Yves here. Colonial blowback is a bitch. All those countries we (as in the largely white person advanced economy “we”) though we muscle aren’t pushovers any more. And this shift to them having a lot more collective economic heft (as in they don’t need us for a market so much) comes just as many many materials, such as ones for the famed green energy transition, face supply pressures.

By Beata Javorcik, Chief Economist European Bank for Reconstruction and Development (EBRD), Professor of Economics University Of Oxford; Lucas Kitzmüller; Sushil Mathew; Helena Schweiger, Lead Research Economist European Bank for Reconstruction and Development (EBRD); and Xuanyi Wang Analyst European Bank for Reconstruction and Development (EBRD). Originally published at VoxEU

A successful transition to a green economy depends crucially on the availability of various critical raw materials. Currently, China dominates the production and processing of many of these materials, and most of the reserves are in countries that are not politically aligned with the Western economies. This column discusses the current situation and potential policy solutions.

With the World Meteorological Organization (WMO) issuing a warning that global temperatures are likely to surge to record levels in the next five years, the task of limiting global warming in line with the Paris Agreement – keeping global temperature rises well below 2°C (and ideally as low as 1.5°C) relative to pre-industrial levels – is becoming more challenging by the day. The necessary large-scale roll-out of clean technologies to fully decarbonise the electricity supply, electrify most final energy use, and scale up the use of low-carbon hydrogen requires a range of critical raw materials (Energy Transitions Commission 2023). 1 These include (i) copper for wiring, (ii) rare earth elements for electric motors, (iii) lithium, nickel, and graphite for batteries, and (iv) silicon for solar photovoltaic (PV) panels. The amounts of materials involved are significant (Valckx et al. 2021, IEA 2022). Few substitutes are available for these inputs at present, and Western economies have poor access to many of them. This would be challenging at the best of times but is even more fraught with rising geopolitical tensions and Russia’s war on Ukraine. In recent work (EBRD 2023), we document the scramble for critical raw materials and discuss possible solutions.

Western Economies Have Poor Access to Many Critical Raw Materials

The supply risk that is associated with a critical raw material is determined by (i) where it is mined and processed, and (ii) the general availability of reserves (known commercially viable deposits in the ground). For example, rare earth elements tend, on average, to be more abundant than silver, gold and platinum (despite what their name suggests); however, few of those deposits are concentrated and economically viable to mine (Van Gossen et al. 2014).

If a country does not have critical raw materials within its territory, firms located in that country may seek to acquire mines overseas or import such materials from trading partners that are regarded as reliable (for instance, countries that are aligned in geopolitical terms).

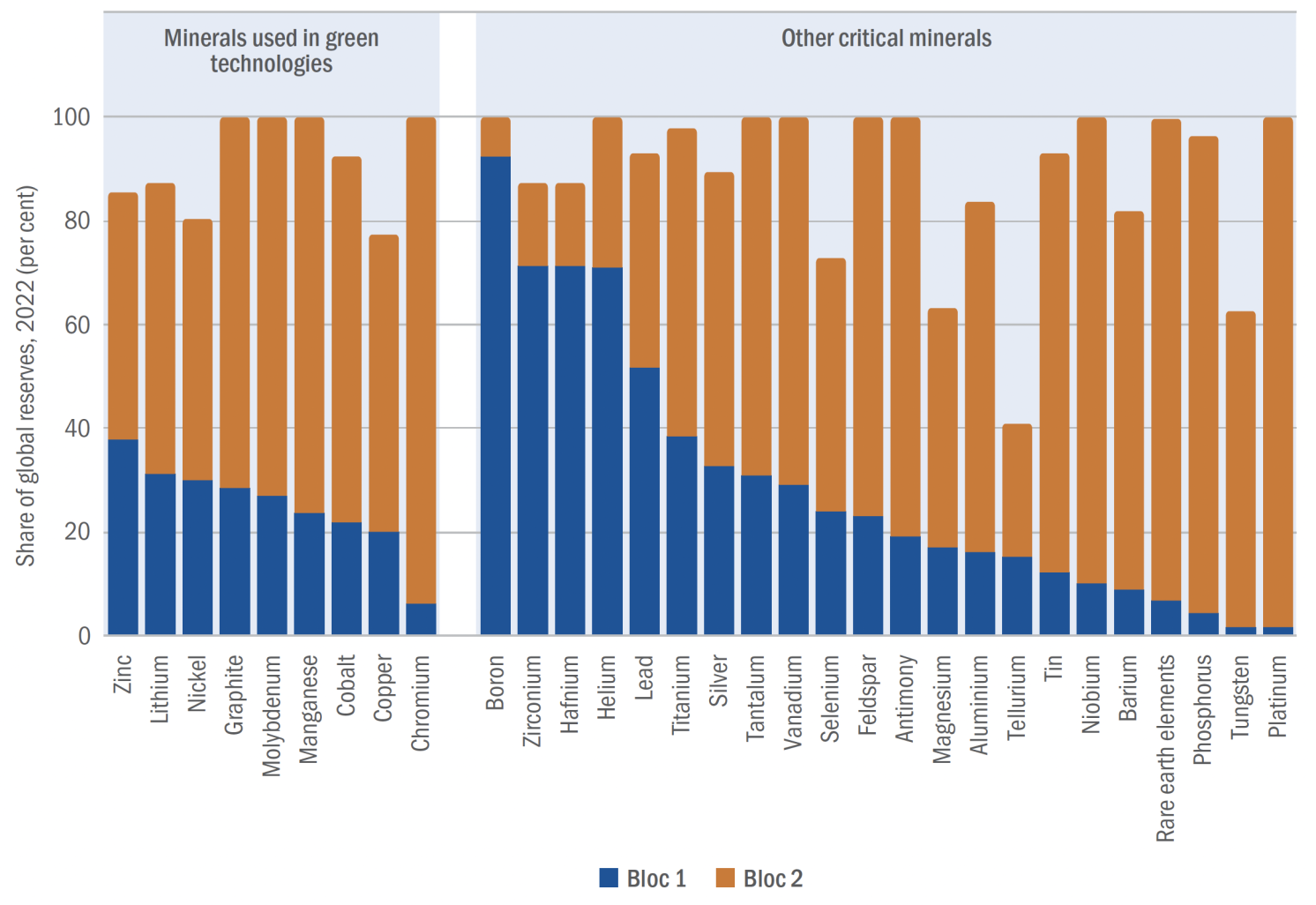

To analyse the extent to which such similarities in values might affect countries’ bilateral trade in critical raw materials, we use data on the United Nations (UN) General Assembly voting between 2014 and 2021 and, following a large political science literature, measure countries’ bilateral political attitudes towards one another using the similarity of their UN votes. We divide them into two blocs based on (i) average ideal points on a unidimensional scale and (ii) the Jenks natural breaks classification method. Bloc 1 comprises countries that are more closely aligned with the United States and other Western economies, while Bloc 2 contains the rest of the world (including China). Of the various countries in Bloc 2, Armenia is the closest to Bloc 1 using this measure. 2

Figure 1 shows that Bloc 2 dominates the known reserves of all raw materials critical for the green transition, as well as most other critical raw materials (except for boron, zirconium, hafnium, helium, and lead). Importing critical raw materials from politically aligned trading partners would thus not solve the problem.

Figure 1 Reserves of critical raw materials in countries geopolitically aligned with the West and the rest of the world

Source: S&P, Voeten (2013) and authors’ calculations.

Note: Based on the location of mines.

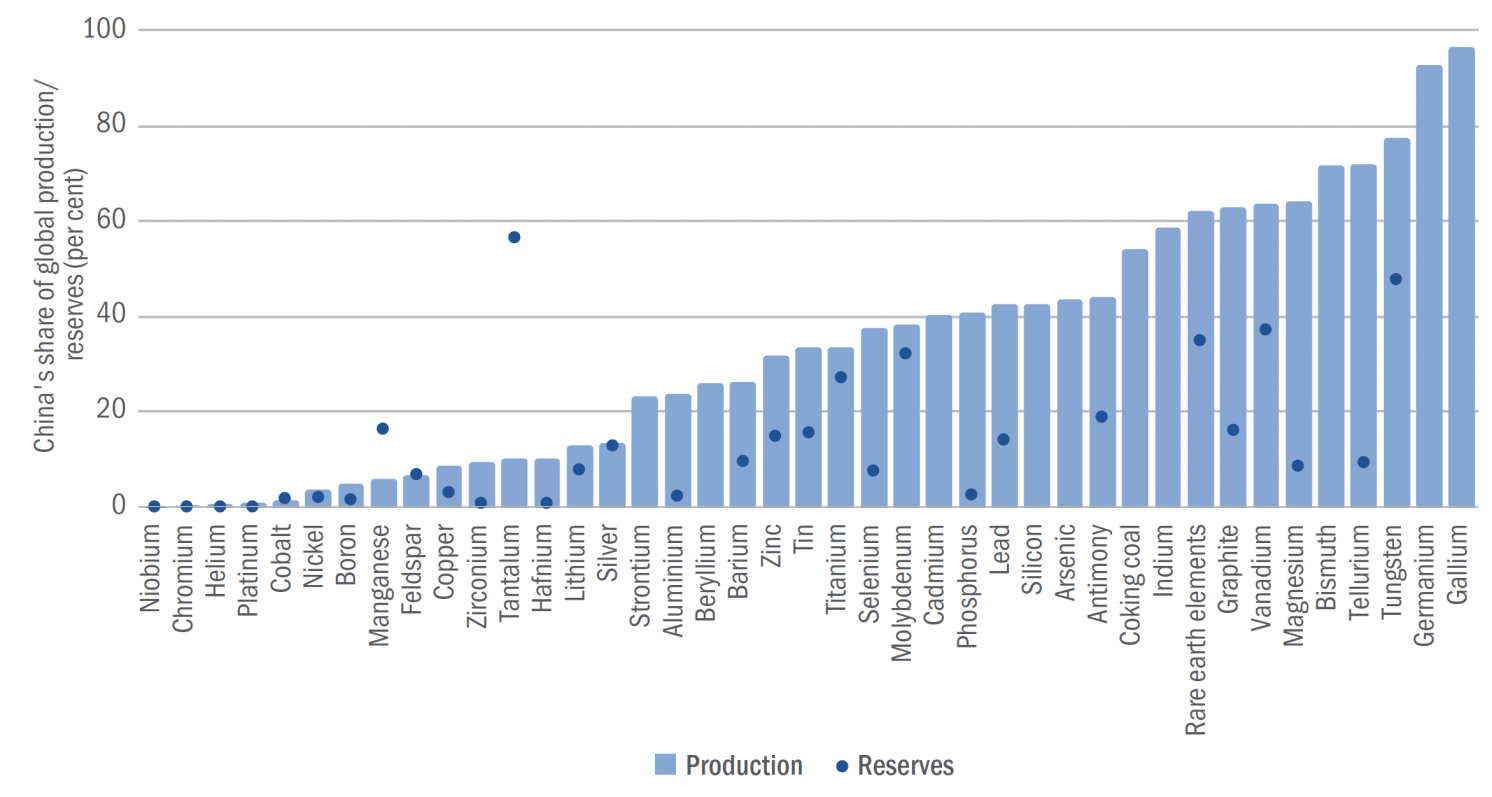

China Dominates the Production of Most Critical Raw Materials

The production of critical raw materials is heavily concentrated in a handful of countries, particularly China (Figure 2). The minerals with the highest levels of geographical concentration are gallium and germanium (used in chips), followed by niobium (used in steel alloys) and tungsten (used in wear-resistant metals). In contrast, zinc (used to protect steel from corrosion), silver (used in solar cells) and copper mining are the most geographically diversified.

Reserves are only slightly more geographically diversified. While China has more than half of all known reserves of tantalum (used in electronic components), as well as significant percentages of the world’s reserves of tungsten, vanadium (used in batteries and steel) and rare earth elements, almost 90% of all known reserves of niobium and boron (used in fertilisers, EVs, wind turbines and solar panels) are in Brazil and Türkiye, respectively.

Figure 2 In 2021, China dominated the production of most critical raw materials

Source: EBRD (2023).

Note: “Platinum” refers to the platinum group of metals. Data on reserves are not available for certain minerals. Production refers to 2021, while known reserves to 2022.

As the scramble for resources has intensified, major mining companies have sought to explore deposits and buy mines around the world. While companies headquartered in the US and Canada own the most mines overseas, Chinese companies have been actively buying overseas mines over the past decade. In Africa, which is home to about 30% of all known mineral resources, the number of Chinese-owned mines has doubled since 2013. From an individual country’s perspective, acquiring overseas mines increases the security of supply for critical raw materials.

Does It Matter?

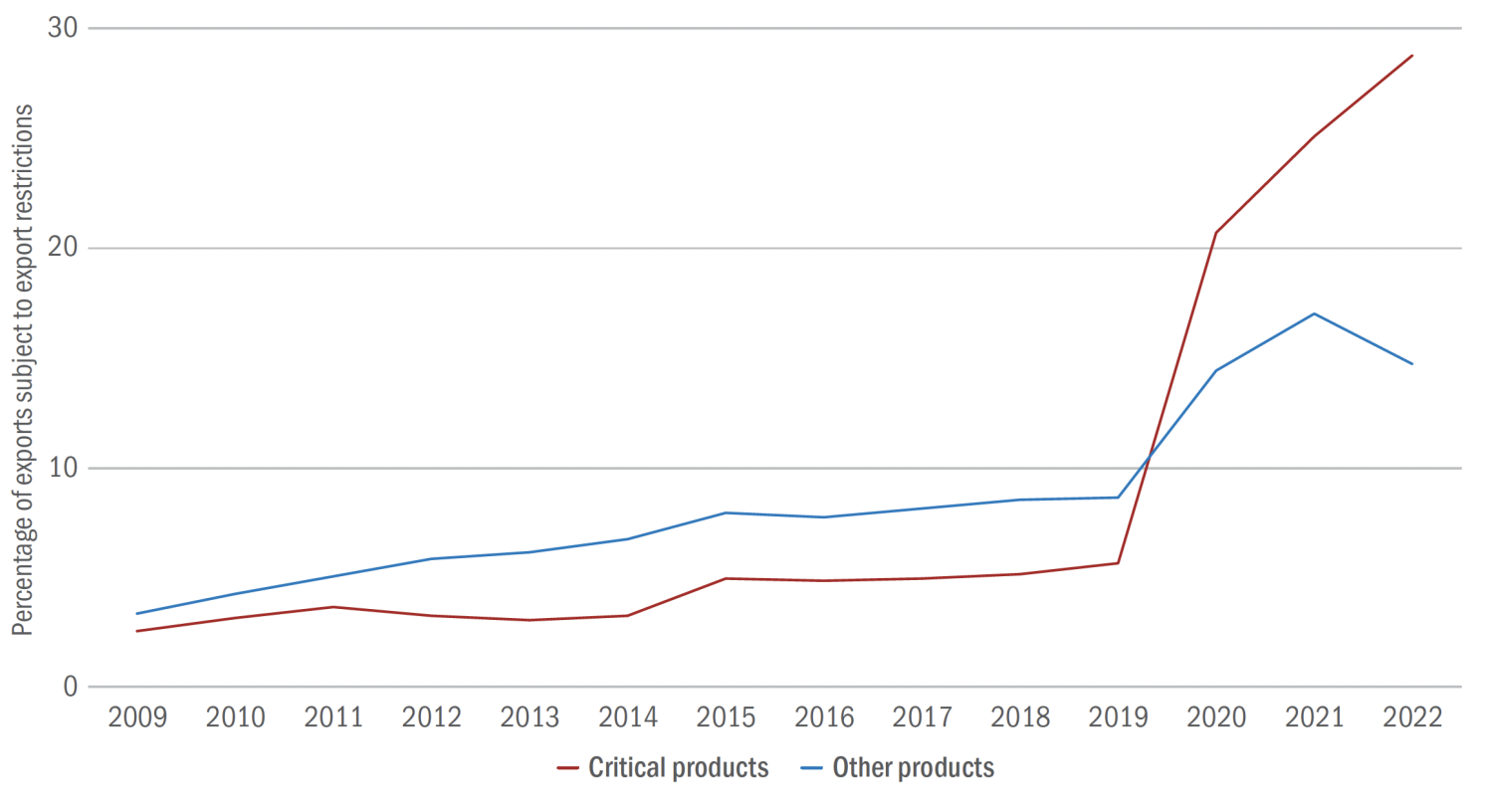

Access to critical raw materials and products that (currently) cannot be manufactured without them is important because they are crucial for a successful green transition. While demand for critical raw materials has grown in recent years, the percentage of critical products that are subject to export restrictions shot up around 2020. Data on export restrictions taken from the Global Trade Alert can be combined with data on international trade flows to gauge the economic importance of such restrictions (Evenett and Fritz 2020). This analysis reveals that around 30% of global exports of critical raw materials by value were subject to restrictions in 2022, up from just 5% in 2019 (Figure 3). A much smaller increase, 5 percentage points, was observed for other products over that period, reflecting broader trends in terms of geopolitical tensions and the fragmentation of global trade (Aiyar and Ilyina 2023).

Figure 3 Export restrictions on critical products have surged since 2019

Source: EBRD (2023).

Note: Global Trade Alert data as at 11 July 2023.

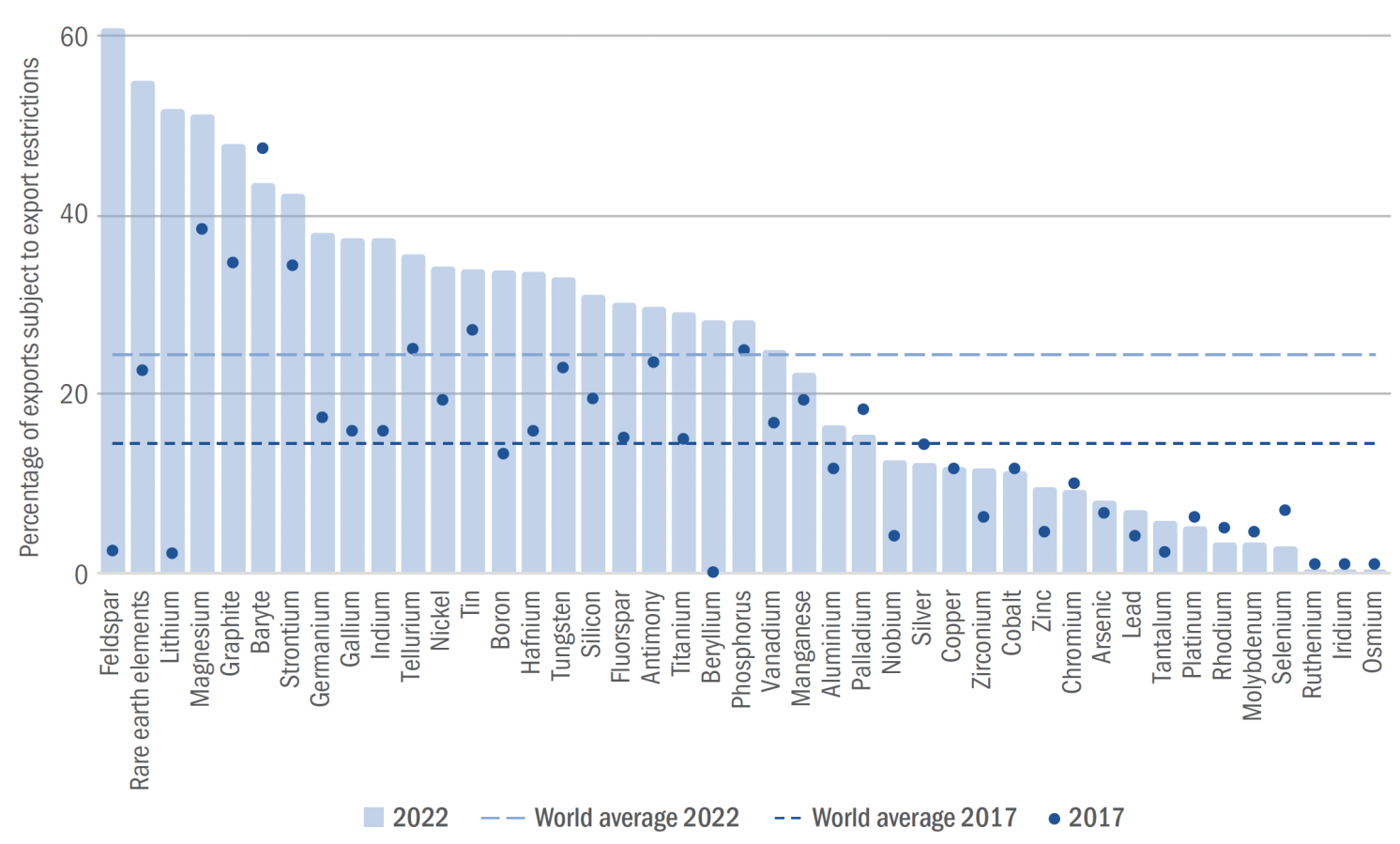

The biggest increases in the percentage of critical materials subject to export restrictions occurred in the US, Vietnam, and China. 3 In terms of individual materials, export restrictions have been tightened for feldspar, lithium, and rare earth elements, while trade in selenium, baryte, and palladium has become less restricted (Figure 4).

Figure 4 Export restrictions have increased substantially for lithium and rare earth elements

Source: EBRD (2023).

Note: Global Trade Alert data as at 11 July 2023.

Countries impose export restrictions on critical raw materials to capture more of their value by embedding them in other domestically manufactured products, or to make it more costly for others to obtain them. For example, when the US CHIPS and Science Act of 2022, which provides subsidies for the construction of semiconductor manufacturing plants, prohibited recipients of such subsidies from expanding semiconductor manufacturing in China or other countries that pose a threat to US national security, China retaliated by imposing restrictions on exports of gallium and germanium.

Conclusions

A successful transition to a green economy will require massive investment in clean energy and a wide range of critical raw materials. This is a challenge in the current geopolitical climate, with the production, processing and reserves of most of these materials concentrated in economies not closely aligned with the US and other Western economies. The first best solution would be to resolve the tensions. Failing that, here is a list of things policymakers could do instead.

To reduce their dependence on China and other strategic rivals, policymakers can seek to diversify the supply of critical raw materials – though that may not be straightforward if they wish to focus on politically aligned countries. Promoting clean energy investment at home, as the US Inflation Reduction Act does (Arezki and van der Ploeg 2023), requires not only sufficient fiscal space but also time and managing environmental, health and social consequences.

A more promising avenue would be to manage demand through measures that accelerate improvements in technological efficiency (such as improved load factors for wind farms or shifts to cobalt- and nickel-free batteries). Such measures should include regulatory standards (for instance, rules favouring technologies with high levels of recycled content, or performance standards for new clean energy technologies, akin to fuel-efficiency standards for vehicles), as well as targeted inducements and R&D-related and economic incentives for recycling, such as cost-reflective land disposal fees.

See original post for references

Glad to see the focus on inducements for recycling.

Recycling is enabled at three major points: 1) via design, wherein the product is designed so the parts that break or wear out are easily removed and new on swapped in, and 2) using chemicals / materials that assist/enable separation of the rare materials from the not-rare at recycling time, and 3) strategically locating the reclamation facilities right where the rest of the waste streams terminate. Where’s that strategic location? The local land-fill.

The “land disposal fees” could be used to fund the construction of land-fill reclamation facilities, which helps move the land-fill from pariah status to high-value, socially-rewarding activities.

Those activities may eventually become not just reclamation, but possibly re-manufacturing facilities to upgrade those materials into a form immediately suitable for subsequent manufacturing activity.

Recall that most land-fills take in metals, glass, plastics, paper fiber, refrigerants, fuels/lubricants, and batteries. That’s a lot of raw materials, all available in one place.

Why not re-form those materials into common shapes / conditions which are amenable to in-situ value-add manufacturing?

This isn’t just good environmental practice anymore; it’s just plain ol’ good economic policy.

Lastly, I note that almost all the phosphorus (macro-nutrient for almost all ag-related plant production) is located in countries not politically aligned with the West. That’s going to be a problem; we use huge amounts of P to grow grain and soybeans.

So, how do you recycle phosphorus? Got to put in place waste-stream capture facilities at the water treatment plants, and get more serious about controlling farmland runoff. Sounds draconian at the moment, but … take a look at Figure 1 above, and make your own calculations.

There is/was a lot of phosphate rock in Idaho, I believe. It also had an uranium content.

Regarding the projected need for rare earths needed for battery manufacture: Perhaps there will be some wiggle room if sodium ion batteries take off?

Northvolt claims a sodium ion battery with energy density of 160 Wh per kg that “is free from lithium, nickel, cobalt and graphite.” [https://northvolt.com/articles/northvolt-sodium-ion/]

(For comparison the energy density of the battery used in the Tesla Model 3 has energy density of about 246 Wh per kg. [https://insideevs.com/news/342679/tesla-model-3-2170-energy-density-compared-to-bolt-model-s-p100d/])

Whether this will displace lithium batteries in low end consumer electronics I have no idea, but I am at least hopeful that it will make home battery storage more affordable and less environmentally problematic.

Tks for link, New_Okie. Really cool stuff, hope it works out for them.

Check this out, from their home page touting their commercialization track:

New product development is where it’s at, folks. Nobody’s going to give up the old stuff until and unless we give them something better.

Right? And they aren’t the only ones working on sodium ion battery tech.

There was an article in Links today about battery storage facilities beginning to outbid new gas plants for grid backup. Combined with the iron nitride magnets [https://electrek.co/2023/11/08/gm-stellantis-invest-niron-magnetics-develop-rare-earth-free-ev-components/] maybe offshore wind really will work as a power source largely unconstrained by raw material bottlenecks.

Of course it’s not a 100% solution (what is?) and no solution works when human consumption continues growing without limit. But I suppose I get through these dark times by reminding myself that we cannot forsee everything, both bad and good.

Rare earth elements are more critical to magnet and coating uses than batteries.

Obviously, the solution to those problem is in two critical steps:

1. Boost military and related spending to a trillion dollars per year (Pentagon, CIA and other 16 intelligence agencies, air to Ukraine etc.

2. Force/convince allies to follow on that trail.

The results on battlefields in Ukraine are impressive. The stalemate hides huge technology improvements on both sides…

Luckily, this capital and intellectual potential is not wasted on technologies related to avoiding global warming. Of course, sabotaging supply chain of adversaries and shunning what they could provide is another trillion dollar obstacle (in orders of magnitude). We avoided the path of following competitive advantage and exchanging the fruit by sanctions and other trade barriers. In a cooperative world, the investments would be less driven by de-risking and more on globally useful improvements.

Even USA finds it impossible to keep primacy in assorted new technologies. For example, equipment critical of chip making in Dutch and production, largely Taiwanese, 40 years ago USA was a leader. And we cannot even utilize old energy saving technologies like railroads — doubling their share in moving freight (and electrification which is easy) would save a lot of energy and carbon.

I don’t think that word means what you think it means.

Please read more carefully. That term is used by the post authors at VoxEU, so it is incorrect to attribute it to “you” as in a site writer.