By Johannes Petry, IRC Postdoctoral Research Fellow at the SCRIPTS Centre of Excellence, Free University of Berlin, Jan Fichtner, Senior Research Fellow at the CORPNET project, University of Amsterdam, and Eelke Heemskerk, Principal Investigator at the CORPNET project, University of Amsterdam. Guest post at Notes on the Crisis.

Over the course of 2020, Elon Musk’s wealth skyrocketed from $27.7 billion to $147 billion. Musk even overtook Bill Gates, to become the second richest person in the world. This was a tremendous jump in fortune: Musk was only at 36th place in January 2020. Musk’s enrichment was mainly due to Tesla’s rising stock price (TSLA:US), which surged from $86 in January to $650 in December. Tesla is currently one of the ten most valuable companies in the US stock market.

In an already record-breaking year, Tesla’s largest and most rapid increase in valuation came in November, due to its announced inclusion into the S&P 500 index, now scheduled for 21 December 2020. Within a week of this announcement, Tesla’s share price rose by 33%, as passive funds now have to invest more than $70 billion. This was a remarkable boost for stock of a company that many analysts say is already obviously overvalued.

Just a few weeks earlier, on 21 September 2020, Yinghang ‘James’ Yang was arrested for insider trading by the Securities and Exchange Commission (SEC). Yang was an employee at S&P Dow Jones Indices (S&P DJI),sitting on an index committee that decided about which companies were to be included and excluded from S&P DJI indices. Yang had used this insider knowledge, to trade options on these companies through a friend’s account, making almost $1 million in the process. The case is currently being investigated by US authorities.

While these seem like unrelated incidents, both these episodes in index committee decision making are part of a tectonic shift that has fundamentally transformed capital markets globally. That is, the move towards passive index investing — and the concomitantly growing power of index providers.

Based on a recently published research paper, let’s explore the rising importance of indexing in this new era of US financial markets. While rarely discussed by industry outsiders, grasping the contemporary state of index provision is indispensable for making sense of financial markets. Today, indices rather than ‘the market’ increasingly steer financial flows.

The un-American Age of Passive Investing?

Why has passive investing become so important in the 21st century? While passive funds (i.e. exchange traded funds and index mutual funds) have been available for decades, investors shunned them for a long time. For many years, pundits even called these investment vehicles ‘un-American’. It was complained that they merely replicated the performance of specific stock markets, rather than trying to outperform the market by picking stocks. Some critics even asked whether passive investing was ‘worse than Marxism?’

By contrast, investors who beat the market — from Warren Buffett to George Soros, and Ken Griffin — were perceived as the bedrock of American finance, not free-riders who merely imitated the market’s average success.

This changed dramatically with the global financial crisis of 2007-2009. While the ‘Great Moderation’ before the crisis was marked by an exorbitant growth in financial asset returns, in a post-crisis QE-world active fund managers could no longer achieve high yields while simultaneously charging hefty fees. This made it apparent how expensive their business proposition actually was. As a consequence, globally at least US$3,200 billion of investments have exited actively managed equity funds, while concomitantly more than US$3,100 billion have entered index equity funds between 2006 and 2018.

As S&P’s SPIVA scorecard shows, the vast majority of actively managed funds have been incapable of beating broad market indices over longer periods of time but nonetheless charged high fees. While this was not perceived as a major problem in the pre-crisis period of exorbitant asset returns, it became fundamental for investment decisions in a post-crisis, low yield environment. The result was a money mass-migration from actively managed funds to much cheaper passive funds, that merely replicate financial indices throughout the 2010s. By mid-2019, for the first time the assets of US equity index funds have exceeded the assets of actively managed equity funds. As a result, we have now entered the new age of passive investing. One in which indices are front and center.

One crucial characteristic of this new era of global finance is the new relationship of funds and providers. Index funds in effect delegate their investment decisions to index providers. Index providers are the companies that create and maintain the indices on which passive funds are built. They profit nicely from the new status quo, because asset managers have to pay fees if they replicate them. As Howard Marks of Oaktree Capital stated: ‘somebody is making very active decisions about which stocks will be in each “passive” product. […] the people who create the indexes are deciding which stocks will be invested in’.

Index investing thus represents a form of ‘delegated management’. Every discretionary decision by index providers has a ‘flow through effect on the investor’s portfolio’.

In the past, indices primarily served informational purposes. An index such as the American S&P 500, the British FTSE 100 or the Japanese Nikkei was primarily a numerical representation of a particular stock market. In this context, indices served a humble role: as benchmarks, against which analysts could gauge the performance of stocks. While the decisions of index providers had some influence on actively managed funds, the recent rise of passive investing transformed their role profoundly. Today, they are ‘steering’ funds, via their selective inclusions of companies or countries. Appearing in key indices can cause inflows of many billions of US$, while conversely exclusions can lead to large quasi-automatic outflows. Enrichment (such as that enjoyed this year by Elon Musk) or ruin can depend on index entries.

Rather than ‘the market’, it is increasingly index committees that make financial investment decisions, shaping the fate and fortunes of listed companies. Index providers have therefore become powerful actors in the fabric of US capitalism, playing a newfound role as kingmaker. The indices they create are crucial building blocks in the new era of passive investing. As the FT’s Robin Wigglesworth points out, ‘financial indices are arguably the most under-appreciated force shaping global markets’.

Where Do Indices Actually Come From? Why Do They Matter?

Put simply indices are numerical tools that allow for the comparative evaluation of groups of assets over time. The purpose of indices is to display the performance of a specific economic entity in one single number — for example, a nation’s stock market (S&P 500). This makes the fortunes of a given basket of companies relatively easy to understand, and also comparable over time.

An index typically consists of a series of corresponding dates and numbers, evaluations based on a series of assets (e.g. stock prices). These assets are assigned specific weightings, whose sequence depicts the performance of the evaluated assets. In this way, the index demarcates the boundaries of what these entities are: the 500 companies that the S&P 500 evaluates are synonymous with the US stock market (or at least, they are widely perceived this way).

These indices are important measures for economic activity and have become a constant feature of our depiction of and thinking about the economy. As index theorists Rauterberg and Verstein have noted:

[There] is a myth of objectivity, which characterizes indices as near-Platonic mathematical constructs that exist largely outside of human intervention and creativity. […] According to this view, indices are either themselves objective facts or else factual statements about the world. For example, that the S&P 500 is above 1000 is an observable, objective truth and one that does not rely on human judgment or interpretation […] like the temperature.

But rather than a purely technical exercise, constructing indices is inherently political. They represent ‘deliberate decisions’, as every index is a managed portfolio whose composition is decided by the respective index provider. The committees at index providers decide inclusions and exclusions, and as such they have ‘enormous discretion’ in these decisions. In fact, processes of index production are inherently subjective activities. As Rauterberg and Verstein put it: human discretion and value judgement are essential ingredients in even the most “objective” indices’.

The index provider industry has adopted ‘free float’ market capitalization — total market capitalization minus shares held for the long-term by founders or governments — as their ostensibly objective basis for virtually all index calculations.

But clearly this ‘free float’ approach leads to outcomes that surprise most laymen. Take for example the well known MSCI World Index. For many retail investors, this index is synonymous with a globally diversified asset allocation, but actually the weight of US stocks is over 66%. Similarly, the result of buying a fund that tracks the MSCI Emerging Markets Index is a portfolio that is 41% invested in China, whose weight has surged from 18% in 2014. In the US, the all-important S&P 500 index has become much less diversified. The weight of just the top five big tech companies has doubled from 11% in 2014 to 22% in 2020. By contrast, the share of the bottom 300 companies has declined from 20%, to under 15%.

Moreover, indices have a governing effect on those that are being evaluated. They incentivize the companies or states that are being assessed to comply and conform with the normative assumptions underlying those numerical representations. This seems inevitable: better index performance has positive ideational and material effects.

The most prominent example of such numerical evaluation measures in global finance are credit rating agencies, which can shift the asset allocation of billions of US$ by up- or downgrading firms and countries.

In a similar vein, by deciding what to include or to exclude from an index, providers make assessments about the investment-worthiness of firms and entire countries (e.g. the pivotal MSCI World and Emerging Markets indices) and can move financial flows. The same is true for how inclusion decisions are calculated. The best example is the recent inclusion of China in all key emerging markets indices. This decision alone is expected to result in long-term inflows from foreign investors of up to US$400 billion.

Arguably, in this new age of passive asset management index providers are to equity markets what credit rating agencies are to bond markets — critical gatekeepers that exert de facto regulatory power.

Steering Funds: The Growing Power of Index Providers

Historically, index providers were primarily providers of information. Indices were ‘news items’, helpful for investment decisions — but arguably not essential. Actively managed funds merely used them as baselines to compare their performance, they were not expected to direct financial markets. As previously noted, the hallmark of active investors was to be different from the index — rather than being reliable, the index was there to be beaten. Hence, index providers’ decisions over the composition of their indices had relatively limited impact on financial flows — deviation from the index was a worthy risk metric. But their exact composition was not yet crucial to investors, listed companies or countries.

This changed fundamentally with the global financial crisis, which triggered two reinforcing trends: concentration, and the rise of passive investment. Together, these transformed index providers from merely supplying information to exerting power over asset allocation in capital markets.

First, the index industry concentrated — not least because banks sold non-core businesses to raise cash, as they tried to stay afloat during the financial meltdown that engulfed their industry. By 2017, the three indices S&P DJI, MSCI and FTSE Russell accounted for 27%, 26% and 25% of global revenues in the index industry, respectively.

This market concentration led to a growing power position of the few index providers that had historically positioned themselves and their brands in financial markets. With profit margins averaging between 60-70%, they operate in a quasi-oligopolistic market structure. This is because their indices are not easily substitutable, due to unique brand recognition and network externalities, e.g. through liquid futures markets based on their indices. The S&P 500, for instance, represents US blue chips like no other index. It is also the most widely tracked index globally, and S&P 500 index futures are the most traded futures contract in the world.

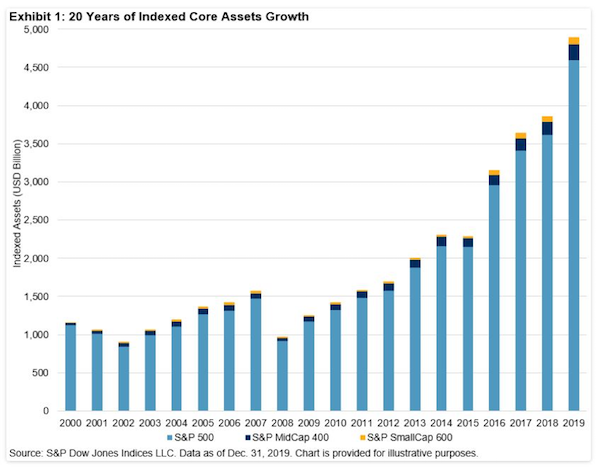

Second, and more importantly, the money mass-migration towards passive investments significantly increased the authority of index providers. They came to influence asset allocation in unprecedented ways, as more and more funds directly tracked the indices they own, construct and maintain. ETFs indexed to FTSE Russell indices more than doubled from US$315 billion in 2013 to US$765 billion in 2019. Meanwhile passive funds tracking MSCI indices even increased more than sevenfold between 2008 and 2020, from $132 billion to more than $1 trillion. ETFs and index mutual funds that follow S&P DJI indices increased from $1.7 trillion in 2011 to staggering $6.3 trillion in 2019. Whereas in the past indices only loosely anchored fund holdings around a baseline, now they have an instant, ‘mechanic’ effect on the holdings of passive funds.

As passive funds simply replicate an index, index providers’ decisions to change index compositions lead to quasi-automatic asset reallocations. Index providers now effectively ‘steer’ financial flows.

In addition, index providers increasingly also have a steering effect over actively managed funds. Established and well-known indices are used as direct benchmarks by actively managed funds which measure their performance against these indices. For this reason they are crucial as baselines to inform investment decisions.

Benchmarking against indices has reached enormous proportions: US$14.8 trillion, US$16 trillion and US$11.5 trillion of assets (equities and bonds) was benchmarked against the indices of MSCI, FTSE Russell and S&P DJI in 2018/19, respectively. This is up from US$7 trillion (MSCI), US$7.1 trillion (S&P DJI) and US$7.1 trillion (FTSE & Russell) in 2013.

Essentially, the rise of passive management also increases the authority of index providers through active management. By steering evermore passive capital index decisions mechanically move ever larger parts of the markets. This produces a ‘pull effect’, that actively managed funds need to follow.

Of course, this effect varies between investor types — with hedge funds having more leeway in following index changes, whereas pension funds have to follow index recompositions much more closely. However, this effect is hard to negate. Today, the largest trading day in the US stock market is Russell Recon — the yearly reconstitution of FTSE Russell benchmark indices in June.

Overall, with the ongoing shift towards passive asset management, index providers turned into powerful market actors. No longer mere benchmarks, their indices have become central building blocks in this new era of US financial markets. In the past, the purpose of indices was to measure markets, now they move markets.

New Era, New Problems

Indices are here to stay and so index providers are becoming ever more powerful actors in this new age of American finance. However, as we illustrated in detail in a recently published paper, their rise and business model are not unproblematic. Instead, distinctive new problems arise in this new era of American finance.

As previously noted, index providers have significant discretion in devising their methodologies of index creation. Adriana Robertson, for instance, highlights that the methodology of the pivotal S&P 500 index was changed at least eight times between 2015 and 2018.

While representing the US stock market, the S&P 500, for instance, allows companies to be based in ‘domiciles of convenience’ — tax havens such as Bermuda, Jersey or the Cayman Islands. This encourages both aggressive tax planning and avoidance schemes. Contrastingly, index providers decided during the 2000s that block shareholdings were excluded from index weight calculations. This led to a global migration of funds away from East Asia and Continental Europe, where strategic blockholdings and family ownership are more pronounced than in US and UK companies.

The ‘new permanent universal owners’ Blackrock, Vanguard and State Street that dominate the index funds industry as the ‘Big Three’ are exempt from this rule, however. These three ‘universal owners’ share many characteristics of long-term blockholders. Especially, the shares they hold in passive funds are not readily available for trading. Finally, index providers have become central actors in a green economic restructuring, as they positioned themselves as key standard-setters for ESG funds (environmental, social and governance). For this reason, index providers have an important effect on setting corporate governance standards, as they increasingly define ‘the norms of what’s considered acceptable in international finance’.

On the other hand, index providers are certainly not free from political influence. As Mike Bird from The Wall Street Journal argued, Chinese authorities have been quite successful in pressuring MSCI and other index providers to include Chinese A-shares into their flagship emerging market indices. Foreign investors forced to invest into China after the inclusion have to play according to Chinese rules of how markets work. As a result, the pensions of US veterans (which are partially invested in passive funds tracking these indices) were suddenly invested in Chinese defence companies. This was hotly debated by US lawmakers, resulting in an investment ban decreed by the Trump administration. This has forced index providers to rethink their China inclusion strategy.

Index providers have become central actors in capital markets — their decisions impact investment allocations worth trillions of dollars. Notably, the coronavirus pandemic has not reversed this trend — it may even have accelerated it. Bond index funds have witnessed record inflows in 2020.

Concentration in the index provider industry is also continuing with the recently announced $44 billion acquisition of IHS Markit (including the iBoxx bond indices) by S&P being a case in point. As the case of insider trading at S&P DJI indicates, rather than being neutral, technical exercises, index calculations can be prone to malicious behavior. While this was the first discovered and publicly disclosed case, it is not unlikely that this is more widespread. And will become more of a problem as indices rise in importance.

In other words, index providers have become oligopolies with enormous influence on financial investment decisions — and the striking case of Tesla will not be the last. Some Wall Street analysts are already advising their clients not to increase their holdings in accordance with the index rebalancing. Contrasting with this one overblown data point, ‘by virtually every conventional metric’ Tesla was dramatically overvalued, as the stock price trades at more than 1,000 times its price earnings ratio.

While this might certainly be the case, passive funds are now ‘locked in’ due to an index inclusion — with an estimated $70-120 billion of (quasi-)passive funds being steered into Tesla’s stock.

Arguably, to exploit this wave of predictable inflows Tesla has announced to raise $5 billion in share sales over the coming months. It might not be an exaggeration to call this behavior ‘gaming’ the index inclusion. But regardless: the pre-eminence of the index is here to stay. Welcome to a new era in American finance where indices, not investors increasingly shape financial markets.

Excellent review of the transformation of markets since 2008. Explains why Target Date retirement funds became de facto 401K choices for companies.

Would love to see the same review done on the options market. Explosive growth and concentration are easy to see, but what lurks below?

Thanks for including in Links.

There are large problems with option markets too, especially since more and more retail investors got into that.

Market-makers in options have to hedge any contracts sold, which generally means buying/selling for calls/puts. Which, if there is a sufficient volume, can create positive-loop feedback – the more they hedge, the more they need to hedge up to the full physical position. Since there’s no limit on outstanding options vis a vis the underlying, that can manipulate the price a lot.

A number of people speculated, that Tesla’s super-performance was driven by something like this, not fundamentals. Especially if through this you can force the company to enter an index.

I believe that index-investing is, in many ways, superior to active-investing, at least as long as active investors fee is based on a percent of AUM.

But that doesn’t mean a number of indices are broken. But, IMO, the whole public-market-shares is badly broken (for a number of reasons), and with indices, the brokennes at least, most of the time, works even to retail investor’s favour (as in most brokennes moves the company price up, not down). In a way, you could say that active-fund investor gets fleeced always, index investors gets fleeced only when the big boys do (I’m exaggerating here, but still).

“a number of indices are broken” was meant to be “a number of indices aren’t broken”.

Index inclusion is the perfect exit strategy for a stock promotion scam. One wonders if we will eventual hear the usual suspects bleating “whocudanode”?

True, but it takes a looot of time and effort to get to the place, compared to the usual pink-sheet stuff.

I’d say that the recent best publicised case was actually Wirecard, as that was a clear scam/stock promotion, and regulators failed miserably.

Didn’t we see this spelled out last year, as governing logic for a startup? Grow enough fast enough and you’d get on an index and then all kinds of funds would be obliged to buy your stock? Was it Theranos that somebody pointed at?

I never find out about crucial bookmarks until it’s too late.

It’s going to take a while for the big boys to unwind their lower cost basis positions. They will keep the markets high as they slowly do it.

Meanwhile, the articles in media to generate FOMO keep coming. Even those disguised as “cautionary tales” are really working to drive FOMO.

And as another commenter pointed out….they have a ton of calls to sell, then dip enough so they expire worthless, then sell some more.

Back in the mists of time, I learned in my Finance class that the minimum number of stocks to hold for a “diversified” portfolio was six. Yes six, at least to reach 80% diversification.

During the tech bubble of the early oughts I had one tech stock which reached almost 60% of my portfolio value. Wow! Unfortunately, while I sat on it along with all the other greater fools, it crashed to zero.

SO now my rule of thumb is this – if any stock reaches more than one-sixth of my portfolio value, I sell it down to one-sixth. Not very scientific, but I’ve used it a few times and it has always paid off.

When the “House” changes the rules 8 tines in that short a period of time…

I’ll try to find another table to sit at, one where I know who the sucker is.

It becomes more and more difficult for me to sustain any belief that stocks represent an investment. The old story of how a Corporation attracts funds for making new ventures has become fairy tale. Price to earnings with stock like Tesla that trades at more than 1000 times its price to earnings ratio reduces old-fashioned notions of stock fundamentals to complete nonsense, and that assumes there is still reason to believe the numbers in Corporate reports. Corporations can buy their own stocks to drive up share prices reflecting a measure of their money war-chests or ability to borrow money at low interest.

Now we find that the impacts of overwhelmingly passive investing combined with index driven stock prices as described in this post suggest there is no stock ‘market’ in the usual sense of the word, certainly no ‘Market’ magically optimizing anything. Instead we have magic rope the Fed can push on by crushing interest rates and dumping money to-let at the feet of the wealthy so they can pour it en masse it into bundles of stocks selected by the makers of stock indices. Whether the stock market prospers and which stocks — have become matters of politics and ‘influence’ rather than an economic response to market forces. No wonder Government is so fond to sell the stock market as the economy — it’s so easy to manipulate and besides so pleasing to the right people and powers.

The US does not have a democracy, a capitalist system, or even a simple plutocracy. The scale and scope of predation, wealth levitation, and austerity for the masses defy standard definitions. The US is exploring a new kind of system.

Eh, its still ‘capitalism’, just a new form of it separate from older forms of Capitalism. Hell, I would even argue Capitalism changes to a different phase of sorts every few decades. 80s-90s capitalism worked differently than the post-ww2 era capitalism, with internet era capitalism being even more distinct.

I suppose one could say modern capitalism lacks some of the ‘values’ of Capitalism from half a century or a century ago, insofar as a system with no central organizing structure can even be said to have ‘values’, which is to say, not very much. Quite frankly even 50 to a hundred years ago, the ‘values’ of capitalism seems to be propaganda added post-hoc in order to justify the then-current system. Especially considering things like child labor weren’t outlawed until 1938, just a few years before the ‘golden years’ of capitalism from between the late 40s-early 60s. Ah yes, such values.

Lastly, to people who say, “REAL Capitalism isn’t like this new style of not-really-capitalism!”, my question is, when exactly in history did ‘pure’ capitalism as it has been theoretically constructed as by economists ever actually exist?

Sounds like the house has stacked the deck in the casino.

Sounds like the deck stacker is AI – like this trading is front run by a million iterations with the highest return being picked up front or some regression analysis used to square the circle.

Am I wrong to think that wall street and other finacial market participants are the one’s spending the most on integrating and advancing these computational models?

There is no excuse for poverty. It is extremely wasteful. It is a great reservoir of untapped wealth in a world where nothing is turned into something by the click of a digit. In fact poverty should be a prime commodity. Why doesn’t some Smart Guy set up the Positive Entropy Money Fund – the PEMF – to establish an index fund dedicated to the elimination of stored up negative entropy in a capitalist world. It could be construed to be environmentally responsible and etc. Janet, are you listening?

Too simple and good–will never be allowed.

I don’t understand this sentence. I guess the authors assume I understand something that in fact I don’t.

Can someone fill me in?

I’ll give it a shot:

The “Great Moderation” refers to the period from mid-1980s until 2007, a period of relatively steady increases in stock prices and low inflation compared with earlier period of stagflation during the oil and energy crises. Like the coinage ‘Global Warming’ the coinage ‘Great Moderation’ makes a nice label for a period of economic change that saw increases in the stock market, moderate inflation of food, housing, and fuel prices, static wages, while the product of the economy grew. During the Great Moderation, Labor was neutered, profits rose, and the stock market was relatively stable — which all together meant there was an exorbitant growth in the returns on financial assets.

Large returns on financial assets were complemented by a greater difference between stock winners and losers. The larger profit from picking winners meant a fund manager could slice off a nice fat piece for fees. But the difference between stock winners and losers grew smaller in the post-crisis QE-world. The profit from picking winners grew smaller and harder to find which meant a fund manager couldn’t slice off the same fat piece for fees while returning gains to the players holding stock funds.

There are many indices besides the S&P. You can invest in an entire market index, or a value stock index, a dividend stock index, a sector index, etc. The problem with the heavy weighted stocks in the S&P has been an issue for many years. But, you can invest in an S&P500 equal-weight index fund, I have no time or skill in stock picking. I just invest in Large cap, mid-cap and small-cap to smooth out the weighting problem a bit.

Eighty zillion words it seems, and yet – maybe I missed but I read pretty closely – not a one was “profit”, let alone “product”.

Sure is a brave new world we live in.

“By contrast, investors who beat the market — from Warren Buffett to George Soros, and Ken Griffin — were perceived as the bedrock of American finance, not free-riders who merely imitated the market’s average success.”

Anyone remember how back in 2008 Buffet made a million dollar wager that a Vanguard S&P 500 index fund would beat the Protege Partners hedge fund over ten years? I do. The Vanguard fund won.

Although passive index, sector-specific, and even IPO ETFs, corporate stock buybacks, private equity buyouts, call options, and other factors have played a role in pushing the prices of stock indexes and some particular stocks higher, I think debt-fueled liquidity and negative real interest rates, together with frequent threats by central bankers to take real interest rates even further into negative territory, are the dominant underlying factors driving speculation in stocks and junk bonds.

IMO, this reflects an ongoing effort to herd citizens attempting to reduce their economic vulnerability and exploitation by others into purchases of equities and junk bonds thru ETFs and other vehicles, time sensitive derivatives, and real estate. It is also clearly the preference that such asset purchases be funded with debt that’s either embedded in the structures of the speculative instruments themselves, or through direct borrowings.

So, what will it be?… perpetuation of the debt cycle through Wall Street sponsored and government/central bank subsidized and back-stopped private debt creation, or another Minsky Moment?

This!:

>> “an ongoing effort to herd citizens attempting to reduce their economic vulnerability and exploitation by others into purchases of equities and junk bonds thru ETFs and other vehicles, time sensitive derivatives, and real estate”

Perfectly said.

And in the face of this, what can you do?

One of my friends asked me for investment advice a few years ago, having come into a substantial lump sum. I said; you can look at the different options out there in terms of “savings accounts” and bonds but you will not find anything like the insane returns you can get by dumping it into a few passive index funds; but you do so at your own risk, obviously.

We resolved that since she wouldn’t need the money for some years it might be acceptable to invest more aggressively. So five or six index funds picked via your Friendly Neighbourhood Assets Manager and you simply don’t have to think about it again.

February time, we get wind of the new virus out of Wuhan, China, and wonder why it hasn’t tanked the markets yet. (Thanks of course in part to the reporting here.) I pointed out that a lot of people like gold (and bonds) as a safe asset when things go south and that their price is likely to rise. It was a good call. Once things began to pick up in April/May, back into the index funds.

Three years, and basically two investment decisions that took all of thirty minutes to execute, and the lump sum has nearly doubled, comparing to the piffling few %s that bonds or savings accounts would have yielded. I’m pleased for my friend, but the world that we live in is utterly insane, and it makes me angry and terrified in equal measure – knowing that this great engine of inequality would have showered my friend with more unearned wealth if she had a greater lump sum to begin with. Under these insane and irrational circumstances, it almost feels like malpractice to tell people not to be in the market, which is presumably the point.

This is how we all end up exposed to its vagaries. Who was it who said that the billionaires will always be able to tell you that you cannot hurt their fortunes without hurting pensioners, too? We’re all being held hostage to the machine that gins the Gini.

> So, what will it be?… perpetuation of the debt cycle through Wall Street sponsored and government/central bank subsidized and back-stopped private debt creation, or another Minsky Moment?

That’s the 100 Trillion dollar question, isn’t it?

I’ve seen the Road Runner cartoon. The strategy of forgetting that gravity exists only seems to work for that crafty coyote for so long.

Then again, maybe I shouldn’t get my understanding of macroeconomics from the Road Runner cartoon. Meep, meep.

The infuriating thing is that the collective realisation that most active managers can’t “beat” the passive market – which ultimately presumably becomes something like a self-fulfilling prophecy when a significant chunk of valuation is based on whether you are or aren’t exposed to the “passive” money ….

is there any evidence that the conventional wisdom that most of the folks who claim to be able to beat the market for you can’t actually do so has actually shrunk the sector, or profits, of folks who claim to be able to beat the market for you?

A few things about tis article:

1) The chart is not adjusted for market cap so doesn’t say anything about indexation proportionality; its there for dramatic effect, like so many charts in finance.

2) Market concentration was similar in 2000; remember the Vodafone saga? That was exactly one of the reasons free float adjustments were introduced. The Tesla thing is nothing new.

3) I would argue that Free float adjustments have very little to do with the US being 66% of MSCI World (Indeed why is that an inherently surprising number?). I would try looking at valuation and profitability first. And then consider that none of Alphabet, Facebook, Apple, Microsoft are listed in Germany or Japan.

More generally it is amusing to see this piece contrasted by the other today on the continued evils of PE, which of course relies for comparison on cheap index funds. It is hard to be anti PE, anti hedge funds and anti indexation all to the same degree. For sure the index providers have become a complex and litigious rent seeking oligopoly but by doing so they have joined most other sectors of the economy. Despite this I still maintain that cheap passive indexing has been a net gain for most small investors and many larger ones. The losers are those taken in by the marketing hype of over priced high turnover managers or those terminally deluded about their unique edge and insight in guessing the next direction of Facebook vs ExxonMobil.