Yves here. This post does a very tidy job of shellacking Biden cheerleader claims about how “good” the economy is for most voters. Not only is “it’s the real wages, stupid” that undermines Biden performance claims, but also large price increases in critically important categories like food, housing and autos.

By NewDealdemocrat. Originally published at Angry Bear

A big focus of political discourse in the past two weeks has been about why Biden seems to be polling so poorly against Trump, and in particular has not consolidated support among younger voters.

Since the economy is always a very important component of voter intentions, unless there is a major superseding event like 9/11, economic performance has historically been a good predictor of Presidential election outcomes.

So let’s take a detailed look.

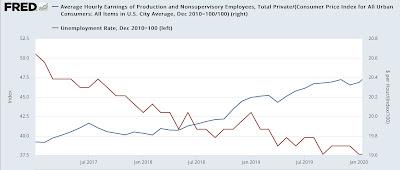

First of all, remember that the election is between two people, Biden and Trump. And the economy was actually doing pretty good during Trump’s mal-administration before COVID. Here’s what real hourly wages and the unemployment rate looked like:

Real wages for non-supervisory workers, increased 3.3% between January 2017 and the end of 2019. Meanwhile the unemployment rate fell from 4.7% to 3.5%.

And that wasn’t just something ho-hum. In the case of real wages, they were the highest since the end of the 1970s. The unemployment rate was the lowest since the end of the 1960s.

So people remembering that the economy was good while Trump was in office, before the pandemic, is not a fluke. It’s the truth, even though it is virtually 100% certain that he had nothing to do with it.

Now let’s take a look at how some important economic sectors have performed under Biden.

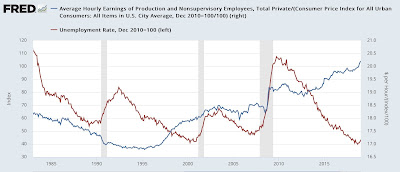

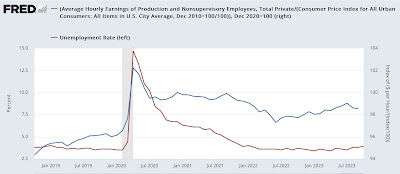

The unemployment rate has varied between 3.4% and 3.9% in the past year, about even with Trump’s best year – but not better. More importantly, while real wages for non-supervisory workers are up 2.2% since right before the pandemic hit, measured from when Biden came into office they are actually *down* -1.5%:

[Although I won’t bother with the graphs, other measures like the employment cost index and real personal income give similar results].

Some of this is compositional. That is, a lot of low-paid workers in sectors like restaurants and hotels were out of work during 2020 and have returned since. So their lot has improved. But this changes the averages, because more lower paid workers are in the mix. However the fact is, in the aggregate, real average hourly wages are down.

But perhaps more important is to compare the costs for some of the most important items with those wages.

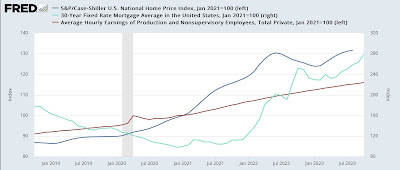

Let’s start with housing, which has gotten a lot of good and insightful attention from commenters.

Below is a graph in which I compare average hourly earnings (nominal, not real) for non-supervisory workers (in red) vs. house prices (dark blue) and mortgage payments (light blue). All of these values are set to 100 as of January 2021 so you can see what has happened during Biden’s Administration. All of these are nominal, not “real,” so that we compare apples to apples:

Nominal average wages have increased 16%. But existing house prices have increased 32%, and monthly mortgage payments for new buyers have increased 279% (!!!), i.e., from roughly 3% to roughly 8%.

Is it any wonder younger workers who would like to buy their first home, or upgrade to a bigger home, would be upset?

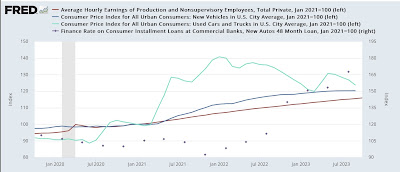

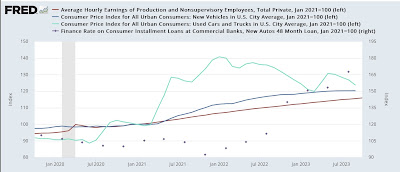

A similar phenomenon is in place as to cars:

New car prices have increased 20%, and used car prices 23%, compared to 16% for wages (at least used car prices are down from their 40% increase 18 months ago). And new car loan payments have increased almost 70% (from about 5% to 8.3%).

Houses and cars are the two biggest purchases that most people ever make. and affording them has gotten much harder since Biden took office.

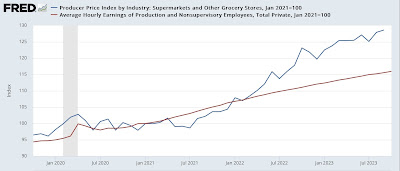

How about a couple of items the prices of which that people see almost every day, namely groceries and gas?

Grocery prices are up 29% since January 2021 (again, vs. 16% for average wages):

And gas prices, even after coming back down recently, are still up 55% since January 2021:

Now let me ask you: if you knew nothing about the personal qualities of the two Presidential candidates, i.e., if they were generic Candidate A vs. generic Candidate B, and you saw the two economic records shown above, who would you be most likely to favor?

That’s the problem Biden has.

Because I don’t like being a Doomer, let me point out that much of this is the doing of the Fed, which has raised rates at the most aggressive pace since Volcker over 40 years ago. And part of that is that the Fed fell behind the curve. Without going into all the gruesome detail, the Fed could started raising interest rates sooner but much more gradually, likely never reaching the level they are now.

Since the Fed will not want to lower rates right before an election, Biden should use whatever soft or hard clout he has to cajole the Fed into lowering rates at least some in the next 4 to 6 months. Additionally, he should explore regulatory actions, which won’t need Congress, to help out especially younger people trapped by higher loan rates. He can also propose actions to Congress, which will allow him to run against them when the GOP predictably yells that such actions are Commie Soshulist!

Also, because house prices all but stopped increasing about a year ago, housing inflation as measured in the CPI should continue to retreat. If Saudi Arabia and Russia are not successful in causing gas prices to skyrocket next year to hurt Biden, CPI on the whole should continue to moderate or at least not re-accelerate. And as supply chains continue to un-kink, we may see sellers actually lower prices on some things like groceries and yes, even cars.

Finally, and maybe most importantly, history shows that voters generally focus on the economy for the last 6 to 9 months before the election. In 2012, the economy improved a lot, and when the unemployment rate finally fell below 8% one month before the election, I knew Obama was in good shape. Contrarily, the economy was weakening close to recession in 2016. If we get better news on inflation and interest rates next year, Biden will be in much better shape.

Recent months and during 2023, a lot of discussion around this site about insuring important things, such as your home or your auto. Looking at my semi annual statement, I see an increase vs May 2023 of about $30, from a premium of $610 up to now for November 2023 a premium of $640. Which does not sound, or seem, too egregious. But it’s the aggregate change in that premium amount that gets the shock value.

May 2022 to November 2022, roughly $495. November 2022 to May 2023, roughly $545. Contrary to talking head idiots on CNBC and the like, inflation is not falling. It is merely subsiding but still a present and real issue for Americans. Last thought, the above is insurance on a 2008 Honda with well over 200,000 miles. Which could lead into a separate discussion on the increase in mechanic hourly pay and the need to maintain or replace parts and key fluids.

We aren’t coming off a golden age either. It’s been a long stretch of miserableness, made bearable by crazy financial products like reverse mortgages. Eventually the plates stop spinning.

Shrub told the divorced mother of three working three jobs that she was uniquely American and fantastic in 2005. This isn’t an issue of immediate temporal politics but long term declines bringing the system into question. Harris isnt likeable, but she should have a reasonable approval rating given that she does nothing. She and other Team Blue twerps don’t enjoy nostalgia, so they are just part of a decayed establishment.

Krugman can rant about rates of inflation all he wants, but the real problem is the real decline has to be changed or societies break. If it’s not Trump take 2, it will come during the Harris administration.

Yep those are good points. Just to highlight, prior to 2009 my experiences working in corporate America had been mostly positive ( never making really big salaries north > $100K but steady improvement in job status and quality raises ). Ever since, the scales seemingly fell from my eyeballs…corporate downsizing and reality of the insurance payments via the COBRA form letters..It is bananas to me to consider how the GFC was a depression for many but not so much in hindsight for the important FIRE sectors.

Added. For a brief respite it looked like I might be in the right “club” until I was not ever really in to begin with. What Buffett says about sharks in the water rings true.

should mention the ultimate non-fungible stat (via hedonic CPI adjustments), federal income tax receipts: down something like $450+ billion YoY. Something is rotten in Denmark.

FICA taxes were marginally up, so the big drop implies that the income drop is among those earning >FICA ceiling, a/k/a the DNC-NPR base

normally a recession hits the minnows first, but given (anecdotally) how non-BA, skilled, semi-skilled job openings are still abundant, maybe the next recession wiĺl be a white-collar/back-office-drive recession.

a bit like southern california in the late 80’s, early 90’s.

maybe the next snarky NPR headline will be: learn how to be a plumber

And let me tell you something: Plumbing is both a trade and an art. Ever seen a master plumber soldering a joint? It’s a sight to behold.

Oh, did I mention that you also need to be a customer service ninja?

Think of the last time you called a plumber. Was something clogged or backed up? Had your home life suddenly ground to a halt? Put yourself in the shoes of whoever came in to solve your problem, and you’ve got the picture.

in my neck of the woods, the residential trades are something like 50% Mexican (as in Mexico Mexico), 35% native Whites, 10% Poles.

with all the NGO money floating around, shaking my head that Black kids are not mentored into the trades.

what an embarassment

I’m sad to report that plumbers are now using these goofy crimp connections instead of solder

There’s a reason for that. I can go to Lowes, buy one of those slip on fittings and they work great. No skill needed.

Talk to a plumber or any contractor about getting workers today. Low skill is all they seem to get. I guess everyone else is writing code.

Yep. I had the same thought. Data is here: https://fred.stlouisfed.org/series/W006RC1Q027SBEA.

Pretty much all previous recessions were accompanied by a drop in federal tax revenues. Based on the severity of the drop we’ve seen thus far in 2023, I’d say we’re already in a recession.

Louis Fyne: maybe the next recession wiĺl be a white-collar/back-office-drive recession

You can probably count on it. AI is about to whack specific white-collar, back-office job sectors, economic recessions aside. Coding and accounting are likely to take big hits in the next five years. If a recession does now hit those jobs, they won’t be coming back.

And you’re correct: it’ll be twenty to sixty years before they’ll have general purpose biped robots to do plumbing.

As computation qua computation, it turns out that regular human movement and operations within the material world — like, forex, merely going to the fridge to pull out a beer can, then closing the fridge door and opening the can — is far, far more computationally intensive than what’s involved in many white-collar jobs.

(Though they’ve just started to have biped robots in an Amazon warehouse, those are networked robots operating swarm-style in a completely controlled, metered environment.)

in totality for the intermediate term, it’s probably much easier just to give a warehouse worker a VR helmet and sensor suit with the data fed into a dumb forklift or a dumb “mech suit”.

then “drive a forklift” or work a CNC machine from home.

can’t decide if this is a good thing or a bad thing.

Interesting thought.

It might cut down on industrial accidents. Or it might not — everything would depend on the effectiveness of the sensors and pickups on both ends, in the factory and wherever the human operator was.

probably not cost effective in a standard warehouse or car assembly.

but anyplace needing a “clean environment” or dangerous conditions, seems like a no-brainer for the humans to be doing the work in a different room—

once VR tech finally discovers that it’s more useful as an industrial work-tool than the next Xbox (given current/near-term tech).

Like the latest South Park episode, where the richest guy in town is a handyman and the day laborers in front of Home Depot are all white collar.

6 to 9 months out, so looking forward to that Spring

OffensivePolicy Miracle to lower my bills for gas, food, insurance and everything else under the sun.Can’t wait for the Biden Lie Machine to get cranked up. So far, they have the gaslighting piece.

The article rambles on about mortgage rates, but rent is what poorer people pay. That has shot up, and wasn’t discussed.

Oh, we’re all paying rents to the rentiers in this the rentiers’ economy. Interesting story about a busted Real Estate fees setup. utube. Big fine.

Real Estate Industry IN FREE FALL After 1.8 Billion Fine | Breaking Points

https://www.youtube.com/watch?v=mJ3Jr8obksk

The pundits and experts can do all the cheerleading they want. It won’t change what people actually experience everyday, in fact it leads to more cynicism. Prices on real stuff people buy have increased 20% to 50% since covid. If someone wants to write newspaper articles saying it hasn’t, good luck with that.

The BS today will be unbearable after the CPI print.

It’s funny this. From time to time I see articles saying how great the US economy is and how it has never been better. And yet in comments the past year or two, I keep on reading people complaining how prices have gone up and inflation is outta control while giving examples that they have seen. These two narratives cannot be both true so I will go with Door Number Two.

They actually held elections in the USSR and often the winning candidate would garner 98% of the vote, which was utterly ridiculous, when results were tabulated and the public informed.

Inflation in the USA is often talked about by economists @ the highest levels as something they’d like to be 2%, which is utterly ridiculous, when results of shopping were compared and the public informed.

Let’s not also forget a gigantic elephant in the room: credit card interest. Rates on cards have skyrocketed, so interest costs on rolling balances have gone stratospheric for many people. For anyone carrying a large balance that is a serious hit to monthly income – which translates into an impression that the economy is not going well (for them at least).

Ben Bernanke, a Republican, was reappointed Chair of the Fed by Obama. He is an an economist and was an academic at Stanford and Princeton. Jerome Powell, a Republican, was reappointed Chair of the Fed by Biden. He is not an economist, but a lawyer and was an investment banker. Where do you suppose his political sympathies lie?

Democrat Presidents continue to appoint Republicans to key positions in the domestic economy, foreign policy and defense. Without suggesting naked political bias, is it not blatantly clear that Republicans instinctively tend to lean right in their policy positions? (The business of America is business, blah, blah.)

OK, you can’t buy a house, a car, or groceries, and the health care system is killing you, but GDP, corporate profits, and the market are doing great. Don’t worry, the Fed will continue with the floggings until morale improves. And Biden’s team is working hard on improving he messaging.

This is related to Stoller’s point about Democrats not wanting to govern and Team Blue’s status as an identity party. Team Blue simply gives important jobs to Republicans. DeJoy is still at the post office.

Why would we want Biden to be in “much better shape”? He is a doddering old fool that has no business running for POTUS in 2024.

I agree. The article seems a bit desperate, a combination of cheerleading and handwaving.

So we spent a lotta money and made it all twice as bad. Sounds like American Exceptionalism. this time it hasn’t fooled anyone. Conversations in the grocery store are very real. so if nobody’s fooled at that level, how can we expect anyone to keep buying up our treasuries? It could already be a self-kicking boot – the Fed and the reserve banks and hedge funds might be the only buyers, getting rich on paper but impoverished in country.

Auto and home insurance prices are up 20-30%. The same bag of groceries are now 30% higher. Auto repair costs are 50% more. Home repair and construction cost are at least 30% more. These are all annual rates. The CPI does a good job of covering the true picture. With all the price hikes (greedflation) why won’t the GDP be higher?

Smoke and mirrors only go so far, don’t they?

When I was in San Diego earlier this year, almost every worker with whom I struck up a chat at a grocery, or café or restaurant and told about wanting to move there told me how difficult things were economically. The economy’s great … for the donor class and PMC. Good luck with the rest, #Jo3yN0rdStre4M

I can say at our house we are not spending anything except on necessities. I can’t believe we are the only ones doing that. Americans cutting back in the face of renteirism and greed-flation. That is Bidenomics to anybody outside the bezzle/bubble.

Most of us are too stupid about the economy. What we know is the price of gasoline and groceries is too high. Personally a 2lb bag of coffee and a 12 pack of beer sets me back $50. That’s the “economy” for many