Mario” Draghi was a master of this sort of thing. One of his programs that goosed Eurobond prices at a time when they were wobbly was the OMT, for “Outright Monetary Transactions”. Doing Paulson (and later Mnuchin) one better, Draghi didn’t get a single new power. He just took existing programs and gave them a new name!

It’s also telling that even an investor like Wolf doubts the wisdom of bailing out Wall Street rather than Main Street and households.

By Wolf Richter, editor at Wolf Street. Originally published at Wolf Street

Why do bondholders and leveraged speculators have to be enriched, instead of providing fiscal relief to the unemployed and small businesses? That’s the question.

Fed Chair Jerome Powell replied on Friday afternoon with his own “Dear Mr. Secretary” letter to Treasury Secretary Steven Mnuchin’s “Dear Chair Powell” letter on Thursday. Both letters were full of compliments for the other and for their cooperation and for their success in inflating asset prices. But with regards to asset prices in the credit markets, Mnuchin’s letter gave specific metrics and said enough is enough. And Powell’s letter said, OK, the Treasury can have the taxpayer money back that it sent us.

You’d think something earth-shattering happened based on the media hullabaloo that ensued.

On Thursday afternoon, Mnuchin informed the Fed of two things: One that he would not extend again the already extended expiration date of December 31 of five of the controversial over-the-line Special Purpose Vehicles (SPVs) the Fed had set up earlier this year under the direction of the Treasury to bail out and enrich bondholders, particularly junk-bond holders and speculators with huge leveraged bets; and two, that he wants the Fed to return the $455 billion in taxpayer money the Treasury had sent to the Fed to fund these SPVs with equity capital, and that the Fed has not used.

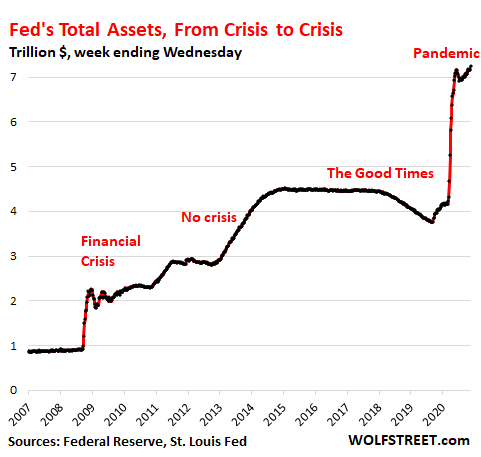

The actual bond purchases the Fed did under these five SPVs were minuscule by Fed standards, whose balance sheet is measured in trillions of dollars. Those SPVs were mostly used as a jawboning tool to inflate asset prices.

Between the Fed’s first announcement of these SPVs in March and the end of October, the Fed bought just $22.6 billion under these five programs, including corporate bonds, corporate bond ETFs, asset-backed securities, municipal bonds, and bank loans to main-street businesses, a minuscule amount considering its $7.24 trillion with a T in total assets. Specifically, it bought:

- $13.3 billion under the SPV the Fed calls Corporate Credit Facilities (CCF), which combines the PMCCF and the SMCCF under which the Fed buys corporate bonds, corporate junk bonds, corporate bond ETFs, and junk-bond ETFs.

- $3.8 billion under TALF (Term Asset-Backed Securities Loan Facility) under which the Fed lends to speculators for them to buy asset-backed securities and place those securities as collateral at the Fed, on a nonrecourse basis, meaning there’s zero risk for investors, and they get all the gains.

- $1.6 billion under MLF (Municipal Liquidity Facility) under which the Fed lends to municipalities.

- $3.9 billion under MSLP (Main Street Lending Program), where the Fed supports banks to make loans to small businesses.

The total assets on the Fed’s balance sheet as of Wednesday amounted to $7.24 trillion, a tad higher than on June 10, with a dip in the middle. Of that $7.24 trillion in assets, the $22.6 billion in these to be expiring SPVs is so small that it cannot even be marked into this chart:

In his letter on Thursday, Mnuchin listed 12 key financial metrics to show that those SPVs did accomplish their goal of bailing out and enriching bondholders and leveraged speculators, and in the process, they created wondrous credit markets that are now frothing at the mouth.

And the Fed did it, as Mnuchin acknowledged, almost exclusively through hype and jawboning, instead of actually buying the corporate bonds and other instruments. And most of the money the Treasury had sent remained unused, and could now be used for direct Covid-related fiscal relief by the government instead of enriching bondholders via the Fed.

In an interview on CNBC, Mnuchin, after being accused of playing political games, said all the right things – maybe for the wrong reasons – when discussing why he’d let these five SPVs expire as planned:

“We’re not trying to hinder anything. We’re following the law,” he said. “I am being prudent and returning the money to Congress like I’m supposed to,” he said. “This is not a political decision.” And he said, “The people that really need support right now are not the rich corporations, it is the small businesses.”

Powell himself has been badgering Congress for months to provide more fiscal support to small businesses and other entities because the Fed was not well suited to do so, which was the reason the Main Street Lending Program (MSLP) never really got off the ground.

OK, what Mnuchin didn’t say was that bondholders and bond-speculators have gotten immensely rich by the market’s reaction to the March announcement of these SPVs and the hype and jawboning that came along with it, as bond prices surged across the board.

Powell in his “Dear Mr. Secretary” letter on Friday afternoon told Mnuchin – after going through the same kind of mutual back-slapping Mnuchin had gone through – that the Fed would return those taxpayer funds to the Treasury. He said:

“You have indicated that the limits on your authority do not permit the CARES Act facilities to make new loans or purchase new assets after December 31, 2020, and you have requested that we return Treasury’s excess capital in the CARES Act facilities. We will work out arrangements with you for returning the unused portions of the funds allocated to the CARES Act facilities in connection with their year-end termination.”

And he added:

“As you noted in your letter, non-CARES Act funds remain in the Exchange Stabilization Fund and are, as always, available, to the extent permitted by law, to capitalize any Federal Reserve lending facilities that are needed to maintain financial stability and support the economy.”

But given how small the actual amounts were in these SPVs, and given the magnitude of its QE binge – $3 trillion in three months – it is clear that letting these essentially unused facilities expire as planned isn’t going to matter to the real economy, though it might matter a little to the speculators and investors who got rich off the jawboning, but they had it so good for so long and they shouldn’t complain.

But returning $455 billion to the Treasury and having Congress fashion new fiscal aid programs for Covid relief to small businesses and the unemployed would make a huge difference. Why do bondholders and speculators have to be coddled all the time to further increase the wealth disparity, instead of providing a modicum of fiscal relief to the unemployed and struggling small businesses? Powell didn’t even attempt to explain that.

Those SPVs should have never been concocted in the first place. They’re just another subversion of the credit markets designed to enrich asset holders.

The Fed should have never been allowed to buy corporate bonds and corporate bond ETFs, which trade on the stock market. But it did so anyway for the first time ever. Back during the Financial Crisis, it should have never been allowed to buy mortgage-backed securities, but it did for the first time ever, and now it’s standard policy – and a $2-trillion line-item on the Fed’s balance sheet.

What these asset purchases accomplished was to increase the horrendous wealth disparity – the “wealth effect,” as Bernanke, when he was still Fed chair, rationalized it, and a term Yellen touted when she was president of the San Francisco Fed. But blame for this horrendous wealth disparity via the Fed’s asset purchases lies with Congress which has authority over the Fed.

Power corrupts. Insider trading is so easy and so profitable.

If I could, I would investigate every treasury secretary since Reagan still alive, with wiretaps and every other artifice used against Gotti or Capone. Maybe, even the dead ones, :-)

I would routinely and automatically do the same to every future treasury secretary, SEC chairperson, “Fed” director or open market committee member, and bank presidents/officers or any owner of the major bank’s control groups.

Did you hear the old joke:

As he exited the door of his beautiful, corporate-provided jet holding the bare arm of his young, gorgeous personal assistant provided to him by his bank, into his luxurious, corporate-paid limo, an owner of the majority of a bank’s shares was asked how much his stock was worth. He said billions and billions with a smile.

He was then asked how much a particular individual, who was a small shareholder who owned the minority of the shares of the bank was worth. He said, “that poor son of a __[gun], he and his shares ain’t worth nothing.”

See https://time.com/5845116/coronavirus-bailout-rich-richer/

It reminds me of the title of one of my favourite albums, but with a change to the final word.

” Automatic for the Elites “.

Ultimately, w/o bailing out the households, you’re a toast. I believe that most investors actually understand that, but if they act on it, they are likely going to lose money (short term), so they won’t. Which is why you need an outside player, like Fed to do it.

Except Fed knows only investors, so they will only goose the investor (or foam the runway). Strangely, even if some investors tell them it’d be better to save the households/Main street. Talk about echo chambers.

In his Econ 1 course, Brad DeLong teaches “What Do Econ 1 Students Need to Remember Most from the Course?” about the benefits of free markets, and, more interesting to me, “What Do Econ 1 Students Need to Remember Second Most from the Course?,” which is about market failures, which most intro econ courses do not mention. One of the causes of market failure is the fact that the market only reacts to you if you’ve got money. If you don’t have money, the market takes no consideration of your needs and interests while coming to the “best use” of resources. Interestingly, if we take all the failures he enumerates, there is no free market anywhere.

The real economy lives in limbo. Wolf understands that the responsibility rests solely with Congress. But that is probably the worst place for the constitution to invest this responsibility. Congress is a snake pit of special interest.

It’s nice to see The Treasury and The Fed climb down a bit from a structure that would meet the definition of the term “national socialism”.

Now on to the question of why the central bank of the U.S. is by far the largest investor in the world in the first place, owning some 22,319 different securities.

And while you’re asking questions, perhaps ask why the top bond purchases made by The Fed recently have been German automaker bonds. Seems like a long, long way away from Main Street.

Next acronym to look for is CBDC: Central Bank Digital Currency. Bank of England has insisted in multiple recent papers that they would not cut commercial banks out from issuance, but with lenders receiving zero in exchange for extending credit I’m not sure at all that will hold.

Ok, so the CARES act was for $454 billion, the feds balance sheet only shows it got $114 billion, leaving $340 billion unaccounted for. When anyone asks the Treasury where it went, they just kinda mumble and wander off.

Tinfoil hat time…

Got’em on nice and snug?

The $340 billion went to China as reparations for the COVID attack. China had solid proof it was us or one of our oligarchs. This of course constitutes an act of war, but, since they didn’t get hit to hard and we are getting walloped by our own weapon, they figure lesson learned and settle for a cash apology (adding insult to injury, while also getting an admission of guilt). They also now have enough blackmail material to turn us into a global pariah.

“The $340 billion went to China as reparations for the COVID attack. China had solid proof it was us or one of our oligarchs.”

…got a link for that?

no, sorry, didn’t mean to mislead. I thought the tinfoil hat comment would make clear that it was just opinion/speculation.

in the future I’ll be sure state more clearly when I’m just throwing out ideas.

So sorry… I was skimming and missed what is now, on re-reading, obvious snark!

my bad!

you’re good!

Most of the post is missing; maybe a copypasta error?

No, that’s false, as you can see if you bothered clicking on the link to view the original post. The last sentence at Wolf’s site is identical to ours: “But blame for this horrendous wealth disparity via the Fed’s asset purchases lies with Congress which has authority over the Fed.”

Wolf’s posts are generally more terse than ours. His target market is traders with short attention spans.

“Why do bondholders and leveraged speculators have to be enriched, instead of providing fiscal relief to the unemployed and small businesses? That’s the question.”

Because the investor class are the only people in America. The rest of us 250 million are just numbers, and if a few million of us succumb to the pandemic, or drugs, mental illness, homelessness, despair and suicide, there are 10 immigrants/refugees for everyAmerican who would be a great deal more grateful than us Citizens, for the privilege of being a glorified debt serf, or to work an essential job for $10/hr.

I’ve been out of work an equivalent 4months in 2020. What have I got, from my precious government? $1000, which is about 70% of one months liabilities. Stonewalled on unemployment, not official enough for PPE, I didn’t expect much, and part of me doesn’t want government help – except government can’t seem to give enough to people who already have a **** ton of money.

It really is true what they say about collapsing empires. The imperial elite really do not have ANY idea what the effect of their policies are on regular people, except when they are ready to put the boot on neck of anyone who objects. BLM, Antifa, Alt-Right types would hold no sway in an egalitarian society designed around the needs of people, less corporations and banks. Otherwise they look to me to the precursor to collapse.

As the thread yesterday about just when the Western Roman Empire began to collapse, defining the ‘point of no return’ is at best a hindsight exercise. Far better to define a constellation of “data points” with which to make the call. Then, apply some basic statistics as to the mix and match nature of the data sets that constitute our “Coal Mine Canary Cassandras.”

Our observation from the cheap seats is that the “collapse” is well underway.

We, being mice in the vicinity of an elephant fight, try our best not to be trampled underfoot.

Even the barbarian warlords tried to save the Western Roman Empire if only to keep getting more loot and using the bathhouses; they failed obviously. The Senatorial Class had so destroyed the economy and society that there was nothing to work with. Long distance trade with each region specializing in producing certain items collapsed during the Crisis of the Third Century and never reached the level of the Second Century.

IIRC, no region of the empire was ever again without the ability to produce everything it needed to survive. For example, the wine makers in Gaul and the jug maker were in different parts of the empire. So just how does the wine meetup with the amphorae? They didn’t in the various wars and coups of the Crisis. So those amphora makers went out of business. And guess the owners of the vineyards had a cash flow problem.

It was something like what happened after the First World War; all those empires with their interconnected, tariff free intra-empire trade and bank, and the international trade and banking between the empires went away. No one was prepared for the chaos. It is one of the reasons for the economic collapse after the war. I am against the unregulated open boarders that our benevolent masters want for us, but places specialize in making or growing certain things for a reason. I have not read anything specifically, but I assume that much of the Roman Empire had a wine shortage for at least the fifty years of the crisis. At least, Europe eventually recovered.

My wondering point is that the Western Roman Empire was in a slow but steady decline for two centuries before its final collapse. You can trace the decline, perhaps decay, of Roman quality in everything for centuries. The clothing, tools, weapons, everything.

This makes me think about the decay of our stuff during the past forty years. Sure, if you have the money and really try, you can much of it made somewhere in the United States. If you are Joe Nobody, good luck getting some jeans of same quality or old Sears Craftsman tools of thirty years ago. How about white goods (refrigerators, washers, etc) or even a waffle maker? They don’t last as long and can’t be reliably repaired. I don’t know much about furniture, but my sense of it is the same.

Like in Roman, most people got increasingly lower quality everything, while the Pelosis’ got their overpriced equivalent of ice cream. And kente cloth. So, I don’t know what cutoff point for successfully reviving the Western Roman Empire was. I do think that it was decades before its fall. When will our point of inevitability be?

BTW, here in the economic Alice in Wonderhell that is our American Empire, that three trillion dollars in SPV (hello, here’s another acronym to learn) could have given every man, woman, and child ~$9,000. I really loathe our “leaders.”

Appreciated this post. Don’t think I’ve seen this much media obfuscation and diversion regarding a Fed program since the GFC. What was up with this intentionally confusing structure in the first place? The Fed can buy these assets without Congressional approval and create the money to do so. Why did they need the Treasury’s equity participation through the SPV structures? Is there something significant in terms of legislation that I’m missing here, or was it done to elevate public awareness of the subsidies in order to support the messaging?

Despite its relatively modest total amounts, I suspect this program was a hidden Wall Street, shadow bank and financial markets bailout to address a precipitous drop in prices of junk bonds and the stock market from Feb 19 – March 23rd that was rapidly gaining traction and could have been affecting some large banks’ derivatives and credit exposures. IMO this was also done in order to save the financial wealth of the politically connected donor class and to support administration spin conflating stock market performance with the real economy in an election year. There also appear to have been other factors beneath the layers of complexity, as California representative Katie Porter observed when questioning the Vice Chairman of the Federal Reserve, Randal Quarles about the Fed’s hidden purchases of large bank debt embedded in Blackrock ETFs under a program administered by Blackrock itself, during a House Financial Services Committee hearing earlier this month. (Hat tip Pam and Russ Martens)

Going forward, I question is whether this imbroglio might mark the beginning of a fundamental policy shift regarding Fed subsidies of Wall Street and the financial markets at the expense of the vast majority of the American people. In this regard, four senators have questioned why those SPVs that could help small businesses and municipalities are being canceled.

Too bad all we’re left with is guesswork and an extreme concentration of enormous financial wealth among a very small percentage of the population while millions of Americans are unemployed, many are lining up at food banks, and many who took out student loans in an effort to improve their prospects are defaulting on loans that cannot be discharged under bankruptcy law. Violation of trust and the social contract.

So when Matt Stoller tells Jimmy Dore this ~500 billion, leveraged x10 like bank deposits to allow for loans of up to 5 trillion, represents the largest upward wealth transfer in human history… and there is massive wealth transfer but it’s not in this precise form – rather, this merely activated animal spirits, making corporate debt issues more attractive with the prospect of an over-active buyer of last resort. So would you put this line to bed, or say that it’s still close enough for jazz?