Yves here. I was surprised when I went to New York (admittedly I did very little, just cabbed to doctors) to see that there wasn’t much of an increase in shuttered storefronts compared to the old normal (and there were a lot due to landlords putting through aggressive rent increases starting 3-4 years back). I have to confess that I didn’t know that there was an eviction freeze for commercial tenants too. The article below has some data on the lease renegotiations for restaurants. Notice most are holding their ground.

Here in Alabama, there are even fewer store closures, when you’d expect to see a marked increase due to the stresses on venues like restaurants and salons. But those shoes may be starting to drop. But the press has also reported that bankruptcies of smaller businesses are also very low. Apparently the various support programs allowed for many proprietors to wind up their operations rather than hit the wall and suffer eviction.

The piece gives a very informative look at the overall storefront commercial rent picture, and highlights the way landlords often refuse to lower rents and will keep retail space vacant. I saw this on Third and Madison Avenue, where departing tenants and other informed people would tell me the landlord doubled the rent, and the property would be vacant more than half the time in the next two-three years, clearly a net losing proposition. Yet landlords refuse to budge. Given that behavior, a vacancy tax for vacancies beyond a reasonable lease-up period seems warranted. The city needs to have people working, and as Richard Murphy says, landlords above all should be taking Covid hits. From a recent post:

The key issue that the government has to decide upon is who will bear the economic consequences of what is to happen. I have already indicated in my first post on this issue that I think that the consequences of this epidemic will fall upon three clearly identifiable groups, which are individuals, businesses and government. However, when appraising who will bear the cost the criteria are slightly different…

But that is not to say that there are no costs to an epidemic: clearly there are. In that case the question has to be asked as to who should bear that cost. There are three groups who should.

Firstly, landlords should. I have already suggested that should the epidemic spread then as a matter of statutory right any tenant should be provided with a minimum three-month rent-free period to ease the stress upon them whilst this crisis last. I would suggest that the grant of that extension should be automatic to anyone who does not make a due payment of rent on the required date during the period of the epidemic. They should be automatically granted this extension by the landlord without having to make any further application or to complete any additional paperwork.

I stress that the cost of this will fall directly upon the landlords in question. I am quite deliberately suggesting that they should bear the heaviest burden of dealing with the epidemic. The reason is simple and is that whatever happens they will still have an asset at the end of this period, and no other sector can guarantee that at present. As a consequence they have the greatest capacity to bear this cost. And, if it so happens that some landlords do fail as a consequence, the assets that they have owned will still exist after this failure and so the economy can manage the consequences of this.

Michael Hudson would agree, given his dim view of real estate rentierism and his support for high land taxes.

Oh, and confusingly, in New York State, the “Supreme Court” is the lowest level of trial court.

By Greg David (gdavid@thecity.nyc). Originally published at THE CITY on November 3, 2020

When the pandemic began, Eneslow Shoes and Orthotics operated four stores in the city. Now it is down to three — two in Manhattan and one in Little Neck, Queens — and by early next year owner Robert Schwartz believes he may be operating only one.

The problem: a mismatch between revenue and rent.

“Our revenue has gone down about 70% since we reopened,” said Schwartz, who was among the speakers at a recent Manhattan Chamber of Commerce town hall on the commercial rent crisis. “Rent used to be 10% [of revenue] and now it is 50%.”

Eneslow Shoes on the Upper East Side, Oct. 28, 2020. Ben Fractenberg/THE CITY

Meanwhile, GFP Properties is collecting only about 70% of its pre-pandemic rent from the 2,800 tenants in its portfolio of 54 office buildings in Manhattan.

Co-Chief Executive Eric Gural has cut deals with the restaurants in his storefronts and negotiated terms with some of his hardest hit tenants, including the large number of theater-related businesses with leases in his buildings near Broadway.

“The way we look at it we don’t want to put anyone out of business, but we don’t want to be put out of business,” he said.

Gov. Andrew Cuomo imposed a moratorium on evictions of commercial tenants early in the economic shutdown and recently extended it to January. But a crisis is growing as many retailers and some office tenants have stopped paying, building up big rent bills.

Landlords say they are negotiating to help their tenants. Store owners say the landlords are not being accommodating enough.

Advocates for small businesses say the commercial rent market simply isn’t working and needs structural reform both for the pandemic and for the long term. The Real Estate Board of New York notes that rents are dropping sharply.

Meanwhile, tenants’ lawyers say some landlords are seeking to circumvent the moratorium by filing actions in state Supreme Court rather than in Civil Court, which is overwhelmed by the pandemic and where commercial disputes are usually litigated.

“When I first started out assisting tenants, we had some success with rent rebates and reductions and extensions into the future,” said Debra Guzov, a commercial litigator who is donating time to help members of the Manhattan Chamber of Commerce with rent problems. “Now I am seeing more aggressive tactics on the part of landlords.”

‘We’ll Do What’s Fair’

REBNY says that members, like GFP, are working with their tenants the way Gural’s firm is.

Gural is allowing his restaurants to pay about 10% of their sales in rent. Theater tenants were able to pay rent for several months using their federal Paycheck Protection Program money. But now they have no revenue, so they aren’t being asked to pay, instead dipping into security deposits and often just agreeing to deferrals.

When there is new federal money or when Broadway reopens, Gural expects to talk to his tenants, review their finances and come up with a plan for the rent owed.

“We won’t collect every penny we are owed,” he said. “But we will do what is fair.”

GFP is in a position to be accommodating because its finances are solid and its banks have been willing to waive provisions on approvals for changes to leases as long as Gural keeps them generally informed. The company has not defaulted on any of its loans, Gural said.

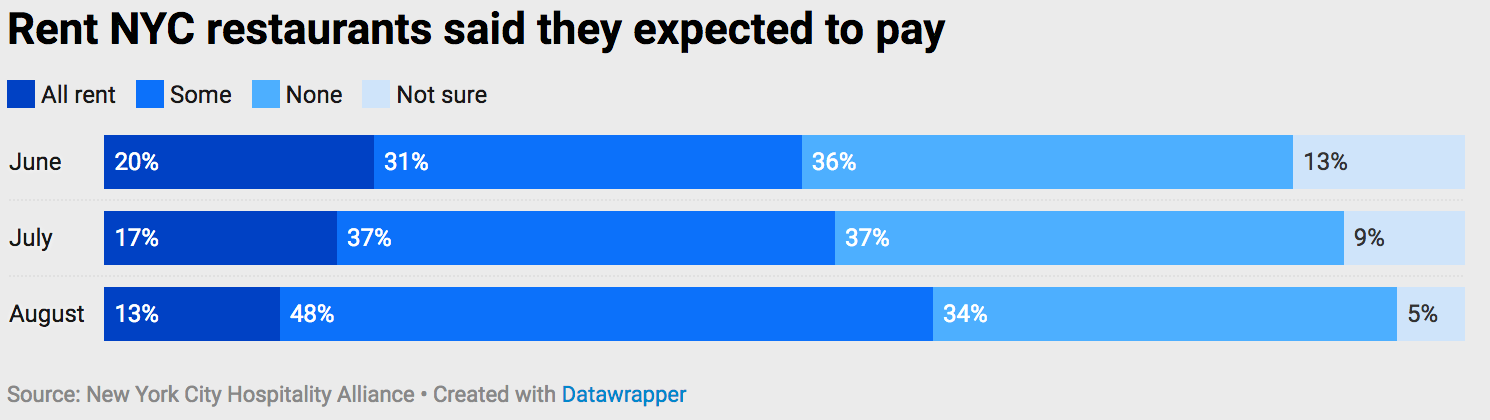

Despite REBNY’s confidence in its members’ approach, a monthly survey by the Hospitality Alliance shows more than half of restaurants have not gotten any relief from their landlords.

Retailers like Schwartz acknowledge that landlords have mortgages and banks that hold the strings for many deals. But the sharp rise in rents during recent years in New York has made many skeptical of landlords’ claims that the market will adjust.

Natasha Amott, owner of the kitchen goods store Whisk NYC, was priced out of her location on Bedford Avenue in Williamsburg after 10 years because other tenants were willing to pay a much higher rent than she could afford. She has kept tabs on what is happening at her old location and notes that area rents have declined somewhat but are still out of her price range.

“We are all wondering if rents will sufficiently drop for the long term,” she said. “I don’t feel that on its own the market will move close enough to affordability.”

Pandemic Reveals ‘Endemic Problem’

Her point is echoed by noted Columbia law professor Tim Wu and legislators proposing sweeping changes to laws regulating commercial leases.

“Rents have to go down for the city to recover, and there is an endemic problem with the stickiness of rents,” Wu said at the Manhattan Chamber of Commerce town hall. “Rents stay high even when the economic conditions don’t support them.”

Wu cites multiple reasons for this market failure.

Because commercial leases are usually for 10 years, landlords are willing to leave spaces vacant while holding out for an economic upturn or for a tenant willing to pay more.

Meanwhile, many mortgages contain minimum rent provisions. Many of the mortgages are securitized, which means it takes approval of up to thousands of institutions holding a piece of the loans to change provisions. Lowering the rent will reduce the value of the buildings, which some owners won’t accept, often for reasons of pride.

REBNY argues the market is adjusting. “Rents were dropping before COVID,” said Paimaan Lodhi, senior vice president of policy and planning at REBNY.

A report released last month by the real estate firm CBRE found that asking rents for retail space fell to $659 per square foot during the third quarter of this year, a 12.8% drop year-over-year and the lowest since 2011.

Bills to Address Rent Bills

Still, some legislators, including State Sen. Brad Holyman and City Councilmember Keith Powers, both Manhattan Democrats, are proposing legislation to help smaller tenants.

They are pushing a plan called Save Our Storefronts, or SOS, under which the state would use $500 million from federal bailout money to help pay rent for tenants who contribute a percentage of revenue, up to 30%. Landlords would agree to reduce payments by 20%, and the state would pay the rest.

Another very controversial idea would also impose a vacancy tax to penalize property owners who hold on to space in hopes of higher rents.

Two other ideas are to eliminate lease provisions holding tenants personally liable for money owed and establish that the pandemic represents an unforeseeable event and eliminate performance penalties in leases.

A better option, REBNY says, is a proposed Workplace Recovery Act under consideration in Congress to provide billions of dollars to cover rent and operating expenses. It isn’t clear how much support the bill, though, sponsored by Sen. Steve Daines (R-Montana), has among Democrats.

The vacancy tax idea is anathema to building owners.

“Landlords are already paying a tax when space is vacant and it’s called real estate taxes,” said Lodhi. “It is akin to imposing a tax on the unemployed to motivate them to seek work.”

‘Need to Have a Conversation’

While it isn’t clear how many landlords may be trying to sidestep the eviction moratorium, Guzov says she is seeking an increasing number of examples.

Traditionally disputes are resolved in Civil Court, which is struggling with COVID procedures and a huge backlog. Instead, she says, attorneys are turning to state Supreme Court where they file either an action for breach of contract for failure to pay the rent or move to evict with what is called an ejection action.

“Those tools are being used to get around the moratorium and delays that are being experienced in landlord-tenant court,” Guzov said.

For example, in July, 1276 Lex Owner LLC filed an ejection action against Sleepy’s Mattress firm to vacate its space in the mid-sized residential building at that Upper East Side address. David Rosenbaum, attorney for the owner, did not return requests for comment.

Lawyers representing real estate firms note that the state and the city have issued a series of moratorium orders that often have different rules — and that under the state’s order from the Cuomo administration, tenants are protected only if they have been affected by the pandemic.

Workers help stock goods in Whisk on Atlantic Avenue in Brooklyn, Oct. 29, 2020. Ben Fractenberg/THE CITY

Even after the crisis ends, tenants like Amott will continue to push permanent changes that would offer small businesses lower rents and especially protect them from sharp increases in rent.

“We need to have a conversation about land trusts (where space is owned by nonprofits offering affordable rents), spaces set aside for small business and for tenants not to be burdened with all of the increases in property taxes,” she said.

This story was originally published by THE CITY, an independent, nonprofit news organization dedicated to hard-hitting reporting that serves the people of New York.

New York rents are too high. Retail particularly so. Clearly losses will be taken, but my suspicion is that the bulk of those losses will be incurred by pension funds. Landlords have spent the last 10 years extracting as much value from their buildings as possible in the CMBS market. Its CMBS which will take the bulk of the hit.

A question I have for the tax accountants out there is “How much do the very favorable real estate depreciation deductions in the US tax code factor into this?”

In most businesses, you simply can’t have a substantial amount of your capacity sitting idle not generating revenue. But if the idle capacity could be used to simply eliminate taxes on any of your actual profits, then the penalty becomes much smaller. But it seems in real estate that maintaining a high rent, even if a bunch of space is vacant, is paramount.

In our community, there was a thriving mall in a very good location that got bought and handed off a couple of times by developers. They have done nothing with it and just finally threw out the last few remaining tenants. All they have done is fight the municipalities over taxes and are now fighting a forced sale under a tax lien (I believe the mall company has declared bankruptcy in this process). The county’s position is that the reason the value of the mall would below now is because the developer did nothing to maintain it (e.g. numerous roof leaks) or attract tenants and customers at the same time other developers are renovating and building new strip mall buildings that are nearly full only a few hundreds of yards away. It appears that real estate is one of the few areas of commerce where deliberate, willful neglect of property is a successful business model and it appears to have a lot to do with the tax code. (This may explain the US pandemic response as well).

Also, don’t the landlords fear lowering rents because it will make future refinancing and rolling over of debts more difficult at a lower stated future income?

No sympathy for greedy landlords. Here on the west coast they have stripmined street life with their empty storefronts and ridiculous rents that not only leave places vacant, but which enourage only high profit margin stores that do nothing for a community like a shoe repair, laundry, cafe or a hardware store would do, for example.

i don’t understand what’s going on here…ex bars and restaurants, 3rd quarter retail sales were 6.4% above those of 3rd quarter 2019. we had a crash in March and April, but are already more than all the way back now… services are still hurting, but retail goods are not..

details here: https://rjsigmund.files.wordpress.com/2020/10/september2020retailsalestable.jpg

I think that the graph you linked to says it all in the next to bottom number in the far right hand column. For the last three month period measured, July 2019 through September 2019, “Nonstore Retailers” posted the largest gain in the column, 23 percent. That would be, if I surmise correctly, internet sales. Department stores showed a net decrease of some 14 percent in the same quarter. So did Clothing and Accessories, Food and Drink (ie. restaurants and bars,) outlets, and Gasoline, all down by ten percent or more in the last quarter. The gainers were Home Improvement, Grocery Stores, and Hobby, Books, etc. all things that can be carried out at home.

Secondly, do remember that the American economy has been changing to a “service” economy for at least twenty years or more. Cut back on those “services” and you disproportionately cut back on the economy.

For years now, the Main Streets of the American hinterlands have been degraded and shuttered. Drive through any small town in America and look at all the boarded up or simply abandoned former business venues. ‘Ghost town” doesn’t do the reality of non-urban America justice. Now the rot is coming for the cities.

“Food and Drink (ie. restaurants and bars,)” meaning independently owned. Eat at Mom’s locally owned cafe, and the money you spend stays in the community and Mom’s is more likely to source local ingredients then say Applebee’s, that uses giant central warehouses to harmonize and homoginize meals nationwide in its 1,586 locations, the profits from which go to Glendale, California.

Money spent locally is essential to communities which are squeezed by corporations from above, and by monetary extraction from below, e.g. Hundreds of billions sent to home countries by immigrants:

https://www.forbes.com/sites/niallmccarthy/2019/04/08/immigrants-in-the-u-s-sent-over-148-billion-to-their-home-countries-in-2017-infographic/

Also, the corporate giants are likely to default on local taxes and bills, whereas local owners have houses and bank accounts to seize:

“The owners of chains like Outback Steakhouse, Applebee’s and The Cheesecake Factory are on a newly updated list of national restaurants that are facing the highest likelihood of not paying back their debts.”

https://www.usatoday.com/story/money/2020/08/13/restaurants-coronavirus-outback-steakhouse-ihop-applebees-cheesecake-factory-dennys/3346312001/

A strong corollary to this is the drop in employment bought about by ‘forced’ retail business closures. Each closed storefront includes laid off workers who used to run the venue. The old question of “how much is too much” comes into play here. If, as seems evident, the rent extraction calculus of the commercial property owning class has now shifted to chasing the ‘high value’ tenants, the fact that past a certain point of wealth accumulation, excess funds go into non productive forms of rent seeking has to have an impact on the economy as a whole. Roughly speaking, [and, as usual, more knowledgeable commenters correct me if I am wrong,] “excess” wealth is being withdrawn from the “productive” economy. This effect acts as a perverse form of economic ‘hoarding.’

I used to believe in the theory of “enlightened self interest.” I now suggest that there is no ‘organic’ connection between “self interest” and “enlightenment.”

Some commentators say that “You can’t make this stuff up.” I’ll add the corollary unto; “You can’t make up for this stuff.”

I can’t claim to be a more knowledgeable commenter, but that won’t stop me from agreeing with you. I believe wealth is being and has been withdrawn from the “productive” economy and what wealth is going into the “productive” economy isn’t going into the “productive” economy in the US. I think Big Money is cashing in their US chips and moving on to other games.

What is especially sad is how Big Money seems so obsessed with bits in bank computers. At least Louis left Versailles. We will be left with ruins.

”isn’t going into the “productive” economy in the US”

THat has got me wondering. Apparently commercial contacts are happening between U.S. and China at the highest level, indicated by the Biden laptop. At the same time a shooting war seems to be this far || away. How to reconcile those?

The career of Zaharoff, the head arms merchant for Vickers Arms back during the ‘Belle Epoque’ and through the Great War (1914-1918) and on is instructive. This man sold armaments to both sides of the Great War (1914-1918.)

The winners and losers of a conflict were of no import to him and his class. Today’s transnational elites, divorced from anything so gauche as nationalism, would take the same view.

Read: https://en.wikipedia.org/wiki/Basil_Zaharoff#:~:text=Basil%20Zaharoff%2C%20GCB%2C%20GBE%2C,%22mystery%20man%20of%20Europe%22.

well…FAKE NEWS

Yes, but which?

another idea is to go back in time and raise interest rates so asset values didn’t go through the roof while wages etc stagnated through unlimited QE that is still going on today, which would have prevented asset owners from getting so high on their hog. That’s was/is the problem with this election, both candidates aspire to represent the hog riders. I still don’t get paid as much as I did pre 2008, while everyone I work for is multiple times wealthier.

It’s HOW interest rates are produced that’s important and currently that’s via welfare for the banks and the rich:

1) Only the banks may use fiat in account form; this and other privileges for the banks result in a so-called “natural” interest rate in fiat of zero percent. And during bank crisis, when the so-called “natural rate” fails, the Central Bank will lend to banks and buy assets from the private sector – more welfare for the banks and the rich.

2) When the Fed or Treasury sell inherently risk-free sovereign debt at non-zero (actually non-negative given overhead costs) they are providing welfare proportional to account balance; i.e. welfare for the banks and the rich.

The proper, ethical way to RAISE interest rates in fiat is to allow the entire non-bank private sector to use it in account form and to abolish all other privileges for the banks.

The proper, ethical way to LOWER interest rates in fiat is an equal Citizen’s Dividend and negative interest on large and non-citizen fiat accounts (since fiat is a public utility).

We have lent money to people we know and trust, interest free since we get nothing from our savings account. It’s a bargain for them.

Another way, lend money at no or whatever interest rate you want and have them write a handwritten notarized loan guarantee based on the equity in their home.

Have never lost a cent. Hopefully we have become an asset to our local community. Chinese people have become very successful in the U.S. by forming lending clubs that obviate banks. Westerners should investigate and emulate this. F* banks.

Small landlords (<10 units) own roughly 60% of all rental real estate.

Why should they get punished? For running a business?

When a landlord and tenant freely enter into an agreement why would it be ok for one party to reneg on the contract?

What if the situation were reversed – the landlord would arbitrarily change the locks and kick out the tenant – would that be ok too?

Small landlords must be punished to make their properties available for purchase by Big Money landlords if they are worth buying — besides the Big Money Banks and Financial institutions cannot take any loses on mortgage payments. If small landlords disappear and a building goes without tenants so much the better for reducing competition.

On a different note: “When a landlord and tenant freely enter into an agreement why would it be ok for one party to reneg on the contract?” I guess I am not entirely clear how “freely enter into an agreement” applies to tenants who enter into the agreement. Can you argue that small landlords and small business tenants are equals in the negotiations? A difficult to impossible to break five-to-ten-year lease as a standard contract vehicle has been the bane of sole proprietors of many a small venture.

Yes, they are equally able to walk away from entering into an agreement. Unless there is coercion, all private contracts must be upheld. Government has no business in voiding private contracts in a free society.

Debts that cannot be paid will not be paid. All private lease contracts cannot be upheld. Forcing small proprietors into bankruptcy is not good for Society. Forcing small landlords into default on their mortgages is not good for Society. Big Money has already been made whole with a huge injection of money from the Fed. Many sectors of the US economy have shutdown. Why is it right that those sectors must continue to pay interest and retire their debts when through no fault of their own they have greatly reduced incomes. Forcing these sectors into ruin benefits no one but Big Money.

I see that you believe in a wise council of angels who know what is good for society and we can now give them free reign to go and void whatever private contracts they think are for the good of society.

Do you see yourself residing in that council?

I don’t know any angels. I am sure no angel and don’t want to be. I don’t see myself residing in a council of angels — I do live in a Society with others few of whom are angels. But it doesn’t take an angel to believe in the Common Good and it doesn’t take much Wisdom to recognize when private contracts lead to private and public harm.

What is the “Common Good”? Who defines it?

Is it the outcome of free individuals looking after their interests in a free world or the counsel of a bunch old wise men?

A closer question: who is included in the “common” of common good? For example in the US for over 100 years black American’s weren’t included in the “common”.

According to the neoliberals there is no common good, there is no “common”, there is only the individual’s rational utility maximization, seeking his highest satisfaction from personal economic and other decisions. “Free individuals looking after their interests in a free world.” The “common” doesn’t exist… for anyone.

The old civilization tension between the “one” and “the many” is eliminated in favor of the “one” by eliminating the “common.” But that leads to a Hobbesian dilemma.

Quoting Herman Melville:

“All my means are sane, my motive and my object mad.”

-Captain Ahab, Moby Dick

(h/t Michael Fiorillo)

I am going to have to find my copy of “Moby dick” and put it beside the bed for ‘dream generation’ therapy this winter of our distemper.

well, quite

the ‘council of old wise men’ part of your false dichotomy strikes me as something of a red herring,

Or duress, or undue influence, or misrepresentation or fraud, or…

why, anyone who’s studied contract law might be inclined to conclude that the judiciary’s ability to void contracts is in fact essential to a free society.

The flipside of that argument is that if the landlord commits to a 10yr lease with, say 2% escalation, and rents in the area explode, s/he is also bound by it.

For quite a few businesses their longer dated lease is a huge asset.

How often? And through whose efforts?

Additionally, if you buy something from Amazon, is that a transaction between equals? Is a tax bill between equals? Conversely, if you tip a waiter, is that a transaction between equals?

Realistically most transactions are not between equals.

Sometimes you’re the statue, sometimes you’re the pigeon.

The money model is:

1) Be a villain

OR

2) Be a victim

with most people being both (exceptions: the very poor and the very rich).

So the system is intensely corrupting though it need not be so.

There is some difference between a transaction and a contract and no the transactions you described are not transactions between equals. Realistically when transactions are not between equals is when Government was supposed to play a role before we discovered there is no alternative.

Landlords are simply being deprived of their property rights and it’s entirety unconstitutional.

It’s amazing that all kind of excuses are being found for the high rents by mainly portraying landlords as greedy evils. Yet no one seem to point out that the reason rents are high is because of the enormous asset inflation driven by QE and Fed printing. Investors who buy property take on mortgages and the higher the purchase price the higher the rent will be pushed provided there is a market for it.

This is how inflation destroys the fabric of society. Self mandated 2% inflation by the Fed is doubling of prices every generation, it’s not price stability. Asset inflation is way higher than that and Fed is hell bent at making sure they stay elevated. If the purchase price is low, lower rents are the normal outcome, but the Fed is buying every mortgage backed security out there making sure there is no price discovery and assets remain elevated.

I don’t understand why media is so silent on how the Fed has become this behemoth of choosing winners and losers in our so called capitalist economy. Their veneration of the Fed chairman is no different than how party leaders were treated in Soviet Union, just watch the Powell’s press conference how journalists treat him with kid gloves, pitiful.

Small landlords, home owners, and small business proprietors are being deprived of their wealth and property, and many renters are being deprived of a roof over their head. Government policies are working to fill our cities with ghost buildings and homeless walking the streets and sleeping in makeshift camps.

The Media is silent on the Fed because the Media belongs to Big Money.

Stop being ridiculous.

If a tenant goes belly up, a landlord can’t get rock from a stone. His “property right” was a promise from that tenant to pay and that promise is only as good as the tenant. Being a landlord doesn’t mean no risk of loss.

The losses are there. The question is how to apportion them. Killing businesses will depress the economy more and frankly kill more people (more homelessness = more disease and social disorder) than making landlords take a hit.

If let to work, capitalism has a process to apportion losses called bankruptcy. It works , it always has. The problem is the when you try to prevent nature taking its course , it creates all moral hazard issues that it’s hard to extricate from. We started in 2008 with banks , now we have all corporations too big to fail and bail them out in the name of jobs and employment and finally its trickling down to landlords bailing out their tenants. Since when was responsibility of landlords to fix social disorder and homelessness?

You needn’t worry a about moral hazards of individuals slipping by without going bankrupt — except for the retirement of student debt. Of course, instead of too big to fail a lot of individuals are too small to bother with. Landlords are not being allocated the responsibility to fix social disorder and homelessness. However, they might want to consider how social disorder and homelessness might impact the value of their properties. How do you feel about moral hazards of shielding landlords from foreclosure and bankruptcy for those landlords who hold mortgages on their buildings and can’t make payments?

Your idea that somehow the Government actions described in this post amount to “landlords bailing out their tenants” is absurd. Landlords, like everyone else — except Big Money — are going to take some losses from the Corona pandemic. In the long run the losses landlords face will be lessened by an effort to keep as many tenants — even non-paying tenants in-business — to be there after the Corona pandemic is licked. Besides the lease and rent forbearance seem somewhat matched by mortgage payment and penalty forbearance. The problem is that at some point in time the forbearance needs to become forgiveness or the whole house of cards will come tumbling down, landlords, small businesses, home owners, and tenants.

I am absolutely against government bailing out landlords or anyone for that matter with taxpayer money.

They should file for bankruptcy, investors should take their losses (not taxpayers) and new owners should try to rent them at prevailing market prices. Property values will take a hit, but that means cheaper rents by the free market not by government decree.

Why is the idea that asset prices might come down such anathema?

Why when real estate prices go up everyone is cheering yet we don’t like price increases on other items?

We wouldn’t be in this pickle if Fed hadn’t blown those bubbles to begin with, yet now we seem to be looking for the solution to the Fed and government. The virus is not the cause of our troubles, moral hazard is. Then virus can be with us for years, some businesses might never make sense in a post-virus world, are we going to keep bailing them out for ever?

Alas, as ‘things’ are set up now, the influence of large property management firms and property trusts means that ‘land’ values are being kept artificially high. This helps the “Big Boys” and harms the Small Folk. I’ll posit that the Fed did not act in a vacuum. The Fed managers listened to their circle of peers and acted for the purported benefit of someone.

Also, as the last decades of “deficit spending” by the Federal Government should have shown us, taxes do not finance the government. Taxes are a tool for Social Engineering. What the goals of that Social Engineering are is the real point of contention. As such, a “taxpayer” bailout of landlords is a perfect example of Neo-liberal Social Policy.

What we fail to take into acount about this situation is that, past some as yet unknown point, the decline becomes irreversible. The entire system collapses and a new Social Contract is formed from out of the wreckage. That is the real danger. Human history has shown that human societies can, and do, collapse back into barbarism and chaos. The same can happen to us. That’s the danger.

The Neo-liberal Dispensation tries to claim that society is a congeries of ‘rational’ actors bouncing around like atoms in a phase change experiment. It wilfully obscures the fact that “higher” civilization is inherently a cooperative endeavour.

Have you ever tried to build a shed? I have. It can be done alone. Now, what about a hydro-electric dam? That is beyond the scope of any individual, no matter how skilled or capable. There is where the pivot point for all this lies; the complexity of the task.

I think the jury is still out on the deficit spending conundrum. If wealth can be conjured out of thin air via printing there wont be poverty in the world. After all every country has a CB capable of printing as much as they want. Things move slowly sometime then all of the sudden. All raw material currencies are made of, is trust. Trust is a fickle thing, it takes years to build, one day only to destroy it.

Its also questionable if our society is based on a “social contract” or the “violence of the state”.

Complex things are product of the vision of a few. Government is helpful in mobilizing resources in a compelling manner but private entities can do as much and better. Cooperation should come as a result of free individuals acting voluntarily.

Humans are mostly rational beings, but tis not against reason to prefer the destruction of the world rather than the scratch of my finger…as Hume would say.

Ah, I’ll observe that “social contract” and “violence of the State” are not separate or opposed items. One enforces the other.

Secondly, I will observe that human beings are not automatically “rational” beings. Rationality is a taught behaviour. In “primitive” societies, “magic” is a “rational” response to unseen and or ungraspable ‘forces.’ A false “cause and effect” is posited and societally accepted as “true.”

Complexity is also not a single state item. Levels of complexity come into play. Some endeavours can be managed by individuals or corporations. Government, being the paramount ‘corporation’ in the social matrix, is thus the ‘Apex Producer’ when problems rise to the level of being existential threats to the society. It could be argued that the State is but a formalized iteration of the Social Oligarchy.

YMMV