Lambert here: Prices rise because firms raise them.

By Kunal Sangani, PhD student in Business Economics Harvard University. Originally published at VoxEU.

Families across the UK are struggling with inflation. This column asks whether low-income households have been disproportionately affected, using micro-data on food products to examine the rate of inflation for different income groups. Though firms passed rising upstream costs on to retailers at similar absolute rates, the increases for low-end products are disproportionately large when measured in percentages – a pattern with real consequences for consumers. This difference in product-level prices was responsible for up to two-thirds of the gap in food-at-home inflation rates between the lowest and highest income quintiles.

In 2022, anti-poverty campaigner Jack Monroe tweeted that the UK’s national inflation index “grossly underestimates the real cost of inflation” for low-income households, listing a dozen low-price grocery products with inflation rates well above the national figure. Her post was re-tweeted over 44,000 times, leading to coverage in several national newspapers and ultimately spurring the Office for National Statistics (ONS) to launch a study of inflation rates for low-price grocery items (ONS 2022).

Despite this interest, evidence that low-income households experienced disproportionate inflation over the past few years remains scant. The ONS study found dramatic variation in inflation rates for 30 low-priced food items but, due to the small number of products it tracked, was unable to conclude that these products had higher than average inflation rates. Meanwhile, other studies using aggregate price indices concluded that inflation in 2021 and 2022 was highest for middle-income households, who spend the greatest share of their expenditures on gasoline and vehicles (Jaravel 2022).

In a recent working paper (Sangani 2023), I revisit inflation rates experienced by different income groups using micro-data on food products. I find evidence of a systematic link between upstream costs and inflation inequality, leading to excessive food inflation rates for low-income households from 2020–2023. This excessive inflation is not due to higher expenditures on aggregate categories like food and utilities (e.g. Jaravel 2022, Hormuth et al. 2023, Cavallo 2023, Soldani et al. 2023), but to differences in inflation rates across products in narrowly defined categories. These results suggest that prices of low-end products grew at double the rate of prices of high-end products from 2020–2023.

How Prices React to Rising Costs

The source of this inflation inequality is how rising costs affect prices of low- and high-end products. To explore this, I begin by determining how the prices of products in a few narrow categories such as rice and coffee react to changes in upstream costs.

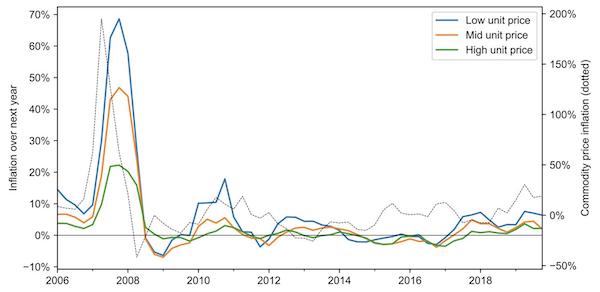

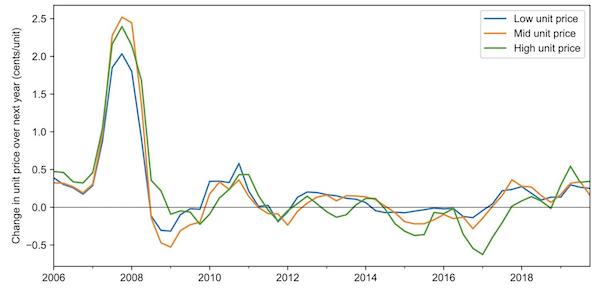

Figure 1 shows how retail prices for rice products varied with changes in rice commodity prices, which exhibited considerable volatility from 2006 to 2020. Rice commodity prices skyrocketed from $350 per tonne to more than $1000 per tonne over the spring of 2008 due to export restrictions by major exporters like India and Vietnam, before falling to under $600 per tonne by the end of 2008. Retail prices of rice products exhibit a corresponding rise and fall over 2008–2009, lagging about one quarter behind the rise and fall in commodity prices.

When changes in retail prices are measured in percentages (top panel), these commodity price movements appear to disproportionately affect the prices of low-end products. For example, inflation for rice products with low unit prices peaked at nearly 70% in 2008, compared to 20% for rice products with high unit prices. When rice commodity prices rebounded in 2011, low-price rice products saw excessive inflation rates of around 20%, compared to under 5% for high-price rice products.

These differences in price growth across low- and high-price products largely vanish when looking at absolute price changes. For example, during the surge in rice prices in 2008, prices of low- and high-end rice products alike increased by about 2 cents per ounce (i.e. 32 cents for a one-pound bag of rice). If anything, low-price rice products saw slightly smaller absolute price increases than high-price rice products. In other words, commodity price increases result in roughly equal price changes for low- and high-end rice products. However, these price changes show up as larger inflation rates on cheaper rice products since the same price increase is compared to a smaller base price.

Figure 1 When commodity prices rise, low unit price products have higher inflation rates, though absolute price changes are similar across products

(a) Inflation (in percentages)

(b) Price change (in levels)

Note: Figure 1 shows average price growth in percentages (top panel) and levels (bottom panel) for rice products. Products are grouped by terciles of unit price (price per ounce of rice) using average unit prices over the prior year.

In my paper, I show that this pattern emerges across several product categories and markets: when input costs rise, low-end products within the category have disproportionately high levels of inflation, even though absolute price changes are similar for all products.

Within-Category Inflation Inequality

Since low- and high-end products have different sensitivity to upstream costs, households can face different inflation rates depending on which products they purchase. Previous studies show that even within narrow product categories, low-income households tend to purchase products with lower prices and margins (Handbury 2021, Sangani 2023b). In other words, low-income households buy precisely those products whose inflation rates are most sensitive to underlying costs.

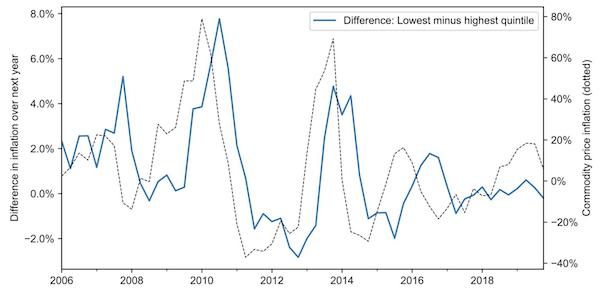

As a result, the gap in inflation for low- and high-income households fluctuates with underlying costs. The top panel of Figure 2 shows the gap between coffee inflation rates for households in the bottom 20% of the income distribution and coffee inflation rates for households in the top 20% of the income distribution.

The inflation gap widens when commodity costs are rising, reaching a peak of nearly 8% in 2010 after a surge in coffee bean prices. Meanwhile, falling coffee bean prices in 2012 resulted in inflation being 2% lower for low-income households than for high-income households.

These patterns extend to the entire food-at-home basket. The lower panel of Figure 2 shows that the food-at-home inflation gap between high- and low-income households from 2006–2020 fluctuates between 1% and -0.2%. Inflation inequality is especially severe when food costs overall are rising, such as in 2007, 2011, and 2014. These cyclical patterns in inflation inequality are distinct from the secular patterns of inflation inequality documented by Kaplan and Schulhofer-Wohl (2017) and Jaravel (2019, 2021), which Jaravel (2019) attributes to innovation and entry at the high end. Instead, these cyclical patterns in inflation inequality occur because of fluctuations in upstream costs, combined with the fact that low- and high-income households consume differently priced products within narrow product categories.

Figure 2 Inflation inequality increases with commodity prices

(a) Within-category inflation inequality: Coffee (with coffee commodity inflation)

(b) Overall food-at-home inflation inequality (with CPI food-at-home inflation)

Note: Figure 2 shows the difference between inflation rates of households in the lowest 20% and highest 20% of the income distribution. Inflation rates are measured using Laspeyres price indices. Panel (a) shows the inflation gap for coffee products (blue) alongside the commodity inflation rate for coffee beans (dotted). Panel (b) shows the inflation gap for all food-at-home products (blue) alongside the CPI food-at-home inflation rate (dotted).

The Food-At-Home Inflation Gap, 2020–2023

What do these patterns mean for inflation inequality over the past few years? A combination of supply and demand shocks precipitated by the Covid-19 pandemic generated large increases in input prices for food products: from January 2020 to January 2023, producer price indices for farm products and food manufacturing rose by 50% and 30%, respectively (e.g. Rijkers et al. 2022). This increase in upstream costs exacerbates the gap in food-at-home inflation across low- and high-income households.

I estimate how food-at-home inflation rates evolved for low- and high-end products, and thus for low- and high-income households, from 2020 to 2023. To do so, I estimate how both the average level of inflation and the cyclicality of inflation with respect to upstream costs vary across products with low and high unit prices. I then combine these estimates with growth in producer price indices from 2020–2023 to estimate differences in price growth across low- and high-priced products.

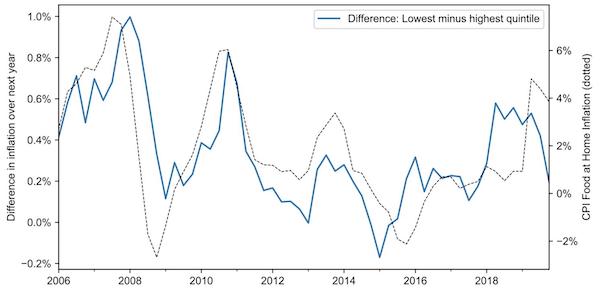

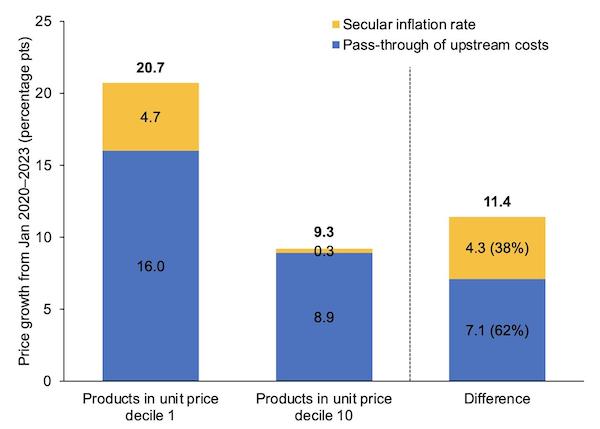

Figure 3 shows a stark contrast in inflation projected for low- and high-end products from 2020–2023. During this period, the prices of products in the lowest decile of unit prices are estimated to have grown by over 20%, compared to about 9% for products in the highest decile of unit prices. Over 60% of this inflation gap stems from the fact that rising upstream costs lead to excessive inflation for low-price products.

Figure 3 Projected inflation for low- and high-unit price products from 2020–2023

Note: Figure 3 shows the projected average price growth for food-at-home products in the bottom and top deciles of unit prices in each product category. For products in each decile of unit price, quarterly inflation rates from 2006–2020 are regressed against a constant and four lags of food manufacturing producer price index inflation. Projected inflation rates are calculated by applying the fitted coefficients to food manufacturing PPI growth from 2020–2023. Price growth is decomposed into a component due to food manufacturing PPI pass-through (blue) and secular inflation (yellow).

These differences in product-level inflation rates also imply substantial differences in overall food-at-home inflation experienced by different income groups. I estimate prices for households in the lowest income quintile grew by 15.6%, compared to 13.7% for households in the highest income quintile. Of the 1.8 percentage point gap, an estimated two-thirds is due to the unequal pass-through of rising input costs.

Conclusion

These findings lend empirical support to recent claims that low-income households have experienced excessive inflation rates over the past few years. But they also cast doubt on some commonly offered explanations. For example, the fact that these patterns appear over the entire period from 2006–2020 indicate that the recent surge in inflation inequality is not due to disproportionate demand at the low-end, fuelled by pandemic government stimulus. Nor does it seem that supermarkets are taking advantage of the inflationary environment to ‘price gouge’ low-income customers.

Instead, the recent surge in inflation inequality stems from more innocuous roots. Firms pass rising upstream costs on to retail prices at similar absolute rates for both low- and high-end products. However, when price changes are measured in percentages, the increases appear disproportionately large for low-end products. This pattern has real consequences for consumers across the income distribution, since rising input prices can lead the cost of a typical shopping basket for a low-income household to grow faster than the cost of a high-income household’s shopping basket. From 2020–2023, these differences add up to a substantial inflation gap for low- and high-income households.

“Inflation” is kind of meaningless outside the context of distribution. If incomes rise at the same rate as prices does anyone feel the effects?

The effect is felt via cash savings but ~2/3 of us have no net cash.

In a closed system where GDP = SUM(Price x Quantity) for every winner there has to be at least one loser ie some subset of people experience increased buying power while the rest experience unchanged or a loss in buying power. Also:

GDP = Labor + Profit

Pretty easy to see which way the money is flowing.

I can’t shake the suspicion that it all came unhinged the day the credit card was introduced. It allowed the working class to leverage their way to higher spending power as long as their wage was enough to cover the minimum required payment.

I guess this is how growing inequality resulting from low redistribution laissez-faire capitalism manifests itself. Proportionately higher cost increases for low end food and lodging would be inevitable.

Lambert here: Prices rise because firms raise them.

Why didn’t they rise them prior to Covid money printing orgy?

Did they just got greedy now?

They now have convenient ‘cover’ provided by actual inflation of commodities, and long-awaited wage increases. They can raise prices way past actual higher costs, and it’s not hard to convince the clueless that it’s all because those greedy Gen Zs want top dollar to work stocking the stores.

I dont think companies need cover to raise prices.

You are suggesting as if they were paragons of virtue and morality.

If they can make a buck, they will sell their soul anytime anywhere.

They rise prices because people have money to pay for their products, that is all there is to it I think.

Remember pharma bro who raised 5000% the price of that drug some years ago?

Why, because there was no other alternative to it and people kept paying for it.

What the market will bear. And if you have a monopoly and people can’t live without your product, it will bear a lot.

right but thats a function of the product and control of it and even then pharma still tries to claim “R&D” publicly, or at least used to. point is i think its true that companies, generally speaking, need an opportunity, a “cover”, a pretext to raise prices. after all, pharma has yet to run the ad-campaign (that i think would be wildly succesful actually) with the catch phrase, “f-k you, you have to” or maybe the more family-friendly, “because your dead without it”.

anyways, the US public may seem tame and the working class is certainly not organized meaningfully to combat the tyrant of capital currently crushing us, boot to neck. but they can be and it actually doesnt take a whole lot to get them there if they are confronted openly with the actual way our society works…

Isabella Weber of the University of Massachusetts) has done work on what she calls “sellers inflation” showing that in times of inflation, many firms are able to raise prices faster than their costs grow, because consumers lose price anchoring (my words). Her analysis has appeared in mainstream publications like the Financial Times.

Yes and they have the most leverage while raising prices on necessities. Like food and rent.

Flat screen TV prices haven’t gone up much…

I blame the PMC. It’s always them. (I’m not being snarky)

“inflation happens because firms raise prices”

i have been saying this for some time now and while it sounds almost dumb in its simplicity it exactly describes what and where inflation comes from and is… more importantly if you repeat the simple notion to yourself a few times and take a moment or two to think about some of the implications for the observation, things start to get interesting… i wont waste everyones times with a huge diatribe here but i do want to mention a couple things.

when i went through the econ undergrad program back in college i always found the idea of inflation odd. not in what it was but how it was talked about and treated. it was a thing that was included everywhere when discussing theories and models and what have you but nowhere did anyone ever make even the slightest attempt at really explaining it.

understanding that inflation is due to firms raising prices, because it has to be since they are the only one’s with the power to do so, immediately highlights the class conflict between capital and the rest of us. think about it. everything you need, food, clothing shelter, beer, dog food, even the dog itself, is priced by the sellers – and i have zero time for people trying to get stupid on “well some are price takers and some are…” NO. EVERY OWNER OR MANAGER REGARDLESS OF THE MARKET CONDITIONS OR ANYTHING ELSE HAS THE POWER TO SET PRICES.

they may find that if they put prices as the please their business is adversely effected but that does not negate the simple fact that they have the power to put prices wherever, whenever.

the implications here are that the same group that decides what number is attached to goods you need is the same group that decides how big of a number to attach to your checks every couple weeks. the goal is to make the two numbers move in opposite directions because thats how you get to their number… profit.

understanding inflation in this way almost immediately, at least for me, introduces politics back into economics where the mainstream so desperately tried to hide it. it is the POLITICAL ECONOMY that is the subject, NOT simply economics. understanding the truth to the simplicity of inflation immediately brings to mind an obvious gnawing question, “if i have to eat to survive, and i need money for food, is it really ‘ok’, appropriate, a good idea, etc. to allow someone to unaccountably decide the price for the thing i need for life?”

its not apparent to me at all that some arbitrary private actor should have the power to set prices for the things we depend on for our livelihoods and quality of life. this is bourne out in the current US healthcare system. it turns out that such power is not a good idea and illegitimate as any honest observer can see when they take a look at a $500 price tag on their monthly prescription while across the border it sells for $22.

there is so much more to say, i welcome the discussion but am very aware of my tendency to blabber on and on and will leave things here

another thing… is it not obvious that inflation and all other effects that have to do with price and money always disproportionally effects the poor? do i really need a harvard phd and microsoft office to hash this out? i think the following is more than enough to adequately show the effect…

next to me are 2 people: frank, who is homeless, and bezos who is, well, bezos

i stick a gun in each of their faces and demand $10. both pay. what are the effects on each of my subjects.

frank: doesn’t eat that night.

bezos: made an order of magnitude more passively on interest accrual in the time it took to mug him then what was demanded.

money is extremely more valuable at lower amounts than at higher. you might now hollar “diminishing returns” but that is not the dynamic in play here. as opposed to your 30th ice cream cone, that will literally poison you or spoil or melt or whatever by the time you get to it, the 10 bucks is the same amount going from $0 -> $10 as it is going from $1,000,000 -> $1,000,010. the value of the 10 bucks still affords the same amount of stuff and therefore has not diminished marginally.

the difference is in the subject. the homeless guy got %100 of his wealth taken, bezos, %whatever, a meaningless sum. and this is the correct way to assess cost. it is why a sales tax overwhelming disproportionately effects the poorest in society and why it is effectively meaningless to assess expense in terms of gross dollar amounts. $0.08 on a $1 purchase to someone who has only $2 is a huge tax versus someone who doesnt bat an eye at spending a couple hundred bucks…

this is also why the argument frequently made by the rich with regard to taxes is so full of shit – “i pay way more in taxes than all of you worthless peasants, i contribute way more…” etc. the reality is that the poor, simply through sales tax pay a much larger debt to their society than does the millionaire who has to pony up of thousands to the tax man on their income and other holdings.

money is valuable at lower amounts because it has an implicit mandate attached to it dicatating it be used to acquire the most valuable goods/services like food to stay alive. the whole idea of “cost” or “expense” from a societal perspective is entirely subjective and should be assessed accordingly.

all that and we haven’t even touched on another related topic, “the infiniteness of money” and the problems associated with the supply and demand of it… almost all immediate social dysfunctions – housing, food, healthcare – can be solved by understanding the real problem: people dont have enough money, so… F-KING ISSUE MORE OF IT TO THOSE WHO ARE EXPERIENCING A SHORTAGE OF IT!

i reject entirely the standard economics gushed from the holes in mainstream assholes’ faces…

fwiw – i just read the article and realize that it is a different topic then what this comment went about addressing – actual differences in the inflation of items for the poor versus rich versus what i droned on about, the disproportionate effects of small dollar amounts versus large dollar amounts with regard to “cost/value”

thats fine. i stand by my arguments and think they are relevant enough in the context to leave em. also, i want to discuss these things with someone. i spend a lot of time thinking and writing but i do not know anyone who knows enough or is interested enough in these topics to bounce ideas off of and talk with… thanks if your that person!

I for one greatly appreciate your contribution and agree wholeheartedly with the main points you have made here, thanks.

I appreciate your comments. You touched on something that is close to my heart: the role of fate/random luck in all our lives. Versus the modern western lie that all have equal opportunity, and that even if you are born in the worst of circumstances, it’s your fault if you can’t individually overcome them in your lifetime.

Excellent point about the original name of the discipline, Political Economy, lost during the “marginal revolution” and buried down the memory hole (along with the distinction between earned and unearned income) by the neoliberal orthodoxy and permanently hidden by the banishment of any study of the history of economics in undergraduate programs in the academy.

Much mischief has ensued …