Yves here. There are many reasons I very much want to leave the US, but one of them is how predictable it is that the rentierism in progress will only get worse, with middle and lower income workers and the elderly facing ever rising housing and medical costs. And with global warming wreaking havoc with harvests, high food prices are likely to be part of the new normal. So while aging sucks in general, it particularly sucks here.

By Judith Graham, a contributing columnist at Kaiser Health News, was previously an investigative reporter, national correspondent and senior health reporter at the Chicago Tribune and a regular contributor to The New York Times’ New Old Age blog. She has also written for Stat News, The Washington Post, and the Journal of the American Medical Association. Originally published at Kaiser Health News

Fran Seeley, 81, doesn’t see herself as living on the edge of a financial crisis. But she’s uncomfortably close.

Each month, Seeley, a retired teacher, gets $925 from Social Security and a $287 disbursement from an individual retirement account. To make ends meet, she’s taken out a reverse mortgage on her Portland, Maine, home that yields $400 monthly.

So far, Seeley has been able to live on this income — about $19,300 a year — by carefully monitoring her spending and drawing on limited savings. But should her excellent health worsen or she need assistance at home, Seeley doesn’t know how she’d pay for those expenses.

More than half of older women living alone — 54% — are in a similarly precarious financial situation: either poor according to federal poverty standards or with incomes too low to pay for essential expenses. For single men, the share is lower but still surprising — 45%.

That’s according to a valuable but little-known measure of the cost of living for older adults: the Elder Index, developed by researchers at the Gerontology Institute at the University of Massachusetts-Boston.

A new coalition, the Equity in Aging Collaborative, is planning to use the index to influence policies that affect older adults, such as property tax relief and expanded eligibility for programs that assist with medical expenses. Twenty-five prominent aging organizations are members of the collaborative.

The goal is to fuel a robust dialogue about “the true cost of aging in America,” which remains unappreciated, said Ramsey Alwin, president and chief executive of the National Council on Aging, an organizer of the coalition.

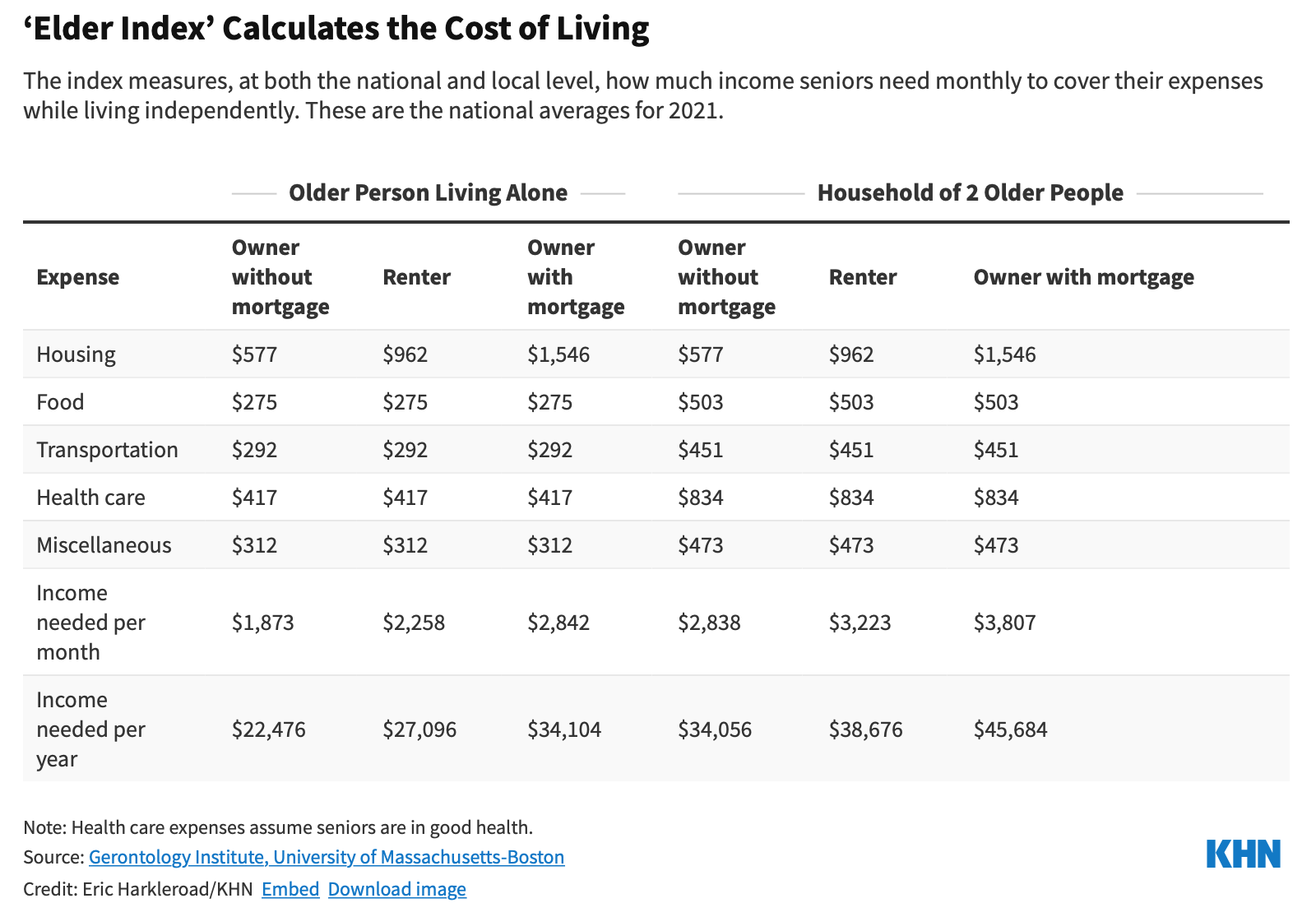

Nationally, and for every state and county in the U.S., the Elder Index uses various public databases to calculate the cost of health care, housing, food, transportation, and miscellaneous expenses for seniors. It represents a bare-bones budget, adjusted for whether older adults live alone or as part of a couple; whether they’re in poor, good, or excellent health; and whether they rent or own homes, with or without a mortgage.

Results from the analyses are eye-opening. In 2020, according to data supplied by Jan Mutchler, director of the Gerontology Institute, the index shows that nearly 5 million older women living alone, 2 million older men living alone, and more than 2 million older couples had incomes that made them economically insecure.

And those estimates were before inflation soared to more than 9% — a 40-year high — and older adults continued to lose jobs during the second and third years of the pandemic. “With those stressors layered on, even more people are struggling,” Mutchler said.

Nationally and in every state, the minimum cost of living for older adults calculated by the Elder Index far exceeds federal poverty thresholds, which are used to calculate official poverty statistics. (Federal poverty thresholds used by the Elder Index differ slightly from federal poverty guidelines. Data for each state can be found here.)

One national example: The Elder Index estimates that a single older adult in good health paying rent needed $27,096, on average, for basic expenses in 2021 — $14,100 more than the federal poverty threshold of $12,996. For couples, the gap between the index’s calculation of necessities and the poverty threshold was even greater.

Yet eligibility for Medicaid, food stamps, housing assistance, and other safety net programs that help older adults is based on federal poverty standards, which don’t account for geographic variations in the cost of living or medical expenses incurred by older adults, among other factors. (This isn’t an issue for older adults alone; the poverty measures have been widely critiqued across age groups.)

“The poverty rate just doesn’t cut it as a realistic look at the struggles older adults are having,” said William Arnone, chief executive officer of the National Academy of Social Insurance, one of the new coalition’s members. “The Elder Index is a reality check.”

In April, University of Massachusetts researchers showed that Social Security benefits cover only a fraction of what older adults need for basic living expenses: 68% for a senior in good health who lives alone and pays rent and 81% for an older couple in the same situation.

“There’s a myth that Social Security and Medicare miraculously take care of all of people’s needs in older age,” said Alwin, of the National Council on Aging. “The reality is they don’t, and far too many people are one crisis away from economic insecurity.”

Organizations across the country have been using the Elder Index to convince policymakers that older adults need more assistance. In New Jersey, where 54% of seniors are economically insecure according to the index, advocates used the data to protect property-tax relief programs for older adults during the pandemic. In New York, where nearly 60% of seniors are economically insecure, advocates persuaded the legislature to raise the Medicaid income eligibility threshold.

In San Diego, where as many as 40% of seniors are economically insecure, Serving Seniors, a nonprofit agency, persuaded county officials to use pandemic-related stimulus payments to expand senior nutrition programs. As a result, the agency has been able to double production of home-delivered meals, to more than 1.5 million annually.

Officials are often wary of the financial impact of expanding programs, said Paul Downey, president and CEO of Serving Seniors. But, he said, “we should be using a reliable measure of economic security and at least know how well the programs we’re offering are doing.” By law, California’s Area Agencies on Aging use the Elder Index in their planning process.

Maine is No. 5 on the list of states ranked by the share of seniors living below the Elder Index, 56%. For someone in Fran Seeley’s situation (an older adult who is in excellent health, lives alone, owns a house, and doesn’t pay a monthly mortgage), the index suggests $22,560 a year is necessary — $3,200 more than Seeley’s annual income and $9,500 above the federal poverty threshold.

A look at Seeley’s budget reveals how quickly necessary expenses accumulate: $2,041 annually for Medicare Part B (this is deducted from her Social Security check), $4,156 for property and stormwater taxes, $390 for home insurance, $320 for furnace cleaning, $1,440 for heat, $125 for water, $500 for gas and electricity, $300 for property maintenance, $1,260 for phone and internet, $150 for car registration, $640 for car insurance, $840 for gas at current prices, $300 for car maintenance, and $4,800 for food.

The total: $17,262. And that doesn’t include the cost of medications, clothing, toiletries, any kind of entertainment, or other incidentals.

Seeley’s great luxury is caring for four cats, which she describes as “the light of my life.” Their annual wellness checks cost about $400 a year, while their food costs about $1,080.

With inflation now making her budget even tighter, “it means I have to cut back in any way I can. I find myself going into stores and saying, ‘No, I don’t need that,’” Seeley said. “The biggest worry I have is not being able to afford living in my home or becoming ill. I know that medical expenses could wipe me out in no time financially.”

My mother worked from the age of 13 to 76. She managed to have a little savings when she finally stopped working (which wasn’t her choice)

She could afford $450 month for rent and that’s just not possible today. She moved in to live with us.

What happens to people who’ve worked their entire lives without children they can rely on?

I can hear the excuses for not caring for others now, “well she didn’t save enough, or she made poor choices, that’s her problem…”

When does American greedy selfish mean-spiritedness stop?

Apparently, Never. Cat Fud Again.

It’s what happens when politicians, media elites, and educators encourage Americans to see themselves as balkanized into many separate categories instead of as Americans that are part of one big family. The lack of emphasis on citizenship and a common language only serves to further divide us. People have always been tribal and modern multiculturalism has a downside. This is not going to change for the better.

Maybe they just want people to keep on working-

https://abcnews.go.com/US/86-year-woman-longest-serving-flight-attendant-guinness/story?id=86063716

They want people to die, CV will do nicely for the cause, before pulling state pension.

Social security was originally created to minimize the number of old people dying homeless in the streets, and yet the dream of all the West-Wing watching jackoffs is to eliminate it and get that money flowing into the economy so that, I don’t know, Jeff Bezos can buy another yacht?

There’s some speculation amongst the Youtubers who cover SS of an even larger COLA next year. I heard as much as 23%. But I’ve only just begun to pay attention to videos on the subject, so maybe they speculate optimistically like that every year?

A COLA is better than a sharp stick in the eye, but is it enough to be considered helpful?

They will also need to adjust tax laws. Even though this years COLA was mostly eaten up by the Medicare premium increase it still sent a good portion of retirees into the category where their Social Security was taxable. I realize that this is a problem for those with other retirement income besides SS benefits, but since for most that is a fixed income where only Social Security increases with inflation it is a good way to throw more people from the tight category to not enough to cover incidentals or emergencies to worse categories.

Under Biden we have the largest Medicare premium increase, the appointment of Liz Fowler to head the Medicare innovation center which is privatizing Medicare, and the appointment of an individual who opposes social security to the social security board. Now we have inflation which Biden tells us is the sacrifice we have to make to try to bring about regime change in Russia while corporations are making records profits. Meanwhile Biden’s is leasing more federal land to oil companies which will keep us dependent on oil for the next 50 years, and certain to see the results of climate change. What should we do, vote democratic in the next election because the republicans are worse?

Without a doubt, the Standard Deduction needs to be doubled again. Trump doubled it, something that was long overdue.

Balance that against the possibility of much higher Medicare deductions, and the privatization of healthcare leading to out-of-pocket theft, and 23% is totally inadequate. Given the ingorance of the last 30 years, with COL indices not counting true costs, and it should be a doubling if not more.

The 2023 Social Security COLA will probably be in the 8 to 10% range. The Medicare premium increase might be lower for 2023. The 2022 Medicare increase was large because of the introduction of a new Alzheimer drug. It alone accounted for about half of the $21.60 per month increase.

The Medicare Powers that Be ultimately severely restricted the use of the new drug. Medicare now says that it will adjust the premium increase in 2023 to acccount for that new information.

Problem is, last time they raised the COLA, they raised the Medicare premium deductions even higher.

Also worries me to hear that Yves thinks about leaving the country. Makes me wonder if I should start thinking about it too.

Problem is, most of us over 65 and not wealthy are precluded from emigrating. So, we have to fight it out here, in our own towns and cities.

The examples of cupidity and malevolence shown by our “Benign Overlords” this Pandemic have destroyed any trust we oldsters may have had in the ‘System.’ [Why do you think that Trump is likely to win a second term as POTUS in ’24?]

“When you have nothing, you have nothing to lose.”

Both Phyl and I have been listening to a lot of old Bob Dylan lately. We have quite distinct tastes in music, so, for us to agree so completely on this is significant for us.

Expect about 8%.

Pope’s apology

—————-

Here is the text of his actual apology: https://www.cbc.ca/news/canada/edmonton/pope-francis-maskwacis-apology-full-text-1.6531341

If I were an indigenous person, this wouldn’t make me feel any better. It may go one step further than his ‘bad apples’ apology issued earlier this year, but I read this as a mistakes were made kind of apology. Never once does he claim the policies for the Catholic Church. He feels personal shame, he mentions all Christians, but not once does he say that the Catholic Church’s policies and systemic and deliberate actions were responsible.

Yeah sure he’s talking about funding mental health initiatives, working together, blah, blah, blah. Not enough.

Also of note, his visit to Canada costs $30M and his first stop is to a reserve that has problems with clean drinking water. Sigh

Sorry, this should be over in Links, she types slapping forehead

Better off in prison, especially for the cold months.

Alas, that is no longer a desirable possibility.

Now, the “low threat” crooks, such as the shoplifters and petty thieves, are thrown in with the Bangers and Serious Felons at almost all levels of the Prison Industrial Complex. I have spaoken to several ex-jailbirds, both male and female, over the last few years and the stories I have heard are horriffic. Roughly speaking, the strong dominate the weak, and the guards stay out of the way as long as it doesn’t end up in a jailhouse riot.

A recurring piece of advice I have recieved from several of the jail survivors is to, when a big tough motherf—-r tells you that you are now his “Bitch,” is to start beating on him for as long as you can last. Do it consistently until you get a reputation as a “Crazy.” Eventually, if you survive, the other cons will leave you alone.

An excellent treatment of this theme is the Canadian play and later film “Fortune and Men’s Eyes.”

See: https://en.wikipedia.org/wiki/Fortune_and_Men%27s_Eyes

this is a slow motion train wreck. It’s not just monetary. It’s all the little things too: like emotional health, making sure chores get done, medicine gets taken, etc.

Given the atomization of society, what percentage of seniors have a reliable relative that lives within a 30 – 60 minute drive? never seen a survey asking that question but I doubt that number >50%.

I have two relative that live close by. One is 80 years old, the other is 68. I am 70. I guess we could prop each other up like a tripod.

Count your self a lucky. Intergenerational households have been on a downward spiral, numerically speaking, since the 1960s. One “silver lining” of the last decade of “Engineered Immiseration” is the increase in ‘adult’ children living at home with the parents after final education, etc.

Phyllis remembers both her Paternal Grandfather and her Maternal Step Grandmother living in a small “apartment” added to the back of the family house during the 1950s when they started to physically fail. Each occupied the annexe for several years, separately, during their terminal years. Compare that with today’s standard, being warehoused in a “Retirement Community.”

I want to go out that way, living with relatives, myself. If it cannot be managed that way, I intend to “go out with a bang.”

Petronius had it right. Make your going a fitting accompaniment to your living.

Petronius Arbiter: https://en.wikipedia.org/wiki/Petronius

Stay safe until it’s time to go.

Yep. Age has reconciled me to being near the end of my days, but I hope and pray it will be quick and final. Being alive but unable to take care of myself would be a nightmare I avoid thinking about.

It really depends on your health. We have a family member that had been lying to their retirement community about their health and how far they had deteriorated. They were told they needed to leave ASAP because they required 24 hr care from nurses – something this community could not provide. I can’t imagine having to provide 24 hr care at home too. Even if we had a suite that was optimized for elder are. There is no escape from the costs that 24 hr care requires if you don’t have the option to take care of yourself.

I want to die well before I’m passing in a diaper and too weak to get out of my recliner.

I am a retiree living by myself. I have many retired friends who are alone or just them and their wife. I can’t give you a particular example, but I am hearing from my friends that things that used to be covered by Medicare are no longer covered due to reasons. Also, the cost of some of these things just keep going up, while our benefits don’t keep up. As mentioned above, we get a raise and our supplemental insurance eats it all up.

I’ve said it before and I will say it again; look how we treat our homeless, our veterans, and our elderly. That tells you all you need to know. Carlin was right – they don’t give a family blog about us.

I continually tell people who think seniors get tons of free stuff that when my income was about $18,000 a year (150% of poverty level), my food stamp allotment was $15 a month. I did not see a reasonable amount until the pandemic, when Pennsylvania suddenly gave me over $100 a month.

A friend my age (78) lives in subsidized housing. She is a lawyer (private practice) who has never earned enough to pay all her bills and lost her house. Her current SS income is at poverty level and her food stamp allotment is much bigger than mine, but it’s not enough. She only buys items on sale.

Neither of us has kids. Her sister lives nearby. My niece lives four hours away. There are reasons I am better off, the main one being I am “working” at multiple ways that earn me extra money but I will have to keep doing them until I die.

Read this at 5:45am/comment @11:35

Thanks for this.

I think comments on this are going to blow up.

I’m retired and at work(cash flow) now.

Tried to share this w a brother stagehand who mentioned his anticipated retirement upcoming—but he “doesn’t read Longform-but thanks”

Something in that too…

And isn’t this truth in your face:

“Nationally and in every state, the minimum cost of living for older adults calculated by the Elder Index far exceeds federal poverty thresholds, which are used to calculate official poverty statistics.”

A food budget of $275/month is beyond cruel. No fresh fruit or vegetables, no fish or meat, even if only once a week. I haven’t been able to live on that little for food in decades and I don’t eat extravagantly. WTF?!

You can live on $9 a day if you have time and cooking facilities… but the killer problem is access to an Indian or Chinese supermarket where the veg is cheap.

Retired here, age 78, disabled vet. Bought a cheap, bare-bones manufactured house in a low cost, rural community during the boom times in high tech. I’m one of the lucky duckies. A few random comments:

1. The numbers in the chart are about right. Since I’m in California, my numbers are a little higher.

2. Kids and family in general don’t appear to be a resource to depend on in old age. In my experience they are all working 2 jobs, long hours, and living in small rentals. That’s my evaluation of the situation, YMMV.

3. VA medical care–which has been great–is slowly being nibbled away.

4. I can drive safely, but if I couldn’t drive I’d be in difficulty. Bus service is a joke, and ‘dial a ride’ is extremely limited.

5. I do yoga regularly, and am in good health, but no longer attend in person classes. I find Zoom classes generally impersonal and a pale substitute for in-person class.

6. Our rural county has a good hospice service. Dying at home is realistic and compassionate. This is a bigger deal than you would imagine.

7. I’ve made advance directives saying flatly ‘no heroic measures to keep me alive’.

8. Cremation costs about $1500 if you go through hospice organization in our county.

9. Car dependency is a huge issue. I live in a car dependent rural area, and have not been able to find a reasonable alternative to car.

A friend surveyed most metro areas in the US before his retirement. He chose downtown Portland as a civilized, walkable city. He found a (functionally rent controlled) low cost apartment dedicated to seniors and retired. At first, it was great. Lately not so much. The crime and racial tensions in his neighborhood have made leaving his apartment fairly unpleasant and occasionally risky. He used to mock me for being out in the country, with no restaurants, book stores, or “civilization”. He no longer does so.

Re: Portland in my comment…

That’s Portland Oregon.

Something I’ve been curious about for a while now — where do potential ex-pats think they’ll find safety? My parter keeps making noises about Portugal or Panama. But between climate change and general elite incompetence I’m not sure any place is a real winner.

re: Panama

I used to live on a sailboat. Over the years I heard good things about Panama. One source for ‘out of the mainstream’ information is the people in the sailboat and power boat ‘live aboard’ and ‘cruising’ communities. Here’s a good example.

https://travelhippi.com/live-aboard-boat-panama/

My personal decision is to spend last years in US, in rural, small town areas. If California gets much weirder I might move to a low tax state, preferably someplace with plenty of water and arable soil. However if I were 10 years younger, I would definitely look at buying a sailboat and living somewhere like Panama. (But then I’m a sailboat nut.)

The other place I’d personally consider is Alaska. I like the independence of Alaskans, cheap housing, and the miles of Pacific shoreline.

“Inside every 80 year old man there’s an 8 year old wondering what just happened…” — Terry Pratchet

I know a retired couple who appeared to be comfortably well off. The wife is a former bookkeeper who is beloved by her volunteer groups for her beautifully elaborate spreadsheets. The couple recently started picking up groceries at local food banks. The woman explained to me that she “ran the figures and this is the only way it will work out” for them.

I can’t see how anything resembling a majority of the population will be able to save for their retirements. With outrageous housing and health care costs, there’s little money for anything else. In my worst moments I wonder if in lieu of expensive medical treatments, we should instead be offered lower cost palliative options, as in, extended hospice care for people who probably won’t die any time soon.

And let’s not forget all the financial resets we will have over the next few decades. How can people save for retirement when there are all these downturns, market corrections, recessions, AND massive inflation, with nearly zero interest paid in easily accessible financial vehicles. Hard to make bank on CDs or savings accounts. Hard to get a financial planner that meets a real fiduciary standard if you have less than 500k$ in funds for them to play with. Hard to save excess funds you may have when everything costs so much to replace or fix.

Case in point, I recently had an awful discussion with family members who had just retired. They had decided to keep all their money in the stock market until the bitter end. So when other people in the family had told them to take their savings and put it anywhere other than stocks, or to at least diversify, two years before retirement, they let it ride and thanks to the recent debacle have 40% less than they were counting on prior to retirement. But that’s not the awful part. No, the truly terrible part was the end of the discussion where they said they weren’t going to cut back on spending or change their quality of life at all… they just moved up when they planned to die. They were so calm. Happy even. They just looked at each other and smiled. Then they served us more cake. I guess I won’t be surprised when something happens to them in the next 10 years???.

I do not know how this ends for our society other than horribly.

Re: Mirjonray

The bookkeeper has it about right, in my opinion.

Looking for a community with a strong hospice organization is definitely a good thing.

I’ve done a small amount of volunteering for hospice, and gotten to know some of the people who work in that field. Not every place has good hospice.