Yves here. The post below on intellectually dishonest behavior by the University of Chicago Stigler Center’s ProMarket publication and three academics is more important than it seems at first blush. As we will discuss, it shows that what looked like a to put a kinder, gentler face on neoclassical economics, which in layperson terms is strong-form neoliberalism, is a sham, an exercise in econowashing. ProMkarket published, then retracted an analysis that disproved the economic logic of the current anti-trust standard, that the only basis for backing anti-trust measures if if they will increase output. That finding should not even be controversial. Yet the shifting and nonsensical excuses for yanking the piece strongly suggest the real reason was that it bucked party line.

The Stigler Center, created in 1977, kicked into a higher gear of activity a few years ago, by among other things sponsoring a series of fellows, many of whom were not card-carrying neoliberals, and hosting conferences that again looked intended to go beyond the University of Chicago faithful. The Stigler Center website depicts it as wanting to promote competitive markets to benefit general welfare. While it’s not hard to see that as anti-labor, it should also entail opposition to rentier activities and monopolization.

One of its publications, ProMarket, has similarly encouraged economists who are well outside the neoclassical/neoliberal fold to contribute pieces. But now that anti-trust is a hot topic thanks to Lina Khan at the FTC. And now that the Department of Justice and the FTC have published draft merger guidelines, we are seeing the Stigler Center and ProMarket’s true colors.

By Darren Bush, Professor, The University of Houston Law Center Faculty; Mark Glick, Professor, University of Utah; and Gabriel Lozada, Associate Professor of Economics, University of Utah. Originally published at the Institute for New Economic Thinking website

A central aim of Neoliberalism was to dismantle the antitrust regime put in place after World War II whose central goal was to protect democracy, small business, local control, and to prevent transfers of income from labor to large corporations with market power. The principal mechanism for limiting antitrust enforcement was the Consumer Welfare Standard popularized by Judge Bork and University of Chicago economists. The Consumer Welfare Standard restricts antitrust goals to preventing decreases in consumer surplus. In practice, this means the goal of antitrust is solely to increase output. The justification rested on an outdated and flawed theory that human welfare was advanced by more output alone, a theory that virtually every welfare economist has since abandoned, and one that only survives in some dusty industrial organization textbooks. The theory is defective because it ignores distribution: in the antitrust world, a dollar transferred from labor to a monopolist has no welfare implications. We have written several papers published by INET and professional journals about how fallacious this approach is.1The response from Chicago partisans, not surprisingly, has been to ignore the issue.

Then we submitted a two-page blog to ProMarket, a publication of the University of Chicago’s Stigler Center, housed in the Booth School of Business. Our two-page blog demonstrated that even in the most general neoclassical model, an output increase is not sufficient to increase welfare. Allocation—how goods are distributed—matters.

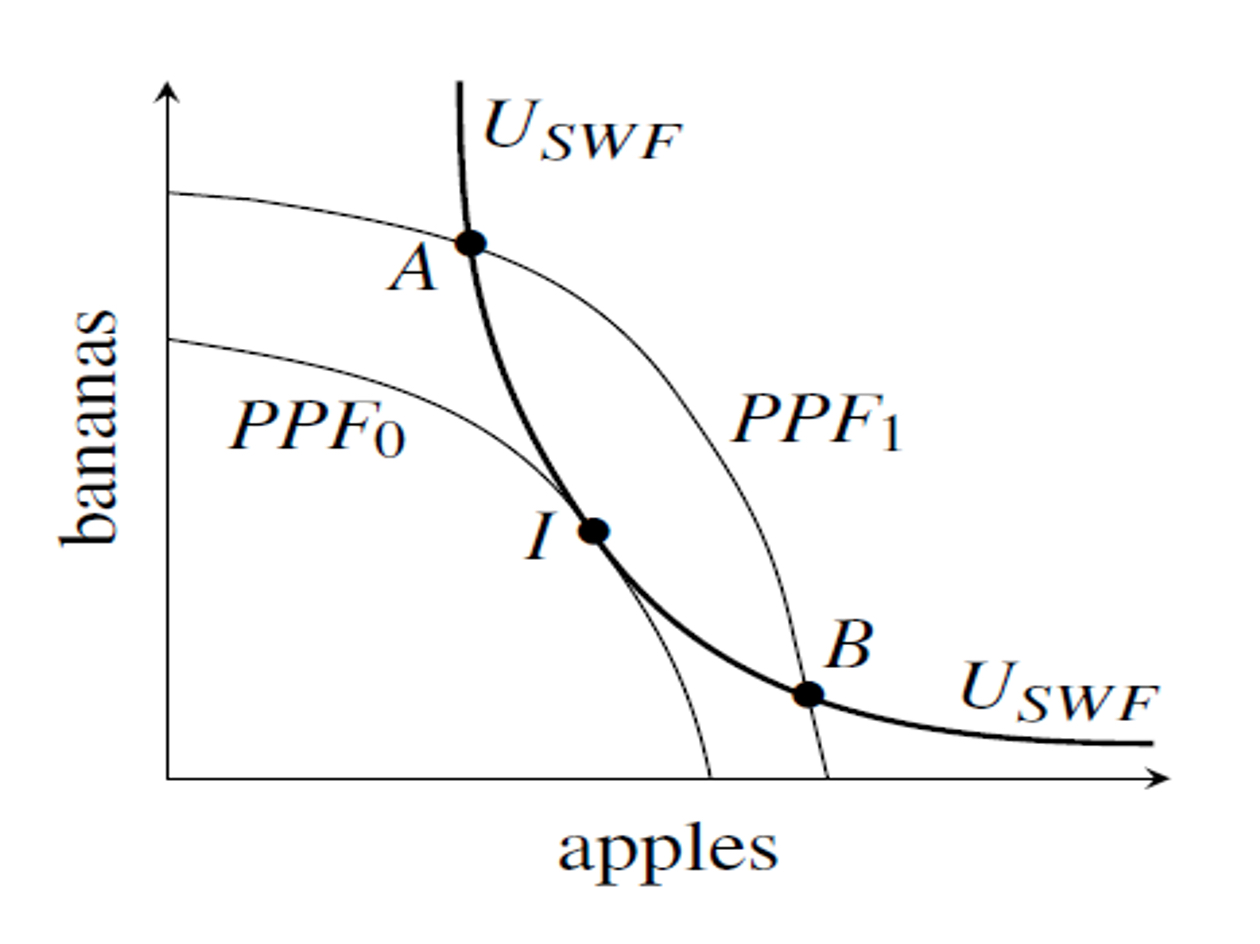

Our original post started with a production possibility frontier (PPF) and a social welfare function. The figure showed an outward shift of the PPF, an output increase. If there is no additional step of optimizing allocation, points below B or to the left of A would represent a decrease of social welfare.

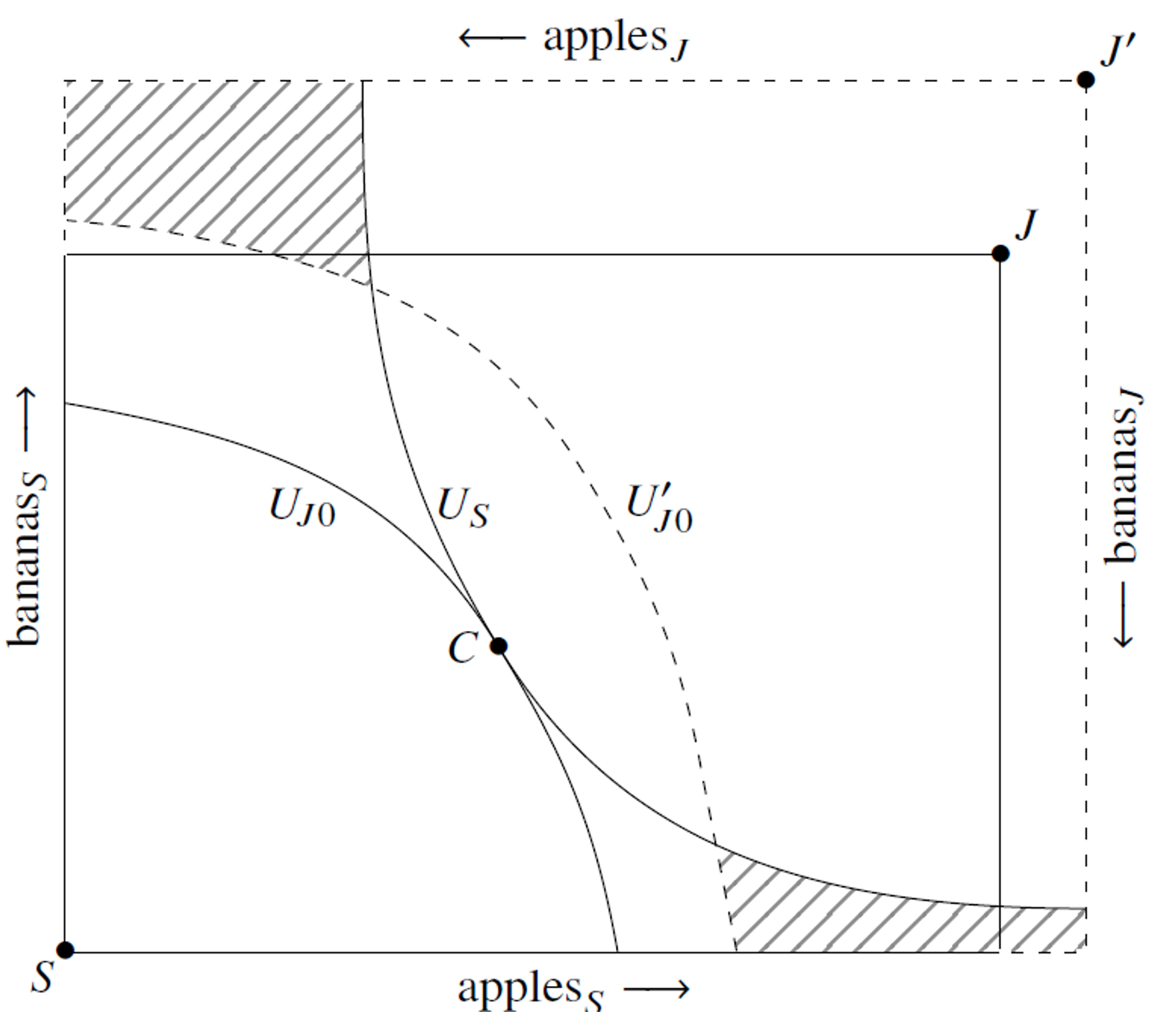

We next offered an Edgeworth Box example, which makes the same point if no social welfare function is defined.

The point of this figure is to show that an increase in output can decrease the individual utility of every person if output is allocated in certain ways.

ProMarket accepted the post and published it. But then something strange happened. An anonymous board member demanded to Editorial Board member Professor Luigi Zingales that it be retracted. At first, we were told our proof was wrong because if you fully optimize and welfare only depends on consumption and all the Arrow-Debreu assumptions are in place, then welfare increases. That one can pile assumptions on top of each other enough to increase welfare is obviously true but beside the point. The response actually implicitly proves our point – that output alone is insufficient.

We responded that whoever had complained should write a signed blog post critiquing our post. We also offered another version of the graphs in which there was no optimizing in the initial position, together with corresponding textual revisions; the conclusions were unchanged. ProMarket staff informed us that while they were prepared to post it as an update to our piece, alas Professor Zingales still felt it was not enough to have a proof that simply shows a possibility.2 Staff asked if we would like to withdraw the piece despite it being already published.

We declined. We then received an email from Professor Zingales. It stated that the original graphs didn’t have an equilibrium and that if the social welfare function is maximized then the proof doesn’t hold. Done right, output alone does increase welfare. Therefore, the proof is wrong.

What followed was a phone call with Professor Zingales and two of the authors. Zingales conceded that the point was in fact a correct description of the feasible set, but insisted that a description of the feasible set, without a full-fledged behavioral model that would specify exactly where on the feasible set the economy would end up, was not worth publishing.

The retraction was carried out with the following unsigned note to readers. We agreed to the language, as we were concerned that ProMarket would put a retraction notice out there that would injure our reputation. That would cause us to pursue litigation. The language reads:

ProMarket published the article “The Antitrust Output Goal Cannot Measure Welfare.” The main claim of the article was that “a shift out in a production possibility frontier does not necessarily increase welfare, as assessed by a social welfare function.” The published version was unclear on whether the theorem contained in the article was a statement about an equilibrium outcome or a mere existence claim, regardless of the possibility that this outcome might occur in equilibrium. When we asked the authors to clarify, they stated that their claim regarded only the existence of such points, not their occurrence in equilibrium. After this clarification, ProMarket decided that the article was uninteresting and withdrew its publication.

A recognition that output increases alone do not increase welfare is interesting, outside of the University of Chicago. It reveals that the opposite contention, which is a central tenet of the Consumer Welfare Standard, crucially depends on very particular modeling and equilibrium assumptions, because without those assumptions, increasing output may fail to raise welfare. The Consumer Welfare Standard is an important obstacle holding back antitrust policy from progressive reform. Many progressive economists have made the case that increased market power has caused irreputable harm to the economy and to the social fabric of the United States. For example, Professor Joseph Stiglitz has written on the importance of allocation. He states: “A closer look at those at the top reveals a disproportionate role for rent-seeking: some have obtained their wealth by exercising monopoly power…” Similarly, Thomas Philippon has demonstrated that increasing wealth inequality decreases reinvestment. Among non-mainstream economists that Chicago routinely ignores, Brett Christophers has documented an increased concentration of assets into the hands of a few, the rentier class.

Some ProMarket contributors have questioned the removal of our piece. Professor Herbert Hovenkamp questioned why the piece was removed when others have made similar points. As Professor Steve Salop noted, the second set of graphs we submitted should have taken care of any problem ProMarket had with the piece.

All of us know from Carl Sandberg that Chicago is a city of big shoulders. Its eponymous economics school has no business shrugging off so central a point. Of course, our conclusion is important, which is why ProMarket initially published it. The claim that it is of no interest is transparently a desperate effort to shore up a doctrine that is now collapsing.

The full piece is available at The Sling.

Notes

-

- See, e.g., Mark Glick and Darren Bush, “The Chicago School, The Post Chicago School and The Neo Brandeisian Schools of Antitrust in Light of Modern Economics,” available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4417509. Mark Glick, Gabriel Lozada, and Darren Bush, “Why Economists Should Support Populist Antitrust Goals” 2023 Utah L. Rev. 769. Mark Glick and Gabriel Lozada, “The Erroneous Foundations of Law & Economics,” available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3812839; and Darren Bush and Mark Glick, Breaking up Consumer Welfare’s Antitrust Policy Monopoly, 56 Suffolk L. Rev. 203 (2023).

- This is a close paraphrase of the communication we received, including the regretful “alas.” We would be very happy if ProMarket released its side of the correspondence to the public.

An anonymous board member demanded to Editorial Board member Professor Luigi Zingales that it be retracted.

It is no surprise to me that Luigi Zingales is involved one more time in stinking up the place. I remember the good old days when a signal concern of his about the Italian economy was that taxi drivers needed economic reforms. As if the neoliberal structural problems of the Italian economy of the last thirty years were being caused by the taxi drivers here in the Chocolate City (or in Roma).

I certainly wouldn’t want to go all ad hominem on Zingales, professor of entrepreneurial greatness, except that he is one more symptom of a university that was captured about forty-five years ago by the business school (now “Booth,” after some mega-donor) and the seriously flawed economics department.

Aside from the Stigler Institute of Economic Correctness, one must also keep in mind the Becker-Friedman Institute, where male and female Vestals of Economics, untouched by Common Sense, keep alive the obsolete and ridiculous ideas of Gary and Milton.

You may wish to indulge in several repetitious paragraphs of “evidence-based-ness,” emphasis on the adjective “base.”

https://bfi.uchicago.edu/about/about-bfi/

I am such an old product of the University of Chicago, A.B. 1976, that I recall the days when many people on campus were highly skeptical of the business school and its pretensions and the economics departments and its lunatical “theories.”

Now, though, a gigantic Booth building sits where my dorm was. Yep, they had to tear down the Saarinen entry building / dining hall. What are esthetics when one can instead frolic in a pool of money?

A monumental edifice built on indifference curves. Ceteris paribus anybody?

“The point of this figure is to show that an increase in output can decrease the individual utility of every person if output is allocated in certain ways.”

The guardians of the neoliberal global economic order are having panic attacks at the word “allocation.”

“Distributed” would have set them off too.

“All they got” is asset bubbles.

Chicago has emulators. Tell them, too.

At some point, the pretense about “uninteresting” will begin to collapse.

Common sense will even start to break through.

Scare quotes can be fun.

Turn the Neo-liberal mind set on it’s head.

I seem to remember that J M Keynes made a fortune “in the markets,” presumably without insider information and “help” from powerful interests. Compare that with the careers of the luminaries from the Chicago School. Have any of them made their fortunes in the application of their theories in an uninterfered with ‘market?’ [Do correct me if I am wrong.]

The financial ‘career’ of the Arch Demoness from Little Rock, (she came from the ‘wrong side of the tracks,’) HRC, is the poster child for that which does not count.

Anyway, the Chicago School is a middling clique that carries a big stick. We may not be in it, but we certainly are within the striking range of it’s “club.”

It would be funny if it didn’t happen to have destroyed several generations of “ordinary” people. Just ask the Chileans from after the Pinochet ‘Coup.’ I used the think, like so many, that “it can’t happen here.” Now I am not so sure about that.

Doomers will inveigh against “progressives” hastening the “end of Society.” I must beg to differ. What is looming is the “end of Capitalist Society.” What replaces it, I know not. Time to revive the “Know Nothing Party?”

> “progressives” hastening the “end of Society.”

I have the impression that from the perspective of neoliberals, “the Public” does not actually exist; it’s all just individuals maximizing their objective functions.

They aren’t afraid of the “end of Society”, they’re afraid of the “dawning of self-awareness of the Public”. But they probably don’t need to be afraid that “progressives” will stimulate that.

I only need to see those slopes and the legends “apples” and “bananas” to know that some grifter’s spiel is about to follow. No thanks, I’ve heard it before, go sell crazy somewhere else.

I’m going to be diplomatic in this instance and attribute that chart weirdness to having to try to explain something to ideologically rigid bosses.

Can they just admit they push ideological propaganda and drop the pretense of academic research and the trappings of science? Oh wait, they just did.

Not surprising that another of our institutions has been corrupted by money and oligarchical ideology to create totalitarianism and all its tools – censorship, unpersoning, and impoverishing. How do you like your fascism now?

And also strange that so many of these fascist institutions pretend they are doing the opposite of what they are actually doing – the NIH devoted to making people sicker and more people die; Anti-Fa actually the harpy enforcers and shock troops of the new totalitarianism; the State Department, supposedly about diplomacy, devoted to fomenting wars. The filthy scum are firmly in charge apparently of major institutions which they are gleefully destroying in service to Mammon.

Sorry to be silly and crude but: Neoclassical/neoliberal/ChicagoSchool ideology? I thought that had become a laughingstock and butt of jokes after the crash of 08 and the start of the TBTF era. Internally valid/externally invalid tautology. The Godfather or the Sopranos is a better educational tool to show us how economics works in real life (only half-joking ;-)

How very convenient: a body of elitist “academic” theory (ideology) that serves to “rationalize” oligarchy. I want a piece of that action, lol.

The only thing controversial about the initial diagram is that you decided to label an increase in production possibilities as an increase in production. It is eminently possible in the PPF-SWF framework for an increase in production possibilities to lead to reduce social welfare. But it is not possible in the same framework for an increase in production (more apples AND more bananas) to reduce social welfare. This seems pretty basic and any competent undergrad would be able to figure it out. Why would this be worth publishing?

As for the Edgeworth Box, I can’t figure out from the diagram what you are trying to say, but again there’s nothing special about the need to worry about distribution once you are making welfare judgments. The whole idea of looking only at output, just like the idea of maximizing economic surplus, is based on the notion that redistribution is more efficiently done at the macro level (i.e., using the tax and transfer system) rather than at the micro level.