By Conor Gallagher

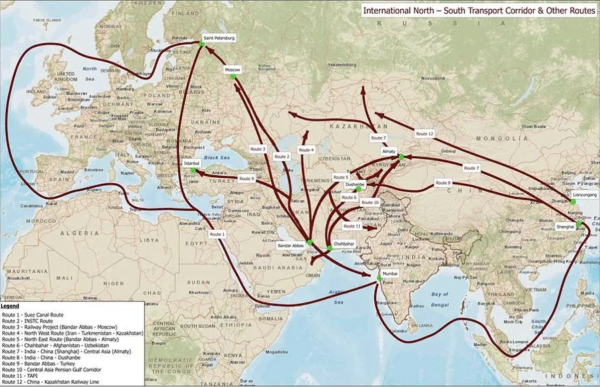

The Riyadh – Tehran detente deal could be a major win for not only the Middle East but also larger projects seeking more integration of greater Eurasia. If the deal is implemented, China’s Belt and Road Initiative could become a key component of the economic futures of both Saudi Arabia and Iran. The rapprochement could also pay dividends for the International North-South Transport Corridor (INSTC) project, which runs from St. Petersburg to Mumbai in India via Azerbaijan (or the Caspian Sea) and Iran and across the Arabian Sea. The “sanction-proof” corridor connects the Indian subcontinent with Russia without needing to go through Europe while simultaneously being 30 percent cheaper and 40 percent shorter than the existing routes.

Following the announcement of the Saudi Arabia – Iran rapprochement deal brokered by China, the chairman of the Russian State Duma Committee on International Affairs Leonid Slutsky praised the deal and explained how it corresponds with Russia’s collective security concept for the Persian Gulf region. He paid particular attention to the INSTC, saying:

In this regard, I view the International North-South Transport Corridor project, which will become the key factor for positive feedback for security, stability and development in this most important region, as a strategic one. The launch of the Corridor will become a milestone event not only in logistics, but also in politics and in security architecture of the Greater Eurasia, it will become the most important economic superstructure atop the strategic basis, achieved in Beijing.

The INSTC was announced back in the early 2000s, but progress was slow until recently when the West’s actions put it into overdrive. The sanctioning of Moscow and Tehran and the severing of Europe from Russian energy created the incentive to accelerate investments by key stakeholders. The authorities in Tehran realize their centrality on the India-Russia trade route, and considering that India’s imports from Russia quadrupled last year, one can deduct the potential upside for Iran. With an investment boost from Russia, Tehran has been trying to speed up the completion of improved railway networks that will connect to the existing railways of Russia and Azerbaijan and Chabahar Port in southeastern Iran.

Yet the major impediment to the INSTC reaching its full potential remains Iranian infrastructure. Much of the transit of goods on the INSTC still takes place on roads in Iran. Much of Iran’s railway is single track, and regular container train services from Moscow to Iran have to rely on transloading.

The government in Tehran is trying to prioritize the improvement of port capacity, rail and road infrastructure, transportation terminals and the modernization of its transportation fleet. The Iran Chamber of Commerce, Industries, Mines and Agriculture is also starting a new Transports Internationaux Routiers or International Road Transport center in the southern port city of Bandar Abbas to expedite the processing of transit cargoes. However, there is a clear need for further investment in transportation infrastructure, which has been difficult due to US sanctions on Iran.

Saudi Arabia’s Finance Minister Mohammed Al-Jadaan said March 15 that Saudi investments into Iran could happen “very quickly” following the agreement to restore diplomatic ties. He added that he does not see any impediment as long as the terms of agreements are respected by Tehran.

Any Saudi economic dealing with Iran would undercut US sanctions imposed to pressure Tehran, if not violating them outright. With tens of billion of dollars in Iranian assets blocked worldwide, the prospect of Saudi investments could jumpstart the INSTC and help maintain the peace between Riyadh and Tehran.

China’s desire to keep the peace could also bring investments. Scott Ritter writes at Energy Intelligence:

With China providing infrastructure-generating investment capital through its Belt and Road Initiative, the new Iran-Saudi détente could evolve into a regional economic relationship that supplants the US-led defense relationships that have defined Middle East politics for decades.

China would have to work around US sanctions in order to increase investments in Iran, but the two countries have already found a workaround to continue the oil trade, with most being rebranded as from a third country. If a China were to up its investments in Iran, it would mark a shift. From Silk Road Briefing:

Russia has now overtaken China as the biggest investor in Iran. This follows Moscow’s conflict with Ukraine from late February last year, as a result of which Iran and Russia have strengthened their economic and investment ties. The UAE, Afghanistan, Turkey and China are the next biggest investors. Although China that was expected in Iran to be the major investor, Beijing reduced its exposure in 2022, and concentrated more on investing into the Belt and Road Initiative infrastructure such as logistics centers, border facilities etc. that would facilitate its own export capabilities to Iran and the region.

Foreign investment flows to Iran have been decreasing from 2012-13 when the volume stood at US$4.5 billion. The lowest level was recorded in 2015-16 with only US$945 million of FDI inflows. UNCTAD estimated that the volume of FDI inflows to Iran stood at US$3.372 billion, US$5.019 billion, US$2.373 billion and US$1.508 billion from 2016 to 2019.

According to the United Nations Conference on Trade and Development, Iran attracted an estimated US$1.425 billion in Foreign Direct Investment in 2021 to register about a 6% rise compared to US$1.342 billion in 2020. In 2022, however, and despite the sanctions, the total volume of investments attracted to Iran hit US$5.95 billion. Out of this figure Chinese companies invested only about US$185 million.

Additionally, Secretary of the Iranian Supreme National Security Council, Ali Shamkhani, announced on Monday that Tehran concluded an agreement with the United Arab Emirates to facilitate trade movement between the two countries using the Emirati currency, the dirham.

The UAE has not confirmed any such agreements as it would run afoul of US sanctions, which have created a financial crunch in Iran. Tehran is hoping that better ties with Persian Gulf Arab countries can help reduce that pressure. It remains to be seen how far these countries will go in order to provide Iran an economic lifeline.

But should diplomatic and economic relations between GCC members and Iran continue to improve, it could spell the end to US efforts to apply “maximum pressure” on Tehran and another nail in the coffin of US influence in the region. It would also cement Iran’s position as key nexus in new global trade routes like China’s BRI and the INSTC.

The US, by trying to put maximum economic pressure on Iran and Russia, hinting that China is next, and the ill-fated oil price cap, has only helped drive the integration of Russia, China, Iran, Saudi Arabia, and more.

Despite all the sanctions and western pressure on countries to isolate Moscow, Russian trade is on the upswing. Iran is eager to cash in on its position between India and Russia, who are rapidly increasing their trade volume. From India Shipping News:

Ruscon, a leading multimodal transport logistics provider in Russia, has significantly expanded its containerized service network from the Black Sea Port of Novorossiysk to Nhava Sheva and Mundra in west India as volumes rapidly rise.

The company, a Deli Group subsidiary, has now increased its tonnage deployments from one vessel to four vessels to provide a weekly sailing frequency on the route.

Additionally, an extra stop has been introduced at Saudi Arabia’s Jeddah Port. The service rotation already includes a call at Istanbul Port in Turkey.

According to Reuters, Russia began exporting diesel to Saudi Arabia in February after the EU enacted its embargo on seaborne imports of Russian oil. The Saudis are now expected to export the Russian diesel to other countries after some refining.

Russia’s largest ocean container carrier, Far Eastern Shipping Co., also recently added a direct Novorossiysk to Nhava Sheva route. And many other countries are jumping in and providing vessels after western sanctions forced regular mainline operators to halt operations into and out of Russia. Even the New York Times begrudgingly admits:

Ami Daniel, the chief executive of Windward, a maritime data company, said he had seen hundreds of instances in which people from countries like the United Arab Emirates, India, China, Pakistan, Indonesia and Malaysia bought vessels to try to set up what appeared to be a non-Western trading framework for Russia.

India’s imports of crude oil from Russia reached a record of 1.6 million barrels per day in February, which was more than one-third of India’s imports and more than the combined imports from traditional suppliers Iraq and Saudi Arabia.

India has been making a profit turning around and selling the refined oil to the US and EU, which are unable to purchase directly from Russia due to sanctions. The same story is occurring in North Africa, which buys up Russian crude and increases supplies to Europe as a sanctions workaround.

Russian wheat and fertilizer exports also rose in 2022 despite sanctions, much of the former going to the Middle East and North Africa (MENA) region, which is the top destination for Russian food exports. Much of the fertilizer went to INdia.

Iran and Russia are cooperating to build ships and vessels in the Caspian Sea. In October, Iran announced Moscow’s readiness to allow Iranian ships to pass through the Volga River. Russia had previously not allowed foreign ships to use the Volga River or the Volga-Don canal, but if the agreement is implemented, Iran will have access to the longest river in Europe, and have access to the Volga-Don Canal, which provides the shortest connection between the Caspian Sea and the Mediterranean.

For another look at how Western sanctions are backfiring and only drawing countries closer to countries the US is trying to isolate, take the Eurasian Economic Union (EAEU) members of Belarus, Kazakhstan, Armenia and Kyrgyzstan, which are also all being boosted by anti-Russian sanctions. From Silk Road Briefing:

It has had the unexpected effects of boosting regional GDP growth rates: in their “Regional Economic Prospects” report, the European Bank for Reconstruction and Development (EBRD), analysts noted that Kazakhstan’s 2022 GDP growth reached 3.4% instead of the previously anticipated 2%.

Part of that has been due to sanctions, with an increase in income due to the re-export to Russia of computers, household appliances and electronics, auto parts, electrical and electronic components. Exports of non-energy goods from Kazakhstan to Russia in 2022 increased by 24.8% and amounted to US$18.9 billion. …

An EAEU Intergovernmental Council meeting held in early February this year showed that the economic situation in all EAEU members states is stable, and mutual trade is growing. Anti-Russian sanctions actually significantly contribute to this growth, meaning that for EAEU members especially, as well as countries such as China and India, the attractiveness of Russia as an economic partner has grown.

India, Turkey, and Egypt are among the countries discussing free trade agreements with the EAEU. And Iran signed one in January. The primary driver for the Iran-EAEU integration is to upgrade Iran’s transport and logistics infrastructure, i.e., the INSTC.

The importance of the INSTC and its link to the Middle Corridor, which enables Russian traffic to head east via Kazakhstan to China, and vice-versa, is growing to include the entire region. At a joint press briefing with US Secretary of State Anthony Blinken in February Kazakhstan’s Foreign Minister Mukhtar Tleuberdi made it clear that EAEU economic participation is critical for Astana, and Kazakhstan would not be opting out of such a beneficial arrangement in order to please the US.

It was just another reminder of how the INSTC and Middle Corridor represent the growing integration of the EAEU, MENA, China, and India, and the US’ fading influence.

Thanks for this analysis of all that has been happening. It might be that the polar route for Russia may also figure into this transport network as time goes on and I think that it will be an important one. I think too that this has really spooked Washington as shown in a recent story. Saudi Arabia came out with a statement that they will cut the oil supply of nations that try to impose price cap on them and this story came out of the blue. So I am betting that Washington – and maybe Brussels – threatened the Saudis if they took part in all this and aligned with Iran. Not a great plan that-

https://thecradle.co/article-view/22541/saudi-arabia-will-cut-oil-supply-of-nations-that-impose-price-cap-energy-minister

But as I mentioned in a comment over in Links, it looks like we are actually seeing the formation of the Mackinder Heartland. Not just in our lifetime but right here and right now. We are seeing Russia, China and Iran being integrated and other countries want in as well like the Saudis. And as a benefit, all these conflicts like in Syria and Yemen will be shut down as being bad for business. I would not be surprised to see the Israelis want in eventually. Who knew that diplomacy was still important and powerful-

https://en.wikipedia.org/wiki/The_Geographical_Pivot_of_History

The polar route is likely on ice (heh), thanks to the Ukraine thing alienating Norway and Finland from Russia. This just as Finland had begun looking into extending its rail system to the Norwegian port of Kirkenes, and digging a tunnel to Estonia. Where it would connect to the EU funded railroad being constructed from Germany.

No sea route is going to survive a hot war with today’s technology but no artic nation would long survive a reverse embargo if it tried to stop trade along that route. Russia could simply pick up the depopulated lands after a year or so. See, the Baltic is also easily closed to “all” traffic. All this noise about having to build up militarily is about the corruption that MIC-IMATT spending rains down on parasites, not about anything actually happening.

Frankly Russia could pick up the lands right now if it wanted to, as the Nordics combined come to maybe 1/10 of Russia.

And ever so often i wonder why we keep picking a fight with them, as we seem to get far more out of cooperating. But when big bro USA wants us to fight we fight, apparently.

The answer is simple, those are two different “we”. Don’t conflate parasites with the host and it will become clear. The first “we” are the people who profit from the corruption that the MIC-IMATT rains down, and who NATO/EU/US-NGO complex insure become the bureaucratic deep state of the EU nations. The second “we” are the host upon which these parasites feed. Eventually the parasites weaken the host to the point of collapse, and you’re seeing the effects of approach to this endpoint.

Everyone, always, eventually gets more out of co-operation than war, but psychopathic chancers when in power just can’t resist the impulse to subjugate competitors to their own precious will, no matter what the damage done to others and even (almost inevitably) to themselves. It’s a sign that the human race has not yet fully adapted to living in (very) large communities.

Thanks, Conor, great work. From a Mackinder perspective, this is a geostrategic catastrophe for US interests, at least as its current planners conceive of them. The centrifugal, disintegrative movements that are supposed to be generated by a proper strategy of offshore balancing have been replaced by integrative forces that appear unstoppable, driven by well-duh level rationales. I can’t think of an equivalent flop in world history. Anyone?

All is very sad in Mudville these days, mighty Casey has been hoist on his own petard. The Times was pretty straightforward today about the large implications of the Xi – Putin summit. One wonders if it reflects mounting pressure for a course adjustment that doesn’t rely on military fantasies.

Looking at this one start to wonder how much of the wars etc over the centuries have been about maintaining Anglo-Saxon control over trade by making land routes less desirable than sea routes.

Stupid question, but why doesn’t China and Russia and Iran and Saudi Arabia and everyone else interested sanction America and the EU? I realize de-dollarization is an attempt to move in the direction of that kind of financial capacity, but is it just access to SWIFT and IMF loans, or is there some other reason a large block of the world can’t just sanction back?

Russia has sanctioned the USA, the difference is Russia doesn’t bother with ineffective ones. An example of an effective sanction is denial of Russian airspace to US Civilian Air Transport, which makes the US uncompetitive for many markets. See earlier links posts on NC for details.

Because they are selling the rope to which to be hanged?

Alastair Crooke also thinks it is a big deal.

https://english.almayadeen.net/articles/analysis/iransaudi-deal:-not-a-diplomatic-normalisation-but-an-archit

That’s what the fight should be all about (within and without all countries): countermoves to the divide and conquer strategies.

There’s 4 goldbug countries:

Iran, Saudi Arabia, Turkey & India, the latter in particular.

The only way anybody is going to break the fiat hegemon grip that the USA holds is by other means.

All these countries have fiat currencies, regardless of how much people in those countries like gold. I’m not sure how that makes them ‘goldbug’ countries.

The central role of the US dollar will be broken by large economies trading using other currencies on a large scale.

Russian exports of grains has increased due to pleasant weather but the reduction of fertilizer exports is more important for the future. Russia and Ukraine are the number 1 combined exporters of fertilizers. This war has knocked out their production which will have profound effects on global food production.

The US system is not part of the global system. I’m starting to see this Ukraine war as America’s war against the globalized world it created.

Nice work Coner! This sure seems to up the importance of Pakistan and Afghanistan or some of the other Stans to get a direct overland route. Given China’s demostrated excellence with HSR, if they get that done and integrate that region of the world, I don’t see what the West can do.

I’ll have to say that the Biden State Department incompetence has certainly exceeded my expectations. Blinken and Nuland deserve an award – from China and Russia.

i do not see russia as china’s jr. partner for which it is being touted. to me its a attempted smear to show that russia is simply a faux super power.

by simply being the large country that it is, its very dedicated citizens, its willingness to share and work with others as equals, its technology, military might, its organizational skills makes it a equal partner, not a jr. partner.

china would never dare do what russia has done. china knows they are next, but russia has put chinas next on the back burner. if china does not realize the part russia is playing, they do not deserve super power status, because they lack the very skills russia possess.

and the nafta types are so so stupid, what are they going to do about china, make a massive order from china and tell them they need it delivered by such and such a date, tipping china off to when the war on them will start.

and you can’t make this stuff up, of course you can’t make this stuff up about bill clintons trade policies either.

so russia is a equal partner.