By Lambert Strether of Corrente.

“We live in capitalism. Its power seems inescapable. So did the divine right of kings. Any human power can be resisted and changed by human beings.” –Ursula Leguin

The United States, it is said, is an oligarchy; it is ruled, by the rich. Hence it behooves us, as a simple matter of self-preservation, to study the habits of our oligarchs, especially those who have achieved dynastic wealth. The International Consortium of Investigative Journalists those habits as follows:

IPS identified six “habits” of highly-entrenched dynasties. These include defeating attempts to raise taxes on the wealthy, not giving away too much to charity, forming a family office to sequester wealth, creating dynasty trusts and loopholes to avoid gift or estate taxation, and using wealth to promote self-serving public policy and weaponizing charitable giving for dynastic interests.

This post will consider family offices. Inequality.org characterizes the purposes of family offices:

Ultra-high-net-worth families — those with $250 million up to the billionaire class — form family offices to bring wealth management services ‘in house.’ Key to their purpose is capital preservation and fostering inherited wealth dynasties. They are major utilizers of dynasty trusts to sequester wealth and avoid estate taxes. In this way, family offices serve to entrench multi-generational wealth inequality. Family offices are an unregulated corner of the financial marketplace with an estimated $6 to $7 trillion in assets under management (compared to $3.4 trillion in global hedge funds).

FINTRX (“the preeminent family office and registered investment advisor intelligence platform”) describes the challenges of characterizing the family office as an institution:

Like any vertical dealing with the ultra-wealthy, every family office is unique in set-up and structure, with each requiring a different combination of services depending on the wants and needs of their clientele. This makes defining the murky world of family offices incredibly challenging.

And that world is murky indeed. From the Dallas News:

“For each family office people know about, there are two they don’t know about because they keep a low profile,” said Colin Carter, managing director of Tiedemann Advisors’ Dallas office.

One example of a family office that — rather like Hunga Tonga — exploded from obscurity to the headlines almost instantly is Archegos Capital, which was structured as a family office. From Bloomberg:

No individual has lost so much money so quickly. At its peak, [Bill] Hwang’s wealth briefly eclipsed $30 billion. It’s also a peculiar one. Unlike the Wall Street stars and Nobel laureates who ran Long-Term Capital Management, which famously blew up in 1998, Hwang was largely unknown outside a small circle: fellow churchgoers and former hedge fund colleagues, as well as a handful of bankers.

He became the biggest of whales—financial slang for someone with a dominant presence in the market—without ever breaking the surface. By design or by accident, Archegos never showed up in the regulatory filings that disclose major shareholders of public stocks. Hwang used swaps, a type of derivative that gives an investor exposure to the gains or losses in an underlying asset without owning it directly. This concealed both his identity and the size of his positions. Even the firms that financed his investments couldn’t see the big picture. It didn’t matter that he’d been accused of insider trading by U.S. securities regulators or that he pleaded guilty to wire fraud on behalf of Tiger Asia in 2012. Archegos, the family office he founded to manage his personal wealth, was a lucrative client for the banks, and they were eager to lend Hwang enormous sums.

This will not, however, be a post about Big Banks setting money on fire. Rather, I will look, as best I can, at history and current status of family offices, their appetite for risk, and regulatory issues. I’ll conclude with a few questions.

History and Current Status of Family Offices

So how many family offices are there? (To caveat, recall the estimate that for every one we know about, there are two more we don’t.) The Financial Times estimates 7,000 with $5.9 trillion under management as of 2019, as compared to $3.6tn in the global hedge fund industry. Here, from the Family Office Exchange, is a calculation (a “guesstimate”) that gives a higher number, and for the United States only:

One way to calculate the figure is to understand the threshold for affordability of a single family office, and then consider how many families are likely to have one.

According to the Wall Street Journal, the threshold for single family offices is generally considered to be $100 million due to the costs and challenges of running such an entity. In the United States alone, there are approximately 20,407 individuals with more than $100 million in assets, as reported in the Credit Suisse 2018 Global Wealth Report. Of course, not all these families have separate family offices. Some manage their family wealth management activities within their family business; others use the services of a multi-family office or a wealth advisor.

For our estimate, we’ll assume that half of those individuals with $100-500 million in assets have some form of a family office. For those with assets greater than $500 million, the percentage is probably higher. According to FOX’s biennial Family Office Benchmarking Study, these families typically have more complexity, can afford it, and desire the privacy and control provided by a single family office. For purposes of this analysis, we assume 75% have family offices. This simple reasoning results in more than 10,000 single family offices in the United States.

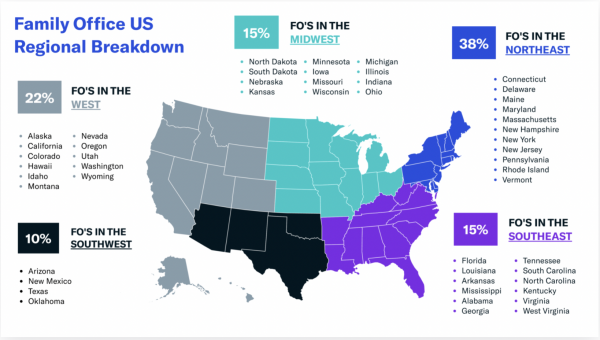

10,000. “There are not very many of the Shing,” as Ursula Leguin says in City of Illusion. Where are they located? Caveats as above, here is a map:

Family offices used to be a pretty sleepy corner of financial universe. From the Wall Street Journal:

For many years, family offices were a fairly staid part of Wall Street. They often searched for conservative, long-term investments and sometimes invested in partnership with each other, with the goal of maintaining the wealth accumulated by the individuals and families, rather than multiplying it. Back then, it was hedge funds that often embraced riskier tactics, such as borrowing huge amounts of money to amplify their returns, strategies that resulted in the collapse of hedge fund Long-Term Capital Management LLC in 1998. This event forced the Federal Reserve to step in to stabilize the financial system. After the 2008-09 financial crisis, hedge funds adopted more conservative investing approaches, as more of their clients became risk-averse institutions. At the same time, family offices became more aggressive.

The Dallas News describes the change after 2008:

“There was an element of trust lost in 2008, and families wanted to have more control over their assets,” [said Tayyab Mohamed of Agreus Group, a London-based recruitment company that works with family offices worldwide.] said. “Before 2008, it was just meant for the Rockefellers of the world, but right at the start of 2010 we saw families with a couple hundred million starting family offices.” A UBS Securities report looked at 121 of the world’s largest single-family offices and found that 31% had been established between 2000 and 2010, and 38% were created from 2010 to 2020.

So family offices became “more aggressive.” Now let’s turn to their appetite for risk.

Family Offices: Their Appetite for Risk

Recall that family offices aren’t really regulated (more below), as Archegos showed. From the Wall Street Journal:

Family offices don’t have a fiduciary duty to keep their trading limited, and don’t have nervous investors to deal with. This can add to firms’ comfort with risk, say some who work with family offices.

So what kind of investments are family offices “comfortable” with, besides co-working spaces and carbon trading? Here are a few:

SPACs. From the Financial Times:

Family offices have participated in the [SPAC] boom, albeit in smaller numbers than hedge funds and other institutional investors. Among the most prominent names active in the sector are the family offices of tech entrepreneur Michael Dell, billionaire real estate mogul Barry Sternlicht and former hedge fund executive Dan Och. Some billionaires have even set up their own Spacs, with or without family office backing, including former Facebook executive Chamath Palihapitiya and hedge fund manager Bill Ackman. Billionaire financier George Soros’s family office has also begun hunting for Spac opportunities.

Startups. Also from the Financial Times:

Family offices are planning to significantly scale up their start-up investing in the coming year, according to an SVB Capital/Campden Wealth survey published in October, and the effort is being led in many cases by next-generation family members, suggesting it is a trend that will endure.

Crypto. From the Open Markets Institute:

Family offices are also emerging as significant investors in cryptocurrency hedge funds. Assets under managers in cryptocurrency funds reached $36.9 billion in July 2021, while a 2020 report by PwC found that nearly half of all investors in these crypto private funds are family offices. These investments are of particular concern given the high degree of leverage available in the cryptocurrency markets, combined with its extreme volatility

Cash. From Citi Private Capital Group:

There can be no doubt that family offices remain willing to sacrifice medium-term returns to maintain high levels of liquidity. Almost a third of offices report running cash levels at 20% or more, and our own portfolio data analytics show this number is higher. Client conversations suggest that a preference for flexibility, liquidity and the ability to act quickly in the face of opportunity remain the key drivers. Indeed, cash allocations do not reflect a negative investment outlook, with more than 70% of respondents expecting 5% plus returns over the next 12 months. More than a third indicated inflation, the cash crusher, was their most significant near-term concern.

Since I don’t play the ponies, my opinion is virtually worthless — but I’ll give it anyhow. SPACs, startups, and crypto all seem a bit… sporty, as do co-working spaces and carbon trading (more on SPACs). Given a financialized economy, startups are likely to focus on rental extraction. Crypto not only does the same, it’s openly fraudulent — hence its increasing normalization by finance — and actively harmful to the environment. And cash…. Well, if you need to leave the country quickly in your socks, cash is good. Or if you need to buy an island, or a ticket to Mars. So I’ll give them that.

Some have expressed concerns that family offices, aggregated, create systemic risk. From Open Markets:

Family offices owned by tech titans raise particular concerns of systemic risk given their size and concentration of investments. Amazon founder Jeff Bezos’ family office, Bezos Expeditions, is estimated to have over $200 billion in assets— ten times larger than Archegos was at its most leveraged. Microsoft founder Bill Gates’ family office, Cascade Investment, L.L.C., has amassed the largest private ownership of farmland in the United States: 269,000 acres of farmland.

I don’t see leverage, so I don’t see systemic risk. On the other hand, I wouldn’t see leverage, because family offices are opaque. Nobody saw Archegos coming, after all. Certainly not the investors.

Regulating Family Offices

The Archelogos debacle provoked a certain amount of tut-tut-ery. From The National Law Review:

The recent defaults by Archegos caused several large broker-dealers to incur significant losses. Archegos represented that it operated as a single-family office, which made it exempt from many provisions of the federal securities and commodities laws. Questions have arisen about whether Archegos properly qualified for the family office exemption and whether, in any case, the exemption is too broad.

Here is ginormous global law and lobbying firm Squire Patton Boggs on the “family office exemption,” and its origin in Dodd-Frank:

In the course of managing the finances and investments of a family, a family office frequently provides advice related to the family’s investments in securities. This activity would ordinarily subject the family office to regulation under the Investment Advisers Act of 1940 (Advisers Act). The Advisers Act defines an “investment adviser” as anyone who provides advice regarding securities, is engaged in the business of providing such services and does so for compensation. As it clearly falls within this particularly broad definition of “investment adviser,” the family office would be required to register with the Securities and Exchange Commission (SEC) unless it can find an exemption. In 2011, pursuant to a directive in the Dodd-Frank Act,1 the SEC adopted a rule, codified as the Advisers Act Rule 202(a)(11)(G)-1, more commonly referred to as the “Family Office Rule,” which effectively excludes family offices from the broad definition of “investment adviser.” The adoption of the Family Office Rule was largely driven by the fact that families who have set up family offices to manage their wealth are financially sophisticated and less in need of the protections that the Advisers Act was intended to provide to typical investors.

(Yes, it’s their sophistication that causes them to invest in crypto. NFTs, too.)

So far as I can tell — and I do feel like I’m juggling chainsaws here, since I am no expert in SEC regulation — nothing has come of the tut-tuttery, and the family office exemption remains intact. From the National Law Review once more, in June 2021:

Review of the family office exemption could be addressed in several ways. First, Congress could repeal or limit the family office exemption. No legislation has been introduced to accomplish this, and it appears that any possible legislative action is not imminent. Rather, it is more likely that the SEC and/or the CFTC will change their regulations to redefine the family office exemption. Existing legislation appears to grant the Commissions broad statutory authority to redefine the family office exemption more restrictively — or even, in the case of the CFTC, to eliminate it completely. Significant changes to current regulations could significantly restrict the availability of the exemption for many family offices.

(AOC did introduce legislation, which passed the House and died in the Senate. From Dentons, another ginormous law firm:

On July 22, 2021, New York Congresswoman Alexandria Ocasio-Cortez, a Member of the House Financial Services Committee, introduced HR 4620, the Family Office Regulation Act of 2021. HR 4620 would limit the use of the family office exclusion from the definition of “investment adviser” under the Investment Advisers Act of 1940 (the “Advisers Act”) to certain “covered family offices” — i.e., family offices with $750 million or less in assets under management (AUM) that are not barred or subject to final orders for conduct constituting fraud, manipulation or deceit. Family offices with more than $750 million in AUM would be exempt from registering as investment advisers with the SEC under a new exemption, but would have to file reports with the SEC as “exempt reporting advisers” (ERAs). The bill would also repeal a grandfathering clause in section 409 of the Dodd-Frank Act that permitted family offices whose clients include persons that are not members of the family to qualify for the family office exclusion. Finally, the bill would authorize the SEC to further define a “covered family office” to exclude family offices that are below the $750 million threshold if they are highly leveraged or engage in high-risk activities.

The Congressional Research Service provided a list of possible policy solutions, including subjecting family offices to the Investment Advisers Act and enhancing 13F and 13D requirements (“But family funds don’t need to file a 13F, so their portfolio positions remain hidden.”) To my knowledge, not of these have been adopted either.

In fact, the argument can be made — see the opening discussion of family offices as an institutions — that regulating them is not possible. From Forbes:

Even if family offices become subject to regulation, there is no standardized version of the family office – so how will they be regulated?

Conclusion

In a significant number of cases, family offices have succeeded in their goal of preserving generational wealth. From a UBS annual report on family offices:

Almost all (95%) of the family offices support just one or two generations. However, almost half (48%) of those family offices supporting one generation no longer include the founder or business owner. Almost a quarter (24%) of the single-generation offices support the second generation, with the balance supporting the third, fourth and fifth.

Whether ephemeral or more permanent, family offices have a disportionate effect on the state of the world. From Forbes:

[Bill Woodson Head of Strategic Wealth Planning and Family Enterprise Services for Boston Private] explains that a select few families control the majority of the world’s wealth, and how their wealth is utilized and managed has significant implications for society. Therefore, the family offices representing these UHNWIs play a critical role and have a unique opportunity to determine how wealth is channeled for good.

(“Of all the works of Sauron, the only fair.”) It’s pretty to think so, but I’m dubious about the overlap between “wealth channeled for good” and, at least, crypto and startups. In any case, I think oligarchs would reject Woodson’s view out of hand, except for public relations purposes. From the Financial Times:

“If it’s their money, they can do what they want,” says Angelo Robles, founder and chief executive of the Family Office Association. “Just like the average person, why should they be disclosing things?”

Well, one answer would be to defang the aristocracy of inherited wealth. From the New Republic:

“Tradition,” wrote G.K. Chesterton, “means giving votes to the most obscure of all classes, our ancestors. It is the democracy of the dead.” Substitute “money” for “tradition,” and you have the situation created in the U.S. by an accumulation of laws protecting people’s money after they depart this vale of tears. Except the end point isn’t democracy, it’s oligarchy.

An end point at which we have arrived. What about a serious attempt at confiscating inherited wealth?

Thank you, Lambert, for this article on how the wealthy maintain their wealth for generations. Where I live, rental properties are being sold sometimes more than once for increasingly more profitable prices. In the meantime, the new owners increase the rent and the people who cannot pay the new rent (often retirees, older people or poorer people) have to move. They won’t be able to find an affordable apartment to rent because there are not many rentals available. I truly believe that it is these kinds of events which make rentals a target for the rich who want to maintain their wealth in perpetuity in spite of making life miserable for others. It is an ugly world we live in where we happen to have a conservative premier who won’t even consider putting a limit on excessive rents because the economy is more important than the people who cannot afford to pay their excessive rents. No wonder we have so many homeless people living in tents in our city with the temperatures at -20 c. It is an abomination. The wealthy are an abomination and all the ways they have managed to make money are the biggest abomination of all.

#Ditto

Thank you Lambert. A thoroughly illuminating read. #TIL

They are available, but the owners, really the investors, choose not to rent, much like how much of the world’s art is stored and not displayed as they are treated like currency by criminal organizations and as investments by the wealthy.

Even in California, developers refuse to build even middle income apartments, forget about working class or the poor, and insist on luxury apartments and condos, which then sit empty. Even in a capitalist economy, if it is a sane one, would have people rent out empty homes for the income and banks who insist that the values of these homes would be reflected in the occupancy rates. No, like those art pieces, nobody uses them, because reasons.

It is like these family offices that invest in financial fraud instead of something tangible like a factory. Just how hard would it be to invest in a knife, button, shoes, jeans, whatever factory? We are not even talking about an expensive, high tech chip factory, but something that produces any of all the umpteen things that even a poor country needs.

The high fructose hit of easy money is more important than the solid hit of a steak or even a hamburger and fries. It is more financial cocaine, not food.

Here’s to me knocking on wood hoping that my new landlord, whoever he might be, in this new year will not raise my rent. You would think that the prices in the San Francisco Bay Area are just to high to increase, but I have my doubts as I have been wrong for decades.

” To invest in a knife, button, shoes, jeans, whatever factory?” in our current Free Trade environment that would be to lose it to lower-priced foreign-based cost-differential arbitrage-racket production. The only way one could dare invest in such factories in the US would be if imports of knives, buttons, shoes, jeans, whatever . . . were strictly, rigidly and totally forbidden.

( Though the snarky-poo investor might well say . . . ” we did that. In China/Mexico/Cambodia/Bangla Desh/ etc. ” ).

While not forbidden by any means, the New Zealand I first visited in 1981 and another 5 visits til the mid 80’s had heavy import duties on everything practically, and they made do with keeping things going in a fashion not unlike Cuba, but with different cars.

They had very strict controls on foreign exchange, it was quite difficult for a New Zealander to buy something from overseas.

Landed in Auckland shortly after the infamous ‘Underarm Incident’ happened, and that wasn’t cricket!

I wasn’t quite 20 and cars meant a lot to me once upon a time, and Queen St in Auckland and elsewhere in the country was a feast for the eyes with the odd newer car seen every now and then, but for the most part, 50’s to early 60’s vintage of jalopies i’d never laid eyes on in the states, and about every 7th car was a late 50’s early 60’s Morris Minor, lotsa early 50’s French cars, one that looked really gangster-ish, and other UK makes of the era.

They had domestic industries such as Skellerup which made shoes and something else, Fisher & Paykel, which made appliances and refrigerators, and a few more i’ve forgotten.

Retail prices for those were dear compared to a similar American model, and of all the english speaking countries i’ve been to, the most expensive new books.

The country seemed on the down low to me, they had a Nixon’ish PM named Muldoon in my early visits and then it all changed in the mid 80’s when they deregulated financial markets and got rid of forex controls , and I got diminishing returns on old cars in another 6 visits from the 90’s to 2011, as they were importing 3 or 4 year old Japanese cars with right hand drive, as yearly registration fees go up as the car gets older in Nippon, so a perfect fit.

They also discovered how to sell their beauty pageant of a place to the world.

America has a big enough population that we could make and sell eachother shoes, knives, forks, spoons, pickle jars, buttons, jeans, food, fuel and fiber,etc. at a thriving wage price just as we used to do before Free Trade and its Bonfire of the American Industries.

And we could still permit import of things we were too particular-input-deprived or too stupid to make.

The historical record exists. We did it before and most of us lived better than we live now.

This was national policy from just before the American Revolution, perhaps 1774 to about 1960. That would be ~185 years. IIRC, the loss of industry started ~1970 with it becoming unofficial, but official, policy by 1980.

Depending where you point to to in time, the process of deindustrialization has been going for 40 to 60 years. It is less than a full lifetime even at 60 years looking at the American retirement age. Let’s say three lifetimes to build up and one life to destroy. The country spent nearly two centuries trying not to be in position of where almost everything had to be imported, which made it vulnerable to exploitation by everyone else. Our elites are short sighted morons. The people who started this destruction have made their children and grandchildren open to destruction; not all of the people who started this were evil, or psychopaths, or did not love their families, and even their friends, but they did this for ideology, wealth, status, and power.

All this makes me think again about what happened to the Bay Area. The destruction of the Port of San Francisco started just before I was born. By the time I could tie my own shoes all the wharves were essentially abandoned, and the Port of Oakland had been built expressly for containers and took San Francisco’s traffic. It wasn’t quite as simple as San Francisco refusing to spend the money on new facilities although it’s close enough. I mean the state of California use to pay for the maintenance and operations of the state’s ports until it did not want to. So various ports were rundown, but Oakland was willing to build an entirely new port and Long Beach also did whatever it took although I know nothing else about Long Beach.

But San Francisco’s establishment did not want to spend the money on the maintenance backlog, certainly did not want to spend the pile of money for rebuilding (and expanding further south towards the city of South San Francisco {don’t ask. It is supposed to be one city, but for reasons I don’t understand, it’s not. Even the street grids and numbers are a continuation from the north.} Also the very powerful local unions, which centered on the dock workers, were too unruly for them. Not to mention all that beautiful bayside property for development. Have I mentioned how powerful the developers are around here are? It’s also corrupt as all hell.

So all the port facilities, the railroads, the warehouses, all the associated industries needed for the ships, all the other light industry, plus all the various ironworks, light ship building, and warehouses in South Francisco went away. The unions were busted, the developers made bank, some really ugly mid-century brutalist shopping/office space/apartments were built, and when ever I visit Mom, she to regularly remind me to be really careful on Sixth Avenue because I could be mugged and knifed. South of Market really was sketchy for thirty years. The area had been mostly warehouses with some housing and whatnot for the workers.

It has gotten better. I least I don’t have to worry about being knifed anymore. My Mom has moved out of the city anyways. But despite all the redevelopment, all the money spent, and all the new work-lofts and upper end apartments and condos, the whole city seems less real every year. Really, every time I visited it again. The further you go from the Ferry Building, the more empty shopping spaces, homeless people, and trash there is, which never seems to be picked up. Market is the main street of San Francisco and anchored to the Ferry Building and the Financial district. Yet, the unease I used to get in SoMa (South of Market) I increasingly feel at the southern or western end of Market (the street slants down and west, splitting the eastern part of the city).

The city’s establishment includes the Pelosis, Feinsteins, and the other old families (old for California that is) plus all the developers and some of the business owners made a lot of money. But it is a theme park with the glitter of the views and the fading veneer of the culture of the 50s, 60s, and 70s. There is incredible wealth, but in transforming the city they killed what made it wonderful. They wanted education, high tech, medicine, and finance or their the clean, orderly, unruly vision of the future as they did not want to kill the city. They have not, but we neither have the old, vibrant, messy, unionized, working class city of the fifties or this beautiful, gleaming city of their dreams.

What has messed up the San Francisco Bay Area has national and international causes, but the local elites (and I include San Jose as they buried Santa Clara Valley with its farms, ranches, and light industries under cement and concrete and changed it to Silicon Valley) hit the gas, added nitro, and turned a large mixed economy with a very large working and middle class prosperous population into this harsh economy of a small wealthy class, a relatively few successful people, and a shrinking middle class becoming the poor and homeless. Reminds of México or El Salvador. And because San Francisco and San Jose are the economic hearts of the Bay Area with something like ten million people centered on them, all nine counties plus all the counties adjacent to those counties have been equally affected in the same way. Much like how the sketchy gangrenous end of Market Street seems to be spreading albeit slowed by regular bombardments of cash. An infection slowly spreading and economically killing at least a quarter of the state and at least ten million people. Baghdad by the Bay. What a lethal dream.

Great analysis. I live in a wealthy town at the base of the south bay and you’re right. Born in SF and raised in Silicon Valley, I feel generally heartbroken. Paved paradise, put up a parking lot which is now looking pretty dumpy. I love California & grew up here, but it’s really just the corruption of extreme wealth. Tax stats estimate that Silicon Valley manufactures 10,000 millionaires A YEAR. Why does it cost 1.8 million for a crackerbox piece of crap house? That’s why. Capitalism. They rent the cardboard houses to them and act like it’s a favor. We know what happens after the cake.

All of this is inevitable today. “The democracy of the dead” precludes a democracy of the living. But creating an equality of well-being for everyone, making it law, including effectuating it, would stop this zombie economy in its tracks.

Chaco Canyon and it’s magnificent Great Houses were in the wide open with roads emanating outwards like the hours on a clock, no defensive strategy whatsoever.

Mesa Verde and it’s cliff dwellings on the other hand was quite stealthy, hidden away from prying eyes with an emphasis on defense.

About 50 years separated the abandonment of Chaco Canyon and the construction of the cliff dwellings in Mesa Verde after climate change came calling.

It’s pretty common to hear of some .01%’er that bought a 48,000 sq foot house and wants everybody to know, but this will be very dangerous in our not so brave world to come.

…things change

On horseback, we’ve threaded our way along ancient trade trails in SoCal, where the Old Pueblo and Shoshone traders managed to make their ways en route to getting sea shells from the Pacific Coast. My much missed deceased neighbor grew up in Chaco, his parents were archeologist and paleontologist. So your post rang up some old memories. The most succinct musing on “what happened” was run in Smithsonian mag, back in ’03. If history rhymes, we’re in for something far worse than we have now.

https://www.smithsonianmag.com/history/riddles-of-the-anasazi-85274508/

Now wait a family blogging minute!

The moment I read that these exalted offices invest in coworking spaces, I darn near went through the roof of the Arizona Slim Ranch House.

Why? Because it’s very difficult to make money with these places. You have to stay on top of the membership churn — which requires major and ongoing expenditures on marketing and sales.

If you don’t stay on top of the membership churn, you’ll have a vacancy problem. This is what killed the coworking space I was in until the summer of 2019.

It could be a way to tax-loss-launder money to be taxed at a higher rate into money to be taxed at a lower rate. Or even into tax-losses to offset against taxes elsewhere.

Shhhhh! Don’t tell anyone, but I was beginning to suspect that the billionaire owner of my ex-coworking space was doing just that.

It was obvious to everyone, including the pigeons that roosted atop the building, that the coworking space’s expense-to-income ratio was listing far to one side. As in, the expense side. Think the good ship Costa Concordia as applied to the business world, and you have the idea.

Oh, did I mention that this billionaire guy also owned the building? The pigeons? He didn’t own them, and for that, I’m sure those pigeons were quite grateful.

Excellent reference for the time soon to come. Thanks for your impeccable research.

Good luck with regulating these FOs with the corporate fluffers at our ‘highest’ court.

Well, propaganda!

W. marched around the country proclaiming the evils of the Death Tax. Did anyone mention that the Inheritance Tax didn’t set in until into the millions? Five million in my last recall. Even with its marginal rate. Yet working class and even middle class fell for the ruse.

The US ruling class is expert in propaganda. The rest are subject to untangling it. Some do, most, it seems, don’t.

Alice X – The Estate/Gift Tax Exclusion amount is now $11.5 million per person.

A married couple can shield up to $23 million from the tax with just some basic estate planning.

One of the justifications for raising it was to save family farms from having to be sold to pay estate taxes. I’m not sure there are a whole lot of those left anymore.

If a familly owns a farm, I gather it is still defined as a “family farm” even if it is thousands of acres.

Family plantations, perhaps.

And since anti-farmer policy since the 1950s was designed to drive millions of farmers out of business in order to consolidate their land into ownership by survivors of the government designed process, Family Plantations is mostly the kind of family farm that is left.

And in today’s environment, even a 5,000 acre farm, like Gabe Brown’s farm , is not considered the hugest anymore. Given what the Brown family has done for the soil of that particular farm, one hopes they in particular are not taxed off their farm and forced to sell it to Bill Gates or Black Rock.

These replies don’t get it, who needs five million clear?

It’s not about need

I worked for a billionaire with clear priorities

Given two potential states of the world, he always chose the one in which he had more money.

Sociopathic, maybe not, but obsessed with “winning “ and using money to keep score…, sure

$5 million is not even entry-level wealthy nowadays in Manhattan or California.

And live in a low-cost area somewhere in rural Flyoverland? Pfft, for mere commoners.

In the second season of Succession they even mocked the idea of a $5million fortune. Hapless Cousin Greg thinks a reduced inheritance from his grandfather would make him rich. The Roy cousins laugh at that…saying 5 mil would be a toe in the door to rich-rich and nothing more.

This makes me think of the great landed estates in the declining Roman empire that became the foundation of the feudal castle and feudalism.

What about a serious attempt at confiscating inherited wealth?

Enough churn generated, and the wealth will be disbursed, dispersed, and democratized: the greater the churn, the more quickly this will happen.

Soldiers dropped their weapons and fled. Others remained, frozen with terror. Sazed stood at their back, between the horrified soldiers and the mass of skaa.

I am not a warrior, he thought, hands shaking as he stared at the monsters. It had been difficult enough to stay calm inside their camp. Watching them scream—their massive swords out, their skin ripped and bloodied as they fell upon the human soldiers—Sazed felt his courage begin to fail.

But if I don’t do something, nobody will.

He tapped pewter.

His muscles grew. He drew deeply upon his steelmind as he dashed forward, taking more strength than he ever had before. He had spent years storing up strength, rarely finding occasion to use it, and now he tapped that reserve.

His body changed, weak scholar’s arms transforming into massive, bulky limbs. His chest widened, bulging, and his muscles grew taut with power. Days spent fragile and frail focused on this single moment. He shoved his way through the ranks of soldiers, pulling his robe over his head as it grew too restrictive, leaving himself wearing only a vestigial loincloth.

The lead koloss turned to find himself facing a creature nearly his own size. Despite its rage, despite its inhumanness, the beast froze, surprise showing in its beady red eyes.

Sazed punched the monster. He hadn’t practiced for war, and knew next to nothing about combat. Yet, at that moment, his lack of skill didn’t matter. The creature’s face folded around his fist, its skull cracking.

Sazed turned on thick legs, looking back at the startled soldiers. Say something brave! he told himself.

“Fight!” Sazed bellowed, surprised at the sudden deepness and strength of his voice.

And, startlingly, they did.”

― Brandon Sanderson, The Well of Ascension

I see your Sanderson and raise you a Herbert (Heretics).

Teg fell to thinking about the “depraved whores.”

It was not correct to call them depraved, he thought. Sometimes, the supremely rich did become depraved. That came from believing that money (power) could buy anything and everything. And why shouldn’t they believe this? They saw it happening every day. It was easy to believe in absolutes.

Hope springs eternal and all of that gornaw!

It was like another faith. Money would buy the impossible.

Then came depravity.

It was not the same for the Honored Matres. They were, somehow, beyond depravity. They had come through it; he could see that. But now they were into something else so far beyond depravity that Teg wondered if he really wanted to know about it.

The knowledge was there, though, inescapable in his new awareness. Not one of those people would hesitate an instant before consigning an entire planet to torture if that meant personal gain. Or if the payoff were some imagined pleasure. Or if the torture produced even a few more days or hours of living.

What pleased them? What gratified? They were like semuta addicts. Whatever simulated pleasure for them, they required more of it every time.

And they know this!

How they must rage inside! Caught in such a trap! They had seen it all and none of it was enough – not good enough nor evil enough. They had entirely lost the knack of moderation.

They were dangerous, though. And perhaps he was wrong about one thing: Perhaps they no longer remembered what it had been like before the awful transformation of that strange tart-smelling stimulant that painted orange in their eyes. Memories of memories could become distorted. Every Mentat was sensitized to this flaw in himself.

and later in Ordade’s musings

“You seldom learn the names of the truly wealthy and powerful. You see only their spokesmen. The political arena makes a few exceptions to this but does not reveal the full power structure.”

and

“The writing of history is largely a process of diversion. Most historical accounts divert attention from the secret influences around the recorded events.”

That was the one that had brought down Bellonda. She had taken it up on her own, admitting: “The few histories that escape this restrictive process vanish into obscurity through obvious processes.”

Teg had listed some of the processes: “Destruction of as many copies as possible, burying the too revealing accounts in ridicule, ignoring them in the centers of education, insuring that they are not quoted elsewhere and, in some cases, elimination of the authors.”

Soros restructured Quantum as a family office to escape the tighter regulation post-GFC. Brother-in-law was a fund manager there up to the restructure. Soros runs his own money only now – possible Druckenmiller et al are also in the structure.

Soros is atypical though. Most family offices are dumb money, hence the crypto and NFT’s. There are a lot of sharks looking to get their teeth into juicy family office market wave surfers. I suspect the set of family offices contains the set of Theranos investors…. :-)

If you think about a family office, the first generation money knows a lot about a single traditional industry but is easy prey for finance and the later generations have lost interest in where their wealth comes from or have the credentials but don’t really kapisch.

I would give (dis)honourable exceptions for the titans of finance, because they know exactly who they are swimming with, and for the Silicon Valley mob, who are pretty fly for white guys. That said, there will be a lot of financial “players” who use the family office to fight the last war, in investment terms, and cannot understand why their tactics are not working, and a lot of SV types who are getting high on their own publicity. They can all F.O! :-)

Silicon Valley (venture capital) took no flier on Theranos. It was Betsy DeVos and the Walmart Family (Offices) that bought the Elizabeth Holmes fairy tale. I listened to a radio interview of a SV investor, who had a biomedical background, and he discerned she was full of shit in thirty minutes of one on one facetime.

I used to date a chick that worked for a family office of a family with a b-school named after the family patriarch and can confirm the dumb money assertion anecdotally.

She used to come home frustrated very often and would vent to me about all of the shenanigans she saw there. Dumb to a tee.

I’m wondering what the next generation of the family office is thinking right now.

“Am I a fattened dork? Do I have an identity beyond “rich”?

“Just once, I’d like to be exhilarated”

“Am I going to get flattened by climate change, too?”

Money can make big things happen. Don’t (necessarily) hold it against them if they happen to be rich.

If they screw up, well, OK, then rank on them some. If they pick startups that actually do something useful, hey, that’s different.

Early stage investing is terrifically difficult. Big-pockets people can do it, and live to tell about it.

Let’s say a person works at the median income in the US ($42,800) in real dollars from the day they turn 18 until the day they hit the standard retirement age of 67. They can expect to make $2,097,200 over the course of their career. 40 hour weeks for 49 years – just over or under 100,000 hours of work depending on how many weeks vacation they get.

If that same person had a relative that died when they were 18, it would only take $111,685.18 of inheritance to make the same amount of money over those 49 years entirely passively. (Assuming just under the historical SP500 real return average of 6%). No work, no having to do anything, and for just over 100k you can make as much as the average american wage slave over the course of their lifetime.

Just imagine the wealth these family offices are distributing to an entire class of people who would make more money sitting on the couch (or skiing the alps, or drinking mai tais on the beach) than just about any salaried worker. If they work it’s because they’re bored. If they don’t like work they can just leave.

And worst of all, that is the frame of reference that the owners of industry + political leaders decide policy for folks who need the next paycheck to buy groceries for their families.

Where I live (near Oprah) the offspring of the well to do work in boutique shops/offices that intentionally lose money so the Family can take a business loss to reduce their tax liability. Don’t need to be a Billionaire to game the tax code.

So you’re saying they lose money to err save money? Lose money to make money then? Huh?

work???

6% of $111,685 is $6701.

There is no reason why a very successful and wealthy person should be allowed to profit beyond a certain point. They can only consume so much, and only require so much to enjoy a good life. Allowing the wealthy to accrue wealth, past a certain point, past the point where money becomes power — is a dire threat to democracy. The entrepreneurs I have known, more than a few, were motivated by a desire to build ’empire’ within the small realm of their enterprise. The accrual of Wealth was a least motivation for the entrepreneurs I have known. They were founders of quiet empire, typically built upon the ruins of precursors of badly badly run enterprise. They simply wanted things to run better and more efficiently, and luck more than any genius guided them to their success — and everyone among them, everyone I knew, acknowledged their debts to luck.

It is too easy to forget that there is a winner for every prize offered up. And it is too easy to forget that luck alone can select winners, and there are too many contests where wealth selects a winners luck.

Confiscate?! Why?? Instead just try to direct it into productive endeavours rather than rentier ones. For example push them to invest in cancer research rather than more rent extracting real estate

Did you miss how rent extracting medicine has become?

Taxpayers already fund a lot of it via entities like the NIH and subsidies for research at universities. The problem is allowing those institutions and researchers to be attached to capital markets via highly paid consulting gigs, profit sharing of discoveries that get turned into private goods.

So, no, you don’t need to confiscate it. But you do need to stop subsidizing Novartis, etc with tax dollars. And instead build a publicly owned drug development pipeline with publicly owned manufacturing facilities. And sold at cost. If pharma had no access to subsidized research, they would be fucked and hopefully be smashed into smithereens.

but !!!!! that’s “Socialism”….. and they have a pill for that… it’s called propaganda… and it keeps the pee-ons in their “proper” position…

The wonderful Michael Hudson said on one of his videos that a $Billion dollars will cut your IQ in half.

Greedy people know one thing well…how to shove their hands in the cookie jar and grab a lot. This is only one type of intelligence but the money and power it gives in this afflicted society makes them think they are as wise as gods.

History is full of warnings.

It never ends well.

I’ve scoured this summation and the comments more than once. One of the very fundamental issues is the very rich* and obscenely wealthy have a legitimate 100 year+ head start. I read a book in the last 10-12 years which was quite interesting, from the historical perspective. The “lowly beginnings” of a few barons in the book were indeed, quite humble. Rockefeller was a bean counter, apparently with an alcoholic father (one example). The Tycoons, written by Charles R Morris, gives great detail on this history of factories and manufacturing. In our modern times, it is a class war designed for most of the people to lose, and especially now incur the debts (higher ed, mortgage) so that maybe you too can win. The wealthy are not going to lose.

*Very rich is defined in varied terms. I suggest starting at $50 million in total wealth, or earned income (labor, dividends, etc) exceeding $5 to 10 million per year. Others mileage may vary.

**Several times in recent months, articles featured dynastic wealth and the families that enjoyed the fruits of their ancestral lineage. Mellon family, Mars candy heirs, Anheuser Busch heirs. Naming only a few. Very much old money, just not the Rothschild old money.

One reason you see FO’s “Investing” in Crypto,NFT’s and the like is that they are competing with their peers for status.

Mirror,Mirror on the wall,who is coolest of them all?

Many of the truly wealthy went to the same schools ( From preschool on in some cases), they vacation in the same places, they screw each other’s wives,husbands, children and probably family pets and they VERY seldom face consequences when they screw up.

Affluenza is a real phenomonon and so is the truism that the wealthy and powerful have very thin skins, barely enough to cover their egos in many cases.

Stupidity is a factor and not a minor one,but I see peer competition as being a greater influence.

Why else spend $68MM for an NFT?

Thanks for this coverage Lambert. The details of elite money management – how it is maintained and misused – are ridiculously under-advertised. Every billionaire-romance reading, stressed out paraprofessional woman in the nation lusts after this kind of info….. even more than they lust after the the 50 Shades dude. Yet, genuine wealth management is almost never discussed in our media. Much less discussed accurately. The dearth of real coverage is even more striking in popular finance venues like Marketwatch, Kiplingers, and the finance blogosphere.

There are a variety of audiences for the details of how the rich ”do it”, yet all we are fed is photo imagery of Kardashians at club openings. And glamour shots of Gulfstreams on fresh tarmac. The salient details are alway conspicuous in their absence.

I’m reminded of this quote: The greatest trick the devil pulled was convincing the world he didn’t exist.

Bezos Musk Gates are the public faces of the billionaire class and absorb much of the attention from those families that lurk in the shadows.

A feature or a bug?

And I’m not hopeful that any meaningful legislation will pass to shine some light in this hidden corner of our esteemed markets.

FO operates at a level of abstraction remote from the average person.

Put in more conventional terms, how do you characterize the life activities of that FOer?

How are their hours used and how do those resemble, if at all, those of the average?

You could develop a geography of FOers, showing degrees of distance from that average life.

Some examples:

Everyone takes nourishment. Some eat tastier foods prepared by others. Some go hangry.

Everyone occupies space. Some have ability to choose that space and to exclude others. Some do not, and so could be called occupants or even vagrants.

There is a divergence of experience inherent in the above, with less familiarity as social or FOer economic distance obtains. At some point, the American experience won’t be recognizable as what was once representative, even with the best efforts of marketers. How much of a country or shared ethos is there at that point, and will the occupants be allowed to notice?

A prior comment mentioned the show Succession. Such spectacles present brief looks at the lives of those in the stratosphere of economic life, like Econ porn. Dallas, updated. Or pick some prior era notion, updated, maybe Le Hameau. What can’t go on, stops, and on occasion has help applying brakes, or new vectors if you will.