Yves here. ZOMG, I could kick myself for not noticing the key fact Wolf discusses here, that even at current interest rates, the US still has negative real interest rates, which is a monetary stimulus.

However, we look to be getting the sort of credit rationing that normally comes about via (real) interest rates due to the freakout created by bank failures….which as we’ve explained ad nauseam, were in turn due to overly rapid rate increases and lax Fed supervision. So we may be soon to get to the place where positive interest rates would have taken us.

By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street

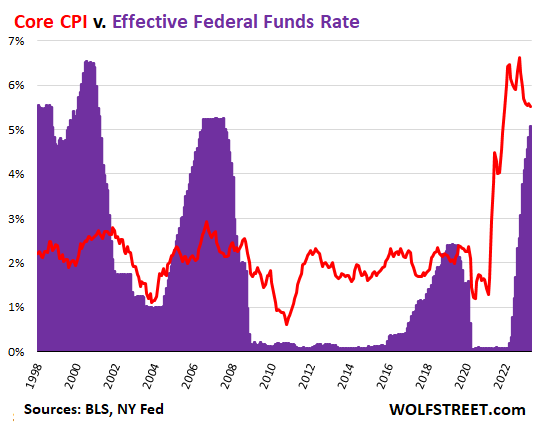

The Fed has now raised its policy rates by 500 basis points in a little over a year, with the top of the range now at 5.25%, and with the Effective Federal Funds Rate at 5.08%. But “core” CPI, which excludes the volatile food and energy components, has gotten stuck at around 5.5% to 5.7% for the fifth month in a row. There wasn’t any progress at all with core CPI in five months. Inflation intensity is simply shifting from one category to another. As inflation temporarily subsides in one category, it resurges in another.

The Fed’s short-term policy rate, as measured by the Effective Federal Funds Rate (purple), is still below inflation, as measured by core CPI (red):

With core CPI at 5.52% in April, the “real” Effective Federal Funds Rate (EFFR minus core CPI) is still a negative 0.44%. And negative real policy rates are still a form of interest rate repression, and are still stimulative of the economy and of inflation.

And so core CPI got stuck at 5.5% to 5.7%, and isn’t making any efforts to be heading toward 2% or whatever, and instead, everyone has gotten used to this inflation and accepts it, and deals with it, and builds it into economic decisions, which is nurturing this inflation right along.

In other words, with its current policy rates, the Fed is still just removing accommodation, rather than turning the screws on inflation.

But the crybabies on Wall Street are out there in force screaming about those unfair interest rates and clamoring for immediate rate cuts, like in June, to remove this incredible injustice of 5% short-term rates and even lower long-term Treasury yields (the 10-year Treasury yield is at 3.43%, LOL), when core CPI is 5.5%.

For those crybabies on Wall Street, the best money is free money. They want their 0% back, and they want their QE back. But now we have this inflation that’s not going away.

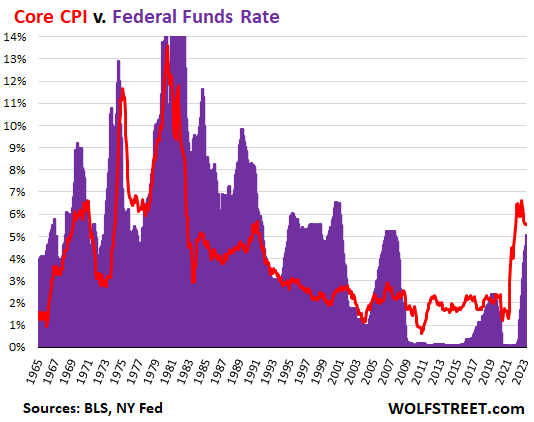

When we look back 60 years, we see what an extraordinary period this QE and interest rate repression since 2008 has been. During almost the entire 14 years — except for a few months in 2019 — the Fed’s policy rate was far below the rate of core CPI. And to this day, it remains below core CPI. But that’s an upside-down version of what was the rule before 2008.

The chart below goes back to 1965. Before 2008, the rule was that the Fed’s policy rates were nearly always higher or substantially higher than the rate of inflation. For example, in the 1990s, the EFFR was around 5% to 6%, while core CPI was around 2% to 3%. In other words, the EFFR was double the rate of inflation, which is what pushed down inflation. And those were booming times. I mean, we even had the magnificent Dotcom bubble.

Over those decades from 2008 back to 1965, there were only a few relatively brief periods when the Fed’s interest rates were below the rate of inflation as measured by core CPI.

But since late 2008, we’ve had the opposite. Policy was turned upside down. And it still hasn’t been turned right-side up. There is still a ways to go. And just looking at this chart, I get the distinct feeling that inflation is just being fueled further, rather than being doused, by the Fed’s current interest rates:

The low 10-yr yields (3.4% LOL) clearly shows what the problem is: the Fed doesn’t have any credibility left. Nobody expects the Fed to see this through, hence low future rates priced in.

This wasn’t very hard to predict, given the way the Fed chickened out every time there was a small dip in the stock market. Now they will have to deal with the consequences. To kill this entrenched inflation off, they need to commit to significantly positive real rates for a number of years and wind down the balance sheet. Deliberately break a few eggs. Not because a recession kills inflation (it doesn’t), but to restore confidence that they will really do what it takes to bring inflation down.

Record profits in the luxury sector (LVMH, Richemont, etc) also tells you all you need to know. Negative real rates are still transferring significant wealth from middle- and lower classes to the rich. Middle and lower classes aren’t very sensitive to interest rates because they can’t afford debt anyway and if they have debt, they are paying much higher rates which aren’t influenced much by Fed funds rate.

I was watching a hedgie on YT this morning talking about this. He posits there are now three FED mandates: Inflation Control, unemployment control and now system stability. And stability trumps all, so essentially inflation will continue for the foreseeable future, because when up against it the Fed will print. The message from the SVB debacle to Mr Market is the Fed will always intervene and bail out.

How many bank failures = ‘stability’ ?

I understand your point, they made this mess and now they have to navigate out. But SVB was truly a systemic risk. The VC’s created a bank run due to the high concentration of uninsured deposits and the bank was already upside down on long term securities.

It became pretty apparent that weekend that if the govt didn’t backstop the uninsured deposits, we would have woke up on Tuesday morning with 4 US banks. The core issue is the held to maturity capital the regionals have that is not MTM. Not gonna hear about that in the media. What you are going to hear is all of the hocus pocus to prevent bank runs, ban short selling, levy fees on uninsured deposits, in flows are great, profits are up, dividend yields are at all time highs etc….

But the next shoe to drop is not likely a bank run artificially created by oligarchs and their bubbleland startup CEO minions with uninsured deposits, it’s more like to be bad loans, and probably corp real estate. It will only take one of those core regionals to fail for the herd to head to the gates, so the Fed is once again going to be forced to intervene. No matter what alphabet soup they call it, it is going to increase money supply and the Fed’s balance sheet garbage. That is eventually inflationary, unless they pump interest rates higher, which then creates an even bigger regional banking mark to market problem.

SVB was lower systemic risk than most hedge funds. It was a golden candidate to encourage the autres but the Fed and Treasury are still too in terror of a second Lehman’s. The rest of the bankers will run wild after this year.

If the Fed wanted the Republicans to win the Presidency next 2024, and they thought that finding and and “engineering the death of” another Lehman would create the conditions for all the passengers to run to the Republican side of the ferryboat in Nov. 2024; when would be the best time for them to pick and Lehmanize a high-impact target in order to achieve maximum anti-Biden election impact?

If in fact that’s what they wanted to achieve?

Your hypothetical conspiracy theory relies on an assumption that the election matters to the Fed and its owners.

Elections are to keep the rabble pacified with the illusion of some meager influence on how things are run. If they really mattered we wouldn’t have them, too dangerous.

Ah yes, the famous(ly apocryphal) Emma Goldman quote:

‘If voting actually changed anything, they’d make it illegal’.

Bingo.

Jerome Powell was a Trump appointee and is a Republican.

2+2=? !!

he was reappointed by biden so how does that fit in your equation, and obama kept bernanke who also swings R

2+2-2-2 or something

80% of NYC office skyscrapers are empty…as well half the storefronts….sooner or later its going to collapse….

So inflation can not ever cause any system stability issues? What happens if it does like say when poor and middle class people can’t afford necessities and rent?

War with China to distract people and rally them around flag and president.

A minor quibble about sensitivity to higher interest rates. Consumers who are carrying debt loads indexed to an adjustable rate setting, or to an adjustable index such as Prime, must surely begin feeling the pinch unless they are capable to manage their expenses on the plastic money thing. Just checking my recent statement, my APR on purchases would be a hefty 20.7%. I typically am (and have nearly always) able to manage this issue, thankful for that, and not pay the going toll upwards to a ginormous card company or global institution.

I tend to believe the 10yr UST is reflecting doubts surrounding the growth outlook for GDP in the next few quarters.

How exactly do banks take advantage of the “EFFR”? Historically, I believe there was reputational disincentive to borrow from the “discount window” until 2008. Did it matter as much as in prior decades where the EFFR was relative to inflation?… there would also seem to be less of a reason for banks to lobby for it to be kept low back then

Interesting. Fed funds rate (EFFR) still below core CPI.

Despite “the crybaby” financial parasites on Wall St., this is still a monetary stimulus environment, as Yves points out.

Inflation still exceeds wage rises, resulting in more decline in real wages and thus living standards. Household & consumer debt at record levels. But that does not seem to be good enough for the Fed and the oligarchy. Unemployment needs to rise, and real wages need to be driven down further, at least in their view.

(Of course, if monopoly/oligopoly price-gouging and market manipulation was curtailed, we wouldn’t have this rate of inflation in the first place. We have to live with rampant institutional corruption).

It seems the Fed is trying to walk a tightrope: increase asset price inflation while driving down wages. When unemployment finally does rise, real wages driven down further how will the debts be serviced? How can a debt crash be avoided?

In a way that I am unable to square up, I think homelessness figures in somewhere.

The willingness to push people over the edge must have some impact, like in a balloon you toss stuff over the side to maintain altitude (picture the balloon as a castle in the sky).

Yeah, It seems the numbers of unhoused folks has increased a lot, but I don’t have any figures off the top of my head. It’s not easy to calculate, since many people with jobs “couch surf” at friends/family houses and/or live in their vehicles. Of course, the parasitical financial oligarchy does not factor that in, they don’t give a toss.

I have to wonder if TPTB are expecting there to be significantly fewer people in the not-too-distant future competing for jobs and housing, and are being proactive in managing the supply of both.

Haven’t you heard? AI is going to take over manufacturing, agriculture, etc., all the elites will need is a limited servant class to help them live lives of luxury without the worry of popular uprising.

Sure…real interest rates matter. But contracts, loans, and all sorts of activity rely on nominal interest rates…just ask the banks. How many people have adjustable rate mortgages? What percent of bank loans are floating rate loans.

Anyway, I’m glad to see someone else notice the negative current real interest rates. But it isn’t all that simple. In theory at least, investment decisions are made based on the expected value of inflation over a period, usually years, which is an estimate.

And commodity prices are still subject to competitive global markets, Oil was over $100 and now it is $70.

There is no reason to believe that supply bottlenecks will continue.

One of the more interesting segments is supply of new automobiles. For decades, cars were near commodities, with serious global over supply issues. Auto manufactures stumbled into a shortage situation, made worse by governmental pressure to transition to EV’s. And liked it so much, they decided to no longer overproduce ICE cars. Which had a further knock on effect since no one manufactures used cars. Not that I don’t believe that a lot of excess profit won’t be competed away. But they are slow walking it. Personally, the last couple of vehicles I bought were for a 10+ percent discount from ‘sticker’ price. And the next one I buy in a year or so will likely be for 0% discount. But I can’t really get that worked up about it. But for someone that needs to drive to a job and is under income pressure…they have to deal with a scarcity of used vehicles, and higher interest rates, and that can be a big problem.

The future? I don’t have any special insights. But AI could replace cheap Chinese imports as anti-inflationary trends. Having been around when PC’s were introduced into businesses, it took over a decade to generate any efficiency gains. Instead of eliminating jobs, there were suddenly staffs hired to administer the things, build and run LAN’s, etc. But it isn’t what inflation does over the next 6 months, its what it does over the next 6 years.

But how to deduce which aspect of inflation is caused by fed policy and which is caused by supply chain issues, Russian SMO, crop failures, diesel prices, deindustrialization of Europe, and so on? Would neutral rates be enough to reverse the situation? What level of suffering is necessary to inflection upon the working class to ‘fix’ prices and inflation expectations?

Good questions. US-imposed economic warfare, aka “sanctions” (illegal), market manipulations and monopoly price-gouging are the leading causes of inflation, I would argue. “Supply chain issues” are an excuse for manipulation and gouging. The Russian SMO is also an excuse – the sanctions are imposed by the US. There is no shortage of wheat, petroleum, maize etc on the world market.

The sanctions on Venezuela, Iran and Russia are key for the petro market. I would argue that the price of oil/gas would plummet if the blockades were lifted and a somewhat normal market restored.

Good questions. I would argue that US-imposed “sanctions” (illegal economic warfare) have caused a lot of this. The “sanctions” on Venezuela, Iran and Russia have contributed to the price rises in oil (and wheat). The Russian SMO is used as an excuse for more sanctions and “supply chain” issues. The destruction of the NordStream pipelines have also contributed, and help the de-industrialization of Europe.

This has enabled an environment of price-gouging and manipulation

If you think through the impacts of rate increases logically (so the opposite of the Chicago School), what you get is the interest rates impact credit purchases. So raising interest rates, should only impact purchases of things bought with credit. And what do we see currently, home prices, car prices, and the stock market have all seen slow downs in price increases as expected. However, most people aren’t buying food and clothes on credit so no slow down in demand for those products.

There are also two other impacts of credit prices that the mainstream seems to completely ignore.

1) Increased interest rates increase money flows from investments. So all those people earning 0.5% or whatever from their interest bearing investments are now earning 5% or so. That’s a lot of extra money flowing INTO the economy from those channels.

2) Credit is an input cost that gets passed on to consumers. Grocery stores, retailers, etc. typically purchase their goods on credit. If the cost of that credit increases, they are going to pass those costs on to consumers. Even if they are big enough to not have to buy on credit, they typically pay on terms (net 60 or net 90 are common). Their suppliers typically have credit agreements where they can get paid up front on credit based on their receivables. In that case, increased rates are going to mean a bigger discount and they are going to raise their prices to compensate.

Establish price controls and then we can talk.

It’s all well and good to talk-talk about doing whatever it takes until they’re screaming for your head and you’re frightened for your family because the national debt is so large the payments to satisfy it frighten congress and Wall Street, both.

Hard to be calm, cool, collected when the guillotine is being wheeled out. Me? I think we see 8% before we see 2%. And I’ll even take the over!

Mosler makes a related point. At these interest rates, and with this level of debt to GDP, interest rates hikes may be net stimulative via the effect of fiscal policy. Interest as an expense in the Federal budget is set to hit $1tr next quarter. Thats about 5% of GDP there in one shot.

Admittedly is the most regressive fiscal stimulus you can find, but thats still a fiscal stimulus.

That’s true, but keep in mind that money that is in short term treasuries, commercial paper, etc. has a low multiplier effect. You can likely see that in dropping velocity.

It’s having a net contractionary effect in that people make decisions to save instead of spend (or not to borrow instead of borrowing) because of the change in rates.

One of my favorite aphorisms i heard somewhere is that, “money is like manure. If you spread it around, it makes things grow. But if you pile it up in one place, it smells awful and gets rancid”

Contrarian take:

1) This talk about controlling inflation was lies. They lie about everything else, why tell the truth about this?

2) The mean Millenial is about 35-36yo, and that is the age of mean peak expenditures: houses, cars, vacations etc. The Boomer rearrangement into retirement mode has already mostly finished. (At 62, I am The Last Boomer.)

From now until the Zoomers hit their high-earning years, the US faces a secular long-term slowdown in consumer spending.

3) There is a commercial real estate (CRE) “Bonfire of the Valuations” (BotV) on the way due to the post-Covid work-from-home revolution. (A much smaller influence here is the above “change of life” by the Millenials. Young people like cities, middle-aged people do not.) The BotV will happen over a few years. The Bonfire has technically started, a big office building recently (somewhere, can’t remember) recently sold for 1/6 of its previous price of several years ago.

4) A “Minsky Moment” is a situation where a network of owners are all overleveraged and must sell some assets, but there are no buyers, and so valuations continuously drop. A Minsky Moment is a fast, sudden-onset deflationary cycle. Named for Hiram Minsky, an unsung economist. There were cases in late 2007/early 2008 where money market funds “broke the buck”, meaning they could not guarantee a valuation of $1, and some have claimed that this was proof of a Minsky Moment in their asset base. I have not heard of any widely-accepted rule for declaring a Minsky Moment, the way we have “rules” for declaring a recession. Minsky Moments are strongly destabilizing.

4) When the Fed talks trash about deflation, what really scares them is Minsky Moments. CRE and its derivatives are a major portion of the FIRE economic sector. When the possibility of the BotV became clear, the Fed realized that due to the zero-interest policy (ZIRP) it had no water in the tank for fire-fighting purposes. They frantically raised rates so that they would be able to once again lower them, hoping to avoid a Minsky Moment in CRE. Hoping to slow down the BotV with a slow drizzle of 25bp drops in the Federal Funds Rate. They how have 22 (?) of these 25bp drops available for use whenever they like.

This, of course, merely conjecture. Making Shit Up. Sorry, no cites for any vaguely-remembered facts. It is an informed amateur interpretation based on a lot of reading without saving footnotes.

Cheers!

Perhaps one should speak of a Minsky Event Threshhold in the sense of a Black Hole Event Threshhold?

Offered in case it might permit better thinking if a particular Moment does not present itself. Or if not, not.

Right, standing at the edge of the abyss peeing into the deflated void.

“Man, that water’s cold.”

“Deep, too.”

This People is not getting used to inflation. Resentful? Yes.

I bank at a credit union. All of a sudden they are offering share certificates (the credit union version of CDs) at 4.07 percent, for seven months, with no penalty for withdrawal. And I just got an email; it is now going to be 4.33 percent.

Why are they doing that? To keep people from moving their money from credit union checking accounts to other banks’ CDs (or share certificates)? Is that really necessary? I wonder. I would have assumed that there would be a lot of inertia among the people who had cash in checking/savings, too much inertia to send them to another institution, and that offering this would just stir them up. The other question is, is this great deal for customers, going to harm the credit union?

(note: I would probably save assets in the form of potatoes, if left to my own devices)

And a best-possible-crafted potato storage space for them as well?

I almost described where the potatoes would be hidden, but then thought better of it.

Matt Levine at Bloomberg has been talking about this very topic lately: exactly how do banks work, and what should their strategies be?

https://www.bloomberg.com/opinion/authors/ARbTQlRLRjE/matthew-s-levine

In 2008, the economy was saved through extraordinary intervention. The question should have been asked about which economy was saved…. financial capitalism (FIRE) or industrial capitalism (widgets whatnots and physical)? To me, it is obvious the that it was the FIRE and, it still is the FIRE. It seems to have been this sector in 1873, 1907, 1929, 2008 and (2024, 2032,) etc. until the planet will no longer be habitable for the, self described, smart.. hominids.

Studs Terkel interviews people who went thru the Great Depression and many of them who were minority or common folks with jobs, had barely noticed the Great Depression in that it barely affected their already desperate situations (no safety nets then) and they mention that the only people jumping out the windows were the ones stacking real estate, wall streeters, and the aforementioned FIRE gang.

Things don’t change much and..

“the crybabies on Wall Street are out there in force screaming about those unfair interest rates and clamoring for immediate rate cuts”

So, the rest of society must pay the price because the FIRE sector does what it does … hissy fits, tantrums, bullying, crying, arm twisting, bribing and general cowardice and unaccountability because it does not want to do real work …just lay about while the money rolls in

Adding onto these thoughts, laws and varied business rules being passed also was an important outcome during and after the Great Depression. It has been covered before, of course, but Glass Steagall was an important set of rules that were bought downward in 1999 by Rubin, Summers, etc..

It worked for a long time, keeping that barrier and then whoosh see what happened in 2008. Oh, and Citibank went onto hire none other than Rubin after his stint at Treasury was finished. Rules are there for thee, and no bothersome rules for me. Summers has a sordid timeline as well.

It’s “heads I win, tails you lose” for rich Americans — when interest rates are low, their assets rise in value, and when interest rates are high, they get the bulk of the increase in interest income.

Thus all the heat and light of monetary policy arguments are a distraction from the inevitable trickle-up.