For some time, this site has predicted the inevitability of a European economic crisis due to the loss of cheap Russian gas and the delay and much higher cost in securing replacement energy sources, primarily LNG.

Mainstream press coverage, likely reflecting European leadership’s “kick the can” reflexes, has touted that Europe has decent odds of having its stored Russian gas (along with other sources, like wind and nuclear power) carry Europe through the winter. And in fairness, gas prices in Europe have dropped since late summer peaks:

But despite higher consumption, prices have still dropped in December

Here we show the front month contract (down a lot the last week) pic.twitter.com/a6ttDupkSb

— Jens Nordvig 🇩🇰🇺🇸🇺🇦 (@jnordvig) December 18, 2022

But looking at current and near term price expectations ignores the cost at which this relief has been achieved, namely, deindustrailization. Energy-intensive businesses, from aluminum, glass, chemical, and paper makers to greenhouse operators are cutting back, suspending, or even shuttering operations. Even with energy subsidies in place, many households are cutting back because they can’t afford the higher prices. Needless to say, budget-squeezed consumers are a further drag on business activity. Germany and the UK have been particularly noisy in warning citizens about possible rolling blackouts over the winter.

We weren’t alone in warning about the prospect of continued hardship. From Forbes back in September:

With natural gas prices over $100 more per megawatt hour than they were a year ago, the Western European economies are heading to the Middle Ages.

Forests are being cut for firewood as Russia retaliates with its own Ukraine war sanctions by shutting off the trickle of natural gas it was still piping into Europe….

Corporate investment goes where money goes farthest. It used to be taxes and labor and environmental costs they looked at. Now European companies will add electricity to the mix. None of this bodes well for European businesses….

For this reason, new UK Prime Minister Liz Truss has given up listening to the climate lobby and said the country would end its fracking ban. Britain is in the same boat as the EU…

“We now expect a deeper prolonged recession and more persistent elevated inflation due to the impact of higher energy prices, a more decisive European Central Bank tightening cycle and weaker…demand,” says Barclays Capital economists led by Silvia Ardagna.

Similarly:

Germany will fall far from its throne in the Eurozone economy…and will not be able to return, as current energy triggered industrial shutdowns add to hollowing out that was already under way as big manufacturers redeployed, now hastened by need to decouple with China https://t.co/xRINsoMy7Y

— Harald Malmgren (@Halsrethink) September 9, 2022

We will skip over the tearing of hair and rending of sackcloth as various EU officials realized that the US is perfectly happy to prey on a weakened Europe via selling them pricey US LNG and then, to make matters worse, passing an Inflation Reduction Act that subsidizes only American green energy companies, reducing the competitiveness of foreign players:

Biden's 'Inflation Reduction Act' prioritises domestic renewables industry by cutting off subsidies for foreign players. An exemption to Canada has been given but not for the EU. Macron has called for retaliatory measures but the satellite states of Europe are unlikely to do so.

— Vivek Shukla (@tweetfromVivek) December 17, 2022

Given that the short-term relief in European gas prices means a lot of people who know better will nevertheless try not to think much about Europe’s sorry prospects, Bloomberg surprisingly published a blunt, fact-filled assessment:

One minor quibble: $1 trillion is total EU energy consumption. I believe the increase is only half that, which is still a hefty number. However, it anticipates, as experts have, that Europe’s energy shortfall will persist until 2026. How will it have any industry left by then?

After this winter, the region will have to refill gas reserves with little to no deliveries from Russia, intensifying competition for tankers of the fuel. Even with more facilities to import liquefied natural gas coming online, the market is expected to remain tight until 2026….

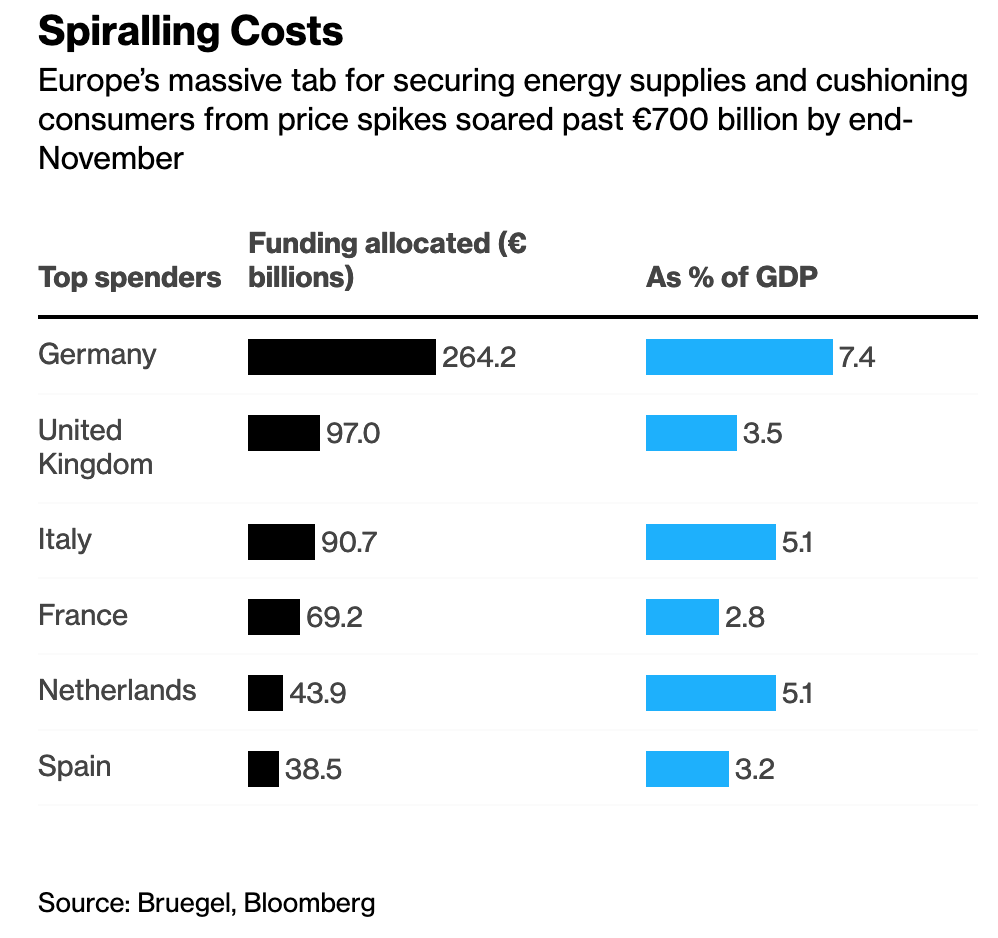

While governments were able to help companies and consumers absorb much of the blow with more than $700 billion in aid, according to the Brussels-based think tank Bruegel, a state of emergency could last for years. With interest rates rising and economies likely already in recession, the support that cushioned the blow for millions of households and businesses is looking increasingly unaffordable….

And the EU has competition:

Chinese gas imports are likely to be 7% higher in 2023 than this year, according to China National Offshore Oil Corp.’s Energy Economics Institute. The state-owned company has started securing LNG supplies for next year, putting it in direct competition with Europe for spare shipments. China’s historic drop in demand this year was equivalent to about 5% of global supply.

China isn’t Europe’s only problem. Other Asian countries are moving to procure more gas. Japan, the world’s top LNG importer this year, is even considering setting up a strategic reserve, with the government also looking to subsidize purchases.

European gas futures have averaged about €135 a megawatt-hour this year after peaking at €345 in July. If prices go back up to €210, import costs could reach 5% of GDP, according to Jamie Rush, chief European economist at Bloomberg Economics. That could tip the shallow recession being forecast into a deep downturn, and governments will likely have to scale back programs in response.

So a sustained 50% increase over current electricity price levels would push Europe into an actual or borderline depression. Recall Europe also did not get its banks out of the sovereign lending business. With some banks and many countries wobbly, a deep downturn could trigger a financial crisis, particularly since governments are going into more debt to soften the energy blow, something they simply can’t keep up until 2026.

Now Europe may get lucky. China dropping Zero Covid looks to be hurting its workforce even more than Zero Covid did. That is likely to lead to yet more supply chain disruption and lower demand within China, both of which will dampen demand for LNG and therefore hopefully alleviate price pressure. Europe may get lucky with the weather, both temperature and wind generation. But even if it limps through the winter, it will still have a structural problem in 2023 even in warmer weather. Electricity won’t get to be cheap enough to bring back those energy-hogging businesses. The loss of jobs and industrial demand will eat into tax revenues, making energy subsidies even more costly in budget terms. Demand for social services will rise.

And we haven’t factored in wild card of a mass influx of Ukraine refugees. Directly they are not likely to add all that much to energy demand. But they will add to government expenditures at a time when funding is scarce.

So while the profile of the decay path is still uncertain, an ugly ending seems almost baked in. Some communities and regions will find a way to adapt (particularly ones in temperate areas), but the average standard of living is destined to fall further.

And every solution to Russian gas is more expensive and more complicated. Qatar has rumbled that EU investigations into World Cup corruption could be bad for gas deals. The idea that Europe will be able to flex financial muscle to enforce human rights is dead. It will do whatever it can to get the needed energy.

In an amazing turn of historical trends, it appears we’ll also see wealth transfer to Asia from Europe as China and India continue to buy discounted Russian energy and resell it to Europe. I’m quite worried that by mid 2023 we’ll find US consumers hit with significant energy price increases from US companies sending LNG to Europe for bigger profits.

Germany is going to have to think about using its military and navy to stop Poland/UK/USA from further destroying the Nord Stream lines and restart the undamaged section.

“First we destroy the Ukraine, then we take Berlin.”

Not a Russian song, but straight out of Neocon Washington.

Yes – this could result in a political backlash in the US.

There would be a clear relationship between the policies of the Biden administration and the rise in cost of living. A smart populist Republican would be able to campaign on the idea that Biden was worsening inflation through his military and economic policies. They would then promise to ban the export of the US natural gas reserves to lower the prices to Americans.

If inflation rates continue to be high, this could work quite well.

I’ll bet you some twerp at the EU commission is doing that right now, fawning in paragraphs over the how the new worker influx of pensioners, widowed/lone mothers, and young refugees will be a great boon to European employers in fruit picking industries or some such. The card probably isn’t very wild either. Studying any large post War refugee influx will likely tell you everything you need to know, right down to the government policy screw-ups, with 27+ chances for this one.

Another problem is NATO countries promise to increase military spending. With less domestic heavy industry that means more foreign arms spending against a falling Euro. As they are currency users, not issuers, this will mean social safety net spending cuts.

Just saw (yesterday?) a claim that already a tad over half of European military budgets go to purchasing US weapons.

Well played.

Well, few countries in the world spend even half of their budgets on procurement (a third is good) and much European equipment is made here. Quite a lot of defence programmes over recent generation have been collaborative (the three-nation Typhoon aircraft, the Franco-Italian frigate) and there are a number of serious players still in the arms market, notably France, Germany, Italy and the UK, with others filling niches. I can imagine, though, that for a small country buying something like F35s (Finland or Belgium for example) the dollar content of the defence budget could be quite high. That said, the long-term future of the European defence industry could be yet more collateral damage.

…European

defencewar industry…one down, three more to go?

European ‘defence’ products are way behind US, Chinese and Russian – for planes and missiles anyway. See ‘Military Watch Magazine’ for a downbeat assessment of Eurofighter and Rafele and Gripen. Tanks too. Industry too small, not enough investment. UK and German ships also poor.

Do not forget that for example Belgium, for buying F35’s, got compensation. Parts of the F35 are produced in Belgium. There is always a give and take.

Why am a skeptical on the ability of US MIC to provide the quantity and quality of weapons demanded needed in time and with no extra costs?

Just to show you how disconnected the Germans are. On a site created by a famous German journalist Gabor Steingart, i.e., establishment https://en.m.wikipedia.org/wiki/Gabor_Steingart

Annalena Baerbock was announced as the politician of the year. https://www.thepioneer.de/originals/hauptstadt-das-briefing/briefings/die-pioneer-highlights-aus-der-hauptstadt-2

I have always admired the Germans, their culture, work ethic, etc, but I am beginning to understand why some people called them Squareheads.

German here. I’m afraid my compatriots wanted it this way. They couldn’t screech “Slava Ukraini!” loud enough and it’s just fair that they will have to bear the costs of a failed economic/ foreign policy. My compassion will be limited.

The Bundesnetzagentur (the German supervising authority for networks) publishes a regular situation report for the gas market. When looking at the latest one, a few interesting points serve to confirm the Bloomberg story:

1) Under “2.1 Verlauf der Speicherfüllstände” (evolution of fill rate for gas tanks), one can see that gas reserves were at their lowest ever in 2021 (as Gazprom Germania did not fill its tanks), but that a sustained effort during 2022 accomplished the objective of nearly 100% fill rate. Since early December, Germany is drawing reserves down (they are currently just under 88%) and this emptying is proceeding faster than the filling up.

2) Under “3.1 Gasverbrauch Industriekunden (wöchentlicher Mittelwert)” we see that the gas consumption of industrial customers (weekly average) has been significantly lower than the absolute minimum of every year back to 2018 since the second half of June. Which is also exactly the point at which gas prices went upwards (see “4.1 Gaspreise Großhandel” — wholesale gas prices).

3) In contrast, under “3.2 Gasverbrauch der Haushalts- und Gewerbekunden”, we see that the gas consumption of households and commerce has been low, but not overall systematically lower than in previous years like for industrial customers.

I am personally convinced that once Russia and Turkey finalize their project of an “energy hub”, there will be a giant sucking sound when large and mid-size European industrial enterprises embark on a mass exodus to Turkey to take advantage of the plentiful, cheap Russian gas available there.

With German Gastarbeiters in Turkiye?

That would be a sight to behold.

When the watering hole shrinks, the animals get ornery. There is all manner of unpleasantness in our immediate future …

This is it exactly. Not that it needs toop much reiterating here, but, no matter where you are, don’t be complacent, it’s coming soon to a theater near you.

Indications at this point seem to be that the winner is going to be the United States. There is a famous old quote from the Watergate scandal that is “follow the money.” The “money”, and the Nord Stream sabotage, seem to point to the US, not Russia. My question continues to be, why did Russia become involved in a full scale invasion of Ukraine rather than a limited, goal directed engagement.

I believe Putin said that no matter what Russia did militarily, it would face the same economic consequences, so it decided to fight the military battle as it saw fit. That said, it might have been more prudent for optics to let Ukraine make the first move to seize the Donbass or Crimea, but the MSM would probably have convinced Western populations that Russia was still to blame, and that supposition is supported by the fact that anyone who follows this conflict with even passing interest is aware that Russia did not instigate the underlying situation.

Ukraine had massed troops and begun intensified shelling immediately before Russia moved in. Your surmise about the MSM seems borne out by reality.

Full scale invasion? Read more widely. No facts to back that up either eh?

Follow the $$ right into RF coffers for all of 2022. Again facts contradict you.

Why do you think russia is involved in a “full scale invasion”?

You have been consuming too much mainstream media disinformation, and not enough actual information. Without going through the many parts to answer you, go though the archives of “new cold war” here at NC…. the answers you seek have all been WELL covered.

“why did Russia become involved in a full scale invasion of Ukraine rather than a limited, goal directed engagement”

because “limited goal directed” implies half baked outcome. Ukraine – the word means border – how do you put a lethal entity long term – limited or not – next door and not have to revisit the subject?

wipe it out – DMZ declared for 1,000 klm – a No Mans Land where rabbits are terminated and anything else that cross the line.

The Bio Weapons Labs / potential Nukes / Missiles with ever increasing range and sophistication / terrorists crossing the perimeter for mischief…….all endless provocations, so there will be no Ukraine in the fullness of time.

Putin has created a slow bleed for Germany and the EU with LNG – 3-4x cost of 2019 …forever – no cheap substitute- so industry sees they all have to make permanent decision.

it takes a while for institutions and people to face the obvious – so why do it quickly ?

Sounds like trade protection. What happened to the WTO arbitration courts (giggle)?

WTO has recently declared Trump’s steel and aluminum tariffs illegal and US trade policy has been put under a magnifier glass by WTO: https://www.globaltimes.cn/page/202212/1282112.shtml

The WTO arbitration court has been killed by the US.

In the years to come, the US may find that it needs strong Allies to deal with the challenges that they will be facing in a multipolar world, especially with major blocks arising. But if they are counting on the UK and the EU to aid them, they will come to realize that helping cause them to de-industrialize will have spiked that option and that Europe as a whole will not be able to bring much to the table. I don’t know what the European middle class will do, whether many of them will try to emigrate like happened in the Baltic nations or whether they will be forced to deal with the consequences of the choice that they made to get on the anti-Russia band-wagon at home. All I can say personally that this whole episode is nothing less than high-tragedy for the Europeans, Ukrainians and the Russians. And the people responsible for this all? They will just walk away to be rewarded or promoted and then start work on their next project – such as Project Iran or Project China.

I wonder if, when we learn that total spectrum dominance by the US cannot even be a pipe dream, we will see military people capable of doing what Russian soldiers have done. When the US decides that if we can’t have the world, no one will, will there be someone human enough to prevent Armageddon?

I don’t know the answer to my question. I’m cynical enough to think that if our current crop of crazy leaders thought that a lone person with a conscience could prevent such a catastrophe, they’d automate the process. I can see the cat-like smile on Victoria Nuland’s face as the bombs start dropping all over the world…

I have wondered about the “if we can’t have this world, no one can!” mentality.

It could be that we continue to become ever-more belligerent as the world slips from our grasp such that we start attacking Russian tankers shipping oil outside of the petrodollar system, or instigate an embargo on Chinese importation of oil. If Pompeo, Niki Haley or Cotton ever become President, that very likely will occur; perhaps DeSantis as well, but he is more of a blank slate foreign policy-wise.

Rev,

How about just using the EU as a test case to see what the future may hold at home? Deindustrialization is a future we may all be looking forward to, so try before you buy!

Political scene in Europe is much more fluid and far less easy to control than in the US. Parties and leaders can pop up from thin air…

Why do you think russia is involved in a “full scale invasion”?

You have been consuming too much mainstream media disinformation, and not enough actual information. Without going through the many parts to answer you, go though the archives of “new cold war” here at NC…. the answers you seek have all been WELL covered.

*******This was supposed to be a reply to “Carolina Concerned”

There are other problems. One is that with the stoppage of the fertilizer industry, Europe is not able to support its own agricultural industry and as a result, the continent’s food security is under threat.

Another consideration is that the Russians are far more likely to be sympathetic towards the nations that have opposed the sanctions such as China. That’s critical given the natural gas shortage all over the world. Yet another issue is that the US also has its own shortages of gas. An astute populist may campaign for an export ban on the basis that it will reduce the amount that Americans pay. That’s going to be especially the big issue if there is a big piece spike.

The US has chosen to have weak and corrupt vassals over strong and well run allies with a more egalitarian relationship. It may be that in the coming years, the US need strong allies that they won’t have because the US ruling class has destroyed them.

Yet another unforced error. With enemies like that, who needs friends?

The gas production has not changed. There is still the same amount pumped up. However the distribution has changed and consequently the price has changed for some regions. The west, including the US, will have to pay higher prices.

The USA is not going to come out of the European Energy Crisis unscathed.

“Union Pacific Railway, one of two railroad companies that haul coal out of the Powder River Basin, is under fire for embargoing shipments to customers, including power plants. The failure to meet customer coal demand has resulted in less coal-fired power generation and higher costs to ratepayers for natural gas purchases to replace coal power.”

A triple pandemic, inflation, cold, and looming blackouts are hard to ignore. North American needs the energy not profiteers selling it to Europe.

I remember the ‘Snowball Earth’ and ‘Global Warming’, part 1′ battle in the Press, in the 1970s. It was most unprofessional, and I was pleased when it ceased. So, I was surprised when a regular BBC weather report warned about the climate getting warmer, in 2001, and I did think that, if we had another before the end of 2002, it wouldn’t end well.

Well, there was one, in 2002, and it hasn’t. It does seem that the 1970s was a battle for research grants, while the 21st century agenda is a lot more sinister, with plenty of Establishment consensus.

The US is uniquely positioned to weather the energy crisis with its huge gas and oil reserves. If we shut off exports we will be swimming in oil and gas. We also have the best land/water regions for crops and a huge workforce. But it will be a major mistake if we pull up the drawbridge and leave the rest of the World to fight over energy and oil. Europe could devolve into warring factions as Russia breaks up into ethnic regions with differing loyalties. The US will once again be drawn into a European war that could make WWII look like a cakewalk.

The gas production has not changed. There is still the same amount pumped up. However the distribution has changed and consequently the price has changed for some regions. The west, including the US, will have to pay higher prices.