Yves here. Wolf does not set a timeline on when more shale gas output and LNG transport and harbor facilities can be built to fill Europe’s energy gap. However, some readers suggested another potential choke point, and I’d be interested in a sanity check: those LNG-carrying ships. Apparently the big spherical storage chamber is particularly fussy to build. Note Wolf does not display that type of tanker, so I wonder if the lower-slung designs will prevail.

From Wolf Richter, editor at Wolf Street. Originally published at Wolf Street

There has been a lot of talk about the US supplying more liquefied natural gas (LNG) to Europe to replace a portion (a small portion) of pipeline natural gas from Russia. Tankers with US-produced LNG are already plying that route. But LNG export terminals along the Gulf Coast are running near capacity, and it takes time to build new liquefaction trains at existing export terminals and to build new export terminals and the pipeline infrastructure to supply them. So those ideas, as good as they may be, are getting complicated in a hurry.

The Status of US Natural Gas.

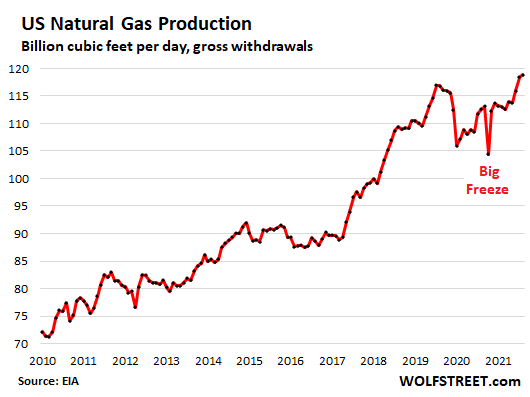

The US is the largest consumer of natural gas in the world. For decades, natural gas production in the US wasn’t enough to meet demand, and so the US imported natural gas via pipeline from Canada, and via LNG from other countries. Fracking changed the equation, natural gas production began to soar, and along the way the US became the largest producer of natural gas in the world. In December, US natural gas production hit a record 118.8 billion cubic feet per day, according to EIA data:

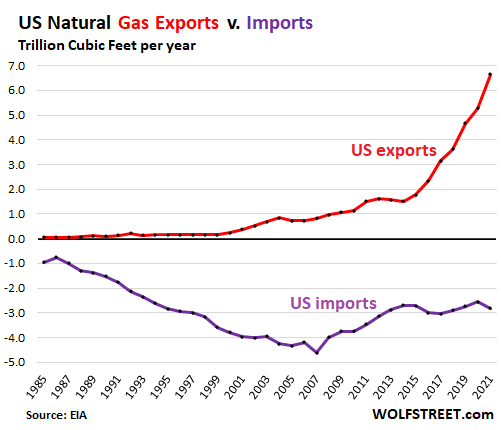

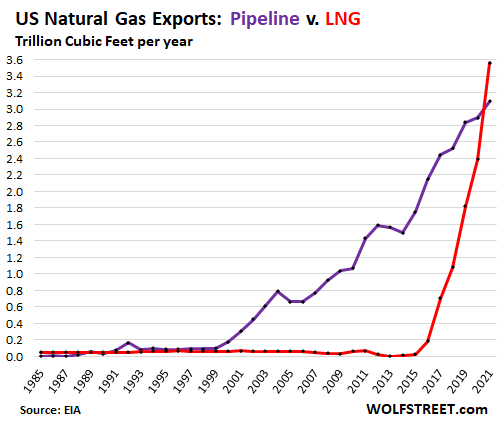

As the price of natural gas in the US collapsed in 2008 amid surging production from fracking, the industry tried to find an outlet. Companies invested in building more pipelines to Mexico, and exports of pipeline natural gas to Mexico rose. And companies invested in large-scale LNG export terminals along the Gulf Coast, and LNG exports from the first of those terminals took off in 2016.

Total exports of natural gas via pipeline and LNG (red line) spiked by 26% in 2021 to a new record of 6.65 trillion cubic feet for the year. Total imports of natural gas, denoted by a negative number (purple line) has remained in the same range since 2013.

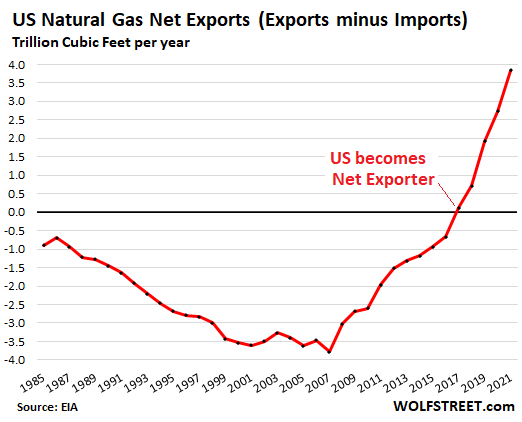

In 2017, the US became a “net exporter” of natural gas, exporting more natural gas to the rest of the world than it imported:

LNG imports essentially ceased, except during the coldest months in the winter in some New England regions that are not well connected via pipeline to producing regions in the US.

The Canada trade: The US exports natural gas to Canada and imports from Canada due to the regional pipeline infrastructure in place. About 30% of US pipeline exports go to Canada. On net, the US imports more from Canada than it exports to Canada.

The Mexico trade: The US does not import natural gas from Mexico; this is a one-way trade, with the US supplying Mexico with ever larger amounts of pipeline natural gas. About 70% of US natural gas pipeline exports go to Mexico.

Exports via LNG (red line) in 2021 exceeded pipeline exports (purple line) for the first time:

Here is our look at The Huge Ships for the Booming LNG Trade: Designs, Technologies, and Challenges for liquefied natural gas carriers.

US LNG exports by country.

The list below shows the largest 25 recipient countries in 2021, in billion cubic feet per year, according to EIA data. South Korea has been the largest buyer of US natural gas. China has now surpassed Japan as the second largest buyer. China was a large buyer but in 2019 essentially stopped as part of the trade war, but recommenced in 2020. Brazil has emerged as the fourth largest buyer in 2021.

By comparison, in 2021, the US exported 2.16 trillion cubic feet of natural gas to Mexico via pipelines. This is about as much as the US exported in LNG to the top eight countries on this list combined.

Also note the European countries that bought US LNG in 2021.

| US Export Volumes, by largest recipients in 2021, in billion cubic feet per year | ||||

| 2019 | 2020 | 2021 | ||

| 1 | South Korea | 270 | 316 | 453 |

| 2 | China | 7 | 214 | 450 |

| 3 | Japan | 201 | 288 | 355 |

| 4 | Brazil | 54 | 112 | 308 |

| 5 | Spain | 167 | 200 | 215 |

| 6 | India | 91 | 124 | 196 |

| 7 | United Kingdom | 118 | 160 | 195 |

| 8 | Turkey | 31 | 124 | 189 |

| 9 | Netherlands | 81 | 86 | 174 |

| 10 | France | 118 | 90 | 171 |

| 11 | Chile | 90 | 81 | 122 |

| 12 | Taiwan | 27 | 64 | 99 |

| 13 | Argentina | 39 | 15 | 83 |

| 14 | Portugal | 53 | 37 | 66 |

| 15 | Poland | 38 | 37 | 56 |

| 16 | Dominican Republic | 10 | 26 | 53 |

| 17 | Pakistan | 27 | 37 | 46 |

| 18 | Greece | 15 | 48 | 40 |

| 19 | Bangladesh | 3 | 11 | 38 |

| 20 | Croatia | 0 | 3 | 36 |

| 21 | Kuwait | 10 | 17 | 34 |

| 22 | Italy | 69 | 68 | 34 |

| 23 | Lithuania | 3 | 29 | 31 |

| 24 | Jamaica | 14 | 17 | 25 |

| 25 | Singapore | 31 | 28 | 25 |

In terms of the US as a bigger supplier of LNG to Europe, well, at the moment, there is not a lot of excess capacity left in the US to export more LNG to anywhere. Major additional LNG shipments from the US to Europe would largely be a shift away from other customers. LNG export capacity continues to be ramped up in the US, and even though it’s already in progress, it still takes time. And ramping up export capacity further than is already being planned will take even more time.

It is all very well to talk about how much US LNG can be supplied to Europe, but what about the rather steep increase in cost compared to Russian natural gas? Already in Britain, millions of people are facing the dilemma eat or heat and it is likely to get much worse. At what point will the dogs stop eating the dog food of it is all evil Russia/Putin’s fault when it comes to having to fork out far more for food and fuel?

The South Korean shipyards have a virtual monopoly on the construction of LNG carriers – its quite a specialist product. They invested heavily over the years on serving the oil and gas industry and held their nerve during periods of low prices. During the down-time of low oil prices from the 1990’s onwards, most Western and Japanese yards shut down or moved to other shipping products. Also, due to the near collapse in price of gas a few years back a lot of the oil majors moved away from LNG investments (there was a lot of interest in producing LNG from off-shore gas fields too distant from markets for pipelines).

So far as I’m aware, The Korean yards already had full order books for a few years before Covid. I’d be very surprised if there was any slack whatever in those yards to produce more LNG ships in the short to medium term.

I’d also note that the availability of LNG terminals is another choke point. They can’t be built quickly or cheaply as suitable deep water sites with sufficient gas pipeline connections are not easy to find (terminals are also a big explosion hazard so they aren’t a good idea for urban ports). In Europe the industry has moved more recently to off-shore wind as the best use for big deep water terminals.

The one thing nobody is talking about is that gas pipelines and LNG terminals are very vulnerable points of weaknesses in time of war (just look at how easily the Houthi’s have targeted Saudi and UAE terminals with cheap ballistic missiles). A sensible defence strategy would focus on more decentralised power networks. In other words, solar and wind.

Great report PK re: shipyard capacity. I’ve not seen that elsewhere.

Shipping capacity is clearly the abiding constraint. The rest of the equation is whose existing capacity gets redirected to EU.

Tough times ahead for EU’s mfg’g income streams.

Neocons have really got themselves into a box. They also flatly refused to pay for Russian gas in roubles. It’s going to be tough to extricate themselves from that one.

While I point the finger at the Neocons, and they certainly deserve a lot of blame, the broader question is “who is enabling these Neocons?”

There’s no way the Neocons, by themselves, could survive this sort of broad destruction of EU’s economy, and the attendant rapid political isolation of the U.S. without a great deal of political cover from somewhere.

I’m missing something. What is it?

The question about the neocons is a good one. I confess to being very surprised that the neocon voice has proven stronger in western Europe than, for example, German business interests, who usually win out in any argument. All the gnashing by neocons for years never stopped Nordstream II. It may be that the fear of the Russian Bear that goes very deep into western Europe DNA (especially in Germans and eastern Europeans) may have been triggered to a point beyond rationality.

Whether the invasion has changed the balance in favour of neocons permanently, only time will tell. My suspicion is that a more pragmatic economic voice will eventually win over. The combined interests of the likes of VW, Siemens, Airbus and so on carries a hell of a lot of weight in Europe. They make a little money from weapons, but a lot more from stability.

NATO is now an occupying force in Europe holding hostages?

Good question. Two ideas. First, perhaps the investors in mil-def-intel corps that benefit from Neocon policies is broad, including the European elite. In other words, there’s no push back from those who have decision-making power because they benefit from these policies. Second, perhaps there’s little/no fear of serious repercussions from public backlash. Or a combination of both.

Good question. My cartoon brain shows an EU just hosing down natgas from the nozzle (Nordstream 2), or pouring it in glasses and drinking in a more environmentally domesticated manner. And the US is the bartender? I’m wondering how we, in the US, are going to mind our manners – which have never been very good. As Gail Tverberg tells us, one way to slow CO2 is recession.

I had questioned the business case for much in the way of LNG terminal building. Shale gas wells have very short lives compared to oil wells. At the old projected level of shale gas extraction, it was anticipated to start tailing off in the early 2030s. Only 10-15 years at peak capacity? That does not argue for sending much overseas.

Yves Smith: At the old projected level of shale gas extraction, it was anticipated to start tailing off in the early 2030s.

True. But natural gas won’t be going away when the US has fracked up its own territorial supplies. At the risk of stating the very obvious, when people get alarmed about a massive methane clathrate release getting triggered by global warming — and it would likely be the end of life as we’ve known it — they’re talking about massive quantities of natural gas under the polar seabeds and the permafrost.

‘An Overview of Seabed Mining Including the Current State of Development, Environmental Impacts, and Knowledge Gaps’ (2018)

https://doi.org/10.3389/fmars.2017.00418

That’s what the competition for the Arctic is about and why Russia has been developing its nuclear icebreaker fleet. So EU countries’ construction of more LNG terminal infrastructure would have a long-term logic — for certain values of ‘logic,’ anyway.

I suggest you pull out a map. The ports used for fracking in Texas and the Bakken won’t be used for LNG from Alaska. No one is gonna truck it or build a pipeline that far. My point stands.

Not sure of the ports or LNG, but the “no one is gonna” just piqued my interest.

Longest LNG pipeline:

West-East Gas Pipeline: 8,707km

I think we can shave a few miles off by considering Canada.

Tuktoyaktuk, Northwest Territories to Port Arthur Texas 7,068 km by road. No I am not suggesting this will happen. Lead time, population centres, right of way etc. You would have to be insane to even think it.

if you want to have an argument about whether ports used for fracking in Texas and the Bakken will be used for LNG from Alaska, you won’t get it from me.

I wrote: ‘EU countries’ construction of more LNG terminal infrastructure would have a long-term logic.’ I repeat: my subject was the viability of building LNG terminals — ports for LNG ships — in Europe.

Frankly, it’s not clear to me there will even be a U.S. in 2035. Or if there is, that anyone would want to live there if they had a choice.

In fact, that’s why I left at the end of 2021. Fortunately, I have more than one passport.

A major LNG terminal has had full regulatory permission on the west coast of Ireland for over 10 years. They recently applied for an extension of the permits. Ireland is in theory a good location for a terminal as its at the end point of the European natural gas network and has excess capacity plus storage due to past off-shore extraction. But its never gone ahead – from what I can understand from the published material, it simply hasn’t been able to get financing. As you say, its a very dubious proposition where there is potential competition from conventional gas sources, which are always going to be cheaper.

So far as I understand, this has been a problem all over the EU. I can’t recall the sources, but a few years ago I read a report where the EU was pushing hard for a network of LNG terminals for security purposes. But there was little interest from the private sector, presumably for the reasons you say.

notice on the table above that Germany isn’t even on the list of countries that have bought US LNG. that’s because they have no regasification facilities. nada. & that explains the other half of the problem with the administration’s plan to send more US LNG to Europe; not only are our liquefaction facilities already running at capacity (some weeks even at 101% of capacity), the European regasification facilities are also at capacity….historically, construction time on both types of plants has run 3 to 5 years and billions of dollars…do you think anyone in the Biden administration is aware of that? are their announcements just politics, or are they made out of ignorance?

Does the PMC look 10-15 years out?

I once had to respond to a refinery fire, which was logically located next to a large oil/gas terminal. There were six “golf ball” above ground gas storage tanks. One of the people on the site told me about what would have happened if the fire had ignited those tanks. I can’t verify the information (and it was by no means official) but he said a kill zone of 20+ miles and Lake Superior would get noticeably bigger on that day. I wouldn’t want a liquification terminal in my neighborhood.

The explosive danger is a huge threat, but at least as big a threat is posed by that refinery using hydrogen fluoride in the process. If the hydrogen fluoride tank had burned, a ground-hugging toxic cloud likely would have killed everyone in that 20 mile radius.

My understanding is that Superior is one of only a few refineries still using that process as it makes refining winter-grade fuels easier and less expensive.

https://www.firehouse.com/safety-health/news/21002833/superior-wi-duluth-mn-husky-refinery-fire-toxic-smoke

I’m very glad that you and others escaped safely.

The planned line 5 is supposed to cross the Mackinaw strait and feed propane from Canada to that refinery; I’d strongly consider moving from the area.

LNG falls into the category of ‘low risk, but very high impact’ in terms of hazard.

In its favour, and in contrast to nearly every other hydrocarbon, its largely non-toxic and non-flammable in liquid form. When vaporised, it disperses very quickly. However, there is a high danger period where vaporised gas hits around 10% with air, where it is highly explosive – essentially its a natural thermobaric explosive. If that happens, its goodbye to anyone within the very large kill zone. This is essentially what happened in the Ufa Train Disaster (this was pipeline gas, not LNG). Most other gas disasters that I can think of were gas vaporising from crude oil, such as the Betelguese explosion.

It should be noted that apart from the Ufa disaster, fatal accidents involving natural gas (LNG or not) have been comparatively rare compared to oil or wet gas products. I’d rather live next to an LNG terminal than an oil refinery. But if a major disaster does happen, it will make that big explosion in the Lebanon last year look like a little firecracker.

“terminals are also a big explosion hazard so they aren’t a good idea for urban ports”

Thanks for mentioning this! In Oregon we’ve fought and defeated three attempts by Canadian companies (the most recent one was Pembina) to build a natural gas pipeline across Oregon and ship LNG from a proposed terminal in Coos Bay.

The site of the proposed terminal was immediately opposite North Bend Airport. The runway pointed directly at the site and all departing aircraft would have overflown it.

Our “liberal” Congressman Merkeley eventually got on board to oppose the project. I’m not sure Wyden ever bestirred himself. But the people (in the sense of a left-right coalition of environmentalists, farmers and landowners) stopped it.

https://en.wikipedia.org/wiki/Cleveland_East_Ohio_Gas_explosion

Cuyahoga County Coroner Dr. Samuel Gerber estimated that the initial death toll stood at 200; however, Gerber was quoted stating the magnitude of the fire and the intense temperatures had the power to vaporize human flesh and bone, making an exact count impossible until weeks after the disaster.

i remember adults talking about this when i was a kid, but i didn’t know it involved LNG….the explosion(s) were felt 200 blocks to the East…(LNG’s volume increases 600 fold when it regasifies)..

with so much LNG being shipped around the world, it’s only a matter of time before something like this happens again…

Other shipyards could, in a pinch, probably do retrofit conversions to LNG similar to the ship shown. They have a series of much smaller spheres in the hold, small enough that they’re not too different to onshore holding facilities and existing capabilities, I assume.

The problem is volume – spheres are power laws on the radius (V=4/3*π*r^3), so those enormous South Korean jobbies are like the difference between the Ever Given and a tramp steamer for containers. So South Korea is the only shipyard that could make a noticeable inroad on transport volumes at the scale needed.

Then a 100′ diameter sphere contains 525,000 cubic feet. 200′ diameter sphere contains 4,200,000 cubic feet. How wide are these ships? I imagine they use spheres since it allows contained volume above and below deck. It seems a cylinder shape would actually be the better shape to carry LNG.

I assume that (shape) would reflect the maximum pressure of the vessel & a sphere would win.

Might be my Artificial Intelligence narrowing silos of information, but there sure seems to be a paucity of information on the apparently huge Nat Gas offshore in the eastern Mediterranean?

I mean, other than the discord in the mideast, there apparently is a huge amount of nat gas there.

No problems, the market will transcend politics and enmity.

Great map at the head of the article. All the playahs are there to happily share the spoils !!!

No worries about carbon, warming… Nat gas is as harmless as a baby’s breath at rest on its mother’s soothing chest.

A bit dated, but the geological change is generally slow

https://www.eia.gov/todayinenergy/detail.php?id=12611&msclkid=6b126873af4e11ec904f4034c58ead74

There is no shortage of natural gas in the world. The problem is connecting the gas to the supplier. With oil, you can just truck or tanker it away to a terminal or pipeline. Its far more expensive and difficult with gas. Iran, for example, has a vast amount of natural gas, but no easy way to get it to potential customers.

The problem with East Med gas is, obviously, political. It can only be extracted with full long term co-operation among all those with claims on the seabed (and pretty much every country there claims a lot more seabed than they are are entitled to), and co-operation on pipelines. This has inevitably proven to be very difficult to achieve. While very high prices is undoubtedly encouraging prospectors in the area, if anything it makes the regional politics even more complex. Russia will have a strong say via Syria. And the Greeks and Turks will never agree on anything.

Notice the change: at ONE time, Guardian was capable of acknowledging: Israel’s attacks on Gaza, Hills’ joy at unloading old cluster munitions, media victim-blaming on Libyan gas used in Syria, any number of al Saud, Israeli, US sponsored & supplied ISIL type (anti-Russian/ Assad) loose cannons were basically in support of pipeline wars. That fracked offshore gas plays seemed a GREAT idea, just like hiring that wealthy bin Laden kid to bog-down Russia in Afghani…

Ooo, er… NEVERMIND!

https://www.theguardian.com/environment/earth-insight/2014/jul/09/israel-war-gaza-palestine-natural-gas-energy-crisis

https://www.counterpunch.org/2021/05/14/pipeline-politics-from-afghanistan-to-gaza/

https://kanekoa.substack.com/p/how-one-ukrainian-billionaire-funded=r

Perhaps another choke point –

LNG facilities and transport require special low temperature steels since LNG is stored at – 162 deg C.

One of the alloys used to produce low temperature steels is nickel and the low temperature steels require about 9% nickel content to achieve the desired low temperature qualities for LNG service.

While nickel production is widely dispersed globally, Russia accounts for 10% to 15% of the global production. Not enough for a crisis however enough to significantly impact pricing.

I try to read news from all sources daily and lately it feels like the media in the US is existing in some alternate universe. The WH keeps pushing their talking points vis a vis Russia and Ukraine and the MM parrots them. Natural gas is one of those talking points. We, the US, are going to come to the rescue of Europe with LNG. This article puts the lie to that and I have read the same in many other places. Without Russian natural gas, Europe is going to be in for a very, very rough time. I think it was on an Alexander Mercouris podcast he cited the number of Europe needing 500 billion cf of natural gas a year, 40% of it now coming from Russia. The deal touted by Biden was for only an additional 15 billion. Where is the rest coming from?

CNG pipelines TCVNs are seldom broken below -40°F but our direct experience was with those manufacturers starting to fudge tensile testing (low yield), mis-read Impacts’ shear area or actually torch coupons from other mills’ linepipe. Duplicate end x-rays, use phased-arrays’ capabilities to lower annoying returns from discontinuities in the HAZ and all the creepy shucks & jives API audits and PHMSA mysteriously MISS, now that 3rd Party and gas company inspectors are frequently 1099 transients, one step ahead of skip-tracers, ex-spouses, deputies, POs, IRS and repo-men. It’s hundreds-of-thousands of re-re-fracked, overlapping well bores with leaky cement-jobs, annulars and casing, quickly abandoned and impossible to plug (without any government or industry oversight and LYING media) we should worry about, as Biden baits war, to bail-out their fracked LNG, oil, bitumen pyramid scheme?

A bit off topic, but in a positive way. The first thing that flashed into my head when I saw this post was Gordon Lightfoot’s great iconic tune, The Wreck of the Edmund Fitzgerald. And then an image of the doomed ship. FWIW.

The German seems to have a “stopgap” solution in the form of floating LNG terminals.

https://splash247.com/germany-locks-in-three-fsrus/

“The federal government is currently examining possible locations in the North and Baltic Sea to deploy the units in the short term, partly for the winter of 2022/23. “With the leasing of the three floating terminals, around 27bn cu m of LNG could be landed in the final stage step by step by summer 2024. As early as in the winter of 2022/2023, an additional 7.5bn cu m of LNG would be available on the market,” the ministry said.”

This estimate of Russian gas supply to Germany stands at 65%. At best it would cover 8% of the Russian short fall for next winter.

Great point about shipyards and ship building capacity. I am old enough to remember, very well, the 1973 Energy Crisis, I was fishing commercially then and watching diesel fuel rise and rise, Carter in a sweater, AND an early rush to LNG ships and traffic. That was nearly a half century ago and here we are now. One big change, not noted above, is that in the last 30-40 years the US electric grid has shifted from, say 60 percent coal generation to now 20 or 30 percent coal generation and a huge rise in natural gas generation, up to now 40 percent of all the electricity we use. Gas is cleaner, or used to be until more recently it has also been cursed as a bad fossil fuel. Point being, any gas price increases are going to ripple through the whole US system, including electricity.

The idea that the US can backstop the gas shortage because Russia is shut off is beyond ridiculous. Btw I have sailed through the Eastern Mediterranean on the way to and from the Suez Canal and there is a long stretch there when you are passing and among one gas platform after another, they are everywhere. But in the end, and I think sooner than later, the Europeans are going to realize, if they have not already, they need Russian gas, period, end of story.

If I were to predict today, I would guess this – Russia and Ukraine make an agreement which essentially gives Russia Donbass and Crimea and Russia withdraws its troops, Ukraine declares no NATO, and the war stops. Russia will claim that by leveling Mariupol and winning Donbass they have demilitarized and de-nazified Ukraine, and Ukraine will never be in NATO, and Putin will be able to say to his people he had fulfilled exactly the objectives he originally described so he can declare a win domestically. Plus by ending the war then there will be a deal whereby the sanctions are lifted and the gas flows again.

The West will also claim victory, they stopped Putin from taking over all of NATO, they exposed how creaky his army is, they saved Ukraine, NATO has been immeasurably strengthened, there is no WW3, Putin blinked, Biden was strong, Europe never has to confront that energy shortage next fall, and now life is good because the war is OVER.

The wild card in this settlement is whether the REAL goal of Russia and China all along has been to break the dollar as the reserve currency. Time will tell…..

CS — yep I concur the final agreement will look much as you describe. Especially the West’s self-serving perceptions.

WRT to the “REAL goal” my assessment RobertC February 18, 2022 at 1:40 pm is similar.

One of the pioneers of LNG exports in the U.S. was Charif Souki. “This is somebody [Souki] who basically enjoys being on a roller coaster,” said Fadel Gheit, a senior oil analyst at Oppenheimer & Company. “It is more likely to see snow in New York in July than to see exports of gas from L.N.G. terminals in the United States.”

https://www.nytimes.com/2011/01/28/business/economy/28gas.html

One of the intentions of the Russia sanctions is to keep Europe a dependency of the United States. This weakens Europe as a competitor with US multi-nationals because LNG is far more costly than natural gas piped from Russia. The United States never wishes to see a united Europe on good terms with Russia because that poses a significant threat to US corporate interests.

I have read nothing so far in the post or comments on it about implication of increasing exports of LNG for US domestic pricing of natural gas. Our local supplier sent customers a letter last fall warning of markedly higher gas prices. They were much higher.

What’s the domestic politics of such increases?

One possibility is that a politician may eventually gain power by calling for a ban on US exports. This is especially likely if prices continue rising. The Republicans are especially likely, as they hace become more nationalist with Trump. It could be framed as “America first”.

I could see people Tucker Carlson gaining power over this. It’s not too hard to imagine how politicians could seize on this.

Of course this will result in enormous international backlash, but it might not make a difference. Europe will see this as a betrayal, but it won’t matter for the base of American voters.

On the Wolf Street charts. Converting the first chart (gross withdrawals in billion feet/day- is that production?) to the second chart of exports (trillion feet/year) is a bit of a pain but unless I’ve dropped a zero somewhere, this means that to total increase in American production since 2016-17 has gone to exports. A small part is LNG and the rest by pipeline (½ of exports to Mexico and ¼ to Canada).

Wolf Street has an article on the ships at https://en.wikipedia.org/wiki/LNG_carrier. But the best article is at https://en.wikipedia.org/wiki/LNG_carrier. Note how huge the ship production and thus the “new LNG on-line” problem is. The bottom line is that the Korean yards are working flat-out to increase the tonnage-in-service by 10% in the next three years. Production of for the massive spheres which must resist stress from thermal change and ship movement require special materials, welding systems and fabrication yards, all of which require long lead times and long-term commitments.

Turning 1,000 foot-long ships on a dime isn’t easy and converting old ship production facilitates into LNG ship producers is no easier.

May I suggest that any peace in the Ukraine will have to find a way to pay for the stranded cost of NordStream 2, keep gas flowing though the Ukraine, restart the Texaco fracking project in the Ukraine’s Donbas region, and slowly transition the EU toward Ukrainian gas over the next 20 years while insuring that Russian gas keeps flowing and somehow the money to pays for it flows on time. “Eastern” gas will always be much cheaper than LNG. And a mix of gas from the Ukraine and from Russia is preferable to gas solely from either. This “Donbas gas in 2030-40” scenario is the most important reason the Donbas needs to stay at least technically in a Ukrainian state.

What is good for Russia and western Europe may not be in America’s interests.

So the United States fracks like there is no tomorrow in order to screw Russia. What are the downsides of this? We have seen massive contamination of aquifers due to injection of toxic fracking fluids. We have seen increases in cancers and other illnesses in regions of the country where fracking takes place. Are we poisoning ourselves in order to screw Russia? This country barely blinked when 1 million died of Covid, so I guess a few million more due to poisoning of water, air, and land is no big deal either. Life is cheap in the good old US of A.

the way this is playing out, it’s not even the American sellers of LNG who are selling our gas to Europe, it’s the Asian buyers who own the US production under long term contract…

so i did a quick search, and found the press release on the 20 year contract on Calcasieu Pass gas that’s held by Sinopec: https://www.americanpress.com/2021/11/05/venture-globals-calcasieu-pass-facility-inks-lng-supply-contract/

so Venture Global is taking American natural gas out of our pipeline system at whatever price they’ve contracted it for (probably less than the recent $5 price, and undoubtedly making a fat profit selling it to Sinopec, who then probably stands to triple their buying price selling it back in China….

but that’s not what they’re doing here; they’re selling the US gas (which they own under contract) right from our terminal at Calcasieu Pass in Louisiana and selling it directly to Europe at 7 or 8 times the Louisiana price of natural gas…

it goes without saying the Chinese would appreciate it if we built more liquefaction facilities and pipelines for them…