Yves here. Because consumers have been hit hard by price increases on many fronts, particularly food, they tend to overlook falling gas and consumer electronic prices. And most households are one step removed from commodity prices. Therefore the fact that softening commodity prices have offset the impact of Fed interest rate increases isn’t as well recognized as it should be. The author New Deal democrat argues that this price relief bolstered consumer spending, and that support is coming to an end.

So will consumers cut back, weakening the economy and resulting in the Fed easing up on interest rates? Or will retail expenditures hold up, leading to yet more Fed attempts to strangle demand?

By New Deal democrat. Originally published at Angry Bear

My strong suspicion has been that the tailwind of declining commodity prices, typified by the big decline in gas prices in late 2022 is what allowed the US economy to grow so well so far this year, blunting the effects of major Fed interest rate hikes. For the last several months, my focus has been whether that decline is over.

This morning’s producer price report added more evidence that indeed producer prices have bottomed.

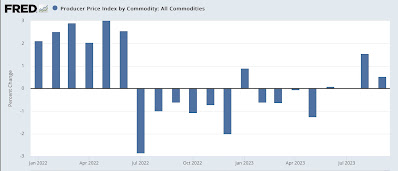

Commodity prices increased 0.5% in September:

They are up 1.9% since June:

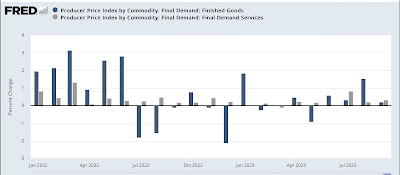

The Final demand prices for goods (blue) increased 0.2%, and final demand services prices (gray) increased 0.3% for the month:

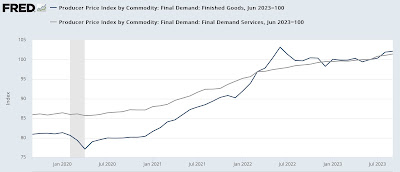

Final demand goods prices are up 2.1% since June. Final demand prices for services are up 1.4%:

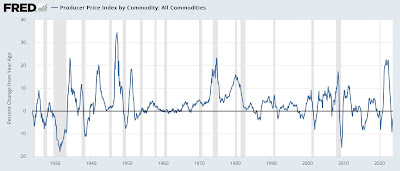

This returns to the more normal situation with producer and commodity prices. Historically, as seen in this 100-year graph of commodity prices YoY, typically there are big declines during recessions. This reflects a decline in demand:

But if you focus on more recent declines since the 1980s, you can see a number of incidents – 1986, 1997-98, and 2014-15 – where the big declines in commodity prices were dominated by declining gas prices, which put more money in consumers’ pockets to spend on other things. In all of these cases, there was no recession.

The nearly 10% decline in commodity prices between June 2022 and June 2023 was the biggest 12 month decline yet driven by lower gas prices, as well as the un-kinking of pandemic-related supply chains. Except for the very unlikely scenario that current geopolitical events drive a further decline in gas prices, that is almost certainly over.

This is probably going to be reflected in tomorrow’s report on consumer prices as well. Remember, if consumer inflation simply stops decelerating, it will lessen the gap between prices and aggregate consumer income, meaning slower economic growth at least.

Thanks for this post.

I wonder is the rise in monopoly pricing power in the US is driving up prices regardless of what the Fed does. If so, the Fed increasing interest rates will have little effect on prices at the store, etc. People will spend just as much as now but for smaller amounts of produce in the future. / my 2 cents.

Maybe CA has some exceptional price-gouging, but gasoline prices have risen in California: 5.59 per gallon is the cheapest I can find anywhere, Diesel is 6.69/gal. Electricity prices: (PG&E) has raised rates and plans to raise rates much faster than CPI, for example, PG&E rates are among the highest, if not the highest in the USA. (.45/kwh+)

Food price inflation has perhaps slowed a bit (down to around 5.5%), but prices are still high and we still have food price inflation. Wholesale wheat prices have dropped significantly, however a loaf of bread is 5-10 dollars. It seems consumers don’t benefit from commodity price declines, at least in some places. Since most of the food here is produced right here in CA, one would think food would be cheaper, in fact it is more expensive.

(Then there is the skyrocketing costs of homeowners insurance and “health care” insurance, but that is another topic)

In Wisconsin we pay $.14/kWh for electricity and about $3 for a loaf of basic, plain jane bread. Gas about $3.40. How do they justify those prices? Is it high real estate costs?

I don’t mean to rub salt in your wounds but it is what it is. We also have a thing called winter.

To be fair, some of the inflated gasoline price are due to CA tax and regs, but the price-gouging for gasoline has got worse. Even if tax is factored in, CA pays a lot more than any other state (except Hawai’i, where all fuel must be shipped in). Sometimes prices in Cal are higher than HI. CA has major oil refineries as well, in both North and South.

Long story but the ridiculous electricity prices are a result of “regulatory capture” and institutional corruption in the CA legislature and state govt. Prices might rise as much as 20% next year, but even the corrupt PUC won’t allow that much in one go, so maybe 12% hike.

I should have qualified the bread price: the 5-10 dollars is for CA and regional bread, you can still get a generic grocery store brand white bread for around 3 – 3.99

Ok, I don’t shop a lot but bread is one thing i will pick up. In Ohio, our so called whole wheat bread goes for about $2.50, the 20 oz hearty rye for $3.50. But the Italian white we buy has stayed under $2.

Gasoline tax in California is indeed one of the highest in the USA, but even in California the tax is only an incredibly low 85 cents per gallon.

https://money.com/gas-taxes-by-state-map/

The Netherlands gets this right, with a tax rate of 0.82 Euros per liter, nearly four times the rate in California.

https://taxfoundation.org/data/all/eu/gas-taxes-in-europe-2022/

I really don’t trust statistics anymore. My neighbor called up to rant about supermarket prices (a common discussion we have). He was incensed that avocados went from 70 cents to $1.10 (about a 50% increase). If anyone remembers my previous rants, I’m still outraged by the price inflation that started with the 2008 meltdown and has never stopped. The large can of cat food that used to cost 38 cents is now $1.35 and the large can of dog food that was 78 cents is now $1.82 (more reasons why people are dumping their pets).

I also ate out at a popular restaurant yesterday with a friend. We haven’t been there in maybe five years. I got a plate of seafood fettucine alfredo. There was a lot of fettucine and sauce and maybe two scallops and three small shrimp. The price: $25. It might take us another five years to eat there again. Yeah, I know anecdotal evidence is often discounted, but whenever the news says inflation is down, I just want to throw something at the TV.

Took my dad & 2 kids to Panera Bread for dinner the other night. 4 meals and soft drinks.

$78!

I’ve found that since the pandemic, you have to look for a business’s promotions and coupons online or in their app before you buy anything. Classic two-tier pricing: low price for the regular customers and price-conscious vs. the occasional customer and non-price conscious. The “public” price can be twice as much.

We’re living in an MBA’s utopia of value curves.

You can’t get lunch around here for under $50 for two people.

Paul Krugman on inflation – “The war on inflation is over. We won, at very little cost…” https://twitter.com/paulkrugman/status/1712494317024026761

It’s hard to believe this moron.

I noticed two large drops in food prices: eggs (that almost tripled in price for a while) and buckwheat. The latter drop was observed by me on Amazon in the form of Russian buckwheat for 5 USD per 800g package, Canadian buckweat is as expensive (comparatively) as before. Someone forgot to put sanctions on Russian buckwheat, recent new sanctions were on diamonds, so prepare for a price shock next time you want an engagement ring (some people need it regularly…). Just it case I used volume discount on buckwheat.

The largest price increase I observed in in legumes that doubled if you look for the lowest prices. Not so easy to be a vegetarian these days… More seriously, USA needs healthy affordable diet that industrialized farms do not provide.

When I was still living in San Francisco, I used to rely on my favorite American snack, Cheetos to gauge inflation. Once the lockdown started, A bag of Cheetos (what I call the medium size) went up 10 to 20 cents every few months from $1.29 :(. I think by the time I left the US, it was $1.99 or something, pretty insane.

Don’t forget that income is still outpacing inflation, real rates are still negative and the US is running a big deficit during good economic times.

Another thing that has been helping to keep CPI down will also end next month: Health Insurance component. https://wolfstreet.com/2023/10/12/acceleration-of-inflation-continues-core-services-inflation-spikes-despite-the-massive-health-insurance-adjustment/

That bag of cheetos is 2.49 now, and this doesn’t tell such a rosy tale, more like…meh.

https://www.bls.gov/news.release/realer.nr0.htm

https://www.oftwominds.com/blogoct23/thin-ice10-23.html

My measure of inflation has been the number of people I see begging in the parking lots outside grocery stores. That number has doubled over the last year. Even the Whole Foods near us has beggars in it now. How can people say this economy is working for people?

the report from the Bureau of Labor Statistics differs from what the FRED graphs show.

for instance, “Unprocessed goods for intermediate demand”, ie commodities, were up 4.0% in September after rising 2.1% in August and 2.4% in July…

most other metrics are quite different as well..

here’s the bls report: https://www.bls.gov/news.release/ppi.nr0.htm

also access the links at the bottom of the release for more details..

i have covered this report for years, and i have not been able to figure out what those FRED graphs are actually showing..