Yves here. One of the big sources of the lack of democratic influence on policy is the way so many elements of fiscal decisions are hostage to economists’ beliefs, many of which are at best outdated, just plain wrong, or shamelessly abused (one example of abuse comes below). The presumption that economists know better shuts off many key decisions from debate.

Nathan Tankus below explains the role of fiscal multipliers, which in lay-speak is “how many dollars of GDP growth does a dollar of fiscal spending generate?” Austerians bizarrely believe in “fiscal consolidation” as in that budget-cutting will improve debt to GDP ratios. The problem with that view is that reducing expenditures results in economic contraction that is even larger than the cut in spending, making debt to GDP ratios worse. Greece was the poster child of this phenomenon. The IMF had nevertheless made this approach the centerpiece of its “programs” which had the appearance of working, because they would usually be imposed on countries in the midst of a currency crisis. Dropping foreign exchange rates in conjunction with imposing the austerity hair shirt would (sometimes but not always) provide enough of a trade boost to offset the fiscal downdraft.

Needless to say, the blind application of “fiscal consolidation” didn’t work in the Eurozone, where member states were all on the Euro and thus could not lower their exchange rates. The IMF admitted as much, when its then chief economist Olivier Blanchard announced that the IMF had determined that at least in weak economies, “fiscal multipliers are greater than one”. Even though that was tantamount to saying its playbook was wrong, the organization continues to dole out the same bad medicine.

By Nathan Tankus. Originally published at Notes on the Crises

Since the CARES act passed in late March, there have not been any more major fiscal packages passed through congress until this week. I’ll be writing about this second fiscal package in more detail later this week.

Since no substantial policy changes have been in the works until quite recently, the more abstract questions about fiscal policy — how effective it is, how you decide how big fiscal packages should be — has been pushed into the background for most of the 2020 crisis.

Meanwhile, because of promising vaccine news (as well as a deep desire to avoid the present), financial market journalists, participants and scholars are jumping ahead to an optimistically predicted “boom” in the summer of 2021. I think these discussions are very premature.

In short, it’s become clear from a number of different angles that the notion that fiscal support to the U.S. economy remains wildly inadequate will become more controversial in 2021. As this package starts impacting the economy and the prospects of a true reopening driven by a vaccine starts to seem like more of a reality (even if it ends up being a mirage), the discourse about austerity and worries about inflation will become louder. No one doubted how deep the crisis was in December 2008 but passing a large fiscal package became much more controversial in 2009. Political and intellectual winds can shift fast. In this context I want to step back a bit, and cover some more basic and abstract points. In this “lameduck” period before the next inauguration, we have some time to make fiscal policy somewhat more understandable. But we need to watch out for missteps in the fiscal policy conversation that happen in Biden’s critical first 100 days.

A Republican witness testified today that federal aid to states wouldn’t produce much economic growth. This is what happened next. pic.twitter.com/Hslx9NS2lN

— Bharat Ramamurti (@BharatRamamurti) September 17, 2020

The most critical concept that gets utilized in modern public policy conversations about fiscal policy is the “fiscal multiplier”. In the video above, you can see Bharat Ramamurti of the CARES Act Congressional Oversight Commission embarrass a right wing witness over his misrepresentation of other people’s research. In the clip, what they are essentially fighting over is how “large” or “small” fiscal multipliers are — for both state and local government relief. And yet, what the fiscal multiplier fundamentally is does not get explained. Nor is the importance of “large” and “small” multipliers spelled out. Why should we care what the size of this “multiplier” is.

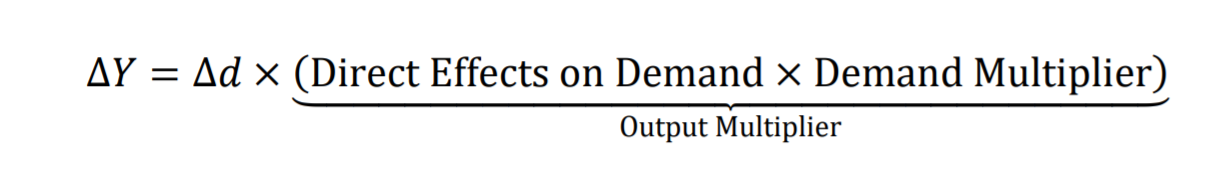

The fiscal multiplier is one of the most famous ideas that appeared in John Maynard Keynes seminal book The General Theory of Employment, Interest and Money — perhaps the most famous single idea to make it to modern thinking. The modern form of a fiscal multiplier as used in public policy is defined by the Congressional Budget Office. In their formulation, there are two important fiscal multipliers. One they call the “demand multiplier” and the other they call the “output multiplier”. The demand multiplier is multiplied by the “direct effects” on demand to tell us how much total income across the economy (The “gross domestic product”) responds to additional spending. So, for example, if the government paid to build a hospital then the “direct effects” would be the total amount of money spent on the wages, inputs and other currently produced goods and services needed to build the hospital.

The “demand multiplier” is thus all the secondary increases in spending (and thus income) that emerge because of that “direct” increase in demand. This can be hard for people to wrap their heads around but it may be easier to grasp when you realize that everyone’s spending is someone else’s income. When your boss pays you, he’s making an expenditure. When you pay someone else, you’re making an expenditure. To that person, what you are paying them is their income. This web of payment relationsmean that when spending increases- either because a company builds a factory or a government pays for vaccine distribution, incomes increase. Meanwhile people with higher incomes generally spend more, even if they don’t spend their whole increase in income. This is fundamentally where this secondary or “multiplier” effect comes from. We will of course return to this concept multiple times later in the series.

If one knows the direct effect of a particular spending project on demand plus the demand multiplier then you can calculate how much total income will increase. Yet the equation above combines the “direct effects on demand” and the “demand multiplier” into what it calls the “output multiplier”. Why does it do that? In order to multiply this “output multiplier” by the “budgetary cost of a change in fiscal policy”. This is important for policymakers who want to increase overall demand for as few dollars as possible. If you think that the limits on fiscal policy are some metrics for how much you can safely “borrow” rather than spending’s effect on employment, inflation or the trade deficit, then it is important that you don’t “waste” your budget on things that don’t increase demand by substantial amounts for each dollar appropriated. Thus if the output multiplier is small a policy will not be worth it to the budget conscious even if the demand multiplier is large- or predictable. This is why it’s so important to Bharat Ramamurti in the above clip to establish that fiscal multipliers for state and local government aid in this crisis are larger than the witness was claiming. The smaller the multiplier, the more unappealing it seems to policymakers. This is a point that we will return to later in the series.This inclusion of what the CBO calls a “budgetary cost of a change in fiscal policy” leads to significant issues in public policy analysis because it is ambiguous what the relevant “change in fiscal policy” is. For example, if congress appropriates 10 billion dollars for the construction of additional public schools should that total amount be considered the “budgetary cost” even if it is not expected that that 10 billion dollars will be doled out by the department of education in that single year? There is a danger of making policies look worse than they actually are by comparing what is effectively a multi-year budget to a yearly effect on demand. In a future part of this series we will examine this critical point when it comes to thinking about the government’s role as creditor and policies- such as student debt cancellation- where output multipliers can vary by extremes depending on what methodology you choose.

I know that that was a lot to absorb from one piece and don’t feel dismayed if you feel that you are missing important elements of what’s been discussed. We will be going over important points multiple times. Part Two in this series will be coming next week since there’s a number of things about the current Covid Relief package that I will need to cover in the next few days… including apparently Trump’s potential veto??

Try to enjoy your holidays with everything going on and please stay safe.

“The problem with…[the Austerians]…view is that reducing expenditures results in economic contraction that is even larger than the cut in spending, making debt to GDP ratios worse.” The Austerians have a debt fetish, particularly when it’s any sort of public debt which they seemingly feel personally responsible for. “D”…the scarlet letter. They are deathly afraid that state and locals will use the federal cash to ease the pain of failing public pension funds, pay teachers or prevent some bit of public property from being privatized. The debt/GDP ratio may be worsened but if the total debt load is diminished then their choir of angels becomes even more melodious. It seems to require the lash of the bankruptcy courts to produce the greatest harmony. One can whistle a happy tune picking through the wreckage.

Many here have mentioned thinking that the League of Austerity’s Hair Shirt (LASH) was being readied for a new public veneration.

Watching the embedded video makes it cleat that the LASH is Standard Operating Procedure for the Neo-liberal Dispensation.

I get the distinct feeling, apart from my personal bias against the group, that Biden is going to begin the winding up of the Democrat Party as it has been traditionally known.

When the Biden Administration begins to apply austerity to America, in the midst of the double shot of Pandemic and Depression, all bets will be off. A Perfect Storm approaches.

I look forward to reading the rest of Mr. Tankus’ posts on this subject. He writes clearly and understandably. Even this “old dog” can learn new things from him.

ambrit – Best wishes for a joyous holiday for you and yours.

You might consider getting on Nathan’s email list. Or, subscribe for more complete posts.

Be well, stay safe.

The more guns and ammunition more citizens have, the more perfect the storm will be.

Does Biden understand that? If he does, watch for the Biden Administration to push hard and early for gun control. “Biden pushing gun control” will be the tell that Biden knows exactly what he is doing at the political economy level.

are u aware, the Hon. Wm Barr, allowed 300K guns sold w/o background check in 2020? Care to Guess which markets those guns will “flip-sell” into? I am continually amazed at the wonders Murican democracy!

https://www.forbes.com/sites/jemimamcevoy/2020/09/15/nearly-300000-americans-may-have-bought-guns-without-background-checks-amid-pandemic/

Thank you NT. I’m looking forward to this series. I can only second guess the neoliberals, whether democrat or republican, by imagining their fear. The world is still a contentious place. The “liberal” West has not achieved its goals even after 2 world wars, one cold war, and the endless war against “terrorism” combined with a financial crisis akin to taking our ball and going home. Is a big temper tantrum the last bastion of neoliberals? Why is this? I always fall back on the explanation that the true goal of western liberals is neocolonialism. Imperialism. Mercantilism masquerading as “free trade”. Free-marketeering. And I blame the profit motive. And I conclude – without evidence of what the future will bring – that if neoliberalism fails as an economic model for the entire world, if it fails in only a few places, then the financial system gets log jammed. If money is log jammed neoliberal marketeering is log jammed. The markets crash because profits crash. But even worse, the biggest obstacle to creating a smoothly operating world economy is the growth model. It has failed miserably. Without it liberalism cannot continue its march forward. It must obey regulations. Which is lethal. Like a shark that cannot swim. If there are some things about neoliberalism that should and can be salvaged there should be an open discussion about it. It’s not like we haven’t achieved some remarkable progress during the last 75 years. Why on earth spending sovereign fiat money on society is a problem becomes a big question as well. Is it because sovereign spending is really the true source of “private” money? Which forces us to admit this is a huge contradiction. There are so many questions to consider in all this perverse ideology – it would be nice if we could just start from scratch. Let’s just fund civilization and the environment as needed. We really don’t have much time left.

But if we funded society to a level of comfort, there wouldn’t be “labor discipline.” If we fully funded social safety nets, public policy would not send the message: “If you don’t take whatever crappy job is on offer, you’ll suffer the indignities of poverty, even homelessness or starvation…(and if you’re extra ornery, we’ll put you in a cage)”

I’d suggest many of those police shootings occur because people have been driven to desperation. “The law in its magnificent equality forbids rich and poor alike from sleeping under bridges, begging in the streets, or stealing bread.”

Austerity is the whip in the hand of the plutocrats. They will give it up only with the greatest reluctance.

Perhaps needless to say, Mr. Tankus’ piece here constitutes a real public service.

I would like to add two points, though Mr. Tankus might prove well aware of them in his upcoming posts. First, PERI of U-Mass@Amherst has long looked at fiscal multipliers, and has documented that the nature of fiscal spending matters. Specifically, spending on the military and war – I say this as a Veteran, as well as an Economist – was found to have a much lower impact on the macroeconomy than spending on social needs, such as (but certainly not limited to) infrastructure such as bridges or water-treatment plants.

Second, the point I raise above points to another concept so rarely discussed these days, but a concept that classical and Neo-Marxist economists did not shy away from: productive vs. unproductive labor. Thus, a fair question to be asked is whether additional spending by the Federal government will results in useless military spending (think: Air Force personnel’s babysitting nuclear bombs) or badly needed social spending, such as housing for the homeless. The better economists will take this question on.

Seymour Melman and others had long documented the unproductive nature of military spending. It was a feature not a bug. The idea was to maintain aggregate demand by manufacturing useless, unproductive products. Scarcity had to be maintained in the face of abundance…or the citizenry might get the wrong idea.

Thanks for the lead. (In fact, somewhere buried in my boxes – we have just moved into a house – I believe I have Mr. Melman’s book. I’ll put it back on my reading list when I find it.)

The lexicon is unlikely to change, but I’d suggest that a global search and replace in all discussions of sovereign government spending: Remove “appropriated,” and replace it with “created.” Since as I understand MMT (admittedly not well) that is how money comes into being— by simple fiat of the legislature, and maybe in interstitial areas, of the executive as well, All in service to “policies” the sovereign has chosen or been coerced or bribed into making.

Providing economists with some sort of halo, e.g., the misnamed prize in economics, is one example of how economists have managed to exclude from normal criticism any discussion of their ideas. Economists are by and large ideologues and not “scientists. And their area of interest is not science. Why they are held in such high regard is simply an example of good pr.

MMT is an example of a political fact. MMT is simply an explanation of how a sovereign government that is solely responsible for the currency that must be used to pay what they “owe” by those who owe “money” to the government, i.e., taxes and those fees that are essentially taxes. The word “debt” cannot be applied in a discussion regarding national budget deficts.

Try to explain this simple idea to a committed “liberal” or “conservative” economist.

Anyway, whenever an economist writes or speaks, one must ask to what extent he or she is committed to an explicit political program. To the extent that one can identify this commitment, one can interpret the economic position taken.

The above is why I find the idea of “economic science” to be so absurd. To the extent that economic explanations are tied to a political ideology is exactly why the explanations cannot be scientific or be called science. I cannot conceive of “conservative” or “neoliberal” quantum mechanics, biology, mathematics, etc.

When will Tankus further presentations take place?

What about the UK in the late 70’s? Not trying to be combative, just genuinely wonder what to say to (classically) liberal friends who bring it up as a counter-example to MMT. Expansionary fiscal and monetary policy that leads to currency devaluation will have adverse effects for net importers.

I think that “counter-example to MMT” is a category error. MMT is a description of how monetary sovereigns function.

MMT does not imply that monetary sovereigns have unlimited fiscal freedom, I don’t know the details of the specific era in question, but it could be noted that US in the ’70s experienced a period of relatively low growth and relatively high inflation, largely due, I think, to cost-push effects from external oil suppliers. There was, IIRC, also considerable wage pressure, which suggests that national output was approaching its limits, and under such conditions, fiscal stimulus simply raises prices without increasing real output.

.

Nations that rely a great deal on external inputs that must be paid for in other nations’ currencies have less fiscal freedom than nations whose economies are more nearly autarkic. UK may not have a great deal of fiscal policy freedom at the present time for that reason.

I believe that Randall Wray’s “MMT Primer” at the New Economic Perspectives weblog has some posts that discuss how fiscal policy freedom is affected by the relative size of a nation’s economy to its trading partners’, how dependent the nation is on imports, the currency regime (peg to external or float) etc.

http://neweconomicperspectives.org/modern-monetary-theory-primer.html

the headings for posts 26-29 look relevant, It’s worth reading the whole thing from the top, if one has time for that.

What about digging ditches?

Just kidding. In all seriousness, I think that Keynesian fiscal policy does not work in quite the same way in the 21st century as it did in the 1950’s. Ideally, fiscal stimulus improves the conditions for capital accumulation (e.g. the big infrastructure projects of the 30’s that enabled the West to be settled on a massive scale), but if that’s not possible (e.g. repairing a bridge that needs to be repaired is very important, but only endures that traffic will continue to be able to cross it as normal), it at least puts money into the hands of businesses/consumers that they can spend, stimulating economic activity. But economies are now much more globalized, and for nations running trade deficits, this money being put into consumers’ hands is used to spend on goods and services from abroad, subsidizing those firms rather than domestic ones, which defeats the whole purpose of increasing the national account.

Also, the whole basis of Keynesianism is that governments must spend during recessions and run a surplus during periods of growth in order to curb inflation. Well, what happens when because of globalization (cheap labor/outsourcing from abroad), prices are sticky? Do the rising prices from fiscal stimulus lead to reduced competitiveness (and, thus, job-shedding)? And at what point is there supposed to be fiscal consolidation? Never? Just keep spending no matter what? Sounds like a free lunch.

I’d suggest the Republicans understand MMT very well indeed, they just spend that fiat money without limit to support the rentiers while proclaiming they are “balancing” the budget.

“Reagan proved deficits don’t matter”–Dick Cheney

The distinction between productive spending and economic rent is the one missing from your account. Feeding the parasite rather than the host has been a bipartisan enterprise for some time now.

Was the 1970s really a time of low economic growth? It certainly seemed so at the time, what with the energy crisis and stagflation, the concurrence of high inflation and high unemployment, which wasn’t supposed to happen. But I have recently read that, despite that, economic growth in the 70s was actually good. What’s the story?

Try Rick Perlstein’s latest: Reaganland for the history…and the way Carter misused austerity to his discredit.

I remember reading in 2011 that the most effective government expenditure in the wake of the financial crisis was unemployment insurance. That makes sense to me, since we are putting money into the hands of people who will spend it right away. Does that hold true in general?

The only other place that has better returns might be infrastructure. Think about great depression TVA electrification for example.

But for a quick fix where it does the most good is giving money to the poor who cannot do other than spend. They spend it and help the economy, even when most consumer spending ultimatively might go abroad via trade deficit. Spending it on banks and big corporations for stock market shenanigans and balance sheet games is definitely a bad place to spend.

Spending it on small corporations it can help too since they can retain their staff: another form of unemployment insurance of sorts. So the question is, is it easier to spend on small businesses since that is a load of bureaucratic overhead or is it better to spend it on unemployment when said unemployment has been gutted in various ways over the years (like <24h per week) and many people might not even quality for it or too overwhelmed to apply properly, another form of detrimental bureaucracy.