Yves here. This paper, depending on your point of view, is either thorough or long-winded. But it is well-written and has lots of data.

A big reason we didn’t hear as much as anticipated about the much-touted coming European energy train wreck is not just that Europe had a warm winter and a fair bit of demand destruction. It also had lots of energy subsidies that shielded consumers and businesses from worst outcomes at pretty high costs. This article makes clear, perhaps not as directly as it could, that the big complaints about this approach are correct: it subsidizes demand for fossil fuels and it’s too expensive to continue for long or be repeated full bore next winter if needed.

By Giovanni Sgaravatti, Simone Tagliapietra, Cecilia Trasi. Originally published at Bruegel

Only a third of the massive fiscal interventions put in place by European governments 1 to shield consumers from rising energy prices have been targeted at vulnerable categories. This must change. Building on the ECB recommendations, a “Green triple-T” criterion for future interventions to be tailored, targeted and transition-proof should be established to help Europe become greener and fairer.

It is often said that nothing is so permanent as a temporary government programme. When it comes to the fiscal side of Europe’s energy crisis, this certainly seems to be the case. In Summer 2021, governments began adopting fiscal measures aimed at subsidising the energy bills of both families and businesses when energy prices started to increase across Europe. These measures were initially intended to be temporary, if not even a once-off occurrence. However, fiscal measures multiplied and inexorably ballooned in size when energy prices kept rising after the Russian invasion of Ukraine.

Facts

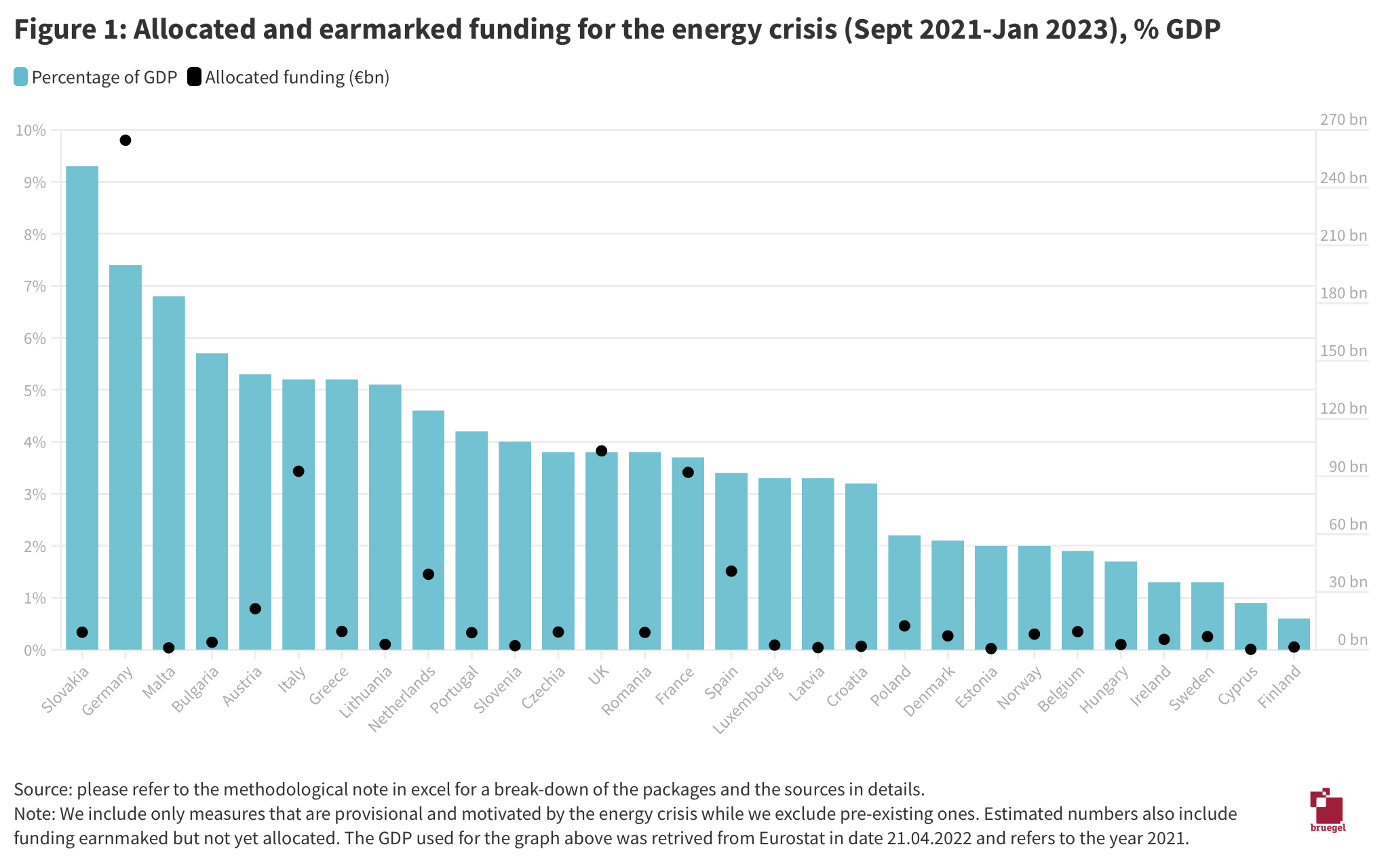

As shown in the Bruegel dataset National fiscal policy responses to the energy crisis, governments across Europe allocated and earmarked €768 billion to shield households and firms between September 2021 and January 2023. EU governments collectively allocated and earmarked €657 billion, the UK €103 billion and Norway €8 billion.

It is important to stress that these figures represent budget allocations and earmarking, meaning that they might not have been entirely used up yet. In some cases, like Italy, countries iteratively announced short-term measures and immediately spent most of the allocated budgets. But in other cases, countries allocated and earmarked large amounts so to prepare for a potential prolongation of the problem into 2023 and possibly beyond. This caveat is particularly important for Germany, as the country made a big fiscal commitment by allocating €200 billion to an “economic defence shield”. This funding was intended for use in 2022 and following years but might ultimately be spent only in part.

As illustrated in Figure 1, allocated funding varied widely, both in absolute and relative terms. In absolute terms, three countries alone constitute 70% of the overall allocation for households and firms by EU countries: Germany (€264 billion), Italy (€92.7 billion), and France (€92.1 billion). In relative terms, allocations range between 9% of GDP in Slovakia to less than 1% in Finland.

From an economic policy point of view, one of the most important questions concerning these interventions is whether they have been targeted at certain categories (e.g., the most vulnerable ones) or not. In fact, the poor are particularly hard-hit by inflation when prices skyrocket. For example, from April 2020 to January 2022 households in the bottom quintile of the income distribution reduced their savings to face increased spending five to six times more than the top quintile.

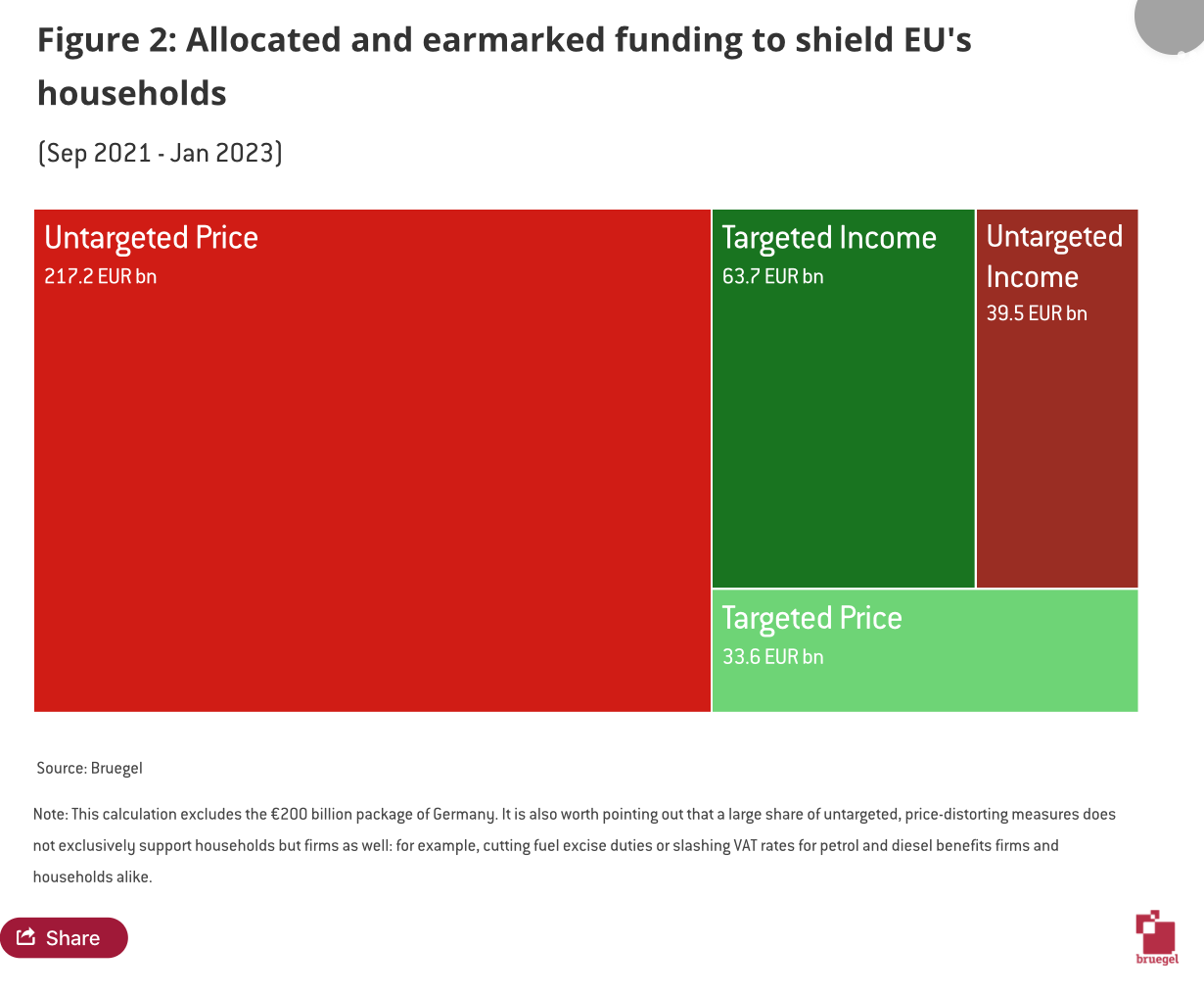

While investigating the funding allocated and earmarked for households specifically, it was found that EU governments have largely favoured un-targeted price-distorting measures compared to targeted income-supporting measures. To date, targeted policies have represented only 27% of the total funding disbursed, while untargeted ones accounted for the remaining 73% (Figure 2). This most likely reflects the urgency of action during the peak of the energy crisis, as these measures are relatively easy to roll-out and their effects are immediately felt by consumers.

Problems

Interventions of this kind are problematic for several reasons.

First, they might reduce the incentive to save energy, propping-up consumer demand and consequently worsening the energy demand-supply imbalance lying at the core of the crisis. This is because policies such as price-caps prevent the passthrough from wholesale market prices to retail prices paid in the utility bills of consumers. As a result, consumers do not face the actual price of the energy they consume and do not have the price-incentive to reduce their consumption.

Second, price distortions to block the passthrough of high fossil fuel prices might have been a social and political necessity at the height of the energy crisis, but are in contrast with commitments to the energy transition. As remarked by the IEA, the large amounts spent in reducing the energy bill for consumers not only disincentivise energy saving and switching to cleaner energy alternatives, but also support incumbent fossil fuels.

Third, such interventions are expensive to sustain over time. While they might be among the fastest to roll-out, they are fiscally heavy to sustain and their real cost might end up being considerably higher than predicted when market prices remain high for longer. The IMF estimates that completely offsetting the consumption losses of the bottom 40% of households in the income distribution would have an estimated cost of 0.9% of GDP for European economies. This is a much lighter burden to public finances than the measures rolled out so far that cost around 3.2% of the EU’s GPD annually. Smarter spending would avoid imposing unnecessary strain on already-tight public budgets.

Fourth, they are not necessarily equitable. Blanket measures that apply to all end up supporting well-off consumers in the highest part of the income distribution that may not need help with their energy bills. Some price-suppressing measures can even be regressive in some European countries. For example, Bruegel’s dataset on inflation inequality finds that “Transport” (the HICP category including petrol and diesel) generally weighs more in the consumption basket of people in the top income quantile than those in the lowest. Similarly, the OECD found that in a third of European countries, high income households spend larger shares of their income on car fuels than low income households, implying that excise duty cuts on petrol and diesel might be regressive in these countries.

Fifth, as also noted by the IMF, untargeted price distorting measures might lower peak inflation in the short term, but set the conditions for an extended period of elevated inflation in the longer run. As stressed by ECB President Lagarde, delaying their dismissal might compromise the ECB’s ability to achieve its medium-term objectives, resulting in monetary tightening for longer than what is otherwise desirable.

Sixth, they are politically difficult to discontinue. In fact, governments may face strong political backlash from citizens when measures are removed, as illustrated by the recent uproar in Italy following the withdrawal of extended excise duty cuts on petrol and diesel.

Seventh, they have global distributional implications. As outlined by the IMF, preventing demand adjustments in countries on top of the global income distribution indeed prolongs high prices on global energy markets, harming energy-importing lower-income economies.

Prospects

European governments have been advised to abandon un-targeted price-distorting measures going forward. For instance, the ECB has consistently recommended that measures meeting a “triple-T” criterion should be prioritised. This criterion includes temporary, tailored and targeted solutions.

Measures should be “temporary”, meaning they should be incidental and cautious so as to avoid driving up aggregate demand excessively in the medium term. This would keep inflation under control. The term “tailored” refers to measures that should be designed in a way that does not weaken incentives to cut energy demand, but rather encourages energy savings, while “targeted” means that the measures taken should shield vulnerable households who are most affected by the reduction in purchasing power.

The IMF also reported that the right framework would need to prioritise targeted income transfers that are adjustable to both the income level of the recipients and their exposure to energy price shocks, which can vary depending on household size, housing type and geographical location. Ideally, these measures expand to citizens outside existing social schemes and top-up support to people already covered. This “triple-T” criterion represents the correct policy approach to crisis management. This would be the right way of facing an eventual new wave of price volatility – a possibility not to be dismissed as European and international gas markets remain tight.

However, Europe needs to move beyond emergency fiscal responses and focus on structural changes to allow the EU to decisively accelerate its decoupling from fossil fuels. Doing so would provide a better and longer insurance against fuel price volatility and improve EU’s trade balance.

This not only affects households, but the economy at large. While the EU saw a significant decrease in the import volumes from Russia in 2022, the higher cost of fossil fuels led to an EU bilateral trade deficit of 56 billion USD for mineral fuels alone (or 3% of Russian GDP in 2021). This increase brought the total EU’s trade deficit for energy vis-à-vis Russia to USD 156 billion, which is 9% of Russian GDP, compared to an average of USD 100 billion between 2019 and 2021.

It is also worth mentioning that renewable energy sources have the potential to substantially lower wholesale electricity prices, with an average impact of 0.6 percent for each 1 percentage points increase in renewable share. Finally, removing the dependence on fossil fuels to prioritise access to affordable, clean energy sources would restore and maximise the competitiveness of the EU’s industry hard-hit by high energy prices and losing out to global competition as a result. Thus, it will be important to further develop the ECB “triple-T” criterion into a “Green triple–T”, for policies to be transition-proof, tailored and targeted.

According to the “Green triple-T” criterion, policies should, along with being tailored and targeted, also be “transition-proof. This means that they should support structural green solutions by lowering the economic cost and administrative burden of switching to renewables and improving energy efficiency. One of the best examples of policies that would fit into this “Green triple-T” criterion is in Austria.

In 2022, the Austrian government rolled-out the program “Clean heating for all” which granted up to 100% of the total costs of replacing fossil-fuel with climate-friendly heating systems. The coverage rate varied according to the income level and the family size of the household. The programme targeted only those in the lowest three deciles of the income distribution. The bonuscould be combined with other local initiatives and incentives for solar energy.

Policies should aim at explicitly complying with at least two criteria out of three. In this sense, a second-best example is found in Germany. From June to end-August 2022, the German government implemented the “9 for 90” ticket to drastically cut the cost of regional trains, buses, trams and underground rail networks. The measure led to an extreme level of participation as 52 million people bought the pass during the period. Encouraged by the high uptake of the measure, Germany then introduced the “Deutschlandticket” structurally lowering the price of public transport to €49 per month from May 2023.

Another example of these policies happened in the Flanders region in Belgium. In 2022, a cooperative company called Aster launched a tender for the installation and maintenance of 395,000 solar panels on more than 52,500 social housing units. The project mobilised a total investment of around €150 million with the support of the European Investment Bank and Belfius. The tariffs for electricity provided by solar panels will reportedly be kept below commercial tariffs by the Flemish government.

As the peak of the energy crisis increasingly seems to be behind us, governments now have a window of opportunity to re-direct support in a more efficient and equitable manner and expedite their commitments to the energy transition. That is, developing and implementing a “Green triple-T” framework might offer governments an opportunity to exit the energy crisis by making Europe greener and fairer.

[1] In our dataset and this blogpost, we refer to “European governments” to address the governments of EU Member States, Norway and the UK.

Europe may be subsidizing more than what was mentioned.

I took a look at the DAX, FSTE, CAC40, & Stoxx 600 and those indexes are at all time highs this week. They didn’t get that high during the subsidies given out at the beginning of Covid.

A little bit of asset bubble blowing?

I had a good chuckle while I was looking.

There’s a bigger issue I think that is not being discussed. Yes, the article does make it clear that this is not fiscally sustainable, but there’s the matter of being structurally noncompetitive in the long run.

Short term demand destruction means factory closures. Not every winter will be warmer than normal and if the industries that are energy intensive don’t stay in Europe, that means lay-offs that are permanent.

The long-term competitiveness of European manufacturing and other energy intensive industry. These cannot be temporary unless Europe ends up like the Midwestern US did after NAFTA, unless relations dramatically improve with Russia.

When the manufacturing losses result in massive layoffs, it could result in a spiral. Sure, energy demand will drop, but so too will employment and government tax revenues that the manufacturing sector brought, along with the export revenues.

Judging by Putin’s most recent speeches, it does seem like Russia is in the process of completing its divorce with Europe and is now more focused on its other partners, most notably China and India, because of the subservience of the Europeans to the US.

Unless Green energy truly does become cheaper than fossil fuels (and keep in mind that one has to add the storage costs because green sources tend to be intermittent), Europe is at a structural disadvantage. Even if Green energy does become cheaper, there’s nothing preventing other nations from adopting Green energy themselves (which I suspect will happen – China is already the leader here as well).

The only way out of this is for the European nations to ditch the neoconservatives and the US ruling class, then begin a rapprochement with Russia. That’s going to require revolutionary political change..

All Europe has done is to kick the can down the road, probably at great expense (depending on uptake of the subsidies). For example, the statistical agency in my bijou country of Luxembourg has already projected that electricity prices will rise by 40% next winter. This compares to the initial jump of 50% last winter before the government stepped in with subsidies, so slightly better, but not significantly so for me as a consumer. Will it be enough to make industry happy?

Meanwhile the EU is congratulating itself on reaching the 15% reduction in gas use without asking itself which proportion came from the warmer winter and which from reductions independent of winter temps, especially demand destruction, which would point to the long-term loss of competitiveness Altandmain refers to.

The other day, BASF announced that they would lay off 2,600 people at the main site in Ludwigshafen, Germany. Now this was supposedly mainly in admin, but they are closing one or two facilities. I suspect this is first small step to open the eyes of the government to things to come, BASF’s CEO having been widely derided for a very outspoken interview he gave last year.

As a final aside, Colonel MacGregor keeps hoping for the fall of the German government, but I doubt it would change much. The only two parties opposed to the war are the (right-wing) Alternative für Deutschland and the Left Party. The Christian Democrats, the main opposition party, are almost as war-happy as the Greens, certainly more than the Social Democrats.

The AfD and the left part led by Sahra Wagenknecht (as opposed to the half of the left that is now a pro-war identity politics Establishment party) are Germany’s only hope.

Yes, the BASF layoffs are only a small opening number – a sign of things to come.