Yves here. Retirees are typically worried if their limited incomes are losing too much ground to inflation. Wolf Richter argues that the upcoming Social Security increase will fall short of inflation. Mind you, that’s what it’s been designed to do as a result of “reforms” implemented in the early 1990s. What I wonder is how the mix of goods showing hefty price increases (new and used cars, lumber, food) matches up with the typical senior consumption basket. Seniors do eat but they tend to underconsume home renovation and car purchases, for instance.

By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street

Among the inflation data released today by the Bureau of Labor Statistics was the Consumer Price Index for All Urban Wage Earners and Clerical Workers (CPI-W), which is used to calculate the Cost of Living Adjustment (COLA) for Social Security benefits.

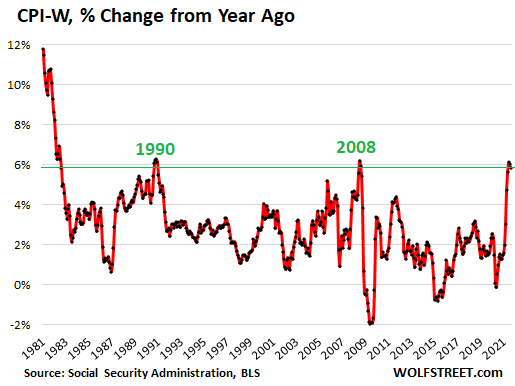

For August, the CPI-W jumped 5.8% year-over-year. In July, it had jumped by 6.0%, in June by 6.1%. The summer readings are the highest since July 2008, and before then, since 1990:

By comparison, the regular headline inflation number that was released today, CPI-U, rose by 5.3% year-over-year.

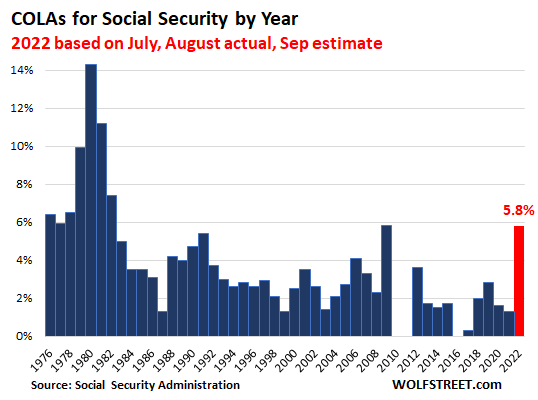

The COLA to be applied to Social Security benefits starting in January 2022 is based on the average year-over-year percentage increase of CPI-W in July (6.0%), August (5.8%), and September (to be released a month from now).

If the September reading comes in at 5.6%, the COLA for 2022 would be 5.8% (the average of July’s 6.0%, August’s 5.8%, and September’s 5.6%). This 5.8% would match the COLA of 2009. Both would be the highest since 1982 (7.4%).

When the September value of CPI-W is released in about a month, we can estimate with some accuracy what the COLA for 2022 will be (red = estimate based on actual July and August and September projection of 5.6%):

While this type of COLA will provide some relief from the price increases that have been gnawing away at fixed incomes, it will still be insufficient to compensate for the surging costs that individuals may face in housing and other major expenses, depending on their situation and location.

If the beneficiary rents in a city where rents have been soaring in the double digits, a 5.8% COLA won’t go far. If a beneficiary drives a lot, the 43% jump in gasoline prices is going to hurt. Used vehicle prices are up 32% from a year ago, new vehicle prices 7.6%.

Housing costs account for nearly one-third of the regular CPI. But the index for housing costs has been repressed by the method in which it is calculated. The index for rent rose only 2.1% and the index for the costs of homeownership rose only 2.6%, while home prices have soared at rates not seen in the decades for which we have data: 23% according to the National Association of Realtors, and 19% according to the Case-Shiller Index (I explain the disconnect in housing inflation and CPI with a stunning chart).

Then there are healthcare costs, which can be a major issue, despite all the parts of Medicare.

The COLA for 2021 was only 1.3%, which was based on the average of CPI-W in July, August, and September 2020, when CPI readings happened to be very low. So, given the price surges in 2021, that lousy 1.3% COLA this year is leaving many people deeply in the hole. And now, a lot of big expenditure categories have already outrun what might be a 5.8% COLA next year.

Inflation means the dollar loses purchasing power. And over time, COLAs will be purposefully insufficient to compensate beneficiaries for the actual loss of the purchasing power of the dollar as encountered in real life. If Social Security payments are the only source of income, actual inflation, as encountered in real life, will nearly guarantee a continual slow reduction in the standard of living.

For this reason, it’s important to have a nest egg with a combination of assets, and/or create or maintain an additional income stream for as long as possible, preferably something that is fun to do and keeps people active and engaged. Even a small-ish income stream helps out in a major way. Inflation, as encountered in real life, is the enemy of fixed incomes, even if those incomes are adjusted for inflation because those adjustments are likely insufficient to compensate for the actual loss of purchasing power of the dollar.

This reporting is especially suspect because of how much time Wolf spends complaining about what’s considered in an index’s basket of goods, and that people shouldn’t receive state money for not working.

How does Wolf’s opinion on aid change the math of how COLA is calculated? And are you arguing that inflation is over-counted, because the current basket of goods is designed to undercount it (I’m not why sure complaining about what’s considered would be a critique otherwise)?

It doesn’t change the methodology or the numbers, but it’s suspect whenever someone practices that type of motivated reasoning, flips flops, and then makes these conclusions.

He’ll rail against “free money” driving up inflation and keeping people out of the workforce, but here he’s suggesting the “free money” isn’t enough to keep up with inflation and that some people might need to rejoin the workforce.

The important distinction for him is clearly who happens to be on the other end of his moralizing stick.

Thanks for this post. The CPI calculation used to adjust SS benefits also affects military retirement benefits and military disability benefits. Remember this the next you hear some politician proclaiming he supports the troops.

https://themilitarywallet.com/chained-cpi-decreases-cola-adjustments/

As a senior, I feel obliged to comment on Yves remark on seniors’ underconsumption of home improvements and car purchases. While we won’t be adding new home additions or buying a new car, we’ve had to replace appliances and our HVAC system (no longer repairable) and we’ve experienced large delays (3 months for a/c equipment) and unbelievable price increases. And to repair my 2007 BMW wagon with only 100,000 miles, annual maintenance costs are nearly 50% of the resale value.

The maintenance costs are not what have been skyrocketing for cars. It’s the implicit cost increases for new cars, with the degradation of features due to chip scarcity, and the explosion in used car prices. We’ve had to have our 2003 Buick have some fixes and I haven’t seen that the shop has increased its charges.

I keep telling my wife that we should buy American.

Thank you for this information and some explanation about how the ss cola is calculated. I see a downward trend from July to sept each year. Curious that other months are high except those three. Is there a monthly chart for say the last 3-4 years to share?

Thank you for this information,I am a retiree who truly depends on my ss money.

You are not alone in depending mainly on Social Security for living expenses. Many of us just scraped by over the years and, in our case at least, sank our discretionary income into buying a house. That left nothing significant for “Investments.”

I dabbled in the stock market when young, but ‘things’ were different then. One could at least have faith in the PE ratio meaning something as far as investment decision making went. I never made anything noteworthy as far as profits went. The game of it all was a big part of the allure. As long as you didn’t mortgage the house and invest the rent money, you could suffer the shocks and come out intact.

I remember seeing television and film tropes about financial investments being the purview of the wealthy. One fifties film had a musical number about “clipping cupons, counting interest,” as a comedic image. Who from our age cohort doesn’t know Mr. and Mrs. Howell from “Gilligan’s Island?” These have been promoted as role models for the middle class in America. Something and someones to be aspired to and, thus, accepted as normal and tolerated. “You too can become Rich! [Put down that pitchfork friend.]”

One big ‘lesson’ we are trying to ‘front run’ today is that Hard Times are coming for the lower 90%.

Stay safe!

One could at least have faith in the PE ratio meaning something as far as investment decision making went.

Yes, investment was not based on trading. Now, a well compensated CEO studies the stock price rather than the profit or that ancient relic–dividends. Widows and orphans (and retired people) cannot rest on “blue chips.” The stock market is all about gambling.

Just 799 days, 23 hours, 11 minutes & 43 seconds until I can claim back the entitlement I put $XXX,XXX.xx into, but i’m not anxious or anything.

Don’t be anxious. You live in a defensible position. Once the fire, hopefully, passes you by, you can settle in to a guaranteed few decades of fire safe living.

If worst comes to worst, you are pretty close to the Nevada border. You can claim asylum there and survive the Californapocalypse.

Stay safe. Fingers and toes crossed!

Unfortunately our sense of community was burned out by vacation rentals, and i’m loath to call on Bob & Betty Bitchin’ from Burbank and their adoring kids Trevor & Truly if I need them in a pinch, for they’re only here on a 3 day tour-a 3 day tour.

noting:

several of my women friends in their seventies and eighties have lived in homes they owned that had become unlivable/unsafe due to their inability to pay for needed structural maintenance over many years. e.g. roofs, basements, floors, plumbing. these were old houses when they bought them in midlife; they bought what they could afford, which was not very much. in two cases, wood floorboards gave out and were never replaced. in one of these, a visitor fell into the basement, and the home was declared uninhabitable.

these women were used to their homes and did not want to move out. eventually social services kicked in, the properties were sold (not for very much), and the owners were moved into low-income senior housing.

my point is simply that today, in my sixties and better informed, whenever i pass a run-down home on a road or street, i now understand that i may be looking at one with an elder inside, more likely female, who may have been divorced involuntarily in midlife, who has been living for years on social security only (and, by the way, has been paying property taxes). and supplies of low-income senior housing nowadays in most states (unlike the state i live in) are miserably low or nonexistent.

just a comment on elders’ housing issues. old ladies, especially, whose SS is usually lower–especially for those of the generation who were not taught to save for their own future.

. . .and not talking about the stage where one needs cohabitation with relatives or institutionalization for care, which is a whole other issue.

That’s very fortunate that these women were transferred to low income senior housing. I’m not readily familiar with any state that does this. But I completely understand. It’s often extremely difficult for older women, particularly if they had patchy paid work. I had a very close friend in NJ whom, despite owning her home, had to sell it due to property taxes. After moving to a tiny apartment in another neighborhood, she later became ill with Alzheimer’s and we literally couldn’t find her.

And then there’s this:

Wow, this is the truth. A good Medicare B policy and D policy, necessary particularly if one is chronically ill, are amazingly expensive. Those would be out of reach if you’re solely on Social Security, imho. (Which is why there will be a huge push for good old Medicare Advantage.)

Every year I inch further below the FPL My minimal SS might increase slightly but my even more minimal pension never changes. I own my house but half of the plumbing doesn’t work and it won’t be fixed with me. My property taxes keep increasing, though I do get a major chunk back at tax time. Still I have to put the money up out front, which I always borrow. It could be worse and probably is for a lot of people. If I budget carefully I end each month with a little over while having had enough to eat.