Yves here. Not a cheery picture. But to what degree is new home construction concentrated in hot markets?

By Wolf Richter, editor at Wolf Street. Originally published at Wolf Street

Homebuilders are on a wild ride, beset by shortages of materials and supplies, near-eternal lead times, spiking construction costs, difficulties in hiring, and projects that are bogged down. And inventories for sale, driven by homes that are still under construction and cannot be completed due to the shortages, are piling up.

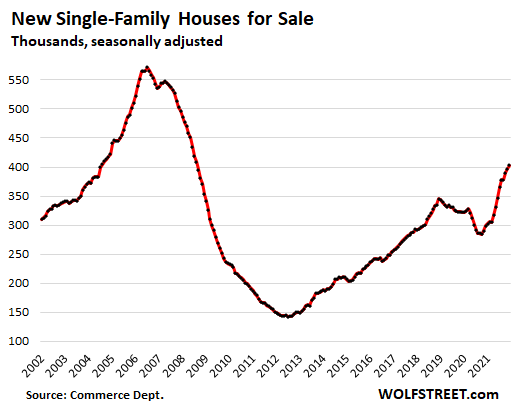

Inventory of single-family houses for sale at all stages of construction has been surging throughout the year 2021 and in December hit 403,000 (seasonally adjusted), up 58% from a year ago, and the highest level since August 2008. This represents about 6 months’ supply, according to date from the Census Bureau today:

Massive supply in the pipeline, by stage of construction.

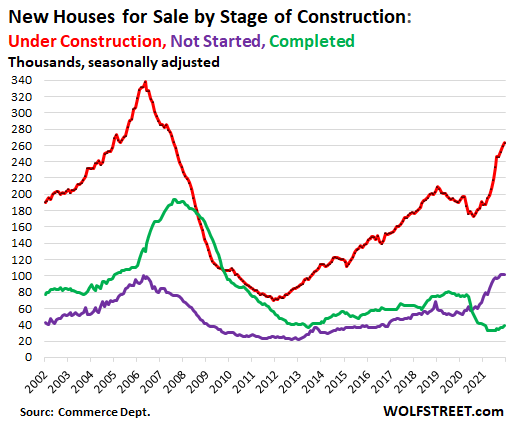

The number of single-family houses for sale that were still under construction jumped to 263,000 in December, the highest since August 2007 (red line in the chart below).

The number of houses for sale where construction hasn’t started yet remained at 101,000 in December. The past three months were all above 100,000, the highest in the data, having edged past the prior high of April 2006 (purple line).But the number of completed houses for sale has been bouncing along record lows in all of 2021, as builders face shortages that prevent them from completing the houses. These shortages range from windows to appliances. And once houses are completed – if they haven’t sold already during the prior stages – sell quickly. In December, 39,000 completed houses were for sale (green line).

Construction costs spike most in at least 50 years.

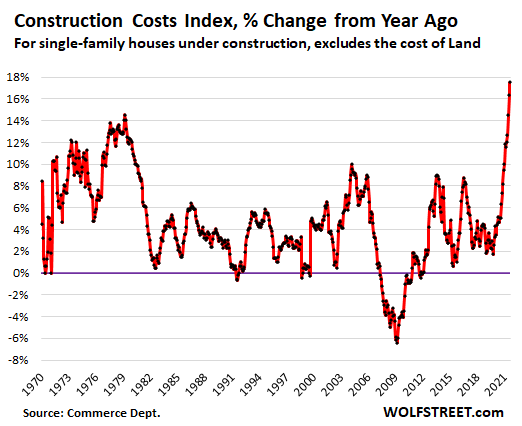

Construction costs of single-family houses spiked by 17.5% year-over-year in December, according to separate data from the Census Bureau today. This was the worst spike in the data going back to 1970. Compared to two years ago, construction costs are up 23.5%. These construction costs exclude the cost of land and other non-construction costs:

Median price took a massive dive as mix shifted.

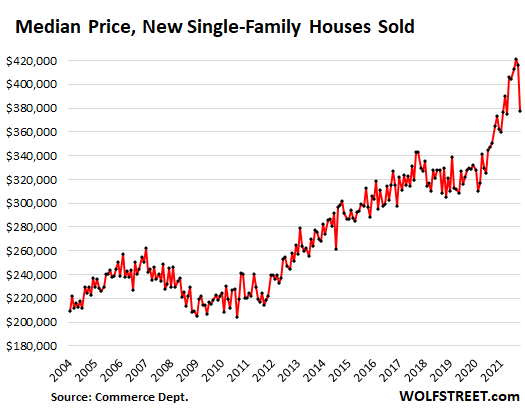

The median price of single-family houses sold in December plunged from $416,100 in November to $377,700 in December. This slashed the year-over-year price gains that had run in the 23% to 32% range since July to just 3.4%.

The median price is volatile and is skewed by changes in the mix of lower-priced homes versus higher-priced homes that sold that month. And there was some of that in December, with the number of houses sold in the $200,000 to $299,000 range rising and with the number of houses sold in the $400,000 and up categories falling, which shifted the mix.

Sales of New Houses, in Total and by Stage of Construction.

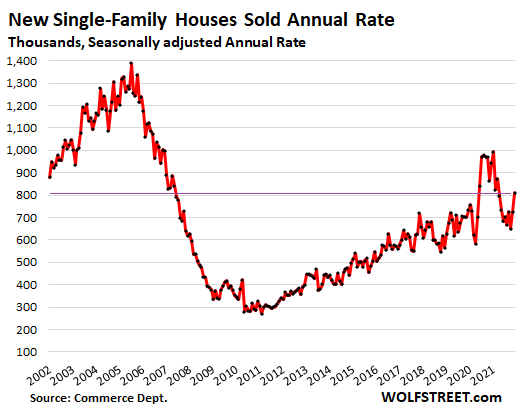

Sales of new single-family houses in December, at all stages of construction combined, rose from November, but was still down 14% from a year ago, to a seasonally adjusted annual rate of 811,000 houses. Sales remain far below the boom years of 2002-2006.

Apartment buildings and condo buildings are not included here, and the huge boom in multi-family construction in urban centers over the years is not reflected here. This is just sales of new single-family houses:

Within those total sales:

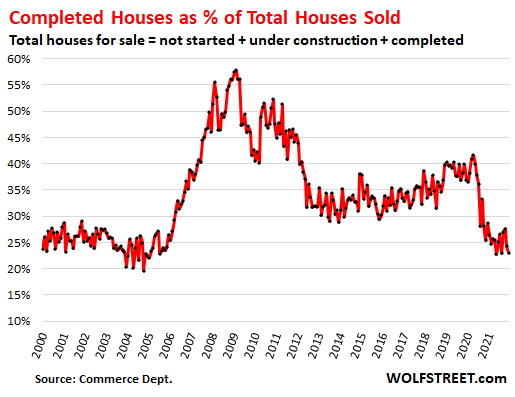

Sales of completed houses rose from November to a seasonally adjusted annual rate of 187,000 in December, but were still down by 31% both from December 2020 and from December 2019 as inventories of completed homes hovered near record lows, and there wasn’t much to sell.

The share of completed houses as a percent of total sales dropped to 23.1%:

Sales of houses under construction jumped to a seasonally adjusted annual rate of 393,000 houses in December, the highest in a year, as more buyers who couldn’t find a completed house ended up buying a house that was still under construction.

The share of under-construction houses as a percent of total sales backed off from the record high in November, to 48.5%:

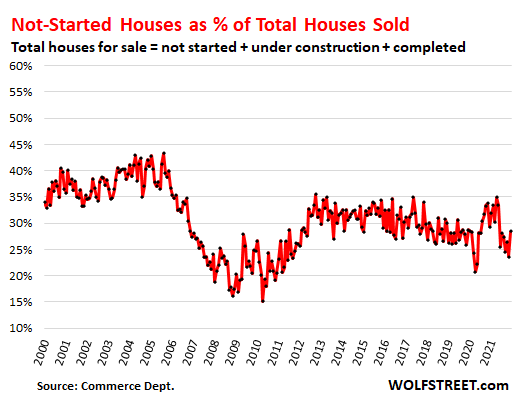

Sales of houses where construction hasn’t started yet – customer buys a house that the homebuilder will then build for the customer – jumped to a seasonally adjusted annual rate of 231,000 houses.

The share of not-started houses as a percent of total sales jumped to 28.5%, just a little below the middle of the range since 2021:

What these charts are showing are the results of the massive distortions that have spread across the economy. The distortions include interest rates (now surging) that are still far below the rate of inflation; artificially stimulated demand for goods of all kinds leading to shortages and transportation chaos; and labor shortages of the type we haven’t seen before. So now there is lots of supply of new houses, but that supply is building up in the pipeline and much of it remains stuck there.

Here in Vermont there is another inflationary effect: Our homeowner’s policy renewal jumped over 15% for 2022. When I called the agent to ask why, he said “Construction costs – across the board increases for all policyholders and similar increases for the other insurers we carry”. I am shopping around but so far it looks like he is right.

You’re lucky at only 15%, Last year my policy went up 25% due to costs to rebuild. I’ve already trimmed just about everything to keep it a bare bones policy with maximum deductible. My renewal is in March and I’m not looking forward to it. To be fair, I’ve been with the company for so long that I know I’m operating off a lower base rate than someone buying insurance anew.

grayslady and Amateur Socialist – Most insurance companies increase each year’s premium for inflation even in those years when building costs have not gone up. Ask your agent to re-evaluate the coverage limit from scratch.

You may be able to get them to decrease the limit to the current cost structure if your current coverage is unrealistically high.

I did this a few years ago when I realized the coverage I had was significantly higher than it needed to be. At the time, my house could have been built for about $300k and the coverage was up to almost $500k.

You can go without insurance. You cannot go without food, medicine or energy. Raw material costs are, in one year, up over 25%. It takes a while for that to be reflected in prices at retail. Wait’ll that appears, if the shelves are not empty.

Food prices have almost doubled in the first year of Bidenflation. What do years 2, 3 and 4 offer?

People are furious, or scared. Not a good thing going forward. All forms of government authority are deservedly becoming mocked and ignored. Got “experts”?

Watch participation in the voluntary income tax, federal, state and local level reporting to drop off precipitously. Withdraw cash and use only that to help your small businesses and workmen survive.

I am genuinely curious about what you think Biden has or hasn’t done to cause the Bidenflation.

CJFoster

Please show some links to your statement that: “Food prices have almost doubled in the first year of Bidenflation. What do years 2, 3 and 4 offer?”

Thanks

No fan of the current POTUS, but we have no way of knowing what inflation might have been if the last POTUS were still in office. The executive, any executive, just isn’t that powerful in the face of a pandemic + a supply a chain set up to fail + working class jobs being so unbearable during a pandemic that any way out was enthusiastically grabbed by many workers.

Tell that to my mortgage lender.

“Bidenflation”. Way to let the last 4 Presidents and Fed Chairs off the hook. Biden truly is Superman, he can take an economy that was absolutely perfect in less than a year! Trump should take some lessons in getting stuff done from Biden. That’s remarkable efficiency.

After narrowly escaping DC 22 years ago, we just moved back to NoVa to be with grandkids. There was a one year wait to buy a new home, but we lucked out getting into a 55+ community. Old people are still dying from Covid.

Out of the frying pan, into the fire. Meanwhile, back in the frying pan, private equity is exploring new frontiers in property management.

“34 [homeowners’] associations say that American Property Management Services LLC will not hand over the funds entrusted to it and is refusing to turn over bank statements.”

https://www.businessobserverfl.com/article/lawsuit-accuses-area-property-management-company-of-embezzlement

The owners have reportedly skipped the country. Meanwhile, Wells Fargo appears to be trying to figure out if it’s a plaintiff or a defendant…

I’m shocked, shocked to find that gambling is going on in here!

Bethesda housing market = expensive. 3 BR 2 BA near a good elementary school will cost $850K to 1.2M. These are not fancy houses mind you – mostly middle class Brady Bunch ranch/split levels, probably would cost $200K to $350K in a KC Suburb, but for some reason is immune to large price decrements, really at most points in history over the last 30 years. Remarkable is that in the last 3 years – these houses have gone from a floor of $700K to the current levels $850K floor.

Not sure what to do with this information, except rent or move. Buying into this market seems the epitome of insanity.

The reason DC and its suburbs are more immune to price decreases is because federal government employment (and contractors?) doesnt tend to fall during recessions

IMO, one under-reported factor, Covid changing the typical housing-ladder churn of seniors downsizing for institutional living.

On my section of the block, out of 14 homes 3 homes are over-70 widowed empty nesters, 2 houses are empty as the owners are riding out Covid at a second home, 1 house is empty as the owner is in a senior care home.

We are having an amazing construction boom here with most of it multifamily but also some large tract house projects. Lumber prices are quite high.

Just anecdata, but around here, here being the Heart of the North American Deep South, there is also a big supply of “flippers” that are languishing on the local market. On one inner suburban block, I passed four houses for sale in a row. All had been renovated within the last two years and are ‘on the block.’ One I can definitely say from memory has been for sale now for over a year and a half.

Looking at the local “For Sale” listings, I see that the “cheap” end of the ‘gently used’ house market is running at about $85 to $100 USD per square foot under roof.

The other shoe that has not been dropped for Prince Charming to find is the loss of purchasing power of the lower middle and working classes.

It all holds together, until it doesn’t.

In my nabe, there’s a two-house eyesore that is under contract for $385k. Holy cow.

This is a rental property has been neglected for as long as I’ve lived here, and I think that the buyer(s) are going to need at least $385k more for renovation costs.

Pass the popcorn. This is going to be a very interesting show.

That’s assuming the new owners do any renovations.

We bought our older house from a local slumlord, cheap. (Make a capitalist an all cash offer and watch his or her eyes light up.) Then we put in about ten grand in materials alone in bringing it up to livability. (I supplied the bulk of the labour.) The rentier involved prior to us did the absdolute minimum in repairs, and those were ‘cheaped out.’ That person owned and rented out about twenty houses in any particular year.

Don’t assume that anything other than the bare minimum will be done to that rental property, if it is going to stay a rental.

Be safe!

Here’s the thing about this neighborhood: We’re very good at making reports to the city’s code enforcement division.

If the new owner does anything that’s even slightly out of line, well, there’s this handy little online reporting form. We have that form in our browser histories. And we know how to use it.

We’re also very good at calling the city council ward office. They’re good at getting on the cases of local slumlords.

Ah! Similar to our neighborhood. How do I know this? Well, I got a visit from Code Enforcement this morning. It seems I was ‘turned in’ for not repairing the car in the driveway fast enough. (I’ll cop a plea here. I hate this particular job and have been dragging my feet on it.) Then the young man tells me about his having the semi-wrecked work truck of a neighbor, two houses down, towed due to a similar complaint. (Can’t have those pesky deplorables doing the Redneck Yard thing on our sainted city block, can we?) I now have two months to get the car running, plus the project car in the back by the old garage. I might have to invest in a six foot wooden fence.

It seems this town has an ordinance that prohibits the placing of non running vehicles anywhere on your property. There is also an anti-hoarding ordinance. (No piles of discarded items allowed.)

All in all, standards must be maintained!

Now, I will split this off from unlivable dwellings. Public safety and sanitation are legitimate functions of the organizing authority.

Anyway. That’s my story and I’m sticking to it.

Oh, that reminds me of something. Park Tucson.

Our neighborhood is at the southwestern corner of one of our city’s busiest intersections. And, for some reason that evades those of us who live here, we’re quite the place for dumping cars that were most likely stolen and then wrecked.

Well, sorry to tell you, car thieves, but we’re good at letting the authorities know that your ill-gotten vehicles are not welcome here. Matter of fact, I’ve already made three Park Tucson reports this month, and I’m about to make a fourth.

My neighborhood. Don’t mess with it.

I can get behind you on the stolen car dumping ground. I had a vehicle that was obviously being worked on. Unfortunately, it was visible to someone or someones who don’t like that kind of thing.

I’ll give credit for “standards” being useful, but must observe that many people apply standards applicable to a higher wealth bracket to the generality of the neighborhood dwellers. This is an inner ring, older suburb that is experiencing “demographic changes.” The tornados just happened to destroy a big chunk of the lower income residential neighborhoods. Those people are moving into the previously sacrosanct “upper(sic) class” areas. Many of them are renting what were previously family owned and lived in houses. Once Grandad and Grandma “shuffle off the mortal coil,” the places become rentals. One block over from us has an irregular problem with Badd Boyz cruisin the hood with their car sound systems blasting. (You know the music is loud when you can understand the lyrics to Gangsta Rap.)

When we lived down on the Gulf Coast, I used to pass across the old Highway 90 between Slidell and Pearlington. Several miles of two lane road across the delta of the Pearl River, with several small concrete bridges crossing over strands of the river. One such bridge, literally in the middle of nowhere was discovered to have been a dumping ground for stripped stolen high end automobiles. Twenty or thirty vehicles were ‘recovered.’

A heretical thought. Can’t the local coppers put up some of those much vaunted video cameras, targeting the “dumping ground” in the search for evidence? Hunters do it all the time in search of game trails.

Stay safe!

“It seems this town has an ordinance that prohibits the placing of non running vehicles anywhere on your property. There is also an anti-hoarding ordinance. (No piles of discarded items allowed.)”

shudder.

what would i do without my debris?!

prolly 80% of the things i’ve built depend upon collecting things that others toss in the dump(or intecepting it before it goes there).

i’ll admit that my debris field(yes, that’s what we call that part of that pasture) has grown somewhat unruly in the last 3 years, what with wife’s cancer and then covid chaos…still.

one of the piles(of gutters liberated from landfill) hides the 2 canoes(the free navy) from passerby.

my dad lived in one of those HOA dominated places.

i never really appreciated it until i was on his front porch from well before dawn until 7am drinking coffee and smoking and reading.

fancy get up white lady with an imperious demeanor shows up in the yard with a little elementary school ruler and measures the grass!

then she noticed me…bathrobe, hairy and bearded with a crazy eye…just sitting there watching her mutter about 1/8″ violations…and she almost leapt back to the sidewalk.

i told dad that it appeared that he really didn’t own that property, after all.

weird that the otherwise property rights uber alles crowd stands for such nonsense as a matter of course.

Oh yes, the Hyacinth Bucket cohort. It seems we now have one of these on our block. It’s the same old same old; rules for thee and rights for me.

I do have some empathy for whoever it is because this neighborhood is “in transition.” One street over are some not quite respectable rental properties. Loud cars and noisey teenagers. (Some of us would call that state of affairs the American Melting Pot.)

Last year, I was in the back yard doing something or other and noticed some teens pawing some stuff in my neigbhor’s carport. I yelled over at them to desist their activities. when one of the surly youths replied with some profanities, I mentioned that my neighbor was home and was well armed. I then called out as loud as I could, “Jack. Some thugs are stealing your s—!” Amazing as it was, Jack was home and came to the back door. “OK. What are you little punks doing on my place?” The want to be crooks faded into the mists quickly. (They actually ran.) None of us on this alleyway segment has had any problems with sneak thieves since. There is the kind of community solidarity a small neighborhood needs. Not just Nextdoor rants.

speaking of rants, this one endeth here.

Be Ye of good cheer!

no junk cars?

https://www.reddit.com/r/mildlyinteresting/comments/d1h1gm/a_tree_grown_through_an_old_car_in_roslyn_wa/

it’s not junk, it’s a planter box…

when i built a chicken house when we lived in town for a time, i put it on wheels…not so i could ever move it(impossible)…but to end run the weaponised permit regime.

made it tax exempt, too,lol.

when we finally moved back out here, i dismantled it…most of the lumber is part of this house, now.

In San Diego, wildfire exposure continues to cause non renewals in homeowner insurance market. Prices up. SF Bay Area commercial property has same issues.

Construction costs aren’t adding to premium as our building costs are already high.

State and City allowing SFD lot splits for construction of new units. Each lot can have a duplex and a couple granny units. Protests are state wide and falling on mostly deaf ears. CA will have 60MM people before I exit earth. Probably less before I exit CA.

In the meanwhile, haven’t seen a building inspector in years esp at flips or remodels.

There’s a lot half a block away from my house here in Dallas that’s been an on-and-off construction site for several months. The previous 1970s-ish house on that lot sat on the market for months before that, and once the buyer’s contractors started demolition they removed all the house’s glazing, left the rest of the building open to the elements and wildlife (exposed fiberglass insulation and all), and didn’t show up for any further work for weeks. After they finally tore down the building last fall, more weeks passed before anyone showed up to start foundation work on a new structure, and progress has been spotty ever since. There’s a slab foundation and some studs up now, but little sign of further progress. Given all the supply chain problems and the fact that staffing levels in city permit and building inspection offices have not recovered to their pre-Covid normals, maybe I shouldn’t be surprised!

I see a lot of teardowns in my near midtown Kansas City area neighborhood. Basically, I’m guessing they buy an old house/lot for $150K-$250K, tear the house down, then build a new one and sell it for $600K-$1M. So there’s profit margin there, and people like to live closer in these days.

But I definitely see the construction delays, and they are bad. The construction post-teardown is painfully slow. The outer shell of the house gets built at a decent pace–although sometimes the windows take awhile to go in. But then the real slowdown starts. I’m guessing there’s tons of delays waiting for many interior things like floors, fridges, cabinets, etc.

Thanks for the warning. I was thinking of replacing my fridge this year. But, ya know what? The current fridge isn’t the greatest, but it works. I’ll just keep it for the time being.

Slim, our >14-year-old HotPoint refrigerator compressor was making unfortunate noises, so we called our local (only one, I think) appliance dealer and he had a KitchenAid double wide in stock that fit in the space better and matched our HotPoint dual-fuel range and dishwasher we got from them about 4 years ago. Expensive but in the “Ford/Chevrolet” range instead of the Nancy Pelosi range. The previous versions of those were a Viking gas oven/range and a Bosch dishwasher, which came with the old (1858) house. Both magnificently dysfunctional, with the nearest willing repair shop 85 miles away. Maybe time for you to look? Our dealer’s lead time is “indeterminate” for just about everything else. We were able to get a new Amana dryer from him, too. All analog and the twin of the previous Whirlpool that I replaced everything replaceable in to no avail. It was about 14 years old. In 40 years of marriage, dryer life has declined from 26 years with a few repairs to 14 years and no repairs. This one might outlast me! Overall costs were the same as Lowe’s and Home Depot, but the money stayed in the community.

PS: I was in Tucson for a meeting in May 2019 after a rainy spring. Every cactus was blooming and I’ve never seen more beauty in one place. The tacos and margaritas were special, too.

I used to live in between the Plaza and Westport. I returned for a wedding a few years ago and was shocked to see the amount of exactly what you describe. Especially considering how damn cheap it was prior!

I’m confused. This says that there’s 6 month’s worth of inventory but also that,”…once houses are completed – if they haven’t sold already during the prior stages – sell quickly.”

Am I missing something or are these at odds with each other?

Aren’t we all going to see higher insurance rates to pay for PG&E’s wildfires?