Legions of European companies are succumbing to the final straw of Europe’s largely self-inflicted energy crisis.

Bankruptcy proceedings in the Canary Islands, Spain’s heavily tourism-dependent island chain, soared a whopping 276% year over year in 2022, according to the latest data published by the General Council of the Judiciary (CGPJ) in its report, “The Effects of the Economic Crisis on Judicial Bodies.” The archipelago also saw the highest rate of dismissal claims in Spain, with around 400 of every 100,000 inhabitants losing their jobs.

But this trend is not unique to the Canary Islands, nor indeed Spain. It is happening across large swathes of Europe’s economies, as legions of businesses succumb to the final straw of Europe’s largely self-inflicted energy crisis.

In the EU as a whole the number of bankruptcy declarations initiated by businesses increased substantially (26.8%) quarter-on-quarter in the fourth quarter of 2022, reaching the highest levels on record since Eurostat began collecting EU-wide bankruptcy data in 2015. The number of bankruptcy declarations increased during all four quarters of 2022. As the Eurostat graph below shows, at the current rate of business destruction it won’t be long before businesses are closing at a faster rate than they are opening.

This trend, of course, was not hard to foresee. In August 2022, I warned that the EU’s largely self-inflicted energy crisis and resulting inflation is tipping legions of small businesses over the edge:

After reeling from one crisis to another, Europe’s heavily indebted and deeply debilitated small businesses — the backbone of the economy — face the ultimate threat from energy shortages and soaring prices.

With the specter of stagflation looming large over Europe and the price of energy rising at a blistering pace, hundreds of thousands, perhaps even millions, of small businesses face the grim prospect of closure this winter. In the UK, much of the news cycle in recent weeks has been dominated by the plight of struggling families grappling with surging energy bills. But many businesses are, if anything, in an even worse pickle, since they don’t have price caps on the energy they pay. Some business owners are facing an increase in bills of more than 350%.

Across Europe small and medium-sized businesses (SMBs), particularly in sectors like travel and tourism, culture and hospitality, have borne much of the brunt of the economic fallout of the pandemic. The stimulus packages — including furlough programs, debt moratoriums and low-interest emergency loans — helped to tide over many (but not all) of the worst-hit businesses but that support has ended. Meanwhile many of the economic problems spawned by the pandemic, including supply chain bottlenecks and labor shortages, continue to linger. Energy shortages and surging prices are likely to be the final straw.

In 2022, inflation in the EU tripled to 9.2%, its highest reading ever. According to Eurostat, all economic sectors witnessed a rise in the number of bankruptcies in the fourth quarter of 2022 compared with the previous one. But the hardest hit sectors were transportation and storage (+72.2%), accommodation and food services (+39.4%), education, health and social activities (+29.5%), sectors that had already suffered significantly during the pandemic.

The contrast with the pre-pandemic bankruptcy rate is particularly striking. Compared to the fourth quarter of 2019 — the last quarter before the Covid-19 lockdowns and other pandemic restrictions came into effect — bankruptcies in the accommodation and food services sector surged by 97.7%, while the transportation and storage industry registered a similarly noteworthy 85.7% increase.

As I reported in February, companies in the United Kingdom, now a distinctly non-EU member, are hitting the wall at the fastest rate since the Global Financial Crisis. Much the same is happening across large parts of the European mainland.

The country that witnessed the highest rise (64%) in bankruptcies last year was Spain, whose economy actually grew by 4.7% according to the OECD. This can be partly explained by a new restructuring law enacted in late October, which simplifies and accelerates the debt restructuring process. Yet Spain also registered the second highest rise in bankruptcies in 2021, behind Romania. It is hoped that the insolvency rules will help reduce the country’s high bankruptcy rates, thereby attracting investment into the eurozone’s fourth-largest economy. For the moment it appears to be doing the opposite.

Another reason for the recent sharp rise in bankruptcies in Spain is that the obligation to file for bankruptcy was suspended during the COVID-19 pandemic to prevent an avalanche of business failures. This meant that many companies that would have hit the wall, including some longstanding zombie firms, were given a stay of execution. That suspension was lifted in July 2022. The result, as feared, has been an avalanche of business failures.

Other EU countries that have seen a notable increase in bankruptcies in 2022 include Austria (57%), France (51%), Belgium (42%), the Netherlands (18%) and Finland (8.5%). It is small and medium-size companies that are at the sharpest end of this trend. As Euractiv reported in January, insolvencies in France and across Europe have hurt small businesses, particularly one-person outfits, the most:

Yet [a report from data analytics consultancy] Altares… shows the situation is becoming increasingly worrying [for] larger SMEs with 10-99 employees.

“3,214 SME insolvencies were recorded in 2022 compared to 1,804 in 2021, a surge of +78% over one year,” the report reads. A third of these insolvencies occurred in the last three months of 2022, representing a 93% increase.

“When SMEs fall, it is the whole local economic network that is impacted,” Thierry Millon, who directed the study, told EURACTIV France.

“They can no longer pay their suppliers, and the job loss is much greater across the value chain,” he said. What’s of particular concern to him is that some of these SMEs were economically sound to start with before they were forced to unwind.

Soaring energy bills, low economic growth and the numerous financial constraints imposed by the repayment of state-guaranteed loans all contribute to this trend.

The “whatever it takes” era coined by President Emmanuel Macron to help companies by any means possible during the pandemic is also over.

This is a common theme in many countries: the financial, fiscal and furlough-based safety nets that were erected for businesses during the pandemic have long disappeared. A lot of the small in-person businesses that remained standing during the pandemic took on huge amounts of debt to weather the lockdowns and other restrictions, often for the first time. Once economies began reopening, not only did they have to start repaying those loans; they had to do so against a backdrop of surging input prices and, in some sectors, lacklustre demand.

It is easy to forget that long before Russian and Ukrainian soldiers began exchanging fire in February 2022, inflation was already rising fast in most Western economies, due to a cocktail of factors including, most notably, ongoing supply chain shocks and dislocations. Other factors include post-lockdown pent-up demand, worker shortages and the unprecedented fiscal and monetary stimulus unleashed during the pandemic.

Central banks have since begun hiking rates in a largely vain attempt to contain inflation. In the process they are making it even harder for heavily indebted consumers and businesses to service their debts.

For many businesses, the conflict in Ukraine and the spiralling rise in energy prices triggered by the US and EU’s backfiring sanctions on Russia were the final straw. In Belgium three-quarters of independent retailers fear bankruptcies over the coming months, according to market analysis firm GraydonCreditsafe. Shopkeepers blame their financial difficulties on multiple factors, including soaring energy bills, government-mandated wage indexations, and broader inflation.

But curiously, not all countries are suffering a sharp rise in bankruptcies. Some, such as Italy, Portugal, Poland, Rumania and Slovakia, actually registered fewer bankruptcies in 2022 than 2021, for reasons that are not entirely clear to this humble blogger but presumably have to do with each country’s particular bankruptcy rules legislation, the financial support programs offered to companies and ongoing debt moratoriums. Perhaps NC readers living in those countries can help shed light on the situation.

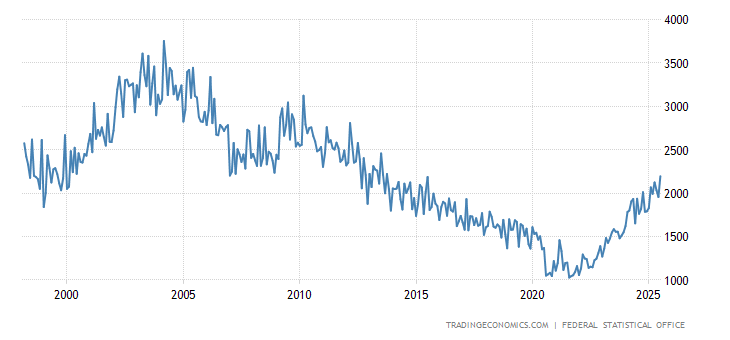

The full-year data for Germany is not yet available, but the data to November (as shown in the Trading Economics graphic below) suggest that the long-term downward trend in bankrupcties is beginning to reverse, albeit slowly.

The National Association of German Cooperative Banks (BVR) expects significantly more company bankruptcies in 2023, reports the German business weekly Wirtschaftswoche. Compared to 2022, BVR has forecast an increase of around 12% to approximately 16,300 insolvencies.

That would still be lower than the levels pre-Covid. Generous state-aid programs throughout the pandemic and the energy crisis have played an important role in protecting German companies from bankruptcy, the WW article notes. This is a luxury that other, more indebted EU governments can ill afford to offer. Another key factor in staving off (for now!) a dramatic surge in bankruptcies is the high levels of equity held by many German companies.

However, while German businesses may be hitting the wall in fewer numbers, many larger companies are voting with their feet and relocating a large part of their operations elsewhere. They include the automotive giants BMW and Volkswagen. Just a few days ago BASF, the world’s largest chemical company, unveiled plans to downsize its production in Europe, closing several of its German production facilities and laying off around 2,600 workers. The German chemicals giant cited increased energy prices as the main reason for its decision.

A small price to pay to fight Russian fascist imperialism.

(And yes I am European)

A large price to pay to service US hegemonic pretences. And this is only the beginning of it.

(European too)

Well, which one would you prefer to have energy subservience to?

Well, if the choice is being vassal in either case, them probably to the cheaper one?

But perhaps the problem is with the implied notion that buying oil from Russia makes one subservient? I find it interesting that Europe must stop trading with Russia completely and immediately to make itself free, but when Russia turns to China for trade, it is presented as fail for Russia, because China will eat them for breakfast and somehow make them their vassal just by buying oil and gas. If only Western masters could learn from these cunning Asiats!

Well said. Many don’t know, or won’t admit as to who caused the problem in the first place.

Is that you, Ursula?

Nah! That’s “Jungle”‘Josep Borrell

Sure sounded like it.

I know we’re all supposed to have been brainwashed by now (European here), but last I checked I did not sign up for this war or the wholesale destruction of European businesses and jobs.

I hope our “dear leaders” see the light sooner rather than later, but doubt it, or pull the proverbial rabbit out of the hat (faster, but not too pricey energy transition, but also doubt that).

Failing that, will have to cut my losses and leave this continent.

At least it’s novel strategy. Last time when Europe was fighting Russia for real, the aim was to get hands on their oil and other resources as fast as possible. I guess after studying that fiasco the front row folks determined the best way to defeat Russia is to starve ourselves of resources as much as possible.

I suppose you’are a german, Leo(pard), as they sadistically love to name their tanks after big cats

Since the globalists have defined that nations are over, I guess I can say that I am European too…

And I am very happy to be sacrificed for “western values”, azov battalion and austerity!

“A small price to pay…”

You owned one of the bankrupt companies?

Or is that a small price someone else had to pay?

None of that is the price for fighting anyone. That is a price for financial stupidity and medical ignorance.

(And yes I am Russian)

How useless is this?

“highest levels on record since Eurostat began collecting EU-wide bankruptcy data in 2015”

Data on corporate bankruptcies in Europe likely exists going back to 1615. An institution such as Eurostat must have the personnel to pull together historical data going back decades, if not centuries. Data going back to 2015 tells us very little. We would do better to search our own memories “Oh yeah, there were a lot of bankruptcies in 2008-10” and get a better feel for the current data than just looking back to 2015. Jokers.

Nevertheless, the self-inflicted energy crisis is a complete failure of political governance. Cutting one’s nose to spite one’s face, springs to mind.

Nice to know that everything’s going to plan as far as Washington is concerned. As an economic competitor to the US, the continent is being de-industrialized and industries encouraged to move to the US. All these bankruptcies are just a sign of this process at work – and those businesses & jobs aren’t coming back either. And now that Washington has their hands on the gas supply to Europe, they can dial it up or dial it down depending on what they want those European countries to do. So for example, they might demand that the EU adopt US unemployment practices and use the money saved to buy US weapons instead. A US general actually suggested something like this a few short years ago. And if they don’t, then maybe those LPG tankers might start to run late.

Nick Corbishley: Some on-the-ground ideas from Italy, and the other commenters from Italy can correct me.

Italy did well in 2022, with GDP growth estimates up to 6 percent (positive). Growth for 2023 is estimated / guessed at 3.0 percent.

Some factors helped to keep businesses afloat:

–Introduction of reddito di cittadinanza (guaranteed income) means that many people have more disposable income. In Italy, food shops, open-air markets, and grocery stores are always crowded–and the more disposable income, the more these small businesses can thrive.

–The Superbonus, which encouraged renovations of buildings and buying of new appliances, stimulated the economy. For most of 2022, I was constantly steering myself around scaffolding and draping that blocked sidewalks. There is less of it now, but still plenty of work going on. A major, effective stimulus.

–In 2021, the Italian economy was still staggering from the pandemic. Because Italy is still very much a country of small and family-owned businesses, that produced a cash crunch.

–In 2022, some restrictions were removed, and Italians began to shop for basics and such. Now, in 2023, the crowds are out–a friend of mine and I were in a crowded historic square here in Chocolate City yesterday, early evening, and the locals were out in droves. He commented on how it would make the merchants happy.

Now, Salvini and Meloni have wrecked reddito di cittadinanza and the Superbonus. So the local branches of the U.S. Republican are in control–and the economy doesn’t look so grand. Keep an eye on developments in late 2023 and into 2024…

Molte gratzie, DJG.

And Italy needs that growth badly, after 25 years of stagnation to be a founding member of the euro.

This seems ominously like Versailles II this time in the form of energy prices killing the economy. Wonder who said “Family blog Germany” then.

The article ends in „The US“. Something seems to be missing.

Aaaaaaaaand it’s gone! Thanks, Futility, for the heads-up.

In Austria, we had fewer bankruptcies during the first Covid years compared to pre-pandemic times due to massive gov. spending, this might explain some of the surge mentioned in the article

BMW had already announced an expansion of their local plant into EVs. That plant sends cars all over the world. The high value add gasoline engines are still made in Europe but BMW, like other car makers, may see that as a fading business.

We have BASF too. Going by local billboards they may have trouble with staffing. Or maybe they too are expanding.

Well, BASF just announced they would fire 2600 people in Germany.

I’m happy to welcome the new kids on the colonial block: Western European States!

In truth they’ve been a semi-colonial semi-core since WWII. As the US ptb perceive themselves losing control of the rest of the world, what the Western Europeans are now on is the chopping block.

Not every business which closes declares bankruptcy. Some just shut up shop. So the actual figures may be worse.

Fantastic that Italy has this reddito di cittadinanza (guaranteed income)! How did they sneak that past the EU?