Yves here. Admittedly I have a warped sample from here in Alabama, but our aides, who tell stories of the messes in their lives and those of family members (like how catastrophic a car breakdown or emergency root canal can be for finances) are giving me a far more graphic picture of the life of the just-above-poverty class is like. For instance, the mother of one aide’s boyfriend is dying slowly of gangrene. They keep cutting more pieces off her but the end point seems inevitable.

The point for this sort of intro is Wolf Richter keeps banging on about overstimulated consumers. This “overstimulation” has not helped the near poor down here, as far as I can tell. By contrast, I have no idea why it was deemed necessary for me to get a $1400 check. That money should have been used for a business mandate for all workers, including contractors, to take 2 days off for Covid shots and reactions, no questions asked. The businesses have to comply; they’d get reimbursed for missed days for hourly workers and salaried workers working <2 days a week remotely. The rule could also provide for big bounties for whistleblowers who reported violations and firings. Carrots like that would have helped a great deal in increasing Covid vaccinations, which like it or not, is a fixation of current policy.

But aside from the fact that our current leaders seem allergic to doing anything practical, another might be admitting that many people have serious enough reactions to make sick days an important policy measure.

By Wolf Richter. Originally published at Wolf Street

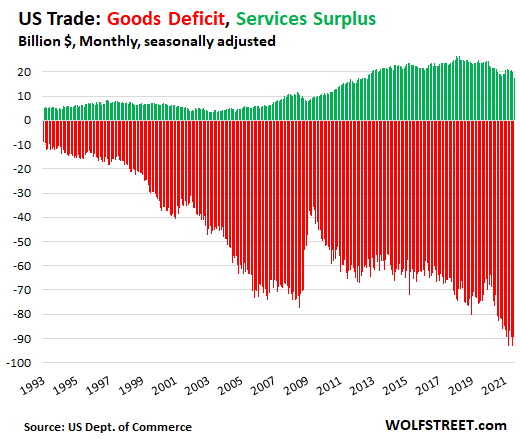

Back when offshoring production by Corporate America to cheap countries was hailed as good for the overall economy, rather than just good for Corporate America, any fears about potentially exploding trade deficits were papered over with visions of the new American Dream: America was great at producing and selling high-value services – the financialization of everything, movies, software, business services, IT services, etc. Exports of these high-value services would make up for the imports of cheap goods. And trade would balance out.

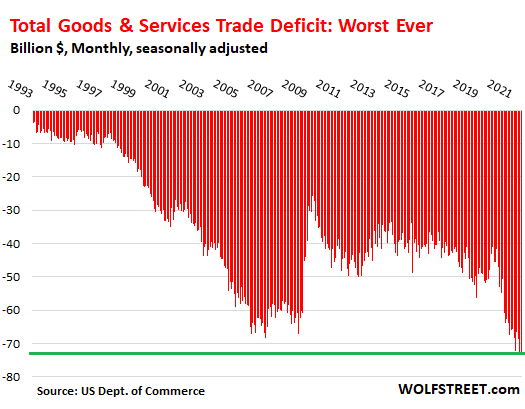

Today, we got another dose of just how spectacularly this strategy has failed. The overall trade deficit in goods and services hit a new all-time worst in August of $73 billion (seasonally adjusted), according to the Commerce Department today.

The trade balance in services deteriorated to a surplus of only $16.1 billion, the lowest since 2011, while imports of goods reached the worst ever $239 billion, and exports of goods edged up to a record of $150 billion, thanks to $33 billion in exports of crude oil, petroleum products, natural gas, natural gas liquids, products from the petrochemical industry, and coal.

Following the Financial Crisis, the overall trade deficit improved substantially, as imports plunged as consumers cut back on buying imported goods. That was the one major strength in the GDP formula for those months, as nearly everything else cratered. But it didn’t last long.

During the Pandemic, the opposite happened: Consumer demand exploded, fueled by $4.5 trillion in monetary stimulus and $5 trillion in borrowed fiscal stimulus, for the most grotesquely overstimulated economy ever.

It fired up imports of goods and boosted foreign manufacturers and caused the worst supply-chain problems and transportation chaos ever, but did little for what would really move the needle: US exports.

Trade deficits are not a sign of a growing economy, and they’re not a sign of economic strength, but a sign of continued large-scale offshoring of production by Corporate America of consumer and industrial goods to cheap countries.

Imports are a negative in the GDP calculation; exports are a positive. And GDP in Q2 was hit hard by the record trade deficit and disappointed expectations.

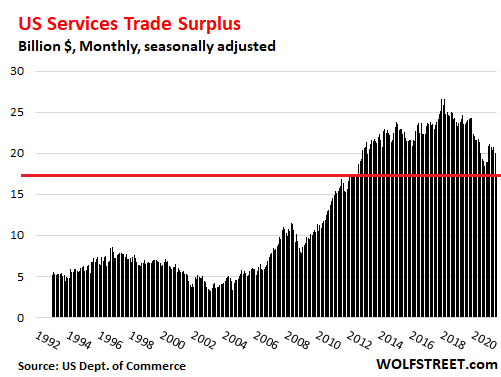

Services: the American Dream-Not-Come-True

The trade surplus in services (exports of services minus imports of services) in August fell to $16.1 billion, the lowest since December 2011, and was down 33% from the average month in 2019. And it was dwarfed by the immense trade deficit in goods (exports of goods minus imports of goods) of $89.4 billion.

Exports of services, the product of American genius, ticked down to $64 billion in August, and imports of services rose to $47.9 billion. The difference between these exports and imports is the fizzling and small trade surplus in services:

Turns out that in this American Dream-Not-Come-True, it wasn’t the American genius of exporting the financialization of everything, IT services, business services such as consulting and auditing, that would dominate, though they’re clearly very good. For example, Chinese property developer Evergrande, whose shares are traded, I mean were traded, in Hong Kong, was audited by an all-American institution of genius, PwC and got a clean bill of health. So these are truly high-value services exports.

But no, that’s not what is dominating US services exports. So what is dominating – or rather was dominating?

Foreign travelers coming to the US for business, personal, educational, or healthcare reasons; their spending on lodging and other travel expenses in the US, and spending by foreign students on tuition, room, and board in the US are part of “services exports.”

In 2019, travel spending by foreigners in the US was the #1 category of exports and blew away the American genius categories of #2, business services, and the distant #3, financial services.

Then in 2020, foreign tourism in the US collapsed as borders closed. Over the first eight months in 2021, foreign travel spending in the US was still down by 70% from the same period in 2019. And in August, it was down 68%.

Business services, financial services, and fees from the use of intellectual property – the #2, #3, and #4 services exports in 2019 – grew this year, but not enough to make up for the loss in the travel category.

The table shows the major categories of exports of services in August 2021 and year-to-date 2021, compared to 2019. This is the American genius that is supposed to balance out the massive trade deficit in goods (if the 7-column table gets clipped on the right, hold your smartphone in landscape position):

| Exports of services | Billion $ | % Diff | Billion $ | Diff % | ||

| Aug

2019 |

Aug

2021 |

YDY

2019 |

YTD

2021 |

|||

| Travel | 16.2 | 5.3 | -68% | 132.8 | 40.2 | -70% |

| Other Business Services | 15.7 | 17.3 | 10% | 123.5 | 134.4 | 9% |

| Financial Services | 11.2 | 13.6 | 22% | 90.6 | 107.1 | 18% |

| Fees, Intellectual Property | 9.5 | 10.8 | 13% | 76.5 | 82.7 | 8% |

| Transport | 7.6 | 5.2 | -31% | 60.8 | 40.2 | -34% |

| IT services | 4.7 | 4.7 | 1% | 36.0 | 38.2 | 6% |

| Maintenance, Repair | 2.3 | 1.0 | -59% | 18.2 | 7.9 | -57% |

| Gov. Goods and Services | 2.0 | 1.9 | -9% | 15.0 | 15.4 | 2% |

| Personal, Cultural, Recr. Services | 1.8 | 2.3 | 22% | 14.9 | 16.3 | 9% |

| Insurance | 1.6 | 1.9 | 17% | 12.2 | 14.5 | 19% |

| Construction services | 0.3 | 0.2 | -16% | 2.1 | 1.8 | -15% |

Services surplus v. goods deficit.

The declining and small surplus in services (green in the chart below) and the huge and worsening deficit in goods (red in the chart below) paint the picture of US trade: Out-of-control imports of goods by Corporate America lead to out-of-control trade deficits in goods despite the surge in exports of products based on petroleum and natural gas. The exports of American genius — services — have never come anywhere near even papering over the massive trade deficit in goods. And it’s not even going in the right direction:

Kate Raworth (Doughnut Economics) and Tim Jackson (Post Growth: Life After Capitalism) have both enlightened me about another “benefit” of offshoring manufacturing. Neoliberal shills like Bruce Yandle (a Koch hireling at George Mason) have been claiming that economic growth actually benefits the environment. This highly counter-intuitive claim was buttressed by data showing that rich countries like those in the OECD were seeing significant increases in efficiency of energy use and were supposedly de-linking economic growth and carbon emissions. The claim was that economic growth plotted against environmental damage, including carbon emissions, looked like the Kuznets Inequality Curve (another fairy tale)

That was until somebody asked the question whether they were including the energy costs of imported goods. Oops.

When these rich nations’ global material footprint was calculated, including the footprint for imported goods, negative environmental impacts for those rich nations continued to grow in lockstep with economic growth.

So offshoring had the effect of an apparent reduction in carbon emissions because of the reduction in manufacturing. That apparent reduction was a lie, however.

See Kate Raworth, Doughnut Economics, p. 179.

On top of this, add a crap-ton of filthy bunker fuel required to ship goods back from where the jobs were exported.

what wolf said about the genius, is word for word what nafta billy clinton said as he destroyed over 200 years of american wealth and innovation, free trade is a win win!

its why wolf needs to start demonizing these con artists and grifters that did this to us.

and the UBI people who refuse to recognize, that under free trade, a UBI would just super charge this mess, and create even more instability.

keynes warned against free trading, and any added stimulus would just go offshore.

cash for clunkers stimulated germany, korea, japan, and china, not so much for americans. and the dim wit obama called it a success.

these dim wits need to be publicly demonized and embarrassed. other wise the deplorable will and are being made the scapegoats.

why don’t the deplorable learn how to code, nafta joe biden said that in public to a deplorable.

it took 30 years to get into this mess, might take that long or longer to extract us out of this mess nafta billy made of america. if we can extract ourselves that is. i have my doubts.

watch this interview from 1994, some people knew exactly what was going on.

https://www.youtube.com/watch?v=wwmOkaKh3-s&t=2264s

i remember watching that interview. it was great. someone who knew where their bread was buttered.

it should be required watching for every high schooler, and it should be required for every congress critter, and it should be the basis for a truth commission before the inevitable hammer comes down on the deplorable, that its all their fault, the dummies never learned how to code.

here is another one,

clintons own advisors warned him a economic disaster would be the direct result of his free trade policies, he ignored them, and sold us out to the chinese communist party and wall street, and we reached that disaster by 2008.

http://www.epi.org/publication/issuebriefs_ib137/

Yeah true, but I must have forgotten the Repub controlled House and Senate trying to stop him.. Maybe they were too busy deregulating everything…

Do remember Ross Perot’s very accurate ‘Giant sucking sound’ one-liner..

He got 20% of the vote.

That video has been on youtube since 2015 and less than 80K views. We need to get PewDeePie to link to it…..

Thank you so much for the link. I had nearly forgotten about Goldsmith. Too bad no one listened to him nearly 30 years ago.

Back in that time frame I attended a forum at which a veteran and renowned foreign correspondent based in London for a major US newspaper spoke and took questions. I asked him what he thought of Goldsmith, and the correspondent basically brushed off the question, dismissing Goldsmith as a crank.

Perhaps if we had listened to “cranks” like that back then, we wouldn’t have ended up with clowns like Trump occupying the White House.

The tragedy is that you dont need a degree in economics to understand what Goldsmith is saying, total common sense for anyone willing to listen. Laura Tayson was totally wrong and unbelievable, yet she was the one making the policy. Credo quia absurdum.

here is another good one, basically says free trade is complete economic nonsense.

does not name names, that is bad, but you get the point.

https://www.counterpunch.org/2021/10/06/globalization-meets-entropy-and-we-lose/

Also Goldsmith’s book, “The Trap”

Great link. Fascinating interview. All the more fascinating and authoritative in my opinion given Goldsmith’s background as a well-connected global aristocrat and successful capitalist. I’m guessing he probably realized the relationship between his first major objection and his second major objection to GATT (comes up around the 36 minute mark); The promotion of western-style corporate agriculture abroad leading to the immiseration of the subsistence farmer of the global south. Being an astute businessman and a student of European history I imagine he either knew or suspected the planned effect of creating an immiserated pool of surplus urban labor was to provide an abundant pool of cheap factory workers for multinationals relocating production overseas just as the English Enclosure movement paved the way for the first industrial revolution. I’m guessing he didn’t want to clearly articulate the obvious link between his two objections to GATT making himself appear as a tin-foil-hatter, his interlocutors who were extremely hostile to his globalist heterodoxy would have pounced.

Eh, a UBI wouldn’t help with exports, but it would spread the consumption more evenly. Import excise Carbon taxes, possibly with domestic carbon taxes would help, which are what I think that a UBI should be paired with.

i am not interested that much in exports. in the 1950’s the share of exports in GDP was actually under 10%, closer to 8-9%. which meant that the american worker under the protectionist new deal, consumed over 90% of what we made.

the well paid innovating american worker, otherwise known as the deplorable today, were well paid, and production is the real wealth of a nation.

wolf acknowledges that.

i am not against a UBI, what i am against is a UBI under free trade. as wolf points out, that stimulus flows offshore, creates world wide havoc, and does nothing for the american economy nor for the deplorable.

the 2008 crash was more than the results of nafta billy clintons deregulation, a lot of it was because of the trade deficit, and the blowout of millions of unionized high paid workers, who could no longer pay their bills. that is what helped blow out the worlds economy.

dean baker clearly lays out that every thing the free traders believed in, was hogwash that left america in deep poverty racked by severe shortages.

dean baker clearly says its not chinas fault, its the fault of nafta democras and GATT like trade is our best bet

https://www.counterpunch.org/2021/09/27/the-us-and-china-a-productive-path-forward/

have a UBI under Gatt, bring back GATT. also couple it with a jobs guarantee.

keynes warned against extra stimulus under free trade. it flows offshore. we saw that with cash for clunkers, and now.

At the level of overall National balance, if America did not import anything, America would not need to export anything because America would not be having any imports to be paid for by exports intended to raise the money to pay for them at the National balance level.

We should get back to having as close to zero trade as possible in either direction, and the necessary-evil trade we can’t prevent should be draconianly regulated for exact fairness and balance.

under protectionism, you buy offshore what you have to, you sell what you can. but with most of the GDP coming from well paid workers who can consume most of what is produced, exports become just a minor thing.

of course it was nafta billy clinton disastrous policies that elected trump, and if those policies are not reversed, nafta democrats will lose again

Democrats Lost the Most in Midwestern ‘Factory Towns,’ Report Says

DUH, the 82-page report explicitly links Democratic decline in the region that elected Donald Trump in 2016 to the sort of deindustrialization that has weakened liberal parties around the world.

AND THE FREE TRADERS SIMPLY CANNOT UNDERSTAND WHY, and cling to trump derangement syndrome

https://www.yahoo.com/news/democrats-lost-most-midwestern-factory-114643377.html

I remeber reading stories back in ’09 which claimed when the ‘cash for clunkers’ plan was drafted it originally included a ‘Buy American’ provision but it “had to be” stripped out suposedly due to WTO treaty language related to state subsidies. (Perhaps it was actually a Toyota lobbyist at work?) More fuel for your argument regarding the self-defeating nature of free trade agreements, just wanted to point out that sometimes politicians aren’t as clueless as they pretend to be regarding trade and how the economy works, they’re just corrupt and indifferent.

Found this old story: https://www.mlive.com/auto/2009/08/debbie_stabenow_buy_american_f.html

So what you’re saying is that Trump’s campaign promise to bring manufacturing back to the U.S. failed, bigly. And are the tax incentives still in place that makes off-shore manufacture attractive? If so, then a failure of not merely Trump but both parties, who are in thrall of business interests, the common working man be damned.

Yup, I had a hunch this was going to be Trump’s fault/failure, somehow, in the end. Ross Perot, where did ya go?

what trump did do though, was break the back of nafta billy clintons free trade, which had so much of america enthralled. the deplorable that voted for trump in droves, were not enthralled at all by nafta billy clintons free trade.

under nafta billy clintons free trade, they lost their jobs, homes, wealth and pensions, and this spread through the american economy like a hot knife through butter, resulting in the 2007-2008 world wide economic collapse.

so it was easy for a trump type to win. and the nafta democrats are at it again, they will hand it to trump on a silver platter.

trump got ride of the investor dispute kangaroo courts, for a while a had the fascist corporate kangaroo court W.T.O. on its back, nafta joe biden called it the rules based economy, and he pulled us out of the TPP.

he needed to do way more. so yes he was not organized, and he was a fraud, but, the deplorable saw him better than a nafta democrat, not once, but twice.

that is how low the bar is under nafta democrats.

I get the feeling Wolfie is being sarcastic when he refers to the “exports of American genius” (our services). Just looking at this info it is apparent that if we are exporting our favorite-all-time commodity – petroleum products – then we have to buy the manufactured goods it produces for export in those countries… that is, if we want to keep exporting our lovely petroleum products. Why would anyone puzzle over this? Clearly the best way to lower our trade deficit is to stop selling petroleum products. All we do is facilitate productivity in other countries by facilitating the use of industrial machinery for manufacturing in order to produce cheaper goods at cheaper rates of labor in order to make a profit on the goods sold in trade back to this country. This really is not a trade deficit. It’s just another scam.

Susan the other:

I enjoyed this zinger about exports of American genius:

For example, Chinese property developer Evergrande, whose shares are traded, I mean were traded, in Hong Kong, was audited by an all-American institution of genius, PwC and got a clean bill of health. So these are truly high-value services exports.

It makes one realize all the more that someone like Buttigieg, with his peculiar training as a consultant, is an example of American genius colonizing itself. We are the McKinseyBananaRepublic.

https://en.wikipedia.org/wiki/Elite_overproduction

In fairness, if the elites were mostly taking liberal arts degrees in the classics, or philosophy, or even history, that would be good. Instead, they are degrees like MBAs. The former teach you how to think while latter is teaching you the art of profitable destruction while not thinking.

remember, a third world economy exports unfinished commodities and agricultural products. before nafta billys free trade we were still a first world country. today under nafta billys free trade, we are a banana republic, without the bananas.

i think it was the clearly genius dim wits, hillery clinton and empty suit hollowman obama that lifted the restrictens on petroleum exports. this was to offset imports, clearly a third world policy.

could be wrong, might have been others, but i remember it being mentioned by those geniuses.

As long as the “infrastructure” bill has lots of tax dollars for ports on the coast and other methods of bringing goods into the U.S., everything should be all right again. America doesn’t make anything anymore except asset price inflation, so it’s not like we need to care about making jobs for folks with no assets, who at some point in the past used make the stuff we buy. Because we can just import to replace what those jobs used to make. And as long as China and nations like those in Latin America think it benefits them to hoard USD, we can keep doing this forever.

I’m surprised the Financial and IT services are showing up at all. The MNC’s all have offshore entities they book overseas revenue to. If it is flowing into the the US, that has to be a result of some tax break strategy.

There are a number of rather opaque policies that have contributed to the US trade deficit:

The US dollar as the primary global reserve currency is key to the global power of politically influential US constituencies, along with control of global markets and being the only nation that possesses the capacity to project military force globally.

Debt denominated in US dollars is key to influence over commodity-based and emerging manufacturing-based foreign economies, to enable US weapons systems sales, and to the global influence of large international banks. The capacity of the debtors to service their US dollar debts requires more US dollars be distributed than are required in payment for US exports of products and services, the very definition of a trade deficit.

Suppression of US labor costs due to US labor being required to compete with low-cost foreign manufacturers has disempowered and disenfranchised US labor to the benefit of capital.

As Warren Mosler has long argued, imports are real benefits, exports are real costs.

Unfortunately, these policies have also led to:

Long-term loss of US manufacturing capabilities, as former Intel CEO Andy Grove accurately predicted way back in the early 1980s.

Suppression of US labor incomes and jobs losses due to US labor being required to compete with low-cost foreign manufacturers has materially contributed to economic malaise and social unrest.

To supplement former U.S. Treasury Secretary James Baker’s famous statement, the US dollar is our currency AND our problem. The questions we Americans should be asking about policies that are leading to a diminishing quality of life and economic and political disenfranchisement for the majority of Americans are Why this is so, What can be done to address it, and How? Channel Keynes at Bretton Woods?

Yves’ experience with the near poor in Alabama struck a chord with my wife and me. We just moved from upstate New York where, over nearly 5 years, we encountered similar stories (though none quite so dire as the woman dying of gangrene). We constantly marveled at the hard work, ingenuity and resilience of people bearing various seemingly impossible burdens that would have crushed either one of us. I quickly grew to love those people, who also BTW were invariably kind and helpful.

I moved from South Africa to Upstate New York in 1977.

The NY level of poverty was close to as the South Africa Townships. The towns west of Woodstock and West Hurley were very poor.

At least SA was much warmer than NY,

Welcome to Walmart.

Get your shit and get out.

Oh boy…Hapsburg Spain redux?

I’d love to see a similar breakdown for Canada. As a climatologist, I have no idea how to go about putting this together. I think that all we do is export raw materials and import finished goods.

To think that most everything I saw at home as a child was made in America. Now, I cruise eBay looking for old stuff like a waffle iron or tools that are not expensive overseas made junk.

There’s a certain awareness that what we know won’t last; or rather that the good times have ended. People are panic buying before the new normal hits and some sort of massive, irreparable supply chain shortage occurs that permanently disrupts the economy. Who can say what it is – perhaps another oil crisis, a computer chip crisis, or even an internet bandwidth crisis. Perhaps all three simultaneously. As times are uncertain people buy what they can now rather than be stuck without it later. This is already an increasing problem with automobiles as more and more factories go dark as the amount of available chips are reduced by Taiwan’s drought and mainland China’s brownouts.

While obvious to us, the trade deficit was itself a sign of massive, untenable economic expansion that will soon shrink. Millions will be hurt, and some sort of social revolution will begin. Probably not in America though, but elsewhere the “illiberals” are poised to win if the liberal center fails to keep the ship upright.

Now factor things like High Frequency Trading or algorithms into this. Every decision making computer is about to make the wrong decision. Despite humanity knowing this, we are unable to stop it due to the profit class deluding itself into feelings of impunity. Tomorrow’s Hitler has already been born, and is biding in the shadows for the correct moment – again, more relevant to the non-USA work than the Five Eyes.

Alot of American companies i.p is now ”owned” by offshore subsidiary companies e.g Apple, allergan, phizer, etc

So this may be the reason why the surplus in services are appearing to go down