By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street.

I was no fan of money-printing interest-rate-repressing Fed Chair Janet Yellen, though she did hike interest rates and kicked off the Fed’s balance sheet reduction. But she’s now getting huge brownie points as Secretary of the Treasury for trying to deal with the catastrophic corporate tax code by including something I have been jabbering about since 2012:

Large corporations – and there are only a few dozen to which this would apply, according to the proposal – should pay income taxes on the inflated and puffed-up income they report to their shareholders under our glorious accounting principles GAAP, rather than paying no taxes, or even getting paid tax benefits, on the losses they report separately to the IRS under the tax code.

Small corporations, such as my WOLF STREET media mogul empire, use the same accounting principles for earnings and for taxes, or vice versa, and we have no illusions, and there is no reason to inflate income.

But Nike reported $4.1 billion in pre-tax income to its shareholders over the past three years and had a three-year effective tax rate of minus 18%, meaning the IRS paid Nike large amounts of money, the so-called “tax benefits,” instead of collecting taxes from Nike, according to a report by the Institute of Taxation and Policy. There were 55 companies of this type in the report.

Yellen’s approach isn’t as radical as mine would have been. Since 2012, I have been arguing, throw out the entire corporate tax code and replace it with a tax on the inflated and puffed-up income that companies report to shareholders under GAAP.

Yellen isn’t going there. But she proposed to impose a minimum tax of 15% on “book income” – namely the inflated puffed-up income that corporations report to their shareholders. This measure would apply to “large companies that report high profits, but have little taxable income.” The proposal calls it the “minimum book tax.”

“This minimum book tax is a targeted approach to ensure that the most aggressive tax avoiders are forced to bear meaningful tax liabilities,” it said.

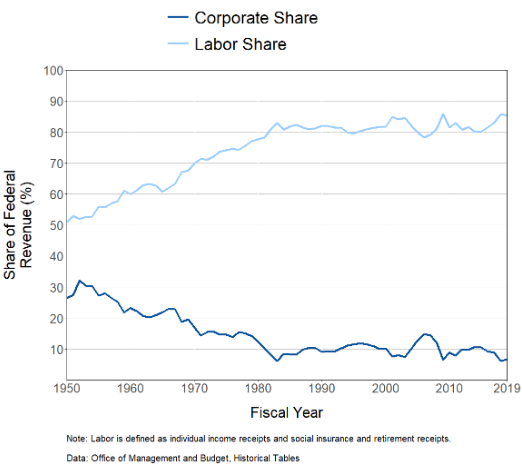

This was item #4 in the 7-item Make-Corporate-Taxes-Great-Again plan… no, just kidding, I mean in the “Made in America Tax Plan,” which came with this chart that we have seen a million times, showing how the share of federal taxes that labor pays has soared to 85% and how the share of federal taxes that corporations pay has collapsed into the single-digits:

Yellen’s proposal goes on to explain:

“In a typical year, around 200 companies report net income of $2 billion or more. Of these, a significant share pay zero or negative federal income taxes, despite reporting hundreds of billions of dollars in profits to shareholders in the aggregate. This is because significant gaps in current tax law, as well as the presence of offshoring incentives, provide large and profitable corporations with many ways to decrease profits exposed to tax liability—in many cases, to zero.”

Back in 2012, I introduced my article on our corporate tax dodge code this way — and the issues have remained the same:

Between 2002 and 2011, Boeing reported to its investors that it earned $31.8 billion. But it reported something entirely different to the IRS and didn’t pay income taxes. Instead, it received tax benefits of $2.06 billion, an effective tax rate of -6.5%. Other companies were similarly agile. Bailed-out GE earned $10.5 billion, paid zero taxes, and received $4.7 billion in tax benefits….

These companies are presumably doing nothing illegal; they’re just using GAAP to show huge profits to their shareholders, and they’re using the tax code to show huge losses to the IRS. The tax code encourages them to do that.

Yellen’s proposal goes on to lament (what I lamented in my obscure corner nearly a decade ago):

Corporations have at their disposal two kinds of reporting rules (book and tax reporting) that provide for a variety of allowances that shield them from meaningful tax bills.

Corporations are simultaneously able to signal large profits to shareholders and reward executives with these returns, while claiming to the IRS that income is at such a low level that they should be freed from any federal tax obligation.

The proposal explained how it would work in conjunction with the regular tax liability:

Large corporations that report sky-high profits to shareholders would be required to pay at least a minimum amount of tax on such out-sized returns. Under this proposal, there would be a minimum tax of 15 percent on book income, the profit such firms generally report to the investors. Firms would make an additional payment to the IRS for the excess of up to 15 percent on their book income over their regular tax liability.

And the proposal put a number to it: “In recent years, about 45 corporations would have paid a minimum book tax liability under the President’s proposal.” And “the average company facing this tax would see an increased minimum tax liability of about $300 million each year.”

Yellen Calls for Taxing Large Corporations on Puffed Up Earnings they Report to Shareholders, Which I Called for Years Ago

by Wolf Richter • Apr 7, 2021 • 137 Comments

The “minimum book tax” on reported earnings would be a tax incentive to produce realistic earnings reports. Wall Street will fight it furiously.

By Wolf Richter for WOLF STREET.

I was no fan of money-printing interest-rate-repressing Fed Chair Janet Yellen, though she did hike interest rates and kicked off the Fed’s balance sheet reduction. But she’s now getting huge brownie points as Secretary of the Treasury for trying to deal with the catastrophic corporate tax code by including something I have been jabbering about since 2012:

Large corporations – and there are only a few dozen to which this would apply, according to the proposal – should pay income taxes on the inflated and puffed-up income they report to their shareholders under our glorious accounting principles GAAP, rather than paying no taxes, or even getting paid tax benefits, on the losses they report separately to the IRS under the tax code.

Small corporations, such as my WOLF STREET media mogul empire, use the same accounting principles for earnings and for taxes, or vice versa, and we have no illusions, and there is no reason to inflate income.

But Nike reported $4.1 billion in pre-tax income to its shareholders over the past three years and had a three-year effective tax rate of minus 18%, meaning the IRS paid Nike large amounts of money, the so-called “tax benefits,” instead of collecting taxes from Nike, according to a report by the Institute of Taxation and Policy. There were 55 companies of this type in the report.

Yellen’s approach isn’t as radical as mine would have been. Since 2012, I have been arguing, throw out the entire corporate tax code and replace it with a tax on the inflated and puffed-up income that companies report to shareholders under GAAP.

Yellen isn’t going there. But she proposed to impose a minimum tax of 15% on “book income” – namely the inflated puffed-up income that corporations report to their shareholders. This measure would apply to “large companies that report high profits, but have little taxable income.” The proposal calls it the “minimum book tax.”

“This minimum book tax is a targeted approach to ensure that the most aggressive tax avoiders are forced to bear meaningful tax liabilities,” it said.

This was item #4 in the 7-item Make-Corporate-Taxes-Great-Again plan… no, just kidding, I mean in the “Made in America Tax Plan,” which came with this chart that we have seen a million times, showing how the share of federal taxes that labor pays has soared to 85% and how the share of federal taxes that corporations pay has collapsed into the single-digits:

Yellen’s proposal goes on to explain:

“In a typical year, around 200 companies report net income of $2 billion or more. Of these, a significant share pay zero or negative federal income taxes, despite reporting hundreds of billions of dollars in profits to shareholders in the aggregate. This is because significant gaps in current tax law, as well as the presence of offshoring incentives, provide large and profitable corporations with many ways to decrease profits exposed to tax liability—in many cases, to zero.”

Back in 2012, I introduced my article on our corporate tax dodge code this way — and the issues have remained the same:

Between 2002 and 2011, Boeing reported to its investors that it earned $31.8 billion. But it reported something entirely different to the IRS and didn’t pay income taxes. Instead, it received tax benefits of $2.06 billion, an effective tax rate of -6.5%. Other companies were similarly agile. Bailed-out GE earned $10.5 billion, paid zero taxes, and received $4.7 billion in tax benefits….

These companies are presumably doing nothing illegal; they’re just using GAAP to show huge profits to their shareholders, and they’re using the tax code to show huge losses to the IRS. The tax code encourages them to do that.

Yellen’s proposal goes on to lament (what I lamented in my obscure corner nearly a decade ago):

Corporations have at their disposal two kinds of reporting rules (book and tax reporting) that provide for a variety of allowances that shield them from meaningful tax bills.

Corporations are simultaneously able to signal large profits to shareholders and reward executives with these returns, while claiming to the IRS that income is at such a low level that they should be freed from any federal tax obligation.

The proposal explained how it would work in conjunction with the regular tax liability:

Large corporations that report sky-high profits to shareholders would be required to pay at least a minimum amount of tax on such out-sized returns. Under this proposal, there would be a minimum tax of 15 percent on book income, the profit such firms generally report to the investors. Firms would make an additional payment to the IRS for the excess of up to 15 percent on their book income over their regular tax liability.

And the proposal put a number to it: “In recent years, about 45 corporations would have paid a minimum book tax liability under the President’s proposal.” And “the average company facing this tax would see an increased minimum tax liability of about $300 million each year.”

Yellen Calls for Taxing Large Corporations on Puffed Up Earnings they Report to Shareholders, Which I Called for Years Ago

by Wolf Richter • Apr 7, 2021 • 137 Comments

The “minimum book tax” on reported earnings would be a tax incentive to produce realistic earnings reports. Wall Street will fight it furiously.

By Wolf Richter for WOLF STREET.

I was no fan of money-printing interest-rate-repressing Fed Chair Janet Yellen, though she did hike interest rates and kicked off the Fed’s balance sheet reduction. But she’s now getting huge brownie points as Secretary of the Treasury for trying to deal with the catastrophic corporate tax code by including something I have been jabbering about since 2012:

Large corporations – and there are only a few dozen to which this would apply, according to the proposal – should pay income taxes on the inflated and puffed-up income they report to their shareholders under our glorious accounting principles GAAP, rather than paying no taxes, or even getting paid tax benefits, on the losses they report separately to the IRS under the tax code.

Small corporations, such as my WOLF STREET media mogul empire, use the same accounting principles for earnings and for taxes, or vice versa, and we have no illusions, and there is no reason to inflate income.

But Nike reported $4.1 billion in pre-tax income to its shareholders over the past three years and had a three-year effective tax rate of minus 18%, meaning the IRS paid Nike large amounts of money, the so-called “tax benefits,” instead of collecting taxes from Nike, according to a report by the Institute of Taxation and Policy. There were 55 companies of this type in the report.

Yellen’s approach isn’t as radical as mine would have been. Since 2012, I have been arguing, throw out the entire corporate tax code and replace it with a tax on the inflated and puffed-up income that companies report to shareholders under GAAP.

Yellen isn’t going there. But she proposed to impose a minimum tax of 15% on “book income” – namely the inflated puffed-up income that corporations report to their shareholders. This measure would apply to “large companies that report high profits, but have little taxable income.” The proposal calls it the “minimum book tax.”

“This minimum book tax is a targeted approach to ensure that the most aggressive tax avoiders are forced to bear meaningful tax liabilities,” it said.

This was item #4 in the 7-item Make-Corporate-Taxes-Great-Again plan… no, just kidding, I mean in the “Made in America Tax Plan,” which came with this chart that we have seen a million times, showing how the share of federal taxes that labor pays has soared to 85% and how the share of federal taxes that corporations pay has collapsed into the single-digits:

Yellen’s proposal goes on to explain:

“In a typical year, around 200 companies report net income of $2 billion or more. Of these, a significant share pay zero or negative federal income taxes, despite reporting hundreds of billions of dollars in profits to shareholders in the aggregate. This is because significant gaps in current tax law, as well as the presence of offshoring incentives, provide large and profitable corporations with many ways to decrease profits exposed to tax liability—in many cases, to zero.”

Back in 2012, I introduced my article on our corporate tax dodge code this way — and the issues have remained the same:

Between 2002 and 2011, Boeing reported to its investors that it earned $31.8 billion. But it reported something entirely different to the IRS and didn’t pay income taxes. Instead, it received tax benefits of $2.06 billion, an effective tax rate of -6.5%. Other companies were similarly agile. Bailed-out GE earned $10.5 billion, paid zero taxes, and received $4.7 billion in tax benefits….

These companies are presumably doing nothing illegal; they’re just using GAAP to show huge profits to their shareholders, and they’re using the tax code to show huge losses to the IRS. The tax code encourages them to do that.

Yellen’s proposal goes on to lament (what I lamented in my obscure corner nearly a decade ago):

Corporations have at their disposal two kinds of reporting rules (book and tax reporting) that provide for a variety of allowances that shield them from meaningful tax bills.

Corporations are simultaneously able to signal large profits to shareholders and reward executives with these returns, while claiming to the IRS that income is at such a low level that they should be freed from any federal tax obligation.

The proposal explained how it would work in conjunction with the regular tax liability:

Large corporations that report sky-high profits to shareholders would be required to pay at least a minimum amount of tax on such out-sized returns. Under this proposal, there would be a minimum tax of 15 percent on book income, the profit such firms generally report to the investors. Firms would make an additional payment to the IRS for the excess of up to 15 percent on their book income over their regular tax liability.

And the proposal put a number to it: “In recent years, about 45 corporations would have paid a minimum book tax liability under the President’s proposal.” And “the average company facing this tax would see an increased minimum tax liability of about $300 million each year.”

Secondary Benefit: More Honest Earnings Reports.

And this is where the fun begins: If large corporations have to pay 15% minimum income tax on their profits as reported under GAAP, it could possibly bring some honesty and reality to financial reports because, under the 15% minimum tax on book income, companies that inflated and puffed up their income would have to pay 15% taxes on that inflated and puffed-up income. This would be a costly disincentive to inflate and puff up income.

It would make CFOs think twice. In theory, GAAP financial statements could become more honest, policed by the threat of having to pay 15% in taxes on puffed-up income. And that could be a game changer – when there are suddenly tax incentives to be realistic with financial reporting. And that’s why Wall Street will fight furiously to sink this thing.

Yellen/Biden apparently also support the drive to set up a minimum corporate tax globally. I never thought I’d hear that from the US..

I read that Christine Lagarde thought it was a great idea. And everyone is saying it will stop the “race to the bottom.” But, I would think, only if there is a global minimum wage… and then there is the healthcare snafu. Universal healthcare in all other countries helps corporations compete because they have no matching funds for employees – whereas here in the US our corporations are forking over lotsa money to health insurance companies and that will maintain an uneven playing field going forward for US corporations. And we all know Biden is ducking the entire issue.

If, as I am assured by wiser persons than myself, Federal Taxes do not ‘fund’ the government, but are, instead, tools for social engineering, then I rate even this “surprise” ‘soak the rich (corporations)’ proposal as a smokescreen behind which the same corporations can hide from the increasing public anger at the now massive wealth inequality bedeviling our society.

Call me a cynic if you will, but I see Yellen as jumping in front of a building mob in an attempt to redirect said mob’s furious energy into parading.

Insofar as Franklin Roosevelt is said to have “saved capitalism from itself,” I can well see Biden as trying to emulate FDR.

Unfortunately capture of our legislative system has guaranteed that our corporate culture has no “skin in the game”, so to speak.

Not only should taxes be used as a stick to force the C Suite to accurately report on the business to shareholders AND to the public, but the threat of punitive taxes and levies (not to mention removal of patents, trademarks and intellectual property protections) be used to keep.jobs and manufacturing in America.

The socialism for corporations and their heads that have been part of our system for most of the last half a century has helped turn us into a highly unequal society rapidly devolving into a third world country. Biden and Yellen’s mild suggestions are probably too little too late, but I am desperate enough to still welcome them. Don’t expect them to happen but…

Why not require just one set of financial statements for the IRS and the people they want to impress?

Two out of Three is said to be not bad ….

For some corporations getting them to pay anything would be a starter. Or maybe just get them to not take money from us when they don’t pay taxes.

55 Corporations Paid $0 in Federal Taxes on 2020 Profits

https://itep.org/55-profitable-corporations-zero-corporate-tax/

My pessimistic guess, not much will happen from this. I apologize for being pessimistic, but, I have no faith in either political party.

I think it is clever. Equities deserve huge valuations due to earnings, but there are no earnings? Might be good to see that get broad public attention. Seems like a fruitful thread to pull.

Given the choice, surely most companies will just use their IRS numbers to avoid taxes. Zombies like Uber have managed to raise funding and pay their execs a billion dollars even while showing everyone how much money they’re losing.

The near zero tax rate of many companies is bad, and some of it has to do with how U.S. companies transfer ownership of their intellectual property to a foreign subsidiary. This foreign subsidiary exists to collect royalties on every sale of the companies products in compensation for the right to use copyrights, patents, and trademarks associated with these products. Each subsidiary that sells a companies products can deduct these intellectual property royalty payments to zero out its taxable earnings from local sales, resulting in little taxable income reported in the country where a sale originates. This strategy effectively shifts most of the taxable income on a companies worldwide product sales to its foreign intellectual property subsidiary, which resides in a low tax jurisdiction.

A hypothetical situation for Nike (or Apple, Microsoft, ect) might be they sell a pair of running shoes for $50 which costs them $20 to produce, and suggests $30 in profit or taxable income. But Nike’s intellectual property subsidiary will (hypothetically) collect an additional $29 in royalties for this sale, which shifts most of the profits to a tax haven jurisdiction (Bahamas, Cayman), and leaves only $1 in local taxable income. And then Nike deducts these intellectual property royalty payments to itself from the $1 in taxable income. Like magic, all taxes disappear.

The chart of Federal Revenue would be more telling if it also charted in the falling share of the top 1% of Americans who usually claim that because corporations pay taxes their incomes are being taxed unfairly.