Yves here. I have regularly been mentioning a US diesel shortage as a real risk if the Russian sanctions aren’t relaxed soon in private discussions and should have Said Something on the blog. This post depicts the issue as much broader.

However, it does not unpack the technical issue at all and yours truly will take a stab. This is a layperson/simplified version, so if I got anything wrong, please pipe up in comments. Additional details also welcome.

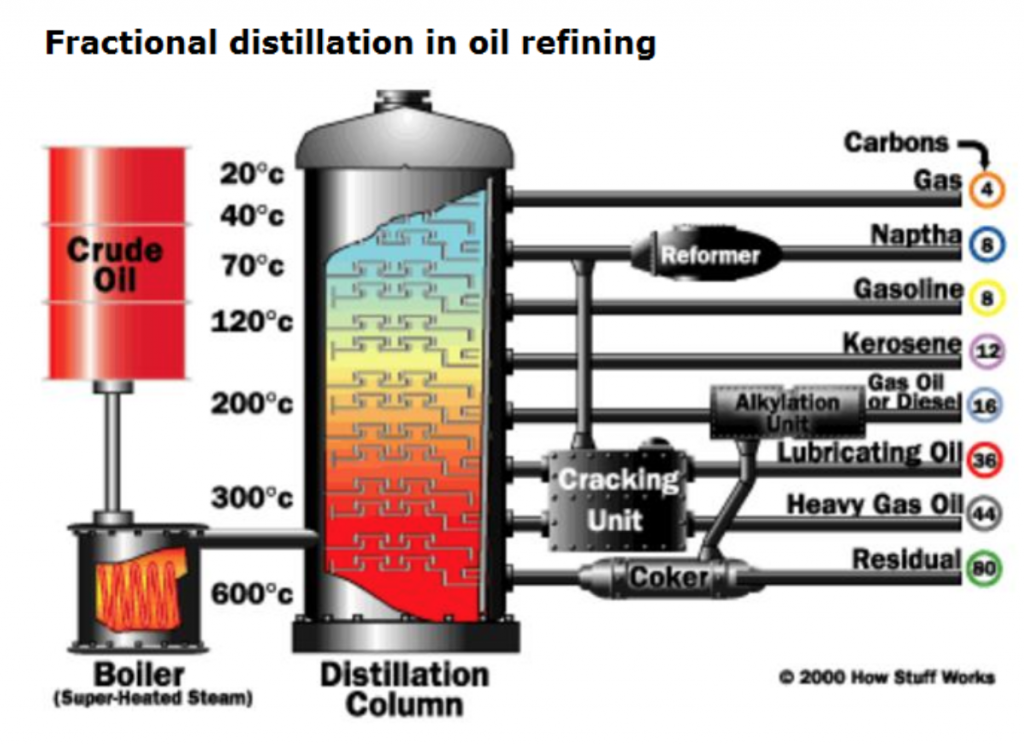

This is a very simplified view of how petroleum distillation works:

Notice the ordering from top to bottom. The “lighter” products have shorter carbon chains. That means less energy per unit volume. So diesel is more energy dense than gasoline.

But this simple picture ignores that crude oil is most assuredly not created equal. Light sweet crude, the sort that comes from Saudi Arabia, is very much skewed towards the gasoline end of the spectrum when refined. Shale gas is even lighter.

By contrast, Iran and Venezuela produce what is called heavy, sour crude.

Refiners can change some of these “fractions” to others, as ACEA explains:

- cracking, which breaking large hydrocarbon chains into smaller ones

- unification – which combines smaller hydrocarbon chains to make larger ones

- alteration – which re-arranges various isomers to make desired hydrocarbons

However, this process is not cost free. For instance, I have regularly read that oil from Iran and Venezuela are attractive on world markets only at prices of over $100 a barrel. I take that to mean only when prevailing prices are high is it worth the cost and effort to crack them to produce gasoline.

My understanding is that Russia oil is heavy but not as heavy as Venezuela’s or Iran’s crude, that its energy density is very well suited for home heating oil, and as the article below suggests, diesel. Diesel is important for Europe since many passenger cars as well as trucks use diesel.

In addition, I assume (and welcome reader input) that getting diesel from light sweet crude by unification is mighty inefficient, otherwise coming up with more diesel would not be such a big problem.

And as for Venezuela, experts have opined that due to years of sanctions-induced underinvestment, Venezuela can’t produce enough to fill America’s Russia shortfall. Plus the US is unable to get over itself. From the Financial Times at the start of the week:

The White House this month sent three top officials to talk to Maduro, even though the US does not recognise him as president and has indicted him as a drug trafficker with a $15mn price on his head. The US government acknowledged last week that one aim was “certainly” to discuss energy security following Russia’s invasion of Ukraine.

The visit — the first by a White House official to Caracas since the 1990s — prompted a fierce backlash at home, not only from Republican hawks like Florida senator Marco Rubio but also Bob Menendez, the Democratic head of the Senate foreign relations committee…..

The official US explanation for the trip changed during the week and by Friday, state department spokesman Ned Price said the delegation had travelled to Caracas with “two priorities in mind”. The first was the release of US prisoners and the second was “championing the democratic aspirations of the Venezuelan people”. He made no mention of oil….

Analysts say the Biden administration has been considering a change in its Venezuela strategy for some time, given the failure of the Trump-era “maximum pressure” policy to topple Maduro.

But no groundwork was laid in the US so the whole thing went pear shaped.

Now to the OilPrice story.

By Irina Slav, a writer for Oilprice.com with over a decade of experience writing on the oil and gas industry. Originally published at OilPrice

-

- Kemp: diesel fuel stocks in Europe are at their lowest since 2008.

- Russia is a major supplier of diesel, meaning Western sanctions for its invasion of Ukraine are affecting these supplies too.

- A further rise in diesel prices is expected as production still has to catch up.

A crude oil shortage is invariably bad news for those that consume oil products. But when it comes to these products, a diesel shortage has the potential to be even more devastating than a crude shortage. Reuters’ Rowena Edwards reported in early February that the supply tightness in crude oil, gas, and coal was beginning to spread to oil products, most notably middle distillates, the most popular among which is diesel fuel.

The fuel, whose biggest market is freight transport, got hit severely during the pandemic lockdowns as transport rates declined. After the end of the lockdowns, however, as economies began to recover from the worst of the pandemic, transport picked up, and diesel fuel demand jumped. Yet production still has to catch up.

Reuters’ John Kemp reported this week that diesel fuel stocks in Europe are at their lowest since 2008, and 8 percent—or 35 million barrels—lower than the five-year average for this time of the year.

In the United States, the situation is graver still. There, diesel fuel inventories are 21 percent lower than the pre-pandemic five-year seasonal average, which translates into 30 million barrels.

In Singapore, a global energy trade hub, diesel fuel inventories are 4 million barrels below the seasonal five-year average from before the pandemic.

What is perhaps worse, however, is that over the past 12 months, the combined diesel fuel inventories in the U.S., Europe, and Singapore, have shed a combined 110 million barrels that have yet to be replaced, Kemp noted.

On top of all this, Russia is a major supplier of diesel, meaning Western sanctions for its invasion of Ukraine are affecting these supplies too. With the market increasingly tight, Shell and BP have shied away from offering any diesel fuel cargos on the German market for two weeks, Reuters reported last week, for fear of shortages.

In the UK, meanwhile, the Daily Mail cited analysts as warning that the government may need to resort to diesel fuel rationing from next month because of the state of the market and the ban on Russian oil imports, which include diesel fuel. Russia supplied a third of the UK’s imported diesel before the ban.

“Risks of energy rationing and ultimately a recession are growing by the day – something most policymakers seem to be ignoring or not grasping right now.

‘If Russian oil is not integrated back into the market within the next few weeks, we are at a real risk of having to ration crude and products by the summer,” the Daily Mail report quoted an unnamed spokesman for consultancy Energy Aspects as saying.

Back in February, Morgan Stanley recalled a situation in 2008, when diesel fuel prices reached $180 per barrel, while crude oil was flirting with $140. And there wasn’t a war in 2008.

“A repeat of that is not our base case, but it is notable that diesel prices have been tracking the 2007-08 period closely in recent months,” the bank’s analysts said, as quoted by Reuters’ Edwards, adding they expected crude to reach $100 per barrel in the second half of the year. Of course, both Brent and WTI reached that only days after this forecast was made.

A tight supply situation invariably pushes prices higher, which cannot be good news in an environment of persistently high inflation coupled with soaring energy prices that keep on feeding that inflation.

Diesel, it seems, is turning into more kindling for consumer prices amid the Ukraine war and the sanctions. And even diesel fuel production growth may not help, according to Reuters’ Kemp. It would only move the shortage from diesel fuel to crude, he said in his latest column.

Yves here. I take the final comment about “producing more diesel absent Russia oil” to be a confirmation of fact that light sweet crude, which is ideal for producing much less energy dense gasoline, would have to be used in comparatively large quantities to make diesel, on top of existing demand for gasoline. Not a pretty picture.

In addition to the delicate tightrope on the supply side, there is a tightrope on the demand side.

Even if diesel prices rise, if there is slack demand for naptha (plastics feed stock) or jet fuel or industrial lubricants, the refiner might not increase diesel production as the refiner just ends up w/a surplus of other products.

There is some kind of additive you need for diesel trucks – especially California – do not remember the namw of it but it was and is in short supply because hardly anyone produces it- got something to do with environment safety. Did not see anyone mention it. Thanks to all for information. ,,,,,Paul

Hey, wait a minute. Tractors use diesel fuel as well so there would be knock-on effect in price increases in food production. I did a quick check and it looks like that two-thirds of the tractors in America run on diesel. Come to think of it, it will even cost more to transport the diesel tankers over the highways so that is going to add to the costs even more through delivery costs-

https://www.dieselforum.org/about-clean-diesel/agriculture

Maybe that is why the Russians have not launched major counter-sanctions. They are just content to let the forces of supply and demand make their argument for them.

Biden’s TikTok stars will explain that it’s Putin’s fault that you don’t have enough to eat.

I’d like to make a small correction.The quote is “two thirds of farm equipment runs on diesel”.

This would include, cars, pickups, quads, side by sides, pumps etc.

But tractors, they are all diesel.

And the semi’s and the other field vehicles, etc.

The only non diesel ones would be made 50+ years ago, which might be found in very small ma and pa farms.

But all the others will be diesel.

There are some running on wood gas though but that’s only a very niche thing i think.

Balancing up the ‘fractions’ of crude with demand for those fractions has always been a huge problem. To a large degree, the reason European car manufacturers went in so heavy for diesel over gasoline was precisely because that was what the refineries were producing in surplus. While North Sea grades are relatively light, Russia is a major source of quality diesel (Ireland actually swapped access to Shannon for flights to Cuba in exchange for diesel back in the 1970’s).

The deal with Venezuelan crude is not so much that it need high prices to refine, but that it provides a heavy counterweight to the very light crudes produced by fracking. Both are needed to keep most ageing US refineries churning. Such ‘mixing’ of crudes is a common part of the oil trade. This is why net export countries still often import crude and refined products. When the US tried to cut back on Venezuelan crude it had to seek similar heavy sour crudes elsewhere, usually from Brazil.

China, incidentally, is going all in on yet another infrastructure splurge. Infrastructure investments are always diesel heavy. You can’t build roads to nowhere without lots of diesel. For that matter, you can’t grow much food either.

“You can’t grow much food either.”

Add to this shipping foodstuffs from farm to factory to warehouse and on to shops.

Go ‘long’ personal vegetable gardens. (To which I’ll add; there will be a lag time from realization of looming starvation to first crop harvest in the “new” food garden. This next winter might be brutal.)

potatoes

Yes. You’re right. Down here we also have sweet potatoes.

I’ve started redigging the old herb corner. I wonder how many herbs go with potatoes.

Many do. Potato is almost the “tofu” of underground rootiform vegetables.

And go longish on long-term storable food to slowly eat back down to zero while the garden is coming in.

I still think you are missing the significance of the “>$100 a barrel” factoid for Iranian and Venezuela crude. Their crude would be valuable at much lower price points for mixing. But Russian crude had largely fulfilled that need. Thus the surplus production over what would be needed for mixing outside Iran and Venezuela would need to be cracked. And that seems to be attractive only at high prices.

I think its certainly true for Venezuela that under Chavez they invested heavily (and probably unwisely) on some very marginal fields that were only profitable at high prices. But the most productive coastal fields (so far as I know) have always had a steady demand from US refineries. How quickly they can bring their marginal fields up to speed is something I don’t know. Historically, the main replacements for Venezuelan heavy crude came from west Africa and Brazil.

I’m not up to date with the Iran situation, but it used to be that they had suffered so much underinvestment that they would always struggle to raise production no matter what the price. My guess is that if they did have the capacity to raise production significantly then the Gulf States would not have been so casual about refusing Biden’s request to raise production.

Incidentally, cars here are mostly diesel. Its a holiday long weekend here, and I’ve heard several people already say that they’ve cancelled plans for driving breaks due to sky high diesel prices. Although oddly it hasn’t hit airline ticket prices yet.

Investment skirt was to low …

“championing the democratic aspirations of the Venezuelan people”

When the US tells you that it means you’re about to get invaded. The Venn diagram of countries with huge oil reserves and countries that we genuinely care about democratic aspirations of their people is a perfect circle.

My guess is that the Americans offered to trade the two US/Venezuelan citizens for Alex Saab, the Venezuelan diplomat whom they have kidnapped. The Venezuelans honoured their part of the deal, but the US proved … not to be agreement-capable.

> When the US tells you that it means you’re about to get invaded.

Or “meddled” with. Among the key players in negotiations to buy heavy crude from Venezuela is Victoria “Toria” Nuland. Chaos follows that woman around as sure as Fear and Panic orbit Mars.

Here she is playing coy at a Senate hearing. The most obvious foily conclusion is that the U.S. will get its heavy crude from Venezuela, just not from Maduro.

https://www.cnsnews.com/article/international/patrick-goodenough/youre-not-ruling-out-buying-oil-tyrant-maduro-nuland-i

She’ll have to act fast, though. The Summit of the Americas takes place in June, and only one leader gets the invite…

How much of Venezuela’s “huge” oil reserves are really Orinoco Tar Dreck? Just as drecky as the Alberta Tar Dreck in Canada?

How much of Venezuela’s “huge” oil reserves are really Orinoco Tar Dreck? Just as drecky as the Alberta Tar Dreck in Canada?

Glossolalia wrote: “The Venn diagram of countries with huge oil reserves and countries that we genuinely care about democratic aspirations of their people is a perfect circle.”

In fact, it appears that: “The Venn diagram of countries with huge oil reserves and countries that we genuinely care about democratic aspirations of their people is complete disjunction [eg: no overlap at all between the two populations].

We could go the coal-liquification route. I gather it generates a lot of CO2.

“FT synthesis chiefly produced high-quality diesel, lubrication oil, and waxes together with some smaller amounts of lower-quality motor gasoline”.

https://en.wikipedia.org/wiki/Coal_liquefaction

Whenever someone argues that we can’t hit 3-4 degrees warming because there isn’t enough easily accessible oil I immediately think about this.

FT would get us there in a jiffy and I fear that it is inevitable because it’s so much easier than alternatives like mass conservation

Rocks and hard places comes to mind

As I’ve said before, since the ‘street fleets’ often run on diesel, expect the “shipping and handling” prices for internet purchases to rise steeply as well. Especially hard hit will be the small time vendors. The big outfits can obscure the shipping costs to a certain extent by spreading the costs around. Small outfits have their shipping costs front and centre, often at the website point of sale. (Shopping sites like E-bay have a filtre function that shows: “Price + shipping: lowest first,” as well as “Price + shipping: highest first,” “Best match,” etc.) This indicates that the “average” online shopper is very aware of the shipping prices. Said “average” shopper will notice the transport cost inflation right away. How much online buying and selling will an extended fuel cost surge eliminate? I’ll venture a guess and say that the answer to that will depend on the amount of disposable income available to the general public.

This looks like a perfect Econ 404 experiment.

If there is a shortage of diesel, would that also mean a shortage of home heating oil or what is called, in North America, No. 2 Fuel Oil?

As I understand it, both diesel and No.2 Fuel Oil are pretty much the same fraction and composition and are only called different names based on their uses.

This may cause shortages with people who heat their homes with heating oil as well.

short answer diesel = #2 fuel oil + more sulfur.

Tough call. Do you refill the heating oil tank now and potentially watch prices fall by September? or do you wait until September and find out that dealers are rationing?

You might want to talk to family/neighbors and see what they think. or see if your house has some low hanging fruit (insulation, cracks, etc.) that you can work on.

Yes. You can put it in your truck. It is died red so if you get pulled over and a cop checks your tank you might get a ticket (cause you didn’t pay yer fuel tax)

Most people here heat with oil. Some do propane. Some do wood with one of the other as backup.

Our oil bill for Jan-Feb was $587. Last year same period it was $265.

Price rationing is already in effect. Next winter could be deadly for some.

“home heating oil” and “off road diesel”… must be close enough ,at least for old engines, since my family nursery used to buy home heating oil for the bulk tank, and would run our tractors on it. These were older tractors, and decades have passed since. But we did it for decades, and the tractors ran fine.

In north carolina, there was a push for “bio-diesel”, which a couple of cooperatives in the state, which made road fuel, had the price down to $3.50/gal. in 2005@….

The “bio-fuel center” which was a large effort to expand the working knowledge, was shut down by a bought and paid for republican controlled state legislature. And the fracking boom/cheaper fuel put the cooperatives out of business.

But the laws of nature, remain the same.

Friends of mine who have run bio-diesel in vehicles said the main difference was the need for a fuel heater, in line, as well as extra filtration… but other than that..

So there are ways, just not “the will”… and “the price-point”… but at $5.50/gal of diesel… it looks like it makes sense now….to put the work in and have a steady source, made in usa… diesel.from farm to tank.

I’ve been wondering what happened to the biodiesel that was plentiful about 15 years ago. We ran it in our tractors on the farm with wonderful results. It smelled like french fries when we were haying. There was local production too. People were buying old cooking oil from restaurants, filtering it and selling it as biodiesel. Then it all stopped suddenly. No one seemed to know what happened. Now maybe biodiesel will make a comeback.

So it’s greater supply chain problems and consumer inflation versus the Blob desire for a forever war in Ukraine?

Saudi Arabia last week, through its Aramco Trading, “sought 1.2 million to 4.6 million barrels of low sulfur diesel for delivery to several ports in Saudi Arabia by mid-March to April via a tender, said traders close to the matter, who asked not to be identified. It’s a rare move from the country, which usually is a net exporter of diesel, according to the traders.”

It has not previously done this, so more strain on the markets.

https://www.bloomberg.com/news/articles/2022-03-10/world-s-oil-giant-adds-to-diesel-strain-with-rare-buy-tender

As of today’s headline, Saudi Arabia is now willing to accept payment from China in the form of the yuan.

https://www.wsj.com/articles/saudi-arabia-considers-accepting-yuan-instead-of-dollars-for-chinese-oil-sales-11647351541?fbclid=IwAR1i0RScddlbfg-qAK1UOla1alixpQWMWCwL8txeIFVrTKIG2-2MkJOSpdY

“In the United States, the situation is graver still. There, diesel fuel inventories are 21 percent lower than the pre-pandemic five-year seasonal average, which translates into 30 million barrels…”

Even with all that was said, I’m having a hard time wrapping my head around the USA lacking in the capicity for refined oil.

It’s a world leader in refined oil production – since the Rockefeller monopoly days. About 35 states have oil refineries and many deal with diesel fuel.

Wasn’t a war in 2008 eh? Shows how normalized war is, or that bullies only respect countries that can defend themselves. Afghans and Iraqis don’t count! No wonder N Korea wanted nukes so bad.

It’s been almost 40 years since I worked in the oil business, but I have never heard of “unification,” except in the alkylation process. Alkylate goes to gasoline, not diesel as the diagram shows. Also, the reformer output goes to gasoline, not naphtha, aka “straight run gasoline.” https://encyclopedia2.thefreedictionary.com/straight-run+gasoline

However, the overall story of a diesel shortage seems right to me. The cheapest diesel (and home heating oil and jet fuel) comes from the middle of the barrel and is supplemented by cracking and coking the heavier fractions.

A big problem is that refineries tend to be configured to be most efficient when processing a certain kind of crude oil. If a refinery configured to run a light sweet crude slate has to process heavy sour crude, it will not have enough cracking, coking, or desufurization capacity. By “capacity,” I mean it would have to add to or expand a processing unit(s), which takes time and would not pay out for a short-term supply problem. Such investment would be especially unattractive in a situation where there is long-term downward trend in demand for refined petroleum products–as saving the planet may require.

The world availability of diesel might have had problems even without events in the Ukraine. Asia had an unusually cold winter reducing their reserves, China is clamping down on oil refiners and has reduced export quotas by 50 percent, China has been buying up sanctioned oil from Iran and Venezuela (324 million barrels according to kpler), Transatlantic refined diesel flow from Europe to the US did switch to Baltic sea sources (Primorsk/Russia diesel export loadings were at 8 month highs).

Recent Statistics are all skewed by the pandemic, but the count of drilling rigs targeting heavy crudes has not really picked up which you might expect. With Europe moving rapidly away from diesel (diesel vehicle sales down 50 percent) there are suggestions that diesel refining is switching to jet fuel refining as the aviation industry starts picking up long supply chain issues.

Maybe a mixture of short term and longer term trends roiling the market?

Good Lord, nowadays fubar is just snafu.

Is fubar even acheivable anymore? I think I’ll recognize the blazing light of a thousand suns.

Fubar, fubarer, fubarest.

And since renewable energy requires lots of oil energy to get established, and the best option is yet to be designed (geo), the conservation of oil is very important. We need it for another 50 years – just to get away from it. This turmoil we are now in, the end of war, hopefully, is a good time for burying the crazy-hatchet. Let’s ration oil now. Let’s not pretend like we have any other choices.

I agree with your sentiment, but must observe that “we,” meaning, I assume, thinking persons the world over, are not making the decisions. Given the nature of psycopathy in the Terran human psyche, I fear that an ‘eliminationist’ strategy might be necessary.

Go long, pitchforks, streetlight gibbets, and guillotines.

the conservation of oil is very important. We need it for another 50 years

I think we need to run away from Fossil Fuels ASAP in order for the kids and Grands etc to have a chance, in addition to all the Flora and Fauna.

But you do state the ugly truth, imo, that what we have built around the Energy of Petrol cannot just go away–we need to systematically De-Commision and Redirect just about everything. And that will take time–and will.

And we need that bridge energy and raw content for critical applications until alternatives are in place.

Damned if we do, damned if we don’t.

Yet we have the residue of embodied oil everywhere in the form of Plastic/Tires/Shingles etc that are proprietary formulations that disregard circular recovery deliberately.

The terrible depravity of our myopic Hubris.

In the cold winter of 2032, what will we want more–a barrel of #2/ Cubit of NG, or 10,000 Plastic water bottles/1,000,000 Bread Bag Tags?

Looks to me like Biden (or his handlers, whatever) made one immediate and one current mistake with respect to heavy oil/diesel.

On his first day in office he killed the Keystone XL pipeline that would have brought oil sands oil from Canada. Now he’s trying to get the same stuff from Venezuela?

The Natural Resources Defense Council explains why oil sands oil is bad. The Canadian Engergy Centre explains why if you are looking at oil sands oil Canada is a better option than Venezuela.

Both are advocacy organizations, so make of that what you will.

“Syncrude” from tar sands oil is extremely light after pre-refining and, therefore, maybe not so helpful for diesel. Venezuelan oil is heavy and sour–also has high vanadium which will poison refinery catalysts. They are not good substitutes for each other. The Canadian Energy Centre link does not address our apparent need for a higher proportion of middle distillates.

I think the Canadian syncrude is mostly expected to be exported from our Gulf Coast rather than refined in USA. That would be why one of the arguments against Keystone XL is that Canadians should build their own pipeline from Athabasca to a port in British Columbia and not put USA water at risk.

If we are going to put USA foreign policy to work making access to imports, why not target imports that best fit the refining capacity we already have? Immediate impact with no investment required. This chart shows the extreme differences among select world crude oils. https://www.eia.gov/todayinenergy/detail.php?id=7110

We need to define some terms. Oil sands are sand held together by bitumen. Pretty solid. Buckets and trucks move it to extraction where the bitumen is separated from the sand. Bitumen does not flow except under high heat.

An upgrader cracks and separates this into synthetic crude in the presence of heat, catalysts and all the other magic. The syncrude is, as you mention, a sweet light crude.

Upgraders in Alberta and Saskatchewan can handle about half of the bitumen. The rest is mixed with a diluent, lighter oil fractions ranging from natural gas liquids to crude oil. This dilbit (name obvious) can flow through pipelines. This is what is similar to Venezuelan heavy oil.

The Gulf Coast refineries are complex refineries, capable of handling sour, heavy crudes, designed originally to handle Venezuelan crudes, but quite happy with Maya (Mexico), Arab Heavy, Oriente (Ecuador), Iran Heavy, and dilbit. Building more Canadian upgraders rather than using existing plant is pointless duplication.

With the pipeline option gone railbit enters the picture. You can use less diluent because it just has to flow into and out of a tank car at the beginning and end of thousands of miles of rail journey through Canadian and US towns and cities, rather than thousands of miles of pipeline. It is handled by the Gulf Coast refineries just as well as any other sour, heavy crude.

All heavy crudes are suitable for diesel production.

Now I’ve left out a lot of complexity: economic and political factors, substitution options, sanctions, changing export and production restrictions, and so on. In any case Canadian, Venezuelan, Mexican, Ecuadorian, Iranian and Saudi heavy oils can all be refined in the US to produce diesel. Looking to Venezuela rather than Canada makes no sense.

Canadian Oil Sands production is heavy sour. Exactly what US refiners need to produce diesel. Biden shot himself in the foot cancelling Keystone and Canada’s increased capacity construction on the existing Trans Mountain pipeline from the Fort Mcmurray area to the west Canadian coast will be completed this year enhancing Canada’s access to non US markets. Diesel is going to go much higher. Putin’s out of favour but the despots in Saudi and Venezuela are just fine when the US needs a top up.

What makes you think he is getting the Orinoco oil sands product from Venezuela rather than their main product?

Biden is not getting anything yet, but if he does get something from Venezuela, it will be a heavy, sour product in any case. See my reply to Skeptic above.

As a side note, the entire offshore oil and gas fleet runs on Marine Gas Oil, which is basically diesel.

Cargo ships also swop over from the dirtier heavy fuel oil when transiting in and out of port. This can be a significant additional cost and any increase will added to the general inflation of cargo carriage.

In port, they will only be running their AC generators for electric power. Low consumption of diesel fuel compared to main engine. California makes them switch over to shore power. Now we have zero consumption.

Bunker Oil is Really Bad OIL:

from looking at it in 2019

https://www.argusmedia.com/en/news/1831097-co2-cost-could-raise-bunker-price-25pc

Shipping emissions of CO2 are not currently regulated, although the European Union (EU) has proposed plans to cover the sector.

Since there are about 3.0-3.3t of CO2 in each tonne of marine fuel burned,

I think any shortage should be defined in terms of how much diesel we’re exporting. For a number of years as the EV agenda gathered _steam_, other countries were increasing their demands for diesel. According to a Marathon spokesman, the demand was so great, a number of US gasoline refineries were being transformed into diesel refineries, which I understood to be a semi-permanent transformation (and I’m probably introducing some inaccuracy since this was research I did years ago), and all that additional diesel was immediately leaving our shores.

Is this a potential shortage, then, because we wouldn’t be keeping enough for ourselves?

It all seems to be more like a financial problem than a science / capability problem.

How many bankers does it take to screw in a lightbulb?

In the short-run Venezuela’s oil is a non-starter. In the old days it was put into heated tankers to keep it from cooling to room temperature and turning to something like tar. It was sent to the nearby Dutch Island of Aurba and to the Texas coast which had the specialized refineries to turn it into heating oil for the US northeast and Number 2 bunker oil for the huge diesels that drive most big ships.

Nobody trusted Venezuela enough to build refineries there; thus the nearby Aruba refinery. Since this oil was so widely used in the past, I doubt the “100/barrel” break-even point number.

When we stopped taking Venezuelan oil, the special tankers were scrapped and the Texas refineries were converted to use other, less polluting types of crude with fewer impurities like sulfur. Basically we outsourced the pollution by outsourcing the diesel refineries. It will take a decade to bring those missing pieces back together.

That low number for diesel in Singapore reserves is a bell-ringer for me; I think that’s where many container ships and big tankers refuel.

By the way, nice drawing to describe how crude is refined and what the choices are.

Um you doubt the number yet say we can’t even transport and refine it. So I infer the $100 a barrel is correct, even low, that it would indeed take the prospect of sustained prices that high or higher to get those heated tankers back (assuming they even still exist in remotely adequate #s) and build new refineries or invest in existing ones (see Skeptic above re considerable equipment additions needed for a refinery set up to process light sweet crude to process heavy sour).

You forget the CIA gun boats back in the day that strafed onshore facilities ….

Re: “For instance, I have regularly read that oil from Iran and Venezuela are attractive on world markets only at prices of over $100 a barrel”

The price is not so important, it is the discount that VZ grades trade at relative to WTI or Brent. It is usually around $25/bbl, probably more now due to sanctions. The discount is due to the higher costs faced with refining VZ grades, as they are extra heavy (API gravity < 15) and have a lot of metal contaminants. Since sanctions, US refiners have switched to Canadian grades (West Canada Select has API ~ 20).

While the US refining base is the most complex and efficient, it has limited capacity for these extra heavy grades. Most of the heavy grades these days are going to India, China, and South Korea.

The US still exports a significant amount of diesel, something like 1 million bbl/day. Turning off the export market would greatly impact Europe.

High diesel prices in the US are here to stay. Transitioning to renewable diesel grades will be expensive – seed oils sell for the equivalent of around $200/bbl.

Just something alternative to think on:

Driving to a Greener Future with Hemp Biofuels

Hemp biodiesel is made from hemp seed oil and can be used in any conventional diesel engine. UConn’s research showed hemp oil had a 97% conversion rate into biodiesel and passed all lab tests. Imagine a fleet of transport trucks powered by fuel made by a plant which left the soil in better condition than it found it.Jun 21, 2018

https://www.cannabistech.com/articles/driving-toward-a-greener-future-with-hemp-biofuels/#:~:text=Hemp%20biodiesel%20is%20made%20from,condition%20than%20it%20found%20it.

i’m a little late to offer this, but here’s Platts’s periodic table of over 100 different crude grades:

https://www.spglobal.com/commodity-insights/plattscontent/_assets/_files/downloads/crude_grades_periodic_table/crude_grades_periodic_table.html