Yves here. Larry Summers alert! He’s still among us and worse may have people in positions of authority listening to him. Take this article as the sort of thing that McKinsey also peddles: leading edge conventional wisdom. This piece uses unemployment data to argue that it shows the economy is overheating and therefore it makes perfect sense for the Federal Reserve to stomp on those uppity workers to stop inflation, since the Fed has been in the business of using recessions to whack worker pay via recessions. You will notice astonishingly that it does not mention anything that people in the real world along with most economists see as the cause of the current inflation: supply chain issues, high energy prices, high food prices, commodity shortages. And those are now being made worse by the blowback from the sanctions on Russia.

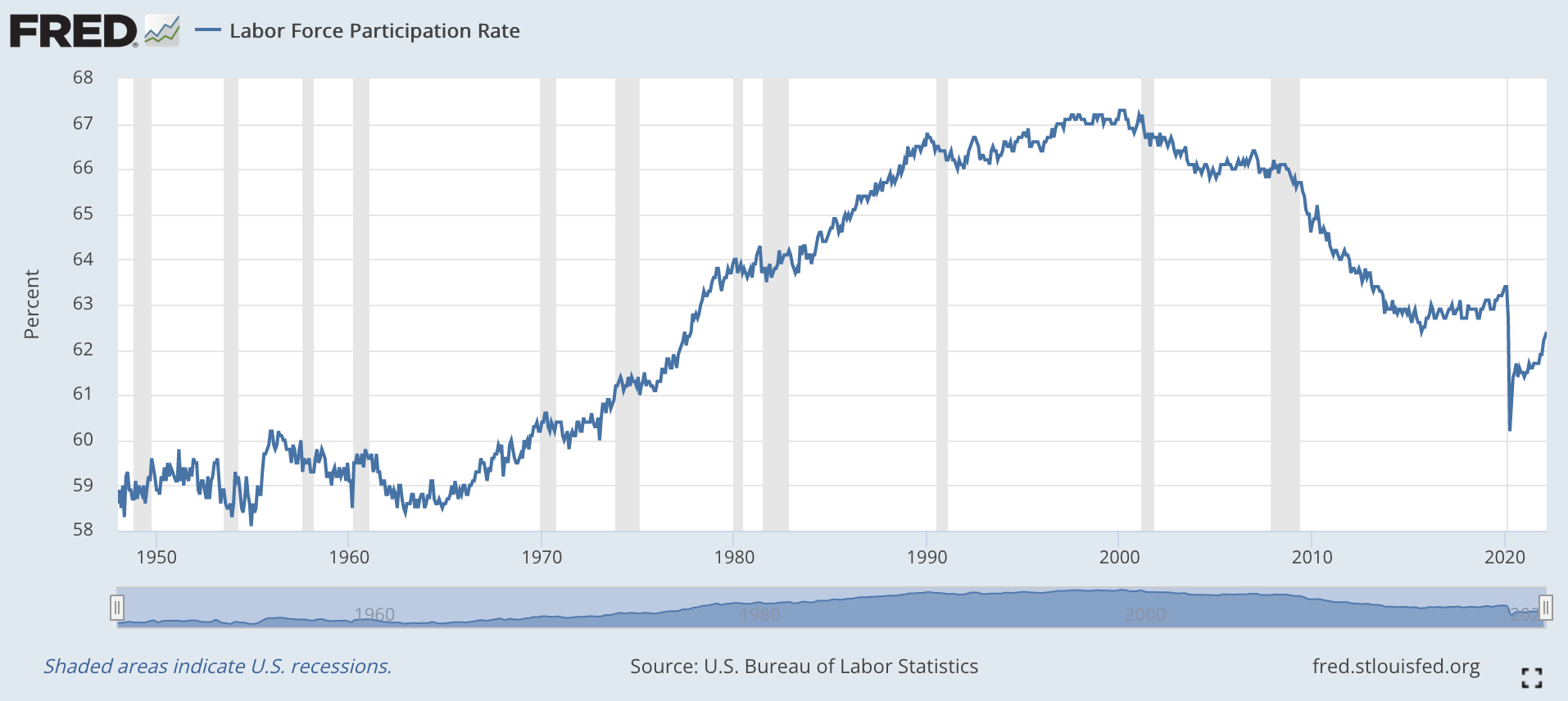

As for the little story that the labor market is tight, you can see that labor force participation is still below where it was when Covid hit:

The reason that formal unemployment measures are low is people who were in the workforce before aren’t now. Some, particularly in medical fields, retired early. Some have long Covid and either aren’t working or are working fewer hours. Some are not willing to go to badly paid workplaces with high Covid risk any more. Not clear how they are supporting themselves but fast food joints are among the walking wounded.

By Alex Domash, Research Fellow, Mossavar-Rahmani Center for Business & Government, Harvard Kennedy School and Lawrence H. Summers, Charles W. Eliot University Professor and President Emeritus, Harvard University. Originally published at VoxEU

With US inflation reaching 7.9% in February 2022, the Federal Reserve moved to increase the federal funds rate by 0.25 percentage points at its March meeting. The Federal Open Market Committee’s (FOMC) latest Summary of Economic Projections (2022), released at the same meeting, projects interest rates to reach 1.9% by the end of 2022. In response, there has been much discussion over the plausibility that the central bank can achieve a soft landing without pushing the US economy into a recession.

While engineering a soft landing is historically very rare, Fed Chair Jerome Powell told lawmakers in early March that he believes achieving a soft landing is “more likely than not” (Powell 2022). The FOMC’s March forecast (FOMC 2022), as well as the consensus forecast from the Federal Reserve Bank of Philadelphia’s Survey of Professional Forecasters (FRBP 2022), supports this claim: in both forecasts, inflation recedes to below 3% by 2023 and unemployment remains below 4%.

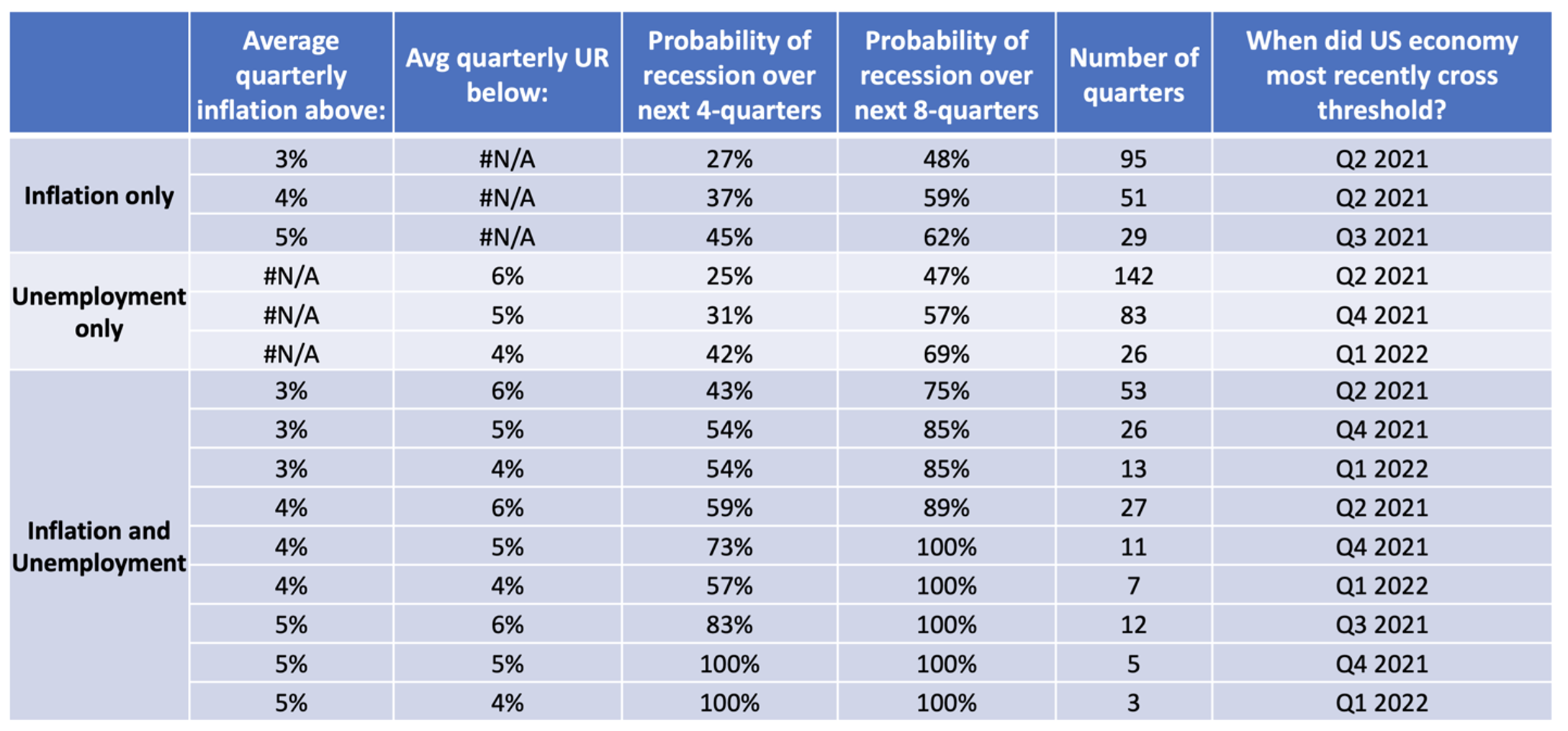

To examine the plausibility of the Fed’s forecasts, we look at quarterly data going back to the 1950s and calculate the probability that the economy goes into a recession within the next 12 and 24 months, conditioning on alternative measures of inflation and unemployment. Our analysis is motivated by the fact that overheating conditions like low unemployment and high inflation are usually followed by recessions in the near-term. For example, Fatas (2021) shows how the US economy has never displayed significant periods of low and stable unemployment, such as those predicted by the FOMC.

Our central finding is that given the current inflation of nearly 8% and unemployment below 4%, historical evidence suggests a very substantial likelihood of recession over the next 12 to 24 months.

Historical Evidence Suggests High Probability of Recession

Table 1 shows the historical probability of a recession occurring within the next one and two years, conditional on contemporaneous measures of CPI inflation and the unemployment rate. The results indicate that lower unemployment and higher inflation significantly increase the probability of a subsequent recession. Historically, when average quarterly inflation rises above 5%, the probability of a recession over the next two years is above 60%, and when the unemployment rate drops below 4%, the probability of a recession over the next two years approaches 70%.

Since 1955, there has never been a quarter with average inflation above 4% and unemployment below 5% that was not followed by a recession within the next two years.

Table 1 Historical probability of a recession conditional on different levels of CPI inflation and unemployment, using data from 1955-2019

The above results do not reflect our use of the CPI rather than alternative inflation measures, or the use of the unemployment rate rather than alternative labour market tightness measures. Measuring labour market tightness with the job vacancy rate, which we have advocated for in our prior work (Domash and Summers 2022), suggests an even higher probability of recession over the next 12 and 24 months. Similarly, using Core PCE inflation or wage inflation rather than the CPI also yields the same conclusions.

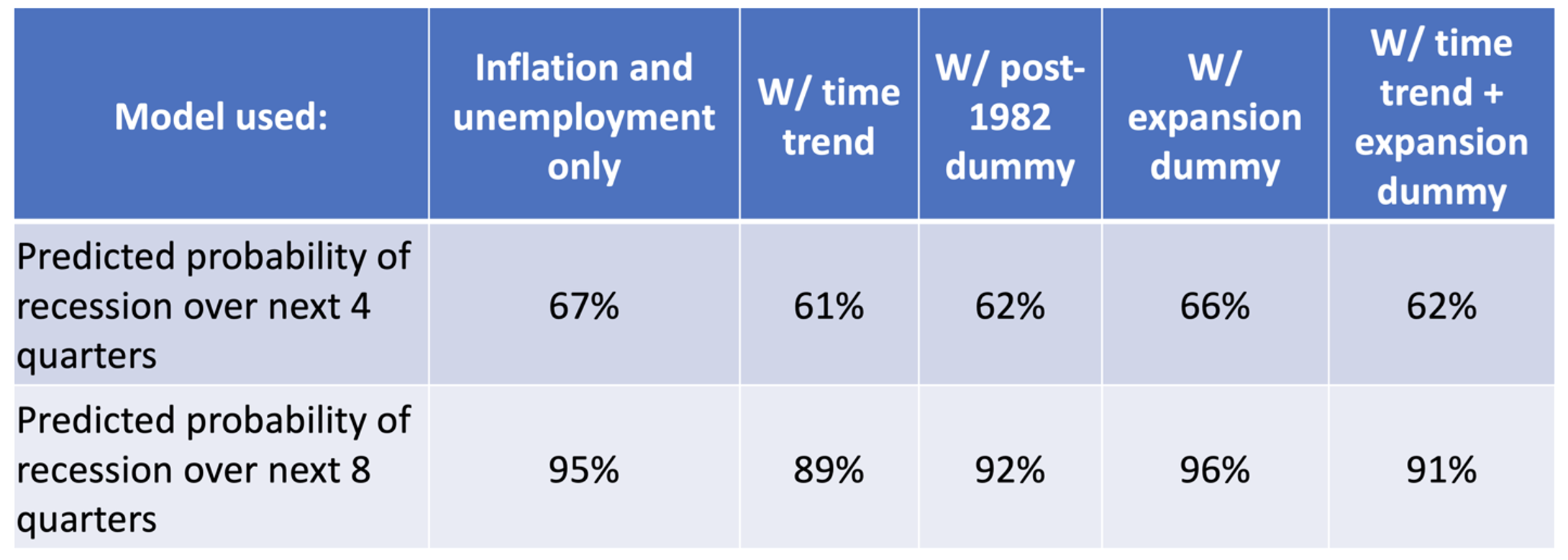

Some may argue that the historical data presented in these tables overstate the probability of recession, since there has been a trend towards greater business cycle stability in recent decades. Motivated by this concern, and to make maximum use of available information, we use a probit model to predict the probability of a future recession based on current economic conditions and controlling for a time trend.

Table 2 presents the results from our probit models, showing the predicted probabilities of a recession occurring over the next 12 and 24 months for five different model specifications. In our baseline model, we use a four-quarter trailing average of inflation and a one-quarter lag of unemployment as our main explanatory variables. To allow for the possibility that recession probabilities have declined over time, we also have specifications that include a time trend (column 2) and a dummy for years after 1982 (column 3). We find in our regressions that a trend towards greater business cycle stability does not appear in any significant way once one controls for economic conditions. Finally, we include a specification with a dummy for whether the economy is more than six-quarters into an economic expansion (column 4), and with the time trend and expansion dummy (column 5).

Table 2 Predicted probabilities of a recession occurring over the next 12 and 24 months

These results suggest a very high likelihood of recession in the coming years and are robust across many model specifications. Moreover, the findings do not reflect our choice to use the CPI as the inflation measure or the unemployment rate as the slack measure. Using wage inflation, rather than the CPI, results in higher predictions of the probability of recession, and using Core PCE inflation results in similar predictions. Replacing the unemployment rate with the vacancy rate (which we believe to be a better tightness indicator) also yields higher predicted probabilities of a recession over the next years.

Overall, the evidence we present suggests that engineering a soft landing is a very difficult thing to do in a rapidly growing, inflation economy.

Soft Landings Are Historically Unprecedented in the US

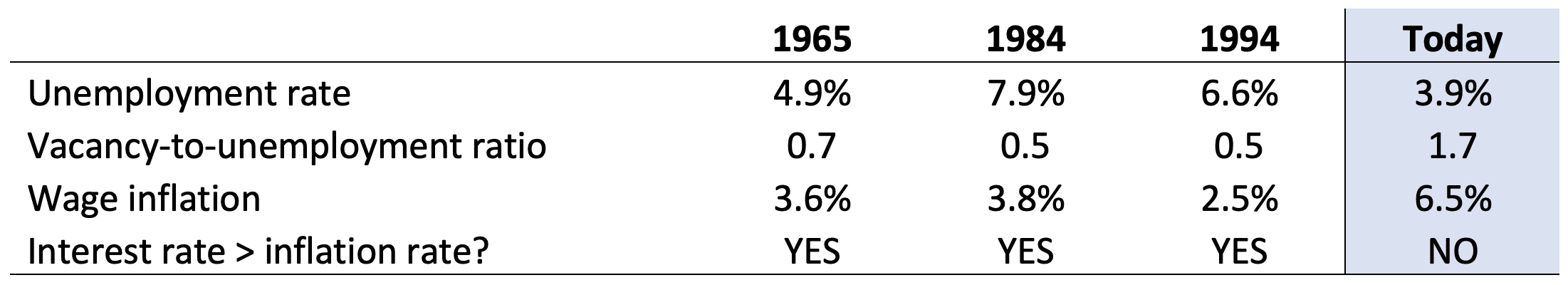

Some have argued that there are grounds for optimism on the basis that soft-ish landings have occurred several times in the post-war period – including in 1965, 1984, and 1994. We show, however, that inflation and labour market tightness in each of these periods had little resemblance to the current moment. Table 3 summarises the labour market conditions during these alleged soft landings.

Table 3 Labour market conditions today compared to past periods

Note: This table uses quarterly averages from the first quarter of the tightening cycle

In all three episodes, the Federal Reserve was operating in an economy with an unemployment rate significantly higher than today, a vacancy-to-unemployment ratio significantly lower than today, and wage inflation still below 4%. In these historical examples, the Federal Reserve also raised interest rates well above the inflation rate – unlike today – and explicitly acted early to pre-empt inflation from spiralling, rather than waiting for inflation to already be excessive. These periods also did not involve major supply shocks such as those currently experienced in the US.

With inflation nearing 8% and unemployment below 4%, the Fed today is way behind the curve, and now has to play catch-up to try to tame price increases. Rather than grounds for optimism, the historical experience in the US is that slowing rapidly accelerating inflation always leads to substantial increases in economic slack. Our conclusion echoes Ha et al. (2022), who argue that bringing inflation back to target likely requires a much more forceful policy response than currently anticipated. Moreover, none of the calculations in this column accounts for the recent supply shocks associated with the war in Ukraine, which will only increase the probability of recession even further. We therefore believe that the likelihood that the Fed achieves a soft landing in the economy is low.

As inflation accelerates in the US, the Federal Reserve will raise interest rates in the hope of achieving a soft landing for the economy. This column uses historical data on unemployment and inflation to evaluate the likelihood that the Fed can lower inflation without causing a recession. The authors find that low levels of unemployment and high inflation are both strong predictors of future recessions, and that overheating indicators today suggest a very high probability of recession over the next two years. The likelihood of the Fed achieving a soft landing in the economy appears low.

See original post for references

The best part is if the inflationary pressure is not being caused by labor scarcity, while destroying demand by causing unemployment, there are enough problems, both existing and deliberately engineered, to continue to drive up prices.

I think that at this stage we can assume that a recession is baked into the cake. Washington has gotten themselves wrapped around the axle of the Ukraine and every time they get frustrated, they double down further no matter what effect it has on the US and world economy. And they may be now ignoring the pandemic but the pandemic is not ignoring them which continues to put a monkey wrench into the economy and all you need is a more dangerous variant to emerge to cause further chaos. If they had concentrated on helping the economy, they may have helped themselves and the country as well but by forgetting ‘It’s the economy, stupid’ they have now, in my opinion, made a recession a certainty. The Biden regime – not fit for purpose.

“Fundamentally, nothing will change…”

Promises Kept!

A corollary should be added:

Nothing will fundamentally change… except for worse.

Nailed it!

I’m something of a broken record on this but the only options are a recession or inflation that will soon end up in the double digits. People seem to have fallen into two camps, both of which have tunnel vision. One side started out claiming that there wasn’t actually any inflation, then that it was “transitional”, and when that was no longer plausible, they switched to saying that inflation was good, actually, or that it had nothing to do with the Fed and QE but that it was all just corporate profiteering and unrelated supply chain issues. The other side is the neoclassical, Friedman, hard money libertarian crowd that thinks fiat currency isn’t real, much of which ended up becoming crypto cultists. The truth is that inflation does matter and that at a minimum the actions of the government and the Federal Reserve were a major contributor even if its debatable that they were the primary cause. That award probably goes to COVID itself. There is no one cause of inflation, and there won’t be one solution either. Some of this is undeniably due to the actions of the Fed such as bond & treasury buying and ZIRP, some of it is due to all the stimulus during the pandemic, some of it is due to constant tax cuts which ultimate just pump more money into the system in a different way. Some of it are the sanctions (although inflation was a problem long before the war) and the resulting oil price increase, and some of it is very obviously the supply chain woes brough on by COVID.

There is no right answer for the Fed at this time. I pretty firmly believe that. The talk now seems to be that they are serious about getting inflation down and will cause a recession to do it, but that could change very, very quickly when push comes to shove and economic pain starts to bite. We could easily end up right back on the inflationary path towards the double digits if stocks dip by 20% or so. QE has pretty much gone on uninterrupted since 2008 and it seems that 10-15 years later we’re finally out of runway.

> some of it is due to constant tax cuts which ultimate

> just pump more money into the system in a different way

In MMT, is this more “tax cuts which result in fewer fiat dollars being destroyed”?

Roquentin – Good comment. There are indeed many factors contributing to inflation which means monetary policy can’t bring it down except by causing a recession through higher unemployment and demand destruction.

To add some context, corporate profiteering is a major contributor along with others you mentioned. Back in December, 2021, Matt Stoller wrote a piece on how much those industries with price-setting power have massively increased their profit margins far above the increase in their costs.

BTW, it’s not QE that’s boosting the markets, it’s the massive buying of securities by the Fed that’s doing that. It keeps the wealthy happy and makes them richer by the month.

“We could easily end up right back on the inflationary path towards the double digits if stocks dip by 20% or so.”

A lot of stocks have dipped more than 20% in the past 8-10 months or so. You can probably count on one or two hands the number of stocks doing the major part of the heavy lifting by just looking at indexes.

For example, I figured even more weirdness would start with the indexes as soon as Tesla was added.

The workers are getting too uppity. Howard Schulz returned to Starbucks to announce that workers are attacking corporations. Heavens! Please, somebody engineer a recession to snuff out this union fever that’s sparking across the nation.

Remember when this guy was going to run for president as a “moderate”?

And let’s not forget that, if Jason Furman is to be believed, in real terms wages have not kept up with inflation in the slightest (https://twitter.com/jasonfurman/status/1513882254099025922). If the theory is that a ‘tight’ labor market is the cause of inflation via a wage-price spiral, then surely real wages should either be matching or exceeding the rate of inflation, no?

Also, on a bit of a tangent, I’d like to add another possibility as to the source of tightness in the labor market. There was a study published in the Harvard Business Review last year (https://www.hbs.edu/managing-the-future-of-work/Documents/research/hiddenworkers09032021.pdf) and written up in the Wall Street Journal (https://www.wsj.com/articles/companies-need-more-workers-why-do-they-reject-millions-of-resumes-11630728008) about “hidden workers”. The long and the short of it is that businesses have increasingly relied on automated systems to handle recruitment of new employees. And these automated systems are generally designed around weeding out applicants rather than bringing people into consideration. So for any number of reasons, people who apply for a given position are simply rejected out of hand without any human eyes ever seeing their application. These reasons can range from someone having a criminal conviction or 6+ months out of the work force to businesses poorly coordinating between recruiting and the operational side of things to develop job descriptions (i.e. a nursing position wanting someone who can do data entry but listing programming as a requirement, thus excluding applicants who either don’t have or don’t include programming experience on their resume).

Now this all fine and good when in the labor market of at least the past two decades, the supply of labor increasingly outstrips the demand for labor from business. But when COVID hits and substantially upset the labor market, I would bet anything that businesses have found themselves hoisted by their own petard. Since they’re still using recruiting techniques that automatically exclude large numbers of potential employees from consideration, they’re in a position where they have positions they want to fill, there are people who want to work (as can be seen by the upward trend in prime-age labor force participation), but they’re recruiting systems simply reject large numbers of applicants out of hand. Thus at the very least exacerbating issues businesses are having filling positions. And likely contributing to some level of wage growth as a result of businesses artificially constricting the supply of labor while having some open positions that need to be filled.

And one that is unlikely to change as a consequence of capital presuming that conditions in the labor market are more likely than not to return to the normal that has characterized the past two decades (as can be seen in predictions from the likes of JP Morgan that the elevated levels of investment of the past year or two are likely to decline in the near term). Meaning that any changes made to increase the ability of companies to bring people on board would need to be reversed if the general demand for labor returns to it’s previous level and long term trends. But until then, to the degree that the above speculation is accurate, I absolutely love businesses that have gotten into the habit of expecting/demanding/wanting three years of experience for an entry level job having difficulty not being able to find enough people with said three years of experience to fill those positions.

I was in the labor market during 2nd half 2021 into early 2022. I would surmise that on most occasions, my application for job openings were at least 50% dismissed out of height. For any number of reasons – too tall, too short, no MBA required but 20+ years experience might indicate higher salary expectations. The experience marker ultimately came in handy however, as I’m now working on a contract basis. Best commute I’ve ever had!

I think your point is relevant at the end. Experience required for this position but we do welcome entry level job seekers. Can’t Make This Up. Good grief it’s bizarre.

People need to mention the other elephant in the room. Boomers aging out of the workforce. I have no research to back it up, but I’ve always suspected a lot of people took COVID as their queue to retire, early or otherwise.

I have the same suspicions about the job recruitment algos doing what you described.

I’m going to add, a good number probably have settings to weed out the unemployed – not just those unemployed for a number of months. Unless searching while currently employed, it’s almost not worth the time using on online submissions.

For the most part, get a connection at the place of interest, then, if required submit online.

I think the real disequilibrium is in wages. They have not gone up. If the poor (everyone but the elites) can’t pay their debts then (argue if you must) debt does matter and debt holders have losses. Who are the debt holders? Why banks

This is one of the reasons why the FED shouldn’t be responsible for inflation or full employment. When there is little or only a modest amount of private debt in the economy rate fluctuations can be absorbed. But in our now highly indebted (private debts – personal and business) economy, rate adjustments can very quickly lead to economy wide financial instability. Toss in a hot war or 2 and we should be discussing how hard we’ll crash versus can we make a soft landing or not

Broad increase in U.S. producer prices underscores tough inflation battle for Fed

Yves / Lambert,

Question…

I was just looking at the PPI numbers at wolfstreet (https://wolfstreet.com/2022/04/13/inflation-nightmare-keeps-getting-worse-producer-prices-break-out-inflationary-mindset-rules/) and they are crazy, especially when you consider 2019 going into 2020. I get the supply chain issues and it’s obviously a factor, but how big? I was looking at the US manufacturing numbers and durable goods order at Warren’s site (http://moslereconomics.com/2022/04/07/new-manufacturers-orders-vehicle-sales-unemployment-claims-rents-oil-prices/) and I’m like there’s no signs of domestic overheating… Even initial unemployment claims are now rising.

It got me wondering… do we have any idea how much of this could be the result of financialzed commodities? I mean oil prices went negative in 2020 basically because too many people with zero means of taking delivery had to bail at the same time. We know so many commodities are now investor traded. Is this just a giant bubble that’s going to pop on way or another vs. a wage-price spiral?

I expect the Fed to go full Paul Volker, while insuring that the private equity parasites who are making housing unaffordable are protected.

Why do you expect that? I think it’s prudent to look a little farther back into history than that. I think the better parallel would be coming of WW2, where rates were held down, capital controls and let inflation run hot. When so many people are holding debt from the private sector to the government, if they are serious about paying down debt is there any other way to make that easier than to devalue the currency? The federal governments debt alone is unserviceable after a few percentage points, same with the ~12% of major corps considered zombie status. So I’m my eyes they let inflation run, which every major government has done in this situation throughout history in this position or we under go a major structural change that keeps the party going for those in power in the public and private side to either kick the can or make the debt not matter as much. Our government has done that successfully though several times over the last century as well… so who the heck knows! My point is though the 70s and 80s was a different game then we are playing now.

Didn’t IBM name its chess champion computer Big Blue? I’d sure like to know why we don’t have a Big Blue to counter all the idiocy of little thinkers like Larry. Shallow waters run loud. But still, Larry is ushered in to talk his blabber without any questions. He looks straight into the camera and cites pure nonsense – because the charts have always “shown” that when unemployment falls too low we always descend into “recession.” Well, gosh why has that been such a consistent thing? Is it because Larry and his ilk are mind controlled by the slime-mold logic of quick profits, preferably by having a strong dollar in all of their big fat transactions? And why is the economy considered healthy when it is choked and starved into chronic suffering? Because some nitwit said that sovereign social spending is debt and this debt is somehow held against the currency itself. That is pure bullshit. Gosh. Larry. I just don’t think you are that stupid. I just don’t think you are too stupid to see the self-serving logic you push. And I find it hard to imagine that your “statistics” are anywhere near a depth of understanding necessary to maintain a healthy economy. Just please go away unless you are willing to have an extensive open discussion – not larry-summers-gobbledegook – on everything you claim to be predicted by historical charts based on selective nonsense. Every time you go on the air there should be someone asking hard detailed questions. And other voices need to be considered which clearly offer better choices. I doubt you’d ever go on TV again if you had to face your own nasty music.

Larry “The Tick” Summers. No, no, no.

It seems likely to me that current inflation is part structural due to supply chain weakness unwinding and part political due to sanctions. On top of that we have businesses taking advantage of news to bump up their profits after pandemic losses. The problem for policy makers is that the measurements of key indicators have become corrupted to the extent that making decisions is ends up being politically biased.

Inflation measures quoted tend to be core ones which do not reflect experienced inflation due to certain exclusions, substitutions, hedonic quality reductions, basket of goods bias. These changes were introduced to reduce social welfare and pensions costs, but because they are used for wage bargaining they also increase inequality. A blend of R-CPI-E and CPI-W might be better but even these are faulted.

http://www.shadowstats.com/alternate_data/inflation-charts

Unemployment measures are also tinkered with with the U3 rate typically being quoted, yet U6 is generally accepted as being closer to real world due to including the discouraged, underemployed in the country. Taking into account the US participation rate is 68% compared to 74% in Europe it would be easy to argue U6 unemployment measures under report unemployment.

http://www.shadowstats.com/alternate_data/unemployment-charts

Producer price index data tends to be based on factors affected by news. Energy price rises last October seem to be the start of changes (before Ukraine) although final demand changes excluding energy and food have been running at 7% increases for 12 months. Unprocessed energy materials are down 11% for the month of march. We also see service cost rising 7% year on year. This looks like jet fuel costs being the tail that is wagging the dog and there is evidence of businesses jumping on the price rise band wagon.

https://www.bls.gov/news.release/ppi.nr0.htm

Jolts (job openings) data in the US is not really moving and quits from large businesses is up. This looks like a precursors to recession is in place. Anybody suggesting policy based on only one officially indicator should probably not be listened. All data seems messed up including the shadow stats (There were good and bad reasons why the old statistics were changed) ones in the links such that a policy misstep is almost inevitable. This seems like an environment where businesses can gain market share by cutting margins, so an upset to the employment figures could happen as market restructuring takes place.

This is intentionally dishonest?

They’re making descriptive statements and equating them w/probability. “I flipped heads on a coin 5/5 times.” =/= “There is a 100% chance on the next flip I will flip heads.”

They are describing wage inflation in nominal terms. 6.5% nominal wage gains vs a 8%+ inflation rate is a loss in real wages.

This is pretty basic stuff.

An amusing infographic at Politico This cheeseburger explains your bigger grocery bill American consumers are seeing food prices rise at the fastest rate in decades. Supply chain snarls, labor shortages and climate challenges (plus the conflict in Ukraine) share the blame.

I read the article until I finished the eggs part. Imo it’s really poor. Just giving general facts instead of specific reasons.

I stopped when I finished reading about eggs since there was no mention of the bird flu which is affecting chickens in the USA currently. I just checked on duckduckgo and the second hit was this:

https://www.msn.com/en-us/news/us/el-paso-wholesaler-increases-prices-by-12-percent-due-to-avian-bird-flu/ar-AAWccg0

Whoever wrote this article did a crappy job.

Yeah I should have emphasized the amusing part and de-emphasized infographic part. Apologies for wasting your time.

Yves, back when the Raygun curse was elected, the Feds changed how they reported nationwide unemployment. I’m not a financial/economist expert, but you know what I’m trying to say. They manipulated the figures so their FRightwing cartel looked good. No way. But, the Powell Memo garbage knew what they were doing. I majored in American English communication. That gives me some cred.

Here in San Diego where cost of living has become the worst in the nation, demand destruction has started hitting in the last month or two based simply on my visual observation of places and things people would normally spend disposable income on. Between exploding rents and $6 a gallon gas people are spent.

This is what happens with predominantly supply driven inflation when it gets out of control like it is now.

Well, they like to lead and lag variables in order to come up with a guess. I wonder how many of the models include deficit spending of $2 trillion per year? This year is exceptional because this year’s excess spending is already over $2 trillion.

This looks like a data mining effort to establish correlation. I am willing to accept the argument that a recession is likely fairly soon if the economy continues to behave in a manner consistent with the date range for past data (this is not exactly news, as they tend to come around every 15-20 years or so and we’re about due). I do not accept the leap to causation, or the strongly implied argument that said recession can be softened or prevented by lowering inflation or increasing unemployment. To establish that you would need to compare recession rate in scenarios where the inflation/unemployment criteria applied when the central bank intervened and when it didn’t. The data are already thin on the ground before slicing and dicing further in this way. The authors don’t even attempt it, but offer three examples of ‘soft landings’ where central bank action might have been a factor, but admit that it might also have been due to lack of supply shocks or other more significant factors.

The article seems to accept that there is little evidence that Fed intervention would make any difference:

but assumes that it’s desirable for it to happen anyway:

and states without evidence that it would work if it was ‘forceful’ enough:

I suppose if you are failing to fly by pulling on your bootstraps, you could always pull harder. Let me know how that works out for you.

The numbers are (somewhat) interesting, but as usual economists have no idea what to do with them, except to use them as a faux-scientific smokescreen for orthodoxy.

(There’s also an assumption that the Fed can directly influence inflation/unemployment via monetary policy, which I’m not even going to touch).

If they increase unemployment the recession will worsen, since it will reduce demand. Basically if you do the opposite to whatever nonsense Summers comes out with, you’ll be in a better place economically.

Labor participation rate chart: Is that part that looks like the overpumped market indexes where women powered into the workforce?

And it was already trending down long before Covid hit. Then strangely stagnant for a few years.

Sure, it may rise a bit, but the downtrend appears to be the “normal’ before Covid.

Raising interest rates will cause a recession — that is the whole point of raising them: to crush inflation by disciplining labour. This has been the Fed’s playbook since the Volker years. Volker used to brag about it (at least in private) but now the Fed at least publicly pretends to be concerned about unemployment while turning the screw.

This whole process is brought to you by the same logic that gave us,“in order for the village to be saved it had to be destroyed” …

Maybe raising interest rates to where they are above the rate of inflation – maybe that would cause a recession. T-bills are at 1.75% – still a negative return in real terms.

Labor particpation rate chart: after the shaded areas for recessions notice the climb in the participation rate. Then look at post 2000/2008. Rough time climbing, if at all.

Call those the “recoveries” of diminishing returns. Imagine what it’s going to look like after the next recession?

As for the rest of the article, not a word about all the money pumped into the economy that largely went to the already wealthy. Guess we can’t ever say whacked out distribution of wealth contributes to inflation.

Hmmm. China has 72% labor force participation and still doubles real wages every decade, like clockwork

Almost as if they’re using some kind of plan….

Interesting that none of the above comments includes the phrase “global heating” or even that squishy euphemism, “climate change?” Could it be that global productivity has actually been falling for quite a while and at an increasing rate?

Any good articles which deconstruct the inflation? Noticed that Steve Keen has an article posted at ZH: https://www.zerohedge.com/economics/steve-keen-aint-your-daddys-inflation-part-1. Doesn’t really have a verdict, so presumably that’s in part 2.

I was looking at fed gov current expenditures. https://fred.stlouisfed.org/series/W068RCQ027SBEA . The spikes due to Covid were huge. But looks like the bow wave has pretty much passed. It’ll be interesting to see if the most recent quarter reflects increased infrastructure program kicking in.

Not included in that would be stimulus due to suspension of student debt payments. That contributes about $100B per year, according to https://libertystreeteconomics.newyorkfed.org/2022/03/student-loan-repayment-during-the-pandemic-forbearance/. But I can’t see that being significant enough for inflation. Still, it would have been interesting if Biden turned off that benefit in the interest of “fighting inflation”. Otherwise, there’s about $100B unspent in state and local funds per https://www.nytimes.com/interactive/2022/03/11/us/how-covid-stimulus-money-was-spent.html.

So assuming the bow wave of Fed Gov stimulus is pretty much out of the way, that leaves the perpetual stimulus of private debt creation due to the good graces of the Fed Reserve keeping the punch bowl out. But that traditionally hasn’t translated into inflation in goods and services – the plebs aren’t invited to that party. So something is different. Still, that’s the only battle the Fed Reserve is equipped to fight … by taking their punch bowl away. And it won’t be a soft landing. Either the punch bowl is in place (risk on) or it isn’t (risk off). There is no equilibrium inbetween. But even ignoring present inflation in goods and services, I think the Fed Reserve would be on path to take the punch bowl away anyways, just due to too much inflation in assets (stock market, housing, stupid money in NFTs, crypto, etc). Not many people remember that the Fed Reserve was on path to doing that at the end of 2019 until it was overtaken by events (Covid). So to some degree I see the Federal Reserve re-starting that campaign from 2019 again. Having nothing to do really with the inflation in goods and services that we’re seeing now.

I do not believe inflation is only 7.9%. Nearly everything I buy is up anywhere from 15% to 60%–when the stuff is on the shelves…. The biggest jumps were in canned soup and cans of dog food. Not to mention package shrinkage. It’s 2008 all over again.

And it’s affecting the underground economy too. I sell at a Sunday flea market and there are fewer and fewer buyers.