I can see the future. The odds are very high that SBF will still be in it.

It was a reasonable assumption to think that now that SBF had been charged with Federal crimes that could result in a sentence of over 150 years, that he would start listening to attorneys and zip his lips.

Nope. To much eyerolling on Twitter, SBF launched a Substack to try variations on his already tired theme of “Nothing bad happened and it was everyone else’s fault.” Earth to SBF: Richard Nixon’s “I am not a crook” and Bill Clinton’s “I did not have sex with that woman” didn’t work very well for them either.

Not only is it just about impossible to take any of this seriously, particularly since former FTX/Alameda officials Caroline Ellison, Gary Wang and Dan Friedberg are all cooperating with prosecutors. But perhaps we can do just a tiny bit of scatology so you can rest assured SBF has not miraculously become more credible or more interested in faking concern about the harm he did to literally millions of investors.

Some of the intelligence-insulting nasties1:

SBF defends the virtue of FTX International as if that was all that needed to be discussed.

SBF keeps acting as if he had nothing to do with Alameda when that dog will not hunt. New FTX CEO Roy said that the FTX/Alameda empire operated as one business. Co-founder and CTO Wang has allegedly confirmed that he created a software backdoor on SBF’s order for Alameda to hoover, um, borrow funds from FTX. From Business Insider yesterday:

Sam Bankman-Fried instructed his FTX cofounder Gary Wang to create a “secret” backdoor to enable his trading firm Alameda to borrow $65 billion of clients’ money from the exchange without their permission, the Delaware bankruptcy court was told Wednesday.

Wang was told to create a “backdoor, a secret way for Alameda to borrow from customers on the exchange without permission,” according to FTX’s lawyer, Andrew Dietderich…

“Mr Wang created this back door by inserting a single number into millions of lines of code for the exchange, creating a line of credit from FTX to Alameda, to which customers did not consent,” he added. “And we know the size of that line of credit. It was $65 billion.

SBF keeps claiming US customers were onboarded only to FTX.US. It appears this could be easily circumvented by using a VPN and the sort that was drawn to crypto for money-laundering purposes would likely work that one out.

SBF predictably omits North Dimension customers, who were snookered into bypassing FTX entirely and sending funds supposedly destined to FTX via a fake electronics retailer that sent the funds to Alameda. As a different Business Insider story summarized:

In the sprawling drama of Sam Bankman-Fried’s fallen crypto empire, the obscure, low-profile North Dimension played a key role in putting FTX customer funds into the hands of affiliate Alameda Research and SBF’s other ventures.

And according to NBC News, North Dimension operated a fake online electronics retail shop, which has now been disabled and archived. The website did not disclose any connection to Bankman-Fried or his companies.

The SEC complaint against ex-Alameda CEO Caroline Ellison and FTX cofounder Gary Wang — who have admitted to wrongdoing — alleges that FTX told clients to wire funds to North Dimension if they wanted to trade on the crypto exchange. But those were then used to fund Alameda’s trading activities.

SBF again harrumphs that FTX.US was solvent. So what if some pretty-inconsequential-in-the-total-bucks-scheme-of-things of 130 legal entities were OK? That doesn’t excuse the ginormous amount of customer monies that went poof elsewhere.

This argument also smacks of SBF losing whatever legal plot he had. The “US customers all whole” looked like an attempt to contend that the US authorities had no jurisdiction because nothing bad happened to US customers. As an aside, that conveniently ignores fraud on US investors, as in Sequoia and all the others that staked FTX entities. That’s a big part of the SEC filing against SBF. That type of securities fraud was what landed Elizabeth Holmes in jail. But the “US investors unscathed” appeared to be a big leg of the case against extradition….which is no longer germane.

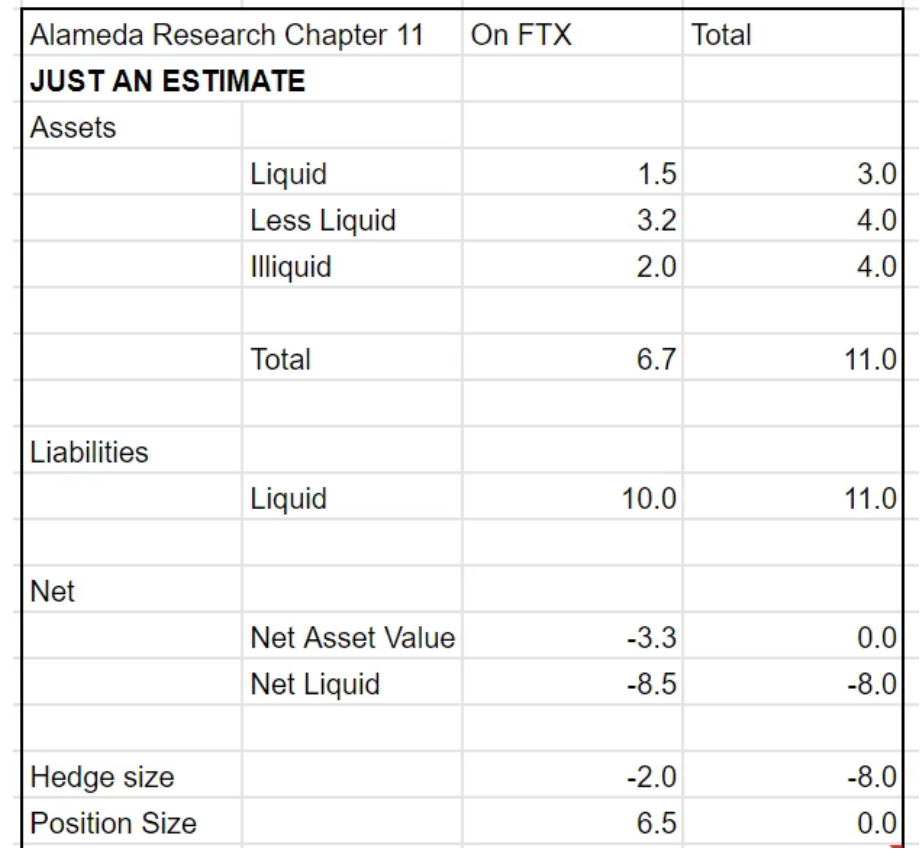

SBF acts as if what he says about FTX and Alameda financials can be believed. SBF provides several thin fables in Excel form, like this:

First, SBF claims he was not involved in Alameda in recent years, yet presents himself as able to provide a reasonable accurate if very high level balance sheet at various points at time. This is with him repeatedly whinging he has no access to any FTX or Alameda information.

Second, new FTX CEO John Ray has gone on at length about how the FTX empire is hands down the worst records disaster he has ever seen, and that he and his team will have to attempt to reconstruct much if not all of what was up forensically, from the bottom up. So even if SBF suddenly developed a Putin-level memory, anything SBF can dredge up from those days is garbage in, garbage out, because the books were no good.

Third, in an attempt to fend off egg-throwing over attempts to make claims about FTX/Alameda financial, SBF trotted out sections of a clean accounting letter. FTX International’s “never heard of them” accountant Prager Metis does not claim to have a practice in financial services, and in the industries where it says it has expertise, the entertainment and music industries, it lists no clients. Moreover, Coinbase ferreted out that its “entertainment” seems to be on the raunchy side. Mind you, sex industry businesses have just as much right to solid record-keeping as anyone else. But they are generally pipsqueaks compared to FTX.

Yes, there is more, but that’s already more effort to parse than SBF warrants. Some additional observations:

SBF posts FTX ‘pre-mortum’ on new substack, @briebriejoy and @robbysoave react: pic.twitter.com/KZpFoQrmdY

— Rising (@HillTVLive) January 12, 2023

And poor Caitlin Ostroff had to perform the thankless task of writing a Wall Street Journal story on SBF’s Substack, meaning she had to go the “just the facts” route as opposed to heaping well-warranted scorn on it. But she managed to get some revenge:

heh whoops that was unintentional, good catch–think there shouldn’t be a paying option anymore…

— SBF (@SBF_FTX) January 12, 2023

Sadly, what SBF’s insane insistence on trying to sell what no one is buying, his reality-untethered version of The Persecution and Assassination of Sam Bankman-Fried As Performed by the Inmates of the Asylum of Cryptoland Under the Direction of the Department of Justice, tells us he will never shut up. Even if he lands up in a Federal gaol for a very very long time, he will do everything in his power to get heard. Substack. Twitter. Articles if anyone will have him. Rumble. Rokfin. YouTube. And if the authorities decide to choke off media and publishing outlets, it’s not hard to imagine SBF would work to create a ginormous Pen Pal following.

In fact, obsessive dedication to a task or hobby is a survival strategy in prison. SBF already has staked out one, his tiresome, endless denials. From The Marshall Project:

The first time I heard someone use the term “bid” was on my first day in federal prison, just four days before my 21st birthday…

Most new guys just end up lying in bed on their first day; the bunk becomes a sanctuary, a safe space where they hide from others, as well as a new reality — as if you could just go to sleep and one day wake up and suddenly everything will be back to normal. After watching me lie in bed all day, my celly — a skinny, middle-aged dude from Detroit — tried to offer some words of encouragement.

“Man, you gotta get a bid,” he said.

“What’s that?”

“You know — a bid. It’s how you do your time.”

We went back and forth on the details. It seemed like an arcane term that didn’t really make sense until you’d lived in the system for a while. From what I could gather, the word seemed to derive from the noun “bit,” pertaining to the length of a prison sentence, much like a “stretch” or a “stint.” Something like: “This seven-year bit is a fuckin’ bummer.”

“Bid” was something entirely different, more like a purpose or raison d’être. It was all about how you did your time, like finding a hobby or hustle to get you through your bit. For many guys, it was about winning, no matter what the endeavor was. Others just wanted to make money. Some guys used it simply as a way to occupy their minds. For everyone, though, it was all about escaping the slog of captivity. My celly told me he bid off a lot of things, but mostly just gambling — although he did like to dabble in some prison hooch from time to time. He said if I could find this thing — this sense of purpose — it would make all the difference in my life. Without it, he said, my sentence would feel like an endless misery. “Do the time,” he said. “Don’t let the time do you.”

All across the compound, there were countless ways of bidding, from gambling to religion, education to gang life, sex, art, and prison jobs (the average prisoner only made about 10 to 50 cents per hour). Sports were a popular way to bid….Weightlifting seemed to be the most popular form of bidding. …

Sometimes, perhaps inevitably, certain bids overlapped, propped up by their own sub-economies. Some guys bid off of gambling on the games — basketball, softball, soccer — while others sold food to the crowd. Cooking homemade (in other words, cell-made) food was probably the most common form of bidding. To do this, the cell chefs would often rely on overpriced commissary items, which they would use to concoct elaborate rice bowls, burritos, even pizzas, using just a microwave and simple ingredients like packaged meats, ramen noodles, and seasoning salt. Even if only momentarily, these meals gave you comfort and escape from the everyday wretchedness of prison life.

So we can already guess at what SBF’s bids are likely to be. Vegan home cooking. And doing everything he can to tell a story with him at the center. Perhaps he’ll keep beating the “I was done wrong” horse. Perhaps he’ll try a new ruse, like coming up with a new Agey self-redemption formula so he can cast himself as a star behind bars.

The one silver lining, from the patience-strained, finance-literate audience perspective, is that SBF’s loquaciousness not only increases the odds of success prosecution but also the judge throwing the book at him in sentencing. He’s not manifested any willingness to admit guilt and show remorse, and he’s dug himself in so deep that it’s hard to see how he could pull off a Damascene conversion.

But he will not go away quietly. And even though SBF’s body may wind up being locked up, it is likely the public still won’t be fully protected from him.

____

1 I wanted to say “turdbits” but Lambert said no.

Glad you found time to post on this latest breaking development from Crypto Boy Wonder. We need an alliterative term to describe or define him, perhaps, so to take away his most famous attribute, which is initials in all capital letters. Famous or infamous, we know some historically monstrous individuals this way. Bundy, Gacy, Dahmer. Ponzi, Madoff, SBF. See what I did there…

In the recent series on Netflix about Jeff Dahmer, episode after episode just repeated the errors by the adults in Dahmer’s life. So by the time Dahmer himself becomes an adult, his lies seem to be acceptable enough and things just continually slide into a horrific series of final outcomes. Reverting back to FTX, instead of murdering, we get SBF separating marks, er investors, from their money and he continues to believe his own truth. It really is going to be his personal historical version. Hand me the popcorn.

Millions were swindled, some of those millions are criminals trying to hide their winnings in crypto and lost it all to PsychoSam.

PsychoSam, if he were smart, would demand solitary.

Yves Smith: Delicious reference >>

“Sadly, what SBF’s insane insistence on trying to sell what no one is buying, his reality-untethered version of The Persecution and Assassination of Sam Bankman-Fried As Performed by the Inmates of the Asylum of Cryptoland Under the Direction of the Department of Justice, tells us he will never shut up.”

Yet the original Marat/Sade by Peter Weiss is riveting and brilliant. And disturbing.

The Fried Logorrhea is definitely a problem. It’s as if we are seeing Death of a Salesman, but the death of a truly bad salesman who doesn’t have the moral compass of Willy Loman. As if there was much of a moral compass.

ABC. Always be closing. It is what passes for an ethos now. Add to it Fried’s ultra-privileged background and his ability to find his meretricious niche in an “industry” one step below smash-and-grab.

Yet Fried also represents the logorrhea of the times–the endless lengthy blog posts, the instant books (with sequels), the YouTube channels with long daily episodes, the repeated interviewing of such blabbermouths as Hillary Clinton and Jordan Peterson and Mayor Pete and Kanye West.

Why, one may even note Zelensky’s logorrhea.

How will Fried end? Not with a bang but with a whimper. Zelensky, too. (I suspect that there will be an end–unless Fried finds a way of going into syndication.)

I did see the movie version. Excellent.

Another disturbing but very fine film, set a bit earlier and in England, is The Libertine. Johnny Depp is terrific.

https://www.appliedbehavioranalysisprograms.com/lists/five-signs-narcissism/

See #7.

The working theory among mental health care professionals is that something pretty traumatic happens to these perpetual children early on from which they never recover, somewhere along the lines of #8. They are alone and in danger, probably from those most in entrusted with assuring them they’re safe. It’s a defensive mindset that prevents them from developing an inner life (where one develops compassion and connection with others), that hollows them out since all their energies go into strategizing and defending their outer selves. Their own opinion is the only one they really trust.

There’s no cure for borderline personality disorders. Unless he can find some use to admitting guilt to HimSelf personally, he’ll never change his tune. See ‘Donald Trump’… ironic that his wall is falling down.

Unless Sam is given a country club prison to serve his time in, he is not going to do well behind bars. Not long ago he was one of the Masters of the Universe. Billions flowed through his fingers and he could literally afford anything that he wanted. Power players came knocking on his door for ‘donations’ and his mug was well know in the media. But what happens when he starts his sentence and that all goes away? How will he cope? Will his parent’s fly in from the Bahamas to visit him in prison if it might mean their arrest? How many of his friends will stick by him? Unless he successfully stashed away a lot of money, what will await him on his eventual release? A book deal? The speaker circuit? For everybody else, the best thing that could happen is where things reach the stage where people ask ‘Say, whatever happened to SBF?’ and other people ask ‘Who?’

Martha Stewart was in a country club prison for six months. She made clear it was pretty awful. You go to bed and get up at set hours, on a nasty mattress, eat only at set hours and get pretty terrible food and can’t go anywhere. Even if there is an OK library and Internet room and gym, that has to get old fast.

I had a friend who was in a low-security federal prison for three years in the late 90s. He was a relatively young man at the time but almost died while inside when he suddenly had a serious medical issue but could not get the staff to pay attention to his condition. He eventually passed out and two of his friends took him to the infirmary, leaned his body up against the door, knocked and left. He was then treated but would have been a dead man it not for his two buddies. It’s no picnic.

Coming from another angle, I suspect that SBF is an extreme example of flawed neoliberal PMC child rearing practices. The daily gold stars in highly curated$$$ childcare for minimal accomplishment to support self esteem.

This continues on through schooling which rewards a certain type of brightness. And certainly includes puberty onset pot use and gaming that replaces the development of any real coping skills.

“Raised” by clueless careerist academics who would only monitor the stats and have no idea of the teen lies.

Actually raised by feral peers whose first rule was to keep the parents chill.

Not so uncommon in neoliberal PMC Amrika although SBF worked it to an astonishing scale.

I would call him Davos Boy Interrupted, not quite the Man.

“Coming from another angle, I suspect that SBF is an extreme example of flawed neoliberal PMC child rearing practices”

Saw a bit of this firsthand. Years ago I applied for a job as an assistant at a Manhattan daycare. Looking back, I realize the ripe potential for a comedic disaster movie in the making.

Thank the gods, I didn’t get the job. I was obviously out of place amongst the perma-grinning, sparkly clean cut Aryans who staffed the place. But their conduct around the children was telling.

Constant praise for every action the children made. Constant affirmation of everything they did. If they did something wrong, accidentally or not, it was verbally smoothed into being ok. No one contradicted the children or told them a firm “No.” that I heard.

The reveal was when I was monitoring the children as they climbed up a short ladder and slid down a slide. (The indoor playground was a marvel of expensive toys and jungle-gym equipment.) One little bugger slid down then immediately hopped up and ran full tilt until he smacked head first into a wall. He plopped down on his bottom and began to cry.

Instantly, I was swarmed by staff members. “What happened!? What happened?!” They surrounded the child and began cooing and soothing him like the attendants of some princeling.

The thing that stuck with me the most was the abject fear in their eyes. Gone were the perma-grins and the upbeat tones. This was a very expensive place. A sad kid with a bruise would bring the hellfire of the manager and not unlikely the threat of litigation from the parents. I got home and realized I dodged a bullet when the guy called to tell me that, unfortunately, I wasn’t hired.

That certainly rings true. Dear friend, now retired, taught community college English. One of her students, who received a low grade on a paper, informed her that he needed an A. She told him that wasn’t happening, since the paper in question wasn’t A-level work. Student’s parents then complained to administration, who didn’t back her up. She saw the writing on the wall (pun intended) and got out.

Perhaps related? My employer, a national nonprofit, last year required firmwide remedial grammar training, since written internal and client communications were that bad.

Uhhh… where’s little brother Gabe?

Excellent question – he seemed to have been running the political donation arm of the enterprise so perhaps he will be protected…

I regularly talk to and financially support an inmate (son of a longtime family friend, we grew up together). “Bid” might be short for “bidness“ but he’s not sure.

Once I started supporting him financially, he dove directly into arts and crafts, and often sells his wares, like the article says. He also does that in-cell cooking. Having become quite familiar with the commissary catalog, I can tell you that there’s likely not many vegan options anywhere on it. It’s really got a convenience store kind of selection.

Just a quick comment this time. The absolute topper of BF’s delusion is that he apparently thinks he could still trade Alameda out of its multibillion hole if only allowed to run the shop. I don’t have his exact words but he’s said/written that the current John Ray mgmt team is too risk averse, that if Sam Bankman Fried’s Flying Circus were still airborne that it would only require his trademark fearlessness and tolerance for risk to redeem the situation. Ironically, this is exactly what every bank teller who has a system for betting the ponies has said when his till comes up empty and he’s arrested for embezzlement.

The overlap between trader and gambler is blurry but I learned a long time ago, while reviewing my own mistakes committed during the Dot-Com crash, that the truly successful traders have two characteristics: first, they take winnings off the table periodically on the way up; second, they close out losing positions long before less successful traders, especially amateurs. When a position starts to head down they don’t hold on hoping to recapture the fleeting high values but instead walk away with what they’s still got. It is very rare for pros to ride a position into the ground.

The amount of flattery and verbal fellatio that BF has received in his life has been undoubtedly prodigious, and it will likely resist any corrosive effects of reality. His vaunted “effective altruism’ is nothing more than old utilitarian wine in new bottles, and at the end of the day it’s just situational ethics 101: what’s banned for thee is OK for me because I mean well. My strong suspicion is that crypto detectives are going to be sleuthing in BF’s records for years and will find many millions of dollars stashed in “cold wallets” all over the world. Unless BF deluded himself as well, which is always possible, he must have known how fragile his house of cards was and put aside major ‘rainy-day’ funds. BF cold wallets may even become the new “Lost Dutchman’s Mine” legend that inspired countless adventurers in the 19th and 20th centuries to head out into the desert to track down a rumor.

Cheers

P

Good intel on prison life thanks. I worked with a guy last year that did time in not so pleasant prison in CA. His stories seemed like his glory years, as he often related them to me. I learned more than I wanted. As in you have to wet your shank within 3 months to be accepted into your one of 3 gangs in the prison. He also got revenge on someone’s son who’s father slashed his brother and almost killed him on the outside.

Not pretty. The best advice he gave me was to to Fed time. As fed time is the best time. I might have to resort to that option in the dystopian future. Can I bring my kindle?

For me, the most infuriating aspect of the sociopaths is their arrogance. Their relentless self belief that every one else is stupid.

Look at Elizabeth Holmes desperate attempts at avoiding facing the music. How do her lawyers sleep at night, producing school books showing her writing when as a child, do good, do no wrong as mitigation. It would be laughable if it wasn’t so infuriating. Thank goodness her infant children will be saved from her sociopathic behaviour, when they slam the cell door on her for a decade.

The is a fabulous book by Dr. Paul Babiak;

Snakes in Suits, : Understanding and Surviving the Psychopaths in Your Office

It’s a must read to understand where it all goes wrong when deranged ego mixes with power and money cocktail.

Fortunately we can rest easy that Sam FB (I’m not using his full initials, as it gives him a unjust allure, so I use his given name and shorten his ludicrous pretentious surnames to initials) that he will get media saturation, then disappear down the penitentiary hole he will deservedly be dropped down.

Now more importantly, it’s his parents I have the real issue with. Firstly for spawning him, and secondly for condoning his nefarious actions.

They look to be in it up to their necks. Let’s see them hauled through the courts.

Seen on TikTok: SBF = Scam Bankrupt Fraud

Thankyou. Joe Renter what is ‘Fed time’? Does that mean Federal prison is better than county or state prison?

A major theme of this post is that SBF is in our future like it or not. I really take exception to this concept. It reminds me entirely of EMusk. Attention seeker. And the media just keep giving it to him. And for our part, because he is a headline we chose to click and consume it. All we need to do is remove our attention. Attention is the only thing that keeps propping him up. Ignore him and he will go away.

Stop being distracted and place our attention on subjects more worthy of our attention. If it’s not ‘news’ that is actually necessary, and just noise, then we need the discipline to ignore it.

Now I entirely appreciate that certain subjects are necessary for us to be involved in –

the fraud by multiple parties, the injured parties (investors). Tesla going bankrupt (has it happened yet?) SEC filings and so on.

But on the level of personality or ‘infotainment’, these fool caricatures are not in my future and not in my headspace. No way.

It’s not clear to me from the story whether a ‘bid’ is necessarily a money making endeavour or just a pastime, or sometimes a combination of the two and sometimes not.

Putting on my tinfoil hat for a minute, I’m pondering whether it might be possible that sbf is basically continuing to make clearly flimsy/false protestations about his fraud to keep public discourse/attention focused there rather than on whoever might be implicated in his supposed political donations and whatnot.

I’m not sure if I find myself more accepting that someone could be such a morally wretched man-child or that various politicians/political operatives/etc could be so scheming. I suppose these aren’t mutually exclusive though.

(also I like “turdbits”)