The Biden administration continues to insist that the economy is strong and its efforts are improving the situation. So, what is in its most recent efforts announced on Wednesday? From the White House:

Today, the President will outline several new, concrete steps in the Administration’s effort to crack down on rental junk fees and lower costs for renters, including:

-

New commitments from major rental housing platforms—Zillow, Apartments.com, and AffordableHousing.com—who have answered the President’s call for transparency and will provide consumers with total, upfront cost information on rental properties, which can be hundreds of dollars on top of the advertised rent;

-

New research from the Department of Housing and Urban Development (HUD), which provides a blueprint for a nationwide effort to address rental housing junk fees; and

-

Legislative action in states across the country—from Connecticut to California—who are joining the Administration in its effort to crack down on rental housing fees and protect consumers.

Importantly, while these commitments from rental housing platforms will make renters better informed about the total cost, they do nothing to make housing more affordable. Here is what the platforms are doing:

-

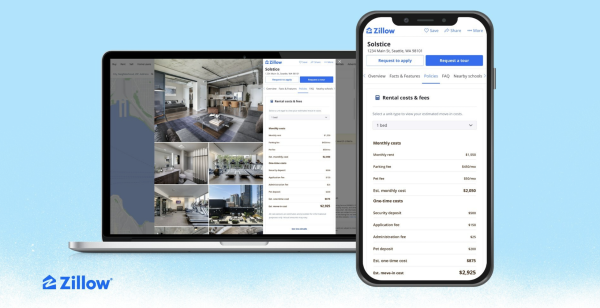

Zillow is today launching a Cost of Renting Summary on its active apartment listings, empowering the 28 million unique monthly users on its rental platform with clear information on the cost of renting. This new tool will enable renters to easily find out the total cost of renting an apartment from the outset, including all monthly costs and one-time costs, like security deposits and application fees.

-

Apartments.com is announcing that this year it will launch a new calculator on its platform that will help renters determine the all-in price of a desired unit. This will include all up-front costs as well as recurring monthly rents and fees. The Apartments.com Network currently lists almost 1.5 million active availabilities across more than 385,000 properties.

-

AffordableHousing.com, the nation’s largest online platform dedicated solely to affordable housing, will require owners to disclose all refundable and non-refundable fees and charges upfront in their listings. It will launch a new “Trusted Owner” badge that protects renters from being charged junk fees by identifying owners who have a history of adhering to best practices, including commitment to reasonable fee limits, no junk fees, and full fee disclosure.

So a search could now look something more like this:

More from the White House release:

Today’s announcements build on the Biden-Harris Administration’s ongoing efforts to support renters, including through the release of a first-of-its-kind Blueprint for a Renters Bill of Rights and a Housing Supply Action Plan, focused on boosting the supply of affordable housing—including rental housing. Reducing housing costs is central to Bidenomics, and recent data show that inflation in rental housing is abating. Moreover, experts predict that roughly 1 million new apartments will be built this year, increasing supply that will further increase affordability. The actions announced today will help renters understand these fees and the full price they can expect to pay, and create additional competition housing providers to reduce reliance on hidden fees.

The problem with these efforts to support renters is that they do nothing to stop the eviction and homelessness crisis now. The Housing Supply Action Plan could maybe help with affordability at some distant date, and a blueprint is just that. Why can other places figure this out, but the US can’t? For example, Ross Barkan writes about Austria:

Americans are usually shocked to learn that a vast majority of Viennese qualify to live in deeply affordable, high-quality housing. There is no downside to renting there because the rents will always be a small fraction of your annual income. Forty-three percent of all housing is insulated from the market and the government subsidizes affordable units for a wide range of incomes. Decades ago, a great amount of housing supply was built, and unlike in the United States, Vienna never abandoned the cause of public housing.

It’s obvious to any tenant reading about Vienna that life there, from a standpoint of sheer economics, is better than life in any major American city. Rents, always high in New York and California, surged across the country during the pandemic, fueling a homelessness crisis that will not abate. For those who have housing, existence is only stress-free as long as the job is well-paying. One wrong turn and eviction is around the corner. Certain localities have stronger tenant protections than others. Either way, rent is something many Americans—those who don’t own property, and are nowhere close to buying anything—must think about constantly. It is an economic and psychological burden. To be liberated from it, like the Viennese, would be to enter a utopic state.

Instead of anything resembling such policies, the Biden administration has been relentlessly hyping the junk fee efforts as a key part of its economic policy. From USA Today:

The White House is also convinced it’s good politics, particularly as Biden tries to improve his standing with the public on the economy as the U.S. rebounds from 40-year high inflation.

“Often policy is a way of showing character,” said Celinda Lake, a 2020 Biden campaign pollster who conducts regular focus groups with voters. “When you’re a longtime politician and you’re in office, people think you get out of touch with their lives, you don’t have any commonsense. This shows, ‘Hey, I am in touch. I do have commonsense.'”

But does it? With the announcement of the administration’s latest efforts, it seems like that plan is running on fumes. With rent increasingly unaffordable for many, will it really make a difference if fees are more transparent? Announcing such voluntary commitments from rental housing platforms without any additional measures to do anything about costs seems like a strange way to go politically, especially as rents continue to rise.

Evictions are also rising. From Quartz:

Eviction filings are on the rise in some US cities, according to datacollected by the Eviction Lab at Princeton University. The lab published the first dataset on eviction filings in the US going back to 2000, which is based on (pdf) tens of millions of public state and county records. Rising costs of living are affecting Americans across the US, while stock of affordable real estate remains low.

…Landlords in many US cities have completed at least half of their eviction filings since 2020 in the past year.

New research in California – which has roughly a third of the country’s 582,000 homeless population – shows that the main driver behind homelessness there is simply that Californians were priced out of housing. The study from UCSF’s Benioff Homelessness and Housing Initiative is one of the deepest dives into the state’s crisis, and it shows how the homeless population is getting older and is often the result of just one bad break. According to the study, “in the six months prior to homelessness, the median monthly household income was $960. A high proportion had been rent burdened.”

In a recent YouGov survey, more than 50 percent of Americans thought limits on price increases would probably or definitely be an effective policy, and 61 percent blamed large corporations seeking maximum profit for inflation – the highest recipient of blame in the poll. Americans want more action. From Newsweek:

Poverty remains a huge issue in the U.S., much more so than in other countries with similar levels of distributed wealth, and it is a cause of concern for a majority of Americans, as shown by the Newsweek/Redfield & Wilton Strategies poll. The poll, conducted among a sample of 1,500 eligible voters in the U.S. on May 31, found that some 53 percent of Americans are “very” concerned about the level of poverty in the country.

Among Democrats—identified as people who voted for Joe Biden in 2020—the number went up to 58 percent, while among Republicans—identified as people who voted for Donald Trump in 2020—48 percent said they were “very” concerned about poverty in the U.S. Some 21 percent of Americans responding to the poll don’t earn enough money from their primary job to pay bills or maintain their family’s standard of living, while 52 percent are working multiple jobs to tackle the daily cost of living.

The Biden Administration is betting its junk fee efforts, which have also included concert ticket vendors and others, along with softening inflation will be enough to overcome all the other bad news. So far, it’s not looking very promising. At this point in his term Biden is the second-most-unpopular president in modern U.S. history. Wednesday’s announcement might be part of the reason why as it represents the woefully inadequate response to the economic situation faced by so many.

Just consider some more of the recent news:

- With inflation biting, credit card debt in the US has been rising at one of the fastest rates in history and is at record highs.

- Increasing precariousness has homelessness rising across the country, including up 40 percent in Los Angeles County over the past five years. It’s jumped18 percent this year in New York City.

Here’s the Federal Reserve Board’s Economic Well-Being of U.S. Households in 2022 report:

The report indicates that self-reported financial well-being declined in 2022, in part reflecting ongoing concerns about higher prices. In the fourth quarter of 2022, 73 percent of adults reported either doing okay or living comfortably financially, down 5 percentage points from the previous year and among the lowest levels observed since 2016.

Consistent with these changes in overall financial well-being, fewer adults reported having money left over after paying their expenses. Fifty-four percent of adults said that their budgets had been affected “a lot” by price increases.

According to a new survey from Bankrate, Americans said they would need to earn, on average, $233,000 a year to feel financially secure. The median earnings for a full-time, year-round worker in 2021 was $56,473, according to the US Census Bureau. Despite all that, the Biden administration continues to express confusion as to why voters aren’t happier with the economy.

It would be nice if there was a link that described the problem of excessive and hidden fees for renters. Sure, I’ve lived out of the country for 5 years so that’s one reason I don’t know what the problem is, and I also owned a home since 2010. Before that I rented houses in California and I don’t remember there being a problem with undisclosed fees at all. Hopefully someone in the comments can provide more information about the problem statement.

Here in Uruguay they have a form of co-op housing, where a group of people get together and form the co-op which then seeks a loan from the state mortgage Bank to build the property and hires designers, architects and builders to create their building. They then pay back the loan to the state-owned bank over a time period of up to 30 years. But it can take many years from the formation of the group of want-to-be homeowners before they can move into their finished properties. I am thinking of interviewing someone who has done this here in Uruguay and writng up a little piece about their experience. If people have any interest in that, they could throw out some questions to me and I’ll look back here to see what would be good to include in the interview.

Wouldn’t it be great if a US president put forth a program based on a state-,owned mortgage Bank that would help people with an affordable path to home ownership in an apartment building/condo?

I have a question. Where you said that a group of people ‘hires designers, architects and builders to create their building’, to cut costs, is there a sort of standard design emerging or selection of designs that they can choose from? If one group designs and build a building that is both functional and beautiful, I could see other groups choose the same design rather than re-inventing the wheel.

They go along the lines of…

Application fee: $300

Credit report fee: $75/person

Cleaning fee: $400

Mandatory Concierge Fee: $50/month

Surprised financialization isn’t mentioned. There was a line in one of Michael Hudson’s books that stuck with me: “rent exists to pay interest”.

The Democrats continue to offer better PR as their preferred solution.

And the solution that republicans are offering is?

Let’s go, Brandon!

It’s a competition to determine the lesser of two nightmares.

Inevitable when both parties are owned by the 0.1%.

Not a relative comment for this article. My cynical point of view is that Republicans stab you in the chest while Democrats stab you in the back.

My version of this for years has been: The Republicans tell us they’re going to F**k us over, and then they F**k us over. The Democrats tell us they’re going to help us, and then they F**k us over.

.human, your version is shorter and therefore sweeter. Hope you don’t mind if I borrow it?

That’s it. And the Rs stab you in the chest, while the Ds stab you in the back. De-facto one party dictatorship.

I suppose that the purpose of US presidential elections is to offer citizens an alternative as to where they would prefer to be stabbed for the next 4 years?

Isn’t “our democracy” wonderful?

Not cynical, but a reflection of reality. After being stabbed so many times, the vision becomes 20/20.

It’s painfully simple. Obama bailed out the banksters by inflating asset values to cover the banksters gambling debts, which also paid one half of the country to kill off the other half. You’ve ridden lesser of two evilism as far as that horse is going to ride. At best we have 2 republican parties fighting over who can take credit for further enriching the comfortable. Regardless of what republican policies may or may not be (feel free to provide some republican policies on this issue) no working class person should vote for the dems as they have become the party of the rich. This policy is nibbling at the edges and the whole “aw gee what do we have to do for these people?!?” schtick is insulting.

“You’ve ridden lesser of two evilism as far as that horse is going to ride.”

Indeed. We are now firmly in the era of greater evilism. The knives now become longer, sharper, and doused with poison. And looking back towards more hopeful times is strictly forbidden (a mantra for the era inaugurated by Saint Obama: “I also have a belief that we need to look forward as opposed to looking backwards.”)

Please, no binary thinking.

The only movement that can fight fascism is socialism

And what are the Republicans offering? Fewer illegals and refugees to compete for scarce apartments, jobs, houses, forcing down wages, making mockery of benefits, expectations of employee privacy, used cars, spaces in schools..other than that, can’t think of anything.

C’mon, man! He told you:

No, change in inevitable and things will fundamentally change.

But it will be due to the global south not due to the imperial core for all roads have led to Rome.

Americans will never make meaningful change, at least not now.

The global south will and this plus internal contradictions will euthanize the American imperialist and capitalist system.

But it will not be pretty.

Mine just says “ask again later”

Is this a fresh voice from the South? Welcome.

Interesting that the credit card debt is hitting an all time record. Yet again, one for the books and this Administration is winning hearts and minds! ( Sarc ). I do think that inflation, while trending down yes, still needs to be tamed further but I could contend living with 2.5% to 4.0% inflation, annualized, if you made me. Rental fees have become a bit more pernicious compared to 10 years ago, but fortunate that even allowing for instances of ownership changes, my apartment complex is locally managed. Reading the fine print is a pain in the neck. Heck, 10 to 15 years ago my recall it was 1. the monthly rent and 2. any monthly utilities ( water or sewer, primarily ). Precariousness of the average American has become more a feature than a bug, post Great Financial Crisis.

I am more and more convinced that the stagflation specter was conjured from the introduction of credit cards. This because it allowed workers to maintain consumption in the face of stagnate wages.

I also have to wonder how much of that increase is being fueled by interest increases. And with the Fed raising interest rates there are going to be increases. Oh I know that on paper it doesn’t seem like much but if your $100 payment towards your credit card debt no longer has $75 dollars go to the principal, but only $50… well that does have an effect. (and yes a friend was just telling me that their card’s interest has almost doubled in the last month). If you have to backstop anything no matter how small or briefly it will seem like more.

There is likely a wonky think tank or Federal Reserve district that has such a study in the works. Maybe New York or perhaps the St Louis Fed site, FRED, but I am postulating. All of them PhD need something to earn their keep I’m certain, aside from not observing actual price pain points in our tremendous and strong economy. Best economy evah, comrades!

Anecdotal to me, last Friday / Saturday I had a singular PITA (pain in the butt) episode trying to access the “customer service” of my credit card wheeler dealer, Citi Card. It is as though their copper landline was somehow extricated at the moment ( Sarc ). Last attempted on Monday, nothing.

Using the phone to access a real person is nigh impossible today. You can use the phone tree but it will only offer scripted answers. The new, more efficient (cost cutting) method of customer service is the website that asks you to select from a long list of FAQ’s before requiring customers to scour incoherent webpages for an answer to their inquiry. Of course, this is all a tax on YOUR time; and a transfer of costs from them to you!

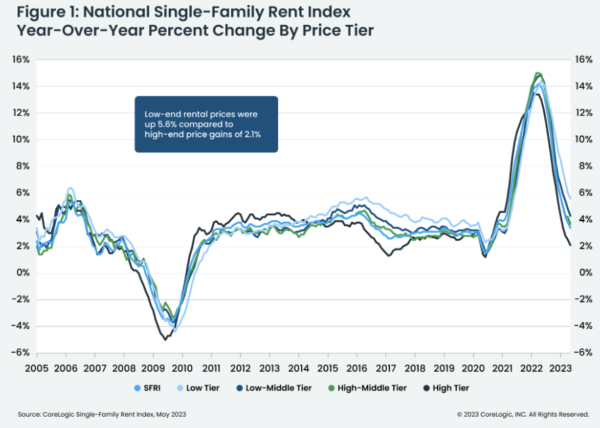

That rent index graph was an eye-opener. Inflation is up because workers’ wages have gone up 5%?? Come again?!

As a business turnaround specialist, I am privvy to all kinds of data, especially the kinds that come from privately-owned companies. In my opinion, this economy and its coupled inflation is almost solely drawn from the greed of corporate America. You can’t use wage growth as a reason or cause of inflation. You can use price-gouging and swine-troughing C-suite compensation (along with stock splits and buy-backs from the public companies) as reasons and causes, though. It’s hard to defend a company that had a pretty good margin of profit before Covid that had increasing profit margins and profits every year since 2019…and I’ve worked with about a dozen of them during that time frame.

Yeah, they initially got away with it thanks to supply disruptions from COVID. But now they are just exploiting consumer acclimation to the “new normal”.

Isabella Weber’s work agrees with your observations and assessment.

Indeed. I recently got a text from my cell phone service, T-Mobile, saying that if I wanted to keep my $5.00/month autopay via credit card discount, well, no more credit cards for Slim.

Instead, I would have to give T-Mobile access to my bank account or to a debit card.

Heck to the no! Both of those payments are quite risky, T-Mobile.

BTW, I am not the only customer who’s quite unhappy with what is essentially a back door price increase.

AT&T emailed me couple of days ago.

Your discount per line will drop from $10 to $5 per month if you continue to use a CC.

Want to use your card on file? No problem!

Til next year heh.

I link a lot of payments to checking account. And don’t have to redo a bunch if a CC gets stolen or whatever. The checking account does not have overdraft protection, and I move money into it as needed for upcoming bill paying. I don’t see much risk, but I might be missing something.

Try shutting off the payments. Say you move, or have a dispute, or they just screw up and charge you the wrong amount you are without power. If for some reason the companies don’t cancel, override your dispute or just can’t get their customer service to follow through you have no recourse, they can just keep taking.

But then you may trust all those entities more than I do.

Yes, the one time I had to stop disputed automatic bank payments that, admittedly, I didn’t notice in time, I had to attest that I did not receive a benefit from the payment. In any event, stopping them is more difficult than I anticipated. And Slim, I’m not sure it’s a back door rate raise (I also have T-Mobile and I ain’t doin it either) as much as I think they want access to your bank account. Not gonna do it.

Those motherfuckers now charge an extra five dollars if you pay your bill in person WITH CASH!

Someone buys a triple decker for 30% more than what it was worth three years ago. Then jack the rent up 40%.. but yeah let’s blame salary inflation.

Real estate developers are an enormous political lobby, and their profits are subsidized by huge tax breaks. They are also one of the main industries that props up our big banks. If we wanted to prioritize more affordable housing, we would change the tax incentives. You will know that is going to happen when a pig flies by.

It’s almost like they don’t care what voters think because their votes won’t matter.

As Bill Clinton replied after being told he was “alienating his base” (after endorsing NAFTA, financial de-regulation, social spending cuts etc.) “what are they gonna do? vote Republican?” and then chuckled.

The joke is on us. But look how many folks still believe in the fairy-tale of US democracy.

I saw a clip about good financial advice. It said that to buy a $32,000 car with the appropriate down payment, not financing more than 4 years and the total payment being a financially sound portion of monthly income the buyer should earn … $98,000/year. Rent and housing are even worse when considered from a traditional sound financial planning perspective.

There’s almost no way to get ahead for the vast majority of Americans anymore. Not unless your son can leverage your position as VPOTUS and kick back 10% to the big guy.

Hey that’s an alleged 10% !! Unverified sources per an AP news release about the Senate Repubs that I saw late yesterday, not that it ever stopped anyone from either party playing a good bit of political football with unverified information.

No, not ever! Only done by those with a pure heart and open mind. \ sarc

Part of the problem that rarely, if ever, gets discussed is that for most middle class and lower class (excluding downright poor) Americans their lifestyles are simply too rich. Examples are cable TV, high end cellphones, manicures & pedicures, hair salons, dining out frequently, unneeded (but desired) consumer goods, etc…Perhaps if people would downsize their lives a bit they would be under less financial stress.

But why is that

lifestyle thought to be normal/acceptable?

What became of living within ones means?

According to the whistle blower the gov purposely let the statute toll on the Burisma millions so he got a big chunk tax free. Interesting that the mainstream press is not covering that.

I am a renter looking to move and am astounded at the hidden fees – one company charged xx for a pet, xx for admin fees, xx for water, trash, and pest control, and xx for mandatory renter insurance – EACH MONTH – on top of their advertised rental fee.

I check craigslist frequently and these charges never seem to be listed – and they are not optional and are always in the rental agreement / lease as required monthly payment.

The *really* hilariously exploitative one I have been seeing lately is being euphemized as a “renter benefits package.” They report your rent payment to a credit bureau, call to I guess set up your utilities when you move in, and deliver you an air filter at whatever interval. The price? $50 a month, mandatory. $600 a year for some air filters and them calling the power company one time.

I also love the “non-refundable pet deposit.” If it’s not going to be refunded under any circumstances, that is a *fee*, not a “deposit.”

Canada isn’t winning any awards for its homelessness and housing performance either. I’m fairly certain that housing starts peaked in the 1970s. For some context in 1975 there were about 23 million Canadians; now there are over 40 million. Perhaps not coincidentally Canada’s Federal and Provincial governments got out of the business of building public housing in the ‘80s “because neoliberalism.”

Let’s face it — “the market” has never, and will never, provide sufficient low income housing. The experiment has been run for at least 40 years now and it has been an abject failure. With apologies to Keynes, “when the housing development of a country becomes a by-product of a casino, the job is likely to be ill-done.”

Governments need to get back in the game of building affordable housing yesterday. But I’m not holding my breath, living as we do in nations governed for rentiers by rentiers …

I was reading a memoir by Martin Kalb of the time he was posted to the US embassy in Moscow, and one of his Soviet interlocutors was cynical about the US. This is a quote from the book:

And that was in 1956. Very prescient indeed.

Honest question, because I don’t know and the article really didn’t explain what they meant by the term… what exactly is Bidenomics? I cut point to a single unique policy proposal or position from this administration that has been supported long term and can be considered a platform like object. I had thought the child tax credit thing was going to be something like that, but it was briskly killed. And I had hoped student debt relief would be in the mix too, but instead we have that dreaded “fighting for status” so I have zero confidence anything will ever be done. There’s been no tax reform. There’s been nothing to help workers. Biden has squashed unions occasionally but not enough to be either pro-union or pro-management. So what is this thing?

Bidenomics: Tell them a check for two thousand is in the mail, and it arrives six hundred short.

reaganomics out of the microwave with a few billion microplastics added

CHIPS Act and the Inflation Reduction Act. Nope, no sarcasm tag is necessary.

You see those poor companies like Taiwan Semi and Intel just need governmental bootstraps to support their corporate, for profit organizations. Intel honestly seems to be lacking at the moment, particularly in the profit seeking goal. And separately on manufacturing, I have observed quite a few regional anecdotes for EV battery manufacturing plants either built or gonna build in the Carolinas. Toyota has one in the Greensboro / Burlington / Asheboro corridor, my recall anyway.

Sears / Willis Tower in Chicago can be converted to house 11,000 people @ 400 square feet each.

This is not even a betrayal. It is worse, all perception management, public relations, BS and not really as solutions of kind.