Yves here. While many eyes in investing and econ-land are on the Fed’s annual Jackson Hole conference, data keeps chugging in on the state of the economy. As Angry Bear and others point out that initial jobless claims suggest that unemployment will rise (as in Fed efforts to whack labor are starting to have an effect), Wolf Richter describes below how inflation is proving to be, erm, resilient. We mentioned that the Fed and the Biden Administration seems to be giving themselves undue credit for the way the fall in energy prices since summer-early fall 2022 has blunted inflation. That decline instead seems to be due significantly to Russian energy finding its way to advanced economies via various work-arounds and the Chinese economy being weaker after the end of its zero-Covid policies than was widely expected.

In other words, the latest data keep confirming that this inflation is to a very large degree driven by supply issues largely outside the Fed’s control, and not due to labor having excessive bargaining pawer and labor costs and high consumer demand driving up prices.

By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street

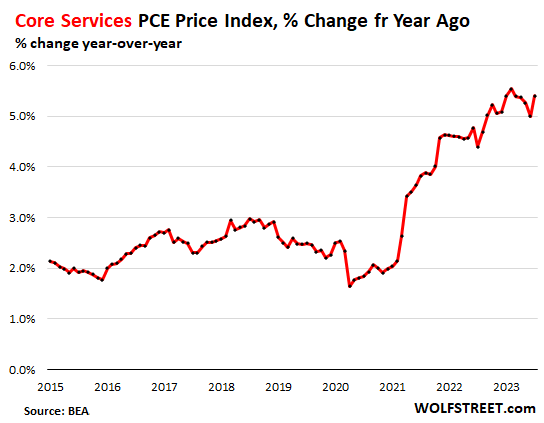

Services inflation is at it again. Year-over-year, the “core services” PCE price index accelerated to 5.4%, the second worst since 1985, according to data by the Bureau of Economic Analysis today, sharing that spot with January 2023. February had been the worst.

The Fed’s job is far from done. Powell has been fretting about core services inflation for a year, and today he got what he worried about he’d get: an acceleration of core services inflation, especially in the red-hot “non-housing services”:

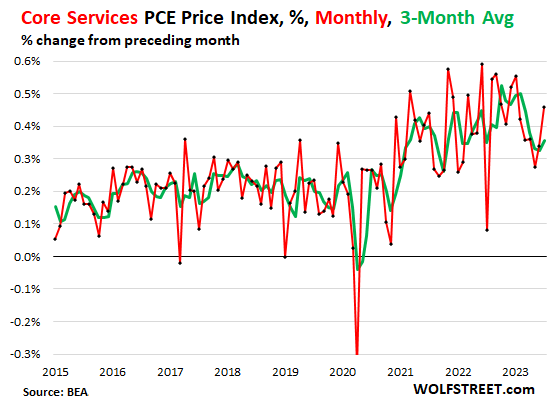

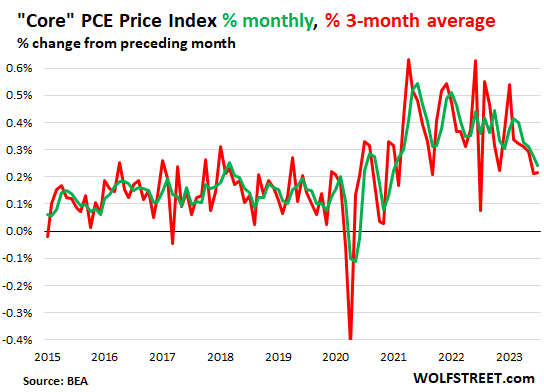

Month-to-month, the “core” services PCE price index – services minus energy services – jumped by 0.46% in July from June (5.7% annualized), the second month in a row of acceleration, according to the BEA today (red line in the chart below). The three-month moving average (green line) accelerated to 0.36%.

In core services is where inflation has gotten entrenched. Durable goods prices fell on falling prices of motor vehicles, electronics, home furnishings, etc. But inflation in services is where it’s at, and where it is very hard and frustrating to eradicate from.

Note the massive increases in some of the non-housing services listed here (finance and insurance, transportation, recreation), which is precisely what Powell has been fretting about. The biggest month-to-month increases were in:

- Housing: +0.42% (5.2% annualized)

- Transportation services: +1.03% (13.1% annualized)

- Recreation services: +0.79% (9.9% annualized)

- Financial services and insurance: +1.64% (21.6% annualized), which people have already figured out from their new insurance premiums.

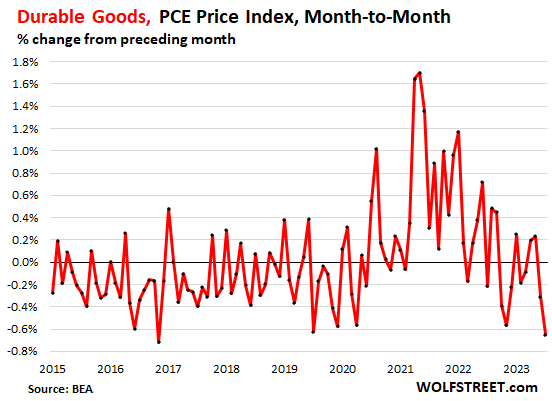

But the durable goods PCE price index plunged by 0.65% in July from June, the steepest drop since 2017, after having declined by 0.31% in June, with all four major categories declining, as some of the ridiculous price spikes, particularly for motor vehicles, have been partially unwinding since mid-2022.

- Motor vehicles, which dominate the index: -0.65%

- Furnishings and durable household goods: -0.23%

- Recreational goods and vehicles: -1.11%.

- “Other” durable goods: -0.37%

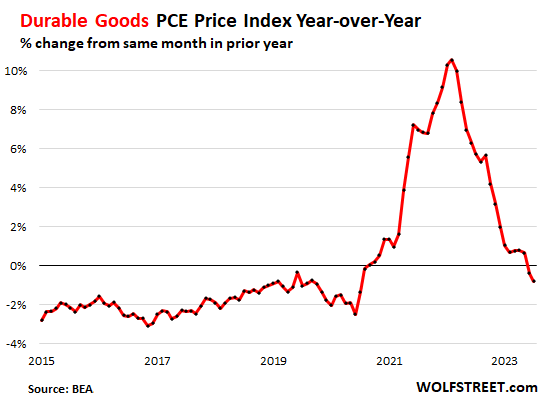

Year-over-year, the PCE price index for durable goods fell by 0.8%. The index was negative in the years before the pandemic as a result of manufacturing efficiencies, offshoring, competition, and the infamous hedonic quality adjustments that remove the costs of improvements from the cost base, on the principle that consumer price inflation is the change in dollars to buy the same product over time, and cost increases due to improvements are not inflation. Here is my explanation of hedonic quality adjustments, including my chart of prices of the F-150 XLT, the Camry LE, against the new vehicle CPI, to demonstrate the perverse effects of these adjustments.

The durable goods PCE price index is now normalizing. Absolute prices of durable goods remain high but are giving up some of the ridiculous price spikes of 2021 that had been caused when an overstimulated consumer ran into supply disruptions and was willing to pay whatever:

The core PCE price index, which excludes food and energy products, was revised higher for June month-to-month (was 0.17%, now is 0.21%) and accelerated from there in July to 0.22%, on the mix of the surge of the core services index (+0.46%) and the plunge in the durable goods index (-0.65%):

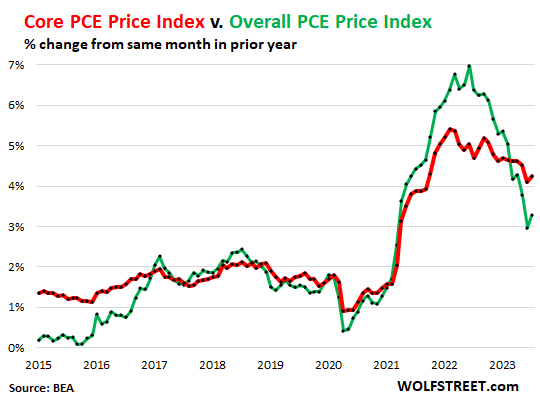

Year-over-year, the “core” PCE price index, the inflation measure favored by the Fed, accelerated to 4.2%, from 4.1% in June, over double the Fed’s target of 2%, and going in the wrong direction (red line).

The overall PCE price index accelerated to 3.3% year-over-year, pulled down by the 22% year-over-year plunge in energy prices (now abating), which caused the overall PCE price index (green) to remain below the core PCE price index (red) for the fifth month in a row. And both are going in the wrong direction.

Insurance prices are the worst offenders, and while there is almost certainly some gouging going on, I have assumed for some time that the increase in natural disasters would translate to higher insurance rates. But how high can they go before people really start to push back? We just downgraded our home insurance because the bill was getting absurd, and we never make any claims anyway even if we get some storm damage. The repair cost is usually below the deductible anyway. My question is, why aren’t insurance companies at the forefront of the climate debate? Their entire business model is dependent on a relatively stable world without constant, massive disasters. You would think that insurance company lobbyists would be swarming DC trying to get some action on emissions.

In areas deemed to be at high risk for flooding, severe storms, and related disasters, perhaps they just withdraw? Here in South Texas, our insurer for 20+ years decided not to renew our homeowners policy, despite our never having had a claim.

Why?

They can just raise premiums and most people will have to keep paying because home/car insurance is almost required to not go bankrupt from 1 bad event.

the insurance industry is also reliant on relatively risk-free asset returns.

2022 messed up portfolios as both stocks and bonds fell in value.

– why aren’t insurance companies at the forefront of the climate debate? –

My conception of the insurance industry (health, home, etc.) is that their profits are a set percentage of the revenue flow. The larger the revenue flow the larger the profit. All natural disasters increase revenue flow.

The reason home insurance companies don’t care about climate change is the same reason health insurance companies don’ care about finding the best solutions for pandemics.

Maybe someone with greater knowledge of the industry could clarify if this conception is correct.

I don’t know about home insurance companies not caring about climate change, but at the very least, 2 major insurance companies are no longer selling home insurance in California over major wildfire risks, https://apnews.com/article/california-wildfire-insurance-e31bef0ed7eeddcde096a5b8f2c1768f.

Meanwhile, over in Florida, home insurance companies are pulling out because of massive fraud issues, https://fortune.com/2023/07/22/housing-market-florida-trouble-as-home-insurers-pull-out/, not surprisingly the remaining ones are raising premiums out of the wazoo, contributing to inflation no doubt.

So, I do think they do care, in a sense. I had a meeting with S&P Global Market Intelligence about 3 months ago and we specifically looked at ALL of the data they have for climate and environmental intelligence. The data set is vast, detailed, and very clean. Like you can pinpoint on location and the impact on specific firms investments / capital overtime. I was very impressed. (You can see the data sets here – if necessary, select ESG data. )

S&P were clear that the insurance companies were their biggest clients for the data and had been for some time. They actually developed the data sets FOR the insurance companies originally. It’s the kind of data sets that mean they know EXACTLY what has been going on for a while. And in discussing the data with S&P, the insurance company view points are pretty close to what most people espouse at NC.

They question isn’t if they care or why they aren’t at the forefront of the climate debate, but why only now are they raising their rates or exiting contracts that 5+ years ago, looked iffy and they KNEW it was iffy? Maybe insurance companies couldn’t make their moves until it became obvious that the sh*t is hitting the fan? That there would be social pressure (from investors and even governments) to stay in markets that they knew they would need to exit at some point – but since those markets were still profitable, they’d need to stick it out until an exit came through. When I look at how quick they are refusing to renew contracts or exiting markets full stop, it does make me think they wanted the cover of things going bad, like they KNEW it would. Also – probably needed the cover of inflation to be able to raise the rates to where they knew they needed it to be.

Basically – capitalism is the “Why”.

Insurance is a scam here.

1. Insurers are calling record profits. And so we get high dividends for shareholders. It’s customer gouging to benefit the stock price.

2. Here insurers are playing a game. They send the bill for next years bill for insurance, and it might have gone up by say 10% which isnt good.

But then if you call your insurer, you find they have deliberately under-insured you. I assume this is to keep the premium looking lower and not shock you into getting further quotes.

They told me that if i followed the quote they had mailed me, my home would be under-insured by 30%.

Under-insurance is the best way to lose your life savings and your home in the event of fire, flood, storm etc damage.

All of those multi $trillions from 2- 4 years ago had to go somewhere.

I may be off-base, but I think you mean billions to trillions in Fed Reserve “stimulation” of the stock markets, banks, and real estate monopolies every year since 2009.

Reverse repurchase agreements are paying 5.3%, taking in just under $1.7 trillion in ‘cash’ to put a larger face of treasuries in the counter parties’ ‘account” ‘over night, every night.’

The economy is awash in ‘cash’ while the treasury is loaded with federal notes……

Huge rev repos are a new feature with the covid response.

How to keep the bubbles away?

Addition of rooftop solar panels, professionally installed, raises homeowner policy cost by nearly a third (specific incident, do not know average) …

As in medicine, higher risks/payouts translate into higher premiums and insurer profits.

Subscribers may want to watch out for more exclusions and denials, coupled with additional required supplemental add-ons for basic coverage.

I don’t care how they want and try to measure it. The administration has touted their success fighting inflation – but many of us still feel it.

Home insurance – yoy – up 10/15%

Auto insurance – yoy – up 10%

Electric cost – warned by AEP it will go up ~30% – my bills ran around 100, now 150-160

Grocery – buy same stuff every couple of weeks – used to run $50-80 – now $90-120

Gas – small town midwest – $3.49 a gallon but it has been over $3 a gallon for as long as I remember. I don’t think we can sustain this. People are hurting, this doesn’t help.

We had a grocery store change hands this last month. The new owners give a senior discount. I bought a gallon of milk the other day for $3.03. I about had the big one – thank you so much (I go through about 3-4 gallons a week) It had been almost $4.

Another one I notice is one of my favorite vices – beer. I could buy a 12 pack for $9.99 since forever. Not anymore. Has been steadily climbing and now $12.99. *spit*

But my PMC friends and the never ending Tweets from the administration keep telling me how they have fixed all this. Bullspit – what universe do you live in?

I assume you’re drinking Pabst like me. Most other beers are closer to $20, at least where I live.

Not Pabst, but another name brand like that.

Adding to the above; I live in farm country. We have produce stands all over the place, and even a store in town from a local farm with all kinds of goodies.

Last week I bought a home grown tomato. No tomatoes better. It was about the size of a baseball. $2.50 for one. Used to be half that.

Other things I thought of since I posted above;

Green fees at local golf course; 3 years ago $14 for 9 holes, half a cart. Now $20.

TV streaming went from mid $50s to $62 for subscription.

Internet went from $35 to $50.

Our local city council just passed a new ordinance to raise our monthly sewer bills by 5% ANNUALLY – like forever (which means a double in 14.5 years). They said this was due to cost inflation which has gone up 40% (their numbers, not sure where they got them).

On top of this regular stuff, don’t get your car fixed, call a plumber, electrician, use a mowing service, or heaven forbid – use a doctor/hospital.

It’s not pretty out here, and getting worse.

My non alcoholic beer is $9.99 for a 6’pack. Started hurting my wallet and had to make drinking effing beer a treat for just friday’s :-(

My 25lb all purpose flower we buy at Costco went from $6.49 last August to $8.99 this month. That is close to 40% increase.

Flower is to the poor what oil is to the industry.

I don’t know what to substitute flower with, tell the kids to go eat grass?

I don’t believe those inflation figures. There is not a single thing i buy that is not 10% more than last year.

I know the price of weed has been dropping but that’s still amazingly cheap for a whopping 25 lbs of flower. ;)

Re: the title

I’m curious, why was inflation so high in 1985?

Just going from memory, it wasn’t that inflation was “so high” back then – it was that it had been decreasing from the much much higher inflation in the ’70s. The decrease wasn’t smooth – it bounced around a lot after the Volker rate shock. Presumably, 1985 was just the last time it was over 5% on it’s gradual long term descent.

GDP Now latest figure: 5.6%. That is a super hot economy.

Our protest against the Bideneconomy is to hold off on ALL discretionary spending until February 2025, the first full month of the new president, whomever that may be.

Many repairs of applicances and things around the home are covered in detail on Youtube. So far we’ve restored a dryer, fixed plumbing problems and other things that we never would have attempted until now. Craigslist is a bonanza of free and discounted items instead of buying new.

Powell stated in his Jackson Hole speech that, “The effects of Russia’s war against Ukraine have been a primary driver of the changes in headline inflation around the world since early 2022.” He brought that up in his discussion of the slowing the inflation rate since early 2022, which seems to suggest the war has had a deflationary effect.

The useless lockdowns of California. Mom and pop groceries and restaurants closed forever, while Target, a major Newsom donor becomes a “grocery” and is allowed to remain open. Citizens prohibited from going to the beach but Netflix lobbyists at the French Laundry get permission to keep filming, and serving catered food in the parks.

The verdict is clear: Gavin Newsom and the Supermajority are guilty of the most harmful policy blunder in modern U.S. history.

House member Kiley’s hearings.

https://twitter.com/KevinKileyCA/status/1684629386358616064

Powell claims deflation?????

Biden said “we would all sacrifice for as long as it takes for Ukraine to be free.”

His executive actions cut off 29% of the world’s grain supply to the west, cut off Russian fertilizer exports, cut off American’s natural gas to home owners for “environmental reasons,”so it could be liquified and sold at 10X the cost to the Europeans, cut off Russian machinery, car parts and electronics and that’s supposed to not raise inflation?

Imagine your family vaporized in WWIII, or starving to death with their guts liquifying from radiation. Is Ukraine’s looting and business opportunities for the MIC and Demdonors worth that?

If not RFKjr, then Trump, the only logical choice to save the biosphere. If they steal another election, a national tax and general strike are in order.

Biden didn’t “cut off Russian fertilizer exports”. BASF and other mega monopoly ag chem corps decided to dismantle their fertilizer plants in Russia and they’re rebuilding them here in Texas.

Globalization is dying due to many factors outside Biden or Trump’s control.

If the natural gas fields in Wyoming and other parts in the U.S. keep being developed, we’ll have U.S. based Urea production in the future vs. shipping it in from overseas. That was never the optimal equation in the first place.

And America used to provide plenty of healthy grains, corn and rice to ship out to the rest of the world, which made our country grow rich since the the 60’s and 70’s.

But our Agchem and toxic farming model ruined much of our best farm land, while polluting our air, waterways and near shore ocean pastures, our bodies, and our children and grandchildren. Russia doesn’t want our GMO toxic grains. They want the fertile fields of Ukraine to feed their country in the future with healthier, more sustainably grown grains. The same is true for Mexico.

One man, or one President didn’t cause this current mess. We all did. And one man, one president, is not going to be able to fix it. No matter who it is that gets elected, or put in the seat by the puppet masters.

Meanwhile, get back to work all you debtor slaves.

Please, no Making Shit Up.

The US shock and awe sanctions most assuredly did cut the rest of the world off from Russian fertilizer by among other things preventing payment for it. That is why the so-called Ukraine grain deal called for the West to exempt Russia’s agricultural bank from sanctions and restor its connection to SWIFT so buyers could pay for Russian fertilizer. African leaders complained about this collateral damage virtually from the start of the sanctions and the West had done squat. Russia refused to renew the grain deal because Ukraine and the West persistently were not delivering on their commitments.

Ukraine also blew up an ammonia pipeline, further sabotaging Russian fertilizer/fertilizer component exports: https://www.barrons.com/news/russia-accuses-ukraine-of-blowing-up-key-ammonia-pipeline-ministry-96363315

And BASF did not dismantle its plant in Russia, it merely wound down operations: https://www.ft.com/content/d23f4a3e-e7a4-487c-b27a-a4fa402fbdeb

It seems we’re totally focused on inflation and interest rates. Is that the only game the Fed is playing?

The Fed’s balance sheet was roughly $900 billion in 2007. It peaked at $9 trillion in 2022.

I have no idea if this is sustainable but, it seems to me, Powell doesn’t think it is. While interest rates get most of the attention, Powell has been using QT, quantitative tightening, to the tune of about $90 billion per month.

It’s my understanding the Fed was supposed to be the creditor of last resort, not the buyer of last resort. And QT means the Fed is not buying; that surely affects prices.

If Powell maintains higher interest rates and QT, then the questions about higher rates should include how low Powell thinks the Fed balance sheet should go.

Also, is Powell sending a message the Greenspan Put is unaffordable and the Fed must get out of the bailout business?