Wolf Richter noted a week ago that applications for new home purchases fell 21% from year earlier levels. The Wall Street Journal and Financial Times today are handwringing that the rise in mortgage interest rates, the most sudden in the last 35 years, is suddenly taking a lot of air out of a housing market that had gotten very bubbly due to a decade plus of super low interest rates.

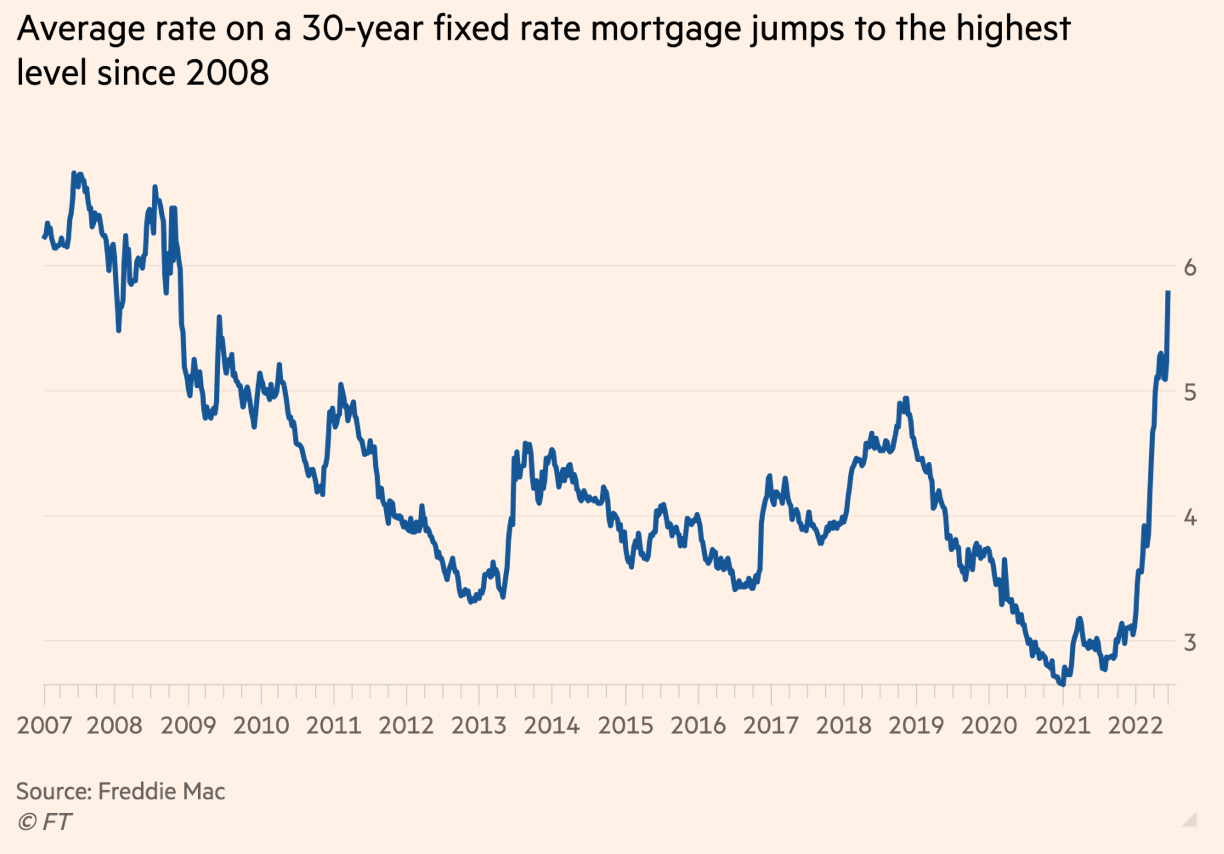

A housing correction is going to be another big whammy on top of high energy and food prices and increasing numbers of shortages. We’ve warned that above all, these problems are due to supply side issues: the blowback of the Russian sanctions, the continuing impact of Covid (diminished workforce due to early retirements and long Covid, some workers foregoing high-risk employers, plus supply chain interruptions out of China), and pre-existing supply problems (jammed ports, a chronic trucker shortage, a diesel crunch). The US and advanced economics have gotten accustomed to artificially low mortgage rates due not just to ZIRP-y policies but also the Fed specifically seeking to lower mortgages spreads over Treasuries by buying Freddie and Fannie bonds as part of QE. When I was younger, 6% was mighty cheap for mortgage. It now looks catastrophically high:

The average thirty-year fixed rate last week rose to 5.78%. That was before the Fed’s 75 basis point interest rate increase this week.

Remember that the Fed was keenly interested in goosing the housing market after the crisis to boost housing prices, which would reduce the number of underwater mortgages and help rescue big banks’ second mortgage portfolios. The other motivation was to stimulate “wealth effect” related spending. Increases in residential real estate prices have a much bigger impact than stock price gains.

And of course, the direct impact of housing sales, both new and existing, are important for the economy: home construction and renovation, new furnishings, moving costs, broker and bank fees…lots of money moving around!

So the rending of garments is understandable. From the Financial Times:

Moderation is already starting to show up in the data: the rate of US new home construction fell in May to the slowest pace since April 2021.

US housing starts fell 14.4 per cent month on month to an annualised pace of 1.5mn, according to the commerce department. Building permits, considered a leading indicator of the housing market, fell 7 per cent from the previous month to an annualised pace of 1.69mn.

Sentiment among homebuilders declined for the sixth consecutive month in June, as inflation and higher mortgage rates weakened demand for new homes.

Sellers have also started to take note, with Redfin on Thursday reporting that the number of for sale homes with price drops reached a record 22. 4 per cent in the four weeks that ended June 12.

An optimist argued that the Fed’s 75 basis point rise might not be reflected fully in mortgage price increases, since they are priced off “the belly of the curve” as in ten year Treasuries. A Wall Street Journal reader in its comments section said that Mortgage Daily News was quoting 6.05%, which so far is less of an increase than the Fed rise.

The Journal gave more color to the impact of higher interest rates:

Mortgage rates don’t move automatically when the Fed raises rates, but they are heavily influenced by it. The short-term rate that the Fed directly controls has risen by 1.5 percentage points this year. The average mortgage rate has risen nearly 2.7 percentage points, the steepest such increase in decades.

Mortgage rates are tied closely to the 10-year U.S. Treasury yield, which tends to move in tandem with expectations for the Fed’s benchmark rate. The 10-year yield this week hit its highest level since 2011, having more than doubled this year due to escalating bets on rate increases….

Home buyers in May paid about $740 more a month to finance a median-priced U.S. home than they did in May 2021, when rates were closer to 3% and prices were lower, according to Realtor.com.

Note that the Journal continues with an oversimplified account:

Sales of existing homes fell to their weakest pace in nearly two years in April. But with so many buyers competing for so few homes, prices continued to rise.

That’s not entirely correct. Wolf Richter showed that the bigger reason for average prices going up was the bottom dropping out of the market. A sudden shrinkage in sales of cheaper homes versus higher priced homes will move up the average. Having said that, in this ‘hood, prices continue to appreciate. The current Zestimate for this house is up 1% over last week and 29% over January. Admittedly, there’s been a long-standing shortage of inventory here and a lot of demand for this suburb, since it has the best school district in the state.

With retail sales unexpectedly down in May, the Fed might slow its pace of increases if it sees other signs of economic weakness. But if their aim is to slow the economy enough to bring down gas and energy prices, it’s going to take a lot of “demand destruction” as in killing of incomes, to accomplish that.

My prediction is that if it comes down to us vs them – those who get hurt by inflation/cost of living vs those who benefit from inflation (asset holders), THEM will win every time. Meaning the Fed will go thru the motion of pretending to fight inflation, reverse course quickly, and re-inflate asset prices. And advice to Fed: if you are serious about lowering inflation numbers, just cook the books more than you have been already by jiggering the items you include in the CPI. Meanwhile I heard you can get a nice 2 bedroom house in a St. Petersburg suburb, Russia by saving for it for just a few years if you have a good job….without needing a mortgage.

Unless the plan is to get major asset holders even richer. How? By getting enough people to sell whatever they have at rock bottom prices before doing a 180 on interest rates. The national home ownership rate in the US is around 65% i.e. there’s still a lot of room for that number to fall. Imagine half of homeowners selling their houses to the likes of Blackrock, Blackstone, etc at bargain basement prices. Afterwards, the Fed can goose the value of those homes by lowering interest rates again.

That’s the prerogative during every crisis, unfortunately. Wealth will continue to consolidate to asset holders.

Wealth is gravitational, it draws other wealth to it. A crisis that wipes out wealth for many accretes to the wealth of the wealthiest.

Fed has nothing to do with CPI. That’s BLS which is significantly less politicized. That said, some of the changes to CPI (cough cough.. hedonic adjustments) do appear designed to make inflation look rosier but those are decades in the making.

“Fed has nothing to do with CPI.” Just like the Fed has nothing to do with housing? Except it does. In both cases. Am aware of the time-line issue meaning HISTORICALLY changes to CPI have been slow which is why my advice to Fed to get on it, but I also think the Fed is capable of smashing that historical slow speed. Trillion and trillions are involved. Obstacles can eliminated for the wealthy.

I perhaps could have worded that better: “The Fed has nothing to do with *measuring* CPI”. Thanks for pointing out the discrepancy. As to longer-time line, I meant that with respect to methodological changes to the measuring the CPI. The BLS commissions reports and studies on the effects of this or that change before actually doing any of the changes. They cant (or wont) just abruptly change the way CPI is measured like the Federal Reserve makes changes to policy

Thought the Fed uses GDP deflator (GDPDEF) from the BEA?

Well, when looking back, it does look like the Fed intervened.

It was none other than Nixon’s Fed Chairman Arthur Burns who created the first version of what is now fondly known as the core inflation rate (free of the volatile “special factors” of food and energy).

Burns insisted price trends were heavily influenced by peculiar external factors and excluded oil and energy-related products from the consumer price index. (Energy had a weight of over 11% in the CPI)

When in 1973, surging food prices were said to be traceable to unusual weather, he removed food, which had a weight of 25%, out of the CPI.

With similar reasoning he went on to take out homeownership, prices of mobile homes, used cars, etc. until only about 35% of the CPI was left.

I realize things have changed but how much more manipulated than this carnage from Arthur Burns? I mean how much darker than the con of this man.

If I recall correctly, the shelter component of May’s CPI increased 7% (on an annualized basis).

If I recall correctly, the shelter component = 30% of CPI. Gasoline is only 4% of CPI. Food at home is 14%

CPI will not go down until housing gets crushed.

https://www.pewresearch.org/fact-tank/2022/01/24/as-inflation-soars-a-look-at-whats-inside-the-consumer-price-index/

https://www.bls.gov/news.release/cpi.nr0.htm

Speaking of CPI… can we trust the official numbers from the BLS, or should we be looking instead at something like John Williams’ Shadowstats?

Shadowstats is great at documenting how various official statistics have changed over time. However, Williams has no foundation for producing alternate metrics. He’s not a big data shop that hoovers up lots of real economy info and can crunch it. For instance, before the 2007-2008 crisis. his CPI was simply official CPI + 4%

It’s interesting that you mention big data. There are data brokers with access to financial transaction data in the US who could conceivably generate a better CPI based on what people are really spending. BLS is apparently very interested in these latest developments.

Yes. Shadowstats always seems to be a more trustworthy measurement.

My CashApp is $NeedsHelp999 as I am homeless and hungry.

Thanks so much for any help.

Susan

The shelter component of CPI has nothing to do with actual housing prices though. It’s based on imputed rent. While I don’t pretend to have a crystal ball, I could see increased interest rates being passed on to renters.. it’s not the price that necessarily matters to investor’s, it’s the carrying cost

OK. Thus 740$ more per month in mortgages, Gasoline at 5.2-7$/gallon in the US if I am correct… one can predict reduced spending on everything else anytime soon: restaurants, leisure, delayed spending on clothes, etc.

Being housing pro-cyclic lay-offs and recession must be a given by now. And because this is all for Ukraine, or at least we are told so, we have to keep happy face on economic war.

Then we have that stuff about derivatives and specialized TBTF in queue for rescue plus some Covid stimulus fatigue… we are doomed aren’t we?

One wonders what other stupidity has the PMC in queue to surprise us.

My Father was a Real Estate Appraiser and expert witness for 3 decades and there was a tool he used to determine whether a home price was “In the Ballpark” and worth taking a closer look at, ” Gross rental multiplier”.

A home in a solid working class neighborhood could have a value up to 100X Monthly rent, A home in zip code 94610 (Lower Piedmont Ca) up to 125X Monthly rent, a Julia Morgan designed home on an acre or more in upper Piedmont ( Think Atherton) 150X Monthly rent if in perfect shape.

A nice little home came on the market here recently on a street comparable to lower Piedmont for $825K, a very comparable home a block away recently rented (1 year lease) for $3,500 per Month.

Small?

1,100 Sq Ft on a small lot.

Tom, my father used to say that a house’s monthly rental rate should equal 1% of its current market value. Does this square with the metrics you just described in your comment?

Low interest rates messed up this guideline. 1% is significantly more profitable to an investor if they have a lower interest rate–that’s why there was a ton of money poured into the space which drove prices up. Now rents are well below 1 percent in most cities.

It also greatly depends on the area. Low appreciation areas like flint michigan or detroit require higher then even 2 percent of rents, whereas high appreciation areas like California, or NYC, could be had for less than 0.5 percent as investors banked on the appreciation, or high wealth owners who weren’t buying as an investment simply didnt care.

Yes, for a solid middle class neighborhood and a home in great shape.

That’s 100X Monthly rent.

150X is for best quality in the best area, Nob Hill and the like.

Thanks, Tom. Your comment provides an excellent summary — with real world context — of what Dad told me.

In our So CA neighborhood, mid-class but quite a nice private colleges community (Claremont), our townhouse would rent at 0.43%. The housing market has behaved just as it did prior to the 07 crash. Faking interest costs has done nothing but produce artificial equity. I could have easily borrowed $300K on the equity when refinancing at 2.65% but I’m done with the gambling mentality on RE. Too close to retirement to be played a fool …imagine putting that into stocks in September 2021 so that I could reach for a McMansion later …. When is THAT shoe going to drop?

Sounds like trouble already: https://www.bloomberg.com/news/features/2022-06-14/airbnb-rentals-turn-into-real-estate-goldmines-with-easy-money-mortgages

It would be very enlightening to follow up on this article in two years to find out how many of these “instant millionaires” are still in the short term vacation rental property business. Few if any is my guess.

I sold my Fannie Mae stock @ $59 15 years ago when the crash of housing bubble numero uno was coming, but then things went on hyperdrive in housing bubble numero dos, hell they managed to make a home in Boise worth $500k!

So riddle me this Batman, why is Fannie worth a measly 56 Cents today, less than 1/100th of its previous value?

The facts or the approved narrative…the approved narrative is how bad bad bad Fannie and Freddie were for guaranteeing the handing out of loans as required by federal law to folks who would never be allowed to get a recommendation to join the yacht club…thus allowing the riff raff to not have to rent from Potter in Bedford falls…the reality sits closer to isda “perpetual on hold mediations” vs. a triggering event…the old Fannie Mae watch eventually bribed/coerced congress to reduce competition by attempting to force Fannie and Freddie out of certain markets the bankers themselves had insisted Fannie/Freddie handle for them in respects to the CRA laws which have NEVER been anywhere near fully enforced…less than a week after congress accepted the “suggestions” from lobbyists and reduced liquidity by reducing the capacity of Freddie/Fannie to operate, the to be trusted not ready for prime time “free market invisible hand geniuses” couldn’t be trusted to play nice amongst themselves and the whole system froze…AIG and Fannie/Freddie regularly spent excess funds to purchase tail risk out of the money derivative positions as end of the world insurance…as the dust settled, if the isda had allowed AIG and Freddie/Fannie to cash in their positions, everyone else would have been out of business and only those three would be standing…therefore…they had to go…despite the facts…and before some ex fanniemaewatch pr hack tries to bring it up…the 2004-5 issues with Fannie were since they were “under” reporting profits and holding the funds as additional reserves…as they were major counter parties on these out if the money derivative positions…there is a method to the madness….

That was my understanding too–Fannie and Freddie were nationalized not because they had performed poorly, but so the Fed could stuff all of the crappy non-performing loans from all the other TBTF banks on their books.

Timothy Howard–the former CFO of Fannie–had an excellent book on the subject: The Mortgage Wars if anyone is interested

Thanks. That’s a great book referral.

My Cash App is $NeedsHelp999

Thanks for any help.

Susan

Who does not miss the orange man …

“The US and advanced economics have gotten accustomed to artificially low mortgage rates due not just to ZIRP-y policies but also the Fed specifically seeking to lower mortgages spreads over Treasuries by buying Freddie and Fannie bonds as part of QE. When I was younger, 6% was mighty cheap for mortgage. It now looks catastrophically high:”

“Mortgage rates in the 1970s fluctuated between 7% and 11%.

In the 1980s, rates seesawed from 11% to just shy of 17%, and back down to 10%.

The 1990s were a bit more stable, with rates oscillating between 7% and 10%.”

I can remember my mother bragging about the, oh, 6% mortgage that she and Dad got on the house that they built back in 1965-66. I also recall that my folks paid the mortgage off during the mid-1980s.

Oh, why was Mom bragging? Because more recent arrivals in the neighborhood were paying much higher mortgage rates.

Existing home sales are the elephant in the room. In 2020 there were 822,000 new homes sold compared to 5,640,000 existing homes sold. Existing home sales numbers are 7 times larger than new home sales numbers. The recent price rise for single family homes was created by low supply and high demand. There were low levels of new home construction after 2007-08 and increased demand caused by low interest rates, more single home owners, “Covid work from home” and population increases caused by immigration.

Yves notes that in her fairly well-off suburb of Birmingham, AL, which has a school system with few poor- or Black- students, home prices are up “…29% over January. Admittedly, there’s been a long-standing shortage of inventory here and a lot of demand for this suburb, since it has the best school district in the state.” This is happening everywhere including Austin, TX where I live. The well-off who want good, safe schools are migrating to places that provide them and housing prices there, already high, are going up. In places near or in big cities with poor schools, the prices were not going up nearly as fast and are now likely to come down.

In the past six months interest rates for home loans went from 3.25% to 5.5%. According the local real estate people I know, the housing market for homes under $400k has simply collapsed because of mortgage payment issues while the “Pay cash I got from selling my California house” crowd is still paying cash for $600-1,200K Austin houses.

But for the under $400k homes, the price will come down, which benefits me because I need to buy a small townhouse near the National Archive in College Park, MD. That’s in the poor suburbs of Washington, DC; majority Black and immigrant with declining schools so middle-class parents will no longer buy there. I have no kids in the schools so I don’t care. And there are places in the area which are quiet and safe, which is what I do care about. Prices are coming down fast for the $200,000, 900 sq/ft townhouses I want, so I’m in luck since I’ll pay cash.

We now more that ever are facing two diverging housing markets.

Same is occurring around me here in Brisbane where there has been a pronounced shift away from anything spec built to early 80s and older in the outer city rings or cured with good transport outer suburbs from the CBD. Per se my area and those like it post GFC trended around 500/600K till just the last 6mo and now surpassing 1M.

It seems two dynamics are at work – L.A. like late 80s dynamic of corp restructuring forcing middle age workers to sell RE and move to new work/lower RE cost locations like Colorado. In my case in Brisbane its Melbourne and Sydney refugees.

But more importantly in my opinion is people are moving away from the spec builds due to poor quality construction – largely based on sale metrics of 2/4/6 year RE flipping in the past. Seems many of the new buyers are looking for primary RE that has piered slabs [not floating et al], hardwood frames, and old pine/hardwood trims, not that over the last 10 years most have renovated wet areas/kitchens/lighting-electrical, solar, hardwood floors, et al.

Here is a recent example that I worked on 10 minutes from where I live. – https://jasonadcock.com.au/property/house-qld-kenmore-r2-3293370/

Wish I could link before pictures because the outside had not been painted in over 15 years and the inside about the same. Painted the house to the left just afterwards and it just sold for 1.2M, painted the house 2 down on the right, and going to paint the 3rd house on the right in Aug for possible sale or just to keep up with the state of the neighbors homes. The increasing speed of sale of these sorts of homes is really increasing the price IMO.

This will have no effect on wealthy or corporate buyers who can pay cash, in fact it means there is less competition for those entities.

Sure, but why should they buy 1 at $X, if they can buy three at the same price.

“Buy when there’s blood in the streets”.