As the US government begins setting up the regulatory guardrails for a digital dollar, the EU forms a consortium to develop a prototype for a digital euro. Its members include Amazon and dozens of large EU banks.

It is a rare experience to find oneself in more or less full agreement with a senior central banker, particularly these days. Yet that is what happened to me just over a month ago. In early August, Neel Kashkari, ex Goldman, ex Pimco employee, currently the President of the Minneapolis Fed, lambasted the idea of creating a digital dollar, arguing that US consumers already had access to instant digital payments through private-sector platforms.* Speaking at the 2022 Journal of Financial Regulation conference at Columbia University, he also flagged concerns about the threat central bank digital currencies (CBDCs) could pose to privacy, anonymity and other basic freedoms.

“I can see why China would do it,” Kashkari said. “If they want to monitor every one of your transactions, you could do that with a central bank digital currency. You can’t do that with Venmo. If you want to impose negative interest rates, you could do that with a central bank digital currency. You can’t do that with Venmo. And if you want to directly tax customer accounts, you could do that with a central bank digital currency. You can’t do that with Venmo. I get why China would be interested. Why would the American people be for that?”

Kaskari is right, of course: they probably wouldn’t. But they’re not being consulted on the matter. In fact, in most cases they’re not even aware it is happening.

White House Recommends Creating a Digital Dollar

Today, the digital dollar is closer to becoming a reality than ever before. On Friday (Sept. 16), the Biden Administration released a framework for the responsible development of digital assets, including cryptocurrency, CBDCs and other items of value that exist only in digital form. An alphabet soup of government agencies, including the US Treasury, the Justice Department, the Consumer Finance Protection Bureau and the Securities and Exchange Commission, have been tasked with contributing to reports that will explore the risks, development possibilities and usage of digital assets.

All of this was put into motion just over six months ago by Joe Biden’s Executive Order 14067, officially dubbed “Ensuring Responsible Development of Digital Assets.” Signed on March 9, it represented the first ever “whole of government approach” to regulating digital assets. Among the executive order’s many goals is to make the handling of digital assets easier and more secure; to safeguard US global leadership in digital asset innovation; and, as laid out in section 4, to lay the groundwork for the creation of a digital dollar:

Sovereign money is at the core of a well-functioning financial system, macroeconomic stabilization policies, and economic growth. My Administration places the highest urgency on research and development efforts into the potential design and deployment options of a United States CBDC. These efforts should include assessments of possible benefits and risks for consumers, investors, and businesses; financial stability and systemic risk; payment systems; national security; the ability to exercise human rights; financial inclusion and equity; and the actions required to launch a United States CBDC if doing so is deemed to be in the national interest.

On Friday, US Treasury Secretary Janet Yellen posited two reasons for developing a digital dollar: first, because “some aspects of the current payment system are too slow and too expensive”; and second, “to reinforce the US’ role as a leader in the world financial system”.

This is seen as increasingly necessary as China forges ahead with its digital yuan. China’s central bank has been exploring the possibilities offered by digital currencies since 2014. The digital currency is now being piloted in more than 20 regions and cities and was also widely showcased in this year’s Beijing Winter Olympics. As British technology news website The Register reported last week, the Chinese government is now looking to integrate the digital yuan with China’s private digital payment systems — most notably Alibaba’s AliPay and Tencent’s WeChat Pay, which dominate China’s payments landscape and which already have millions of payment terminals outside China.

Simpler, Cheaper, More Direct

In theory, CBDCs will allow for the creation of a simpler, cheaper, more direct payment system, by cutting out most, if not all, financial intermediaries, as the Washington-based analyst NS Lyons notes in his brilliant article, Just Say No to CBDCs:

A customer would open an account directly with a country’s central bank, and the central bank would issue (create) digital money in the account. Crucially, this makes the money a direct liability of the Fed, rather than of a private bank. Using a simple smartphone app or other tools, the customer can then initiate direct transactions between Fed accounts. The digital money is deleted in one account and recreated in another instantaneously.

However, in its Future of Money and Payments report, the US Treasury envisages a two-tiered model under which the Fed would issue and redeem digital dollars but the distribution of those digital dollars would be handled by intermediaries eligible for an account at the Federal Reserve. Payment services would also be managed by banks and other private sector players:

This would be similar to how paper currency is distributed through commercial banks. It also shares similarities to responsibilities surrounding noncash retail payments today: the intermediaries onboard, provide customer support, and manage payments. In addition, intermediaries would likely implement AML/CFT obligations, while relevant supervisors would monitor compliance with those obligations.

In other words, a select group of banks and non-banks chosen by the Fed would continue to play a role in the new financial system, while most financial institutions — including the small local lenders and credit unions that serve local communities — would presumably get disintermediated. As the European Central Bank recently warned, a broadly adopted CBDC is likely to lead many people and businesses to pull their money out of commercial banks at the first whiff of a financial crisis and put it into the supposedly safer accounts held with the central bank.

Playing Catch Up

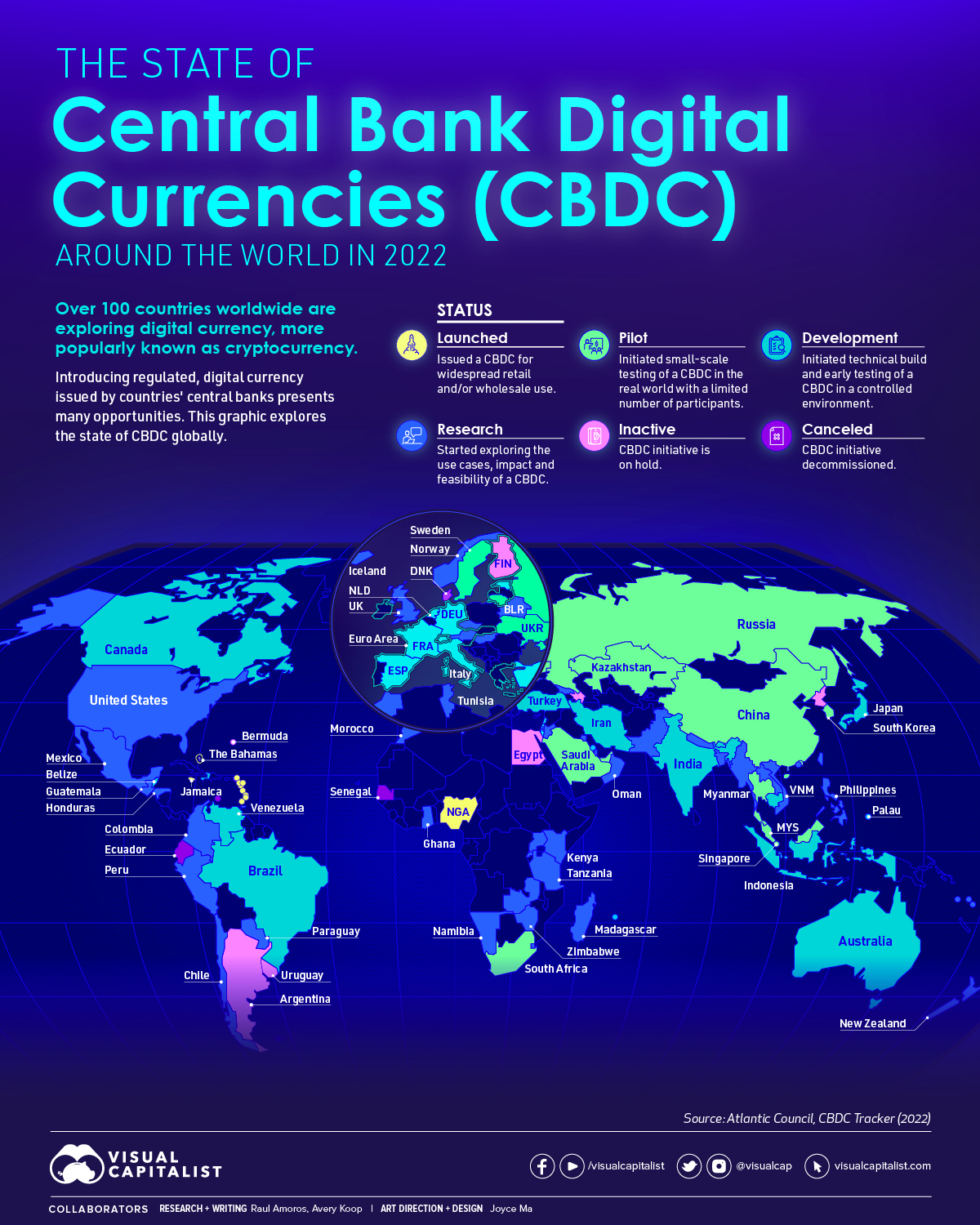

Currently, just over 100 jurisdictions representing 95% of global gross domestic product are exploring or have already created a central bank digital currency, according to the Atlantic Council. They include the US, the Euro Area, China, India, Russia, the UK, Australia, Canada, Brazil and Mexico. Here’s an infographic, courtesy of Visual Capitalist, depicting the global state of play in the CBDC space:

Naturally, the Atlantic Council — a Washington DC-based US think tank that aspires to “shape the global future” — believes the US should lead the way in the global rollout of CBDCS, but that will be easier said than done given the head start China has on it (and most other large economies):

The Treasury Department says it wants to talk more with other countries, share knowledge on digital currencies, and help set international standards. Treasury recognizes that it is in the national interest to create a digital dollar and that there are national-security concerns connected to it.

What does that mean? It means that, as China is creating its own digital currency, the United States wants to make sure the model that proliferates around the world is one that respects democratic values—for example, privacy. But in order to do that, the United States needs to bring its own model to the table. Treasury is saying today that the United States is going to do that and that it’s a whole-of-government priority. The issue is urgent.

The US has not exactly been sitting on its hands all this time. The Digital Currency Initiative at MIT has been working with the Boston Federal Reserve to explore the steps necessary to create a safe and effective central bank digital currency, “applying the learnings from a decade of cryptocurrencies toward designing CBDCs and integrating them into our increasingly digital lives.” In February, the Deposit Trust and Clearing Corporation (DTCC) launched a prototype, known as Project Lithium, to explore how a CBDC might operate in the U.S clearing and settlement infrastructure leveraging distributed ledger technology.

Amazon to Test-Run a Digital Euro

The EU seems to be somewhat further along the path toward creating a digital euro. On Saturday (Sept 17), the European Central Bank (ECB) announced it had handpicked a team of five companies — Amazon, Spain’s CaixaBank, France’s Worldline SA, Italy’s Nexi S.p.A. and the European Payments Initiative, a consortium of 31 large Euro Area banks and third-party acquirers — to develop a prototype for a digital euro, with each firm exploring a specific digital use for the euro-area currency.

“The aim of this prototyping exercise is to test how well the technology behind a digital euro integrates with prototypes developed by companies,” the Frankfurt-based institution said. This follows an announcement from the ECB in July that work on a digital euro has entered its second development phase, which will involve testing the CBDC for retail use cases in preparation for a 2023 rollout.

So, while the US government is in the process of setting up the regulatory guardrails for a CBDC, the EU is in the two-year “investigation phase” of the digital euro project. Although the ECB claims that no formal decision on whether to launch a digital euro has been taken (what else would it say?), the most likely outcome, as Bloomberg reports, is that the ECB will be among the first advanced-economy central banks to issue a digital form of its currency, with officials pointing to the middle of this decade for a possible rollout.

A research paper recently published by the ECB, titled “The Economics of Central Bank Digital Currency,” concludes that CBDCs are the only possible means of safeguarding sovereign money in an age of declining cash use and proliferating private digital currencies such as cryptocurrencies and stable coins. It also posits that cash, whose volume in circulation in the Euro Area has almost doubled in the last decade even as usage has fallen, does not meet the needs of the digital age:

“Since cash is only available in physical form, it is by construction not ‘fit’ for the digital age… Accordingly, the introduction of digital cash in the form of a CBDC appears to be the only solution to guarantee a smooth continuation of the current monetary system.”

Of course, the ECB disclaims that the research paper paper only reflects the opinions of its authors. It has also repeatedly stated that a digital euro would coexist alongside physical cash. But the ECB has a habit of saying all sorts of things it ends up not doing.

The paper’s authors also note that although repeated surveys have shown that consumers place a high value on privacy, they are usually willing to give up their data for free or in exchange for small rewards or gains in convenience. But what about those who aren’t? As I’ve warned before, if central banks and governments were to do away with cash or to vastly accelerate its demise by penalizing its use (while incentivizing the use of CBDCs), we would probably see a huge increase in financial exclusion

The creation of a CBDC would not just require consumers to hand over their data. As Kashkari noted in his speech, it would mean giving up what remains of your privacy and anonymity. It would mean handing even more power — a lot more power, arguably total power — to the governments, central banks and select tech companies and large commercial banks that will end up running this new monetary system.

That power could be used, among other things, to take interest rates into far deeper negative territory. If there is no cash, there is no means for people to escape negative rates no matter how negative they go. In a CBDC world central banks will not only know exactly what we spend our money on; they will also be able to determine what we can and cannot spend our money on.

CDBCs could also be used to strongly encourage “desirable” social and political behavior while penalizing those who do not toe the line, as recently happened in Canada. As Lyons points out, “The most dangerous individuals or organizations could simply have their digital assets temporarily deleted or their accounts’ ability to transact frozen with the push of a button, locking them out of the commercial system and greatly mitigating the threat they pose. No use of emergency powers or compulsion of intermediary financial institutions would be required: the United States has no constitutional right enshrining the freedom to transact.”

The fact that the US dollar and the euro are currently the world’s two preeminent reserve currencies and are used globally makes this an even more important issue. Other risks associated with CBDCs include cyber security and system resilience. As even the World Economic Forum noted in its 2020 report, Central Bank Digital Currency Policy-Maker Toolkit, “compared to physical cash, risks from counterfeiting, theft and network failure for digital money entail more catastrophic consequences.”

As I noted in a previous article (Unbeknown to Most, A Financial Revolution Is Coming That Threatens to Change Everything), CBDCs and the digital IDs that will come hand-in-hand with them are among the most important questions today’s societies could possibly grapple with — not only from a financial or business perspective but also from an ethical and legal standpoint. They promise to totally transform the societies we live in and the economies we depend on. As such, they should be under discussion in every parliament of every land, and at every dinner table in every country in the world.

* This is not the first time Kaskkari has deviated from the official script. In his first speech as President of the Minneapolis Fed, he said all sorts of unpleasant truths, as Yves reported at the time. He spoke about the huge costs the financial crisis imposed on society as a whole, about how Dodd Frank didn’t go far enough and how the authorities won’t be willing to risk using untested new powers in a financial meltdown and will bail out banks again. He also argued that the financial system was now stable enough to make (by implication overdue) transformative changes to end the “too big to fail” problem, such as breaking up banks and regulating them like utilities.

Now that we live in a word of discretionary sanctions regime this is more than risky. Discretionary means that prosecution of fraud, corruption etc is a politically driven thing that leaves aside the fraud, corruption etc that our monetary elites tolerate or even promote, when, for instance, you need to do favours to a friendly country/company/donor… Very little has been done to fight tax havens and now digitalization might be seen as a tool to tighten the screws on those that are already screwed. Trust is in short supply these days and there is every reason to suspect this won’t go in favour of the general public. We have seen how the EU Commission discretionary plans want to apply anti-corruption policies against Governments not complying with their anti-Russian policies and at the same time letting aside their own corruption scandals and many other corrupt practices that are tolerated in complying countries.

Biden’s executive order confesses one of the real objectives “safeguard US global leadership” meaning this strengthen the capability to twist arms here and there…

Sorry for auto-replying. What it is clear to me is that BEFORE introducing digital currencies, safeguards should have to be introduced. Not safeguards to some misunderstood sense of ‘leadership’ that Biden might have internalized in his twisted brain (everybody has a twisted brain) but safeguards for the citizens, their rights to anonymity, liberties etc. If they seem to be running to fast without the previous work being done we have all reasons to distrust the project.

There aren’t any safeguards that could realistically be imposed on or built into such a system. Even without CBDCs, the only real safeguard citizens currently have for the privacy and control of our transactions is cash money. One of the characteristics of digital currency is every transaction is traceable within a ledger. No silly IRS reporting rules required.

The thing that makes me laugh a bit at this is the grand ambition of it kind of insures its failure from a technological standpoint. Software tech only really works when it starts small and iterates, especially when it must integrate into complex systems like the proposed.

Its ambition will also likely make it fail from a business angle as well. How would it integrate into our current systems and if it didn’t why would the financial system get behind this? Its too damn risky for them with very little upside. Since when does the financial system care about tracing everyone’s transactions? They love opacity so they can have “freedom” and launder money for the rich and drug cartels, etc. Its become apparent that real industry in Europe (and the US?) is subservient to government but is big finance also subservient?

And if this didn’t work well people would simply not use it (and if the US govt thinks its going to force the citizenry away from the cash dollar at gunpoint, well, in the words of Vlad Putin, let them try).

Combined with the “race” to define a global standard (for democracy!) pits governments against each other and will guarantee an incoherent morass of conflicting and non-interoperable standards.

There are a hundred other pitfalls in this that we haven’t thought of yet. To me it feels like just one more insane, totalitarian fantasy of the dying boomer zeitgeist.

In prisoner-of-war camps, cigarettes became a form of cash in the absence of coins!

One protection for CBDCs would be the proliferation of digital IDs: why should I just be limited to one? And if at some point I can exchange one of my digital ID’s with someone else’s (say by exchanging crypto keys), then tracing becomes more difficult…

From the late 1970s to the collapse of the Communist regime in Romania in 1990, Kent Cigarettes were the subject of intense demand and near-obsession amongst Romanians. Where exactly this obsession began is difficult to pinpoint. Spokespeople for Lorillard and Romanians alike are disputed or unable to answer the question. How the cigarettes became one of the economic enigmas of the surreal state, however, is possible to explain.

Following their introduction to Romania in the late 1970s, Kent Cigarettes grew in popularity due to them being used as a rather foolproof bribe in the domestic market of the Communist country. However, as Romania slipped into an economic crisis and the living conditions for people became increasingly dire, the cigarettes were withdrawn from circulation and only officially sold in hard currency shops which were out of bounds for most Romanians. However, the black market was in full boom and inflated prices for these cigarettes flourished. Smoking cigarettes, however, was not the primary reason for obtaining them.

As the Romanian currency became more and more worthless and Romanian citizens were strictly barred from owning foreign money, Kent cigarettes soon turned into a black market substitute for cash, and sometimes one carton could mean the equivalent of $100. But what could Kent Cigarettes buy you in Communist Romania?

For an ordinary citizen to smoke Kent cigarettes would be the equivalent of lighting Cuban cigars in Miami with $100 bills. One box of these cigarettes could get a Romanian citizen teeth repairs from an extremely competent dentist. If you had ten cartons, you could pretty much guarantee your way to the front of the line for the status symbol of a color TV.

Four packs in the alley behind a restaurant could get you a few weeks of meat in an era of intense rationing. The meat supplies of Communist Romania were mostly exported abroad to the USSR, the Middle East, and the West. This was all in order to pay off the $10 billion debt Romania owed for their heavy borrowing of currency to invest in energy-intensive industries.

In a Wall Street Journal article written by Roger Thurrow in 1986, it was noted that the distinctive gold box of European Kent cigarettes could be spotted at surprising distances and had the power to turn the owner into a ”big shot” in Romania from preferential treatment and better food at the market to getting past aggressive and corrupt border guards.

https://www.youngpioneertours.com/the-story-of-kent-cigarettes-socialist-romania/

You are 100% right about the tech thing. But on the other side don´t forget that huge layers of the population and businesses depend on public money to survive. All this people will just get slave coins aka CBDCs.

If it involves Biden and bankers, I’m agin it.

And conversely, they’re agin us.

The present day purpose of propaganda is….the same as it ever was. Control.

Or the word ‘responsible’ in a White House proposal. I suppose the word ‘reform’ is also in there.

So much to pick on, but what Kashkari said is enough for now.

“…The Digital Currency Initiative at MIT has been working with the Boston Federal Reserve to explore the steps necessary to create a safe and effective central bank digital currency, “applying the learnings from a decade of cryptocurrencies toward designing CBDCs and integrating them into our increasingly digital lives.”

If anything was being learned from the fraud of crypto, there wouldn’t even be this discussion.

This is first and foremost a danger because this corporate owned government is wanting to force people to spend.

They want a 99% poverty rate.

Why would any government want to use Digital Currency when every day there are examples of fraudulent use of digital currency? How big would the mining holes be when every government starts using blockchain for its digital currency?

It’s not about that. Blockchain or not, it doesnt matter.

It’s not a “digital” currency. It is a CENTRAL BANK currency. This means total control and total visibility into every money transaction. It also likely means no small, regional banks and extreme centralization of credit creation. Opens the door to making money ephemeral – ie. with expiry date, all kinds of things we haven’t thought of yet.

I wish it is discussed as “central bank” currency, not as “digital” currency.

In any case what is the legal framework that allows this??

Should it be pointed out that if there is a digital currency in place, that it would be dead easy to have it that certain organizations will be denied funds in transferal? So you might be talking about a political group that has been ‘deemed’ too radical or perhaps an environmental group that is opposing an oil pipeline being pushed through environmentally sensitive land. In fact, any group or organization that does not meet the pleasure of our betters may find themselves starved of funds. We saw that a very long time ago when PayPal stopped receiving donations to Wikileaks. Where will it end? Who knows? But over time you will realize that your money is in fact not your money any more. Somebody else gets a whimsical say on what you can or can’t do with it. And if it comes to pass that we have a digital currency, perhaps in that year we will find that it will be no longer possible to donate to Naked Capitalism.

The only thing crypto is good for is getting money to, say, a Palestinian relief effort directly instead of going through a US NGO. Would be good if there was a non-governmentally backed digital currency that also didn’t use an entire country’s worth of energy to utilize.

Not the only thing. Crypto is great for drug deals also.

On your second point, I read but haven’t confirmed that ethereum has switched from proof of work to proof of stake which should greatly reduce power consumption for its mining efficiency…

Ah but that’s a feature, not a bug.

Money is a relation. Creating a money with a central counterparty is like having the state mediate every association of its citizens. Our ancestors fought and died for freedom of association. If we would not invite the state into our friendships or marriages, our affairs of the heart and the soul, why would we invite it into our financial affairs…?

The idea is a path to slavery, when your assets and your income can be taken from you after you have worked for them and, as Ignacio points out, by prosecutorial or administrative discretion rather than by judgment.

The closest historical parallel is with the writ of attainder, by which the King’s enemies and their families were rendered harmless paupers because their estates and titles were seized and their rank reduced. All land is held in fee of the king and the king is the fount of all honour, so whatever you may currently have, he can take back….

Augustin Carstens, head of the BIS, on the “benefits” (to the BIS and central banks) of digital currency -CDBC.

https://www.youtube.com/watch?v=rpNnTuK5JJU

” central banks will have absolute control on the rules and regulations of …the use of [CDBC], “the technology to enforce that”, aka it’s programmable.

It’s being pitched as a solution to cross-border payments. But there’s no problem with cross-border payment. There are plenty of guardrails already in place for cross-border payments. The cross-border sales pitch is a metaphorical Trojan horse.

typos: That’s CBDC. Central Bank Digital Currency.

In Amazon We Trust; what could possibly go wrong with that?

Big Brother replaces the ATM. Gold and Silver and land or property, physical and time worn bastions of financial continuity, are my remedy.

I think all hell is going to ensue in the financial and economic worlds during the next couple of years or so given debt levels and interest rate policies. As Rahm Emmanuel said “ Don’ t let a good crisis go to waste”……

I think they’re going to have a hard time getting ahead of the next crisis. They almost let go of the rope in 2008. The next one won’t have a central bank “remedy”.

I think when Biden mentions insuring US global leadership he is talking about saving the dollar as the reserve currency by cancelling the government’s debts and allowing endless printing with ones and zeros on a computer at the Fed without threat of having to pay any of it back. And it means more wars will be the endless norm of our future, as recycling dollars through weapons sales to “allies” and dictatorships helps keep the dollar afloat. Any comments?

Wouldn’t this technology take a massive amount of electricity to implement? From what I understand, Bitcoin is super inefficient. Multiply that times tens of millions of USD transactions per day.

Exactly! We should be going forward to using LESS energy, not more. Cash uses no energy, except that used to produce the paper and print it. It has been very obvious to me for a long time, and I’m 68 years old, that nothing will be done to ease any of our current crises, everything being done is only exacerbating them. And that’s not even talking about the security issues and the governmental control issues of a cashless society. It’s all about the money, Honey!

Bitcoin and other similar so called digital currencies use what they call block-chain which is basically a public ledger with all sorts of encryption and processing that allow it to exist without your typical financial institution managing the ledger. It’s this complexity along with their “mining” which makes it so energy intensive.

From what I gather here CBDC’s are basically real-time payments (think Zelle), but where the base institution is the central bank and not a private financial institution. It probably doesn’t consume any more power than we’re currently using processing Zelle, ACH’s and debit and credit card transactions today. That alone doesn’t mean it should replace physical currency mind you.

Not worthy of inclusion in NC. Author provides only unsubstantiated biased opinion,

maybe you can expound…otherwise, thank you for your unsubstantiated opinion.

Ask the people in Puerto Rico right now how a cashless, all-digital economy would be working out.

Exactly. What happens when the power goes out for a week?

Es ellent comments!

It is becoming more and more apparent that economics, and monetary policy, is a faith based system. Sort of like church dogma in the 14th century – a tenuous connectiion to the real world.

So Kashkari was also saying why it is the US would want a digital currency whilst referring only to the Chinese. Would our esteemed billionaire class be subject to the same infringements of privacy? I think not.

Use cash whenever and where ever and as much as possible. Grocery stores, coffee shops, hardware stores, etc.

Paper currency has only such value as custom lends it.

I have only in small ways invested in synthetic gems as a hedge against currency devaluation. Synthetic gems embody substantial investments in energy and have the advantages of durability, small size, little weight, and high intrinsic value — they are truly beautiful. They seem an ideal currency for the uncertain future. Only cut and polish remain a clouds on their value, but the eye can tell in most cases.

I am also considering nichrome wire heating elements and the long screws used in lathes as other currencies for the future.

Perhaps others might have suggestions for items which could serve as currency or have great value in the future — tungsten metal? vanadium? — as an additive to glass mixtures [significantly lowers the melting point of glass] — silicon wafers and/or chips of various sorts? energy hungry precursors for certain drugs or chemicals? more IDEAS — help me here, I need ideas for how to invest my limited funds to provide for the futures of those who inherit and come after?

Aluminum in natural metal form was hundreds of times as rare as gold until alchemy allowed it to be commonplace and we take it for granted.

Aluminum foil is very handy for cooking and can be reused, and forget about making some in your backyard furnace.

Buy 5-10 rolls.

You don’t need to put out a lot of money for something you’ll eventually use, it isn’t as if it goes bad.

Thank you! Good advice and a good recommendation. I will add aluminum foil to my cache. Aluminum is also a nice store of energy when powdered and combined with powdered magnesium.

More Ideas? Ideas are welcome and honored guests.

Elimination of physical currency has been the ultimate goal of the Federal Reserve Bank for decades.

I worked for the Kansas City FRB as a telecom. analyst in the late 70’s/early 80’s. New employee

orientation included basic explanation of Fed functions (& basement-to-roof tour of the building*) At that time it was openly stated that paper money was considered inefficient & they were looking forward to one day having all “money” be thru “electronic” transactions.

*In one large section of the basement there were rows & rows of women at small desks counting & bundling old, worn out bills. The bundles were collected & shipped out in armored cars to be incinerated. All the counters were women because, it was claimed, women have a better sense of touch than men. These jobs (i.e. costs) could be eliminated if cash was no longer used… .

Seems like one way to eliminate all sorts of middle merchants. No wonder Amazon is already doing its own DC trial. If a CBDC is the equivalent of “sovereign” (a word used to indicate a royal head of government and a coin) what it really indicates is that everyone will go along with it; will protect it. So to follow that thinking, a sovereign CBDC would actually be required to command allegiance in order to exist. I doubt it will be popular enough to get more than derision if it does not, in fact, protect basic human rights and equality. So just like fighting inflation with inflation, we might be fighting an inadequate sovereignty (the joke we live with now) with a new universal sovereignty – one that would have to perform honorably in order to survive. As it is, our sovereignty is usually up for grabs, at least socially, and when it gets right down to equality, sovereignty and equality are not even related. So that’s one thought more or less in favor of a CBDC. One thing above that made my skin crawl was the plan to “apply the learnings from a decade of cryptocurrencies” to a new DC and to explore how a CBDC might operate the US clearing and settlement infrastructure. Right now the USD is preferred because it is trusted to maintain its relative exchange value. What happens when currencies are all automatically adjusting their relative value using crypto block chains for valuing what are actually fiat currencies? Splain me that one. And furthermore, if they plan to “leverage distributed ledger technology” won’t that be even worse than uncontrolled derivatives flying in every direction all at once?

A few points from a pro rather than anti perspective:

Cbdc is not a crypto currency nor does it use block chain.

For privacy there can be a digital cash option built in.

What’s not to like about bypassing Wall St? As Michael Hudson says either you have public non profit government running the economy or you have Wall St running the economy, it is always centralised whether you like it or not. Fwiw this is why I doubt this will happen in the US Wall St ain’t gonna let it happen.

Add the potential for stopping tax evasion and other forms of crime.

Add the multitude of new possible monetary tools for policy.

Yes we need safeguards in the design, but what doesn’t?

Please see this article and reconsider your position. The headline and tone are alarmist, but there’s ample reason for alarm. The scenarios of misconduct are right wing favorites, but a digital currency and the expected elimination of cash can be used the same way against any protestors, like BLM and Occupy Wall Street, or women of reproductive age who travel out of state without a negative pregnancy test:

https://kanekoa.substack.com/p/central-bank-digital-currencies-are

CBDC are inevitable despite the pitfalls. But safeguards can be built in, like requiring a court order to look at private transaction above an x amount or raising suspicion. That is even the case today; prosecutors can get a court order to obtain bank records. The US government has shown it can even impound private crypto accounts. Even China is building in certain safeguards. I did a piece on this earlier this year for the Asia Times:

https://asiatimes.com/2022/02/china-takes-money-into-21st-century/

Why are they inevitable? Nothing is inevitable. This is a choice.

As Nick explained, they will be a layer over current bank systems. They do not increase efficiency, they reduce it. If you think this isn’t mainly about the snooping, you are kidding yourself.

Nice article, with some considerations and information I didn’t know. You have some other really interesting content too. I think there is a real chance to win on the privacy side as the US CBDC is developed. It’s too big a political issue already. And the real motivation on a US CBDC is to maintain dollar dominance and relevance.

It’ll be interesting to see adoption and requirements across banks, corps, individual, etc. Could meaningfully reduce the banking sector and potentially some systematic financial risk as we’ve seen tokenized finance do in crypto. Not going to happen in the current captured regulatory environment but I can see why the Goldman mouthpieces are against it…

How about including the Office of Science and Technology Policy (OSTP) paper that was also released by the White House at the same time? It weighs a lot of the issues being discussed in the article and comments.

https://www.whitehouse.gov/wp-content/uploads/2022/09/09-2022-Technical-Design-Choices-US-CBDC-System.pdf

And also some political context…

In January Tom Emmer introduced a bill prohibiting the Federal Reserve from issuing a central bank digital currency (CBDC) directly to individuals for privacy and censorship reasons. “Regardless, any CBDC implemented by the Fed must be open, permissionless, and private.” In March Ted Cruz did something similar. Stephen Lynch seems to trumpet privacy and censorship resistant in his involvement.

I don’t really believe the intent and motives behind all these efforts but another important data point. Debates have been happening at the congressional level for months so we’re well into the details and ‘freedom’ part of this fight already.

https://emmer.house.gov/2022/1/emmer-introduces-legislation-to-prevent-unilateral-fed-control-of-a-u-s-digital-currency

https://www.cruz.senate.gov/newsroom/press-releases/sen-cruz-introduces-legislation-prohibiting-unilateral-fed-control-of-a-us-digital-currency

https://lynch.house.gov/2022/3/rep-lynch-introduces-legislation-to-develop-electronic-version-of-u-s-dollar