Yves here. This new OilPrice post makes a point that oil analysts have made elsewhere, that the draining of oil from the Strategic Petroleum Reserves is bullish for oil in the intermediate term, since the stock will have to be replenished, which means more buying in the future.

However, the important additional information provided is that the Biden plan of increasing shale gas production levels in six months, which is when the Strategic Petroleum Reserve releases are set to ens, appears to be mere hope. There are shortages of critical materials for frackers that will limit their ability to ramp up output.

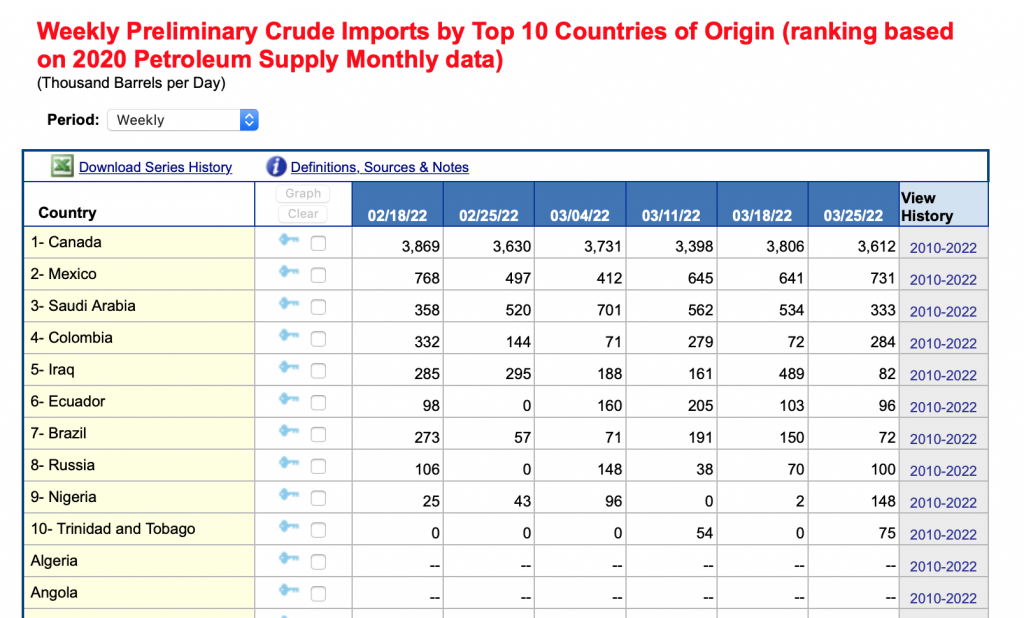

But perhaps the US is not embargoing Russian oil despite Biden’s claims. Reader Glass Hammer pointed to the latest EIA report. Note the line for Russia, with supplies still coming on the week of March 25, when Biden imposed the supposed ban on March 8:

Look closely at the table. Russia is listed as number 8, which as the headline explains: “ranking based on 2020 Petroleum Supply Monthly data”.

But if you look at the amounts supplied by nation the week of March 25, Russia is actually the #6 source, so at least that week, Russia was more important to the US than it had been in the same month in 2020. Russian officials taunted the US about it.

Now this could be an artifact of deliveries, that the US is wink and nodding in cargoes that were contracted before the Biden embargo began. But it may be that the embargo is running on an honor system basis, and not everyone is honoring it. Indirect confirmation comes from this Telegraph India article: Tanker loaded with barrels of Russian oil loses buyer:

A tanker loaded with one million barrels of Russian oil set sail from Murmansk this month, headed for Philadelphia. Then, in the middle of the Atlantic, it did an abrupt U-turn.

The ship, Beijing Spirit, had apparently lost the buyer for its oil. It removed “Philadelphia” as its listed destination, according to the global maritime data provider MarineTraffic, and listed its new destination as “For Orders”, which indicates that the oil on board is for sale…

“Once you put the crude somewhere in a tank on land, it is anonymous,” MVan Schail said. “You blend it with some other crude, load it on another tanker and sell it as European Sour Blend and nobody knows its origin was Russia.” At the same time, at least seven tankers are still sailing towards the US to offload their shipments before the US ban on Russian oil takes full effect on April 21.

So the embargo is not yet stringent. But as other sources pointed out, oil sold into storage is not subject to embargo. So a trader could buy it, take delivery and then resell it. There would be intermediation costs but Russian crude is selling at enough of a discount that it could be an attractive play, even before allowing for the direction of prices likely to be up during any storage/oil laundering time.

By Irina Slav, a writer for Oilprice.com with over a decade of experience writing on the oil and gas industry. Originally published at OilPrice

- President Biden’s huge SPR release announcement has pushed WTI prices back below $100.

- SPR release may calm crude prices only in the short term.

- U.S. SPR may need to be replenished at higher oil prices.

This week, the Biden administration revealed that it will release as much as 180 million barrels of crude oil in a bid to calm oil prices, which have remained above $100 per barrel for an extended period of time. The International Energy Agency, meanwhile, is coordinating a smaller but international reserve release of some 60 million barrels and has called an emergency meeting to discuss how exactly to go about it.

It remains unclear whether part of the 180 SPR release in the United States will be a completely separate endeavor or if some of these barrels will be part of the IEA release. Earlier this year, the U.S. had agreed to release 30 million barrels as part of the IEA push. What is clear is that the success of these releases in calming down oil prices is quite unlikely.

The United States last year announced the release of 50 million barrels in an effort to bring down prices t the pump, which were eroding Americans’ purchasing power and weighing on the President’s approval ratings.

This pressured prices for a few days before they rebounded, driven by continued discipline among U.S. producers, equal discipline in OPEC+, and a relentless increase in demand for the commodity.

Then Russia invaded Ukraine, and the U.S. banned imports of Russian crude and fuels. It also sanctioned the country’s financial system heavily, making paying for Russian crude and fuels too much of a headache for the dollar-based international industry. Prices soared again before retreating some, but remain firmly in three-digit territory.

As of mid-March, the Department of Energy said, some 30 million barrels of crude from the strategic petroleum reserve had been sold or leased. That’s more than half of the 50 million barrels announced in November, and it appears to have had zero effect on price movements.

But the new reserve release is a lot bigger, so it should make a difference, shouldn’t it? It amounts to some 1 million bpd over several months, per reports about White House plans in this respect. Unfortunately, but importantly, oil’s fundamentals have not changed much since November.

U.S. shale oil producers, the companies that a few years ago prompted talk among analysts that OPEC was becoming increasingly irrelevant, have rearranged their priorities. They no longer strive for growth at all costs. Now they strive for happy shareholders.

This has given more opportunities to smaller independent drillers with no shareholders to keep happy. Yet these have also run into challenges, mainly in the form of insufficient funding because the energy transition has had banks worrying about their reputations and their own shareholders.

Pandemic-related supply disruptions have also affected the U.S. oil industry’s ability to expand output. Frac sand, cement, and equipment are among the things that have been reported to be in short supply in the shale patch. Now, there’s a shortage of steel tubing, too.

Meanwhile, OPEC is doing business as usual, sticking to its commitment to add some 400,000 bpd to oil markets every month until its combined output recovers to pre-pandemic levels. Just this week, the cartel approved another monthly addition of 432,000 bpd to its combined output despite increasingly desperate calls from the U.S. and the IEA for more barrels.

OPEC has been demonstrating increasingly bluntly that its interests and the interests of some of its biggest clients may not be in alignment right now. It has refused to openly condemn Russia for its actions in Ukraine and has not joined the Western sanction push.

On the contrary, OPEC is gladly doing business with Russia. And Saudi Arabia and the UAE, the two OPEC members that actually have the capacity to boost production beyond their quotas, have deemed it unwise to undermine their partnership with Russia by acquiescing to the West’s request for more oil.

In this environment, releasing whatever number of barrels from strategic reserves could only provide a very short relief at the pump. Then, it may make matters even worse. As one oil market commentator on Twitter said about the SPR release news, the White House will be selling these barrels at $100 and then may have to buy them at $150.

Indeed, one thing that tends to get overlooked during turbulent times is that the strategic petroleum reserve of any country needs to be replenished. It’s not called strategic for laughs. And a 180-million-barrel reserve release will be quite a draw on the U.S. SPR, which currently stands at over 580 million barrels. If oil’s fundamentals remain the same, prices will not be lower when the time to replenish the SPR comes.

This seems the most likely development. The EU, the UK, and the United States have stated sanctions against Russia will not be lifted even if Moscow strikes a peace deal with the Ukraine government. This means Russian oil will continue to be hard to come by for those dealing in dollars or euros.

According to the IEA, the shortfall could be 3 million barrels daily, to be felt this quarter. OPEC+ is not straying from its course. In some good news, at least, U.S. oil production rose last week for the first time in more than two months, by a modest 100,000 bpd.

Hard not to notice that in all the expressions of concern for the impacts on the economy, nobody is seriously calling for measures to reduce demand. An immediate lowering of speed limits and re-introducing covid work from home orders could take a small but significant bite out of demand pressures. On the contrary, the imperative to go ‘back to normal’ means that governments are actively promoting more air travel and traffic. It seems even measures that were acceptable in the 1970’s are no longer deemed politically viable. In Europe, fishermen and farmers are being given supports to buy diesel instead of, for example, making public transport free. The coming crisis in energy is being put off into the near future.

As for increasing supply, its clear that the Biden team have been appallingly inept in their handling of the Middle East. They’ve somehow managed to strengthen the Gulf autocracies. Of course they love the Ukraine war, $100 a barrel oil is their saviour.

US oil will not be able to ramp up production in the short to medium term. Its not just supply bottlenecks, it takes time to get drilling skills up. The sweet spots for oil and gas are already all worked out or have active extraction, it takes more time, know-how and money to get oil from tougher geologies.

I think that both, the release of oil reserves in US and the unwillingness to impose some kind of rationing suggest that the western leadership believes that by summer or autumn oil supply problems might be solved one way of another. If I am recalling correctly, the German emergency plan and TOTAL assessment were that Germany or France would no longer require Russian oil by autumn. So, go ahead with consumption rising, no problem there. This seems to be the official stance. Unfortunately I have not seen any serious study on this apart from links and posts here at NC that don’t see such a brilliant Russian oil-free future. On the other side recession warmings have been issued so it seems to me that leaderships might be willing to let demand corrections come done by ‘markets’ without any intervention except those current subsidies that might well turn counterproductive some time. I find all this puzzling.

I am getting distinct shades of the summer of 2007, when on the one hand, after the Bear funds blew up (June) and heading into the $400bn SIV blow-up (August) everyone in the trenches instinctively knew that we were in for one hell of a ride, but every investment banker on the Street was pushing the “everything will be fine after Labour Day” narrative like there is no tomorrow, and the press just sort of went along with…

…in other words, it seems to me both the White House and the EU are in the “it will all blow over soon” mode, not the least because the business community (still on the let’s-get-back-to-normal-after-COVID warpath, particularly airlines, tourism, hospitality et cetera) is probably telling them that there is no need to even think of cutting back demand. That’s on top of the apparent limitations of this White House to respond to ANYTHING in a timely or pre-emptive fashion, not to mention the midterms coming up so the impetus is likely to push off any demand-side measures until at least after November…

A subjective opinion, of course, but them’s the vibes I am feeling at the moment. Sadly, I live too far above ground to contemplate constructing a personal bunker at this stage.

Yes, the upcoming mid-terms are part of the calculation.

I find it puzzling too.

Either the Western leaders are (1) lying (despite the anti-Putin rhetoric, Russian sanctions will be rolled back and economic relations will return to pre-war and western leaders know it right now) or (2) incompetent.

Given the past 20 years of policy failures, I say #2.

Whether the EU-US realizes it or not, we’ve escalated to a full-blown West v. Russia economic war.

Referring to this in NC today and other similar articles, it seems we’ve escalated to a full-blown West vs. 85% of the world economic war.

At least it looks like most of the world is willing to be neutral (even if being a “collateral damage”) if not actively aiding and abetting the enemies of the West. There’s now even talk about detente between India and Pakistan, almost like they’re preparing for a big re-alignment by trying to finally bury the hatchet.

It also seems to me that Saudi Arabia or UAE (or some other nation) could purchase Russian oil, offload it into their storage, then ship it out. There are several countries that I think see leverage here and either will use this chance to screw over the USA & the West, or at least use the leverage to extract some kind of concessions.

I was thinking this morning about rationing. The thing in the 70s was that the older adults had lived through WWII and ration cards, and maybe the Depression and all that entailed. I think that during the energy crisis, people 40+ years old just shrugged and said “It’s this all over again”. Now the USA has become really spoiled and asking even the slightest inconvenience of us turns into incursions against freedom and all that.

These are not serious people. They didn’t plan the sanctions or responses to counteractions. They assumed that Russia would give up under bullying alone or that their “sanctions from hell” would destroy the russian economy immediately. They were so confident that they didn’t even manage to get their ducks in a row and figure out who would support these sanctions if they were enacted. They’re also not intelligent (the application of raw brain power) people, so they’re just flailing at this point. Every next thing will the one that turns the whole shitshow around, never mind about potential consequences, we’ll plan only on best-case scenarios.

I saw an article with “quotes” from Gulf leadership/intheknow types saying that they appreciate that the Russians say what they’ll do and do what they say they’ll do as contrasted with the Americans who are unreliable and fickle. Apparently Putin’s loyalty to Assad, even though it’s on the opposite side of the Gulf monarchies is also respected.

Sure, lower the speed limit to conserve fuel works, right? Maybe. Let’s do some grade school math (yes, you may use your fingers).

500 mile trip at 70mph obtaining 20mpg means a trip of seven hours consuming 25 gallons (5 gallons per 100 miles traveled).

Same 500 mile trip with reduced speed limit a la President Carter’s bright idea in the mid-70s tore duce the speed limit to 55mph and now you’re cracking along whilst achieving 25mpg – yippee! This, because instead of 5-gallons per 100 miles you’ve achieved 4 gallons per 100-miles, or a trip consuming 20 gallons instead of 25. Worth it? Depends.

So at 70mph you burned 25 gallons for the trip, but at 55mph the trip takes an additional 2-hours and yes, you saved money on fuel (20 gallons versus 25 gallons), but you added 2-hours of operation to the engine and automobile, took two more hours out of your life, and basically imposed a 15% time penalty to the mission. This is called reduced productivity in the real world.

Commercially, multiply this by the millions of truck hours used to deliver cargo across our nation, and the fact we’re bound by a limited supply of truck drivers and containers leading to inflation and I – most respectfully – posit this is actually a very bad idea.

Go further and do the math for our civilian workforce, one which is experiencing shortages already. Can we afford to reduce productivity by 15%? Honestly, no we can’t and thus, I feel this is an outright bad idea for America right now under all circumstances.

Worse, this ban on Russian crude purchases is a sham. And it’s a bad idea. We pushed the Russians into this by winking and nodding at Kyiv as they demonstrated bad faith by not abiding by the Minsk Accords just as surely as we pushed the Japanese to attack in the run up to our involvement in WWII. That time by embargoing their crude oil supplies in 1940 (because they attacked French Indochina to obtain those supplies of bunker and other goods making their way to the Chinese war effort in defense against Japan). Point being, our acting surprised the Russians reacted is disingenuous at best, world ending at worst. Not sure why our nation wants to goad Russia. Totally baffled but here we are.

Some vehicles don’t do as well in mpg at 55 mph vs. 70 mph.

Lower the speed limit is a very politically motivated idea, just like daylight savings time. It’s much better to ration fuel or provide incentives to those who conserve energy.

Which vehicles would that be? The largest strain on a vehicle motor (and fuel consumption) is a function of the vehicles velocity passing through air. The pressure, or friction, is a function of the shape of the vehicle, its velocity (speed, if you will), and rolling resistance (tire pressure).

The friction on a perfect sphere (something most cars aren’t) is a cubic function of velocity (v^3).

So reducing speed from 70mph to 55mph is a reduction of ~25%. The actual reduction of resistance (fuel use) is closer to a 50% improvement in gas mileage.

Here’s a real world example from 2005:

https://www.sfgate.com/news/article/Drive-55-save-gas-get-flipped-off-Trip-2600719.php

You don’t need to use high school math, you can find some detailed technical reports on the impacts. For high speed roads the reduction in fuel use is very significant (although in reality complex depending on vehicle and road type). They key issue is air resistance – above certain speeds most energy is used pushing air out of the way, this is why fuel consumption can rise very rapidly in some vehicles above around 50mph, even if their engines are at a supposed optimal rate.

Your assumptions on slower times are not born out in real world driving unless you are fortunate to have nice open empty highways everywhere. In reality, lowering speed in congested roads improves traffic flow and efficiency – this is why many road authorities enforce very low speed limits in very congested parts of the network. You may feel you are going slower, but if everyone is going slower there are fewer hold ups.

If the FedGov imposes a speed limit and a hundred million Republicanons and Trumpanons make a point of ignoring it ( ” Freedom Speed! No Limits! ” ), what does the FedGov do then?

We have a different climate here than what we had during the Nixon Administration.

According to the Russian Information Agency news dated 3 April 2022 USA increased purchase or Russian oil by 43%

https://ria.ru/20220403/neft-1781559523.html

It looks like no sanctions are used on purchase of Russian oil by USA at the moment

That’s EXACTLY THE SAME DATA I POSTED ABOVE.

100 million the week ended 3/25 divided by 70 million the week ended 3/18 = 1.43 or a 43% increase.

But it was 0 the week of 2/25 so there may be catchup.

Existing contracts were given 45 days to wind down, so unless I’m totally missing something, Russian oil could show up in the weekly stats thru the week ending 4/23. Maybe that also partially explains how the numbers could have risen following the ban?

i read the entire article (and excerpted from it for an email) before i checked the comments and didn’t see that, so it’s easy to miss…

broadly there are 3 types of petrol tankers, VLCC (very large, think 2-trailer semis), Suezmax (the biggest that can fit through the Suez Canal, think 1-trailer semi) and Aframax (think box truck).

Everything was in just-in-time equilibrium pre-war with the oil delivery.

Just as Russian airspace ban mean airplanes are taking the long way to travel, Anti-Russian sanctions means tankers are not taking the most efficient pre-war shipping routes.

This effectively means less oil can be transported per day around the world, and may negate any savings from the reserve releases as oil can’t reach European terminals because there are no empty tankers .

We are still in the top of the 2nd inning re. the impact from the Russia sanctions. And given the Putin has suffered a ‘strategic blunder’ rhethoric for Blinken, DC is probably feeling really smug right now.

If I understand correctly, according to Energy Intel Rusneft expects to export 50% more crude in April than it did in March.

But nobody knows where, since Rosneft is not publishing the the full information anymore. Now why would they want to do that?

correct. and if you’re India and getting a big crude discount, you’re happy to pay whatever the price for a tanker.

If you want a cargo delivered to Spain and paying the full price for crude, can you match the Indian rate? I don’t know, but I doubt it.

Is it possible that this SPR release will last until the elections and give Democrats a chance to pretend they fixed stuff, so then it’s the Republicans that will have to replenish at higher prices?