Lambert: A doom loop for climate, eh?

By Stavros Zenios, Professor of finance and management science at University of Cyprus, Member of the Cyprus Academy of Sciences, Letters, and Arts, Non-resident Fellow at Bruegel, and Senior Fellow at the Wharton Financial Institutions Center of the University of Pennsylvania. Originally published at VoxEU

Evidence suggests that sovereign debt markets are taking climate effects into account in pricing, creating the potential for a climate-debt doom loop. However, climate risks to fiscal stability do not attract the same attention as climate risks to financial stability. This column discusses how integrated assessment models can be linked with stochastic debt sustainability analysis to inform our understanding of climate risks to sovereign debt. In a case study of Italy, introducing climate risks causes the debt dynamic to deteriorate and risk premia to increase non-linearly as a manifestation of the doom loop.

Bold (and costly) climate action is required during the current decade, but at the same time, sovereign debt has reached levels not seen since WWII. Unprecedented central bank interventions during the pandemic have averted a debt crisis, but concerns are voiced that climate change imperils the ability of countries to repay Covid-19 debts (Dibley et al. 2021). These concerns go to the heart of the hypothetical proposal by Greta Thunberg, suggested by Kotlikoff et al. (2021) when they put words in her mouth for a bargain deal at the 2019 address to the United Nations:

“Since we cannot count on you to act morally, let me propose bribing you to save the planet. Adopt a high global carbon tax. However, cut other taxes so, on balance, you are better off. My and future generations will pay higher taxes to service the deficits you run.”

But can Greta’s cohort service the debts they inherit, given the climate effects on debt?

The CEPR collection (Di Mauro 2021) provides a “fascinating insight into the evolution of economic research on climate change over the last decade”. Climate risks to financial stability take centre stage, next to carbon pricing and green finance. Climate risks to fiscal stability attract scant attention, with only Persaud (2021) dealing with debt. A 2019 survey of the EU national fiscal councils found that their quantitative analyses do not cover climate risks. A Google trends search since the Paris Agreement has an average rating of 92 for “climate risks + financial” and 36 for “+ fiscal”. Google Scholar lists 1.94 million documents on the former topic and 0.3 million on the latter. Cognisant of the challenges ahead, the European Fiscal Board recently asked for a holistic view of climate risks to fiscal planning (Thygesen et al. 2022).

In Zenios (2022), I suggest developing such a holistic view by capitalising on advances in climate risk and debt sustainability analysis (DSA). Combining narrative scenarios of climate analysis (Climatic Change 2014) with scenario trees from stochastic DSA, I argue that we can link integrated assessment models (IAM), pioneered by Nordhaus, with DSA to inform our understanding of climate effects on debt.

Channels from Climate Change to Sovereign Debt

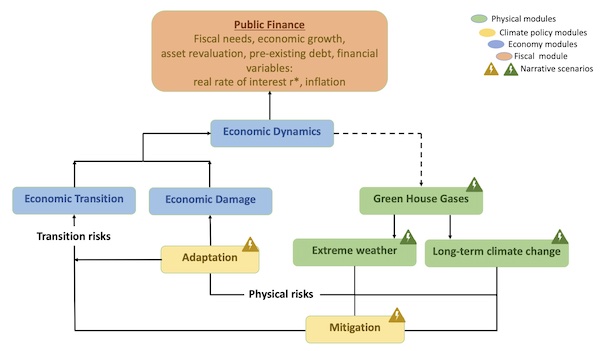

Climate change impacts sovereign debt through multiple channels: economic growth, acute and chronic damages, and costs from low carbon transition (Figure 1).

Figure 1 From climate change to public finance

Let us look at indicative magnitudes. A Tol (2014) meta-analysis finds that a 5°C temperature rise could adversely impact the world economy by 3 to 15% of GDP. The impact would be 2.5% under a 2.5°C increase, although some regions suffer more (15% for the tropics). Damages are documented in international disasters databases but extrapolating from history underestimates future damages as the number and severity of extreme events accelerate; EM-DAT reports a doubling of events from 1985 to recent years. Losses from severe weather for European countries are projected to grow by €170 billion p.a. (1.4% GDP).1 Transitioning from fossil fuels also causes sovereign wealth to be repriced, with assets worth $12 trillion (3% of the capital stock) estimated to be stranded by 2050 (Banque de France 2019).

The bond markets are pricing climate risks (Cevik and Tovar-Jalles 2020), and rating agencies anticipate that climate change will affect ratings in the coming decades. Klusak et al. (2021) find that 55 sovereigns face downgrades under a 2°C increase and eighty under 4.2°C, with concomitant increases in debt servicing costs.

Putting the pieces together suggests that unchecked climate change could precipitate a ‘climate-debt doom loop’. Increasing debt servicing costs add to the costs from damages and climate policies, and the compounded effects can become a first-order problem for some sovereigns. Indeed, countries with greater exposure to climate risks have more precarious public debt positions: the climate-vulnerable EU tercile averages a debt of 133% of GDP compared to 78% for the least vulnerable. If climate costs raise concerns about the ability to repay, the sovereign is downrated, and its financing rates go up. The sovereign is caught in a debt trap that can be difficult to escape if climate change lowers growth. Greta’s cohort will be in a bind.

Debt Sustainability Analysis with Climate Risk

DSA with a climate module can assess the risk of such a trap. It tells us if a sovereign can sustainably finance its debt or estimates the available fiscal space if the debt is sustainable. These answers go to the heart of Thunberg’s hypothetical proposal. To assess whether future generations could service the debts, we need to weigh the debt created by today’s policies and the climate effects on debt. Linking IAM with DSA allows for structured dialogue on this complex issue.

The DSA of Zenios et al. (2021) uses scenario trees to represent future uncertain GDP growth, government primary balance, and interest rates. Debt-to-GDP ratios are stochastic variables on the tree. A tail risk measure tells us if the debt remains on a non-increasing path with high probability so that it is deemed sustainable with high confidence. If the debt declines, we can estimate the available space to run more deficits ‘to save the planet’.

Presently, DSA scenarios ignore climate risks and extend over medium horizons when experts’ projections are reliable, with probabilities calibrated to market data. Beyond that, scenarios converge to long-term trends, such as the historical average growth or inflation target. The analysis of climate risks, on the other hand, is complicated by deep uncertainty. There is ambiguity where outcomes may be known, but their likelihood is not, and there are misspecifications with no consensus on models.

It is possible to deal with this complexity, even if not with high precision. Climate scientists postulate possible future states of the world, but they cannot pin down probabilities as future conditions depend on unknown policy paths. To integrate climate risk into DSA, we calibrate scenario trees on IAM economic projections under future states. To deal with the ambiguity about future conditions, we build on the work of the Integrated Assessment Consortium (IAC).2

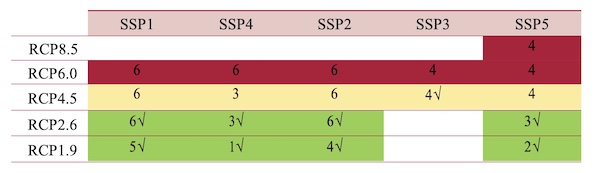

IAC developed a narrative scenario architecture (Climatic Change 2014) that combines representative concentration pathways (RCPs) of atmospheric greenhouse gases with narratives on shared socioeconomic pathways (SSPs). Table 1 illustrates the scenario architecture. For each cell, the number of available IAM can generate projections and using ensembles of models, we deal with model misspecification.

The scenario architecture provides transparent states of the world for what-if analyses. For each SSP-RCP pair, existing IAM provide forward-looking projections of mitigation and adaptation costs, damages, GDP growth, and other outcomes to integrate climate risks into DSA.

Table 1 Narrative scenario architecture of climate risks

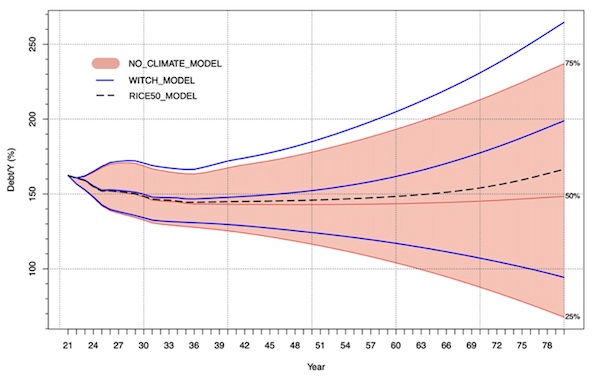

I present the case study for Italy, using growth projections from two prominent IAM to showcase the climate effects on debt and the challenge of misspecifications.3

Figure 2 shows the 25/75 quantiles of debt dynamics with climate-free DSA using projections from the IMF World Economic Outlook and the ECB, with volatilities and correlations matching their historical values. The median debt is stable with significant upside risk. I then introduce climate effects consistent with the Paris Agreement (RCP2.6-SSP2) using the WITCH model (Emmerling et al. 2016) and RICE50+ (Gazzotti et al. 2021). Both models project downward adjustments to Italy’s growth, and I use these projections to re-calibrate the trees. The climate-adjusted DSA results are overlayed onto the fan chart of Figure 2, and we observe deteriorating debt dynamics. With RICE50+, the effects kick in from 2050, whereas WITCH changes are noticeable from the mid-2030s. We note an accelerating trend after mid-century due to increasing adverse climate effects and the nonlinear increase in risk premia as a manifestation of the doom loop.

Figure 2 Dynamics of Italian debt stock with climate impact on growth

Climate‑Proofing Public Finance

Governments need to prepare public finance for climate change:

- Climate challenges are global (or regional) and require coordination. A coordinated modelling effort using the scenario architecture will deliver transparency and ensure the acceptability of scenarios for fiscal planning. A network for climate-proofing public finance could play the coordinating role.

- Fiscal authorities should mainstream climate risk analysis in public finance. Budgetary plans should include damages and the costs of mitigation and adaptation, including social costs, perhaps as contingent liabilities, and seek risk-sharing instruments that provide fiscal space during weather shocks (Demertzis and Zenios 2019).

- Fiscal authorities should disclose their exposures following the Task Force on Climate-related Financial Disclosures guidelines. The resilience of a country’s debt to climate change is essential, whether the country is contributing a lot or a little to climate change.

It is not up to any single country to mitigate climate change. But it is up to the fiscal stability institutions to ensure that the budgetary position of sovereigns is resilient.

Hmmm… well, it is progress I suppose when even mainstream neo-classical influenced economists are sounding alarmed.

Its interesting that he quotes the Tol paper, which is one of a series of horrible papers produced by economists that have been heavily and justifiably criticized for grossly underestimating the costs of even moderate climate change and refusing to incorporate even a modest level of risk assessment – and yet it still concludes that we need pretty fundamental changes to how we are managing the financial side of climate adaption.

We are of course in the midst of unprecedented summertime temperatures in a broad swathe of the planet from western Europe to Japan, not to mention a huge drought in the US. These temperatures are very firmly at the worst case scenario side of projections over the past couple of decades. And still many newspapers illustrate reports record breaking temperatures with photographs of beaches full of swimsuit clad happy looking folks. We really are screwed.

In France it is so hot and dry that agricultural vehicles harvesting wheat start fires that destroy the fields.

As if the tensions on grain markets caused by the war in Ukraine were not enough…

Thank you, Vao.

France 2 news covered that on Monday evening as per https://www.francetvinfo.fr/meteo/secheresse/secheresse-les-agriculteurs-s-inquietent-de-la-multiplication-des-feuxagricoles_5250772.html.

The harvest has also started 3 weeks early due to the weather.

And also in France, protestors disrupted Stage 10 of the Tour de France. My spouse woke me this morning with videos of people glued (?) across the road, blocking the cyclists, some of whom simply weaved through the prone bodies. I had to do an internet search to discover what was focus of the action: climate change. So, not a specifically French problem.

The tour announcer snarkily remarked that in Britain, people who glue themselves to roads or objects are automatically thrown in jail. After they are scraped off, one hopes.

basic econospeak: “do nothing because doing something will not do anything in the long term, and we can’t get our rightful money back out if you do something”?

how can a sovereign be “sovereign” if they have issues repaying their debts? no existe’. isn’t this just the old “sustainable level of debt for a country as percentage of annual GDP” thing, recast into another argument?

if a laborer takes out a long loan, and makes a promise to pay it back, and then tomorrow goes out and gets their arms and legs broken (or a simple back injury), can they ever pay back the loan?

dithering over money should be the last thing on anyone’s mind when it comes to preventing catastrophe, but unfortunately our societies are so caught up with who is going pay what to whom and who owes what and whether there is too much or too little “money” to do anything, that nothing will get done. this is just saying that same thing with elaborate models and data analysis. and the inability to do something in the present is going to likewise make paying anyone anything or doing anything at all in the future highly unlikely.

or i am too stupid to understand it, yet again.

tl/dr addendum: we can’t have the future, because we can’t afford to pay for it!

“Sovereign debt” is the term of art in finance for debt issued by national borrowers.

ahh, so even debt from Italy counted in Euros is “sovereign” debt under this definition.

and here i was thinking in MMT. sorry!

This is like a nice little chat on how best to “climate-proof” sovereign finance – which is in a total shambles due to its current level of indebtedness. Oh, just tax high and make it up in profits – never mind that profit is gained almost exclusively by exploiting and polluting the environment. What we need is a countervailing form of gain – one that can be fiated like everything else. It will all be digital so who cares? But the point should be to stabilize societies while we fix the planet. So let’s go with David Graeber’s “money is debt.” If money is debt then debt is money. Change sovereign debt into collateral. There’s no reason why not; sovereign debt should reflect a higher level of technology. Create a Global Climate Bank backed by all the sovereign debt on the planet. Everybody. That instantly “stabilizes” a new financial structure. Worth many, many trillions so far. By “buying up” all this doomed debt we can transmogrify it directly into the credit necessary to fix the planet. No pearl-clutching necessary. This eliminates the anxiety of “a climate risk causing the debt dynamic to deteriorate” because it would be illogical – what is logical is that there is no reason for a “debt dynamic” to deteriorate if it is designed properly. Debt should be just another human engineered moveable feast. And debt servicing will become part of a virtuous circle. The one mandate will be, “Cause no harm.”

you know, i like your solution.

it’s much better than the WEFlike solution which has been proposed, which is to turn the entirety of natural world into shares that they auction off for “preservation” to the corporate rentier masters and sell it on a “natural world” stock market, with all of the fraud baggage algorithmic trading that will entail.

but, they will surely turn a good solution like yours into the one that benefits them, somehow and someway. that’s my only point of shared reference with these people (economists with their “do nothing” arguments): doing anything will be perverted against itself by these people, because they will not allow a system that does anything other than further enrich and empower them. that’s all they are really waiting for—the guarantee that everything we do to “save” the planet makes them money upon money into eternity.

they have to charge us for the use of “their” planet, don’tcha know.

Preservation is a good thing – but I agree that if we use the current value system based on money and natural resources we will not solve our problems. The medium of exchange (the token of value that we clamor for) needs to be something that directly represents preserving value and that value is the planet. Our system of profiteering does the exact opposite because it promotes exploitation for profit. So planet and profit are diametrically opposed. And our problems go much deeper than simply preserving what’s left – we need mitigation, reclamation and a full-on effort to contain ourselves. To give in proportion to what we take. And I realize this sounds pretty extreme.

Currency sovereigns can pay off their sovereign debt with a tap on their keyboard.

On the other hand, Tol’s estimate that “a 5°C temperature rise could adversely impact the world economy by 3 to 15% of GDP” is 85 to 97% too low.

I estimate the value of this paper to be negative.

What is your 95% confidence interval on your negative valuation estimation for this publication?

By calibrating scenario trees on a full spectrum of economic projections and deducing a narrative scenario architecture including representative concentration pathways of complete guff, inversely regressed against judiciously selected shared socioeconomic pathways I arrived at an estimated value of between -1 and -17.8736251893764 with a confidence interval of 110%. 95% is for pikers.