Yves here. I must confess to not fallowing the cascading failures across crypto-land all that closely, save for the spectacular and instructive collapse of FTX. As most of you know, Silvergate offered dollar deposit services to many crypto exchanges, and also got out on the wild side by taking on crypto risk via products like offering collateralized loans against Bitcoin.

Readers may recall the ire over the fact that Silvergate borrowed $4.3 billion from the Federal Home Loan Bank of San Francisco. It was able to do so because it was originally a tiny mortgage bank….and one suspects did not ‘fess up to the FHLB about its huge change in business focus.

I can’t recall the last time a bank voluntarily liquidated, as opposed to failed or was sold. Given that it is in legal hot water (under DoJ investigation for fraud), no one with an operating brain cell would buy it, charitably assuming it had any remaining value. Silvergate says it has fully repaid the FHLB and will also return all deposits. One imagines this is to try to minimize liability while it is still possible to make the most important creditors whole.

Wolf Richter linked to the Silvergate press release announcing its intent to wind down. The statement that depositors will get all their dough must be reassuring…..but why is Silvergate still willing to take in more of those funds? See the note at the top of the website:

Separately, you can still poke around the site and get a heady dose of crypto triumphalism.

By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street

In a tersely worded press release this afternoon, Silvergate Capital, the holding company of crypto bank Silvergate Bank, announcedthat it would “wind down operations and voluntarily liquidate” Silvergate Bank “in an orderly manner and in accordance with applicable regulatory processes.”

This comes a day after Bloomberg News reported, based on its sources, that FDIC examiners were rummaging through the banks books and records at Silvergate Bank, and that FDIC officials have been in discussions with Silvergate management to figure out how to move forward.

So it seems, management has arrived at a decision on how to move forward.

On January 5, I’d said in a headline about Silvergate’s shocking filing that day, that “I’m waiting for the FDIC to show up.” I had to wait about two months.

In the announcement today, Silvergate said:

“In light of recent industry and regulatory developments, Silvergate believes that an orderly wind down of Bank operations and a voluntary liquidation of the Bank is the best path forward.

“The Bank’s wind down and liquidation plan includes full repayment of all deposits.

“The Company is also considering how best to resolve claims and preserve the residual value of its assets, including its proprietary technology and tax assets.”

The announcement of the final act for the bank comes just days after Silvergate Capital issued a “going concern” warning, on March 1, along with a slew of other bone-chilling items – bone-chilling for Silvergate’s investors and any remaining depositors with balances above FDIC deposit-insurance limits. It said:

It would be restating its financial statements and would show an even bigger loss than the $1 billion loss it booked for Q4; it would not be able to file its annual report by the deadline due to “management’s evaluation of internal controls over financial reporting”; these losses would “negatively impact the regulatory capital ratios” and “could result in the Company and the Bank being less than well-capitalized”; and it was “reevaluating its businesses and strategies in light of the business and regulatory challenges it currently faces.”

“Oh dude,” I moaned after I put that list together on March 1.

And so it seems, management completed the reevaluation of its businesses and decided to shut down and liquidate the bank.

But it did pay back the loans from the Federal Home Loan Bank. Part of the additional losses disclosed on March 1 come from the sales of additional Treasury securities to raise the funds to repay the $4.3 billion in short-term advances it had received from the Federal Home Loan Bank of San Francisco (Silvergate Capital is headquartered in California). Silvergate had disclosed the advances as part of its filing on January 5. The fact that the FHLB was lending $4.3 billion to a crypto bank had caused quite a ruckus. On March 2, the FHLB confirmed that these advances have been “fully repaid.” So that’s off the table.

Silvergate also said that it shut down its real-time payment system into the crypto world, Silvergate Exchange Network (SEN).

Silvergate announced on January 5 that it had scuttled its efforts to develop its own stablecoin, based on the Diem technology that it had acquired from Facebook, and wrote off $196 million, which was part of the $1 billion loss in Q4.

Silvergate has been under fire from regulators and from inquiries in Congress. And according to Bloomberg earlier is being investigated by the Justice Department’s fraud section.

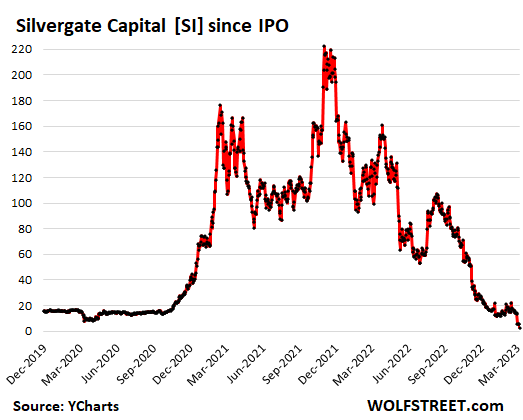

In terms of the stock, Silvergate Capital [SI] has attracted hordes of short sellers and hordes of dip buyers. It has been one of the most brilliant heroes in my pantheon of Imploded Stocks.

In after-hours trading today, the shares kathoomphed another 44%, I mean, not that it matters anymore, to $2.76, down 99% from its crypto-crazed consensual-hallucination peak in November 2021, of $239. But that’s one of the ground rules in the crypto world, and for companies that want to ride up the consensual-hallucination of crypto: easy come, easy go (price data via YCharts):

That stock chart can be summed up in Dickensian terms. It was the best of times, it was the worst of times. Okay then it was the ending. I was listening on CNBC after 5pm yesterday and they covered this announcement.

Yeah you hope the regulators appeared in dark SUVs and were wearing Oakleys when they showed up. It will also be interesting if the particular FHLB bank (not the entirety of the FHLB system banks) gets scrutinized for actually permitting the advance to occur. I mean in hindsight there is a lesson, and it’s typically to not extend advance funding in particular circumstances.

Interesting point. Its an interesting time for the staff of the FHL systems banks. Are they arguably just as important for the system? I think so. They are certainly used. Should they still exist? Well, its a long story.

Are they propping up a moral hazard-ridden process of mortgage origination in the US? To me, obviously so. But the whole process of US mortgage origination is absurd on multiple levels. Its interesting to see how that process can get wrapped around the whole crypto world.

Very appropriate quote since the Dickens novel you’re quoting from ends with the fall of the guillotine.

Hopefully there will at least be a perp walk or two in this case. Hard to believe the company could be this involved with crypto and fail so spectacularly without there being some fraud involved.

FHLB advances are essentially collateralized short-term funding loans. They are haircutted on schedules that are, by industry standards, deeply punitive for liquid (often times fhlb) collateral. As Richter noted in the article these were fully repaid; if they weren’t I suspect that FHLB San Fran would’ve turned a quick liquidation profit.

I suspect that Silvergate couldn’t outrun the rate hikes and the market value of its fixed income portfolio, hence the FHLB wouldn’t lend anymore money vs. the counterparty credit regardless of the creditworthiness of the collateral involved. To be fair this unwind so far seems like a non-sensational story about the system working effectively and limiting contagion. That’s not to say people aren’t idiots or scamsters, I’m sure they are and I’m sure Silvergate and its associates have both in their ranks. I’m just pointing out that idiots and scamsters don’t have the impact on the financial system they did in 2008, think of the notional loses of Archegos compared to BSAM and the subsequent impact.

I do think there is a big story in all this, about how ZIRP perverted the nature of money, culminating in non-sovereign “crypto”. About our culture of speculation using crypto as a vehicle to speculate on speculation itself. About financial engineering creating fixed income returns for crypto holdings in a way that clearly fleeces the crypto deposit holders (although this may be peripheral to Silvergate). But I don’t think there is anything untoward about the behavior of the FHLBs. It’s plain vanilla behavior, not a “bailout”; I think the scrutiny around it arises from the familiarity we all have with the structure and terminologies of the GFC. Of course nearly two decades hence it’s all different. We keep looking over the horizon for the next crisis but really it’s all around us.

I don’t intend to be contrary to the above statement, as generally FHLB advances are intended to be over-collateralized for the very nature of capital protection and risk aversion to the FHLB institution in any instance of insolvency or possible liquidation. I was thinking back to the aftermath of the financial crisis in 2008 – 2009; by the time of 2011 – 2012 I worked at a smaller bank that was a member of the FHLB Dallas bank. Funding processes were typically to pledge (generally speaking) Agency MBS collateral in exchange for short term funding (as short as an overnight advance).

The overall system was in some level of upheaval given the nature of the economy, the financial system both during and after the GFC. I dug up this report below which covers this in some level of detail. It also gives a great insight into the operational structure, for each individual institution and the overall system. AKA, the Seattle bank was officially unsatisfactory per the regulator.

https://www.everycrsreport.com/reports/R41102.html

Not entirely related, but I noticed at least one buyer’s club I’m familiar with that would hoover up new US Mint issues that were expected to rise in value, those deals died as soon as the Fed started raising interest rates. I assume these deals were done with cheap money that’s been withdrawn. (The buyers club buys up more coins than any individual could and then forwards them on to the actual buyer; I had no idea this was even a thing.)

this is free market, free trade americas idea of innovation and production. bill clintons bridge to the 21st century ran out of pavement in 2008, it won’t last much longer.