Yves here. The Bank of England and Fed are engaged in economic malpractice on a large and increasingly dangerous scale. The Fed did recognize that its post-crisis experiment with super low interest rates was producing economic distortions and dysfunction (some contacts say as early as 2012). But when Bernanke tried backing out in 2014, he got the famed Taper Tantrum and lost his nerve.

So when Covid hit, and with it, sticker shock in particularly affected sectors like cars, food, and lumber (compounded by the bad luck of an avian-flu mass chicken cull), and then sanctions-blowback-induced energy price increases, the Fed waded in to fight inflation, even though, as we pointed out, the result of using the hammer of interest rate increases would be to kill the economy. There are much more targeted approaches,1 starting with designing more spending to be countercyclical. But nearly all require political will when it’s so much more convenient to let unelected central bankers do the heavy lifting, even with their handiwork being predictably pretty poor…unless the object is further reducing worker bargaining power and standards of living.

But as we and others predicted. the use of the wrong medicine for this inflation meant central bankers would have to keep interest rates high for a comparatively long time. Even though the Fed did signal its intent to raise rates pretty aggressively, many banks and investors were wrong-footed. It isn’t crazy for regulators to let banks get away with not recording most of their mark to market losses if there are good odds of the central bank lowering rates out of nosebleed territory fairly soon. But if that does not happen, banks start reporting income statement losses. And high rates in an economy not prepared it will also produce credit losses as borrowers have to roll maturing debt and can’t get it at the price and quantity they need.

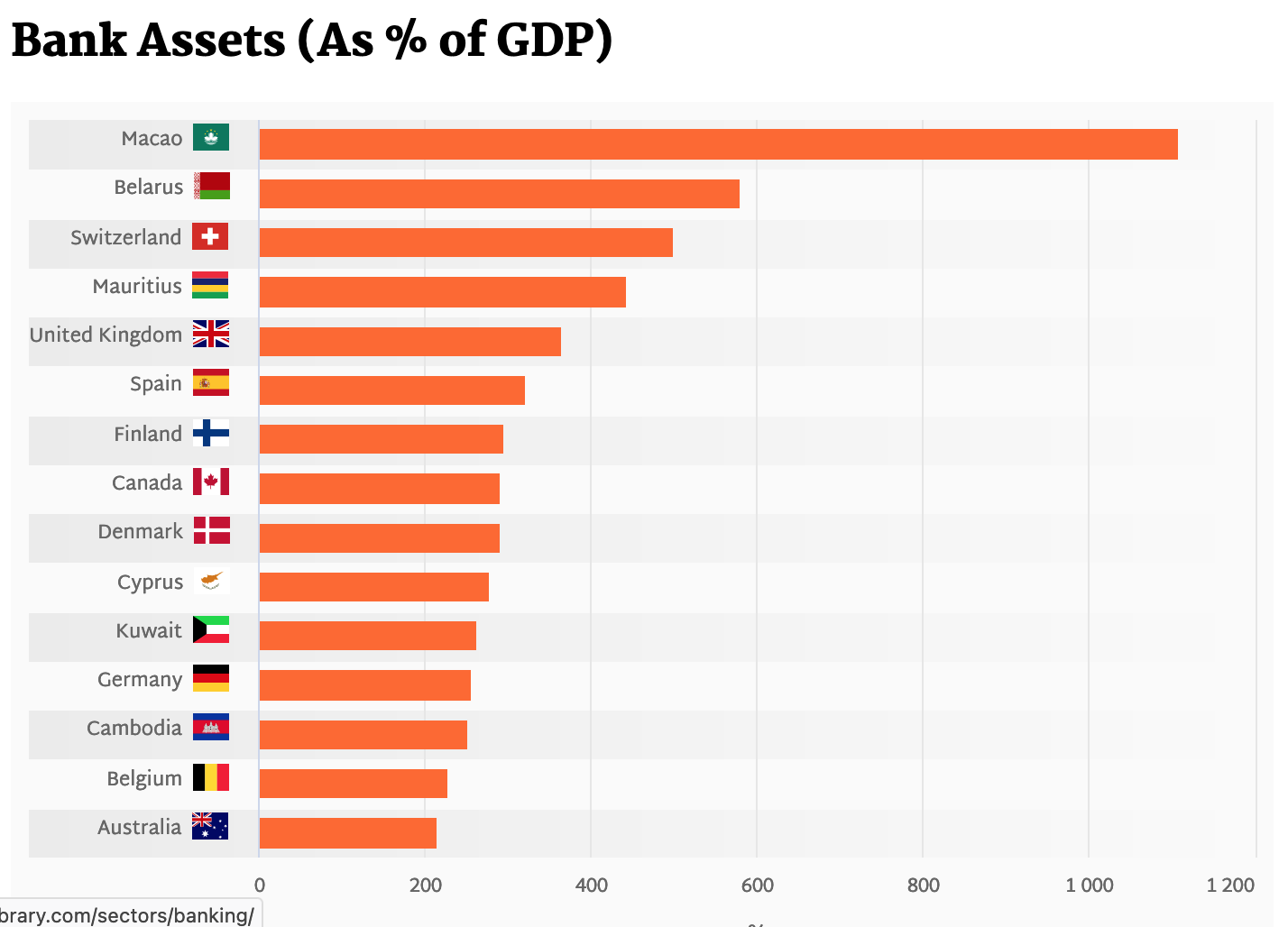

With all that said, the UK could be the canary in the coal mine. It was already suffering from lower growth than pretty much everyone in the EU due to Brexit effects. It also experienced serious energy and food inflation last fall and early winter. UK banks’ total assets are somewhat down relative to GDP compared to the level before the global financial crisis (by memory, around 450%). But they are still high on a comparative basis. From HelgiLibrary:

If any UK banks start looking green about the gills, it’s not hard to see concerns rising here, due to questions about whether any US players were similarly situated plus contagion concerns. And if that were to start, increases in funding costs can create a down spiral. I’m not saying that is happening yet but the potential is there, particularly if the Fed does not ease up.

By Richard Murphy, part-time Professor of Accounting Practice at Sheffield University Management School, director of the Corporate Accountability Network, member of Finance for the Future LLP, and director of Tax Research LLP. Originally published at Tax Research

The economic outlook appears to be even poorer this morning.

Those renting are having a torrid time. Rents are up at least 10% in the past year.

Those who can get a property are accessing some of the poorest housing stock in Europe.

The government is going to make things worse. They plan to solve the refugee processing backlog by releasing 50,000 into the community without support, many of whom will then become homeless.

And things are little better for homeowners. MetroBank is in financial crisis (although that’s being talked down). The bank has a loan book that few think of the highest quality. That is why its value has fallen to £100 million. The problem for it is it needs to refinance £350 million of its own loans in the next year, and raise £250 million in extra capital. There is, I suggest, no way that it can survive that dual demand in its existing form. A white knight will have to be found, and that is always a sure sign of an impending financial crisis. Just think back to 2008.

That is not the only problem for banks. As the FT has noted, bank third quarter earnings look like they will be hit hard by the fall in the value of their bond holdings as markets take the impact of long-term high-interest rates into account. Since interest rates and bond values are pretty much the inverse of each other, those rates are now hitting the value of bank balance sheets hard, just when their mortgage and loan portfolios are severely threatened by bad debt risks, also created by high-interest rates.

Those bad debt risks are, of course, the consequence of personal and business debt crises as high interest rates hit. So, there are further threats of homelessness whilst unemployment is bound to rise.

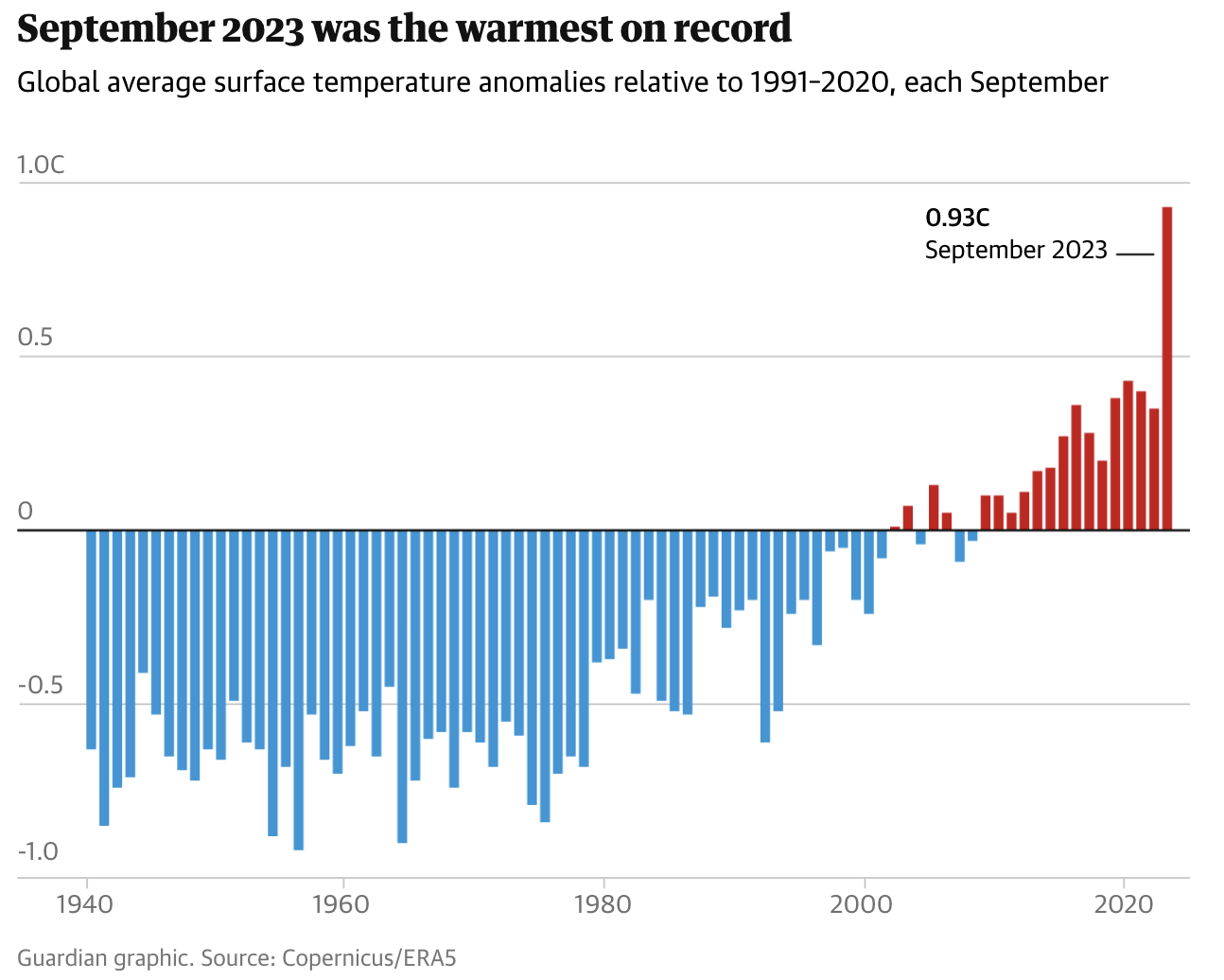

And let me add some more misery into the mix. September was totally abnormally hot:

That’s not just aberrational: it is staggeringly abnormal, and that is continuing. I am writing this in the open air and just shirt-sleeved at 8.20 in the morning in October, with 25 degrees forecast for the south at the weekend. The scale of investment required to manage this is also off the scale.

So what does all this mean?

First, it means that the Bank of England policy of high-interest rates is working as I predicted it would, to crash the economy. That did not require me to be an exceptional seer: the Bank of England wanted this to happen to crush demand in the economy and is getting what it wanted. I just had the honesty to call it out. The crisis we face is not necessary: it is being manufactured in Threadneedle Street.

Second, the cost of this is not going to be some little blip in the economy. This moment now feels like 2007 – when everything began to go wrong but few said it (again, I was one of the exceptions). It feels like everything could totter over soon, with calamitous (I do not use the word lightly) consequences.

Third, no one is getting ready for this. The Bank of England is talking about selling £100 billion of its bond portfolio in the next year as part of its quantitative tightening programme as part of its programme to maintain high interest rates when the reality is that it should be planning for the emergency support that the economy is going to need, soon.

The Tories are playing games. The whole focus of their conference was putting spanners in Labour’s works: HS2 abandonment apart, nothing they announced will have the slightest consequence before they are out of office.

And then there is Labour. This weekend will be interesting only for the sentiments on display. If they win today’s by-election in Scotland they will be buoyant. If not (and you can guess where I stand on that) they will be hunkering down before even reaching office.

My suspicion is that they will win because there is always a backlash against a sitting MP who has failed. In that case, expect talk of them saving pubic services without spending a penny on them because fiscal rules will be referred to time and again, whilst nothing of substance will be said because (as Pat MacFadden has tediously said, yet again, this morning) they ‘need to see the books’ before deciding on anything. It is as if imagining what might be revealed is a task way beyond their ability.

Fourth, then, there is the real need. That is for an economic redesign. I mentioned the need for innovation around what is possible yesterday. Nowhere is that more apparent than in the economy itself.

We need to cut interest rates because that is possible and would cut inflation. It is economically counter-cultural, but when convention is very obviously not working what is wrong with that?

We also need to raise taxes on the wealthy for three reasons. The first is that the government needs to spend more as a proportion of GDP in both the short and long term and that will require that the inflationary impact of that spending be removed from the economy by making extra demand on those best able to meet it.

The second reason is that income has to be redistributed into the hands of those who need it if they are to survive the stresses to come.

And third, when markets are failing to direct savings towards real investment – which they are so obviously not doing – the state will have to intervene to achieve that goal.

What we then need is a plan for the required spending. It will not be possible to cut our way out of the crisis to come – at least not if the lives of the people of this country matter – so there have to be such spending plans.

My great fear is that Labour is doing none of this thinking. It is not even aware, I suspect, that it is required even though this crisis is going to emerge on their watch unless something very unexpected happens to save them.

We are already in the proverbial creek. My fear is that no one in charge knows where the paddle is. And that is really scary.

____

1 Notice how the media does not take up this idea much? Nevertheless, one example from ABC Australia, Beat inflation without raising interest rates? We can do it, but it’s slow, hard and politically risky.

Whatever is going to happen with the economy the UK, it is going to be made much worse by that fact that at the present moment, there is no real leadership group willing or even able to take charge. The Tories are a train-wreck and have been for a very long time and when Labour likely wins, they will be like the proverbial dog that catches the car – and hard. The guys at the Duran have been saying for some time that the leadership class in the UK is abysmal and there are no real clear signs where any competent leadership will come from. And my ow take is that if there was a group that showed competent leadership, that both political parties would unite to destroy them.

Zero/negative real rates and/or central bank intervention saved the financialized Establishment in 00, 09, 2020, 2022.

so idiocy was never purged drom the system, but rather rewarded.

2024 may finally be the year when the can can’t get kicked?

Likely because both parties are beholden to the City, much like both parties in USA is beholden to Wall Street.

The Murdochs and their allies are the real government of the UK. The UK is badly governed as a result because frankly why should these people care? As long as their power bases are maintained and their privileged tax status – non-Dom, non-resident or whatever – they are happy.

I do not remember the precise words but recall reading a while back that when Murdoch briefly came to live in the UK in the 1960s he reportedly said he was going to stick it to the English. Of course he left for the US a few years later, but I think he can now say ‘mission accomplished’.

Stephen Zeng report Deutsche Bank conclusion,

… with banks holding cumulative unrealized losses of $558.4bn in Q2, the estimated increase of around $140 billion would widen their unrealized losses to a new record, surpassing the previous peak of $689.9bn in Q3 2022, and potentially rising above $700 billion!

Back pocket Prediction… A Severe Asset Deflation is Coming !

I don’t follow Luongo but saw this post this morning and thought, as a reader of history, that it was some pretty good CT.

https://tomluongo.me/2023/10/03/ukraine-was-always-the-uks-war-first/

Did the WASPs ever truly revolt from Britain and have our elites, including the would be non WASP cohort, fallen back into Loyalist mode?

Relevance being that in finance as well as foreign policy, as UK goes so goes my nation?

Wasn’t the revolt mostly about taxes? As in they would have been happy to stay under English rule, if they had been provided a voice in Westminster?

Heck, congress is pretty much modeled on parliament. Only swapping lords for senators and a king for a president (that at this point may well be a tag team job between two clans).

It was a little more than that. The colonists thought of themselves as Englishmen (or English gentlemen) with Magna Carta rights that George and his parliament were violating. Solution: get rid of George who wasn’t even an Englishman but minor German aristocracy.

Now our elites (including Trump) love the royals but natural rights not so much.

So say it was about class conflict (aristos versus the king) rather than just money but also money. This too is in the great English tradition if you read your Shakespeare.

Clueless 1619-ers think Americans were some kind of new species dropped down onto North America.

And a tradition that has been playing word games since the first time “democracy” got uttered on the emerald isles.

I have become less and less a believer of “taxation without representation.” My thinking is that the crown wanted cash from the colonies to pay off the French and Indian War bonds. The colonies didn’t have any cash…they had lumber, fish, slaves, land, etc…no specie. So, long/short, the revolution devolved from a liquidity crisis.

The English were also outlawing slavery and the US southern leaders didn’t want to lose their human assets.

Luongo has got half the way there, which is more than most. He’s still naive.

He writes: It’s easy to believe the UK has no influence here. But if that’s the case why did they work so hard to neuter Donald Trump’s presidency at every turn (Christopher Steele, Joseph Mifsud)?

For those who haven’t been following, Christopher Steele (of the Steele dossier) formerly ran the Russia desk at the UK’s Special Intelligence Service (aka MI6) from 2006-2009. Hillary’s accession to the White House in 2016 or shortly after was when the Ukraine proxy war was originally set to kick off, and also when Putin and Russia would have been less prepared and the Brexit vote had just happened.

Head of SIS/MI6 and Steele’s boss for most of Steele’s tenure there was Sir Richard Dearlove. Note Dearlove’s political views, in particular —

https://brexitcentral.com/former-mi6-chief-accuses-theresa-may-surrendering-british-national-security-eu/

https://www.telegraph.co.uk/politics/2019/01/10/theresa-mays-deal-threatens-national-security-says-former-head/

Luongo writes: .…the great war to end 300+ years of Russia fighting colonial Europe wasn’t going to end with the building of a pipeline … Russian/European or, more explicitly, Russian/British animosity goes back centuries.

This is naive. Russian oligarchs’ money is still flowing through the City and UK corporations continue doing business in and with Russia — and the UK doesn’t gain from longterm animosity with Russia. Nevertheless, the UK does have a relevant foreign policy position here and it goes back not 300-plus as Luongo claims, but 500 years. A satire but the truth….

Sir Humphrey explains Brexit

https://www.youtube.com/watch?v=lFBgQpz_E80

Luongo: This isn’t an existential crisis for the US, but it is for the old colonial powers of Europe, especially the UK.

Naive. The Ukraine war would have originally kicked off in 2016-17 in Brexit’s immediate wake, so it started four years late. But the end result is the same. Germany, the EU’s former industrial motor is now de-industrializing, while the centrifugal pressures of different EU governments pursuing their own interests when there’s a shrinking EU pie (eg Germany-Poland) are increasing, as is populist unrest in EU nations in reaction to the misgovernance of neoliberal EU leaders who are de facto US subaltern/vassals.

In other words, from the UK’s viewpoint, it wasn’t enough for Brexit to happen, the EU had to be substantially degraded, if not destroyed. Ugly, but necessary. And now, with Germany de-industrializing, there’s no way it can be put back together again.

Moreover, the fingerprints of the US’s stupid elites will be all over the Ukraine war’s promotion — the same stupid elites who gifted US manufacturing hegemony to China, so Luong is wrong about any loyalty to the UK being responsible — and everything I’ve suggested is merely a conspirary theory.

Meanwhile, the UK and the City is pivoting to Asia —

https://www.swift.com/news-events/news/why-london-leading-renminbi-trading-venue-outside-china

https://hongkongfp.com/2023/02/01/over-144000-hongkongers-move-to-uk-in-2-years-since-launch-of-bno-visa-scheme/

https://www.gov.uk/government/news/uk-signs-treaty-to-join-vast-indo-pacific-trade-group-as-new-data-shows-major-economic-benefits

The first panacea for a mismanaged nation is inflation of the currency; the second is war. Both bring a temporary prosperity; both bring a permanent ruin. But both are the refuge of political and economic opportunists.

Ernest Hemingway

Richard Murphy speaks for us as well. We need a coordinated domestic spending plan. One that will be coherent enough to be the basis for future spending as well. A foundation designed to fit the needs of our neglected economy – homelessness, health care, education and ecology. A process that will kick start local economies across the nation. I think it would be wise to subordinate foreign policy to this planning so that domestic concerns do not get postponed. And there could always be a beneficial synergy between our new economy and the rest of the world. The entire planet needs a spending plan, imo.

As Albert said to Pogo, “Us cousins is all up the creek too.”

Interest rates are still too low. Real rates are still deeply negative. The housing market is still in a bubble. The labour market is still overheated. Inflation is still out of control. Corporate profit margins are still too large. Kill all these excesses that have grown out of 15 years of easy money and overspending. There is no easy way out of this.

Plan A is to do “everything that is needed to rescue the economy” now, because it needs some rescuing. I do not understand exactly how, but the gist seems that X spending is necessary, and because it could accelerate inflation, it should coupled it with “soak the rich” taxes, because taxing the poor more does not bring much anymore (they pay VAT as consumers already), middle class has a precarious part etc. Plan A sounds like creating Communist Tory Party of UK, worthy in itself but hard to accomplish in the Parliament. Alas, UK is not an absolute monarchy, yet.

Plan B may be easier. Proclaim national emergency due to existential threat, but no worry, we survived London blitz, we shall survive again, and for now, do everything necessary to let Ukraine win her just war. And since Varadkar promises full solidarity on the topic, we do not need to worry about any Celtic backstabbing after we send the last tank and the last missile to Ukraine. Perhaps it helps that both islands have leaders with family roots in India. After Ukraine wins and despondent Russians drop all malign ambitions, we will take care of economy.

Strange tidbid: the largest concentration of people surnamed Sunak is in western Ukraine. Nobody there knows what it means.

It is not counter cultural in some circles to think that increasing interest rates to address supply side inflation is not just wrong but is, itself, inflationary.

The same circles would also agree that fiscal policy is where the heavy lifting needs to happen, especially as the poly crisis starts to bite. Unfortunately, it looks like it will require authoritarian government or at least coalition government.

And they would also agree that taxation is a deep and subtle problem – how to fairly syphon spending out of the economy and not let is coalesce into stagnant pools of destructive wealth.

But at the heart of all this is a system that creates 95% of our money for profit. Why would the proper ratio of credit money to fiat money not be more like 50:50? It’s another way of saying our colonial and exploitative monetary system is no longer fit for purpose. It means rethinking banking regulations (speculative loans vs productive loans), size of banks, public banks, ie, how we create our money in the first place, and for who?

In other words a complete rethink of the capital-oligarchic order, which is why it won’t happen. Or at least, not by rational action. It will happen as collapses always do, when the weakest part of the structure fails – probably financial but it could be food, climate, another pandemic, and of course the old perennials, war, revolution and social breakdown.

Corruption in the UK has now reduced more of the population to glorified serfdom, which is the inevitable end-state of neoliberal economic systems & the more extreme the ideology, the faster this endgame is reached. The writing was on the wall back in 2015 when Cameron lurched further to the right to stay in power, effectively turning his party into UKIP to survive; this necessitated a purge later of anyone capable of moderation or with the ability to run a country. Brexit is only the most obvious car-crash economic result. But follow the money & the usual suspects are getting even richer, while nothing will change because it’s hard for the masses to revolt when tired, hungry & homeless.

IMO, there is much pain baked in to the economies of the west. The silver lining, there to take if any leaders have the backbone, is the prime opportunity it presents to weed out the bad actors and bring the too big to fail to heel. (I’m imagining a residential real estate market rid of private equity. One can dream.)

Never mind. Private equity to the rescue. “Who Could Back a UK Real Estate Rebound? US Private Equity Funds” (Costar). The lede, Private Equity Firms Are Raising Ever-Larger Funds to Build Real Estate Platforms Instead of Assembling Portfolios. There’s even a graph titled “Opportunistic Fundraising for Europe Gathers Momentum”.

Yes, save the world but only if it makes a profit.

So far no evidence of a crashing economy. And the US jobs report blew past expectations. I think the bigger worry is that the economy doesn’t slow down enough and rates just stay high exacerbating the negative ramifications in the future.