By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street.

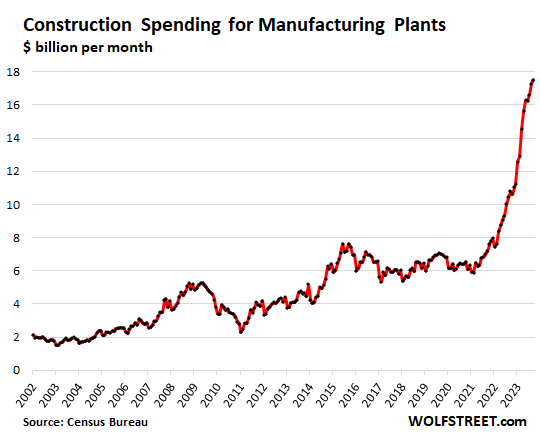

This is amazing, and I’m not sure how long it will last, but spending on construction projects for manufacturing facilities in the US continues to spike in a historic manner. In September, $17.5 billion, up by about 150% from the stagnation range before the pandemic.

For the first nine months of 2023, spending on factory construction jumped to $140 billion, up by 131% from $60 billion in the same period in 2019 and $59 billion in 2021.

Since January 2021, roughly when this boom started, spending has nearly tripled. The rate of spending over the past five months exceeds $200 billion annualized (not seasonally adjusted).

Factory construction announcements continue. For example, just this week, German industrial giant Siemens announced that it will invest $510 million in the US to build factories: $150 million for a factory in Texas to manufacture electrical equipment for data centers; $220 million for a factory in North Carolina to manufacture passenger rail cars and offer overhauls of railcars and locomotives (Siemens diesel-electric locomotives are used by Amtrak, Brightline, and other passenger railroads); and $140 million for factories in Texas and California to manufacture electrical products.

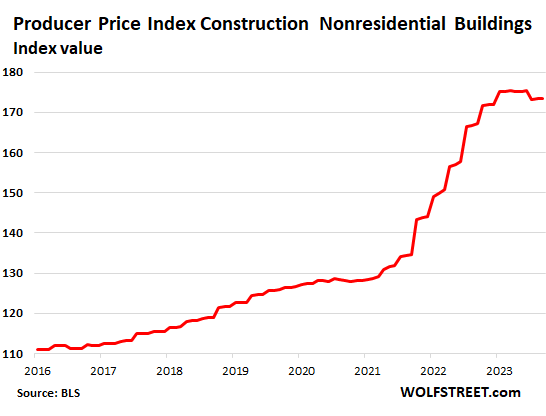

Part was inflation, but construction costs have cooled. Over the 33 months since January 2021, the Producer Price Index for nonresidential construction has surged by 35%. Over the same period, spending on factory construction has spiked by 195%.

But the PPI has actually declined a little so far this year. And the huge year-over-year gains have been whittled down to just 3.8% by September.

And there are lot more dollars involved. Construction spending just covers the buildings. Companies invest in factories in the US to make high-value technologically advanced products such as semiconductors and vehicles. They use highly automated factories full of industrial robots. Then there is other investment activity to support the factory, including infrastructure construction. The whole package counts as investments in GDP. What’s even more important for the economy is what comes later when the factory starts producing, creating its own ecosystem of economic activity.

Industrial robots cost about the same in the US as in China. The cost of labor is still very different. And other costs are different. But on the plus side are shorter lead times, less transportation expense, less geopolitical uncertainty, more control over IP, etc.

Taxpayers are shanghaied into subsidizing factory construction at the local, state, and federal level, and this has been going on forever.

What is new is the disruption experienced by global supply chains – they practically all run through China – during the pandemic that led to shortages of all kinds. In addition, there are all kinds of frictions, disputes, uncertainties, and tariffs between the US and China. US manufacturers have to toe the line in China. Even Musk, a big defender of free speech, is mouse-quiet in China about free speech. His gigafactory in Shanghai is worth a lot more than free speech, that’s for sure.

What’s also new are huge federal subsidies for semiconductor manufacturing plants, EV battery plants, and EV assembly plants, and subsidies for purchases of EVs that conform to geographic production limitations. Makers of computer, electronic, and electrical equipment are also big drivers behind the surge of factory construction, according to an analysis by the Treasury Department.

But wait… the construction boom took off in the spring of 2021. Over a year later, in July 2022, Congresses passed a package of subsidies for select manufacturing industries, such as semiconductor makers (up to $52 billion). But construction spending doesn’t immediately happen when the law is passed. The government takes its time actually handing out the money. And these big construction projects themselves take a while time before construction can even start. So a portion of those subsidies for factory construction are likely to provide further fuel going forward.

By output, the US is the second largest manufacturing country behind China, and has a greater share of global production than the next three combined (Germany, Japan, and India). The majority of motor vehicles sold in the US are assembled in factories in the US. All major foreign brands have assembly plants in the US. Tesla makes vehicles in the US, including for export.

But the US, as the largest economy in the world, has fallen far behind China in manufacturing, while many sectors have become dependent on manufacturing in China. And issues during the pandemic, including the semiconductor shortages, were a brutal wakeup call.

Could an explanation for all this be the number of factories and even industries that are leaving the EU – especially Germany – because of the skyrocketing energy costs due to the blowback from the Russian sanctions? Biden did specifically target EU corporations to make the move across the Atlantic to the US and this may to a large part explain the boost in factory construction. So these are not really new factories so much as factories that are being relocating.

It’s been a long time since I did any math like this, so I may be mistaken, but both eyeballing and back of the envelope calculations say that over 50% of the peak is explained by the inflation.

And according to the US Treasury the rest is the semiconductor industry funded by the CHIPS act.

I’d also be more interested in a number of factories comparison with their types and locations.

Wolf’s graphs show a three fold increase in spending but just a 50% increase in prices…that suggests a real doubling of construction (3.00 / 1.50 = 2)

Well, these are “new-to-US factories,” but as you point out, energy-input costs now make Western Europe non-competetive in several manufacturing sectors, hence the “historic spike in factory construction” in USA.

Of some interest to me is the Seimens electrical products and how this may possibly reshape the field of industrial automation in the USA as Allen Bradley still holds a lion’s share of industrial computers/controllers in this market.

However, I do wish Wolf had included a more detailed overview of the types of factories under construction, percentages of the total, rather than only annecodotal examples (though these are helpful too). More location-data would be good too as this could help illustrate the shift of major manufacturing regions within the USA itself.

i also write about this report and don’t know of any place such detailed data is published

Yes, a breakdown of where as in which nations this increase is coming from could say it all. The spike on the graph starts shortly (as in at most 8 months) before Western sanctions on Russia. Soon after came America’s terrorist attack on Nordstream. Wolf’s site is well represented with China/Russia phobia and UDA#1’ers, so a breakdown of nations doing this investing would be revealing.

I saw the CEO of Seimens on Bloomberg this week when the announcement of all this was made, and not once did he mention energy costs, and I said, huh. He also didn’t talk about all the lost jobs in Germany. Something tells me that his country is heading for hard times, with the cities filled with immigrants, including the newly arrived Ukranians, and much lower living standards. Like Detroit.

Wolf only cares about US construction. If other parts of the world are immiserated in the process of the US gaining wealth that is merely the empire getting its due.

In the long run, the European countries re going to realized that they were betrayed by the US. As the standard of living continues to fall, that’s when the existing governments will face a legitimacy crisis.

At that point, an alignment to China and Russia is possible. This was entirely preventable by the US, but if course the Biden administration has never been good at long term planning.

I agree it will happen on four grounds: the EU will be forced, of necessity, to change fundamentally and it will rid itself of those institutions which are essentially political, turn Brussels into little more than a post box and negotiating forum for it’s member states and revert to its various economic roles; second, China and Russia will view the European economy as worth investing in as a market, manufacturing base, service provider, and as an integral part of the new Silk Route; third, Europe will once again recreate and expand it’s links to the Russian energy economy to aid the economic development of it’s member states; and fourth, that EU member states have associate status or become members of BRICS and the emerging international institutions.

Rev Kev, re “Could an explanation for all this be the number of factories and even industries that are leaving the EU”

Wolf says “the construction boom took off in the spring of 2021”, so the timing is off for that to be the reason…

I wonder how much of the expanded manufacturing capacity is intended to address the increased demand for munitions and other implements of destruction.

Nah, the new construction will look like factories but be fit out for condos, yoga and art studios right from the start. Woo hoo, the cats sure were up early this morning.

Are distribution centers included in the total construction numbers?

The water and energy use projections (or even the size of the pipes/lines) for each project would discriminate between distribution and manufacturing.

Using the word “shanghaied” struck me as more than a little biased. Taxpayers in all countries are “shanghaied” into subsidizing their respective country’s manufacturing. Some see this as a good thing, some not.

But I’d like to see this word used far more often when mentioning the nearly $1.3B overall US “defense” (War) spending taxpayers are shanghaied into subsidizing.

Shanghaied is precisely the correct word. The genesis of the moar chips act was alarm about the self destructive decision to cancel chip orders by big auto at the beginning of the pandemic when sales cratered and the rest is history. The good thing, I suppose, is that it keeps the spice flowing, typically translated into giant pick ups and SUVs.

We are being overwhelmed with digital crapola and there is no off switch.

Did a quick check and found this-

‘According to estimates, the average modern car has between 1,400 and 1,500 semiconductor chips. Some cars can have as many as 3,000 chips. That’s a lot of chips! You could say that modern cars are like giant computers on wheels.’

https://www.icdrex.com/how-many-semiconductor-chips-in-a-modern-car/

I wonder how many of those chips are critical to even being able to turn your car on much less drive it. Personally I think that cars should be designed so that even if every single chip dies, that the car’s mechanical system means that you would still be able to drive it – but I always was a romantic.

That’s a very dumbed-down article, in the tone of describing memory capacity in terms on number of songs.

“semiconductor chips” means “computer” to much non-tech audience. Yes, cars have lots of microcontrollers, many doing simple functions like door lifts. But that deliberately scary number is actually the number of individual semi packages, which includes simple integrated parts like voltage regulators, plus discrete components such as individual diodes and transistors.

To be Shanghaied is to be pressganged from freedom into military service. Taxpayers by definition pay taxes, they are not free of them. Forcing non-taxpayers to pay taxes would be to Shanghai them. Forcing taxpayers to pay taxes us like Shanghai’ing sailors into their existing navy, it is a contradiction in terms.

This is all logic and no emotion though….

1.3 Trillion per year. And Ukraine and Israel want billions more in handouts. (subsidies to the weapons of mass destruction corps) And what happened to the trillions that cannot be accounted for at the DoD?

No corruption here eh

So sorry, the filing cabinets with all the records were incinerated on the one out of five unreinforced side of the Pentagon when the plane hit it.

FBI STILL has not released the only video of that from the gas station across the street. For national security you see.

An exhausting job, the Pentagon’s controller resigned in 2004. He was a conservative Republican who graduated from Jew’s College in London in 1973.

Rabbi Dov Zakheim first joined the Department of Defence in 1981 under former president Ronald Reagan.

https://en.wikipedia.org/wiki/Dov_S._Zakheim

You cannot make this shit up. Facts are stranger than fiction.

The Citgo gas station has since been removed, FYI.

Yes, typo on my part, T, not B.

$200B annualized for a couple of years is a drop in the “shanghaeid” bucket compared to the trillions “shanghaied” over the last 20+ years for the technically illegal wars we wage around the world, not to mention some obvious war profiteering here in the US.

At least these newly built factories are making something other than bullets and bombs.

It takes years of planning to start a new manufacturing facility.

As noted elsewhere above in comments … the trend started 8 months prior to Russian sanctions

Thus the impetus for the redirection started in 2018? 2019?

While it’s not really clear what counts as construction cost, all that planning comes with a price tag, too.

It seems that all the surveys, permits, assessments, consultations, evaluations, plans, drawings and land purchases done before the first blue collars are even hired are easily more than 3/4 of the final cost of a construction project.

The Obesity in America essay on https://www.nursingpaper.com/examples/obesity-in-america-essay/ tackles a pressing issue. It’s an insightful read, exploring the factors contributing to this epidemic and its impact on healthcare.

For an excellent read on this topic try “Ultra Processed People – The Science Behind Food That Isn’t Food” by Chris Van Tulleken.

Ultra Procssed Food (UPF) is a diabolical product that scientists and capitalists have put into our bodies effecting our health and is a direct cause of the obesity crisis. The author even throws in some humor that helps keep our spirits up while we are being slowly killed off by our current iteration of what food has become. All information is backed by science not funded by Big AG, Pharma etc. A definite must read.

+1

I read it. I am now compulsively reading labels on just about anything I buy. Well not the raw carrots and onions.

Is this surge in construction spending supposed to be good news? I don’t think it is. At what point do we begin seriously dialing back consumption (and therefore construction) in order to combat the environmental catastrophe presently unfolding across the world? Or is forever growing GDP still the Holy Grail? I’m looking forward to the day when GDP begins a steady decline as we transition to a low consumption lifestyle and forego things like personal motor vehicles and reduce our purchases of an array of electronic devices and throwaway clothing. A man can dream, can’t he?

We can dream, sure. But to achieve what you outline, the entire legal/political/economic/financial structure would have to be rebuilt from the ground up – basically our entire civilization would have to be restructured. That’s not going to happen unfortunately. To be crude: the oligarchy does not want to give up their wealth/power – power is the most addictive of all drugs. Meanwhile, the US govt. is pursuing nuclear war and genocide as foreign policy options. Using DU ammo and blowing up everything, subsidizing genocide, nuclear weapons etc is not good for the environment, and the US military machine is the largest polluter and destroyer on earth.

So if things truly are hopeless we all may as well party like it’s 1999. Why waste time trying to achieve “net zero” (whatever the heck that actually means). James Hansen can retire with a good escape book.

https://www.ecowatch.com/military-largest-polluter-2408760609.html

That will happen in 1 of 2 ways: catastrophic collapse or by intentional change. Since a large number of people support the status quo with their actions if not their words, intentional change will likely have to look like a revolution. And if intentional change doesn’t happen or it fails, collapse is what’s left.

>…”Industrial robots cost about the same in the US as in China. The cost of labor is still very different. And other costs are different. But on the plus side are shorter lead times, less transportation expense, less geopolitical uncertainty, more control over IP, etc.”

It seems that the cost of labor in the US is lower in real terms than in the past, it is still too high to be competitive with China. US labor is saddled with sky-high housing, “health care” costs, transportation costs, insurance costs etc. – in short, the overhead is way too high. It seems like a pipe-dream that US labor could be competitive across the board. Subsidized industries in the weapons/war/surveillance/aerospace sectors are a special case.

Sorry, one more thing: …”Even Musk, a big defender of free speech, is mouse-quiet in China about free speech. His gigafactory in Shanghai is worth a lot more than free speech, that’s for sure…”

Defender of free speech? Yeah right, his speech, but f everyone else. Dude likes the US gov to subsidize him with fat contracts, tax breaks, and subsidize death and regime change to source lithium (eg. Bolivia) while he sits back and makes billions.

A heavily subsidized oligarch that is a “defender of free speech” is an oxymoron and utter hypocrisy.

Neo-Feudal techno-totalitarianism: we are told to worship celebrity-oligarchs. As in Medieval times, the peasants are supposed to worship the oligarchy as if they are God’s representatives on earth. Plus ca change…

I was watching the Duran and the Alexs talked about the Inflation reduction act. Massive US government deficit spending to underwrite subsidies to de-industrialize Europe. Alexander said last year US spent $350 billion, this years $512 billion, and in a few years it will be over $1.5 trillion a year. Makes some sense that if the US government is de-industrializing vassal states that it will need labor and is allowing illegal immigration. Like they say, it’s dangerous to be America’s friend, but deadly to America’s ally. How long can they hide these facts from the European populations or do they even care?

The immigration from Europe spigot will be opened wide over the coming years in order to meet the demand for skilled labor. Most of the immigrants coming from south of the border are generally unskilled.

If part of our global strategy here is to remove Siemens and their defense technologies as far away from Russia as possible, I think maybe all the cats are out of the bag. But a Siemens transplant will give us a good new jumpstart. IIRC (or imagining?) there was talk of not just deindustrializing Germany, but also plans to make it into primarily an agricultural state. That’s a good idea because it will focus German tech on ecology.

You would have to seriously depopulate Germany to make it an agricultural state. Hitler wanted Ukraine, western Russia, and the Caucuses simply for the land for expansion for his population that was leaving to other countries, especially America, because there was no room for them.

It only took about 80 years, but it looks like maybe the US is finally getting around to implementing the Morgenthau plan …

As much as it’s great to finally see some investment in America’s manufacturing base, I cannot help but think that it’s CEOs and PMC remain completely focused on making a fast buck above all else. These people are masters at tearing down and dollarizing generations of previous investment in plant, equipment, workers, education, housing, healthcare, you name it.

But they are not so good at creating, research and development, seeing beyond next quarters numbers or, you know, actually investing in America as opposed to just padding their bank accounts. So far America has flushed at least a generation of true investment in it’s industrial base, and it will take about the same amount of time to recover.

is there anyone who thinks all that green factory construction is good for the environment?

Great post