The Wall Street Journal has done a terrific job of reporting in a new article, ‘Financially Hobbled for Life’: The Elite Master’s Degrees That Don’t Pay Off. Even though it discusses a general phenomenon, that of too many students of modest means acquiring student-debt-funded graduate degrees where the prospects of the borrowers paying off their obligations is practically nil.

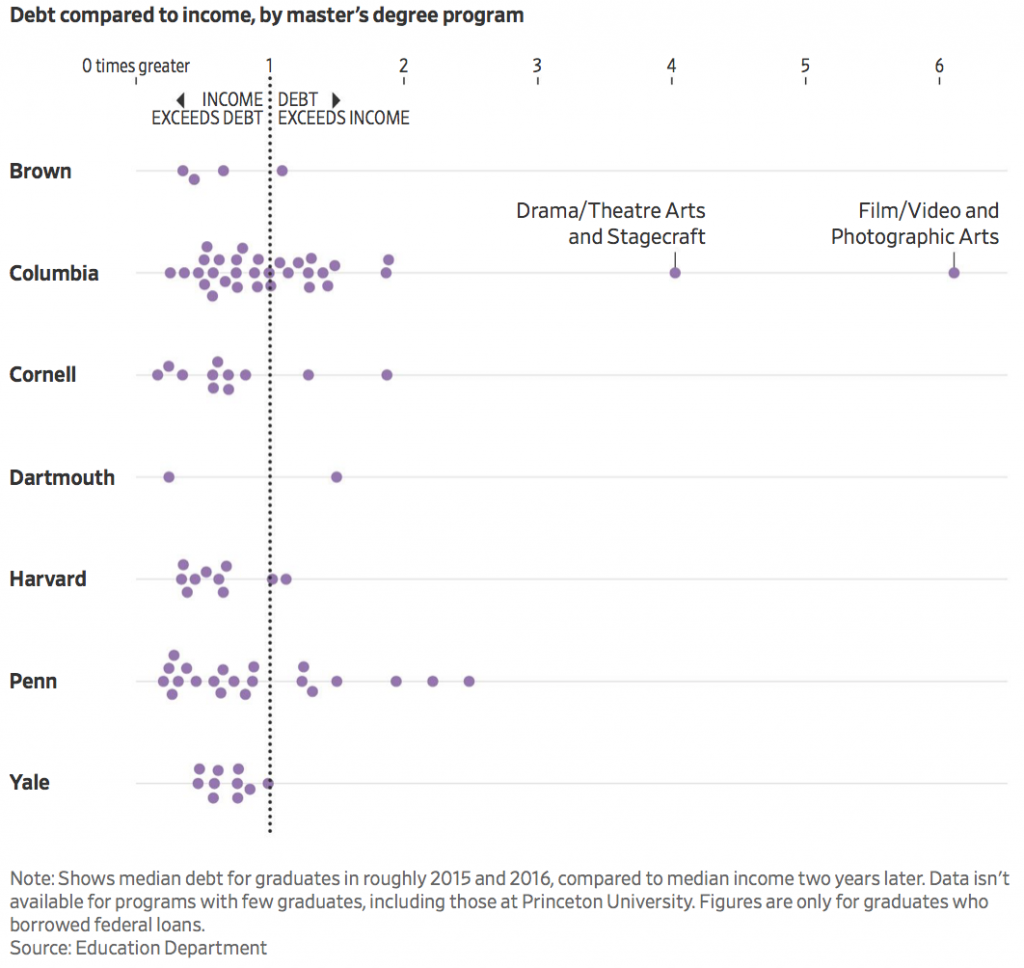

The Journal documents that Columbia is the outlier, both in the ratio of “untenable if you don’t have rich parents paying for them” master’s degrees, and the particularly dreadful cost/earnings ratio (proxied by the debt/income ratio) of two programs, drama/theater arts and film.

The strength of this piece is the number of damning vignettes, so my recap will fall well short of the full weight of the story. My favorite is the revelation that Columbia’s answer to “Let them eat cake” is “Let them walk dogs”:

One foreign student said he notified School of the Arts officials in 2016 that he may need to drop out of the film program because he could no longer afford tuition and living expenses….He received an email that August from an administrator.

“I was informed that you might be interested in additional on-campus work opportunities,” said the message, viewed by the Journal. “We were contacted by the Office of President [Lee] Bollinger who hires students for dog caretaking.”

President Bollinger said he didn’t know that his Labs were being offered up as income opportunities, and offered that he paid only “pocket money” level remuneration. But the fact that an official steered a desperate student to a clearly meagerly-paid gig demonstrates how unwilling or unable Columbia was to offer meaningful help.

Now I am sure many of you are saying, “Theater and film graduate degrees? What did they expect?” First, these students, often from modest backgrounds, say they felt misled by Columbia. This situation reminds me of subprime lending. From 2005 to 2008, in just about every trip I took outside NYC, when I asked about the state of the economy, at least one cabbie would volunteer that he’d looked into buying a house, and the banker had pushed him to buy a much more expensive house than he’d been looking for, arguing that he could borrow enough to acquire it. To a person, these drivers said they knew it was reckless to take on as much debt as the banks wanted them to, and rejected the advice.

Here, even if these student borrowers had looked into typical pay levels for master’s degree holders in their chosen fields, they likely believed that going to a top school would enable them to earn markedly more than the norm. Entertainment, like sports, is subject to power law dynamics. A very few at the extreme end of the distribution do fabulously well, and another tier lives nicely. But the dropoff is very steep.

Columbia’s own website strongly implies that it has a Harvard-Business-School-like mafia of graduates who will help program participants in their careers. The opening paragraph:

Columbia University’s MFA Theatre Program is collaborative, international, and interdisciplinary. It defines itself by its location in New York City. It thrives on the extensive network of Columbia alumni and faculty who work in prestigious theatres at every level, who direct and perform in award-winning productions, and who engage with our students far beyond the classroom.

The article suggests that graduates also believed the programs were over-sold. For instance:

Matt Black graduated from Columbia in 2015 with an MFA in film and $233,000 in federal loans. He signed up for an income-based repayment plan that in leaner years requires no remittance from him. With interest, his balance stands at $331,000.

Mr. Black, a 36-year-old writer and producer in Los Angeles, said he grew up in a lower middle-class family in Oklahoma. He earns $60,000 in a good year and less than half that in dry stretches. The faculty at Columbia was stellar, he said, but he blamed the school for his “calamitous financial situation.”

“We were told by the establishment our whole lives this was the way to jump social classes,” he said of an Ivy League education. Instead, he said he feels such goals as marriage, children and owning a home are out of reach.

During a car ride last year with three friends from the film program, Mr. Black said, they calculated they collectively owed $1.5 million in loans to the federal government. “Financially hobbled for life,” he said. “That’s the joke.”

And before you insist that it’s silly to major in theater, go back and look at the chart above. Yale has a drama school too. Yet you see that none of Yale’s master’s programs leave their students drowning in debt. I can’t do an apples to apples comparison, but Yale is clearly more exclusive than Columbia, admitting only 5.4% of its applicants to the drama school versus a 21% acceptance rate for Columbia across its fine arts programs. At least when I was a kid, getting into the acting program at Yale was extremely difficult; only 12 were accepted.1 I recall going to a charity lunch and seeing Meryl Streep spend most of her lunch speech complaining that the then head of Yale’s Drama School, Robert Brustein, would regularly single her out as the worst performer in the class. She was clearly still embittered about that.

Yale recognizes that having a particularly successful program may still not be enough to protect students from bad financial outcomes:

“There’s a virtual army of young people, most of whom may be naive about the financial obligations they’re undertaking,” said James Bundy, dean at Yale University’s drama school, which in June announced it would eliminate tuition. “I think there are some schools with debt loads that are indefensible.”

And for those of you who still prefer a mercenary perspective, pray tell, how do you propose dealing with the problem of societally valuable jobs, like architects and veterinarians, where no financially rational person would ever go into those professions? With architecture, the disconnect between the cost of education and apprentice time has long been badly out of whack. I recall the parents of a good college friend who graduated from a top architecture program lament that their paying for her degree hadn’t added to her earnings potential.

Back to Columbia. The school’s defense it that it isn’t as rich as Yale (apparently a $11 billion endowment is shabby) and is generous with financial aid to undergrads, who it regards as deserving, but not graduate students. The Journal article mentions that Columbia embarked on a big real estate development program in 2008 as a way to attract donors. Perhaps readers can confirm, but my understanding is that that scheme turned out to be a white elephant.

Needless to say, the Journal account has some eyeopeners:

Columbia’s theater graduates who borrowed took on a median $135,000 in student loans, four times what they earned two years after graduation, the data show….

Around two-thirds of domestic students in the MFA film program take federal loans. The median debt for 2017 and 2018 graduates of Columbia’s film program who borrowed fell 5% from two years earlier but still topped $171,000, according to the latest federal debt figures, which combine the MFA and Master of Arts degrees.

Grant Bromley, 28, accumulated $115,000 in federal loans while getting his Master of Arts in film and media studies at Columbia. He had hoped to advance into academia after graduating in 2018. Instead, he moved back home with his parents in Knoxville, Tenn., for a year, taking a job at the TJ Maxx where he had worked as a teenager. He now works at a TJ Maxx near Chattanooga.

He is working on his third feature film in his spare time and credited Columbia for giving him the chance to pursue his passion.

For now, Mr. Bromley earns around $16 an hour and can’t afford to pay down his loan balance, which is $156,000, including undergraduate debt and interest. “It’s a number so large that it doesn’t necessarily feel real,” he said.

The faculty wants a better deal for students:

Christian Parker, a Columbia theater department faculty member and former department chair, said he and colleagues talked constantly about student debt. “I’ve never been to an all-school faculty meeting where it wasn’t brought up and where faculty were not advocating and agitating for this issue to remain at the front of the list of priorities for the dean’s leadership,” he said.

Before you point fingers at the teaching staff, the big cause of ever-escalating costs of higher education isn’t lavishly paid instructors. It’s adminisphere bloat (both body count and compensation levels) and over-investment in real estate to try to pull in donors (all those naming opportunities!)

And despite the faculty agitating on behalf students, the top brass is turning a deaf ear, led by “Let them walk dogs” Bollinger:

“There’s always those 2 a.m. panic attacks where you’re thinking, ‘How the hell am I ever going to pay this off?’ ” said 29-year-old Zack Morrison, of New Jersey, who earned a Master of Fine Arts in film from Columbia in 2018 and praised the quality of the program. His graduate school loan balance now stands at nearly $300,000, including accrued interest. He has been earning between $30,000 and $50,000 a year from work as a Hollywood assistant and such side gigs as commercial video production and photography….

At least as far back as 2016, students said, they complained to top administrators about debt.

Mr. Morrison, who owes nearly $300,000, said he was invited to a fireside chat for graduate students at Mr. Bollinger’s Manhattan townhouse that year.

Mr. Bollinger asked for a show of hands by those who felt prepared to pay off their student loans and to succeed in the workplace, Mr. Morrison recalled. The grad student didn’t raise his hand, and Mr. Bollinger asked him why.

Mr. Morrison said the job market for aspiring screenwriters and directors looked bleak for someone with a six-figure debt load. He recalled Mr. Bollinger saying he understood the concern but that Columbia was a really good school.

“My immediate takeaway is that there’s a huge disconnect between the administration’s perception of the School of the Arts,” Mr. Morrison wrote to a faculty member a few days after the meeting, “and what’s actually happening for students.”

Mr. Bollinger said he recalled asking a question like that, and “I’m very much aware of what the School of the Arts needs in terms of financial aid support.”

Yes, Mr. Bollinger is aware of the need the same way a 400 lb. diabetic is aware of the need to lose a lot of weight. Nothing in this article suggests that Mr. Bollinger intends to do squat. Perhaps the harsh light of this Journal account will rouse him from his torpor.

____

1 I wrote a recommendation letter for a successful applicant. He later won an Emmy.

This is a classic area where there is an information assymetry which works against the purchaser (in this case, young students). It is simply impossible to know what the ‘right’ career is in 5-10 years time, so any choice is a gamble. I went to college during a deep recession – in fear nearly everyone jumped into business related courses as a ‘safe’ option, the result being a surplus of business students with low pay rates for those lacking a very high rated MBA (plus a lot of business students with no interest or aptitude for business).

In contrast, I knew a few archaeology students who hit gold dust. A change in regulations set off by a court decision just as a building boom hit meant that developers had to get qualified archaeologists to sign off on foundation works when there was even a possibility of hitting some remains (which is pretty much anywhere in Ireland). They ended up doing financially as well or better than those with ‘sensible’ qualifications.

There must be a limit to how much these colleges can keep pushing this scam. Eventually even well healed parents will decide it makes more sense to set their kids up in business than to pay a vast sum for what will probably be a worthless degree. And Covid will undoubtely have an impact, especially on foreign students. These universities will find it very hard to roll back from extraordinarily high fees.

Slim here.

And, let me tell you, I am breathing gale-force sighs of relief over the fact that I never considered getting an MFA. Whew-w-w-w-w-w-w-w. There goes another.

I’m sure that spending two years in such a program would have been an absolute blast, and, what the heck, it might have enhanced my photographic, writing, and design skills, but …

… the debt.

Thank goodness I’m the offspring of frugal parents who abhorred debt.

And here’s a little secret I’d like to share with everybody: If you want to improve the skills I just mentioned, there are free resources like this-here Internet and your public library. Use them. They won’t saddle you with debt.

In conclusion, this University of Michigan alum isn’t surprised to see Lee Bollinger’s name so prominently featured in this story. He displayed the same kind of character when he was in Ann Arbor.

> I’m sure that spending two years in such a program would have been an absolute blast …

Two years? Why cut yourself off?!? From the article:

> The length of the [Columbia] MFA film program also was reduced to a maximum of four years from five.

I’m with you, Slim. Even in the early ’90s as an undergrad pursuing what I knew was likely a ‘useless’ BA in history, it was clear that taking it to the masters/PhD level would only add to my debt without any definite promise of improved employment prospects or job security. And even then it was trending that schools were trimming down their full professorships and tenure was going to eventually be untenable for all but the most accomplished [i.e. published] historians. Like most kids without a trust fund, I instead decided to join the workforce and pay off the significant loans already accrued.

I’m a rare bird in that I graduated from the school in question and then returned to find employ there after post graduation prospects- a very brief and unenjoyable stint as securities broker- didn’t pan out. From my lowly position as a staff member at Columbia for the last twenty-plus years, I’ve seen the entirety of Bollinger’s impact from the start. Massive donor increases leading to rich family names like Lerner and Milstein being added to new buildings on campus. A whole new campus in Harlem’s ‘Manhattanville’ neighborhood, acquired partly through use of eminent domain which could go down as one of the biggest real estate coups since the days of Peter Minuit. Tuition is now almost triple what it was when I enrolled my first year. Endowment exploded. All the administrative bloat that Yves mentioned is particularly obvious when one has the long view perspective that I have.

Coming from a very much lower middle-class upbringing in upstate NY, the quotes from Matt Black in the story above really resonated with me because I think every high school guidance counselor tells their charges exactly what he related- that the ivy league degree will open doors just by its own accord and that over time the payout will vastly exceed the investment. Note how no evidence or cases are ever usually presented to back this claim. A university education was an easier argument to make in pre-internet days when those institutions had the greater portion of collected knowledge confined within their gates. But like Slim points out, it is a lot easier to educate oneself about just about anything now and people are realizing that $300K in debt can be better leveraged elsewhere. The problem, like everywhere, is getting that message through [and past all the pro-college propaganda] to students and parents before they sign on the dotted line.

I attended a wedding where the couple work in Hollywood’s middle class. The wedding guest list did include some A-listers.

As a total outsider, I was mildly surprised how many writers, actors, etc. have degrees from Ivy- league or other elite schools. What genuinely surprised me was how much they talked about it – including people in their early thirties.

When you look at the history of cinema, many of the greatest film makers (directors, screenwriters, cinematographers, etc) often came from humble or unusual backgrounds – quite a few had seen a lot of life before they first set hands on a camera. A lot of this was the result of the much maligned studio system, which often encouraged talent from unusual angles and wasn’t particularly impressed by credentials and didn’t need to schmooze investors.

But increasingly it seems dominated by those of a background that can afford the luxury of a top degree thats considered relevant. Its not just about getting the qualifications, to make a film now you need the sort of social connections to raise the money and just get invited to see the right people, or have someone show your script to the right person. There are still occasional outsiders breaking in, but (perhaps this is just my perception), but it seems to be rarer now for someone like Scorsese or Tarantino go to mainstream.

The rise of digital film making was supposed to change all this and democratize filmaking again, but I don’t see any evidence of this. If anything, there seems to be a tighter and tighter inner loop of people involved.

How many of them have rich parents?

I remember listening to a lot of the audio commentaries for Simpsons episodes and a huge number of them went to Harvard (including Conan O’Brien). I got the impression that a lot of them got jobs because the Harvard Lampoon created a network. One of them said that his dad owned a hardware store and another is a son of a doctor.

I also remember O’Brien giving an interview where he said that in the 80s, many people thought that becoming a TV writer could be the equivalent of the Ivy League grads who a generation earlier became stock brokers.

(Highly subjectively) I’d argue that Hollywood’s artistic product, regardless of genre, has gone down as the credentialed homogeneity has gone up.

Student loans are nothing more than future punishment for daring to aspire above your station.

(The above statement really sinks in only after you understand MMT.)

The full article can be seen here.

I think this is the very visible tip of the iceberg. I hope there is more reporting on this from other schools.

I’m at a community college, where student completion rates are around 30%. Yet, starting this past year, our president has been pushing faculty and staff to call all students, enrolled or not, to give them a hot-sale on enrolling for the next semester. It’s predatory, particularly at the community college level, where students end up with no degree, the same dead-end jobs, and about $10-20 grand in debt.

A new take on let them eat cake? Instead let them serve coffee, walk our pets, etc…this reads like a train wreck where only those already in their comforting 10% train car feel financially secure.

I’d like to predict this too ends poorly in the coming 10 to 20 years, but I’m too likely to be proved wrong.

Reminds me of Graeber’s writing on college administrations:

No wonder the costs have gotten so out of hand.

And at the same time, public investment has been cut off.

Trying to re- coup the losses via tuition is bankrupting everyone’s future and the future of the country.

https://www.pbs.org/newshour/education/most-americans-dont-realize-state-funding-for-higher-ed-fell-by-billions

Another anecdote about Columbia, from my physicist PhD brother: Columbia’s physics department is NOTORIOUS for mistreating grad students with stuff like, “I know that your thesis is ready, but I need you for 2 more years for my research,” being the rule rather than the exception.

I can’t decide with whom I’m more annoyed: Columbia University for seriously misleading students about the value of their fine arts programs, or the US Department of Education for blinding shoving federal loan dollars into a situation that is arguably fraud.

At least two of the film students interviewed for the article had borrowed more than $300k for their master’s degrees. I borrowed less than half that amount for my house, and to do so I had to provide evidence that I could repay the loans. Credit checks, proof of employment, disclosure of financial records, assessments, the works. Now I realize that it’s more difficult to establish credit-worthiness for a student who hasn’t gotten a job in their field yet, but surely somebody could have looked at the situation at Columbia and said, “These loans are getting to be 5X (or even 10X) the median annual wages that the graduates will earn afterwards. This isn’t going to end well.”

But nobody is looking.

I went to a state school. I knew my major interest in life was the theatrical arts. But was self aware enough that I would never make s living as an actor and flibbertigibbet enough not to be sure I was entrepreneur enough to be a producer. So even though I got into a Seven Sister and a couple of other more prestige universities, the thought of graduating with between 20 to 40 thousand in debt for a BFA was just not feasible. Even thirty years ago you were unlikely to get a good position in the fine arts education field as fall back. Of everyone I went to school with one who went on to get a graduate degree made a living in fine art academia and that was because he bilingual with a dual citizenship. Without a graduate degree three of us made our living in the craft part of the craft. Others taught public school and did school productions, while the majority had regular jobs that supported their auditions and/or community theater habit. Those BFAs and even some MFAs were expensive pieces of paper on their own, and only as good as a BA or MA.

Surprisingly the best advice I never took from that period came from the instructor with the most actual real world experience. In a throw away comment during a theater management course they told me to get a sugar daddy or become an entertainment lawyer. He never sugar coated that success was against the odds and unlikely to look as you imagined. And that was before the insanity truly took over higher education in America, considering a semester at that same state school now costs almost 100 times what it did then.

While they weren’t going for arts degrees, it has broken my heart watching the young people I have met over the last few years on a gig job graduate and then have to avidly compete for unpaid internships. I know they all have debt, and even with degrees with more chances all will struggle to pay off that debt, no matter how small.

Bollinger is only one of a multitude of careless bureaucrats, masses of greedy rentiers and countless political operatives who have sold out their jobs who deserve to be horsewhipped over and over for preying on Americans desires for a productive comfortable life. Whether that took the form of license to cut hair, a degree that lets you work in a lab, be a doctor or yes create a film that tells a story people love, breaking the backs of those dreamers…well I truly hate people sometimes.

The extent to which masters programs can act as cash cows for universities is be an interesting subject for which I wish I had more hard data.

I remember how in the Stanford polisci department the masters courses, even many of the instructors, were almost entirely insulated from the “serious” academic work being done at the place, the program as a whole being seen by faculty and PhD students, fairly or unfairly, as a spot where foreign oligarchs could park their failchildren for a couple of years in pleasant surroundings.

Federal student lending needs to be limited based on median income from the degree. If a masters in film studies leads people to have a median income ten years later of about $30,000 than the maximum amount one should be able to borrow for such a degree is zero.

There will be fewer people with degrees in film studies and a degree will likely cease to be a requirement or even an advantage.

In terms of actual buildings and parcels of land, I believe Columbia is second only to New York City in property ownership in the city. They are rapidly gentrifying more land uptown, largely opposed by the student body. “Prezbo”, as he is called by the students, has a big house ON CAMPUS, a huge salary, and must run one of the biggest grifts in town. I admit, I do not have the economic acumen to fully diagnose the “business model” in question, but I am convinced the “University” aspect of the institution is becoming more of a front than anything. Before it is a school or research institution, Columbia is a real estate holder, it’s a capital fund, it’s a wealth-extractor through massive debt, it’s an arm of the NGO-complex with all of its nebulous “institutes” (see the journalism school, for ex.)— all of this along with its more traditional function as a meeting (and vomiting) ground for children of the elite and purifier of the otherwise upwardly hopeful grovelers. The labors of its students and faculty are exploited, its architecture and intellectual history are glorified, only to provide a facade for this wealth-hoarding apparatus.

There are plenty of brilliant faculty and students at the school and I think most of them are aware of this situation on some level, yet there is little resistance relative to the offense. Above all, one is “lucky to be there” and should not complain. If one is faculty, there is little incentive to risk a very favorable personal position. If one is adjunct or a grad student, there have been strikes, yet last I heard they have been outmaneuvered and sold out. If one is a paying masters student or undergrad, you are both paying for the service and providing the labor to make it valuable. What are you going to do? Boycott yourself? It’s hard enough to even realize this before it’s all over. If you come from below, you better find your own grift quickly. If you’re already above, well, get drunker and fail further upward. One day you’re eating free steak and lobster on the lawns, the next your classmate has hanged themselves in the bathroom. The scene is decadent, depraved, and depressing.

Any real intellectual development is made in spite of the present conditions. If you are an engineer or scientist, you work like a dog to have any chance to compete. If you’re serious about something “soft”, you either lock yourself away to churn out those papers or lash out fruitlessly against the cultural stagnation. Most just struggle to keep their heads above water and handle their workload. It’s eerily similar to keeping the poor down and distracted having to work multiple jobs. Too much σκολή with your school may dangerously engender some spark of disputation. God forbid it. There is too much in the dynamic to describe here, but, all in all, these administrative regimes spit out (aside from the already super rich) either these marginalized, indebted rejects (as selected in this outline) or fresh Stockholm-syndromed grunts for the mines. Both share the trauma— and the soul-crushing debt, but some get to stay in the club and, if they say the right things, maybe, possibly pay it off. “Trauma” is not even an exaggeration. A very close friend of mine did not want to talk to anyone from school for a year after graduation. All my friendships are, to an extent, “trauma-bonds”. Once back on their feet, recent grads look back and realize how horribly mentally and physically unhealthy they were. Why is this necessary?

Notice I say nothing of the various quasi-religious horrors gripping their respective university departments, whether a hubristic, sell-out scientific absolutism or the humanities closing and purging their ranks to form the in-group and protect it from attack. It’s only symptomatic of the imposition of these extractive regimes.

I was one of the naive poors who showed up from the Hinterlands expecting Kerouac & friends and finding Exeter and Goldman Sachs. I was lucky it was undergrad and my parents instilled the debt-terror in me early, so I did not commit until I knew it would be essentially free. Many of my friends and acquaintances were not so lucky. The debt is devastating, but so is the creeping suspicion (to put it very mildly) that your academic work is not, in fact, the priority of the institution.

I would’ve loved to contribute to my field in graduate studies… or even (can you imagine?) pursue my artistic development through expert instruction. By my Junior year, however, I had seen through the scam, had no hope in the situation, and I figured I would have better luck getting a job and working by myself with free resources nights and weekends. A very senior professor of mine told me straight up never to go to any graduate program that is not totally funded— it’s a cash cow, she said. So, I spent my last two years of school getting stoned, navel-gazing, and enjoying rent-free life on Riverside Drive. I wasn’t going to have the opportunity again. I know other brilliant students who feel and did similarly. Meanwhile, there is and has been nowhere for us to direct our scholarly and artistic passions. We are the out-group. In my opinion, a movement of independent, autonomous, peer-supported scholarship is the only way forward.

Recent graduate from Columbia undergrad, just my two cents. Apologies if this is an unwelcome type of comment. I’ve been lurking here for awhile, respect the community, and felt compelled to share.

so much truth here, thanks for writing this.

It really is a tragedy that it is made so hard and even impossible to pursue different artistic and intellectual avenues in this country.

Wowsa! The only thing I’ll add to this extraordinary “rant” is to not overlook NYU as the competing real estate management apparatus downtown.

The only thing I find surprising here is that NYU is not also on the chart and looking like a Columbia Univ. twin.

Columbia, being where it is, probably draws a bigger group of people who just want to be artists than many of the other Ivies. This was certainly the case with my wife, who did her MFA at Columbia after her BFA at Bennington. (btw, she has considerable affectionate nostalgia for Bennington. Columbia, not so much.) She was an absolute romantic about it, and then proceeded to spend her requisite decade of genteel poverty in DUMBO trying to make that go somewhere. Given her lack of a businessperson bone and utter disinclination to self-promotion, it didn’t really take off.

But the New York of that era was somewhat more abundant in ways for artists to make ends meet than the New York of today. She, like many I know, spent a significant chunk of time doing word processing for Skadden, supplemented by Graphic Arts temping in the early days of the mac, waiting tables in the Rainbow Room of the Chrysler building, and at a Brazilian nightclub.

She also for a few years leased an abandoned industrial building, lived in it and sublet to other artists. It lacked hot water and until somebody rigged a cold shower it had only utility sinks for personal cleaning purposes, beyond the bathroom lavatories.

Naturally we still get the Columbia Alumni magazine, largely focused on the success stories and innocent of any suggestion that a Columbia alum ever has any difficulty.

Jacques Barzun (professor at Columbia many years ago) had some things to say about too many artists in the population with academic institutions legitimizing the career. I have to agree. I have an MFA from a private university and still have a pile of student debt even though I received grants and scholarships and worked constantly. I was an older student with no parental support. There is no real job outlet for most arts graduates. Many people I know have a partner to support them, run small non-profits so basically they are running businesses and not doing their own art, or have gone into some kind of regular job in order to live. And that’s just to eat and pay bills – it doesn’t mean they are able to pay off student loans from much less glorified institutions than Columbia. I worked full time and went school part time and then vice versa. I had no illusions about making any money from art. I adjunct taught for a bit which was a complete joke – probably paid less than dog walking. I felt like I could not in all honesty push the students to continue in art without an alternate plan. It’s irresponsible for colleges and the loan industry to treat these degrees as if they are worth it. As most know, the whole system is based on fraud – certainly to do with the student loan system. Many colleges besides Columbia and NYU have turned into real estate companies. My undergrad school was lovely and small – Montclair State U in NJ – then Susan Cole got her hands on it and turned it into a more successful Xanadu (if you know the NJ Meadowlands you know what I mean). It’s got so many buildings that’s it’s a small city but I don’t see how any of that improved the education. The arts could be more of an enjoyable sideline and not a career path if anyone’s day job gave them some slack but that’s not how we do things in the U.S. But anyway, you don’t need a degree to make art. I realized way after the fact that I got very little out of it compared to what I paid for in time and money.

Has anyone here watched the Anime “Full metal alchemist”, the USA seems to be a place where human souls are consumed much in the same way.

I’ve commented here before on my days as a graduate student at Stanford in the early 70s. Greatest time of my life. Being around some of the smartest minds in the scientific world was awe inspiring. This was before the neolib blight set in and ruined the place. I still talk to my thesis advisor and his stories are pathetic. I was there during a time when a grad student could actually pay tuition on the salary his wife earned as a secretary in the engineering department. Just as an aside, she was Vint Cerf’s secretary during a one year sibbatical away from the Naval Research lab. Nice guy. He had a terminal for the ARPANET in his office. It was primarily used to send rabid jokes back and forth. Ahhh the good old days.

Anyway, I sincerely doubt we could pay the costs there using the same technique now. Our on campus apartment cost $180/month in those days. Bikes to get around and groceries were dirt cheap. Even had enough left over to pay round trip airfare on student charter to New York at Christmas. Graduated with PhD in 75 and no debt. I got a good salary as a research assistant (double the normal rate) because I was one of a few students who could actually build machines. Advisor had huge grant from DoE and he needed a very complex laser with computer control built in a short time. I did that including writing all the control code (in assembler) on a PDP-11 using CAMAC crates. He got his money’s worth for that project. Had enough left over to put my wife thru the Montessori program at College of Notre Dame up the peninsula. Like I said, best years of my life.

Ohnoyoucant, you’ve hit the proverbial. It’s impossible now. Beyond draconian, in my opinion. I remember those salad days, and I’m so grateful to have lived in that time as I watch young people struggle under monstrous financial burdens.

Undergrad, good state school. Scholarship and no tuition, cheap rent and ciggies. Same for MS degree in social services. When it became clear that social services would be going in the toilet, so to speak, I returned to school. I was able to pay fully for an excellent second tier private law school via flexible self employment (even single with a toddler at the time!). Those days were stupendously happy. And recall, a part time job during school, should you need it, often offered medical benefits and universities had excellent full service student health centers. Quite a different world indeed.

Regarding the “whadda they expect gettin a useless degree like that” aspect – when I think about the people I know from back around 1998 when I decided to go back to school and how they fared (both late 20s adults like myself who decided to give the “better yourself” and “retraining” slot machine a try and those younger who went to University right out of high school) the ones who in the end did the best were the music students surprisingly enough. Some of them are actually earning a decent living in the field. The rest are largely doing jobs that have no connection whatsoever with their degree and few are doing particularly well income wise.

Me, I studied music for two years, made a one semester abortive attempt at computer science (only to discover I hate coding and am truly terrible at it), completed an intensive Aviation Maintenance Engineer (M) program and got a business degree focused on accounting. My job now? I make small batch cold process soap in my garage… and I’ve actually earned a little money playing music a few times whereas I’ve not made a dime working on aircraft or any book-keeping/accounting related work!

seriously:

from 2019

A New Study Says the Arts Contribute More to the US Economy Than Agriculture. Here Are Five Other Takeaways From the Report

The arts also contribute more than transportation or warehousing.

https://news.artnet.com/art-world/nea-arts-economic-study-1484587

Here in Austin the son of a friend went UGrad at a famous film school, did the free internships in CA via dad’s credit card, got his foot in the door and is trying to make a go of it. Good kid; nice parents; total cost to the latter so far somewhat north of $200K. Intergenerational transfer 3.0.

When the gov tells both famous universities, and schools that advertise on the back of matchboxes, and sub-mediocre “tradition black colleges” with a 90% acceptance rate “Just let uncle sugar handle the loan, you get the cash now; we will guarantee the loan; if the sucker defaults, why, there is no way out through bankrupcy”. Let the party begin! If this sounds a bit like the 2008 loan scandel, so be it. ALL GOVERNMENT BACKED LOANS tiurn into a way to pass the rewards to institutions and the upper class and have uninformed loan recipients hold the bag…. and have the public pay the cost after the NYT and WP publish the usual first person sob stories about the kid with $200,000 of student debt or the Somali NYC cab drivers who paid $700,000 for a cab license.

Let the universities borrow the money for student loans. The interest rates will reflect the real risk as understood by the people loaning the money. Engineering students at MIT will pay 2.5% and art majors at Bennington will pay 17.5%. Two hundred years ago the U.S. was founded and funded by real estate plans and scams; now we are funded by credit scams like the “self funded” flood insurance program and student loan biz.

I took out no loans and worked my way through school in the 1960s. I know some of the victims of our new loan serfdom system and am deeply angry.

From here it seems as if the present focus on higher learning is a bit of a scam. And this scam is fueled by easy loan money even if the piper has to be paid in the end. And the piper demands his due as much as Betsy DeVoss demands repayment even if the institution is shown to be fraudulent.

The successful graduates today are the folk that drink the company Kool-Aid and curry favor to rise to the top.

Real men and women who actually strive to build and create not so much.

My best instructors were folks who had actually worked and still worked in the field. And there were some outstanding folks – John who got his destroyer sunk beneath his feet in the Pacific, Teeter who still carried a maimed hand from a Jeep rollover – he never got it repaired because he couldn’t wait to get out of the Army and away from the fighting, Bill who operated a dozer as if he were an artist, or even Dave who happily shared tales of his time in reform school.

These were real folks who really lived and worked in the real world.

And now we seem to celebrate the fixers, the clever lawyers and accountants, and the Kool-Aid drinkers.

Real people not so much.

The word “scam” seems fairly appropriate to describe higher education these days. Once thing I noticed is that Columbia charges significantly more tuition to grad students than to undergrads. Why? Because the graduate students can borrow more money. It has little or nothing to do with the actual cost of providing the education.

When I was in grad school 25+ years ago, we paid a small premium relative to undergrads. Given that there were fewer students per teacher in our smaller classes, paying a little more seemed fair. And it was. Less than a 10% premium at a time when overall tuition rates were much lower. But what Columbia University is doing to their graduate students today? Unconscionable.

Columbia’s vice provost for academic programs said master’s degrees “can and should be a revenue source” subsidizing other parts of the university, to which I can only say, “No, no, no!!” It’s difficult enough these days for students to pay for their own educations. They shouldn’t have to borrow even more money to pay for somebody else’s.

While student debt is a particularly heavy burden for graduate students, its problems are systemic and also weigh down undergrad students. Lets not forget that:

“Student-loan balances on the government’s financial statement skyrocketed from $147 billion in 2009 to $1.37 trillion at the beginning of 2020, despite the 11% decline in student enrollment since 2011.”

A 12 year 932% rise in government student loans, from just over a hundred billion to over a trillion during an enrollment decline, is a systemic problem of overcharging that spreads across all cohorts of college students.

At the heart of this problem is colleges are asked to price a product whose customers have access to trillions of dollars in government guaranteed financing, without any credit evaluation or approval. Under these circumstances is it any surprise that universities chose to shockingly overcharge, and their customers financed this product with debts that cannot be repaid?

“Any government program that CAN be abused for power, privilege, and profit WILL be abused for power, privilege, and profit.”

The federal government’s student loan program is perhaps the single purest example of this axiom. The utter lack of credit evaluation and minimal restrictions on loan size practically beg universities to “shockingly overcharge”. After all, there’s no penalty to the universities for doing so. None at all.

I don’t think this price gouging is limited to just Columbia’s arts department. When I started out as an actuary in training, I had a coworker who had six figure debt from their actuarial masters program. We were at the same level and I had no such debt, having mostly stumbled into the job through an “every interview I can find” approach after getting a degree in mathematics/physics at a state school that was mostly paid for through scholarship. A close family relative also went to their PT program and regularly complains about the level of debt he has, though there might be some slight advantage their in terms of prestige though I doubt its commensurate with the cost.

Andy Cuomo? :)

Both New Zealand and Australia are nice, English speaking countries. With a teaching credential, people are quite employable.

A coherent social response to this Columbia Graduate School debt tarpit-entrapment racket would be the best response.

But as long as the society is too incoherent and too disorganized to function at the coherent social response level, individual responses are all we are left with. Perhaps millions of individual responses can add up to have a mass-accretive social effect.

So word of Columbia Graduate School’s position at the worst extreme of this debt-racket gradient should be spread far and wide to all the millions of future graduate students, and we can only hope that so many of them decide individually that Columbia Graduate School is a tar pit best avoided . . . . that Columbia Graduate School goes extinct for lack of revenue caused by lack of new applicants.

The comprehensive extermination from existence of the Columbia Graduate School through comprehensive lack of even one single applicant for decades to come should begin to ” encourage the others”.

The WSJ has always been against borrowers, frankly. This may seem somewhat nuanced, but I can tell that one of purposes of this article was to reinforce the stereotype of young people over-borrowing for shitty degrees.

The FACT is that the highest balance borrowers aren’t young people…they are OLDER PEOPLE who have been trapped under these loans for decades!

I recently discovered that there are more people over the age of 50 with student loans than under 25, and they owe FAR MORE than the younger group. Similarly, there are more people over 35 with student loans than under 35, and again, they owe FAR MORE.

People need to know this. Hand-wringy pieces like this that invoke paternalistic responses from the audience are unhelpful.

The lending system is catastrophically failed at this point. The sub-prime home mortgage default rate was about 20%. Just before the pandemic, over 80% of all federal student loan borrowers were either unable to pay, or were paying but their balance was increasing. Also, the class of ’04- who were borrowing less than a third of what is being borrowed today- have a default rate of 40%. This all points to a default rate of something like 75% or more for current borrowers.

Also, student loan debt for over a third of US States actually exceeds the entire state budget today (these are mostly red states like Texas, Florida, Alabama, Tennessee, North/South Carolina, Indiana, Ohio to name a few). These numbers are just insane and obscene. Republicans everywhere should be taking a very fresh look at this.

Done. Finished. Toast. This lending system is over the cliff. There is no saving it, and it should not be saved. It should be taken to the bath, and drown in the tub. The colleges should be defunded, or at least put on a sever diet. If there are to be government funded student loans going forward (a good question in itself), they should, at a minimum, have the same bankruptcy protections that all other loans have. Frankly, I don’t think the government has any business being in the lending business based on this massively failed experiment.

Time to cancel all federally owned loans, which can be done without needing one dime from Treasury, or adding even a penny to the national debt. Also, bankruptcy protections must be returned to ALL student loans, including those that cannot be cancelled administratively.

Thanks for this comment. Agree with your conclusions wholeheartedly.

One thing I have often wondered about is whether a “feature” of this debt tarpit-entrapment racket (to borrow drumlin’s apt phrase, above) is to serve as a gold mine of high quality non-dischargeable debt that banks can use to clean up (i.e., securitize) and re-sell all of their toxic auto and home loans.

I am a banker and my only real product is debt.

Who can I load up with my debt products?

You’ll do

Students.

Lovely jubbly, another market for our debt products.

We want to get as many of them as possible into university, and charge them as much possible, to shift as many of our debt products as we can.

“Let’s get our experts in from Goldman Sachs to advise us on education” US policymakers

What could possibly go wrong?

I am a banker and my only real product is debt.

Who can I load up with my debt products?

You’ll do

Students.

Lovely jubbly, another market for our debt products.

We want to get as many of them as possible into university, and charge them as much possible, to shift as many of our debt products as we can.