Yves here. It’s surprising to see continued pain in the housing market, as contrasted with consumer spending continuing to be pretty good despite ongoing Fed “kill the labor market” efforts. Recall that Fed economists have long seen home prices as a much bigger driver of the wealth effect (“people who feel richer spend more”) than stock prices. You’d think that works in reverse. Perhaps there’s a lot of anchoring in how owners see the price of local houses, that even if they know intellectually that prices are down, they choose to believe on some level that the old prices, and even higher, are not far off.

By Wolf Richter, editor at Wolf Street. Originally published at Wolf Street

Mortgage-rate buydowns, “smaller product footprints,” and “de-amenitizing” to bring down payments: D.R. Horton.

Homebuilders, in order to sell new houses at a decent clip in this new mortgage-rate environment – even as sales of previously owned homes have collapsed because sellers refuse to accept reality – are using a variety of strategies, outlined by D.R. Horton in its Q3 conference call, including:

- Mortgage-rate buydowns

- Smaller houses (“smaller product footprints”)

- “De-amenitizing” the houses (cheaper appliances, floors, countertops, simpler roof, no deck in the back?)

- And other incentives (free upgrades, etc.)

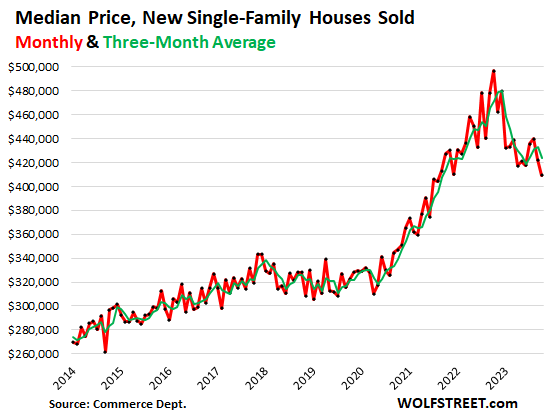

So the median price of new single-family houses sold in October fell by 3.1% from September, to $409,300 (red line), the lowest since August 2021, down by 17.6% from a year ago, which had been the peak, according to data from the Census Bureau today. The three-month moving average is down by nearly 12% from its peak in December last year (green).

These are contract prices and do not include the costs of mortgage-rate buydowns and other incentives such as free upgrades. But they do reflect the lower price points due to smaller footprints and the “de-amenitizing.”

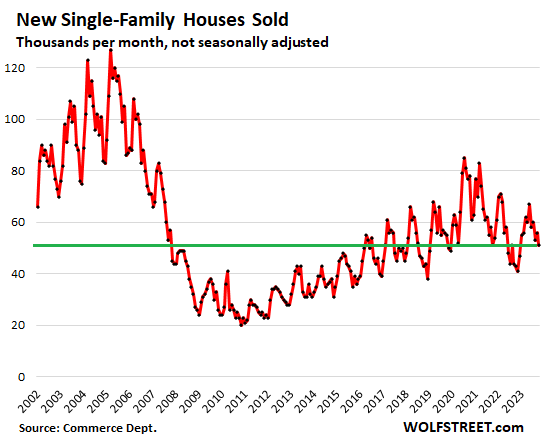

Sales of new houses – not seasonally adjusted, and not the annual rate of sales – fell to 51,000 houses in October, and while this was up by nearly 19% from a year ago, when the market was freezing up, it was still down by 7% from October 2019.

As you can see in the chart below, these sales levels would be nothing to write home about. But in the new mortgage-rate environment, and compared to the collapse in sales of previously owned homes (-27% compared to October 2019), they’re decent and document the effectiveness of bringing down payments via mortgage rate buydowns, “smaller product footprints,” and “de-amenitizing”:

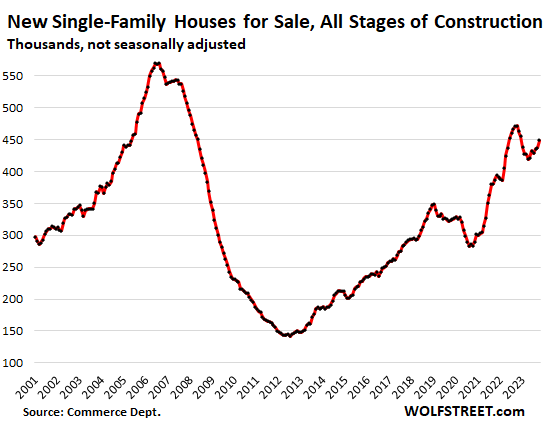

Inventory for sale of new houses at all stages of construction rose to 449,000 houses in October, which translated into 8.8 months supply at the current rate of sales – more than ample inventory and supply, and homebuilders are motivated to make deals to move this inventory:

Homebuilders have figured out this market, unlike current homeowners who are thinking about selling. Homebuilders have to build and sell homes no matter what mortgage rates are, while homeowners who’d want to sell are clinging to their hopes that “this too shall pass,” and they’re not putting their homes on the market, as the national median price, after peaking in June 2022, is on the way down.

Homebuilders are now aggressively competing with sellers of previously owned houses. And they also have to compete with the rental market, including newly-built-for-rent single-family houses by large landlords.

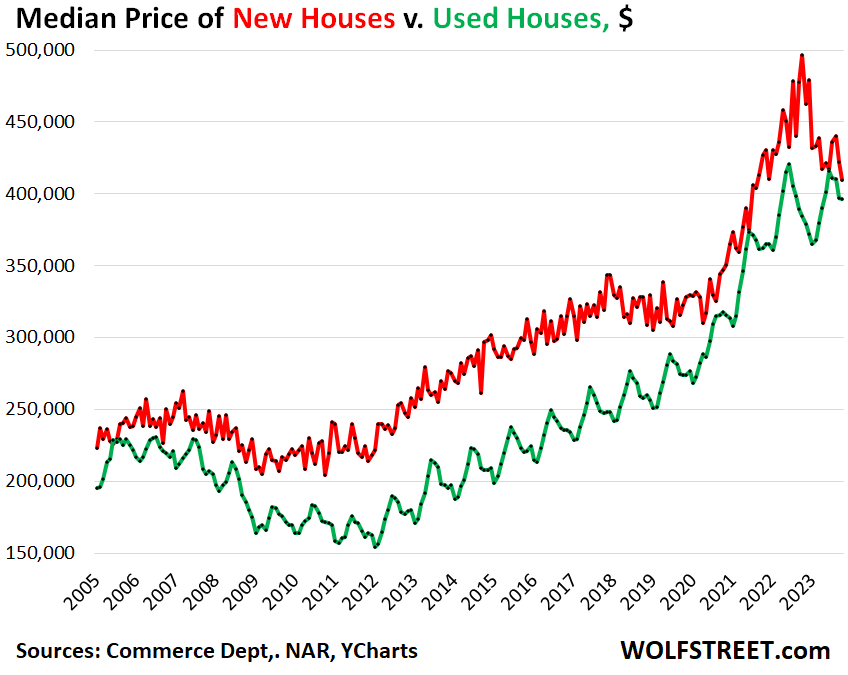

And monthly payments via bought-down mortgage rates make a difference and lower price points make a difference. The national median price of new houses has been falling faster than the national median price of existing houses (via the National Association of Realtors), and they’re now very close, which is unusual:

- Prices of new houses: -18% from peak (October 2022), $409,300

- Prices of existing houses: -6% from peak (June 2022), $396,100

What D.R. Horton said.

In their earnings call for Q3, D.R. Horton executives addressed questions about mortgage-rate buydowns and their other strategies to keep sales up in this mortgage-rate environment. Here are some of the key points (transcript via Seeking Alpha):

“To adjust to changing market conditions and higher mortgage rates, we have increased our use of incentives and are reducing the size of our homes where possible to provide better affordability for our homebuyers. We expect to continue utilizing a higher level of incentives in fiscal 2024, particularly rate buydowns in the current interest rate environment.”

“The average rate can move quite a bit through the quarter, but we tend to stay about 1 to 1.25 points below market at any given time.”

“About 60% of our total closings are used with some form of a rate buy-down … the most successful incentive we have seen.”

“Our buyers are focused primarily on affordability. And for us, the way we deliver that affordability is through the monthly payment process. And that’s obviously been a big driver for the rate buydowns, but also introducing smaller product footprints, and de-amenitizing some of the homes a bit and letting people do things to improve their homes after the closing when their financial position perhaps has changed and they can afford a little more.”

“Over half of our business [is] first-time homebuyers because despite what’s happening with interest rates, those buyers need a place to live. They don’t already own a home, so they’re not a discretionary buyer. They’re in the market looking at buy versus rent opportunities. So, if we can stay competitive with the rental market on that front, we’re going to continue to capture first-time homebuyer market share.”

Interesting — thanks.

With “smaller product footprints” and “de-amenitizing” — funny euphemisms, so, to riff on a popular term from Dr. Housing Bubble, let’s just call this “crap-shackification” —, is it so surprising that “the national median price of new houses has been falling faster than the national median price of existing houses”…?

And I thought(?) mortgage-rate buydowns are mostly temporary. How much does that temporary respite matter when the 30-year mortgage is now the most common term for home loans in the U.S.?

With the WSJ prime rate at 8.5% and variable-rate mortgages at “prime plus” rates, is it so surprising that there is “continued pain in the housing market”? Consumer spending can be up, but how many potential home buyers are going to pull the trigger on a 9 or 9+% interest home loan, which was already the most expensive single expenditure that most working USians will make in their entire lives?

I wonder how long the Fed is going to continue this high rate policy, as it seems likely to crater the residential RE market sooner or latter — possibly sooner.

I rather think its the opposite. All those previously uneeded “ammenities” were the crapification: premium granite countertops and backsplashes everywhere, centralized vaccuums, walk-in closets the size of a bedroom, etc.

I think its a good sign homebuilders are returning to the basics

Need more drops in housing prices – and the margins for builders are high – unless you try to cram a crap build in prime land prices and, also needed, is a demand should be put on new builds to be net zero from start. Also dis-incentivize, through taxes, the buying by large corps for rental, the large depreciation give-away to said corporations and REITs and reduce the finance investment speculations – via taxes – in commodities that are required to live – shelter, food, health, education – that blow bubbles and drive the cost of living up. And, as far as realtors are concerned, they need to cut their vig on every sale and shut their yaps concerning how great rising house prices are. And why are we taxing improvements and needed upgrades to efficiency in homes when services to those improved homes go down – not up.

Bring back Glass-Stegal and take back the tax breaks to speculators and move them to the homeowners.

It’s an affordability thing not a homeowner hold out thing

I am still puzzled by exactly what the purpose of the realtor monopoly is, particularly in a world where anyone can list their property on Zillow and a handful of other websites.

Yes, realtors will help inexperienced sellers set a “reasonable” price. Yes, they can consult on whether various pre-sale improvements are worth the effort. Yes, they do show the home to potential buyers and suggest homes to clients looking to buy. And yes, they take care of the paperwork when the sale is made, providing some peace of mind on that front.

But not every buyer or seller needs all of these services. And the way the fees are structured creates a perverse incentive for a realtor working with a buyer. A buyer’s agent (and the inspectors they hire) should be skeptical. Any home inspections should be done with an eye towards finding any and all problems with the home and bringing the sale price down or preventing the buyer from purchasing a lemon. However the buyer’s agent is instead incentivised to encourage most sales, particularly for homes which offer juicy commissions. The agent for the buyer should work for the buyer, not for the seller.

Seems to me like it would be much more straightforward if agents were paid by the hour or by the service, and if the buyer’s agent was paid by the buyer.

everything is incentivised to screw the customer, when you go to the garage, the dentist or whatever profession today, do you really think they have in mind your best interests or theirs?

I wonder what is happening with the legal actions targeting the Real Estate Cartel’s 6% that Stoller pointed to in one of his recent post’s. My ex-wife is a real estate agent selling high end properties to wealthy Chinese immigrants and investors. The other shoe has not dropped so far although the issue has come up for concern in staff sales meetings.

Ask yourself whether you’d buy jewelry from a guy on the street corner vs. someone who knows something about gems (a consignment jeweler, for example). The same thing applies to a much more complex transaction involving a home. Yes, FSBOs (For Sale By Owner) are possible, but it’s more likely sellers (and buyers) will get a fair price at a consignment jeweler.

The recent court rejection of fixed commissions, or restricted access to realtor.com is a nothingburger. California already made it illegal to have fixed commissions, except by office policy.

Meanwhile, if you’re buying or selling you want someone competent working for you, restricting the potential buyers to those who can actually afford the house, or restricting showing to homes you can afford. It’s really a non-issue. Transaction costs are high because homes are not simple and people who are brokers really earn their money.

I say this after nearly two decades as a broker. Incidentally, in my experience, the Realtors are honest. It’s the buyers and sellers who want to pull the wool over each others’ eyes.

Meanwhile, the rising price of homes, says Michael Hudson (and Henry George) is because of low land taxes. If you think about it, land is a natural monopoly, and monopoly rents, if not taxed away, will accrue.

All good points, not to mention the fact that you probably want someone with detailed local knowledge of the market working for you, and this is something people generally don’t have even if they live in the area.

However, having purchased a home in the US and two homes in Asia during my lifetime, I can say that the real estate industry in the US has too much overhead cost associated with it, and too much focus on commission sales, which causes distortions that are not always in the best interest of the consumer.

So yes moving a lot of the functions to an hourly rate is a good idea, and probably making the commission structure more indirect would prevent some common abuses.

Realtors virtually never do this for a variety of reasons. Most notably that they simply are not in a position to know and the work involved figuring it out would turn off prospective buyers (multimillion dollar properties an exception)

Well sure, that is the marketing line. But what does “high” mean. Depending on the price of the house it could be 6k or 60k and there’s no difference in the work required of the realtor. Thats the rub, not honesty

The term Buyer’s Agent is misleading because the commission comes from the seller’s pocket (shared with the Seller’s Agent).

Hopefully, this marks the end of the McMansion craze.

Depression and grandiosity are “two horns on the same goat”…I wouldn’t bet on an end to grandiose building.

I visited a vendor in a small bedroom community 30 miles from my office yesterday. The route there took me past a new ‘development’ that sat right next to the highway, too close, with no noise barrier, natural or man made.

The houses were too close together, looked like 10 feet apart, and laid out in a truly cramped and haphazard manner.

The most striking thing about what I saw was tiny windows that didn’t match the scale of the houses, obvious money-saving and ugly.

It was a shocking look behind the curtain.

Looks like the ‘developer’ was offering McMansion size houses on what looked like a bad trailer-court site with sub-standard features.

On the whole, a perfect sign of where the economy is at the moment.

A brand new, pre-fab slum, out in the country.

When houses are crammed together builders will sometimes make windows facing other houses smaller in order to provide some level of privacy. I’ve seen developments where the windows were up near the ceiling so that the next door neighbors couldn’t peer in unless standing on a ladder.

Thanks for this post. As Wolf’s first chart shows, the price drop is from a 3-year bubble high. Sales asking prices are still much much higher than 3 years ago. If I remember correctly, most of the huge run-up in price in the past 3 years was driven by PE and Wall St buying up residential housing stock, turning themselves either into national landlords or hoping to “capture the market” and sell on at even higher prices, imo. A house would be listed in a nice area for an area reasonable price and an entity would swoop in and cash buy at over asking price. They jacked prices to the moon, then the Fed jacked interest rates – too late to stop the bubble forming. Now high prices plus high interest rates. What a deal. In the 1980’s it worked because housing prices hadn’t gone to the moon before the Fed’s interest rate hikes jumped, imo. Also before the big banks made a bad name for themselves as in the 2008-9 housing bubble collapse. / my 2 cents

Adding: ” even as sales of previously owned homes have collapsed because sellers refuse to accept reality ”

Have sellers refused to accept reality, or have many many people who bought in the last 3-5 years and locked in a low interest rate simply hanging on to their low interest rate mortage? Or would selling now put them badly upside-down on their existing mortgage?

I think part of the reality is that what sellers there are can still get the marked-up prices of the house market boom years. Here in Upstate New York the only new construction seems to be in the McMansion category. Most of the people in the area live in older housing that seldom goes on the market. The paucity of used property listings and their age — many are over a century old — makes for an interesting housing market. Prices have inflated from the lack of supply and the age of the homes combined with weak buyers in low end of the housing market means that many sales take almost a year to close. I have no idea what is causing these delays other than guessing the banks may be very reluctant to loan money although I cannot guess why that might be.

Anecdotal, but the people trying to get $775K for the crap shack across the street are not accepting reality. They paid around half that price less than five years ago for a very poorly built house – small pre-fab home dropped on a concrete slab because the lot floods on a regular basis, so they couldn’t put in a basement.

House has been on the market a few weeks now with no takers at that price. I imagine reality will set in soon. That house isn’t even worth the $350-$400K they paid for it. In a sane world, that property would be going for around $200K, which is a little more than what it cost to buy the substandard lot and build a new house on it according to public records.

re: “small pre-fab home dropped on a concrete slab because the lot floods on a regular basis,”

I mean this sincerely for any home buyers looking to buy a house they hope to live in for more than a few years: check your state’s flood plane maps – usually available at a state map repository of national/state maps. Look back at the flood plane maps in your area from 50-60 years ago. Really. The modern flood plane maps assume water control via dams etc will materially change the old flood plane designations. It ain’t necessarily so, as they say. Also, the old flood plane designations could flag newer contruction built on “fill landscape” geology, “fill” being “hopefull”, imo.

Much shorter: if the 50-60 year old USGS maps designated an area as ‘flood plain’ is is still flood plain, no matter what the sales pitch claims. Even if the sale pitch claims trucking in huge amounts of soil fill to raise the topographic level, the new homes are still built on and are not different from the old flood plain level, don’t buy it, don’t buy the sales pitch. Do your own due diligence. / my 2 cents

It depends on the area. It seems that in Houston, TX, every five years or so they have “500 year flood”, hurricanes appear where none were before (really!) etc., but someone relaxed the limitation where you can build. So every five years or so folks can engage in a Robinson Crusoe phantasy. But where I live, flood plains are not being redefined, and every two years or so I can see ephemeral lakes near my place, emerging where they should.

Good site specific, area specific info. Thanks.

If history is a guide, this is just the beginning of the downturn in housing prices. I’ve lived through three of these busts and they take several years to run their course. Keep your powder dry if you plan to buy and be ready for opportunities. If you have to sell, oh well, too bad, but know you;re swapping dollars if you;re replacing your house. If it’s a rental, why sell? Take the income stream….

Someone always has to sell, no one ever has to buy.

We have a few years before we hit bottom ( 3 Years?) but prices are always sticky on the way down.

As far as agents telling potential clients that they should price their home realistically, that’s not how you get listings.

From the first day of training the message is “Get the listing” because you can often talk the price down after you have the contract signed if it is unrealistic…given a little time.

When you have a listing every agent in the area will be bringing clients by, when you are representing buyers ( Of which there are few at the moment) you are competing with every other buyer’s agent.

So you buy the listing by promising 10% more than you know it will bring “This home is SPECIAL, I just love the way you glued little rubber penises every where! ”

It was a 1600 Sq Ft 3/2 and there were many thousands of little peckers glued to all of the walls and ceilings.

And even Wolf seems ignorant of how the biz actually works, the “Big Dog” is Realogy which controls most of the big franchise operations and which makes a big chunk of its income from churn.

90% of new agents are out of the Biz after 2 years and 2 deals, and they are sucked dry with fees ( Tech fees, E and O insurance, Administration fees…) while getting a lousy commission split.

After 2 years my E and O insurance dropped by more than 90%, and tech fees and Admin fees disappeared entirely.

This is also why it is so easy to get an RE Sales License, if you can read and do math at a 5th grade level you will pass easily.

Run’em through, suck them dry and the survivors will make you Money, not as much as the newbies but it’s still a Dollar.

A lot of truth to that. My wife is with Coldwell Banker. Semi-retired and the cost just to keep your status is not trivial by any means. Currently the Honolulu market has cooled but prices are stable. I don’t think you are seeing the competing offers over asking like a couple years ago — buyer agents effectively competing against each other to get an offer accepted.

I think folks not in the biz way underestimate the work involved between submitting or accepting an offer sheet and completing a closing. And all the things that can go wrong and get an agent sued. New laws that add more and more addenda to contracts (our latest is climate change sea level rise disclosures).

Most of those new addenda and realtor contracts are designed to escape liability (protect the realtors a””) as far an agent getting sued – it is near impossible to sue an agent.

Completing a closing involves more than a realtors job or an agents job as you would notice at the closing table – A realtors job consists of getting the fill in the blanks contracts done properly – not much of a lift for a 6% company vig. I also find it ridiculous to tax a property on the market cost instead of actual cost or even on a land basis cost but you know – make an improvement and get dinged by taxes. Might it be more relevant to increase property taxes on the new owner or new build and keep taxes even on existing owners living in their property – ie – make up what increases on the county budget that are really needed upon those who newly come in or buy new builds that require additional services – whereas those in place do not require additional services – just thinking out loud

When times are fat, sales agents flood into Real Estate offices. The large number of agents relative to qualified buyers and motivated sellers makes real estate sales a business red in tooth and claw. When the market turns down, sales agents leave Real Estate offices in a flood. The competition between agents remains fierce but there are fewer qualified buyers and motivated sellers and more FSBOs [For Sale By Owner] until the number of qualified buyers drops to a certain level putting a drag on prices and the proceeds sellers hope to carry away from a close. I believe the 6% commission contributes to the oversupply of agents in good times and contributes to the listing hesitancy of home owners. Intense competition between agents and the difficulty enticing sellers and gaining buyer loyalty make the job of real estate agents difficult. There are of course inherent difficulties with the job that I would attribute to activities of the Real Estate Cartel and various other parasites that have attached themselves to the Real Estate Industry — the real estate attorneys, title insurance companies, loan agents and banks, and tax starved local governments.

I believe the 6% commission and 10% commissions for land sales are incommensurate with the ‘useful’ work real estate agents provide. A great deal of the headaches agents much deal with are created outside of the valuable and useful work they do.

I’m guessing you’ve seen this WaPo business article from October 31st this year.

Jury awards $1.8B in realty case that could shake up brokerage commissions

A Kansas City jury unanimously found that the National Association of Realtors and other organizations conspired to artificially inflate home sale commissions

https://www.washingtonpost.com/business/2023/10/31/realtors-home-sales-verdict/

My take on this, aside from the case itself, those inflated sales commissions either come out of the home seller’s realized return on the sale, or they come out of the home buyer’s increased costs. Call it a skim. / ;)

I believe doctrinally correct answer to how the cost of the 6% commission is split between buyer and seller depends on whether the market is a buyer’s market or a seller’s market. In a buyer’s market the sales price is lower and in a seller’s market the sales price is higher to obtain the split. I believe the true answer is more complex than that when the relative level of service is added in, among other imponderables.

In 1950 the population of the u.s was 148 million people. In 2023 the population of the u.s. is nearing 340 million people. How many houses were built since 1950 to house these additional millions? Given the Market’s recent past performance in efficiently providing a variety of goods and services, I am skeptical that the u.s. housing stock built between 1950 and the present is fit for purpose or artfully provided by some invisible hand. The chart showing the median price for houses between 2005 and the present makes little sense to me as a reflection of a growth in demand related to population growth. I believe the Fed money games and u.s. government economic games are playing hell on the supply and cost of housing in the u.s. [And I will say nothing about the population growth and how well it matches birth rates and rates of immigration.] I feel there are patterns here I can neither characterize nor understand but Hanlon’s razor: “Never attribute to malice that which is adequately explained by stupidity.” — does not satisfy me as an explanation for the anomalies I sense. I believe someone — some group[s] — are benefiting on what I suspect is a very large scale.

This verges off topic but I believe deserves consideration: the climate is changing rapidly and radically, fossil fuels are reaching their end, the human populations are peaking as many regions of the Earth become uninhabitable and supplies of food and water dwindle. Present housing and housing going back to over a century ago is not suitable as housing for the future. The structure of our cities, spread out as they are and dependent on remote resources is not suitable for the future. Our coastal cities and inland cities and towns near rivers, streams, and located at the foot of valleys, facing random atmospheric rivers are not suited to the future. The u.s. and many other nations must prepare for a large influx of immigrants. We are not ready for that future that is accelerating toward us. Even at my age I may not be old enough to enjoy the IBGYBG [I’ll Be Gone — You’ll Be Gone] consolations our Elites seem to anticipate.

Right. What exactly do real estate salespeople do to earn their commission of 2-3% (which they then split with their broker on a negotiated basis, but often give over up to half). A buyer’s agent/seller’s agent can refer you (they do not “hire” as above) to local reputable inspectors, lenders, and attorneys. It is much harder to close a deal than most imagine. A buried oil tank, a failing septic, a water test that comes back bad, a rate lock that is about to expire: are these reasons for a deal to fail? Not if you are working with a real estate salesperson worth their salt. Like all complex negotiations, these situations can be managed with skill, expertise, and experience. THIS is why you should be happy to pay your real estate agent. And if you are not, then find one who is worth it. PS: pre-purchasing points on your mortgage is for the life of the mortgage, not some short period as mentioned above.

Real estate agents provide a valuable service but I think the question is just how valuable. I think 2% – 3% to each agent and brokerage house is more than a more valuable than the service provided to buyer and seller is worth.

Real estate agents are often visited by local inspectors, lenders, even attorneys handing out their cards and sometimes offering small “finders fees” to real estate agents for referrals that pan out. There is some truth to the ‘reputable’ part but the same reputation information is available from experienced escrow agents and their like.

When the buried oil tank, failing septic, bad water test, expiring rate lock etc. come up — they usually lead to a renegotiated sales price before a sale will close. However, in spite of all fiduciary promises the agents make to their clients they often work to serve their own interests — sometimes working against their clients — to close the sale. No closing means no commissions — that’s why no agent should count on a commission until an escrow closes. Done badly and these closing time price renegotiations result in a lost sale and the loss of a seller and/or buyer.

[By custom the various inspections and tests come up at closing time with differing customs determining whether the cost falls to the buyer or seller. Ideally they should have been handled by the seller before listing a property for sale, and given many sellers are unaware of such issues — ideally the listing agent should require these tests and inspections before establishing a listing price — and even more ideally should provide the test and inspection results to a reputable appraiser to initiate arriving at a listing price. Of course that is not how real estate sales work. Few sellers would continue to deal with with an agent who will not list at the price and terms the sellers wants to hear. Buyers are famous for promiscuously ‘philandering’ with multiple agents.]

How much effort is required to sell a $700K home versus a $500K home? $12K more effort? I think not. Realtors should not be paid a percentage of the selling price. They should offer their services at a fixed rate, with a menu type price list to accommodate “difficult” properties.In a kinder and gentler world all housing would be public, with residents paying a monthly fee to the government (we the people) that would own and maintain the property. Housing, health care, and education all ought to be public goods, not commodities traded in the “market”.

Been here almost 20 years and until fairly recently, maybe 20 new homes were built in Tiny Town, it was refreshing the lack of development.

Hare Krishna were here in one of their Gurukalas (boarding school) in the 60’s & 70’s, and there are interesting poured cement tubular walled cottages left over from back in the day, and now the newest construction is all geared towards STR’s, with similar dimensions to the Hare Krishna efforts. There must be a dozen being built, all geared to somebody staying a few days.

When the AirBnB boom dies and goes away, they’ll make for interesting minimalist quarters that would never be built otherwise.