Yves here. Wolf gives one of his regular housing market updates. His big message is “Look out below!”

By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street

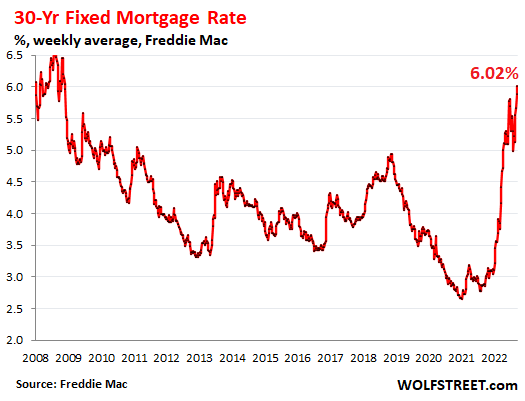

These sales happened during the “Fed pivot” fantasy that pushed mortgage rates down to 5%. Now mortgage rates are near 6.5%.

In July and through mid-August, mortgage rates fell sharply from the 6%-range in mid-June, on the widely propagated fantasy of a Fed “pivot” on rate hikes. By mid-August, the average 30-year fixed mortgage rate was down to 5%. Yesterday, they were at 6.47%. But the brief interlude of dropping mortgage rates slowed down the decline in home sales – sales declined again in August from July but at a slower rate – with Realtors in mid-August talking about the market waking back up.

But prices backed off for the second month in a row, and in a big way, amid widespread price reductions, and that also helped getting some deals done.

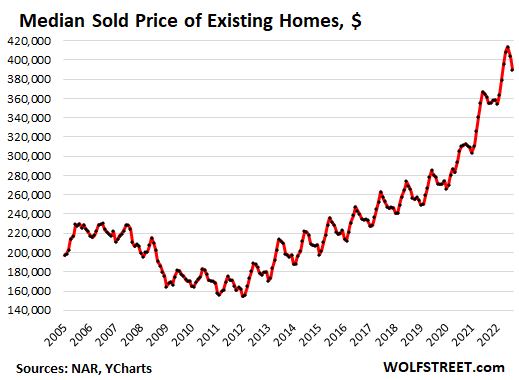

The median price of existing single-family houses, condos, and co-ops whose sales closed in August dropped a hefty 3.5% in August from July, the largest month-to-month percentage drop since January 2016, after the 2.4% drop in the prior month, to $389,500, according to the National Association of Realtors. While there is some seasonality involved, the percentage drop was much bigger than normal in August, whittling down the year-over-year price increase to 7.7%, down from the 25% year-over-year increases last summer (data via YCharts):

In the West, price drops are further advanced, amid dismal sales. For example, in San Francisco and in Silicon Valley, median prices have plunged in recent months – now down on a year-over-year basis in San Francisco and Santa Clara County (San Jose) and up just a hair in San Mateo County, according to data from the California Association of Realtors.

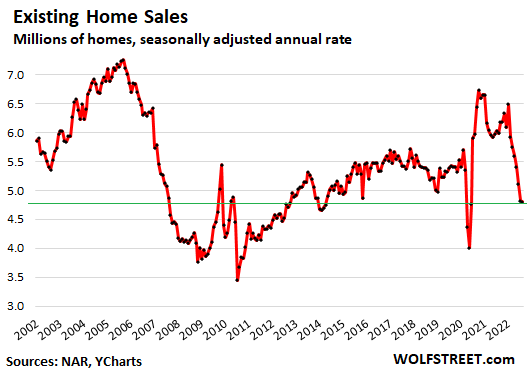

Sales of existing houses, condos, and co-ops across the US dipped a smidgen from July, after the 5.9% plunge in the prior month, to a seasonally adjusted annual rate of sales of 4.80 million homes, roughly level with lockdown-June 2020, according to the National Association of Realtors in its report. This was the seventh month in a row of month-to-month declines.

Beyond the lockdown months, it was the lowest sales rate since 2014, and down by 29% from October 2020 (historic data via YCharts):

Sales of single-family houses dropped by 0.9% in August from July, and by 19% year-over-year, to a seasonally adjusted annual rate of 4.28 million houses.

Sales of condos and co-ops rose 4% from July, to 520,000 seasonally adjusted annual rate, down 25% year-over-year.

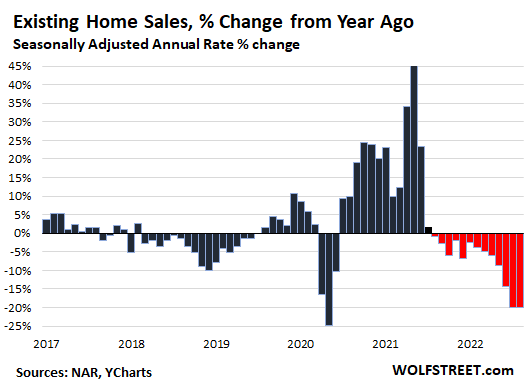

Compared to August last year, sales fell by 20%, the 13th month in a row of year-over-year declines, based on the seasonally adjusted annual rate of sales (historic data via YCharts):

Sales by region: On a year-over-year basis, sales dropped sharply in all regions. On a month-over-month (mom) basis, you can see a little uptick in two of the four regions:

- Northeast: +1.6% mom; -13.7% yoy.

- Midwest: -3.3% mom; -15.9% yoy.

- South: 0% mom; -19.3% yoy.

- West: +1.1% mom; -29.0% yoy.

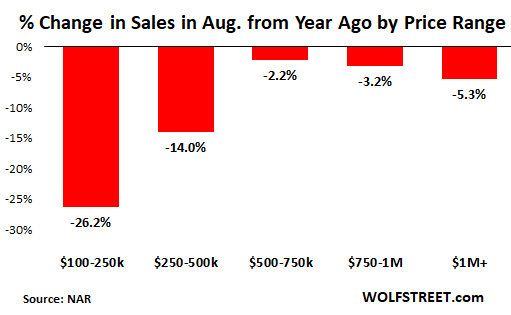

Sales dropped in all price ranges but dropped the most at the low end.

Sales volume has been low because potential sellers are clinging to their aspirational prices of yesteryear, when mortgage rates were 3%, and many would rather keep the home off the market or pull it off the market than sell for less, for as long as they can. But price reductions have now taken off by sellers who want to sell.

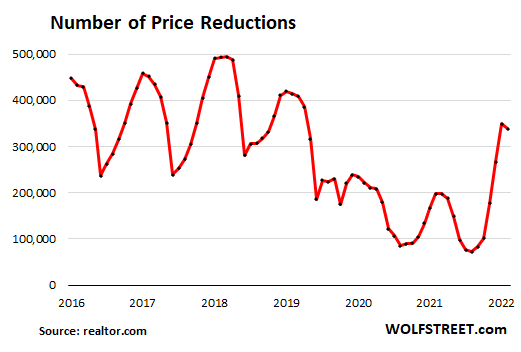

Price reductions started spiking in May from record low levels last winter and spring as sales stalled, and as mortgage rates surged. In July, they reached the highest level since 2019, according to data from realtor.com. In August, price reductions dipped just a little as sellers might have felt that price reductions were less needed, amid the declining-mortgage-rate-Fed-pivot fantasy in July and August:

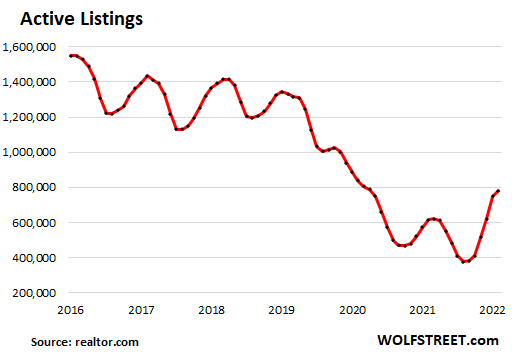

Active listings – total inventory for sale minus the properties with pending sales – rose to 779,400 homes in August, the highest since October 2020, up by 27% from a year ago, according to data from realtor.com:

The National Association of Realtors is clamoring for more single-family houses to be built. But homebuilders, they are having trouble selling the houses that they have already built or are building, sales have plunged, inventories have spiked to the highest since 2008, and homebuilders have started cutting prices, buying down mortgage rates, and piling on other incentives to get their inventory moving.

Investors or second home buyers purchased 16% of the homes in August, up from 14% in July, but down from the 17%-22% range in the spring and winter, according to NAR data.

“All-cash” buyers, which include many investors and second home buyers, remained at 24% of total sales, down from a share of 25% to 26% April through June.

Going forward: holy-moly mortgage rates. After the fantasy-drop from 6% in mid-June to 5% by mid-August, mortgage rates are now solidly over 6%.

The daily measure of the average 30-year-fixed mortgage rate is at 6.47%, according to Mortgage News Daily.

According to Freddie Mac’s weekly measure, released last week, based on mortgage rates early last week, rose to 6.02%, more than double a year ago. These 6%-plus mortgage rates are still very low, considering that CPI inflation is over 8%. But they’re catching up.

And potential sellers that hung on to their homes in July and August because they didn’t want to meet the price where the buyers were – hoping the “pivot” fantasy would push down mortgage rates further – now face the effects of these 6%-plus mortgage rates:

https://www.sfgate.com/bayarea/article/compass-real-estate-makes-layoffs-17455289.php

Laying off tech workers is usually a last resort, so the industry is seeing long term pain.

Rates are now about normal or what should generally always be – 3.0 to 3.25%. What we are seeing is what happens when the Fed stops subsidizing the financial sector economy. Falling home prices benefits those who want a home. And in my working class neighborhood, family friendly homes (split level ranches) are still selling briskly – my immediate neighbor listed her home a few Saturdays ago and it showed under agreement online a few days later. I am seeing signs of weakness in that for sale signs NOT being updated to “under agreement” within days/weeks like they used to on properties on high traffic, main streets (undesirable locations).

neutral interest rate policy should mean fed funds rates near inflation rates, .

in my opinion, interest rate policy should allow conservative savers to at least keep their purchasing power with a short-term CD at the local bank.

But 15 to 20 years of negative real interest years have seriously distorted the US/global economy and pushed/punished savers into riskier assets.

DC/The Fed painted the world into a lousy corner, and it’ll be a hot mess trying to untangle this.

Agree. My work colleagues are saying things like they are afraid to check their 401k because they keep declining. Meanwhile my savings are no longer being stolen by the Fed to inflate their 401k – or being stolen less, as I am actually starting to earn interest. One non home owner wondered how she is to live if all of her SS is needed just to pay the rent.

Yes, my understanding is that historic real interest rates average between 2 and 4 percent. Today’s rates, while higher, are still below the rate of inflation and are a factor in the economy slowing. What would happen with real rates of 3% and nominal rates of 11.3% – there would be economic blood out there.

I see the negative rates as a sign of economic stagnation and when we look at real GDP growth for the past 20 years of less than 2% and factor in the average government deficit of 5% of GDP over the period; it points to an economy running on fumes. Stinky fumes.

Series I bonds are the ticket right now. They always pay double the rate of CPI-U, and compound every 6 months. The biggest downside is $10k purchases per year limit so nobody is going to save their life savings doing it, but it can help most people some.

And you’re going to get this weird distortion in the housing market, supply shortage even if nominal home prices stay high—-many people can’t move as higher mortgage rates wash out any higher nominal equity gains (as well as the early years of loan repayment, your paying back mostly interest due to the amortization).

My cousin’s spouse (two teacher household) seriously joked that his family can never sell their house as he does not want to give up their <4%, 30-year, fixed mortgage.

the US producing/consumes too much housing….but the US economy is so distorted that undo-ing that imbalance will cause too much short/near-term misery.

Don't know if this anecdote is true or not, I was waiting at the doc offce—overheard a realtor explaining to someone that the combination of Covid lockdowns and Covid boom induced a large wave of new realtors.

2022 to at least 2024 will be one hot mess for US economy.

i consider proliferation of realtors as an indicator that we’re in wile e. coyote space, and have but to look down.

not seeing that out here, just yet…at least not at the level of ’07.

i’m going to kerrville, today…and all the way to Boerne manana…and that’s what i’ll be watching on the roadside.

the other thing all this makes me wonder about: when does this translate into lower prices for lumber, roofing metal, etc?

it would be cool if that had already happened, since that’s what i’m planning on doing friday, regardless….unless there’s a good chance of prices dropping a lot in the next week or two(paying cash)…i can wait that long, but i need to move on all this soon.

There ALWAYS has been a proliferation of real estate agents.

But, be that as it may, if you’re good at business and at customer service, you can make some pretty serious money.

Yes, you’ll have to work long and hard. As in, seven days a week. But that’s par for the course for any business where the upside is huge.

However, a lot of agents don’t understand these things, and that’s why there’s such a high turnover.

There’s a heckuva lot more to this business than your glamour shot on a business card.

just back from kerrville, via fredericksburg.

no noticable difference in Kville…but i dont go there enough.

fred i noticed 2 new realtor storefronts…with brand new rockwork and landscaping…not cheap…and on older antique rock houses(something this area is known for)…also not cheap.

and, lo and behold, coming through Mason, and there’s a similar outfit sprung up from nowhere…more landscaping and rockwork, etc.

these “realtors” have capital, that’s fer sure.

the latter was a coach…had 2 other newly minted realtors in town(last year) are also retired coaches…and bootstrap baby republicans(one is also a smoke nazi)…and all with either ample family money or rich wives.

i assume its similar in fred.

point is, same thing happened in 06-08…suddenly Mason had 25 realtors,lol(county pop:4500)…and then it all went to shit.

and yes…the Real realtors are pros…work all the time, drive all over, etc.

maybe 5 or 6 of those in this county who’ve all been there forever(all got started with inherited pioneer ranch spreads, taken from the Comanche, Lipan and Kiowa)

The average new RE agent makes two deals over two years and moves on.

The brokerages milk new agents savagely, fees for this, fees for that and a lousy split to start.

My E and O insurance dropped 90% after two years…

This time it is different, Covid and the death of the petrodollar have yet to really show their effects and with an administration that has a genius for screwing up I don’t see a “Recovery” in the market for a long, long time, if ever.

Prime properties in prime areas will be OK, any marginal areas will be crushed.

I expect prices to make economic sense by mid 2024 and I don’t expect to see real appreciation again in my lifetime.

“Prime properties in prime areas will be OK, any marginal areas will be crushed.

I expect prices to make economic sense by mid 2024 and I don’t expect to see real appreciation again in my lifetime.”

i agree.

that given, it would be cool if the property tax people’s algorithms worked in reverse.

thats another driver for excess appreciation, i think.

here, they’re currently making a lot of noise about keeping the rate low, if not lowering it…but valuations(sic) rise forever.

it’s in their(and the county, city and state) to continue this charade.

on the aspirational front, the place with “The Mountain”, a mile to my west, has been on the market for 2 years. 140 acres, zero groundwater, rock, mesquite and cactus, super rugged, thin soil…and they’re sticking to $800 grand,lol.

i hope the starry eyed entitlement continues, lest some developer swoop in and put a mess of ticky-tacky back there and thoroughly harsh my mellow.

It’s like the sequel to Oliver Stone’s Wall Street about the housing bubble and crash, when Susan Sarandon’s character went from being a nurse to a real estate agent and then back to a nurse. Same story all over again, nothing learned, nothing improved. Looking forward to buying a condo for the price of a fully loaded Tesla within a few years.

I run a brokerage in a seacoast city for MA & NH and the numbers are pretty close, 12% decline YoY in sold listings. They’re also sitting longer, and yes, cash buyers & investors are now our primary buyers where the average home price at our main office is just over $1 million (Essex County is &774K average sale price, with MA overall at $736K). Even in a so-called “Gateway City” (poor), average sale price is $535K as of this morning.

No one is going to leave their 2%-3% refi (including me) for now a 6%-plus, and as rates climb, until home price comes down significantly, a large swath of folks can’t buy. Our mortgage partners say they haven’t been this dead since 2008 (not for same reasons of course). However, if it’s a desirable community with good schools (including private), those get sold quick, and still getting above asking.

Roughly a quarter of our agents haven’t sold a thing, the top agents will still do ok with their pipeline, one is having a record year at $35 million in sales so far, but more to do with price than volume.

/buckleup

Never have so many had their sense of worth-real or imagined-tied up pretty much in entirety in real estate…saving money is strictly for losers, look how a prudent person that saved for a rainy day did with raging inflation which isn’t backstopped by generous interest rates for those who did the right thing, as in the past.

The key here is does the government step in to prop up the market vis a vis their proxies such as Blackstone et al?

It isn’t as if you’re gonna get many retail buyers @ 6.66% interest rates in a market where you can see the high water mark from only a few months ago, as its sinking.

Looked up Fannie Mae stock which I sold @ around $60 a share 15 years ago in the white heat of that housing bubble, and now it’s worth a princely 58¢.

Maybe savers will start to earn a little money now. Maybe pensions funds will have safe, fixed interest investment options that aren’t guaranteed money losers. But but… what will that do to Private Equity companies profits?

Adding, think how many big companies have borrowed money at near zero interest on a rollover basis to do stock buybacks to prop up stock prices. Now imagine what they’ll have to pay in new interest to rollover those loan payments going forward. Look out below. / ;)

/ ;)

From your keyboard to G-d’s ears. I, for one, would love to earn more interest on my savings.

I-Series Bonds…

Since Volcker’s crazy-high interest rates in the early 80’s started coming down in the mid-80’s, and with that came falling mortgage interest rates, the rise in housing prices has been the result of falling interest rates for the past 30+ years. X dollars of mortgage payment per month could afford a more expensively priced house since less of the mortgage payment was going toward interest and more toward principle. Now interest rates are going up again – not a lot but looking steadily upward. So the same mortgage payment of X dollars per month will only afford a lower priced house than last year. (Yes, I do like stating the obvious.) Also, the prices a year or two ago were insanely high in a lot of areas, practically mania level. Prices falling back to where they were 3-4 years ago would still be high but not the crazy-high seen last year. / ;)

The monkeys at the Fed need to stop manipulating the interest rates. It works in favor of the rich with assets prices (stocks and real estate, etc) going up and creating a boom and bust so that the stock traders can take advantage and making money coming and going. The QE of the last 10 years or so has created a lot of rentiers with rent going through the roof. The lower income group are slaves to these people. Most of the real estate agents (there are some honest ones) are there to put up a sign and multi-list to share the commission with the other guys. They don’t do much for their money and make the seller do this and that to prepare the house for sale; moreover, they want the seller to leave the house at a moment’s notice for a showing. The appraisers are in cahoots with the mortgage companies and the realtors who come up with the valuation to satisfy them.

Why is government in the mortgage business and why is mortgage interest tax deductible?

How is this fair to the other part of population that isn’t home owners and rent instead?

Mortgage interest is tax deductible, because it’s an indirect subsidy to the banks, i.e. the anticipated tax savings are plowed into a more expensive home and larger mortgage and larger interest revenue for the banks.

Our grifters in office in Washington know that housing is the major form of wealth for the voting public. You can be sure they will do all they can to blow real estate up again. The popularity of those remodel and flip shows on TV is illustrative. You just have to have staying power in the downturns. If we get a more rational government and move to public and multifamily housing like Europe watch out below. Aint gonna happen.

It would be wonderful if high interest rates nuke a few private equity landlords. This business model needs to be destroyed, but I don’t think the Fed will go that far.

If only the rent would start going down as well.