Since the press anticipated that Sam Bankman-Fried’s fellow FTX/Alameda officer and sometime paramour Caroline Ellison would seek a plea deal, the fact that she and Alameda co-founder FTX Chief Technology Officer Gary Wang have done so may seen anti-climatic. But the Southern District of New York has gotten both to admit guilt to the same seven counts with which SBF was charged with impressive speed.

Note the warning in the first part of the SDNY statement below, that if anyone connected to FTX wants to come forward to try to save their hide, the window of opportunity is closing.

Whoa! Both Caroline Ellison and Gary Wang flipped and have ratted on @SBF_FTX.

Caroline and Gary have been charged and pled guilty. Both are now COOPERATING witnesses with the SDNY (DoJ). 👀

Expect more news to come, per SDNY. pic.twitter.com/sHlT12sP4A

— Compound248 (@compound248) December 22, 2022

Frustratingly, I can’t embed any of the key documents. Both the Caroline Ellison plea deal, apparently first published by Inner City Press, and a new SEC filing against Ellison and Wang are each 9 MB despite being text only pdfs, one 7 pages, the other 38. Even Adobe’s compression tools will not reduce them to below 2 MB, which is the size they need to be to upload them. What gives????

So please see:

United States v. Caroline Ellison, $2 22 Cr. 673 (RA). Note the redactions

SECURITIES AND EXCHANGE COMMISSION v. CAROLINE ELLISON and ZIXIAO “GARY” WANG

The first document is mainly an exercise in prurient interest. It does show that Ellison is pleading guilty to the same list of high level charges in the grand jury indictment against SBF. The way criminal plea bargains work in the US is the cooperating party must plead guilty to at least one felony, and the deal is contingent on how much they actually cooperate. Here, Ellison is hoping to have the DoJ strongly recommend a reduced sentence based on how helpful she will presumably have been. Her maximum sentence on these charges is 110 years.

I assume this sort of language is typical:

It is understood that, should this Office determine either that the defendant has not provided substantial assistance in an investigation or prosecution, or that the defendant has violated any provision of this Agreement, such a determination will release this Office from any obligation to file a motion pursuant to US.S.G. § SK1.1, but will not entitle the defendant to withdraw the defendant’s guilty plea once it has been entered….

It is understood that, should the defendant commit any further crimes or should it be determined that the defendant has given false, incomplete, or misleading testimony or information, or should the defendant otherwise violate any provision of this Agreement, the defendant shall thereafter be subject to prosecution for any federal criminal violation of which this Office has knowledge, including perjury and obstruction ofjustice. Any such prosecution that is not time- barred by the applicable statute of limitations on the date ofthe signing of this Agreement may be commenced against the defendant, notwithstanding the expiration of the statute of limitations between the signing of this Agreement and the commencement of such prosecution. It is the intent of this Agreement to waive all defenses based on the statute of limitations with respect to any prosecution that is not time-barred on the date that this Agreement is signed.

The SEC filing gives an initial sense of what Ellison and Wang are offering in the way o confirmation of allegations and new evidence. The filing significant repeats arguments from the claim against SBF, plus no doubt more will come out, so we’ll highlight just a few points.

One is that, as expected, Ellison and Wang are strongly resisting SBF’s attempts to pretend he didn’t know what was going on, and ergo it was mainly weak supervision as opposed to embezzlement and other chicanery that led to the collapse.

As an aside, the SBF claim that Ellison was the CEO of Alameda and therefore SBF had nothing to do with all that customer money going to Alameda to fill its financial black holes was laughable. The money came from FTX! SBF was running FTX, not Ellison, and therefore he was responsible for its transfer.

The new filing maintains that SBF was and remained “the ultimate decision maker” with full access to all records and systems, though the bankruptcy. However, the SEC document has Ellison and Wang admitting they knew SBF was diverting funds this way, which makes them co-conspirators.

It looks as if Ellison has already provided some detail of how she propped up the price of FTT tokens, allegedly at the behest of SBF, to preserve their value as collateral for borrowings (as in prevent loans from being called and help get new loans). Most of the press tends to focus on the misuse of customer funds, as in fraud against FTX customers. But the filings all together describe frauds against other victims: lenders, equity investors, and the IRS (money laundering), along with the seemingly victimless crime of campaign finance fraud (making donations in the name of other parties).

Wang similarly provided more detail about how FTX software gave Alameda preferential status, such as exemption from position liquidation and ability to carry a negative balance, and when those features were addes.

Even though this is a minor item, it show what a con artist SBF was and how he had Wang (and one also assumes Ellison) under his thumb. Who signs a loan for over $220 million to get less than 0.1% in proceeds?

…Bankman-Fried also used commingled funds from Alameda to make large political donations and to purchase tens of millions of dollars in Bahamian real estate for himself, his parents, and other FTX executives. Specifically, in 2020 and 2021, Wang executed promissory notes with Alameda totaling approximately $224.7 million. The funds borrowed under the promissory notes in Wang’s name were not intended for Wang’s personal use but were instead used by Bankman-Fried for other purposes, including additional venture investments. However, Wang did withdraw approximately $200,000 in funds for his own purposes.

In a move that has the crypto community tearing its hair, the SEC in this filing argues that FTT is a security. Note that if the SEC prevails, this position can presumably be extended to any crypto currency. From the filing:

75. On or about July 29, 2019, FTX launched a crypto asset known as “FTT.” FTX launched FTT as an “exchange token” for the FTX platform (i.e., the crypto asset or token associated with a crypto trading platform).

76. Before launching the FTX platform in or around May 2019, FTX had minted 350

million FTT tokens in or around April 2019. Of the 350 million tokens minted, 175 million were allocated to FTX as “company tokens,” and 175 million were designated as non-company

tokens. The company tokens were set to “unlock” (or become available for trading) over a three-year period after a so-called initial exchange offering (“IEO”) of the token.77. From the time of its offering, FTT was offered and sold as an investment contract

and therefore a security.

Some crypto enthusiasts are arguing that the SEC move is an over-reach, that FTT was never sold to US investors. I doubt that is true. From what I have read, and it is consistent with the poor state of FTX’s controls, that prospective customers could sign up for FTX International (non US) accounts merely using a VPN. So US individuals could and arguably did send fund to FTX International, which were co-mingled and sent over to Alameda to among other things, manipulate the market for FTT.

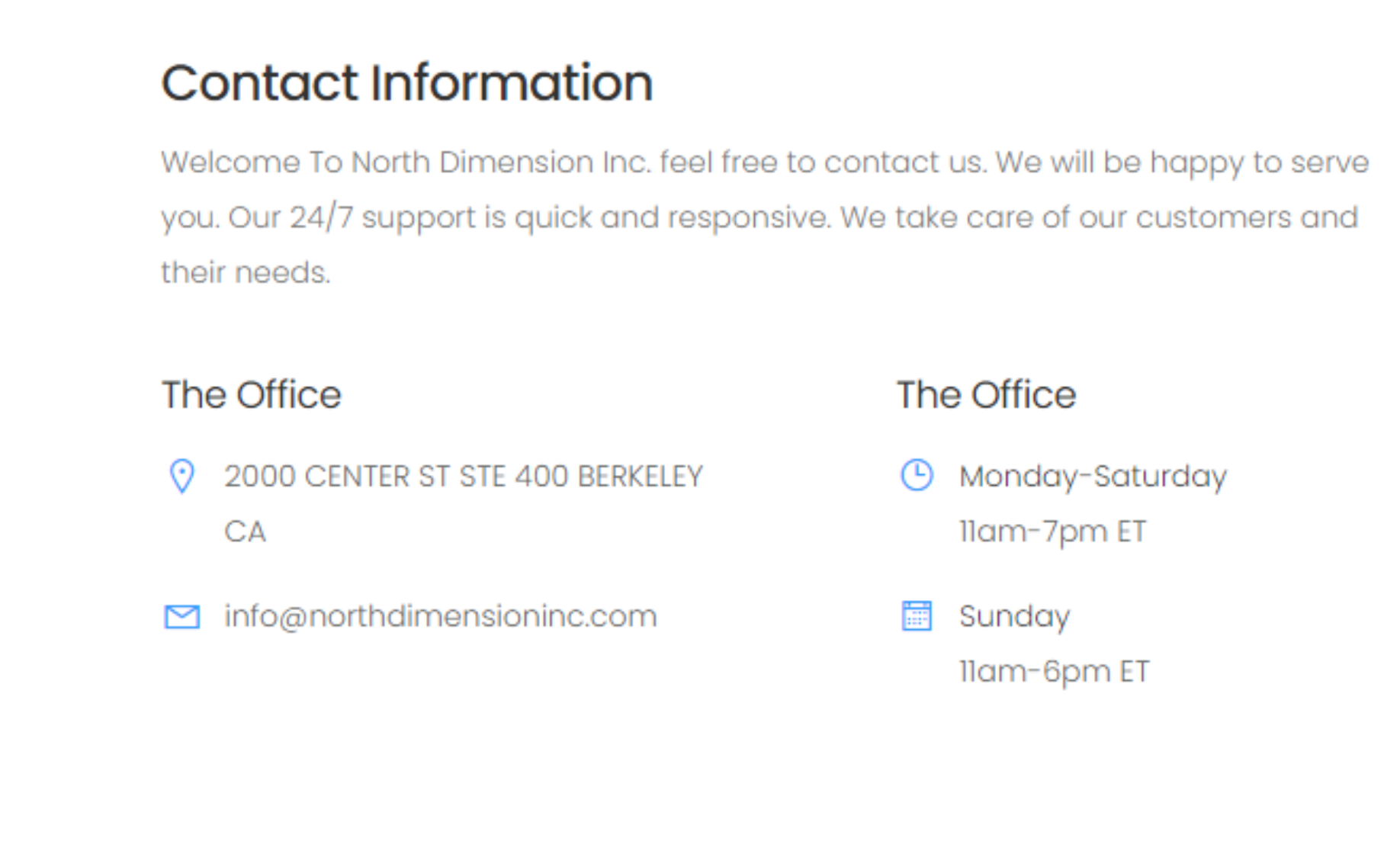

Second, Alameda had a subsidiary, North Dimension, which took US dollars and was not presented as connected to Alameda or FTX. From the SEC document:

38, From the start of FTX’s operations in or around May 2019 until at least 2021, FTX customers deposited fiat currency (e.g., U.S. Dollars) into bank accounts controlled by Alameda. Billions of dollars of FTX customer funds were so deposited into Alameda-controlled bank accounts. Ellison was aware that Alameda was receiving FTX customer funds.

39. At least some of these bank accounts were not in Alameda’s name, but rather in the name of North Dimension Inc. (“North Dimension”), an Alameda subsidiary. North

Dimension’s website does not disclose any connection to Alameda. Ellison knew that Bankman- Fried had directed FTX to have customers send funds to North Dimension in an effort to hide the fact that the funds were being sent to an account controlled by Alameda.

From a tweet on the eve of the bankruptcy filing:

North Dimension was most decidedly in the US, so monies came from US parties and were used by Alameda, among other things, for FTT market manipulation.

Moreover, Alameda, which was buying and selling FTT like a drunken sailor, is a Delaware company. US lenders to Alameda treated FTT as collateral. At least some if not most were in the US, again creating a US nexus for FTT.

In addition:

👀#SEC filing declares $FTT a security in #FTX case development

FTT allegedly raised over $10 million to fund the exchange's business operation, with a promise to return profit for investors as demand for trading on FTX increased.

via @theChriscen https://t.co/TLwotegOLD

— CryptoSlate (@CryptoSlate) December 22, 2022

⚡️#SEC Calls $FTT Exchange Token a Security

SEC highlighted that #FTX would use proceeds from the #token sale to fund the development, marketing, business operations, and growth of FTX while using language to emphasize that #FTT is an "investment" with profit potential.

— Satoshi Club (@esatoshiclub) December 22, 2022

These final points argue for FTT needing to have been a registered security or at least in compliance with state blue sky laws, with a proper offering document and all that.

Many crypto fans are coming to similar conclusion but are mighty unhappy:

Hallelujah — if this prevails ie tokens are security, 💩 tokens likely to disappear like 💩 ICOs

SEC Calls FTT Exchange Token a Security https://t.co/39KWszO03K

— DMKM 🪙 🪙 (@2paisay) December 22, 2022

As the FTX drama unfolded, many were howling for SEC Chairman Gary Gensler’s scalp for not attempting to pursue and casting aspersions on his having taught a blockchain course at MIT, with some help from Caroline Ellison’s father, an economic prof at MIT.

First, crypto was spending huge lobbying dollars on the Hill. The SEC is the only financial regulator that is subject to Congressional appropriations (all the others live off fees and fines). Congress has kept the SEC budget starved and weak and has regularly cut funding when the agency launches initiatives it does not like (see former SEC Chairman Arthur Levitt’s bio for many examples). Crypto was not generally seen as a security and Gensler would have had to spend a ton of political capital and would have likely failed. By contrast, he’s been doing some very bloody-minded private equity rule-making, so it’s not as if he has been fearful.

Second, Gensler was doing MIT a big favor by teaching that course. And regulators have much more credibility if they’ve heard the “industry” case.

Third, the proof is in the pudding. The SEC had multiple fraud charges, including securities fraud related to fundraising for FTX. It decided upon further reflection and/or getting more facts from Ellison and Wang, to take the position that FTT is a security. This is a bold step the SEC did not have to take.

Let me add:

I think the SEC is likely to prevail with its claim that FTT is a security. Its use in fundraising for FTX is deadly, in addition to the US nexus points demonstrated above. On top of that, Ellison and Wang are agreeing to the charges and SBF barely has the legal horsepower to fight anything, and “FTT is a security’ is not the most important thing for him to attest. I also doubt anyone will file an amicus brief on behalf of SBF on this issue, but the industry may be more shameless than I imagine.

However, given arguable special circumstances (particularly the use of FTT in fundraising), any precedent set by this case might be narrowed.

So the drama continues. Pass the popcorn.

‘On top of that, Ellison and Wells are agreeing to the charges…’

Ellison and Wang?

Will fix, that one must have been a weird autocorrect I missed, Thanks.

Gensler has always said that tokens are securities, although he wasn’t yelling it from the rooftops, and the SEC’s pursuit of token issuers has been limited to some of the most egregious examples. It’s all about meeting the Howey test (from 1946), the basic definitions of which go back to 1933. The SEC published strong guidance on tokens in 2019*, which has been mostly studiously ignored by the crypto community, as evidenced by the fact that nobody has been able to successfully argue in court against the SEC’s interpretations.

I was thinking that the SEC was waiting for a major blow up in order to roll out heavy ammo to finally end the ‘is it a security?’ game once and for all. FTX is probably that blow up.

As a side effect, they’ll be involved in a trial that will teach the kids a lesson. Whether Ellison & Wang get the jail terms they deserve as co-conspirators remains to be seen.

(*here: https://www.sec.gov/corpfin/framework-investment-contract-analysis-digital-assets. As a securities industry worker (but not a lawyer) and crypto follower, I see it as a pretty airtight piece of work.)

Thanks for this. I have been so allergic to crypto that I am embarrassed to have missed Gensler taking a strong position but undercutting that by having been quiet about it, so I will read your link with interest.

But the whinging on Twitter says the touts seem to have been completely unaware of the agency’s position, and the rags have yet to mention that with respect to this filing. I assume per your info the more detailed pieces soon will.

I have not followed crypto in detail, but I have noticed that a common defence is whenever something (energy use, specific scams) about crypto is criticised is “not all crypto!”

So to head that of, in your understanding does the SEC position from 2019 cover all crypto currencies?

The public perception/knowledge problem is that in most people’s minds ‘crypto’ is everything: the blockchain (only a method of implementation), a currency, a token. Likewise, what you want to do with it and your role in the activity: ‘mint’, invest’, ‘spend’, ‘trade’, ‘exchange’.

But, in legal terms, each thing is different, and comes under various regulatory definitions and authorities. Example: If a token is a security, if you are offering a place to buy or sell that security, you’re running an exchange, and are governed by a country’s laws governing securities exchanges (and all functioning countries have exchange laws)*. If you’re moving currency around, you’re subject to money handling (‘transmitter’) regulations, which all countries also have (in the US, at the state level).

One of the great misleading terms in crypto is ‘mint’. People associate that with a currency, but the ‘minting’ of certain tokens is actually the creation of securities.

The SEC regulates securities and the handling thereof (and specific aspects of the currency part of a securities transaction), and currencies are not securities (per the Howey test, as well as other legal definitions of ‘currency’). Whether a specific ‘token’ is a security, or a currency, or something else has to have the various definitional tests applied to identify the relevant regulations.

* And just because it’s on a decentralized blockchain with no specific location does not exempt you — the nexus is when you’re transacting with entities/people in a specific country, or offering securities tied to the existence of a legal entity in a country.

I think it’s fair to say that those outside the crypto community do not see the diversity that the touts claim. While the touts claim “this token is definitely not that functionally the same as that token”, I expect regulators are not seeing those degrees of difference.

Proof of work vs proof of stake, for example, don’t affect the financial status at all.

ETA: FMA’s much more detailed explanation from a basis of specific knowledge is better than what I wrote :)

Thank you FMA. My reading of the document is that FTT would be security, but stable coins that always are valued at the same amount would not be a security as there is no expectation of profit.

By the ‘no expectation of profit’ argument, you might say that money market funds that are designed to be stable at $1/share have no expectation of profit, yet they are considered securities (it is a type of mutual fund which holds investments whose value is managed – they do have profits, which are paid as interest, not as an increase in share price). The fine parsing of the argument for stable coins as currencies or securities I leave up to the lawyers.

Thank you for your response FMA. I thought of MM funds, but at least with them there is an expectation of positive interest income (profit).

Lights turned on and the cockroaches all flee. Let’s see what happens next in the court sessions, and this proven liar, SBF, goes into his rightful place in both historical terms and in prison sentencing terms. As summarized in the recent Netflix offering on Dahmer, I hope he burns in hell.

Proven liar, embezzlement schemes, and using funds to seek undue influence on the people who might make some rules that impact his firm / industry. I tend to believe in this aspect, that Gary Gensler was perhaps playing the long game and the circumstances just aligned. Mr. Gensler is not a moron by any stretch.

We (humanity) allow these pyramids of power, we organize power this way. One or a few people at the top having massive influence on the many more below. Lifting mere mortals to titan status, then watching them fall over and over again, while absolving ourselves of complicity.

Inevitably such structures will aspire and attract those pathologically incapable of resisting so much power and control over others; the need goes to the core of their being whether they were born that way or made. On the spectrum of human experience SBF and cohorts are us. If we would only own up to it, we might structure power differently for our own sakes. I hope that we would.

I’d like to see SBF in prison for the rest of his days, for his safety and ours.

There have been many cultures that did not organize power in this way, but western/European culture is not one of them. Some indigenous groups had barriers to that type of behavior and designed their societies to prevent it.

I suppose that when Sam Bankman-Fried shot through to the Bahamas, that he must have been patting himself on the back for fleeing to a country from which the US could not extradite him from. With his parents there as well, he must have figured that he was safe and would still have access to his hidden fortunes. I think that Caroline Ellison was thinking along the same lines as I believe that she wanted to shoot through to the UAE.

Seems that both Caroline Ellison and Gary Wang worked out that somebody was going to have to take the fall for the dog’s breakfast that was FTX and that it they hung around the US, that they would be “recruited” by the Justice department to turn witness against SBF – and leave him swinging in the wind. If SBF had hung around the US perhaps he could have made a deal but as he went to the Bahamas, it was easy to nominate him as the fall guy.

Local angle from the SF Bay Area. I know a retired DA from Oakland. We play cards on occasion, and he calls a hand that has nothing–not even a pair–an “Alameda”, that being the name of the adjacent city on the bay. Along with Bankman-Fried, the name Alameda is hilarious tell. Truth is stranger than fiction.

Crypto isn’t a security because there is literally nothing to secure, other than a future promise of a more naive buyer.

It’s the token, which was tied to the firm’s performance and had to be held for three years. Sounds like one to me.

And what about stocks? A stock is not secured in the Uniform Commercial Code sense. It is a weak legal promise. You get a vote which has no value unless you buy enough shares to control the company or threaten to overturn the board. You get dividends only if the company makes money and the board decides to grant them.

I downloaded the Ellison .pdf and my computer shows it as zero bytes big! Uploaded it to share and it immediately blossomed into an 8.9MB file. I’ve opened it and still the downloaded file reports as a zero bytes document but if I “get information” I see the true size of the .pdf. ?!

Never seen anything like that before. I am running on a ten year old operating system if that could possibly make a difference.

Yves may have gotten the size down, at least on the second (I download this as a 304k file) … here are the totals (in bytes):

The first is reducible to 1738040 bytes (i.e., less than 2MB) using

ghostscript with a 150 dpi ebook output setting (-dPDFSETTINGS=/ebook)

The linked Ellison .pdf file looks like a compressed .pdf format, 38 pages compressed to 303 kb. When opened online or shared it expands back to it’s 38 page size for viewing. It’s odd your system shows the compressed file as 0 size, but I know some older systems would do that for compressed files for some reason.

compressing Adobe .pdf files.

https://www.adobe.com/acrobat/hub/how-to/how-to-make-pdfs-smaller

Because your are the creator of the original file it’s likely you’ll only have read permissions and share permissions.

typo: because your are not the creator of the original file it’s likely you’ll only have read and share permissions.

and another info file

https://helpx.adobe.com/acrobat/how-to/compress-pdf.html

I used the Adobe tool. I would reduce to only 2.7 MB when our maximum size is 2 MB. Tried rerunning on compressed file and Adobe would not do it. Preview in the Mac can reduce file sizes but would not work on this one.

Sometimes printing it to PDF and using that instead of the original file can solve these sorts of issues. But if it was saved as image scans rather than text it’ll be more of a challenge.

I extracted the first 9MB 7 page file. It contains no text but has 2 images of each page.

Zero bytes is likely a quirk of your OS not updating the file properties. Get Info should report the correct size.

As Eric comments, below, the problem with compressing this file is that it contains images that don’t compress well. E.g., notice the handwritten text in blue on the upper corner of the first page. Just for that, the images may be in color, which gobbles up a lot more space. There are various ways to compress PDF, and sadly Adobe’s own tools for this have been somewhat crapified.

This PDF has images which have been OCR’d to create an invisible (but selectable) text layer on top. It’s really common for PDF and I wish there were a simple way to just throw out the image layer on every page, though that would reveal all the OCR errors, which can otherwise sneak by because you see the original page scans.

These high end frauds are always fun to pick apart after they fall apart and everything spills out about how moral haphazard was a given take.

Meanwhile 2x+ good Orwells Fargo over in the legitimate banking sector agrees to $3.7 billion settlement for ripping off customers.

I’m sure the CEO dresses more appropriately for his position than SB-F.

“The amount of scrutiny crypto gets from regulators is wildly disproportionate to its size. If the entire crypto industry were a single company, it still wouldn’t top the Fortune 500 in market cap. But sadly, attacking crypto is more politically expedient than attacking the banks.”

https://mobile.twitter.com/jchervinsky/status/1605212040263598090?cxt=HHwWlIC8kZH27cYsAAAA

(responding to another tweet: “Wells Fargo agrees to pay $3.7 billion for abusing their customers, but crypto is the problem.”)

That was eye-opening. The entire crypto market cap as of today, mid-meltdown, is $812 billion. The market cap of Apple is $2.1 trillion, the Standard Oil of our time.

But how much of that “market cap” represents actual money that was “invested,” versus wash trades, pumps and other methods of inflating for the purpose of attracting new suckers, er, investors? That number should presumably be cut by half, or more.

Hmmm… wonder where is little brother Gabe hiding out these days?

That was fun!

Yeah, If we only had a press that was interested.

Dig up Randolph Hearst stat!

I delved some into the “philosophy” of the “Effective Altruism” cult– mainly so the rest of you don’t have to. It is such a grift! Read my findings here.

Excellent. Wonderfully done. You’ve nailed it. I will have to cite you. I’ve been having my sport with this whole inane CusterFluck on my blog.

Thank you. A very good read.

Seconded!

Thanks for the article. Is Just World News back again? Used to read you regularly in the hey day of blogging.

You are right to treat Effective Altruism as a grift. It is such a grift. Have you seen about the two castles they bought? Super effective altruism…

They are also a more successful offshoot of (or possibly a front to) another grift, the “rationalists” of the Less Wrong forum. Apparently when the Effective Altruism forum started there was a built in option to cross post to Less Wrong, don’t know if that still is the case. This is where the culture of extremely long winded arguments from first principles comes from.

Anyhow, the “Rationalists” believe that the singularity is near and it will lead to an evil AI taking over. To prevent it a good AI must take over instead. To “research” that problem everyone must donate to the “research institute” of their high school drop out leader. This is referred to as AI risk or AI alignment, and has gotten them millions from tech billionaires.

Effective Altruism has at its outermost layer a stated purpose of giving effectively, with legitimate (though probably copied) criticism against some wasteful charities. The bed-nets that you mention is on this level marketed as well in line with Effective Altruisms goals, and is held up as a shining example of how to give effectively. The stated goal of giving effectively fails on its own if castles and costs of the grifts of their golden boys (SBF wasn’t the first).

The next layer is longtermism. Why prioritise the here and now, when larger dangers lurks ahead? This is probably where you saw the snearing against bed-nets. As you point out, the longtermism fails because it ignores the very real existential threats that we face – global warming and nuclear war.

The third layer is and remains the AI apocalypse. Saw recently an old Tumblr conversation where one EA entusiast argued for dropping the pretence and just fundraise to prevent the AI apocalypse. The other EA replied along the lines that it was wiser to get them in by way of the bed-nets and then explain the AI risk. Besides, they would thank you once the evil AI is prevented.

When SBF this summer mentioned to a New Yorker writer that he was re-directing his giving towards AI risk, this means giving to grifters who promises to prevent the Matrix. The apocalypse can’t fail, and can motivate any cost in the here and now, because it is a matter of faith.

I have seen the Vox reporter mentioned as also being an EA. If so, their conversation takes on another aspect. Fallen and shunned, was SBF having a crisis of faith?

Tom Hanks is a Scientologist? First I’ve read. Did you mean Tom Cruise?

This prosecution could get dragged out for years, except that I suspect that SBF will try to cut a deal to save his as yet un-indicted “John Doe” co-conspirators Mommy, Daddy, and Baby Brother. That could get things wrapped-up pronto and I suspect is why they have not yet been charged.

Lamestream Media reporting SBF released on $250M bail allegedly secured by his parents house. What house in Palo Alto is sufficient collateral to back a $250M bond? Smells fishy…

I took it to mean that not only would the government seize his $250 million of ill gotten wealth that he would probably have to disgorge eventually anyway, they would also throw his mommy and daddy out on the street.

Here’s hoping mommy and daddy aren’t thrown out onto the street, but into a prison cell.

Sorry, just saw that they only asked for 1% of the bond upfront.

Yes, I feel conned, as a member of the public who was expecting SBF to spend literally all his next days in jail.

Don’t feel bad; it’s just that we live in an era when the most extremely cynical idea or insight you can come up with will in days be transformed into quaint naivete.

I was thinking that filial piety might have been the reason he didn’t abscond. His parents of course should have absconded with him, but if you’ve known any full-time residents of prestige-land, going into hiding is a fate worse than death for them.

4 years given to the Jan 6 clown that sat in Nancy Pelosi’s chair but house arrest for Sam Bankman Freid for financial crimes that exceed billions of dollars. His parents now appear to own 120,000,000 dollars worth of property abroad. What a disgrace and a slap in the face to law biding lower and middle class Americans.

Apples and oranges. I agree 1/6 guy sentence was excessive. But 1/6 guy has been convicted and sentenced. That’s not happened with SBF. SBF on current charges alone faces 150+ years in prison, and the SEC added charges to its filing based on initial testimony from Ellison and Wang. DoJ may add charges.

Given their cooperation, I don’t see how any plea deal would result in less than (spitballing) 60 years in prison.

I am sure SBF’s lawyers will be extremely eager to cut a deal since the parents will be bankrupted defending the case. The father should be charged. Problem is there is a lot of sympathy at least among Stanford circles for the parents. But this is a slam dunk case for the Feds and they like winning high profile cases.

The court did demand a huge bail bond but then made it look silly by accepting 1% as the pledged portion, not a more colorably, erm, generous 5%. $50 million still would have sounded tough. $250 million v. accepting the house is pathetic. Law prof deference.

The Bahamas property will be clawed back in the bankruptcy as fraudulent conveyance, particularly since the parents claim they have no idea they own it and won’t contest it.

Whoa. Amazing that a document of such consequence to the defendant can be executed by her attorney on her behalf.

Huh? Ellison most definitely executed it. Her signature is under “Agreed and Consented To” and she also wrote in the date.

FTX Chapter 11 lawyers are going to charge up to $2165/hour.

Good luck to all the unsecured creditors out there.