Yves here. Customarily, when publishing a cross post, your humble blogger provides additional and/or qualifying information at the top, and then the post second. Here we’ll provide Richard Murphy’s post first, and then add more tidbits from the IMF paper on inflation that he discusses.

Keep in mind that the IMF’s research wing is well to the left of its “programs” area and often publishes findings that are not friendly towards finance and mainstream economics.

By Richard Murphy, a chartered accountant and a political economist. He has been described by the Guardian newspaper as an “anti-poverty campaigner and tax expert”. He is Professor of Practice in International Political Economy at City University, London and Director of Tax Research UK. He is a non-executive director of Cambridge Econometrics. He is a member of the Progressive Economy Forum. Originally published at Tax Research UK

The IMF published a paper yesterday highlighting some of the impacts of inflation.

Some were totally predictable:

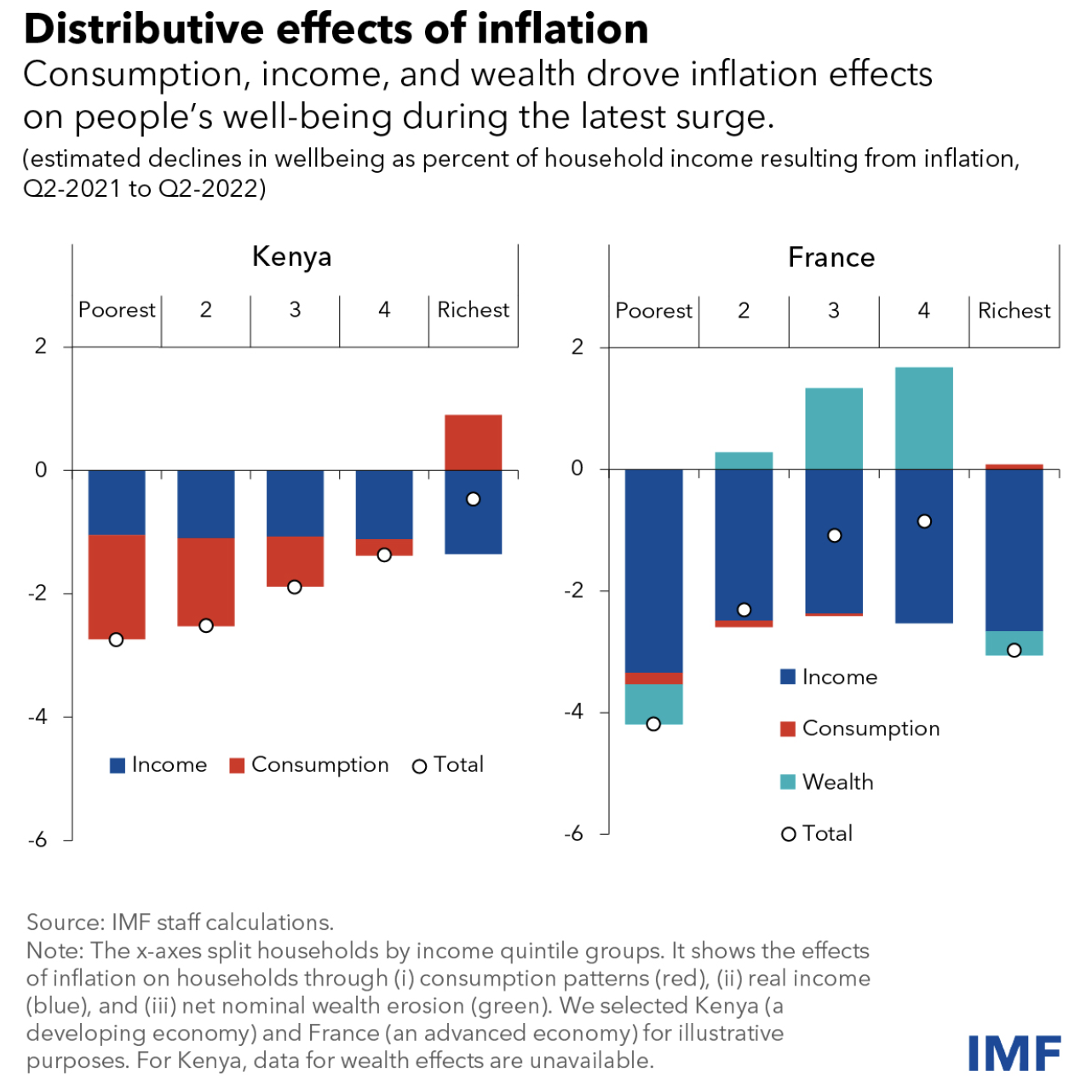

It will be no surprise to anyone that the biggest negative impacts of inflation are on those in the poorest groups in society and that relatively speaking those in higher-income groups do much better.

This is partly as a result of policy measures:

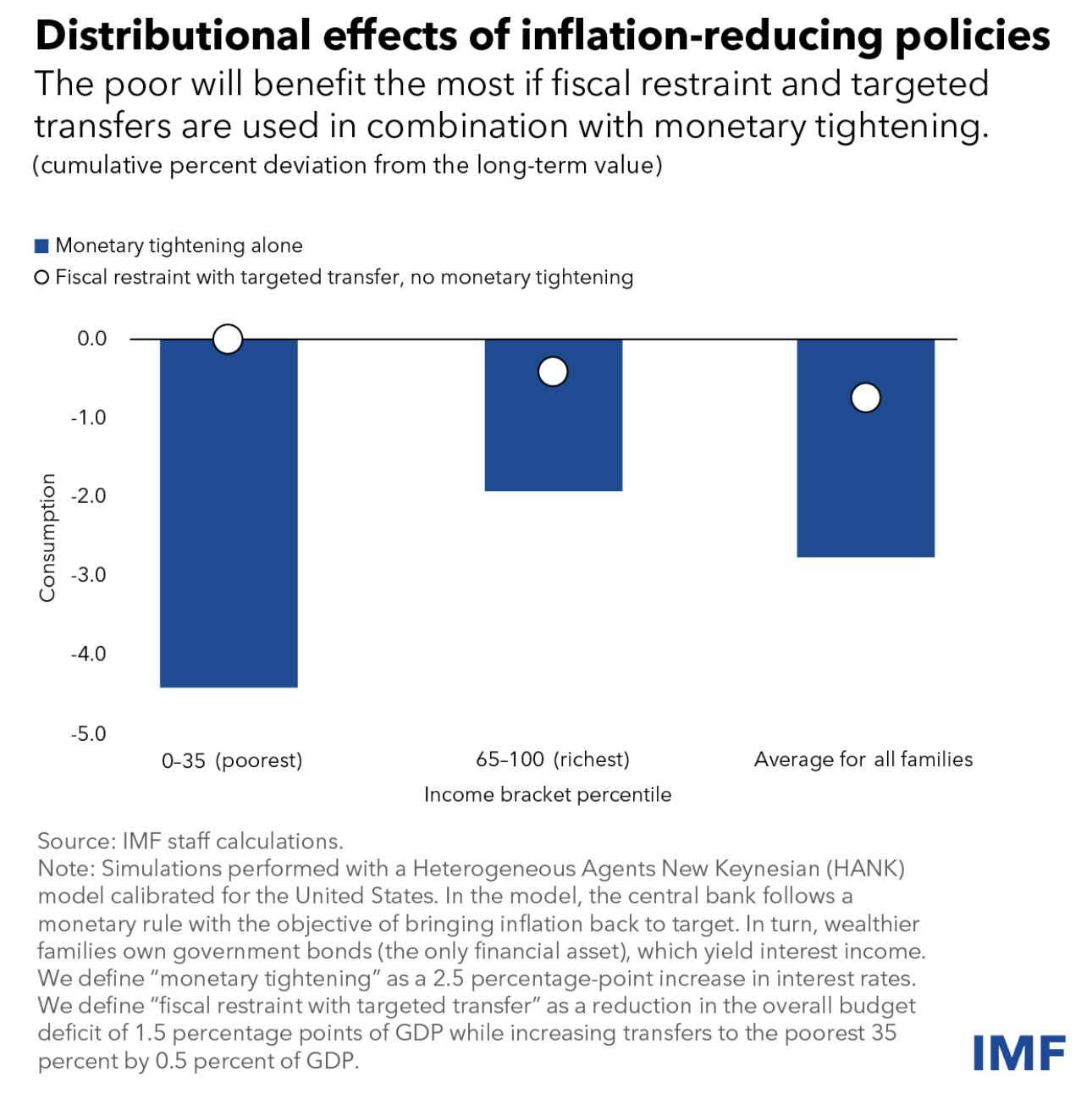

As the IMF notes, austerity combined with tight monetary policy hits the poorest hardest. There is no surprise there. Of course, this could be countered. As the IMF notes:

To safeguard the poor—who benefit more from public services—tax hikes or cuts in lower-priority spending must be combined with larger transfers. This strategy results, by design, in no drop in consumption for the poor, but also in a lower decline in overall consumption.

This is not happening sufficiently in the UK.

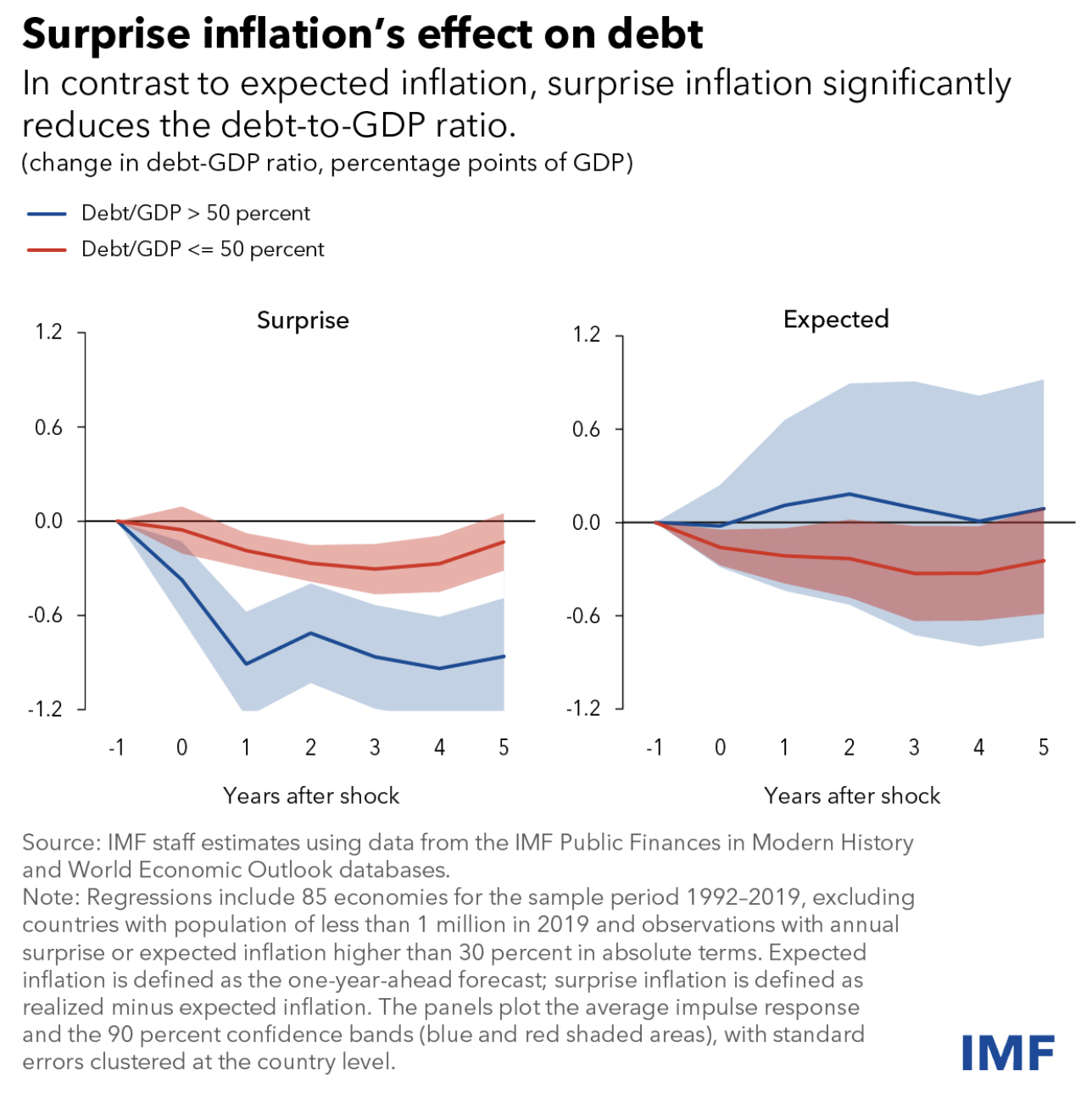

But there is what the IMF call a surprise outcome for governments:

Government debt-to-GDP ratios fall so long as inflation is constrained after breaking out. That is because the government wins at the expense of its bondholders, which s currently true. Of course, governments will claim this fall in debt-to-GDP ratios after inflation is a policy success. Actually, it is the result of their policy failure. In due course, that will need to be said.

As it will also need t be said that the gain should be spent to address the problems inflation has created, but you can be sure governments will ignore that.

______

Yves here. The IMF paper had another noteworthy section:

Although the impact varies across countries (and across income groups), the surveys reveal that:

- The faster rise in food prices compared to other prices hurt poor families disproportionately because food represents a higher share of their total consumption. This effect was most pronounced in low-income countries.

- Inflation eroded real incomes in commodity-importing countries, as wages across all income groups did not keep pace with prices.

- As inflation eroded the monetary value of assets and liabilities, families with negative net worth benefitted at the expense of creditors, particularly in countries with developed financial and credit markets.

- Redistributive wealth effects of inflation were also influenced by the age of the head of household: young families, which tend to be net borrowers, experienced gains through the wealth channels, whereas old households saw their wealth eroded.

This underscores a key point: that rises in inflation hurt lenders and benefit borrowers, which is why the capitalist classes are so insistent it be curbed quickly. It doesn’t hurt that central bankers’ preferred remedy is to increase unemployment and hurt workers.

So my friend who works as a microbiologist tech at a food processing plant had an injury. In the interim it is taking 2.5 people to do her duties. She figured this was a good time to ask for a raise – she asked for another 3 dollars an hour (she makes about 25 dollars an hour). Typically, workers at the plant have been getting about 50 cents an hour more to adjust for inflation. Her raise, that her supervisor said was “fought” for, was 1 dollar in total (usual 50 cents plus 50 cents – so much for loyality and adjusting one’s vacation to suit the employer)

Here is Mish on the nominal wage increases versus real wage increases. And points out that the Fed thinks wages going up is the problem – which makes sense, as they have done a good job of supressing wages for 50 years…

https://mishtalk.com/economics/is-wage-growth-too-high-lets-explore-the-idea-with-pictures

The most “political” part of inflation is that food and energy inflation hit the poorest the hardest, naturally, which is immediate and ‘in your face’ for the poor. Thus, it can be a potent political weapon. See where some of the recent civil disturbances around the world began as strikes and demonstrations against the local Government’s failure to address these ‘direct’ effects.

The wealth redistribution upwards tends to be a ‘lagging indicator’ here. Everyone expects the “rich to get richer” and the “poor to get poorer” as a slow and steady systemic process. Such a dynamic is less obvious and disruptive. It’s effects are cumulative, as in being a real world example of the “Boiling Frog Effect.”

Here “on the street” in the North American Deep South, we are experiencing visible and somewhat ‘painful’ retail inflation. Prices at the grocery stores now rise slowly but continuously. It has now become very visible. One sign of how “dangerous” this can become for the Elites is the fact that people in the shops no longer make fun of the inflation. Now all I hear is complaining. The mood of the public is shifting towards anger.

Stay safe!

Bidenville*, the new Hooverville?

In Francophone countries, there is a term Bidonville.

The meaning is tin can city or shantytown, typically located on the outskirts of a city.

Visualize jerry-built shacks made of scrounged materials like concrete masonry block or brick walls and corrugated sheet metal roofs. Sanitation is, er, inconsistent.

Other countries have their variations like Favela or Colonia.

Thanks, Joe.

I think they call it “slum” in some other countries. The PMC likes to look down on them, not willing to admit they are the cause of the problem.

Not just the PMCs, some of whom are self-reflective. This “disdain” for ‘deplorables’ et. al. is a central tenet of Neo-liberalism in all it’s manifestations. To wit, “Each and every person is responsible for everything that happens to him or her.” This excuses the Elites from responsibility for the destructive social effects of their policies. It’s a neo-ethics based on structural narcissism.

Heaven help us. The inmates are running the asylum.

Stay safe.

This is the first time I have ever noticed little news blurbs about the dollar’s exchange rate being allowed to drop by something like 15%. So in addition to our domestic price inflation, we are going to have higher prices for imported stuff. So if international corporations can no longer get a free ride from the inflated exchange value of the dollar, it makes more sense to have a good industrial policy. I think devaluing the dollar is better than artificially supporting it with arbitrarily high interest rates.