To add to the Biden Administration’s litany of woes: The inflation situation has developed not necessarily to the Biden Administration’s advantage. As we’ll discuss in more detail, an uncomfortably large number of commodities are seeing hefty price increases. For instance:

Here are some price changes since January 2021:

Nat gas +81%

Oil +66%

Agricultural commodities +24%

Rent +13%

Used car prices +44%

Gasoline +36%

Cattle prices +20%

Lumber +15%

Coffee +92%

Hotel Prices +37%Then, today:

CPI: +7.5% pic.twitter.com/r8k2kBCSo5

— Dan Collins (@DanCollins2011) February 10, 2022

A new story in the Financial Times focuses on shrunken inventories in key sectors:

Stockpiles of some of the global economy’s most important commodities are at historically low levels, as booming demand and supply shortages threaten to fuel inflationary pressures around the world.

From industrial metals to energy to agriculture, the rush for raw materials and food staples has been reflected in futures markets, where a large number of commodities have flipped into backwardation — a pricing structure that signals scarcity.

Problems are particularly acute in metals, where spot prices of several contracts on the London Metal Exchange are trading higher than those for later delivery, as traders pay large premiums to secure immediate supply….

Copper stocks at major commodity exchanges sit at just over 400,000 tonnes, representing less than a week of global consumption. Aluminium stocks are also low, as smelters in Europe and China have been forced to cut capacity because of the huge financial strain caused by spiralling energy costs.

As an aside, your humble blogger warned of copper and aluminum shortages in November. Back to the pink paper:

Production cuts are just one factor behind the supply shortages, which have led the Bloomberg Commodity Spot index, a key gauge of raw materials, to rise more than a tenth since the start of the year and hit a record high this month….

Other drivers of the shortages include a lack of investment in new mines and oilfields, bad weather and supply chain constraints caused by the spread of Covid-19.

In other words, some of these results are due to significantly to the direct and indirect effects of Covid: demand whipsawing and supply chain issues due to Covid hitting staffing and cutting throughput. The Covid “recovery” wrong footed many producers. For instance, even though oil production can be dialed up and down, it does not turn on a dime. Automakers were hit by the famed chip shortage, due to slashing orders and then finding that chipmakers had successfully redeployed a lot of capacity to consumer electronics. Automakers, and therefore buyers, are now having to eat the cost of commodity price increases too.

However, an overarching problem is that, as we saw in the 1970s, an extended period of high energy prices in not too long a period of time propagates through the economy. The oil price jump isn’t anything like what we saw then, and is also nothing like the short but attention-grabbing oil price runup of 2008, where prices briefly peaked at $147 a barrel. We correctly called that that spike (and the increases in other traded commodities) didn’t result from fundamental factors ex China stockpiling diesel for the Olympics, and that was set to fall sharply. A current example of energy prices driving other price hikes:

Traders in Kampala city have blamed the increase in prices of commodities, especially those manufactured from factories, on the high prices of fuel.

Fuel prices started increasing at the beginning of this year and as of now, petrol stands at around sh5070 and diesel at sh4430. pic.twitter.com/jGD7bpHs8w— Baba TV Uganda (@babatvuganda) February 14, 2022

For those cynics who have volunteered in comments that they wonder if Biden is escalating with Russia to divert attention from his Covid and other domestic worries, if that really was a significant motivator, it may not be working out so well. Any polling gains from Biden’s macho show may be more than offset by the incremental increase in inflation in key commodities, particularly energy-related ones. The lead story in the Wall Street Journal is Why Russian Invasion Peril Is Driving Oil Prices Near $100:

The threat of a Russian invasion of Ukraine is shaking up a fragile global oil market, pushing prices closer to $100 a barrel as traders calculate that supplies will struggle to cushion the effect from any significant disruption in Russian fossil fuel exports.

Demand for oil has outpaced production growth as economies slowly rebound from the worst of the pandemic, leaving the market with a small buffer to mitigate an oil-supply shock. Russia is the world’s third-largest oil producer, and if a conflict in Ukraine leads to a substantial decrease in the flow of Russian barrels to market, it would be perilous for the tight balance between supply and demand.

Those dynamics have led traders in recent days to price in a sizable geopolitical risk premium, according to analysts. Crude oil prices, which haven’t topped $100 a barrel since 2014, jumped to an eight-year high on Ukraine concerns Friday.

And Russia is an important supplier of other key commodities:

"Russia & Ukraine account 4 nearly 1/3 of wheat & barley #exports, & about 1/5 of corn #trade. Unrest in the region could keep #prices of these commodities elevated & add to #food costs that are already high" #foodsecurity via @markets https://t.co/0TD7fIItPA via @markets

— Souhad A. (@souhad_16) February 14, 2022

Interestingly, some oil price experts contend that as energy prices have kept rising, “ESG” investors, as in those advocating considering the environment, social, and governance issues in their picks, have been backing away from their former firm positions about fossil fuel divestiture as prices, and stock prices, have rallied:

“I think folks have hidden behind ESG when oil prices were just lower. ESG has gone to the back burner. I’m not saying ESG is no longer relevant but it doesn’t seem to be as important."https://t.co/tZ5Cx959U7#OOTT #oilandgas #WTI #CrudeOil #fintwit #OPEC #Commodities #ESG

— Art Berman (@aeberman12) February 13, 2022

The Financial Times, in another new story, also reports that shale bonds have appreciated, which also means the cost of new debt issuance, has fallen. This development is a blow to US climate change activists. We pointed out years ago that most shale producers were not profitable if oil prices were below $70 a barrel, and that shale gas plays continuing to operate despite that was dependent on them still being able to borrow despite that. From the Financial Times:

Investors are loading up on the debt of US oil and gas companies, lured by their ability to generate cash again as energy prices soar.

Funds now hold overweight positions in high-yield energy bonds compared to a benchmark index, according to Bank of America Global Research. This means that, instead of simply trying to track the proportion of energy sector bonds in the index, investors are choosing to own much more.

Investors’ appetite for energy bonds comes as crude oil prices stage a ferocious recovery, more than doubling since late 2020 to $90 a barrel, their highest in seven years. Natural gas prices have also rallied.

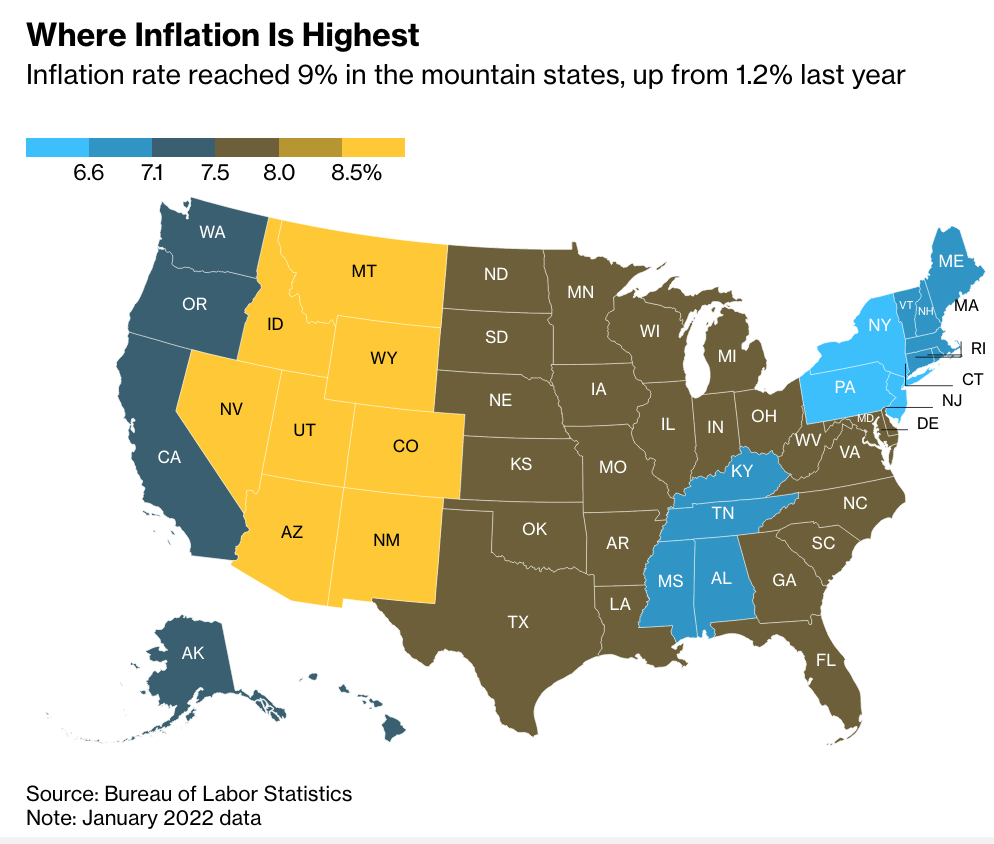

Bloomberg pointed out that in the US, inflation is more pronounced in some areas, with the Mountain states hardest hit:

Even so not everyone is a commodities price bull. Steel is far and away the biggest manufacturing cost input for cars, constituting as much as 47% of manufacturing cost. Consider this end of year steel forecast from Hellenic Shipping News. Even though one could argue that the Omicron caution is overdone, the experts see high steel prices cutting demand by second half 2022:

Steel market participants are becoming increasingly cautious in their purchasing requirements. The forward view on global prices is, gradually, turning more negative, particularly for coil products. The record high values reached in the summer of 2021 took many by surprise….

The outlook for the start of 2022 is becoming clouded by yet another wave of Covid-19 sweeping across the globe. The ominous Omicron variant may slow the recovery in the steel market. Many buyers are concerned about a price collapse, in the coming months. Divergent trends, across the three regions researched, are envisaged in the short term….

Reductions in steel selling values are predicted in the second half of 2022 across all regions researched. Diminishing growth in flat product consumption, due to the inflated cost of steel and other materials, is anticipated. Inflationary pressure is likely to dampen consumer spending. Moreover, the recovery in demand from the automotive sector is expected to be protracted.

And one can wonder how much high prices will start to crimp demand in other sectors. Many of the commodity categories hit by sticker shock, like copper, energy, and lumber, are important to home building and home renovation. Home prices in some areas are already softening due to higher interest rates; elevated costs for new construction and fix-ups will also affect buyers. And slower activity in such a key sector would slow overall growth.

We haven’t said much about agriculture price rises, but like the other types of commodity price inflation, they aren’t driven by factors the Fed can influence, short of such aggressive interest rate increase that it kills the economy. As Econofact explained in a November 2021 article:

• Meat price changes have been a primary driver of overall food price increases. Changes in meat prices have a large influence in the price indices because consumers spend a relatively high share of their food budget on these items. Beef, pork, and chicken prices are respectively 26.2%, 19.2%, and 14.8% higher in October 2021 than prior to the pandemic in January 2020. Indeed, prices for some meat items have reached the highest levels recorded even after adjusting for overall inflation. The retail price of bacon, for example, was $7.31/lb in October 2020, 36% higher in inflation-adjusted terms than in October 1980. The meat price increases were initially caused by disruptions in supply when packing plants shuttered after workers contracted COVID19. Packing has fully resumed, but there remain extra costs from socially distanced workers and the addition of personal protective equipment. In addition, livestock and poultry feed prices have significantly increased as discussed in more detail below. These increased supply costs have occurred as domestic and foreign consumer demand for U.S. meat has also been strong.

• Agricultural commodity prices have increased. For every dollar consumers spend on food, about 14 cents reflect the cost of the agricultural commodities at the farm level. Prices for raw agricultural commodities like corn, wheat, rice, and soybeans have risen since the start of the pandemic. The United Nations, Food and Agriculture Organization, Food Price Index, which tracks global prices of commodities used in making food, is up 30% in October 2021 relative to pre-pandemic levels in January 2020. Commodity prices have been rising because of impacts on supply from adverse weather conditions in major crop growing regions (e.g., derecho in the United States’ Midwest in Summer of 2020; drought in Argentina, Brazil, and in the Western U.S. in 2021) and from higher input costs like fertilizer and herbicides.

Mind you, higher demand, like higher SNAP payments increasing food spending, and more purchases from abroad, also contributed.

But as you can see, none of these factors are likely ta abate soon. Consumers should brace for things getting worse before they might possibly get better.

—cynics who have volunteered in comments that they wonder if Biden is escalating with Russia to divert attention from his Covid and other domestic worries, —

If this indeed happened, Biden’s handlers are genuinely credentialed, brain-dead hacks.

US aerospace can’t function without vanadium (to make speciality alloys).

There will be shortages of catalytic converters if Russian platinum and palladium gets taken off the western market (conversely, Chinese auto makers would be at an advantage)—even the iPhone specialty glass and petrol refining needs platinum.

Fertilizer input prices (potash, ammonia etc) are at 2008 all-time highs. Ask any farmer at a Farm & Fleet store about that (oh wait…with American social atomization, the chances of someone living in Georgetown having a college buddy farming in Iowa is near zero).

If you have a modern diesel engine, you also need ammonia (urea) for the emissions system. No urea, no crank on the engine as the engine module will know that you are trying to be a coal roller. Every trucker knows this.

The US has a $1+ trillion trade deficit in physical goods (<$200b surplus in services). It won't take much to get inflation hit 8% this year—even if housing stablizes.

What a hot mess! Buckle up. Everyone is on their own. DC is not coming to the rescue.

Or even without the “if”? While some of us like to blame Wall Street for everything, Galbraith the other day talked about energy prices as a big driver behind the rise and fall of America’s industrial dominance. And if Biden’s saber rattling has a lot to do with current price rises, just think what will happen should he get his war in Ukraine. Call it the bull in a china shop administration.

Giant truck convoys may be an equally anarchic response to brain dead hacks but somebody has to say “basta!”

—cynics who have volunteered in comments that they wonder if Biden is escalating with Russia to divert attention from his Covid and other domestic worries, —

I can’t help but to think that recruiting has something to do with it….and oh by the way none of my russia obsessed friends would allow their progeny to join up…

https://bleacherreport.com/articles/2029052-the-flag-and-the-shield-the-long-alliance-between-the-nfl-and-the-us-military

What happens next is a disturbing mystery to me…

And then there’s the language which is similar at least to cheerleading about rents…higher prices are just fine for wall streeters and there’s probably a couple of prominent politicians who can be thanked for that…

“Investors’ appetite for energy bonds comes as crude oil prices stage a ferocious recovery, more than doubling since late 2020 to $90 a barrel, their highest in seven years. Natural gas prices have also rallied .”

(my bold)

The graphic above with the states reflecting the inflation impact is pretty helpful. I concur with the graphic for the southeastern US, at least for the Carolinas. That being said, on a drive this weekend through different segments east of Charlotte there is new (very early stages) housing and subdivisions going up some 30 to 45 minutes from the downtown city center. Go long construction and housing inputs, I suppose? Road and infrastructure improvements in the past 5 to 15 years are surely driving a portion of that.

We can attest to the rise in energy product prices. Last winter, our monthly natural gas bill, used to heat a 70 year old house, somewhat retrofitted with insulation, was averaging $45 USD. Our latest monthly bill is $62 USD. Our electric bill, we using a combined gas electric heating regime, was roughly twenty percent higher than last year. Usage was up about ten percent.

What is laughable is how the electric company no longer includes the cost per kilowatt in the bill. The management of perceptions on the micro scale. The gas company, since it was bought out by a regional chain, limits access to usable information in a similar fashion.

Inflation at the grocery store has become a common item of conversation generally. Strangers in the store will remark out loud about a price rise, or, more insidiously, shrinking of package content today. Sometinmes it takes on the aspect of a shared joke. “Look at that! They’re doing it again!” Etc.

Commodity prices may be a see saw affair, but, at the retail level, the phenomenon of “price stickiness” comes into it’s own. Prices go up, and they don’t come back down, even when raw materials prices do so. Gasoline might be the only visible case of a price coming back down, if only, I speculate, due to it’s marquee status, (everyone pays close attention to gasoline prices.) The case of gasoline is fairly straightforward. The price of crude oil is plastered all over the ‘news’ spaces. The relationship between crude oil and gasoline is fairly direct and easily understood. Not so for raw foodstocks and ‘processed’ food items. The cynic in me wonders if perhaps crude oil is highlighted because, as it’s price goes both up and down easily, so does gasoline’s. In other words, a distraction from the other, “sticky” price items.

Oh well, don’t get me going on Social Security payments and how they are chronically shrinking as a percentage of the basic standard of living.

I think the real impact on food prices will be later in the year. I occasionally browse the agriculture media here and its full of articles informing farmers how to avoid spending too much on inputs. A lot of farmers are opting for low fertiliser crops like peas, and some are planning on reductions in milk output as they won’t apply so much nitrogen to grasslands. Little things like this have a tendency to work their way through commodity markets. Good news if you like peas and other legumes I guess.

Food price spikes are coming, and in the developing world, this usually triggers geopolitical unrest. The last time this happened, you had the Arab Spring revolutions. We will probably see a wave of unrest in the ME and Africa come next year as a result.

“Peas and other legumes”. Another supply of natural gas!

Soak them before cooking to avoid the gas. See the book Nourishing Traditions for details.

Years ago to prepare for a visit to an aluminum foundry I had occasion to follow aluminum commodity prices with the thought being that the cost of aluminum would be the driving force of the price of the finished castings / injection molded parts.

And in talking with the management and asking about the impact of commodity price on cost management laughed and said “Nobody I know pays commodity prices.”

So items of note –

For many commodities it is possible to find other sources of supply with pricing significantly below published commodity prices. As an example, aluminum foundries may use surplus electrical transmission lines or even discarded beverage cans.

For some fuels it is possible to substitute waste products – scrap wood, ag waste (barley hulls) paper pulp / latex sludge.

The problem with using published commodity prices is that they are often used for speculation and do not reflect actual costs or prices.

I find this article very ominous. This is not finished products that it is talking about like you see with the container mess on the west coast, This is the materials that you make things or power machinery to make things. And by the sounds of it, it is not just a hiccup but a systematic problem spanning the world and which will take the cooperation of different governments to solve. Good luck with that one, matey. I’m probably being an alarmist here but to me this sounds like that post that came out about two years ago talking about a new virus breaking out in China. And if they are talking about food shortages, then you are talking about food riots and when you get that in the streets – political revolts are not that far behind. Just spit-balling it here but perhaps Biden should tell American farmers there will be no more subsidies for growing crops for car fuel but there will be subsidies for growing food crops.

And yet any loss of confidence in the legitimacy of the managerial class has yet to be fully realized in the consciousness of the managed, as an entire range of future probable intractable crises may prove to be wholly unsolvable due to both human irrationality and the limits of human cleverness.

“We tend to use [transitory] to mean that it won’t leave a permanent mark in the form of higher inflation,” Fed Chairman Jerome Powell said during a congressional hearing on Tuesday. “I think it’s probably a good time to retire that word and try to explain more clearly what we mean.”

In other words, in the world of managerial equivocation, what we mean is not necessarily what we say or do and what we say or do is not necessarily what we mean.

https://fortune.com/2021/12/03/inflation-no-longer-transitory-higher-prices-fed-chair-powell-treasury-yellen/

And cars are using an increasing amount of both aluminum and copper:

(italics mine)

And of course, heh, “chips”, as silly as that is.

https://www.jdpower.com/cars/shopping-guides/what-are-cars-made-out-of

even with all the bauxite in the world, without magnesium, one can’t make many of the specialty aluminum alloys.

that is where DC’s petard is going to get hoisted….all these relatively obscure, but absolutely necessary, commodities (potash, palladium, vanadium, etc) that Russia either is the marginal producer or processor.

…or which are processed in the EU, but rely on affordable Russian hydrocarbons to fuel the factories

not to mention the frantic pursuit of nickel, cobalt and manganese for the EV market. Interesting you mention vanadium though, curiously not on many radar screens but thought to be somewhat superior to lithium as it retains infinite recharging capacity that simply refuses to degrade. A public utility in Washington state installed vanadium flow batteries for much needed energy storage. Vanadium was thought to be somewhat a plus in the electric vehicle production scheme as the energy unit never depleted therefore never requiring replacement. The only thing missing after that would be on-board charging ability not unlike the Light Year 1 vehicle currently being manufactured. I think we are close.

History rhymes. I see a certain similarity here with the 70s. Maybe it is once again being realized that war is a lousy way to run an economy, let alone an impoverished world. But now we are no longer above the squalor – we are in it thanks to a decade of rapacious neoliberal economics. And if we went to the Middle East to secure oil, we did not exactly succeed. Therefore: “inflation”. Which is just another term for devaluing our currency. Not to worry however, because it is all mostly 6s. When Biden said “nothing will fundamentally change” he was leaving that one little thing unsaid. This time deregulation is not an option. So we are going to have to price things accordingly and live more modestly. But, lucky for us, we now have a good understanding of how to spend our money thanks to MMT. With good spending in mind we can do this. Si, se puede, as they say. So with that in mind one big thing will have to change – our government will have to become responsible to us, the people. Yes, Congress, those nitwits. But with a devalued dollar we will be able to manufacture and export again, so jobs – only, it will be a little different this time because we have picked all the low-hanging fruit of the economy/environment. So GND jobs will be a big part of our domestic revival. Good medical care 4A will be unavoidable. So will recycling requirements and environment reclamation. Probably quotas, rationing, price controls, tariffs, and all the usual suspects as well. It’s almost like a sigh of relief at this point, no?

What concerns me in relation to this subject is the degree to which the “ruling elites” have become untethered from reality. It’s an easy trope to use, but the dreaded Versailles Moment is a real thing in world events. So called ‘Rulers’ can and often do follow delusions past the point of no return. In times gone by, this would lead to massive economic and social depressions, but the basics with which civilization can recover were always there, somewhere or other. Today, some of the malefic consequences of elite mismanagement are quite possibly civilizationally destroying. Think atomic war, or extreme climate shifts, or even something as simple as the loss of naturally produced potable water supplies. Look into some of the American Superfund Sites. Chemical pollution of groundwater supplies, that are predicted to last for centuries. Entire regions uninhabitable for large human populations.

The best case scenario for America I can think of right now is an American version of the French Revolution of 1789.

I do see our coming “revolution” as inevitable. I’d just prefer to see a revolution that becomes very organized and goes to work fixing things than the old fashioned kind. We’ve got good technology. I like to think it is possible.

. . . on the other hand the operative phrase could become, sal si puedes! (get out if you can!.)

Whether or not Biden is trying to “Wag the Dog,” I do not believe it cynical or paranoid to conclude that the Democrat nomenklatura suffers as much from Putin Derangement Syndrome as they do TDS.

It is striking that Joe Biden was effectively Obama’s “special envoy” to “Ukraine” and that his son Hunter admits to raking-in millions in “Ukrainian” honoraria — or that Blinken’s great grandpa hailed from Kiev, that he is the son of a founding director of Warburg Pincus, and spent his career destabilizing the Muslim world. Greenwald and Maté tweeted over the weekend a DNC apparatchik claiming “payback for 2016” — can there be much doubt that the Goldwater Girl’s illegal Westchester County server was compromised by the FSB?

Ordinary Americans are dependent on commodities controlled by the Russian Federation and their ally China. It is whack for these clowns and their tools in the establishment media to engage in this bear-baiting when we are dependent on trade with them and they have had time to develop other markets. Putin Derangement Syndrome is rapidly going to take us beyond current inflationary pressures to create severe commodity shortages that can only further destabilize American society. This is madness.

The Minsk Accords brokered by France and Germany were intended to prevent a Rwanda-style liquidation of the Russian majority stranded in eastern “Ukraine” by the disorderly collapse of the USSR. ”Ukraine” was never “invaded” by Russia, since the Black Sea Fleet has been based in Sebastopol since Catherine the Great and tens of thousands of Russian military personnel remained based there after “Ukraine” split from the USSR.

BTW, thanks for the tip on copper wire!

One thing missing when discussing commodities is the influence that financial players have on quoted spot prices. Once they see a trend they tend to start piling in in a self-reinforcing way; knowing that supply is relatively inelastic.

While it is a little hard to tell, I suspect a meaningful piece of the price action is hedge / commodity funds.

Bananas were still 49 cents a pound at Wegmans this morning. Been that price for many decades.

What’s in your grocery cart?

Hah! Banannas in the Bigg Boxx stores have been hovering around the seventy cents a pound price range for several months now, down here. When ramen packs go up from $.32 per pack to $.39 a pack in two weeks, I know something’s up. Thst’s around a 22% or 23% rise in price. Two years ago, I remember seeing the same product selling for roughly $.25 a pack. Now that is a roughly 55% price jump over two years, in a basic staple for poors everywhere.

If you can afford an expensive automobile, you can afford to eat. If you have to take the bus, you might be a bit hungry by the end of the week.

They make it up on volume…

https://community.plu.edu/~bananas/economic/home.html

bananas need to be sold pronto and the industry has a dedicated supply chain for it’s single product.

Concluding remark: stay calm and frugal. Only way to see prices coming down one day.

Our electric bill in our small Silicon Valley condo used to be about $120/month. It was pretty high because CA electricity prices are high, plus we have three air filters (our dog has serious inhalant allergies) and a small stand alone freezer, along with the usual light bulbs, oven, computers. We never used the heating system, which is electric, due to the staggering cost; we would occasionally turn on a space heater.

Then my father in law moved in about five years ago. We have to keep him very warm since he is now 97 years old and skinny. So we got a (fancy, safe) space heater for his room and our bill went up to around $200-$220/month. Sometimes during the summer it is less.

I just got the most recent bill. It is $297 for last month. At first I thought that they hadn’t credited my last payment, but no, that is the actual bill. And in today’s regional online paper, I just read that PG&E will be raising rates. So I can look forward to something even higher.

We can afford this, sort of. But a lot of people can’t, and then there is the cost of these higher utility bills increasing the costs of everything else.

…and on Saturday the US Ag. Dept. shutdown all imports of Mexico grown avocados. (Mexico is the largest single producer of avocados, by far.) The shutdown was caused by a texted threat to a US Ag. inspection agent in the Mexico orchards. (US has inspectors there to monitor for bugs and diseases that could be transported and affect US avocado production.)

All that to say, avocados in my supermarket have gone from $1/ ea. to $2.50 ea,–before the embargo. No telling what price will prevail in the next few weeks. (The next largest avocado producers are the Dominican Republic and Peru—shipping costs will be higher.)

PS. Maybe “your humble blogger” should be Secretary of Commerce ;)

PPS. Avocado growing in Mexico is controlled by the drug cartels

By now they are more than just “drug cartels”. They are “crime of all kinds” cartels.

The problem could be solved by making money laundering, asset hiding, tax havening, etc. illegal in practice as against in theory.

Making it illegal “in practice” would mean de-licensing, de-certifying, de-chartering, etc. all the lawyers, accountants, bank personnel, etc. involved in the money-laundry-design and money-laundry-engineering side of money laundering and money moving.

America has the prison space needed to put a million or so of these money-laundering-social-infrastructure people for the rest of their lives until they die in prison. We just need to release the people currently in prison for various artificially created “infractions” of artificially created “laws”. There is nothing wrong with having a Carceral State if we focus on incarcerating the right people. And the people who make the money-management side of organized crime possible are the right people to mass-incarcerate for the rest of their lives until they die in prison. It would be a form of “bloodless mass extermination” for a sector of people which deserve it.

With all the rising prices it seems like the working class is getting a shocking experience. Those uppidity Americans wanting raises,union repesentation,healthcare, etc. and leaving there jobs willy nilly. People on the edge needs to be concerend about getting food on the table ya know.

re: Stockpiles of some of the global economy’s most important commodities are at historically low levels, as booming demand and supply shortages threaten to fuel inflationary pressures around the world.

there is a lot of backwardation in commodity futures right now…if March oil is priced $95 today but March 2023 WTI futures say it’s worth $80.44 a year from now, no one in their right mind would want to hold any inventory…

The one word that is missing in this article that should be in its title is “profiteering”. It is the basis of the endless wars. Even if Ukraine doesn’t get invaded by Russia, defense contractors have profited from the “wage the dog” charade. Plus enough American Liquid Natural Gas (LNG) has been sold to the European spot market to increase energy prices in the USA. Also, since the 1970’s energy crisis, besides offshoring, the big change in the world economy is the consolidation of corporations. Multi-nationals are either a monopoly or duopoly (i.e. Boeing – Airbus). They fix prices innately. Prices will keeping rising because they can and corporations have backstops at the Federal Reserve or European Central Bank that allows them to stay in business.

In Joe Biden’s words; “Capitalism without competition is exploitation”. A failed US government has killed almost a million Americans with COVID-19. If there are Polar Vortex/Heat Dome energy shutoffs, food shortages, or a world war with Russia; millions more Americans will die.

Here is a tiny little inflation-observation report from the ( my personal) field. A little bit of anecdata, if you will.

I sometimes shop at the Dollar Store ( specifically Dollar Tree).

https://www.dollartree.com/?msclkid=64ce6cd420771359f5270edfe0ade1b1&utm_source=bing&utm_medium=cpc&utm_campaign=DT_Brand_Core&utm_term=dollar%20tree&utm_content=Core

My most recent visit was a few days ago. And I found that the Dollar Store had become the Dollar-and-a-Quarter Store. In other words, every single thing that was a dollar . . . . is now one dollar AND twenty five cents. (Except a few legacy holdover cans of green giant sweet corn, still for a dollar a can. But when they are gone, they will be gone.)