Yves here. I imagine many will take issue with the headline statement, since the inflation that matters is your inflation, as in the one that appears in the basket of goods and services you buy.

Your humble blogger is still seeing increases in food prices, either overtly or through package shrinkage: in dairy, fish, wine, coffee, snack foods, even staples like frozen spinach and black beans. Eggs may not be rising in price but the baseline is now so high as it feels like they are still rising. Consumers are very sensitive to food prices because food is essential and it’s purchased frequently.

Gas and energy prices generally are down but I am seeing price increases in all sort of places, like connectivity and medical charges. And the only place I have seen a decrease is in cut roses (I was buying them for my mother before she died, so I maintain an interest in this category), which ran up and then ran down to their former price.

Note Wolf Richter has a less cheery take, as telegraphed in his headline: For 7 Months, “Core” CPI Hasn’t Improved at All, Stuck at 2.5x Fed Target. Services CPI Accelerates, Rents Not Playing Along, Used Vehicle CPI Spikes. But Energy Plunged

Readers?

By New Deal democrat. Originally published at Angry Bear

Let me cut to the chase right from the outset: except for the very lagging measures of shelter; motor vehicle parts, repairs and insurance; and to a lesser and waning extent, food; consumer inflation is now well-contained and close to the Fed’s target rate.

First, let’s look at the headlines, with the monthly and YoY rates of change:

Total CPI up 0.1% m/m and 4.0% YoY (lowest since April 2021)

Core CPI up 0.4% m/m and 5.3% YoY (lowest since November 2021)

CPI less shelter up +0.1% and 2.2% YoY (lowest since February 2021)

Core CPI less shelter up +0.3% and 3.4% YoY

Energy down -1.2% m/m and down -11.7% YoY

Food up +0.2% m/m and up 6.7% YoY (lowest since December 2021)

New cars up +0.2% m/m and 4.7% YoY (lowest since May 2021)

Transportation services (parts, insurance, repairs): up +0.8% and up +10.3% YoY (vs. October 2022 peak of 15.3%)

Owners Equivalent Rent up 0.6% m/m and 8.0% YoY (down -0.1% from all time YoY high)

This is the same pattern as we saw last month ago, just even more amplified: “Lowest since…” for almost everything *except* shelter, which is close to its all-time YoY high set one month ago.

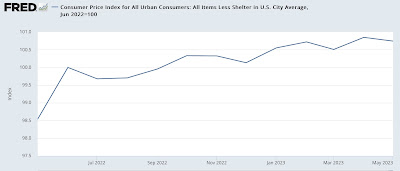

And let me further headline that fact right here: CPI less shelter since last June is only up 0.7%:

That’s an annualized rate of 0.8%.

Keep in mind that shelter component of official inflation, which is 1/3rd of the total, and 40% of the “core” measure, badly lags the real data – as in, by a year or more.

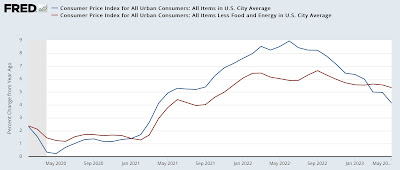

Next, here is the YoY% change in headline inflation (blue), core inflation (red), and inflation ex-shelter (gold)

Both have been in decelerating trends since last June (headline and ex-shelter) or last September (core).

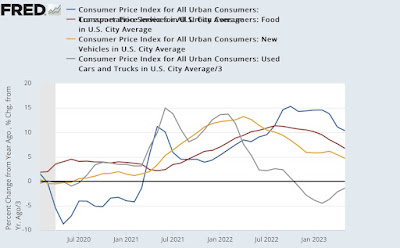

Here are the other big drivers of inflation for the past several years outside of shelter: food (blue), new vehicles (gold), used vehicles (gray), and transportation services (red, /4 for scale!):

All of these are well off their highs, and used vehicles have been negative YoY for a number of months. Aside from food, which is weighted at 13.4% of the total, transportation services are only 5.9%, and new and used vehicles combined only 7.0%.

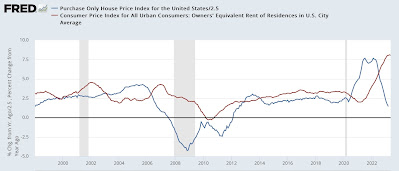

Next, because of the importance of shelter to my analysis, here is an updated long term YoY graph of the big culprit, Owner’s Equivalent Rent (blue), which increased another 0.5% in April, with the FHFA house price index (red, /2.5 for scale), which has been declining since last June and was up 4.0% as of its last reading for February:

Exactly as I have been saying for the past 18 months, house prices dragged OER higher and with it the CPI indexes, with about a 12 month delay. House prices on a YoY basis plateaued for a year between late spring 2021 and mid year 2022, and now OER has finally plateaued as well. The only remaining issue is how long it will remain at that plateau before it follows house prices back down.

Finally, here is “sticky” core inflation ex-shelter:

Even this measure is declining, although less than a “non-sticky” index would be.

As noted above, the FHFA index is only up 3.6% YoY as of March. If it has continued to decline in the 2 months since then at the same rate, it is only up about 2.0% YoY currently, vs. 8.0% for OER. If the FHFA index were substituted for OER, then total YoY CPI for May would only be 2.7%. Core inflation would only be up 3.5%. Neither of these warrants continued restrictive interest rate policy.

In summary, properly measured inflation is no longer a significant issue. Even if OER is a valid way to measure housing inflation, because of the serious lag the Fed should be relying on house prices, and at very least pause.

House prices may have bottomed, YoY price increases (leading inflation) have declined, Angry Bear, New Deal democrat.

Have We Whipped Inflation Now? Angry Bear, Dean Baker, CEPR.

This is more like some kind of shrinkflation, but print runs of new books have been curtailed as in they will print one run and refuse to do a second even for popular books. They want to force people to buy ebooks because it costs nothing. Of course, publishers have also been known to take back or modify an ebook that you

rentedbought.Inflation comes in many forms. “There are lies, damn lies, and statistics.”

I guess that shelter cost is very related to interest rates, but also the mood in the banks. So “the best” interest rates may go down for prime buyers, those that can afford large down payments etc. As it was 40 years ago. But perhaps rents will stabilize, although at higher fraction of incomes than before.

The sleeping dragon is that dollar may weaken gradually because of lower demand as many actors will seek alternative investments, that will put pressure on import prices, perhaps beneficial in the long run, but not in terms of the next year inflation.

I’m with Yves. Food inflation is terrible. Produce, dairy, meat, poultry, fish, staples (condiments, rice, beans, pasta), bakery goods, all up week over week for more than a year. A 4 to 6 oz. box of crackers, many of them broken, goes for $3.99 to $5.99. That’s $16-24 for a pound of crackers! It’s fine to swear off crackers, but then what do you serve with your cheese before dinner? Our grocery bill for two people has about doubled over the last 18 months.

It didn’t help that Covid killed our neighborhood independent grocery store which had a great selection of food and pretty reasonable prices. Now to get the same quality, we have to travel farther and shop at a supermarket that is (always was) significantly more expensive. I know, the problems of privilege…

Yep. Who are ya gonna believe? Govt numbers or your lyin’ eyes in the grocery store? / ;)

Inflation– like real estate, location, location, location.

Stay out of “supermarkets.” Fortunately, I have a choice of 3 types within walking distance. Amazon’s fake organic Whole Foods has increased prices across the board, as has Giant, part of Dutch holding company (forget the name). Trader Joe’s (German) remains stable for staples (bread, rice, beans, canned tuna) with some exceptions like pasture raised organic eggs which are in high demand as people shift to egg protein rather than meat.

I also have farmers’ markets on Tuesday, Saturday and Sunday; some small increases in prices, also for eggs and seasonal vegetables but worth it for the freshness. Artisanal bakers and food producers and farmers don’t have the market leverage for huge prices increases. I prefer to reward their hard work, rather than pay for packaging.

Yep, gas prices in our region are over $4 per gallon. That is much higher than the winter/spring price in the low $3 range.

Eggs at the local Safeway range from $5.99/ Dozen to $11.99/Dozen for jumbo brown organic eggs.

Since the economy is doing so well the “New FDR” has cancelled the increased SNAP benefits put in place by the Orange Hitler, reducing mine as an elderly poor and disabled Man from a little over $300 to $37. My auto registration fee went from $75 last year to $150 and other costs have had similar increases.

I’m one of Millions who is right on the edge financially, but it’s OK because it’s a necessary sacrifice to preserve Democracy in Ukraine…

Similar here, SW Oregon. Pastured organic feed eggs…9.99/dozen. Recent HVAC service call, yearly routine. 2021… price 129.00 This year…189.00. Auto registration…with the new legislation…mpg/gas/electric vehicle…price went up a third for registration. All so very difficult…fixed income, cry me a river. Don’t get me started on PPL (electricity) or…Avista (natural gas)…huge increase in both. Sing song. Rinse repeat.

I guess we’ll have to start drinking gasoline, then.

Like a fine wine, gasoline is best imbibed by first taking time to savor the aroma. ideally in a paper bag.

After a few minutes of that, you’re probably good to go….

Be very, very, very careful not to smoke at the same time. I know a drink and a smoke go well together but in this case—Kaboom!

Apocalyptic talk with the new ecocidal word made up here and tales of lost this and that…maybe better than making new alarming words would be more productive to just stay with the facts, as they are more alarming than any fictional futuristic cataclysmic, like the horrible fact that 108 water dams all over Spain were blown up just last year by the so called socialist government. Those blown up dams will not produce beautiful green hydroelectric energy, will not irrigate any food producing land and will not quench thirst during the hot summers, all that destruction payed with millions of euros by the mighty squished Spanish tax payers and their broken economy without their consent, all done with the blessings of the corrupted politicians in this sad pathetic so call socialist government.

When ever anyone hear about this terrible thing that happens last year, 108 blown up dams!, it follows: Why?? It makes no sense. Spain has an amazing geography, high chains of mountains and might rivers all over the peninsula, dams have been there since the Roman’s times and in particular in the last 100 years, and this government with an agenda 2030 false ecological propaganda, has sabotage one of the things that maintains a live and well the agriculture, the energy and the basic live giving water coming through the house’s tabs. Spear me with the strawberry fields consuming too much water, no one puts light on this catastrophic fact, 108 dams blown up and destroyed all over Spain, where is Germany, the UE and UNESCO about this??? Do they really care about Spain or about controlling, using and destroying Spain?

Do you have any references for this?

Here is one link of many, it appears Europe is dismantling dams at an increasing rate

https://www.euronews.com/green/2022/05/16/why-is-a-record-breaking-year-of-dam-removals-good-news-for-europe-s-wildlife

Food prices in the mid Atlantic region are up 15 – 20% over the last 2 years, with most of the increase in the last year. The price increases seem to have stabilized at the new higher levels and don’t seem to be going higher still. That may change quickly as the Biden Administration is itching for WWIII.

I’m a bit further inland from you at the edge of Appalachia and it’s the same situation here. And even when prices have stabilized, the quality and/or size had declined. My wife likes getting cut flowers and most of those other than maybe from Costco don’t seem to last as long as they did last year, and they got more expensive.

Diesel has gone down noticeably in price, gas hasn’t. Especially when one’s vehicles take premium like ours do.

An average, hypothetical Joe Biden enthusiastic supporter. Joe is working for the average American, see how much less you need to spend compared to just 12 months ago when that evil man Trump had been out of the White House just a mere…16 months! It takes a lag effect to reverse the evil. \ sarc

Yeah this is well and good the downward trending trajectory continues apace. I am troubled by the value increases for new vehicles and used vehicles alike. It has been commented on before, but my recent increase on automobile insurance was quite shocking. Roughly from $500 up to $610 compared to the same 6 month window from 2022 ( May to November, for clarity ). And on a much older Honda Accord, 2008 model; replacement value was the explanation when I have asked before, based on South Carolina data points I’ll presume.

Another insurance data point. My yearly house insurance premium went from $1600 to $2200 this year. Just about fell over and my AAA agent had no answers for the massive rise other than to tell me to cut back on my insurance coverage to reduce the price.

When I moved into my 700 square foot house 12 years ago flood insurance was $400. My recent premium was $900. I dropped it. I’m not in a flood zone. It was cheap enough at the beginning, not so much now.

Huge bump after COVID and now everything costs more than it used to but the increases appear to have stabilized. I imagine some lagging indicators like property taxes and other taxes will go up to defray higher costs for government entities but I am not seeing inflation. This inflation spike reminds me of the jump we had during Bush II and the Iraq adventure, which lead to higher oil prices and then price spikes and inflation freak out, only to have inflation sputter out as oil price stablized. We are not out of the woods, Saudi Arabia and Russia are talking and who can predicted what kind of stupidity crawls out of Congress, so who knows if OPEC+ doesn’t end up embargoing Western countries or something causing high oil prices. Also, who knows what happens with the dollar, if it collapses hard, that would shoot petro prices up again. I don’t really see any evidence of inflation caused by full employment driving up wages. You are seeing a decline in the quality of human capital and employers used to a higher quality of human capital willing to work at lower wages. Not inflation, just unreasonable expectations.

Prices have stabilized, but are so much higher than they were before (especially food). I don’t know how working people are expected to cope — especially people with kids.

Meanwhile Biden continues to cut benefits to the poor while sending billions to Ukraine… the military is a bottomless money hole. The majority of Americans are sick of this I’m sure, but when they go to vote there are no real choices that offer a way out.

Are the food prices going up or is the grocery store of choice the problem? My last dozen eggs were $1.08, and they have been there for a month or more.

I have been convinced ‘they” are desperate to reduce the interest rates they have to pay now on money, and we will soon be back to the “free money” world they loved and prospered in. To do this, “they” will make inflation appear to disappear….just like Covid.

Prices, except for gasoline, are not down in the middle of Georgia. Our Publix checkout cost is still ~20% higher than it was before the jump. The package size decreases are more obvious, too. I suppose Kellogg’s of Battle Creek thinks we are stupid. So I buy the Publix brand of their Raisin Bran based on general principles. Also noticed yesterday that the cost of a harmless microorganism I have bought from American Type Culture Collection for my research has increased by about 150%…It’s everywhere.

The other day at the grocery store I saw the thinnest box of cereal I have ever seen, maybe two inches wide at the most — they are going to have to be creative to make them any smaller.

I have been so annoyed with German food shrinkflation that I have been weighing the goods on a calibrated scale and reducing my portion in inverse proportion to the rising price. Tit for tat. It is getting a little ridiculous. A local maker is now selling frozen food in an 800g “XXL” size, containing only less expensive ingredients, that is exactly twice the price per gram of the standard 750g size they sold three years ago – a price inflation of 25% per year. Their standard size is currently 450 or 500g.

Not sure where the US gets it’s data, but it does not reflect that experienced in my little world. It’s like AI– garbage in, garbage out.

Real Property taxes are going to sky-rocket, as overall increased costs hit local governments that cannot print money. This will impact tenants- whether owner or renter.

The sources are many,especially in what seems to be a major paradigm shift in a post-Covid event world.

Belt tightening is the net effect. Them that have will be less negatively impacted.

Larry Summers said, its those darned high wages. I think wages have very little to do with it.

The bottom line- what eww-mans need– food, energy, and shelter– need to be removed from the inflation figures, stat— we have a four year election coming up.

Why anyone would give a vote to the Scoundrel Class is beyond me.

Our Warrior State—we need The General— General Strike, to replace General Malaise.

Another interesting shrinkflation observation.

My brother-law from America came to stay with me a few days last week. He is even more of a caffeine addict than I am, no mean achievement

He has suspected that the big coffee chains there (and you know who they are!) have been gradually and simultaneously raising prices, lowering the quality of coffee used, and increasing the percentage of water.

Other than price rise, probably no one notices these changes on a day-by-day basis.

When he came over to London and had British Americano (bit of an oxymoron there) from one of the self-same American chains, he remarked, “I had forgotten how good a real Americano can taste.”

In the 1980s, the only place in Southwest London you could get decent coffee was Heathrow (which, as a bonus, was open 24 hours!) Whenever withdrawal symptoms became too great, I would schlep on out there for a maintenance dose.

If you ordered coffee in a restaurant in town, you would get either: (a) brown sludge, (b) a peculiar mixture made from coffee bags (not making this up!), or (c ) a weird bitter drink made from Camp Coffee (note to our woke readers, the logo is now fully PC).

O tempora! O mores!

The world has definitely turned upside down when you can get a better (and cheaper) cup of coffee in London than in New York.

That coffee trick was originally done after WW2 in America where the coffee companies at the time weakened their blends from month to month. If you lived there, you would never really notice it. But if you had gone away for several months and then returned and had a cup of coffee, you would have noticed the difference. Coffee then became much blander than what it was before the war when you could get a decent ‘cup of joe.’ Funny thing was that in the eighties you had these coffee boutique places that served really good coffee. But a case could be made that they were basically serving the same coffee that Americans use to drink before the war.

The fundamental answer to inflation is cheaper competition. Family farms are disappearing. Smaller, locally run stores are disappearing. Large companies are merging into larger companies. Smaller companies that try to compete are bought out by larger companies. The American response is the war in Ukraine that damages EU competitors and an insane trade war with China. These wars seem likely to merge into the eternal American state of war. Add to this the deregulation of the financial economy that guarantees ongoing inflation in housing and other loan related industries. Which political party is going to resist any of this.

Ohio here, energy company AEP announced a while back our bills would be going up %28. It was already creeping higher year after year.

Rising Electricity Generation Supply Costs Impacting Many Customers – AEP

Thanks &%#*&$!

One CPI report and now inflation is over, that seems a bit premature. Maybe I’ll wait a few weeks for the PCE report and then I’ll think about it.

Here in SoCal rents are accelerating again, and not by small amounts, very little real estate inventory, anything decent coming in the market generates bidding wars, buyers writing love letters to the seller, I thought I would never see that again but looks like the frenzy is back. Imagine what would happen to real estate if fed starts reducing rates, prices will explode upwards.

Where do people get the money? My salary has barely increased post covid, are peoples wages increasing by 30%? Everywhere I go restaurants are full, parking lots full, planes full, looks like everything is booming.

Spectrum just raised prices again, $10, basic Internet service is now up $15 in less than 12 months. They did extend my introductory “deal” for another 12 months, though, so these hits won’t really be felt for another 12 months. At that point, it will be almost $100/mo for what had been $50 3 years prior.

Hilariously, Spectrum did own Verizon. They share the towers, and legally, Spectrum can offer a competing cellular service to its own customers, so I am getting Verizon quality service and coverage for $14/mo for 1GB of data. No throttling. Identical service. Kind of hilarious. I don’t leave the house, so 1GB is plenty.

free trade disasters like the exploding shipping rates and ship debacles on the west coast, just send the ships off shore so no one can see them and, WALLAH, mess fixed.

deregulated airlines scamming people with to many ticket sales, not enough planes leaving cheated fliers sitting in airports with no where to go, why arrest them and remove them from the airports, WALLAH, mess fixed.

covid killing and maiming so many people that americans noticed it, why covid is now the flu, no biggie, WALLAH, mess fixed.

the deregulated under invested train system run by psychopaths is imploding nation wide causing massive deaths and destruction. the unions have the gall to try and fix it, bust the unions, WALLAH, mess fixed.

anyone who thinks inflation is under control when michael hudson has plainly said and proven and its true, we have to buy stuff from other peoples now, and pay their prices. wages are going down, but prices cannot go down.

as long as you do not have to eat, live in a home, drive a car, have to pay for insurance of all types, inflation is now under control and WALLAH, mess fixed.

I guess my rant from yesterday was de trop? (I do tend to go off on a tangent sometimes.)

Apologies if I exceeded the extraneous content allowance limit.

[I am practicing my PMC passive aggressive communications policy implementation skills.]

Getting an annual wellness checkup will cost you expensive lab work unless it is for or by diagnosis. So medical expenses are up and Medicare is fighting back. Which doesn’t surprise me considering how the big hospital corporations ordered and billed for everything that wasn’t excluded. Instead of explaining the rationale of the corporations, the patient is warned by and asked to sign documents assuring payment if Medicare refuses which seems to avoid the question of necessity. So medical expenses are suffering their version of shrinkflation. Homeowners insurance is on a rocket to the moon. It now costs $100 to fill the tank. If you can find a handyman for $25/hr, give him a generous tip. Food and booze are holding almost steady – but looking back over the last 50 years they have steadily increased 1000% – in 1970 we spent $50/month on groceries and sun dries, now it’s about $600 – so food is keeping pace with real estate. As long as wages keep the pace everything will be OK. But the Fed doesn’t like that part. I’m guessing that the country has learned its lesson when it comes to labor – it’s the most counterproductive measure to apply austerity to labor. Hell will probably freeze over before the Fed admits to it.

Around here (western WA) real estate is on the moon – under $500k for a three bedroom house in decent shape – fergetaboudit. Inventory is also extremely low so there is a lot of competition so anything decent gets bid up over the asking price.

Besides “shrink-flation” in food there’s now what I call “aqua-flation”. Aqua-flation? Yeah, those wily manufacturers have taken to adding water to almost anything in a can if they can get away with it.

One horrible example: A certain brand of pumpkin-pie filling never had water in it before. Now water is the third listed ingredient. One poor pumpkin-pie lover on a consumer affairs program was mystified that his last pies had turned out so badly. The host showed him the “new” ingredients. Mystery solved and lesson learned.

Call me wild and crazy, but the Fed has been fighting inflation by raising rates. Wage increases seam to be largely on hold, so their real mission has been accomplished. Now anyone with basic math skills and the will to look at the prices charged knows inflation hasn’t really stopped year over year. But the banks need those rates to go down. Real estate is a bomb waiting to go off. Unfortunately other factors are controlling price increases.

America is caught between. We are going to be told over and over inflation has ended, while every bill, trip to the grocery store, etc will tell us otherwise. Selected indices will be crapified even further.

The best headline I saw was “lowest inflation in two years” — but no pay rises to match.

Some smart economists argue that inflation and the Fed rate are simply not connected. If you think about it, how can they be?

Simple price controls would work.