I am late to post on an important study by the National Low Income Housing Coalition, Out of Reach 2021, which is embedded at the end of this post. However, it appears to have gone under the radar when it first appeared last month; CNN was one of the few major US outlets to write up the damning report. The Guardian helped correct this lapse by posting on the report yesterday, which is how I cam across it. Among other things, it finds that a minimum wage worker can’t afford a one-bedroom rental in any county in the US.

Needless to say, before gentrification, many US cities has housing alternatives for low wage workers or those who’d had a bad run of luck. They were called “flophouses” in the Depression and later “single room occupancy hotels” in New York City: a not large room with a bed, and communal toilets and showers. Now their options are things like couch surfing, living in their car (assuming they have one), being a roommate (often in an overcrowded unit), going to a shelter, sleeping on the street, or going into debt. And even seeming middle class workers can’t make ends meet due to housing costs:

Ironically, the National Low Income Housing Coalition lists JP Morgan as its lone big supporter.

The linchpin to the analysis is that HUD sees 30% as a realistic maximum for what a full time worker should pay for rental housing. The National Low Income Housing Coalition using that to derive a National Housing Wage:

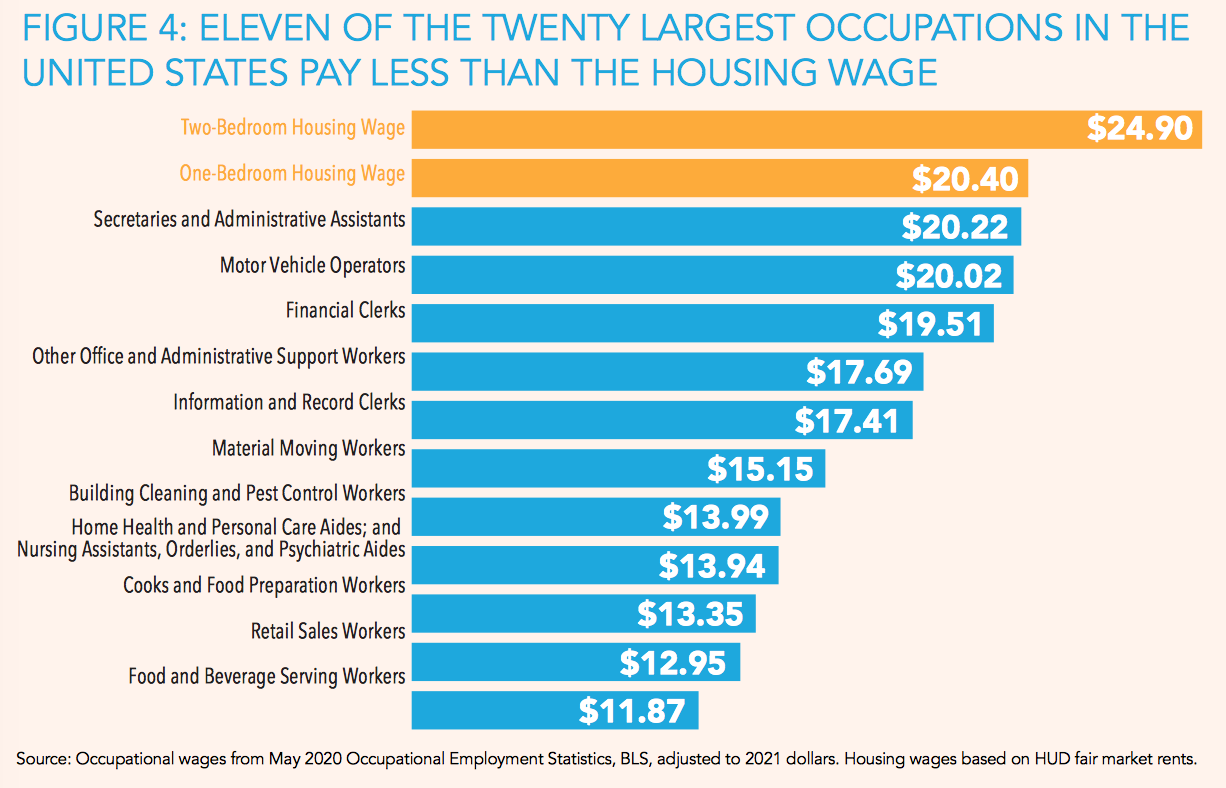

The 2021 National Housing Wage is $24.90 per hour for a modest two- bedroom rental home and $20.40 per hour for a modest one-bedroom rental home….

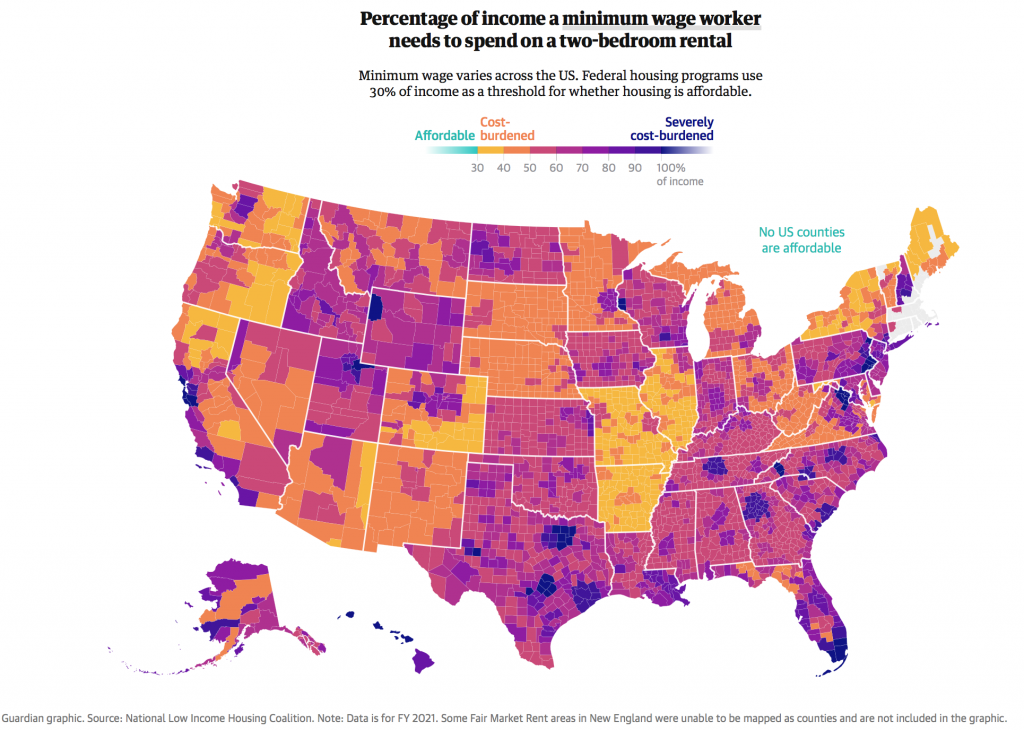

The federal minimum wage of $7.25 per hour falls well short of both the two-bedroom and one- bedroom National Housing Wages…Thirty states, the District of Columbia, and several dozen counties and municipalities now have minimum wages higher than the federal minimum wage, but even taking higher state and county minimum wages into account, the average minimum wage worker must work nearly 97 hours per week (more than 2 full- time jobs) to afford a two-bedroom rental home or 79 hours per week (almost 2 full-time jobs) to afford a one-bedroom rental home at the fair market rent. People who work 97 hours per week and need 8 hours per day of sleep have around

2 hours per day left over for everything else— commuting, cooking, cleaning, self-care, caring for children and family, and serving their community. Doing so is an impossibility for a single parent who needs a larger-than-one-bedroom apartment. Even for a one-bedroom rental, it is unreasonable to expect individuals to work 79 hours per week to afford their housing….The struggle to afford rental housing is not confined to minimum-wage workers. The average renter’s hourly wage of $18.78 is $6.12 less than the national two-bedroom Housing Wage and $1.62 less than the one-bedroom Housing Wage. As a result, the average renter must work 53 hours per week to afford a modest two- bedroom apartment. Many single parents or caregivers find it difficult to work those hours.

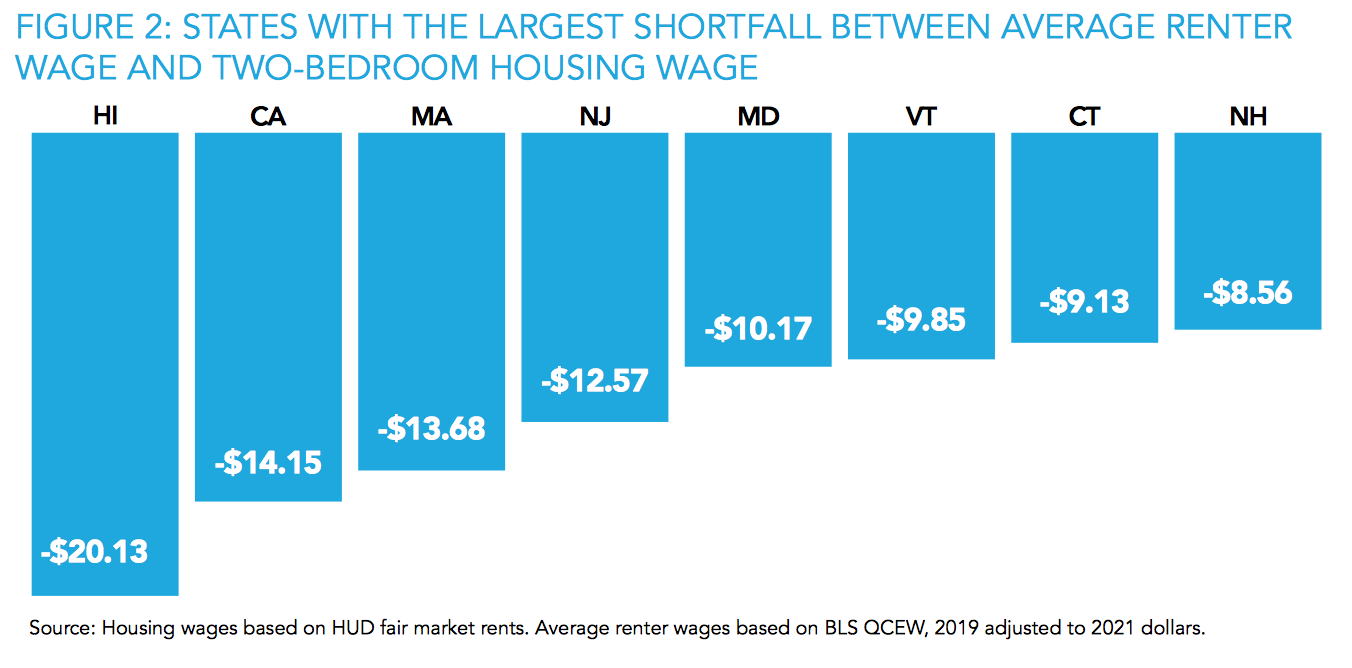

The report also contains a great deal of granular analysis, such as:

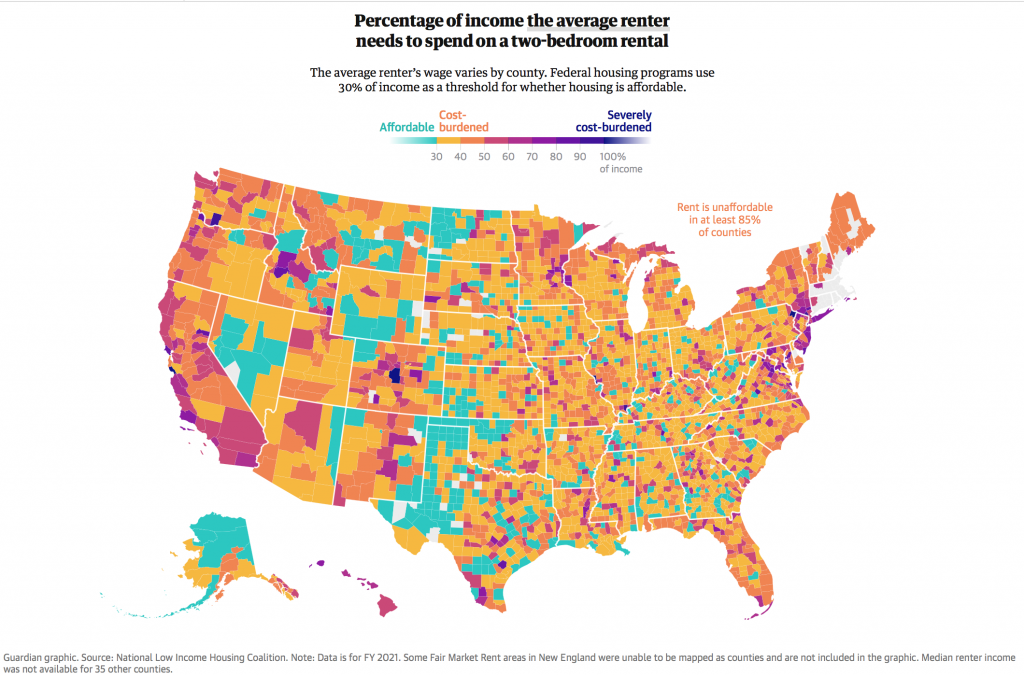

You can look at costs on a county by county and major metro area state by state. The Guardian developed charts of its own using that data:

And Covid has made matters worse:

Prior to the pandemic there were only 37 affordable and available rental homes for every 100 renter households with extremely low incomes (NLIHC, 2021b), and every state and nearly every county in the U.S. lacked an adequate supply. As a result of this shortage, 85% of extremely low-income renters could not afford their rent, and 70% were spending more than half of their incomes on housing costs. Severely housing cost-burdened households have to sacri ce other basic necessities to pay the rent— to cut back on basic nutrition or forgo needed medical care, for instance. While many renters struggle to nd affordable housing, the affordable housing shortage is predominantly a problem for renters with extremely low incomes. Extremely low-income households account for only 25% of all renters, yet they account for 72% of all severely housing cost-burdened renter households.

The Guardian has an impressive and way to large to embed chart showing rent changes from February 2020 to July 2021. Despite the widespread schadenfreude over sky-high rents in San Francisco and New York City taking a beating, rents in most cities have gone up:

A handful of metropolitan areas remain below their pre-pandemic pace, mostly held back by the slower recovery for pricey rentals. San Francisco (-7%), New York (-7%), Boston (-3%) and Seattle (-1%) are not fully back to pre-pandemic prices.

But since February 2020, average prices in 82 of 101 of the top US metro areas increased more than 5%. Among the cities with the largest increases are Boise, Idaho, (+21%), Riverside, California, (+17%), and Phoenix, Arizona (+17%).

The report recommends a set of very sensible policies, the most important of which is constructing more affordable housing, along with providing incentives to keep older units in service rather than replace them with upper income properties, stronger tenant rights, and emergency rental assistance. But it’s hard to see how we get from A to B, with too many on the high end of the food chain benefitting from keeping ordinary people desperate and therefore subservient.

00 Out of Reach rent

The problem at the end of the day is that the housing crisis only affects a minority. Everybody else makes out like bandits.

Homeowners don’t care, they love sitting on an asset that goes up in value without them having to do anything. Even if the gains might be hard to realise in practice, it sure feels good.

The children of homeowners mostly don’t care because they think they will inherit an asset that goes up in value forever.

Landlords obviously don’t care.

Politicians don’t care because the above groups form a voting block that greatly exceeds the struggling low wage renter groups and will thus never do anything that will make housing affordable and plentiful. It would be career suicide to plunge your voters into negative equity.

So, nobody cares except low wage workers.

The housing crisis in the UK and US will continue forever until a pandemic with a 50pc fatality rate or nuclear war hits. It will continue until the end of these societies.

– Low wage slob sharing a house with two other slobs for 40pc of after tax income in England.

When you add in retirees and the unemployed, you are up to over 50% not being able to afford decent housing. The issue is not numbers, it’s the distribution of power.

And you are also wrong about children of homeowners. My nieces know they are going to have to live modestly, way less well than their parents did, and they aren’t sure they will be able to buy a house. The median age of homebuyers is now 47.

The home is sold if the parent has to go on Medicaid. The last few weeks and even years of life usually involve big medical expenses and home health care or retirement home expenses. Those get taken out of an estate before it is settled. Retirees who are not rich do not invest in keeping a home hip looking; they may not even maintain it adequately. So those homes owned by aging parents are often teardowns, yes, still worth something, but the value highly dependent on if it’s located in a good school district.

Agreed. I think the cost of housing is clearly having an effect on the willingness to have children. Which increases the importance of facilitating immigration from South of the Border for the elites.

A disasterous set of policies which is leading to a terrible place. But Blackstone knows what they are doing when the move to buy suburban housing. We need to hold politician accountable.

A lot of parents hate high housing costs in their area because it has significant impact on their kids. If my kid can’t afford rent (let alone a mortgage) near me, I might not get grandkids, and if i do, I might not get to see them. God forbid you have kids who can’t afford to move out while working fulltime! You might end up with grandkids that live with you while their parents work full-time and want their own space. Watching your kids struggle to make ends meet is miserable.

Sure my home might be worth $1 million, but I want a home, and a community. High housing prices ruin communities and families.

Question, can you protect your home from the Medicaid mess by putting it in a trust? Many many moons before long term care via Medicaid is required, of course.

This is an excellent point and makes me more than ever convinced that Johnson will pass a UK social care bill with a relatively low cap on cists, to neutralise a dangerous threat to future Tory voters who would not be able to join the propertied classes if the family home was sold to pay care home fees….

In the UK we dont really need to pay for huge medical expenses at the end of life, funeral needs paying. We have the NHS/welfare state – who looked after my gran brilliantly without paying a penny. Now private retirement homes are different, but I recall a speech BJ made where he said how he wanted and end to people selling their home to pay for residential care. I’m not sure what happened with that

Plenty of homeowners in my small, rural town are not at all excited to see their property values go up. It just means a higher tax bill, and as they are by-and-large planning on staying in their homes until they croak, they aren’t much concerned about how much their shelter is worth on the open market. Just sayin’.

Yeah, I hear that!

I mean – in the grand scheme of things its a ‘problem a lot of other people would be glad to have’ (i.e., for those with no property at all, which is most) but I have some direct experience with the whole rural property tax rising thing.

Our family (just my older bro and me, now) have the family farm that was built in ~1914, family has owned it since ~1924, Big old old-timey barn, huge farmhouse, outbuildings, 7 acres of agricultural land, slowly but surely being butted up against by suburbia from the growing city next door.

Property taxes not completely unaffordable yet, but neither my bro or I EVER want to ‘grow houses or condos’ on this land, to the point of wishing it was still considered polite to run off speculators and real estate agents who come freaking knocking to buy the property off with shotguns and rock salt loads.

If we have our way we will try and get some kind of a foundation, or public/private trust, or who knows what – solely to attempt to preserve the land, the orchards, the berries, in production…and the buildings as they are (or were, if we had enuff $$ to restore them to their 1930’s-50’s heyday glory)

We wish we could mimic what they did with the old Dorris Ranch: https://www.youtube.com/watch?v=qJatA6Jp9II

If McMansions and Condos are ever built upon that property after my death, I will seriously consider returning from Valhalla (with my axe) in order to become a very VERY malevolent & evil ghost, haunting each and every house whose floorboards and pavement dare smother the sandy loam soil I used to walk in, barefoot, as a child…

In MA there is an Agricultural Preservation Restriction program that pays owners of farmland not to develop or sell to developers. Many local farmers have taken advantage.

https://www.mass.gov/service-details/agricultural-preservation-restriction-apr-program-details

I love the Dorris Ranch, we are fortunate to have this in our neighborhood.

Well said, jihad, you have put your finger on this. A lot of otherwise nice people are saying (though they would never admit it) “I got mine, the poors must not be trying hard enough”.

Last night I was standing in line at a grocery store behind a father with two young girls climbing around in his cart. The back of his t-shirt read, “Nobody cares, work harder.” I don’t know if that was a message to himself, but whatever, good luck to his two daughters and the world they will inherit.

“Napoleon is always right and I will work harder” Boxer – Animal farm

“…the housing crisis only affects a minority..” What are you smoking? The situation is classic creditors vs debtors and most of us are not creditors –

‘Great Expectations: How credit markets twist the allocation and distribution of land’ –

https://www.masongaffney.org/essays/Great_Expectations.pdf

“The basis of allocating loans is not marginal productivity but collateral security” – Rainer Schikele

“….the housing crisis in the UK and US will continue forever…” – agreed. Neoclassical economic fantasy logic (which conflates the distinct and separate factors of production – land and capital, and marginalizes the third factor, labor) has been infecting (and now embedded in) the public’s psyche since the vested interest’s ‘marginal revolution’ counterattack to classical political economic theory 150 years ago. We live in a regulatory captured wasteland – peak neoliberalism is socioeconomic and environmental cannibalism.

Haha, just had me thinking… if Veblen were alive today, he’d have published “The Theory of Financial Cannibalism”.

Sometimes it appears the discussion is about apartment rentals? Sometimes it isn’t clear and the picture shows houses.

It’s really about apartments?

The text of the report talks about houses, but looking at the data they have for Birmingham and Jefferson County, the prices look like apt. prices. So I think they finessed the description. I would imagine they looked at the cheapest 1 and 2BRs, which in cities would be apts. I have to confess to not checking the notes.

The living affordability is starting to become an issue everywhere, even in places that used by tenant friendly like Germany (rents in Berlin, unless you have a long-term contract, are now extortionate I’m told).

Say in New Zealand you had now two years with north of 20% property price growth IIRC. Cetral North Island had 40% growth just this year.

This is putting housing on lots of people minds. Central banks are looking at it, lamenting, but don’t want to do anything about the issue they caused (mortgage costs are a massive part in any RE bubbles). Pols – the same.

The large problem is that it’s now a society of haves and have nots, but the split is not 1-99, or even 10-90, it’s much higher. So the status-quo is valued by many people, most of whom (those that have only a single property) don’t realise that their “wealth” is ephemeral, because if they sell, they will have to buy for about the same amount (moving may not help anymore unless you really go downmarket a lot. which sounds nice and romantic to retire in a middle of nowhere, but once you find you have to travel a long way to get anywhere (like a doc), it may not be so great).

So it’s one of those things added to the “ain’t gonna end well” list.

Its a striking feature that the problem is pretty much worldwide.

Its hard not to see it as a function of increasing inequality combined with free-floating excess capital sloshing around the worlds market. A 1% with access to more capital than they know what to do with it are bidding up the price of property at the expense of everyone else.

and as keynes warned what would happen if extra stimulus is added to the economy, yet you still free trade.

that money goes into the coffers of china, has no where else to go but back to the west pumping the bubbles ever higher, instead of staying home and filling up the bucket here.

so the deplorable loses their jobs, then their homes are bought right out from under them, and they get cheap portable dvd players to enjoy under some over pass somewhere.

and they are much better off than a person in the 3rd world, at least that is the view of the free traders.

This seems to be a feature in my opinion. When looking at this in The Netherlands, we have a long long waiting list for social housing, and you pay a lot more for commercial rent. Because of the low interest rate, the house prices have gone up here as well, putting them out of reach for more and more people, which is a boon for “investors”. This isn’t as bad yet as in the US, but we’re getting there. Why am I reminded of the WEF slogan “you’ll own nothing and be happy”? It’s becoming really hard not to think this was planned in advance.

Sound like Worry Free advertising from Sorry to Bother You, Boots Riley’s tour de force debut film.

Air BNB/VRBO had a significant effect here in Sonoma County, as did the loss of 5,000 plus homes in recent fires.

The popularity of short term vacation rentals drove up home prices by about 25% and reduced the number of rentals very substantially.

I recently saw a rental advertised ion a bulletin board that was typical, a 600 Sq Ft cottage in the Sebastopol Area for $2,000 per month.

A friend rents out a nicely converted Garage of 450 Sq Ft for $1,500 a month in downtown Sebastopol, he had 50 applicants the first day it hit craigslist…

The health risks to the general populace are serious even absent Covid,

“The serfs are always calling for land reform’

– Nicholas

If climate change doesn’t wipe out demand, the serfs will make changes.

Nope. I don’t see anyone organizing to challenge power here. People in rural areas still buy into the meritocracy bs. How do we change that first?

It’s amazing that there’s so much unused/underused old housing stock in all the old industrial cities where I live (metro Milwaukee Wisconsin) built over a century ago, but housing is still unaffordable??? Homelessness seems to be a failure of rentier capitalism, not of physical constraints. Really, older houses could/should be had for the cost of annual maintenance and cleanliness to community standards imho.

I’m also in Milwaukee. Lots of those old houses are so decrepit and out of code that it’d be cheaper to tear down and start anew. There are programs for interested buyers (look up Homebuyer Assistance Program on the city website) but it’d still price out the vast majority of residents in that neighborhood. As you know, the old vacant homes tend to be in the most poverty-stricken areas.

You can’t and shouldn’t put homeless people in buildings with lead pipes and fire hazards, so my opinion is the city or county should use eminent domain to seize uninhabitable houses that have been vacant since let’s say 2018 (COVID may have screwed up probate courts), and build affordable public housing on the land. We need a lot more. There is pretty much no way to get into public housing now, even before COVID. Can’t even get on a waiting list. Same for Section 8.

But I am sure the state legislature has managed to outlaw helping “lazy” poor people, and anyway the city budget has been wrecked by the pandemic.

The crash of the boom of 1923 was due to the same causes that wrecked the wall street stock market. People sold what they did not own. They made a payment down in the hope of getting the property off their hands before it began to burn. Real estate fell into the hands of sharp-shooting gamblers who had no interest in land. To them it was just a pile of blue chips on a roulette wheel.

Imputed rents rather than house price rises are used in the UK for calculating inflation, which is handy I suppose for certain interests & I also imagine that for many who struggle to pay a mortgage or their rent would mean that there would be less cash going into the wider economy.

Returning to the situation in Cornwall the Gov’s reply to the emrgency was that they are going to extensively build affordable housing ( food banks included ? ) over the next 5 years to make up for the shortfall which according to the article below also requires 90,000 more social housing properties, which would for the low paid actually merit the term affordable.

The UK Gov also pays out roughly 17bn pa in housing benefit to keep the whole thing & the Tory MP landlords of which there were 90 all propped up.

https://www.cornwalllive.com/news/cornwall-news/affordable-housing-cornwall-anything-affordable-2541594

To think that my Cornish ancestors left because there was no work and people were starving to death.

I just had a read on Wiki about it – about 250,000 ” Cousin Jacks ” left in all to a long list of countries, one failed by going down with the Titanic & you are one of an estimated 2 million descendants in the US. One of the 9 Bounty mutineers was Cornish & his descendants still live on the Pitcairn & Norfolk Islands.

I don’t have any Cornish blood being a mongrel of Irish, English, Scottish & Welsh people who all got intimate under the shadow of those dark satanic mills.

One of 2 million Cousins here, and my name is *still* a challenge to pronounce. To the point where I’ve made it the topic of a standup comedy set.

In my town I see the fight against any development all the time. The same people who are against any apartment/condo development (because it might depress housing values) were the same people against the construction of a new school (because taxes). It’s all self centered NIMBYism in the US at this point, which speaks to how precarious a lot of people view their economic standing as.

Developers do not build to charge low rents, my friend. Quite the opposite.

Rolling Out The Red Carpet For Real Estate Investors

This argument is so common and yet it is like saying water isn’t wet.

Of course, the new housing will be more expensive than existing housing stock.

Are new cars cheaper than used cars?

The idea is precisely to lower the cost of the existing housing stock through competition, which is why small landlords are so anti-development.

Numerous studies have shown that on the whole, building new housing substantially lowers housing costs.

And just think logically, where is housing more expensive? In developer-friendly Houston or NIMBY Boston? Phoenix or San Francisco? Nevada or California? For that matter, in East Asia or the West?

Thank you for making my point so eloquently.

The situation in the rebellious colonies may be different, given they are practically empty, but in the UK nearly every study has shown the price elasticity of housing to be near zero. The price reflects the cost if the land and of the house. Gold taps will raise the cost of the house but the land price is set by geography and it dominates the overall cost of housing. The UK would have to build millions of houses per year it suppress household formation (immigration and divorce and child bans) to reduce land prices through private market housing. Offering high quality subsidised housing might raise quality in the private market because the best tenants would go public but ultimately the supply would have to overwhelm demand to depress prices.

The only true solution is a land value tax.

Re: land value tax, is that different from the property taxes we have in the US?

As for land determining housing cost, that would be largely offset by building more apartment units on the same area of land, wouldn’t it? The obstacle is NIMBY rules that prevent that from happening.

>>ultimately the supply would have to overwhelm demand to depress prices.

Agreed, the most expensive metros have a huge “housing deficit” to make up for. Of course, the federal government could also help by aggressively moving economic activity from those major metros into struggling areas, for instance, through a national industrial policy that encourages a wide variety of industries.

If NIMBY is a way to gloss over quality of life issues in communities. Then I would agree with them

We saw this in NYC a few years back. A ton of new units came on in Manhattan, and mirabile dictu, rents fell appreciably.

I’d love just for once to see a town that raised teacher’s pay as well as the curiculum rather than built a new school when there is often nothing wrong with the old school that modest repairs wouldn’t fix except that it doesn’t put unthinkable sums of money in the pockets of the construction companies. I’ll pay the taxes either way, but I’d prefer it go to education rather than fat cat construction behemoths that use the same old same old line, “If you love your children at all, bla bla bla,” you’ll want brand spanking new (stratospherically expensive) shiny glass and bricks to replace the somewhat older and somewhat less shiny glass and bricks, and, of course, to fill up our already full land fills or those of foreign countries with the slightly less shiny stuff.

I’ll grant there are times when construction is necessary but it’s far less often than one might imagine. I’ve seen schools that were well over a hundred years old and could easily have lasted another hundred or so with proper care and maintenance. Check out Harvard yard. The only weather they couldn’t withstand was slick PR and greed.

This school had geographic features that wore away at the foundation. It was only a matter of time before it needed to be rebuilt. But I agree with you, renovations are usually preferable than rebuild.

In Hamburg I saw a wood house caulked with some kind of mortar that was 800 years old: all natural materials and probably hand-pegged together. They knew how to build then.

Here in Orange County Southern California, I estimate that less than 10% of houses are under $1,000,000.

This with an end-of-Civilization drought. Lawns are still required by the City to be watered.

I have not seen any water restrictions to date (And I might ave missed it).

Building materials have at least doubled in price, and possibly tripled.

are you kidding that lawns NEED to be watered?…. in a drought….?

especially considering watering that lawn will take many times the number of gallons people actually use in daily life….. you could say “most” of their water use is for the grass… that should be a crime. Something to get any civil employee fired.

Lawns don’t need to be watered because lawns don’t need to exist.

In my town in Massachusetts, for sale listings this morning stands at 142. This is up sharply just recently and almost near pre-Fed freak out binge on QE and mortgage purchases and up from stubbornly hovering in the 70’s just a few months ago for quite a long time.

I rent my lower level of split ranch (3 rooms, full bath recently renovated, laundry rm, frig no kitchen) for $800/month includes all to a divorced African American who works 2 jobs (don’t know how he does it and that’s not uncommon).

Listings in Craigslist for rooms in homes pre Covid would be about 6-12 at any given time on in my area. Now they are about 1 or 2.

It is the wierdest thing. There is a glut of rentals available where I live but the rent prices are not dropping. Since I am new here, I cannot figure out why this is happening. I do know that there is one company in town that seems to own most of the decent rentals though. When I called to check out various places to rent, I always seemed to find myself talking to the same woman!

Is there an accountant in the house? Does the landlord company want to keep up x rent to pay its notes and make x profit. And if that’s not possible, do they benefit more by taking a ‘loss’ on an unrented place than by getting a lower rent?

Wondering if there are some perverse incentives at work.

I own a 750 sq ft one-bedroom house on a lot and a half in the squarest neighborhood in this major city/metro area. I just took a job with a union. Entry level, despite that I am vastly overqualified, my wage at $18.41/hr will require me to work until about the 21st of every month before I have the mortgage and utilities paid. Add in credit card payments, car insurance/gas, my contractors insurance so I can legally do side jobs in construction/remodeling/handyman-ing, I’ll have about $200 left over to feed me and the dog, if I don’t have any side work.

That said, the monthly cost of this house and lot with mortgage and utilities is slightly less than the average 1-bedroom apartment rental in this city. In that sense at least I can at least grow enough food to alleviate my poverty.

That is being in a union. Most of the low wage jobs in this country have no collective bargaining, and are a great deal more precarious.

$18.41? What happened to all of the industry cries about shortages of experienced plumbers, electricians, and builders? Or was that all just manipulation to pull in enough workers so that wages could be depressed?

The carpenters here start at $45hr. Painters at $41. Concrete finishers at $26 (no idea why that skill is considered less than painting). I tried to get a carpenter job based on the fact I am a master carpenter and a former self employed remodeler/problem solver and a skilled wood worker. But I was deemed only worthy of picking up garbage, cleaning bathrooms etc. Hiring practices are the most mystifying thing about this place. I just tried for a crew lead opening which I am overqualified for, I was told by the panel what a great job I did and then they flunked me.

“The Guardian helped correct this lapse by posting on the report yesterday…”

Here’s a link to the Guardian article.

Had links where the Guardian chart references were, but added this at the top.

The moment that the covid rent protections ended my landlord raised my rent 33%, tacked on an additional fee for utilities that were formerly included in rent, and added an additional fee for basic cable which I don’t want and don’t use. They refused to negotiate on any of this as well.

My rent is now 48% of my monthly income for a 500sq ft apartment. Rent and utilities are 54% of my monthly income.

So, I’m only one or two rent increases away from homelessness.

House prices are so high in the city where I live that the monthly payments for a 30 year mortgage would be around 80% of my monthly income.

The house next door to my building sold for 450,000 (monthly payment around 90% of my income) after being on the market for only a few days. It had been a rental for years, maybe decades, and is one step up from a squat. The people that bought it have had contractors working on it day and night for two months and they still can’t live in it!

Caitlin Johnstone recently observed that “I couldn’t stop thinking about what a scam rent is, where you pay your landlord to look after their investment”

Yeah, the government has really screwed up encouraging the market to turn a basic necessity for life into a highly competitive profit driven speculative venture.

Land and housing ownership need to be as unsexy, boring, and low profit margin as possible in order to keep roofs over peoples heads. A homeless population, or a population being bled dry by rapacious profiteers, is a danger to everyone, including the government.

I know, I know, poor people have never been constituents that matter when the “important” people make decisions.

There’s a 2004 documentary called Heroin Town about the closing down of the Hotel Hooker (named after Thomas Hooker actually), an erstwhile single-occupancy hotel in WIllimantic, CT (I grew up in the next town over). It’s worth a watch for anyone interested in this topic. And as to the title, some context:

https://www.cbsnews.com/news/heroin-town/

I should add that I love Willimantic and it’s got a lot more going on than this almost-two-decades-old hit piece implies.

little known fact, most junior congressional and senate staff live in shared houses because they cannot afford even a studio apartment. Our leaders are completely oblivious.

TBF, thats in DC where townhomes routinely go for 1.5-2 million and studio appartments (with large HOAs) go for over 500k. Thats hardly representative of the rest of the country.

And if those young professionals were willing to commute like much of middle America they could easily find condos in the 100-200k range and SFHs for 300-400k within an hour commute. Generally that demographic prefers living in the center of the city though where there’s a nightnife

within an hour commute.

that’s a pretty long commute…

Not for Californians. But I think that housing costs have risen so high that there is not any affordable housing inside the state.

I am sure that NC has explained this many times, but how is it economic to maintain so many vacant units? There is AT LEAST a vacant home for every homeless person, yet property values continue to rise, how is this possible?

Economy can maintain empty units as long as interest rates are kept below inflation rates.

And there are tons of those units as people speculate on price appreciation.

Housing has become an investment asset for the middle classes in order to hedge against stealth inflation that is not showing up on government stats but is felt by everyday people who do grocery shopping, pay for healthcare and have kids in college.

When you dont have access to Fed’s 0% interest loans, your next best bet is a 30year mortgage.

People buying houses and staying home those last 10 years made more money on asset appreciation than people working.

Why bother working when your labor is continuously devalued?

So many vacant units? Where?

In Boston, one of the most expensive markets, the vacancy rate was less than 2% in 2020 and has now “jumped” to only 5%.

The expensive markets do not have many vacancies, which is why they are expensive (supply and demand). If you give notice to your landlord that you are considering not extending your lease, your last 1-2 months in the unit there will be strangers entering your home with little or no notice every day so they can tour the unit. The landlords don’t want to leave units vacant more than a day.

I don’t know how accurate vacancy rates are but I see in the evening lights are out in about 30% of the buildings I walk by. Many of them are vacation rentals which means they are occupied 30% of the time, even less this year according to how easy it’s to park in the area.

No landlord will lease now with the eviction moratoriums still ongoing. This will create a lot of demand. Plus landlords will become stricter with the selections and increase the rents to compensate for future losses.

We had one small studio for rent and within a week we had more than 80 applicants. Stunning.

I expect bidding wars in rentals in the near future similar to what has been going on with housing.

More anecdata, but before the pandemic in Seattle it was estimated that about 30% of the empty apartments were not on the market.

This was also true during the 2008 housing crisis. How do you think people were able to stop making payments and then live in the houses for years? The banks kept the houses off the market.

A lot of London new build flats are vacant. A certain London mayor with a Boris nature called them safety deposit boxes in the sky. They exist to shelter the proceeds of capital flight. Rent is secondary to resale value. Having a tenant complicates sale and certain cultures will not buy a used house (e.g. East Asian). Think of them as very expensive box fresh trainers….

In other markets, valuation considerations and lending covenants may drive the preference for voids.

There wont be a housing crisis if the Fed had not embarked in a self appointed mission to inflate and keep asset prices high.

Why is the Fed protecting by hook or crook the asset owners?

What happened to their third congressional mandate of keeping interest rates “moderate”?

There is tremendous pressure on rents since January, and I mean 15 to 30% increases, at least in SoCal where I follow the markets. This will only get worse.

Yes, one cannot help but look at this problem and see the Fed, but I would also add in Obama and his putting Wall St right back in the driver’s seat after they crashed the world economy, and nobody goes to jail.

We are long past the point where the Fed’s actions to “save America” have further wrecked America. It is a complete failure of the American elites, an end of even the thin veneer of capitalism’s supposed meritocracy. The collapse of 2008 was when the housing values should have reset, and thrown the Wall St crooks in jail, but this never happen. Instead we have a system where the Fed bails out the failures of the elites in perpetuity, until it cannot.

Which is unfortunate in the extreme. We’re going to need the Fed’s printing press to handle the real problems in front of us. How do we house our people? What do we do to provide them with purpose, and give them meaningful work? We have plenty of problems which need immediate action, and ensuring that the elites remain rich is not one of them.

House prices did reset in 2008. But the Fed discovered a new toy — Quantitative Easing — and has been using it ever since to ensure 2008 never happens again

House prices did not reset, they partially reset. During a crisis interest rates should rise to compensate for risk. Instead the Fed bailed out the debt holders instead of allowing the lawful (though very painful) process of liquidation. Instead we got bailouts Trump and long term unaffordability!

@Glen — thank you for this comment. It should be shared far and wide.

I think the answer might be they don’t house the homeless…they dont worry about their purpose..they don’t give them meaningful work. As long as the right people are making bank, its not something they care about. And any breakdown in “social cohesion” can be handled in numerous ways.

(Not so) Funny how commodity price inflation scares the bejesus out of everyone, yet asset price inflation is coddled like a newborn….

The “elephant in the room” comes to mind, and this elephant is greedy and encouraged by the bull elephants…

Some old concepts may find their way into contemporary media.

Here are a few to ponder, from Wiki.

Manorialism, also known as the manor system or manorial system, was the method of land ownership in parts of Europe, notably England, during the Middle Ages. It was an organising principle of rural economies which gave legal and economic powers to a lord of the manor. If the core of feudalism is defined as a set of legal and military relationships among nobles, manorialism extended this system to the legal and economic relationships between nobles and peasants. Manorialism is sometimes included in the definition of feudalism. Each lord of the manor was supported economically from his own direct landholding in a manor, and from the obligatory contributions of a legally subject part of the peasant population under his jurisdiction and that of his manorial court. These obligations could be payable in several ways, in labour, in kind or in coin.

Corvée is a form of unpaid, forced labour, which is intermittent in nature and which lasts limited periods of time: typically only a certain number of days’ work each year. Statute labour is a corvée imposed by a state for the purposes of public works. As such it represents a form of levy.

Corvée is a form of unpaid labour — not really forced at all

Often not cited in these articles, and commentary, is the fact of FLATS , two to three levels in old housing, provided the most affordable housing for workers and families from post WW2 to present. Entire floors in big old housing. Not restricted to SF where I’ve lived for over 30 years, but NY, and many midwestern cities also. I know very few people that moved to SF in the mid 80’s, from the ‘center’ that expected to afford a ‘single studio’. And in fact loved to live with 3 or 4 people in dense flat situations. (of course, due to the beauty, walk to work etc also)….The massive speculation and gentrification from late 90’s and now rapidly fueled by hot money since 2009, has destroyed over 20,000 ‘flat’ type living situations in San Francisco alone..Outside of NY the Mission District was the most densely populated area in the country 80’s to mid 90’s with mostly only three level housing. From reading many urban studies books, including Power Broker, much was the same in other cities. My view is that we should center on ‘floors’ of housing with multiple roommates or families. Not apartments. Most of my working class Bay Area friends agree.

Some more anecdata to throw into the mix:

Before the CV pandemic started, it was estimated that 40% of the homeless in the Seattle area were working – they just could not afford a place to live close enough to where they worked (i.e. downtown Seattle).

May be some Internet workers who can work from home can relocate to cheaper countries, USA is becoming too expensive if you don’t have a substantial wage.

After living in USA several years, I relocated to my home town, Buenos Aires, in Argentina, and bought a one room apartment for less than 50.000 USD, near the city downtown. All my utilities (municipal tax + internet + water + gas + electricity) sum less than 50 USD monhtly. And I have top of the line private healthcare (since I don’t want to use the public free healthcare) for 150 USD more.

Sure, it is a third world country, but dollars go a long way here.

you can’t just relocate to a cheaper country. It’s an ordeal, I lived abroad for 15 years

I did that (“digital nomad”) for a while including briefly in BA.

The thing is that no other country welcomes foreigners into society the way US/CA/UK/AU/NZ do. You are at best an outsider, and fairly often, subject to personal abuse. People who don’t speak the local language can imagine a fool’s paradise where everyone loves them, and even enjoy all the people using them for English practice, but that is a very limited existence.

Seriously, try pretending to be a “shanqui” and see how people treat you. It is fun the first few times but gets alienating fast.

And that’s before you get into immigration issues. Or taking care of aging relatives.

I lived in BSAS for a few months in 11 as a digital nomad. It’s a giant unfriendly city, but so is NY. I remember Argentina as being more welcoming than most places for that sort, but mostly because Argentina perennially limps from crisis to crisis. I seriously doubt that today any habitable area of BSAS has decent condos for 50k. In SA housing is your savings plan, even more than here. For comparison I’ve also lived in Medellin, Lima and Sydney.

Crash the housing market on a regular basis and you’ll see all the buy to rent schmucks flee the market.

It’s almost like Henry George had this sussed 140 years ago …

My great grandfather, his daughter–my grandmother, and her daughter–my mother, were all dedicated Georgists. They’re with Henry George now, and the four of them are looking down on us and chuckling at our folly.

My grandmother told a hundred times if she told it once, the story of George, when he was running for mayor of NYC, being heckled by a critic who cried out “All right, Mr. George, tell you what. I’ll take all the factories in the world, all the machinery, all the productive capacity, and all the money — and give you all the land. Just what would you do?”

“Well,” George replied, “I’d ask you to move.”

The problem with the land meme is its no longer applicable …

You mean, because Bezos thinks he can colonize Mars? (Actually, I think he’s just planning to take over New Zealand.)

Surely as we have less and less land due to oceans rising, that land will be less and less available to, let’s just say, “the common folk.”

How does capitalism actually work?

The Classical Economists started to find out, but their conclusions didn’t go down very well at all.

Many of those at the top were just parasites riding on the back of everyone else’s hard work.

The Classical Economist, Adam Smith:

“The labour and time of the poor is in civilised countries sacrificed to the maintaining of the rich in ease and luxury. The Landlord is maintained in idleness and luxury by the labour of his tenants. The moneyed man is supported by his extractions from the industrious merchant and the needy who are obliged to support him in ease by a return for the use of his money. But every savage has the full fruits of his own labours; there are no landlords, no usurers and no tax gatherers.”

What can they do?

They need a new economics, and fast.

Neoclassical economics.

The early neoclassical economists hid the problems of rentier activity in the economy by removing the difference between “earned” and “unearned” income and they conflated “land” with “capital”.

They took the focus off the cost of living that had been so important to the Classical Economists as this is where rentier activity in the economy shows up.

It’s so well hidden that everyone trips up over the cost of living, even the Chinese.

Disposable income = wages – (taxes + the cost of living)

“Who put that other term in the brackets with taxes?” neoliberal policymakers

They don’t know it’s there.

Someone from the CBI (Confederation of British Industry) has just seen the equation.

Disposable income = wages – (taxes + the cost of living)

Two seconds later …..

They realise the UK’s high housing costs push up wages and are actually paid by the UK’s employers reducing profit.

Employees do get their money from wages, so employers are actually paying through wages.

Now we’re getting somewhere.

You should keep housing costs low as employers have to pay these costs in wages, reducing profit.

Who pays?

It’s the right question, but we keep getting the wrong answer with neoclassical economics.

Employees get their money from wages and it is employers that are paying, via wages, reducing profit.

Everyone pays their own way.

Employees get their money from wages.

The employer pays the way for all their employees, via wages, reducing profit.

No wonder all our firms are off-shoring.

Capitalism actually works best with a low cost of living, but no one can see that with neoclassical economics.

It’s rentier economics, it’s designed to be like that.

To badly twist another phrase, “It’s rentiers all the way down.” Right down to the asphalt.

I lived in BSAS for a few months in 11 as a digital nomad. It’s a giant unfriendly city, but so is NY. I remember Argentina as being more welcoming than most places for that sort, but mostly because Argentina perennially limps from crisis to crisis. I seriously doubt that today any habitable area of BSAS has decent condos for 50k. In SA housing is your savings plan, even more than here. For comparison I’ve also lived in Medellin, Lima and Sydney.